|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

|

Protecting your 401K savings401K planning, Financial Groupthink and 401K Investors Delusions "I wouldn't exactly say the financial-services industry

is at Version 3.0. Last updated Aug 24, 2015 |

|

|

Protecting your 401K from Wall Street

Protecting your 401K from government: Lies, Damn lies, and Statistics

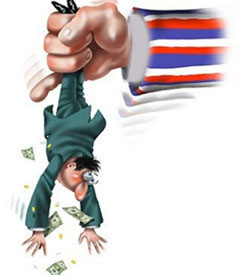

"The Invisible Hand is giving 401K investors the finger"

“The great lie is that the 401(k) was capable of replacing the old system of

pensions,” ...

There are so many great lies with 401(k)’s, the biggest being that it is now expected that

people should be able to save enough for their own retirement

if they would only assume some personal responsibility.

|

|

First of let me state that I am not a specialist in the area to which this page is devoted. I am just a regular 401K lemming. And in 2000-2003, like many other 401K lemmings, I was taken for a ride by neoliberal financial scum :-). After that there was another crash of 2008, in which I fared much better then my co-workers, and during this period this page was considerably improved. Now there is third "neoliberal" crash in the air and I started the third round of updates of this page as readership dramatically increases during uncertain times like autumn 2015 and spring 2017. BTW it drops almost to zero during "good times". So the number of monthly hits might serve as some kind of proxy for VIX index, some kind of uncertainty metric :-)

After that 2000 I realized that something was deeply wrong with the neoliberal economic system and tried to analyze the situation. It is clear that the essence of 401K is offloading all risks to shmucks under the smoke screen of "personal responsibility" a well known neoliberal myth (a dogwhistle about "deplorable" as Hillary called working class) .

"Responsibility" is the code word for "pass the buck." OTHER PEOPLE have responsibility. YOU have "rights and freedoms." YOU are an end unto yourself. OTHER PEOPLE are your means. However, while libertarians have kept the "Personal responsibility" meme, Republicans aren't behind it anymore, probably because it would bring attention to the fact that they no longer believe anyone deserves rights and freedoms, and don't want their voters to notice.

So all investment risks, such as inflation risks, prolonged recession (aka secular stagnation) risks, looting of the company by its brass risks, Wall Street shenanigans risks etc are now your own responsibility. I created many pages during my study of neoliberal economic system, multiple spreadsheets and even simulation models in Perl and R. Only some of them are reproduced on this site but the key conclusion is simple: most, if not all neoliberal talk about "personal responsibility is a variant of propaganda typically known under the name of Corporate bullshit

My impression is that neoliberal economics (aka casino capitalism) travels from one crash to another. In other words economic crashes are not "accidental events", they are immanent feature on neoliberalism (and deregulated capitalism in general; New Deal capitalism in which financial sector was suppressed and tightly regulated behaved differently). And it might well be the intensity if economic crashes can grow with time. We know that crash of 2008 was more severe then the crash of 2000 almost by an order of magnitude. But the problem is that FED in order to get economics out of dot com crash purposely inflated housing bubble. Housing bubble was almost completely re-inflated again under Obama.

While the next crash is given, the timing of it is unpredictable. But hypertrophied role of financial sector under neoliberalism introduces strong positive feedback loop into the economic system and inevitably lead s to Minsky Moment. And it is this positive feedback loop (in which Greenspan FED played the role of amplifier) that make crashes built-in into the fabric of neoliberalism.

But at the same time neoliberal elite tries to protect themselves from those gyrations with golden parachutes but want to give everybody else a lottery ticket instead of a pension. They successfully decimates "defined benefit" pensions (replacing them with 401K which offloads all systemic risks of neoliberalism to individuals) and now are attacking Social Security. Replacing SS with investments that allow people to fall through the cracks is not a good idea. In other words the neoliberal elite is antisocial in a very precise meaning of this word. They are inherently psychopathic. Like a typical sociopath neoliberals believe that life is a kind of war that should be waged by any means necessary, including exploiting greed, and using deception. They are animated by their contempt for ordinary people, as well as by their belief, often openly stated, that man is the most vicious animal of all, and life is a series of battles ending in victory or defeat. It looks like they try to build their success by ticking off each of the seven deadly sins. Big Companies Shake Fingers at Employees for Raiding 401(k)s naked capitalism

cnchalSince American companies are run by the greediest psychopaths on the planet, the real reason for the objection to 401K withdrawals might as well be that selling overpriced stawks and using the cash to pay bills, reduces the opportunity of the chief corporate psychopaths to cash out on their stawk options.

It’s personal. How dare a peasant beat a corporate bigwig by cashing out early, and reduce the bigwig’s monetary takings by even a penny.

Tapping or pocketing retirement funds early, known in the industry as leakage, threatens to reduce the wealth in U.S. retirement accounts by about 25% when the lost annual savings are compounded over 30 years, according to an analysis by economists at Boston College’s Center for Retirement Research.

That’s 25% less available funds that Wall Street can steal from customers. Starve the beast? How do we cut them off from the teat of the FED?

Bernie Sanders: The business of Wall Street is fraud and greed.

Any attempt of the society to put some sand into the wheels of casino capitalism in the form of increasing transaction costs or jailing some overzealous bankers or hedge fund managers are blocked by political power of financial oligarchy, which is the actual ruling class under neoliberalism. The US Congress is just a Potemkin village under neoliberalism.

By nature, human beings are meant to be believers. We aren’t skeptics. We believe, and only at the second step do we subject our beliefs to scrutiny That makes us very vulnerable to skilled deception: We are inclined to believe in deceptive claims unless we have a previous reason not to believe them. And it in this case it's too late.

For ordinary investor (who are dragged into stock market by his/her 401K) accumulating sufficient retirement funds became a dangerous and very bumpy ride. The key issue that you are seduced to take more risk then you ever should. This notes are devoted the this specific issue in context of 401K "investments", but it is important to see a bigger picture.

Those notes were written first of all for my own consumption as an exercise of increasing my understanding of the previously unknown to me field, the field that actually is not that different from programming, especially simulation languages area (Excel is actually a great simulation tool that should be used much more widely by 401K investors, but this is a separate topic; Perl and R are also pretty suitable for creation of simple financial models).

Also I have found that people with extremely limited understanding of statistics and primitive simulation models are often treated as geniuses in this particular area ;-). I have a PhD in applied mathematics, so I decided that at least on those pages I probably can compete with them :-).

Gradually it became clear to me that financial markets under neoliberalism are very inefficient and extremely exploitive and that financial companies. They are skillfully deploying hype and deception, playing upon greed and desperation on million of people, luring them to gamble with their meager incomes and pensions in Wall Street Grand Casino. Advice of controlled by financial oligarchy press should be taken skeptically and with extreme caution. One need to ask the question who is paying the piper. Typically their advice should at best be considered like double agent intelligence and typically is close to the covert attempt to defraud 401K lemmings. It you viewed "masters of the universe" on TV, it looks like for them the rest of society is simply sheep to be sheared, and if they don't cooperate and behave in a properly subordinate way, they must be punished. This attitude is constantly on parade on CNBC . In this sense "Occupy Wall Street" movement should really be called "Liberate America" because it is financial industry that behaves in the USA as occupiers behave in a conquered country. One should see PBS The Retirement Gamble more fully understand what I am talking about (it's 52 min). A short six minute summary can be found at

The US government ties their second-largest set of tax breaks to "forced investments" in 401K. Which usually have a very limited selection of mutual funds. With some 401K populated with "predatory" offerings. The USA government is doing this not because it wants 401K lemmings to prospered, but because this generates huge revenue for FIRE industry, which controls the government (and any US adult with university education probably has very little illusions about whom US government really represents).

