|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

Science, PseudoScience and Society > Insufficient Retirement Funds Problem > Financial Humor > Financial Humor Bulletin, 2010

| News | Cruise to Frugality Island | Casino Capitalism Dictionary | Famous quotes of John Kenneth Galbraith | Lord Keynes | The Roads We Take | Humor | Quotes | Etc |

| 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 |

Due to the size financial skeptic dictionary is now converted to a separate page

|

|

Switchboard | ||||

| Latest | |||||

| Past week | |||||

| Past month | |||||

| Jan | Feb | Mar | Apr | May | June | July | Aug | Sep | Oct | Nov | Dec |

Dec 31, 2010 | Bloomberg

One can only imagine what sort of pledges people like President Barack Obama and Federal Reserve Chairman Ben Bernanke make for the 2011.

Heck, why imagine? Let's write their New Year's resolutions for them.

- President Obama promises his base he will attend a weekly meeting of Tax Cutters Anonymous. He promises the business community to find another scapegoat when he wants to rally support for pet legislation. He promises labor unions it won't be them.

- The Securities and Exchange Commission pledges to find someone, somewhere who is responsible for some kind of wrongdoing and actually do something about it.

- Lloyd Blankfein, chairman and chief executive officer of Goldman Sachs Group Inc., resolves to perfect his Wallace Shawn imitation so that the next time he's called to testify before Congress, the audience will take him seriously.

- Ben Bernanke promises to cut up his U.S.A. credit card, explain why the Q is irrelevant in quantitative easing and recognize that only death and taxes are 100 percent certain. Bernanke resolves to try again to convince the public that lax regulation, not low interest rates, bear primary responsibility for the housing bubble. Good luck.

- >Treasury Secretary Tim Geithner resolves to leave public service for Goldman Sachs so that reality can finally catch up with public perception.

- Julian Assange, self-described Internet activist and founder of WikiLeaks, pledges to continue his crusade of releasing classified government information. All he asks in return is that the media respect his privacy.

- Sarah Palin, former governor of Alaska and Republican phenom, pledges to sign on as an unofficial adviser to Fed chief Bernanke as soon as she finishes digesting the 800-odd pages (paperback edition) of Milton Friedman and Anna Schwartz's, "A Monetary History of the United States."

- Larry Summers, Obama's top economic adviser who is leaving Washington (again) to return to Harvard (again), pledges to patent his unique brand of intelligence. He further promises to introduce a new seminar at Harvard's Kennedy School to train tomorrow's leaders in today's survival arts. According to the Spring 2011 course catalogue, students "will learn the skills needed to become a bipartisan leader, defined as one who is demonized by both the Left and the Right." Registration is limited to 10 students.

- Bill Dudley, president of the New York Fed, resolves to explain how it is the Fed can target inflation to the nearest 0.5 percentage point when it missed the mother of all housing and credit bubbles and failed to foresee the repercussions, even as the bubble was deflating, for the U.S. and global economy.

- Wall Street bankers promise to underwrite monthly seminars for employees and spouses/significant others on "Business Ethics for the 21st Century." The three-day, New Year's weekend seminar at the Ritz-Carlton, Laguna Niguel, is oversubscribed, but there are still openings for February's retreat to Honolulu's Halekulani Hotel on Waikiki Beach.

As for yours truly, I pledge not to pick on Alan Greenspan (OK, so another New Year's resolution doesn't make it past Jan. 1), to bring you clear, insightful commentary, to shrug off the hate mail and name-calling as your problem, not mine (at least I'll try), and to keep telling it like it is to the best of my ability.

(Caroline Baum, author of "Just What I Said," is a Bloomberg News columnist. The opinions expressed are her own.)

December 27, 2010 | nakedcapitalism.com

Psychoanalystus:

I hereby predict:

1. DOW 20,000. Bullish!

2. More Wall Street bonuses. Very bullish!

3. More tax cuts. Highly bullish!

4. More bailouts. Extremely bullish!

Psychoanalystus

William Easterly:

Once upon a Professor: the Christmas Debate Story, by William Easterly: Once upon a time, four Professors met to agree upon a Christmas Gift Policy. 'Twas fortunate for the world that they met thus, for they were the world's foremost Gift Experts.