Now they can skim this huge money flow (aka "401K money river" at multiple places Also regular inflows tend to drive asset prices higher, which create another nice opportunity for speculation for Wall Street. And the current economic system is all about speculation, that's why it is often called Casino Capitalism. You can read a short, but instructive overview of casino capitalism in History of Casino Capitalism.

The way 401K structured reminds me a classic financial racket. Company brass negotiates with some greedy financial company some discounts for the main activities providing them in return the opportunity to manage 401K plan. Typically this is quid pro quo deal so funds available might have really ridiculous fees. In case of Merrill Lynch and Wal-Mart fleecing Wal-Mart lemmings is achieved by constructing some special financial instruments, which are not even regular mutual funds (something to say about the level of greed of Walton's family). Selection is typically very limited: one or two bond funds and half a dozen or a dozen stock funds, so there is an implicit pressure to put all your money into stocks. Which in many case are risky offerings (emerging market growth and like). What I would applaud is seeing administrators of the 401k plans taken in handcuffs to jail for reneging on their fiduciary responsibility to provide risk adjusted return at a competitive price.

But those laments brings us nowhere. Like Margaret Thatcher used to say about neoliberalism "There Is No Alternative" (TINA). We need to play in this game which was forced upon us from the best we can. For that we a plan of actions, a strategy to minimize risks and clear understanding that the game stacked against us. No question about it.

The first step in such plan 401K "investors" (who really are donors or pray for Wall Street sharks) should be "deprogramming" from Wall Street propaganda. One can't go further without a healthy doze of distrust to all those wealth management and fund manager schemes. If this page can provide some help in just deprogramming, then my efforts to write and publish it were not useless. In any case, remember that:

This notes are based on facts that I collected over the last fifteen years. The key assumption that I think we should adopt the understanding that that 401K is not just a mechanism for saving for retirement it is simultaneously a hidden tax on your retirement savings imposed by Wall Street and its agents in government. That means that your real (after tax, after inflation) return typically is zero or negative. Yes they're periods like (2009-2015) when this is not true and stock market grows like there is no tomorrow (actually S&P500 reached 1640 in 2000 so recent run to 2000 is just 400 points in 15 years). But over any 20 years period it is very true, especially if you act without full understanding of consequences (and full understanding requires studying the subject). In any case one of the best strategy is to try to minimize this tax.

At the same time the you can't just bail out as there is no any better alternative to save for retirement with deferred taxes return. So the word "TINA" -- "There Is No Alternative" used about neoliberalism is applicable here as 401K plans are a part of neoliberal transformation of the US society. We just need to be aware that if we are not careful a large part of returns (and may be even a part of principal) might be taken by fund managers and Wall Street via adverse selection of funds, various fees and market volatility (selling in panic when funds dropped during yet another financial crisis (and they come pretty regularly) is a sure way to minimize your 401K returns).

| While eight times of your annual salary in most cases will provide you a pretty comfortable retirement, there is a minor problem: for regular folk this goal is unachievable. |

As they privatized pensions offloading most of the financial risks on the individual, with the current level of inflation Fidelity recommends to save at least 8 times your annual salary before retirement. See Fidelity calculations. If inflation goes up all bets are off (that's why TIPs are an important component of sound 401K portfolio because they can serve as insurance in case of inflation but only when bought from government, not in mutual funds; but as they are tax deductible they should be accumulated outside 401K, with similar tax advantages as within 401K, albeit without the benefit of investing before tax money). While eight times of your annual salary in most cases will provide you a pretty comfortable retirement, there is a minor problem: for regular folk this goal is difficult to achieve due to several factors:

All this factors mean that your financial situation in retirement is much more unpredictable that people think due to existence of several important factors which completely beyond your control. The importance of those factors raise with the length of the period you need to provide retirement income from your own funds. In other words this neoliberal transformation of US pension system is giant screw up of the middle class.

But for baby boomers (whose extremely lucky folks ;-) there is a possibility to beat the system. One obvious way is to adopt a modest lifestyle in retirement. You can also can take your SS pension at 70 years, spending most of your 401K before that. That decreases the inflation risk (SS pension is indexed to inflation, at least partially, although there are efforts to change that) . In this case Uncle Sam adds approximately 44% to what your pension would be at 66 (for example $2000 at 66 became $3000 at 70).

For programmers and other IT folks that probably means that if you are over 50, you better prepare a more or less precise estimate of you living costs using Excel and cut you current expenses. If your monthly cost of living is at or below $4.5K per month spending most of your 401K to get max SS pension at 70 is an opportunity you should consider.

Minimization of inflation risk alone is worth trying this opportunity. If we assume that more or less comfortable retirement for a married couple is possible in most of US states (with possible exception of California, NY, New Jersey and like) for $4500 a month (see calculation at Insufficient Retirement Funds Problem), you need approximately $54K for each year before 70.

|

Item |

Monthly | Annual |

| Total expenses | 4505 | 54060 |

| Rent | 1500 | 18000 |

| Food | 800 | 9600 |

| Travel | 666 | 8000 |

| Suppl Medical Insurance | 400 | 4800 |

| Car amortization (two cars) | 208 | 2500 |

| Car insurance (two cars) | 150 | 1800 |

| TV | 120 | 1440 |

| Gas/transportation | 120 | 1440 |

| Heating/air conditioning | 100 | 1200 |

| Extra expenses | 100 | 1200 |

| Drugs and out-of-pocket med | 100 | 1200 |

| Electricity | 60 | 720 |

| Presents to relatives | 50 | 600 |

| Cloth, computer, furniture, etc | 50 | 600 |

| Internet | 40 | 480 |

| Cell phone | 40 | 480 |

So from 65 to 70 (the easiest period to predict) you will need around $300K (or $200K in husband account, and $100K in wife 401K account for a couple). Let's multiple this figure by 1.5 to take into account possible adverse events (like another financial crisis our friends from Wall Street can unleash on the country) and you get raw estimate $450K. That figure can serve as a very imprecise guide for constructing your own Excel spreadsheet with year to year expenses from your planned retirement date (which can be forced on you before you reach 65 or 66) to 70.

But at least time horizon for this planning is limited to less then a decade which limits variability of many factors. Generally people say that financial plans that predict something for more then five years are useless, and there is great truth in this statement ;-). The hidden beauty of this $4.5K per month living expenses estimate is that assuming that you will get $3K SS pension monthly and your spouse will get one half you can preserve the same lifestyle on just Social Security pension with minimal own funds. That also greatly diminish the possibility of losing substantial share of your 401K holdings due to yet another financial crisis, as you no longer care much for returns as you will spend your own funds in a relatively short period. And due to this can afford to keep them in short term bonds or other relatively stable in case of adverse events funds. If course having your own extra funds after your 70 birthday are better, in the same way as it is much better to be rich and healthy, then sick and poor ;-). But you can do well even if you spend your 401K at the age 70 to the last penny.

It is important to understand that this is one of the few possibility to limit the level of offloading all risks to individual inherent in 401K plans. And "great fleecing" of 401K "investors" are not limited to two latest financial crisis (such as 2000-2002 and 2008-2009). Actually the tendency to fleece middle class off its retirement saving can be traced the to the late 80th and Savings and loan crisis (the law that created 401K plans went into effect on January 1981). It is connected with the rise of Neoliberalism which without going into great detail meant redistribution of country wealth in favor of the top 1% of population. And related squeezing of middle class which lost its comfortable post war position due to insatiable greed of financial oligarchy, automation, outsourcing and other factors.

But let's return to the problem of periodic financial crisis. If you think that those two "great fleecing" of 401K investors, two crashes in 2000 and 2008 were the last, think again. It looks more like a systemic problem with neoliberal economy then accidents. Social system with wealth greatly concentrated at the top is just less stable. And the next crash can occurs in the most inopportune moment for you when you will feel that you need to take losses. That's the problem which is especially acute if you are over 50.

Those "great fleecing" are supplemented by adverse actions of financial intermediaries. As implemented 401K is a private tax of FIRE sector on your retirement savings and should be viewed as such: they do not care about the fact that you need to support your lifestyle in retirement, but they will force you to support plush lifestyle of financial sharks no matter what you try to do with your investments. Some financial intermediaries are better (Vanguard) some are worse (Fidelity), some are horrible (Merrill Lynch), but they are all representatives of the same specie.

That means that the right strategy of 401K investment might be not an attempt to maximize your profits but taking outsize risks, but to minimize risk of not getting the required $300K in 401K account at the age of 65. So it is unwise to abandon this avenue of savings even if the manager of your financial plan is Merrill Lynch, but extreme risk-avoidance might be appropriate.

This is a casino, despite all efforts of Wall-street financed media such as Money, Smart Money, WSJ, Financial Times, etc to convince you otherwise. And house always wins. Please remember that if you lose 30% of your contribution in 10 years after inflation (which is pretty typical result of several common 401K investment strategies such as "Stocks for the Long Run" Strategy (Naive Siegelism)), then it does not matter much whether it was before tax investment on not. In this case you are not breaking even despite tax breaks. Of course everyone of us think that we are more clever then others, and those adverse scenarios are just for fools. But as Bernard Shaw aptly noted the most sure way to be deceived is to think that you are clever then others (he probably forgot to clarify "deceived by Financial industry.")

In case you think that three statement below are an exaggeration you probably should stop reading at this point. Here are those three statements:

Government via inflation imposes another additional tax on your 401K savings by confiscating lion share of gains. Both bond and stock returns have two components: the first is compensation for inflation. The second is so called real return. Inflation is unpredictable factor even for the period of three years, to say nothing about period of 20-30 years. Typically inflation rises suddenly as confidence in the currency evaporate and chickens comes home to roost. That's why it is prudent to use investments that at least partially compensate you for inflation such as TIPS bonds and as well as junk bonds.

Again, if you do not believe that those three statements represent realistic assessment of the current situation for 401K investors you probably do not need to read any further. All subsequent text will look for you like an unwarranted attempt to paint a much darker picture on reality, that it really is.

Facts on the ground suggest that for considerable part of 401K investors who represent so called "all stock" 401K investors returns for periods of last 10 years and last 15 years are negative after inflation (Note: that' certainly was true for investors in S&P500 as of November 14, 2012, but it is not true as of September 2013 ).

| The key assumption here is that a typical 401K plan with all its

tricks and warts (in combination with Wall Street brainwashing) constitute an tax on savings made by 401K investors. Other things equal most allocations will be worse that the direct investment of same amount of money in inflation protected government bonds like TIPs) and even larger share will be worse then 100-your_age strategy with stocks represented by either 401K or by high yield bonds (which for all practical purposes behave exactly like stocks but provide better dividends). And paradoxically this result does not depend much on the level of education of a particular 401K investor -- stock market behavior is a very slow stochastic process that most people can't comprehend because of limit of their life span (but thinking about current levels of stocks in terms of 200 days and 1000 days averages, as well as Shiller cyclically adjusted 10-year price/earnings ratio might slightly help). |

While I wrote those notes mostly after dot-com bubble crush, in 2008-2010 we have had another shakeout of 401K investors, bigger and more dangerous then previous. So suddenly my notes, which were rarely assessed in 2004-2007, suddenly became quite popular again ;-). And responding to this new popularity I slightly updated them. Still please understand that the core material is old and was written after dot-com bubble.

Of course, the bleeding caused by the 2008 financial crisis and collapse of Bear Sterns and Lehman will eventually staunch, but the issue of inherent instability of financial sector and its natural tendency to engage in predatory to the society behavior remains. The resulting loss of economic stability will reverberate to the end of baby boomers lives. As Griff Rhys Jones aptly noted in Times (It isn't very funny to lose your pot of money):

Like Winnie-the-Pooh, I'm left scratching my head. How could a ‘safe' deposit account evaporate, leaving the bankers unscathed?

This will cheer you up. I lost a big sum of money recently. It evaporated with Lehman Brothers. As it happens, I was hardly aware that I had anything deposited with this distinguished banking house (or hopelessly greedy incompetents, depending on the way you choose to look at them) until I telephoned the manager of my account at a hedge fund.

Now let's go back. I am a financial innocent. I distrust all wealth management and fund manager types. I distrust them from a deep, puritanical atavistic well. But I happen to have savings and pension funds to consider. We drones make our money by luck and talent, by inventing things or creating things, and not by accountancy, so we are doomed to be the patsies of the financial sector. We are the wildebeests by the waterhole. We are the ones who have to die to feed these ghastly, lazy, incompetent predators.

Vanguard Finds Investors Fail to Adequately Nurture Their Retirement Savings

ARDEN DALE

DOW JONES NEWSWIRES, November 28, 2005; Page C9

http://online.wsj.com/article/SB113313361680107674.htmlDecember 04, 2005 | 10:00 AM | Permalink | Comments (2) |

Jason

Two thoughts - first, I wonder whether Vanguard took into account that IRAs tend to feature smaller annual contributions, which makes it hard to amass enough capital to diversify across multiple funds.

But the asset allocation is certainly troubling. It looks like the mirror image of what happened in the mid-1990s, when individuals were being told to diversify into equities (an argument that leaned heavily on Jeremy Siegel) and out of stable value/money market funds. Looks like that argument worked perhaps too well.

It's not easy and somewhat counterintuitive to understand that all your 401K money are just chips in the game for the financial industry traders (aka speculators). And stock market speculators, "these ghastly, lazy, incompetent predators" consider 401K investors to be a legitimate target for any dirty trick they can invent. A lot of them, probably majority, have no conscience whatsoever; in a way they are quintessential group of highly educated psychopaths.

| And that "these ghastly, lazy, incompetent predators" view you as a legitimate target for any dirty trick they can invent. A lot of them, probably majority, have no conscience whatsoever; in a way they are quintessential group of highly educated psychopaths. |

This consideration makes unmanaged funds and ETFs definitely preferable from yet another point of view ;-). But this alone can't compensate for the lack of attention to your investments, which most 401K investors consistently demonstrate. Some boast that they never open mailed returns.

I would like to stress it again that any 401K investor who does not use his/her own spreadsheet to see his/her multiyear balance of contributions vs. balance of savings and change his/her allocation according to some sound strategy and instead moves money based on market hype doomed to be a victim of Wall Street predators. Those who refuse to take investing risks seriously (and to hedge against stock market risks by keeping a substantial portion of 401K savings in TIPs, stable value funds, etc) and still live in the la-la land of "stocks for a long run" might eventually lose a part of their 401K principal. Selling in panic at the bottom of one of recent financial crisis's (or close to it) was one sure way to accomplish this trick. In this respect 2002-2003 and 2008-2009 might just be a harbingers of the radical change of the rules of the game and the irreversible switch to the active process of decimation of middle class in the USA.

There is no more trust in the fairness of the system. And this "loss of trust" is shared by many top economists. So this highly skeptical attitude is not limited to the author. As Robert Reich noted:

Typical Americans are hurting very badly right now. They resent people who appear to be living high off a system dominated by insiders with the right connections. They've become increasingly suspicious of the conflicts of interest, cozy relationships, and payoffs that seem to pervade not only official Washington but our biggest banks and corporations. In short, many Americans who have worked hard, saved as much as they can, bought a home, obeyed the law, and paid every cent of taxes that were due are beginning to feel like chumps.