Professor A said he already knew what everybody wanted, and wanted to massively increase financing for the International Fund for Christmas and Development, which will come up with a comprehensive plan for all the complementary technical inputs to deliver the correct gifts to all individuals.

Professor B was worried about the lack of child security inside homes, and wanted a G8 rapid response force to intervene and take custody of the children, after which their needs for Christmas gifts will be identified and met.

Professor C called for a randomized trial of the leading 3 types of Christmas gifts, relative to a control group who received no gifts. The results will not be available in time for December 25, so Christmas should be postponed until the results are published in a peer-reviewed journal.

Professor D said that Christmas gifts never gave people what they really wanted, money spent on Christmas gifts was always one hundred percent wasted, and each person should just buy their own Christmas gift for themselves.

The Professors' fierce debate went on and on, deep into the wintry night, whilst the fire burned low.

Meanwhile, unaware of the debate, individuals around the world went ahead and bought gifts for their loved ones based on nothing other than emotions and guesswork.

And everyone was happy, except perhaps the four Professors.

Merry Christmas!

December 16, 2010 | BREAKFAST WITH DAVE

Ben Bernanke back on October 31, 2007 (when the housing and subprime crisis were going to be "contained" - remember that one?):

"It is not the responsibility of the Federal Reserve - nor would it be appropriate - to protect lenders and investors from the consequences of their financial decisions."

Well, well, well. This is about as consistent as the current Republican Party being the protector of the public purse.

December 22, 2010 | The Big Picture

NEW YORK (Big Picture Exclusive) – Gargantuan money manager Blackrock reported on Friday that assets in U.S.-listed exchange-traded funds and exchange-traded products have surpassed the $1 trillion milestone for the first time. Combined assets in U.S.-listed ETFs and ETPs reached $1.027 trillion late Thursday, BlackRock said. That includes 894 ETFs with assets of $887.2 billion from 28 providers on two exchanges and 185 ETPs with assets of $115.5 billion from 20 providers on one exchange, it said.

There is growing speculation surrounding what is believed to be the next breakthrough product in the ETF marketplace: Single stock tracking ETFs. Unlike their index-based cousins, these new single stock trackers would, as the name implies, track only a single stock, trade at exactly the same price as the stock to which they're linked and consequently eliminate the need for single stock ownership. A top executive with a money management firm who is familiar with his company's plans to launch such a product and was granted anonymity so he could speak freely, put it this way: "Think about the prospect of, say, a GE tracking ETF - an investor could capture over 99% of the movement of GE while simultaneously forfeiting any claim to a dividend and paying us up to 35 basis points to manage the ETF. What's not to like? We think this product paves the way for the ETF marketplace to collect its next trillion in assets."

Project Syndicate

Oscar Wilde said that experience is the name we give to our mistakes.

Experience, it turns out, is not just the name we give to our mistakes. As the financial crisis has shown, it is also the process that enables us to increase our understanding and ultimately to envisage a new world.Unfortunately, however, this process has not gone far enough, enabling many banks, governments, and international institutions to return to "business as usual."

Indeed, today the global economy's arsonists have become prosecutors, and accuse the fire fighters of having provoked flooding.

... ... ...

Dec 21, 2010 | zero hedge

Drag Racer:

people who see the rise in treasury yields as a sign the Fed's purchases were not having the desired effect should look at other measures...

WTF, translated: we blatantly fucked up so don't look

zero hedge

Ben Bernanke is a highly educated PhD from Princeton who has never worked a day in the real world since he graduated from college in 1975. His entire life has been spent in the ivory tower of academia surrounded by models and theories that work perfectly in the comfort of his office. After building his reputation as an "expert" on the Great Depression by studying it and reaching the wrong conclusions,

... ... ...

zero hedge

Translational Lift:

"the teleprompter in chief is expected to announce cuts in Social Security"

Bahamas:

Webster Tarpley called Obama "the ventriloquist dummy", Mattias Chang named him "the mouthpiece", some other name I read was "the hologram", but I think the "teleprompter in chief" is the best nick name so far!

daveeemc2:

http://www.youtube.com/watch?v=sJeFrqBJF6E

Ole George was ahead of his time....n-joy!