Their jobs are disappearing, their savings are disappearing, their homes are worth far less than they thought they were, their tax bills are as high as ever if not higher -- but people at the top seem to be living far different lives in a different universe. They're the executives and traders on Wall Street who have lived like kings for years off a bubble of their own making while ripping off small investors, the financial louts who are now taking hundreds of billions of taxpayer bailout money while awarding themselves huge bonuses and throwing lavish parties, the corporate CEOs who are earning seven figures while laying off thousands of workers, the billionaire hedge-fund and private-equity managers who are paying a marginal tax rate of 15 percent on what they say are capital gains while people who earn a fraction of that are paying a higher rate, and, not the least, the Washington insiders who have served on the Hill or in an administration and then gone on to pocket millions as lobbyists for the same companies they once regulated or subsidized. To the American who's outside the power centers ... the entire system seems rotten. ...

Of course the phenomenon we are talking about is so complex that predictions are extremely difficult and "doom and gloom" attitude (aka buy food and ammunition) is definitely wrong. But high level of caution is not, as you was forcefully put in casino and forced to gamble with your money. That's what 401K is about. And 401K investors should not be sitting still and wait until last drops of their wealth disappeared, like typically happens in casino with "marks". We need to try to fight back and at least limit our "after inflation" losses:

Excerpt:"The middle class and working poor are told that what's happening to them is the consequence of Adam Smith's 'Invisible Hand.' This is a lie. What's happening to them is the direct consequence of corporate activism, intellectual propaganda, the rise of a religious orthodoxy that in its hunger for government subsidies has made an idol of power, and a string of political decisions favoring the powerful and the privileged who bought the political system right out from under us."

-- Bill Moyers, Keynote speech, June 3, 2004

You just can't make this stuff up. You have to hear it to believe it. This may be the first class war in history where the victims will die laughing. But what they are doing to middle class and working Americans -- and to the workings of American democracy -- is no laughing matter. Go online and read the transcripts of Enron traders in the energy crisis four years ago, discussing how they were manipulating the California power market in telephone calls in which they gloat about ripping off "those poor grandmothers." Read how they talk about political contributions to politicians like "Kenny Boy" Lay's best friend George W. Bush.

... ... ..

Let's face the reality: If ripping off the public trust; if distributing tax breaks to the wealthy at the expense of the poor; if driving the country into deficits deliberately to starve social benefits; if requiring states to balance their budgets on the backs of the poor; if squeezing the wages of workers until the labor force resembles a nation of serfs -- if this isn't class war, what is?

It's un-American. It's unpatriotic. And it's wrong.

Shell-shocked 77 million baby boomers for whom 401K in 2008 again became 301K need to understand that any risky investments in their 401K in the age of derivatives and TBTF with their HFT farms of supercomputers trying to steal every fraction of penny possible are not only super-risky. they create positive feedback loops that destabilize the system and make crashes imminent. And huge drop of stock market can and does trigger panic selling. and if sell in this casino at the bottom that the worst situation possible: even with zero return you still get some gains because of matching and tax advantages, but with -5% annualized returns you get nothing. Both stocks finds and bond funds are very dangerous instruments now: they became just a chew gum for maniacal Wall Street and hedge funds trading robots.

The autodafé of the 401K investors in 2008 was the final act of the huge wealth transfer from middle class to financial oligarchs. Probably the biggest in the USA history. Robber barons of the beginning of 20th century were children in comparison, At least in their ability to rob the middle class in comparison with current generation of oligarchs... Add to this additional currency risks which are mostly external and now depends on behavior of China and petro-states. .

Academic studies suggest that we are good at some kinds of risk assessments and very bad at others. Malcolm Gladwell, the author of the book Outliers put forward an interesting hypothesis that 10,000 hours of study/experience as a young man/woman is a prerequisite for getting to the high level of knowledge in almost any field. Few of 401K investors can afford such amount of hours (say 1000 hours (which means approximately 60 days a year, 16 hours a day) for 10 years). Many like the author started to educate themselves while being pretty old...

But without at least minimal training, unfortunately, the kinds of risks that we face in 401K investments are precisely those we are most likely to overlook. They are unobvious, but systemic long term risks: like in casino the more you play the more you lose. But unlike casino where is the morning you are already empty pocketed, this financial bleeding take a long time, several decades. Investing in 401K a slow, very slow process with consequences detached from decisions by several years, if not decades. And without keeping your own records and without comparing the amount you invested and amount you have after inflation (in dollars of the first year of investment or some other "fixed year" dollars) using Excel you will never be able to discover that.

Absolute sum can be even or slightly higher, but if you count inflation you lost money. If you counting inflation then in "constant dollars" S&P500 was barely beating inflation from 1994 to 2013. The value of S&P should be multiplied by 0.62, to get the reading in 1993 dollars. That means that most of S&P500 gains are due to inflation:

| Year |

Inflation |

Cost of $1 item in 1993 dollars | Dollar value in 1993 dollars |

| 1993 | 3 | 1 | 1 |

| 1994 | 2.6 | 1.026 | 0.974659 |

| 1995 | 2.8 | 1.054728 | 0.948112 |

| 1996 | 3 | 1.08637 | 0.920497 |

| 1997 | 2.3 | 1.111356 | 0.899801 |

| 1998 | 1.6 | 1.129138 | 0.885631 |

| 1999 | 2.2 | 1.153979 | 0.866567 |

| 2000 | 3.4 | 1.193214 | 0.838072 |

| 2001 | 2.8 | 1.226624 | 0.815245 |

| 2002 | 1.6 | 1.24625 | 0.802407 |

| 2003 | 2.3 | 1.274914 | 0.784367 |

| 2004 | 2.7 | 1.309337 | 0.763745 |

| 2005 | 3.4 | 1.353854 | 0.738632 |

| 2006 | 3.2 | 1.397178 | 0.715729 |

| 2007 | 2.8 | 1.436299 | 0.696234 |

| 2008 | 3.8 | 1.490878 | 0.670746 |

| 2009 | -0.4 | 1.484914 | 0.673439 |

| 2010 | 1.6 | 1.508673 | 0.662834 |

| 2011 | 3.2 | 1.556951 | 0.642281 |

| 2012 | 2.1 | 1.589647 | 0.629071 |

That simply means that if we assume that the level of S&P in 1993 was, say 1000, then the level of S&P in 2012 equal to 1600 means zero after inflation returns (outside dividends). The amazing rise of S&P500 to 1650 in May 2013 might be not connected to the recovery. It might well be a demonstration of asset price inflation. After all stocks can be considered to be private money of public corporations (like Fed they can print them or buy them back) and stock price -- an exchange rate of this currency to dollar. As such this rise on the background of stagnant economy and flat GDP (only games with inflation calculation make it positive) it is more of a harbinger of a new financial crisis, then sign of a recovery. See Inflation, Deflation and Confiscation

Until 2013 with it mind boggling jump of S&P500 typical 401K to almost 1700 (and simultaneous 10% drop of most bond funds in June due to 1% rise of 10 year Treasury bonds interest) an investor with all money in S&P500 lost approximately 10-20% in a three consecutive decades (1980-1990, 1990-2000 and 2000-2010) in comparison with diversified bond fond such as PIMCO Total Return. so much for "stock for a long run" (aka Naive Siegelism) . But this devastating result was not visible on raw figures. That's why I would actually prohibit to invest in anything, but TIPS or government bonds for people who can't use Excel on at least level of Microsoft Excel 2010 Step by Step and/or lazy/disinterested to calculate real returns of parts of 401K portfolio.

And those who do not have this level of Excel skills should acquire them by taking a course in community college or other educational institution. This is much better investment that paying to financial professional to oversee your funds. It5 is also a better investment of time then reading Money, Smart Money or Kiplinger. Only when you can see your last ten year progress in "constant dollars" in a spreadsheet we can talk about some level of understanding of investment basics. And that process alone will give you valuable insights, insights that statistics provided by mutual funds usually tries to hide. One of such insights is that financial intermediaries is not just managing your money, they are managing them to their benefit and 1% per year fees that you pay for many stock funds over typical ten year period often constitute 50% or more of after inflation return. At this point you might start to understand that 2% after inflation that TIPs pay is actually not a bad deal.

|

Investing in 401K a slow, very slow process with consequences detached from decisions by many years, with results evident often only in a decade or so. This fact alone make most people unable to follow it. That's why 401K planning should involve Excel simulations |

Moreover economic losses for families are often like system failures in engineering -- they cascade from seemingly small events into major crises as drop in 401K can correlate with the drop in house value and the loss of job of one of family members. Generally in financial crisis seemingly uncorrelated assets are suddenly highly correlated and fund allocation recommendations that are fed to us by financial planners and grace pages of Vanguard, Fidelity and other behemoths of 401K business became hopelessly detached from reality.

Due to this inability to weight the long term risks, most 401K investors systematically underestimate the risks involved in 401K investing and the predatory nature of financial intermediaries. Risk of 401K investments is really high due to:

The simple truth is that 401K investors need to fight not for the return on their capital, but for the return of their capital. And despite being simple is very difficult to understand. We are too brainwashed to comprehend this. And many just now are thinking "what a jerk!" or "why I am reading this crap?". That's why most 401K "investors" realistically should never be considered to be investors, but donors as they pay "Wall Street Tax" on their savings higher then their meager returns. Of course that's somewhat compensated by the fact that 401K contributions are free from the federal and local taxes. But in essence one tax is replaced by another and if you are not careful the second tax can be bigger.

| 401k investors systematically underestimate risks involved and as a result on average have negatives returns after inflation for the last 10 years with approximately 27% drop in 2008. Those payment of Wall street Tax should better be stopped. I guess you cannot make money on Wall Street advising 401K investors hold cash or treasuries. |

It's still not too late to understand that the road ahead for "stock for a long run" crowd of baby boomers, brainwashed 401k investors who used static allocation strategy and cost averaging (which brokerages like Fidelity and Vanguard, to say nothing about despicable 401K sharks like Merrill Lynch and Putnam, love so much, as it guarantees their profits) is very dangerous and fraught with risks that will be impossible for anyone to ignore or avoid.

As commenter Bobh noted in Naked Capitalism blog (Such a Huge Rally, and the Little Guy Is Out)

Equities markets stopped being about investing in companies, based on their earning potential, a few decades ago. Now it is about professional gamblers fleecing suckers.

Or using words of Naked capitalism creator Yves Smith "Big financial firms increasingly inclined to prey on their customers and, ultimately, on societies in which they lived." (Econned, p.3). It is difficult but necessary to understand that the industry has become predatory and that they are legitimately should be classified as sharks.

| Equities markets stopped being about investing in companies, based on their earning potential, a few decades ago. Now it is about professional gamblers fleecing suckers. |

You probably need to read a couple of books to understand how management and employees of major financial firms systematically looted their companies (and 401K investors), enriching themselves and leaving the mess to taxpayers and how financial regulation enabled predatory behavior by Wall Street towards 401K investors. You might start with The Looting of America How Wall Street's Game of Fantasy Finance Destroyed Our Jobs, Pensions, and Prosperity—and What We Can Do About It or Freefall America, Free Markets, and the Sinking of the World Economy. Here is the quote from the Amazon review of the book by Loyd E. Eskildson:

Stiglitz believes that markets lie at the heart of every successful economy, but do not work well without government regulation. In "Freefall" he explains how flawed perspectives and incentives lead to the 'Great Recession' of 2008, and brought mistakes that will prolong the downturn.

Between 1996-2006, Americans used over $2 trillion in home equity (HELOC) to pay for home improvements, cars, medical bills, etc., largely because real income had been stagnant since the early 1990s. Economic recovery requires that we repay the remainder of these amounts, overcome stock market losses (10% between 2000-2009), the loss of some 10 million jobs, and reductions in credit card balances, and find an equivalent amount to the former home-equity sourced financing ($975 billion in 2006 alone - about 7% of GDP) to finance another consumer-driven GDP upturn - without the prior boom in housing and commercial building. Stiglitz also points out that the Great Depression coincided with the decline of U.S. agriculture (crop prices were falling before the 1929 crash), and economic growth resumed only after the New Deal and WWII. Similarly, today's recovery from the Great Recession is also hampered by the concomitant shift from manufacturing to services, continued automation and globalization, taxes that have become less progressive (shifting money from those who would spend to those who haven't), and new accounting regulations that discourage mortgage renegotiation.

Stiglitz is particularly critical of the U.S. finance industry - its size (41% of corporate profits in 2007), avarice (maximizing revenues through repeated high fees generated by over-eager and over-sold homeowners needing to refinance adjustable-rate mortgages that repeatedly reset), and 'sophisticated ignorance' (using complex computer models to evaluate risk that failed to account for high correlation within and between housing markets; 'eliminating risk' through buying credit default swaps from AIG -- blind to the likelihood AIG could not make good in a housing downturn), and excessive risk (banks leveraged up to 40:1 with increasingly risky mortgage assets - 'liar's loans,' 2nd mortgages, ARMs, no-down-payments; taking advantage of the 'too-big-to-fail' and 'Greenspan/Bernanke put' phenomena). Much of this behavior was driven by lopsided personal financial incentives (bonuses) - if bankers win, they walk off with the proceeds, and if they lose, taxpayers pick up the tab. However, to be fair, any firm that failed to take advantage of every opportunity to boost its earnings and stock price faced the threat of a hostile takeover.

Even worse, recent developments signify changes to a new, far more risky environment for 401K investors. Offloading of Wall street financial losses on the US taxpayers will have consequences. Dollar is still standing after all events of 2008 but for how long is a tricky bet.

We need to understand that structure of investments (selection of funds available) in most 401K plans is designed to fed Wall Street sharks. Classic example here is Wall Mart 401K plan which has the worst manager of 401K plans imaginable -- Merrill Lynch (which was saved from bankruptcy by government by pushing it into Bank of America arms). This is another reason why instead of trying to maximize returns, 401K investors should concentrate on preservation of the capital.

Even preservation in absolute number (with inflation as losses taken) might be considered an achievement. Only those who are flexible, open-minded, resilient, and are able systematically use Excel spreadsheets to understand consequences of their allocation decisions will be able to do better then that. And if your 401K manager is Merrill Lynch you can probably forget about beating the inflation.

The regulatory destruction of the USA's during conversion of the country to neoliberalism model started under Reagan meant redistribution of wealth toward the top 1%.

And there is nothing accidental in the fact that once thriving "defined benefits" pension system was gradually dismantled first by the introduction of 401K plans in 1978 as a supplementation investment vehicle and gradually in cuckoo eggs manner pushed traditional ("defined benefits") pensions out of the nest. The only exception were government employees (0205fact.a).

1978. The Revenue Act of 1978 included a provision that became Internal Revenue Code (IRC) Sec. 401(k) (for which the plans are named), under which employees are not taxed on the portion of income they elect to receive as deferred compensation rather than as direct cash payments. The Revenue Act of 1978 added permanent provisions to the IRC, sanctioning the use of salary reductions as a source of plan contributions. The law went into effect on Jan. 1, 1980. Regulations were issued in November of 1981.