Djirk:

That job sucks, he is ready to go, write a couple books, cash out and run a foundation funded by all those he made boatloads for. In and out done!

breezer1:

there is no president. just competing crime gangs.

Bob :

Barry is just pulling a Liebermann...

Bob:

What failed Bankster scams? Try looking through the eyes of a banker for a change. I see nothing but exquisite success. Victory.

Mission Accomplished.

Good thing they groomed Barry for his Great Rendezvous with Destiny. Bush and Cheney could never have pulled this off.

NPR

Federal Reserve Chairman Ben Bernanke is so busted.

Comedy Central host Jon Stewart added his voice to others who caught the central banker contradicting himself over whether or not the Fed is "printing money" through its actions to bolster the economy.

On 60 Minutes this week, when asked by reporter Scott Pelley about the Fed's $600 billion purchase of Treasury bonds that is meant to lower interest rates further, the Fed chair said:

The Daily Show With Jon Stewart Mon - Thurs 11p / 10c The Big Bank Theory www.thedailyshow.com

Daily Show Full Episodes Political Humor The Daily Show on Facebook Twenty-one months earlier on the same program and to the same reporter, Bernanke said something quite different:BERNANKE: Well, this fear of inflation, I think is way overstated. We've looked at it very, very carefully. We've analyzed it every which way. One myth that's out there is that what we're doing is printing money. We're not printing money. The amount of currency in circulation is not changing. The money supply is not changing in any significant way

Asked if it's tax money the Fed is spending, Bernanke said, "It's not tax money. The banks have accounts with the Fed, much the same way that you have an account in a commercial bank. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It's much more akin to printing money than it is to borrowing."

"You've been printing money?" Pelley asked.

"Well, effectively," Bernanke said. "And we need to do that, because our economy is very weak and inflation is very low. When the economy begins to recover, that will be the time that we need to unwind those programs, raise interest rates, reduce the money supply, and make sure that we have a recovery that does not involve inflation."

It appears Bernanke won't have to look far to figure out how this myth got legs

12/12/2010 | zerohedge.com

One of the sad side-effects of taking away investment risk, as Ben Bernanke has done with his "global put" doctrine, is that the old maxim of the market staying irrational far longer than anyone can possible imagine, can now be exponented to some irrational infinite number (to throw some wacky number theory into the equation). Whether Bernanke can also succeed in defying nature and mathematics in broad terms remains to be seen: we have yet to see a system that can diverge from equilibrium in perpetuity without some very unfortunate unanticipated side-effects somewhere.

MR. GLASS:

"As long as the music is playing, you've got to get up and dance,. . .We're still dancing." - Chucky Prince

Chartist :

There seems to be a contradiction here. How can money continually be pulled out of funds by retail investors (read dumb money) yet the current environment indicates so-called dumb money shows highest confidence level in last fiver years.

I need more cowbell

something fishy:Excellent comment, made me think. I think J6P is out and on the sidelines pretty much for good, so the dumb money has to be the remaining few, who are traders anyway and not buy and hold mutual fund owners.

How does this mesh with the continuing retail outflows from equities? Also, it looks like the 'smart money' was way too bullish throughout 2008, more so than retail. It seems like 'smart money' isn't that smart after all. My take for what it's worth.

dealbook.nytimes.com

- Oh my, Justice! And the Goldman billionaires stay free to steal another day...

- Micro crime - Programmer at Goldman Sachs. Macro crime - Goldman Sachs with Tax payers.

- Justice has been served. Jail the thief who steals from Wall Street crooks.

- I feel safer at night and my little girl will grow up in country where Goldman's source code is protected. Next up, knock-off merchants in Chinatown to face prosecution for intellectual property violations

- Capitalism this ain't. Corporatism looks more and more like a kind of rigged State Capitalism... which, shock horror is Communism.

Mish's Global Economic Trend Analysis

On Mr. Bernanke: "There is something fishy about the head of the world's most powerful government bureaucracy, one that is involved in a full-time counterfeiting operation to sustain monopolistic financial cartels, and the world's most powerful central planner, who sets the price of money worldwide, proclaiming the glories of capitalism."

In today's NYT comes this sign of speculative excess in China: Day Trading Still Alive, Outsourced to China:

By some industry estimates, as many as 10,000 people in China are doing speculative day trading of American stocks - mostly aggressive young men working the wee hours here, from 9:30 p.m. to 4 a.m., often trading tens of thousands of shares a day.

Hire a bunch of Chinese college kids, fund them and to teach them to day trade American stocks? Sounds like a terrific business plan!

constantnormal:

I suspect that in the short term, this will give TA much higher accuracy, as the fraction of the traders (and some of the algorithms) believing in them as Laws of Nature swings to a distinct majority.

Like an increasingly large number of soldiers marching over a bridge in lock-step, the resonant trading actions will eventually collapse the markets.

As Mark Twain would have said, "It's a difference of opinion that makes for markets".

100 days in the top 100 Decision Points by George W. Bush4.2 out of 5 stars

(386) | 106 customer discussions

In StockList Price: $35.00

Price: $18.89

You Save: $16.11 (46%)

95 used & new from $17.69

Minyanville.com

The Daily Show With Jon Stewart Mon - Thurs 11p / 10c Supercuts www.thedailyshow.com

Daily Show Full Episodes Political Humor The Daily Show on Facebook

www.thedailyshow.com

The Daily Show With Jon Stewart

Daily Show Full Episodes Political Humor The Daily Show on Facebook

12/20/06 | larryflynt.com

It's been said that the U.S. Senate is where good men go to die. That certainly seems to be the case with Barack Obama, the junior senator from Illinois, whose Progressive credentials are DOA.

On Kudlow/CNBC this afternoon I actually heard a guest say, "Trickle down works."

"I'm confident," Mr. Obama said, "that as we make tough choices about bringing our deficit down, as I engage in a conversation with the American people about the hard choices we're going to have to make to secure our future and our children's future and our grandchildren's future, it will become apparent that we cannot afford to extend those tax cuts any longer."

The package would cost about $900 billion over the next two years, to be financed entirely by adding to the national debt, at a time when both parties are professing a desire to begin addressing the nation's long-term fiscal imbalances.

Anonymous Bosch:

Outsider wrote:

This is a cheap shot, but has Obama bothered to change his party affiliation yet?

Why? There is only The Party. .

I prefer to cut out the middle man by shouting into a paper bag and then crumpling it up. :-)

splat :

Hmm.. makes me wonder if a good investment would be in gated communities, with armed security.

mp:

longtimelurker wrote:

Obama has so alienated his base that even a mediocre candidate stands a chance of beating him.

Sar-ah! Sar-ah!

mp:

barfly wrote:

believe me, my faith is wavering tonight

I'm not trying to piss you off, but I advise against relying on faith.

zero hedge

By now, everyone has heard accusations that Cash4Gold is nothing but a predatory site, seeking to "steal" the gold of people in distress for a painfully low price. Often times these stories involve Glenn Beck in some capacity. Of course, there is always "the other side" to every story. Below we provide just one such "other" side. It just so happens that the side is about as funny as it gets.

gwar5:

Cash4Gold: "Your request for an 'Ungreased, backdoor, hammertime lovemaking session with our telemarketers Carol and Tracy' is both feral and preposterous"

"Painted gold rocks from spiritual journey in Tibet with a quadraplegic hooker picked up in Singapore."

That is just hysterical! Thanks mucho.

Mish's Global Economic Trend Analysis

- This ought to be fun: US Rep Ron Paul (R-Texas), long-time opponent of the Federal Reserve, will enjoy an anti-Fed platform as chair of the House Financial Services Committee.

- Try not to laugh: Obama tells Republicans he should have worked more with them.

Ironic quote of the day, from Kazakhstan, via Wikileaks:The Ambassador asked if the corruption and infighting are worse now than before in Kazakhstan. Idenov paused, thought, and then replied,

"No, not really. It's business as usual. They're confused by the corrupt excesses of capitalism. "If Goldman Sachs executives can make $50 million a year and then run America's economy in Washington, what's so different about what we do?' they ask."

NetworkGOD:

Everyone on Wall Street is a lying, stealing worthless piece of scum on the bottom feeders of the world. They all should be shot, hung, drawn and quatered.