Once the envy of the world, the USA privately provided defined benefit pension system now is largely destroyed. For mid-income working families 401K plan was and always will be an inferior replacement for pensions, unless you contribute over 20% (with matching) to your 401K. So in a way that was stealth 20% reduction of the salary. As additional risks were offloaded the figure is probably even higher. Among offloaded risks are inflation risk and market risks. Offloading those two risks to individuals benefited mostly financial industry,

Matching traditional pension with 401K requires approximately 15% annual contribution rate assuming 5% matching.

| And even with 15% contribution it means that at least twice as much risk is taken by the individual instead of the corporation. |

When we think about the middle class, we tend to think of Americans whose lives are decent but not luxurious: they have houses, can buy a new car, have health insurance for all members of the family, and can finance university education for kids. With the destruction of pensions the latter became more problematic. Add to this high unemployment, especially in 50 to 60 age group. baby boomers are exactly the fist generation of people who were when they were in this 30th were switched to 401K from traditional plans (the law was enacted in 1981 -- 32 years from now)

Now in addition to paying the cost of kid's college tuition (which experienced exorbitant growth as another path of wealth redistribution toward top 1%) they need to collect money for their own retirement. The Section 401(k) of the tax code was enacted in 1981 is vastly inferior for everybody but the top earners (let's say those who earn above $200K per family or above $100K per individual). It also has several side effects (as in "road to hell is paved with good intentions" ) and one of them was rapid impoverishment of the lower middle class:

It allows directly quid pro quo games with selection of funds and 401K managers. Many companies offer employees inferior funds with high fees and bad management. Classic example here is Wall Mart. Additional fleecing tricks like folding fund and moving funds to other fund with payment for losses from the pockets of investors are also used (Blackrock is famous for using this strategy).

Actually very few programmers and other middle-class professionals are individual stock purchasers operating through brokers; most are dependent upon mutual fund managers navigating market or on index funds. In 1990th mutual funds became huge industry and saturated mass media with expectations of quick and easy profits. Although they were not the primary factor, they were constructive in creating and maintaining dot-com boom. The need to slow down and prepare for contracting credit after the biggest in the century Credit Boom was lost in the fast-paced world of momentum trading. As a result the first 401K accounts crash badly affected most 401K investors. Few lost less then 10%. Losses such as 30-40% were pretty common. Generally they did not recover probably until 2007 just in time for the second crash. The amount of money transferred to Wall Street from 401K investors can be conservatively estimated as 20-30% of all 401K contributions. That's a huge tax.

It continues to fascinate me that many 401K investors with pretty high level of education including myself are entirely willing to base their financial security on concepts that looks quite unconvincing even after a cursory look at historical data. In other work to junk science. Even a simple Excel imitations model runs on historical data prove that the portfolio theory as preached by Wall Street is in a reality a modern snake oil. For example, since Jan 1, 1996 stable value funds (and diversified bond funds like PIMCO Total Return) outperform 100% S&P 500 investment by at least 17% (as of April 14, 2010 with S&P at 1200). That's almost 15 years span and that suggests that stocks "in a long run" might be unable to outperform even the most conservative investment in bonds. The situation changed only in 2013 when S&P 500 due to Bernanke "easing" rocket to almost 1700 level.

As a computer professionals we work long hours trying to acquire hard to get skills. We try to get certifications to motivate ourselves to study consistently. But when it comes to the decision related to those hard eared money we display amazing stupidity and are ready to believe into almost any nonsense propagated by mainstream press. It continues to fascinate me that many computer science professionals who are better then others are equipped to do simple Excel-based simulations and test hypothesis on historical data are willing to base their financial security on "ad hoc" concepts from some guru, the advice which can be disproved with even a cursory look at historical data with Excel in hand. This list until recently included myself.

| It continues to fascinate me that many 401K investors including, until recently, myself are willing to base their financial security on "ad hoc" concepts from some guru that can be disproved with even a cursory look at historical data with Excel in hand. |

We need to understand that suddenly 401K became "the pension plan", the replacement of traditional pension plans as they disappeared into thin air. And it requires the respect and amount of leg work that is proper for the pension plan. That means a lot... The big lesson to be learned from 2001-2003 is the importance of having a properly constructed investment plan and sticking to it -- not being distracted by short-term "noise":

The first step is to understand that using 401K as a substitute for pension with the typical meager employer matching (say 4.5%) requires higher level of individual contributions (probably 15% is the minimum, if we assume 20 years contribution period) to match the pension plan. This additional 12% "tax" makes life of workers more risky and more frugal (bit at the same time provide "safety net" (you can take out money from 401K without penalty if you are unemployed) in case of long term unemployment, which now is a real possibility for many of us):

| The name plankton is derived from the Greek word πλανκτος ("planktos"), meaning "wanderer" or "drifter".[1] While some forms of plankton are capable of independent movement and can swim up to several hundreds of meters vertically in a single day (a behavior called diel vertical migration), their horizontal position is primarily determined by currents in the body of water they inhabit. By definition, organisms classified as plankton are unable to resist ocean currents. This is in contrast to nekton organisms that can swim against the ambient flow of the water environment and control their position (e.g. squid, fish, and marine mammals). |

The key idea to understand that 401K is not designed to help people to fund their pensions. It was designed as a new tax on middle class by money-center banks, mutual and hedge funds. The rapacious removal of wealth from farmers and small communities by large money center banks is not something new in the USA history. It happened before.

for example this was also the case during the Gilded Age. And what was done for the last 25 years is nothing but a blatant attempt to restore worst excesses of Gilded Age under the cover of deregulation and using the smoke screen of neoclassical economics. Neoliberalism is many ways means the return to Gilded Age.

The problem here is that Wall Street proved to be extremely skillful in separating 401K investors and their money. This "rape" of 401K investors is underreported by MSM. Moreover, if you think about the real life purposes of financial intermediaries the purpose nothing but this centuries old trick. the role of fools here is assigned to 401K investors. Jeff Wenniger from Harris Private Bank says an army of baby-boomers have seen their old age plans shattered by the housing bust. Now they will have to spend less, and save more:

"Generational destruction of a society's balance sheet down not rectify itself in a matter of months".

In the current situation of financial instability it is probably wrong to look at the stocks as real capital. Stock markets are examples of fictitious capital like chips in casino (or fiat currency). They don't produce wealth themselves, but represent a claim on income produced by something else. However, they are bought and sold as if the former were the case. That means that gains can be made but only speculatively.

Just ask yourself, what is the social purpose of a casino ? Stock market social function is very close, although not identical. Now ask how casino attract its customers. It looks like in both cases the demand is based on a huge number of people each of which thinks he/she is above average.

This is not a new situation but just the number of 401K investors changed the rules of the game. Losers' money were always here for taking. And Wall Street never miss a chance to loot: retirement savings are being used to prop abusive short selling at major investment banks and hedge funds with tacit approval of major mutual funds that hold the 401K money. Short sellers and traders can make a killing while most people see their retirement accounts dwindling. Unfortunately we have "CNBC lobotomized population that doesn't question anything." 401K investors have to start questioning more and they'd better start by scrutinizing how 401K accounts are being managed and by informing themselves of what is really going on in financial markets. Otherwise your funds might be lost in the largest casino of Casino Capitalism: 401K casino.

The 401(k), as the plan is known, is literally a do-it-yourself retirement plan completely dependent on the vagaries of the (highly manipulated) market. The 401(k) plan places the responsibility and all risks of the market entirely on the worker. While today 401(k) is a household word, it is a relatively recent phenomena that corresponds to the rise of Reaganomics in the USA. It was nearly unknown 20 years ago. During the dot-com boom of the late 1990s the 401(k) was associated with the promise of easy wealth. William Wolman and Anne Colamosca, authors of The Great 401(k) Hoax, write,

“it appeared as a device that made it easy for the average worker to participate in the biggest boom in history. It seemed the 401(k) would be a perpetual wealth machine for each and every member of the great American middle class.”