November 29, 2010 | Financial Armageddon

Real Deal:

The Fed printed $600 billion and gave it to the Treasury. 'Spend it boy, spend it all." Helicopter Ben told Skinny Timmy.

Timmy complied and pump the whole shipload of free cash out. Black Friday became an astonishing success.

Isn't economics great, especially free-capitalism?

zero hedge

Unclear if Ben Bernanke will follow suit in the same Sex Crime category for repeated involuntary fornication with the world's middle class.

November 30, 2010

Can you really embarrass any of these banks? ...

Unless they have 5GB of video showing their CEOs engaging in bestiality, its hard to imagine Wikileaks embarrassing the big banks.

call me ahab:

"What else can you release to embarrass them . . .Unless they have 5GB of video showing their CEOs engaging in bestiality"

the bankers could just point to the fact that the sheep bend over gladly time and again (and therefore not the banker's fault) but the sheep's

hammerandtong2001:

Goldman, YES! Exactly.

Expat:

The man is a terrorist. Bank of America is a fine, upstanding financial institution which has participated in and assisted the growth of our great country. It is inconceivable that any bank with "America" in its name could be anything but a paragon of virtue and an asset to our great nation.

Darkness:

I am shocked, shocked to discover there is fraud going on in this establishment.

Calvin Jones and the 13th Apostle:

Darkness: Casablanca was on TCM last night. ;-)

zero hedge

The good news: insider sales of S&P stocks were only 218 times greater than insider purchases. This is a notable improvement from last week's nearly 9,000x ratio.

The bad news: the ratio was skewed by what is probably the biggest insider purchase in the past 6 months: someone bought 542,198 shares of Citi at $4.30 (hopefully not a short cover).

One of the most famous Nietzsche criticism of Christianity was related to the quote: "For me to believe in their redeemer, they'd have to look more redeemed". Which means who that actually believe should feel absolute bliss as they floated through life toward this wonderful heaven...

Yet they're always so greedy and discontented. So religion seems fails even at providing psychological relief.

Alpha Magazine reports the compensation for hedge fund managers each year. The top earner for 2006 received $1.7 billion, the second highest received $1.4 billion, and the third $1.3 billion. That adds to $4.4 billion for three people.

The top 25 hedge managers received, on average, $570 million for a total of $14.25 billion.

To put it in Nietzschean terms, neoliberalism seeks the total triumph of a particularly aggressive version of slave morality and mentality.

WashPost

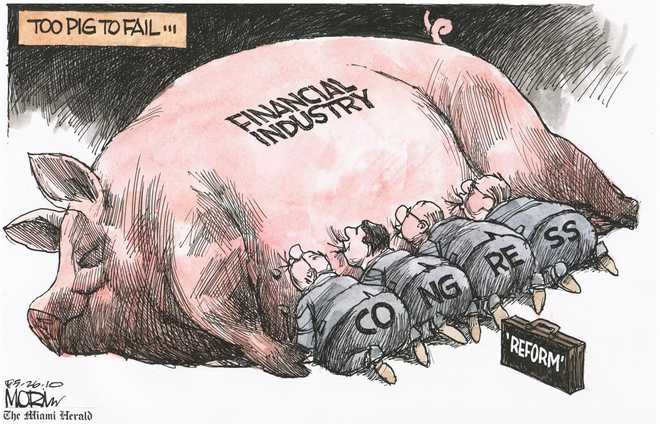

btg

No - the cartoon is wrong - the functions of the other half of the body (including all the messy waste products) are still needed, but was outsourced to China.

"Epipihanies don't grow on trees, at least not on buttonwood trees. Which explains, we suppose, why, while mulling the unpredictability of the market from one day to the next, we were totally unprepared for the extraordinary flash of insight when, out of the blue, it struck us: The fault lies not in ourselves but in the quixotic nature of the market gods. Like those worshiped by the ancient Romans, they can be sadistic, mean and cruel to us, mere mortals, and then, in a wink, turn into kind, compassionate and just plain nice deities.

And so it was last week. On the eve of Thanksgiving (no accident that), they discarded their loathsome personas, donned a few days earlier when they gave the markets a ferocious pasting, and conspired to provide balm for the bruised investor. Wise in the ways of everything, they decided that what could most effectively change the investing mood from sad to glad was to whistle up a wall of worry".