With the rapid rise of high-tech stocks, many workers saw their contributions grow exponentially. And most of them were severely burned by subsequent bust. Then slow recovery happened in 2003-2007. Now we see a new bust that evaporated most gains and put more then a third of 401K owners who invested in stocks into situation when they lost 60-65% in comparison with people who from 1996 invested in stable value fund. But in reality this was a Ponzi scheme with tricks played by "too big too fail" banks over unsuspecting public. Some of those tricks were pretty dirty and directly affect investors who invest via mutual funds (Memories of Citi's Eurobond Price Manipulation):

Recall the case in the Euro bond market, wherein Citi came in and sold an enormous volume precipitously, running the stops and driving the price down sharply. The Citi trader came back in and covered his shorts, pocketing the difference in his market disruption based on size. This trading strategy was known as 'the Dr. Evil' trade. Citi Fined for Euro Bond Trades By British Regulator; Italy Indicts Citi Traders; Citi Haunted by Dr. Evil Trades in Europe;

I recall reading at the time how the Citi traders were incredulous at being outed by the regulators, because that is how they would do things in the States, running the stops and using outsized positions to perform short term price manipulation. In the states 'price management' has become quite notorious around key market events, such as option expiration. It is so prevalent that it has its own momentum among traders. The only time that it is remarked by the exchanges in the states, however, is when other prop trading desks are caught by it unawares and complain. The public is fair game.

Citi had quite a record of bad behavior around the world a few years ago ( Citi Never Sleeps ):

Money corrupts, and under-regulated banks that have the power to create money out of thin air can corrupt all that they touch: regulators, media, exchanges, economists, politicians.

Essentially there are two markets:

One market is for 401K investors were gains are non-existent and most participants are unable to beat inflation in 10 years period frame. For most investors 401K is just a tax on retirement earning.

The second is speculative market of hedge funds and major Wall Street firms that feeds on the first and use it for self-enrichment via huge bonuses (inflated by fraudulent, Enron-style accounting) and dubious operations. The latter include illegal naked short selling, high frequency trading, derivatives, stock manipulation, and the destruction of public companies. Here huge money are made by few well connected players like Goldman Sachs. See Deep Capture Blog

In reality workers were simply invited to spend in casino their retirement money: the long-term financial interests of workers became directly tied to the fortunes of Wall Street and they instantly became feeding ground for Wall Street sharks.

The US pension system is entirely inadequate. Social Security, which came into effect in 1935, provides to this day a very limited benefit that can prevent starving but not much more. It was never conceived as being more than a supplemental pension. Defined benefit pension plan were a very good development but even at its height, fixed pensions covered only a fraction of the workforce; mainly large manufacturing unionized industries such as auto and steel.The 401(k) became the new model for pensions during the 1970s recession. Faced with the economic downturn, major corporations, with the collaboration of the unions, began severing long-term commitments to their employees. According to the authors of The Great 401(k) Hoax, “It wasn’t the current cost of pension plans that most frightened corporate America. The real financial trauma was the implication of these obligations for the future of corporate balance sheets. Long-term pension liabilities were virtual black holes.” Here is one Amazon review of the book:

Sanjib DasA good perspective on the risks inherent in 401k plans,

July 13, 2005 By (Shelton, CT USA) - See all my reviewsThe authors set out to prove that 401k plans are inherently risky and in many cases inadequate to meet the retirement needs of people. They make their case by using historical analysis and they manage to do it well. They draw a parallel comparison between the politics, culture and economics of the 1920s and the 1990s. Just as the 1920s led to the Great Crash and the Depression, the new millennium looks ready for similar economic hardships. This can have a devastating effect on the retirement plans for most Americans.

Before 401(k) plans came into the picture, "defined pension plans" had become popular ( though not as popular as 401k was eventually to become). Those were the Golden years of the American economy (1945-1973). It represented a certain commitment by American companies to their workers. Most companies were doing well in those years and could guarantee the monthly pension checks to retirees.

As America suffered slow-growth years from 1973 to the mid 90s, the solution that emerged for improving corporate balance sheets was simple: Design a pension system that depended not on defined benefits for employees but on defined contributions made mainly by employees. As corporations were having more trouble making money, the 401(k) became the new model for pensions.

Various other factors contributed to Americans shifting more and more of their assets into stocks/Mutual funds/401k plans over the years:

- First is the Wall Street propaganda resulting from the massive drive to capture the public's resources. Andrew Smithers, the brilliant British financial analyst, once told the authors that he could make a lot of money by being a bull and being wrong than by being a bear and being right.

- Delusive academic research, demonstrating that stock investments, patiently made over the years, were a safe and superior source of investment. Professor Jeremy Siegel's book "Stocks for the Long Run" has been one of the most respected sources of delusion. To Siegel, the failure to grow rich is an individual's failure to save enough or to be patient, not of the way in which society as a totality works.

- The economic boom years from 1995-1999 provided much incentive and validated the Wall Street propaganda and the delusive academic research.

The authors discuss the various evils in the stock market, the current American economy and the 401k plan. They propose various reforms such as banning of company stock contributions, allowing employees to shift their funds at any time they want to, keeping transaction fees low and discouraging conflicts of interest between employees and their corporate employees.

Until new legislation arrives to fix our 401(k) plans, we are stuck with what exists. Investing in Inflation-indexed government bonds, though not frequently made available in 401(k) plans, come across as the best way to plan for retirement in the current situation.

This book is worth a read just to get a historical perspective of the US economy and of the retirements plans that existed through the times.

401K investors serve very similar to plankton role of feeding ground for Wall Street. That's why it is more correct to call them not investors, but donors: few 401K investors make any money after inflation. Most lose as they need to feed other financial animals higher in the food chain. Inability to move against the current in this context first of all means inability to determine real risk of investments and that fact that the types of funds 401K investor can invest in are fixed by often very unfair corporate 401K plans.

| The role of 401K investors is very similar to the role of plankton in the marine food chain. They serve mainly as a feeding ground for Wall Street whales. That's why it is more correct to call them not investors, but donors: very few 401K investors make any money after inflation. |

In general investment community looks a lot like a marine food chain. Complex and evolved creatures like whales are at the top of food chain and depends for their feeding on simple plankton directly or indirectly, eating fish that feed with plankton.

In the financial community, the plankton is some guy who buys the stocks or bonds for his 401K plan dreaming about it appreciation. And the guy who buys the house, dreaming about its appreciation. Both the buying operation itself and the ability to short or buy on margin and using derivatives are generally higher in the financial food chain. The problem is that like in many ecosystems plankton is became more and more scares: the USA does not manufacture many things, and the percentage of 401K investors with good paychecks have been shrinking. So Wall Street need to stimulate remaining plankton to spend more of a paycheck in order to survive. This is done usually via Ponzi schemes (and during any bubble stock market is nothing but a special case of a Ponzi scheme). Without Ponzi schemes and naive investors, they would starve.

There are several reason for this situation and one of them is the restructuring of the USA society that took place during the last 25 years (so called Reagan revolution).

Bushonomics is the continuous consolidation of money

and power into higher, tighter and righter hands

George Bush Sr, November 1992.

Neoliberalism (aka Casino capitalism aka Reaganomics) is new economic reality, a new economic system into which capitalism transformed itself at the and of XX century. And the essence (as in above definition of Bushomonics) is the consolidation of money and power to the top 1% or even 0.01%. Our new lords are not that different from feudal aristocracy, may be only less educated, more prone to avoid military service and much more greedy.

under neoliberalims FIRE (finance, insurance and real estate) sector became dominant (which happened around the world around mid 90th, but to greater extent in the USA then elsewhere).

Ideology of neoliberalism is "market fundamentalism" was and still is a powerful political movement which came to the front stage in early 80th and was not that different from the religious fundamentalism:

Market Fundamentalism is the exaggerated faith that when markets are left to operate on their own, they can solve all economic and social problems. Market Fundamentalism has dominated public policy debates in the United States since the 1980's, serving to justify huge Federal tax cuts, dramatic reductions in government regulatory activity, and continued efforts to downsize the government’s civilian programs.

Five centuries ago, Niccolo Machiavelli explained how to undertake a revolution from above without most people even noticing. In his Discourses on Livy, he wrote that one

"must at least retain the semblance of the old forms; so that it may seem to the people that there has been no change in the institutions, even though in fact they are entirely different from the old ones."

Reagan followed Machiavelli's advice very closely. Actually Reagan himself used the word "Reaganomics". In a July 10, 1987 White House Briefing for Members of the Deficit Reduction Coalition, he said,

"America astonished the world. Chicago school economics, supply-side economics, call it what you will — I noticed that it was even known as Reaganomics at one point until it started working — all of it is fast becoming orthodoxy. It’s not just that Milton Friedman or Friedrich von Hayek or George Stigler have won Nobel Prizes; other younger names, unheard of a few years ago, are now also celebrated."

Neoliberalism was reaction to stagnation of manufacturing in late 70th and try to overcome it using complete "financization of the economy": freeing investment banks from all previous restrictions and constrains imposed by New Deal as well as repealing of key legislation from this era. In a way adoption conversion of the USA into neoliberal model meant that Great Depression was wiped out from the country institutional memory and new players were eager to repeat the early XX century mistakes on a new technological level. It was, in essence, commitment of the US government to give FIRE industry green light and abolish all speed limits as well as wiping out capital intensive manufacturing industry in the US as part of a drive to increase short-term profit opportunities in the financial sector. Conversion of the USA into new Switzerland so to speak...

Neoliberalism got tremendous short in the arm by the dissolution of the USSR which gave US economics a half billion of new customers, huge region to dollarize and buy assets for pennies on a dollar and ensured prosperity of 1994-2000.

Gradually via "Quiet coup" financial sector became top political power at Washington, DC making the process irreversible. Like senator Durbin explained:

And the banks -- hard to believe in a time when we're facing a banking crisis that many of the banks created -- are still the most powerful lobby on Capitol Hill. And they frankly own the place," he said on WJJG 1530 AM's "Mornings with Ray Hanania.

For example Gramm-Leach-Bliley which legitimized credit default swap, along with the repeal of Glass-Steagall (with no enforcement or oversight of the newly liberated “Financial Services”), led directly to the problems we are experiencing today.

The important part of neoliberalism is a "counter-revolution" of the old elite. And that means return to Feudalism with its top 1% and the decimating the middle class which enjoyed unheard of prosperity during a half of the century (1945-1995)l. Neoliberalism in general is characterized by political dominance of FIRE industries (finance, insurance, and real estate) as well as tremendous growth of inequality. In the latter sense it is similar to Guided Age. In Martin Wolf's words its defining feature is "the triumph of the trader in assets over the long-term producer" It was serviced by pseudo scientific theories of Milton Freedman and supply side economics (Economic Lysenkoism). As one comment for Krugman article Was the Great Depression a monetary phenomenon stated:

Market fundamentalism (neoclassical counter-revolution — to be more academic) was more of a political construct than based on sound economic theory. However, it would take a while before its toxic legacy is purged from the economics departments. Indeed, in some universities this might never happen.Actually, this is more like religious doctrine than political philosophy — and that could be a bigger problem.

Minsky defined three stages of Casino Capitalism, each of increasing fragility:

Essentially Bushonomics is the Ponzi finance stage of Casino Capitalism. One out of many definitions of Ponzi Scheme is: transfer liabilities to unwilling others. And the name casino capitalism suggest that they are playing with your money, including your 401K money

| We are living at the Ponzi finance stage of Casino Capitalism. And the name casino capitalism suggests that they are playing with your money, including your 401K money... |

There were derivatives exploding all over the world and the rating agencies basically admitted that they didn't understand the structuring of these new products, but it would be a mistake to not capture some of the market action and earn some bucks. Not only the rating agencies and government regulators (and first of all Greenspan's Fed and SEC) were totally unaware of what was going on, They wanted to be unaware.

Criminal negligence of regulators was connected with the "free market fundamentalism", the political agenda of The Bush Ownership Society, based on total lack of regulation and accountability. Similar to Great Depression this is unfolding as " The Perfect Storm!". Too many people at high positions got greedy (aka demonstrated high tolerance for risk), and this resulted in massive bad investments and the United States and Europe. As a result most major banks are now massively in debt and barely able to meet the interest payments. As one commenter to the Naked capitalism post Why the Failure to Understand the Global Financial System noted:

- Anonymous said...

- hahaha, they understand it Yves. They really get it. But you have to understand, the whole point of government is to protect corporations and banks.

The vast majority of people just provide cheap labor. Obama and Co are pretty smart people but they protect the interests of the elite first.

Everyone knows there was massive fraud and greed going on, but no one is going to do a thing. A few fish here and there will get fried but otherwise same old, same old.

It is the Bushonomics that brought the USA to the point of near bankruptcy. This implementation of this radical economic ideology by the Fed (led by Greenspan), U.S. Treasury (led by Rubin) and major regulating agencies (SEC, etc) created a threat (and eventually damage) to the country in comparison with which most acts of radical Islam in terms of economic damage to the USA look like teenagers pranks. I am not sure if many people fully understand the real level of risk they of “structured finance”.

The major players in implementing Bushonomics were Greenspan, Rubin, Gramm along with three last presidents (Bush I, Clinton and Bush II). The key was complete deregulation of financial sector along with reckless monetary policy. As for deregulation, if we compare national banking system with the national transportation network it was much like moving state police from patrolling highways to patrolling just areas in front of Dunkin’ Donuts ;-). At the beginning there were two important events that shaped subsequent development of Bushonomics which are important for 401K investors to understand:

Move to electronic clearing:

The interesting thing is that if we look at the original movement to electronic clearing, we can see that due to physical constraints paper certificates were indeed a drag on operations. Nobody who has been around markets for 30-40 years would argue otherwise. The problem was that the masses could not implement electronic clearing in the 70’s and early 80’s. Only big institutions could afford the computers and programmers at the time (the PC was still just a glimmer). The “bridge” solution was to allow the big brokers to implement electronic clearing and to invite the masses to participate by holding securities in “street name”. The security’s owner was Cede & Co. (DTCC nominee name). Under existing law the DTCC became the legal owner of the security. You, the one who ponied up the money, are the “beneficial owner”. This is why there is no direct correspondence between you and the issuer of the security you ‘bought’. The correspondence is all via proxy (usually your broker). With both electronic and paper clearing coexisting side by side, there was always room for discrepancies to crop up and literally no way to systematically verify the source of the discrepancies. In short, the system greatly increased efficiencies and it was recognized that these discrepancies were the ‘cost’ of progress.

However, the ‘brilliant’ minds at the investment banks soon realized that these “street name” securities could be manipulated to their benefit. In fact, these securities can be counted as the investment bank’s own collateral! When you pony up your money you are effectively giving the broker free money (actually they have the gall to charge you for the money you give to them). Due to the way the system works coupled with direct broker to broker transactions, the DTCC can never be sure that what its records have agree with what actually is occurring (the DTCC’s records are supposed to reflect reality, but there are too many holes and discrepancies for it to actually attain that goal). The end result is that the investment banks have had access to free capital via the ’system’. This was akin to the fractional reserve scheme granted the C-banks! Only better!

Establishing 401K plan which provided huge pool of "street name" securities for investment banks to play with