Let's try some perspective on that "free market", eh?

- Gross Folly #1: How come the eurozone's financial center is... London?!! What this means in practical terms is that a scrum of bottom-line-is-everything bonus-hungry twenty-somethings hardly out of school are running the show. And to top it off, they and their country (the U.K.) are not even members of the eurozone. They don't use it, they don't believe in it and, if anything, they hate its guts. Literally. This like trusting a bunch of juvenile delinquents who amuse themselves with setting cats on fire to run the pet shelter.

- ... ... ...

- Gross Folly #3: We have allowed huge amounts of public and private pension monies to be managed by "alternative-investment" firms, e.g. hedge funds who are compensated on the outrageous 2/20 schedule. (The US Social Security is still OK, as it can only invest in Treasurys, but it came close to succumbing a few years ago.) This is like giving a bunch of convicted arsonists a tank-farm full of gasoline, asking them to put it to profitable use.

The title refers to an ancient story (which the author finds is probably at least 100 years old by now) about a visitor to New York who admired the yachts that the bankers and brokers had in the harbor. Naively, he then asked where the customers' yachts were. Naturally, there were no customers' yachts....The author's favorite review of the book contained this phrase, "If I were J.P. Morgan, and I have no reason to suspect that I am not . . . .", and was signed by the author of the review, Mr. Frank Sullivan.

...The chief concern of this book", he states, "will be with an examination of the nonsense ... ." One example is this excerpt from a paragraph he takes out of The Wall Street Journal:

"the action of the market was regarded as in the nature of a technical recovery, with little thought of the imminence of dynamic action."

Nonsense was apparently well articulated before the bull market of the `90s. Another example is his explanation of why people buy high and sell low when they go to the stock market. They mistakenly believe that once prices are rising (or falling), they'll continue to rise (or fall). "But it is not a fair thing to say of the stock market," he claims, "which, not being a physical thing, is not subject to Newton's laws of propulsion or inertia."

November 26, 2010 | naked capitalism

Don:

I have wanted just one time during any of the hearings to see anyone ask Hank Paulson just one question: Sir, while you were CEO of Goldman Sachs in 2006, did you know how your company was making money?

November 24, 2010

REG: All right, but apart from the sanitation, the medicine, education, wine, public order, irrigation, roads, a fresh water system, and public health, what have the Romans ever done for us?

XERXES: Brought peace.

REG: Oh. Peace? Shut up!

- Monty Python's Life of Brian

Paul Krugman making the case for currency devaluation. All that's missing is the classic Monty Python quote above.

November 23, 2010 | paul.kedrosky.com

Just when you think the financial services industry has gone entirely rogue and needs to be eradicated, it goes a little rogue-er:

Facebook Inc.'s soaring valuation is spurring shareholders to slice and dice their stock, giving investors everywhere from Silicon Valley to Wall Street a chance to bet on the company.

EB Exchange Funds LLC, based in San Francisco, as well as New York firms Felix Investments LLC and GreenCrest Capital LLC, have opened Facebook funds for investors looking to get a piece of the social-networking company and its half-billion users.

By creating derivatives of the stock, the investment firms are helping Facebook keep its shareholder count at 499 or less, the maximum number a company can have before it has to disclose results to the public. They're also potentially creating a new class of assets for investors, letting them tap fast-growing private companies like Twitter Inc., Zynga Game Network Inc. and LinkedIn Corp. -- all valued in the billions of dollars.

Unbelievable, dangerous, greed-headed and yet another example of the craven idiocy of what passes for regulatory oversight in this country.

More here.

What is Mr. Bernanke doing with QE2 (quantitative easing part two)? By his own admission, he is unleashing a flood of money into the system in order to forestall deflation. And how is more (fiat) money going to help the so-called "real economy"? Again by his own admission, by pumping up asset prices (i.e. stocks), creating a wealth effect and thus giving birth to a virtuous cycle of confidence, consumption and investment.Here's an excerpt from the link above, an op-ed Mr. Bernanke wrote for the Washington Post a few days ago.

"And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion."That's an astonishing statement of intent, coming as it does from the Federal Reserve, but let's accept it at face value (but, really, could you ever imagine that a head of the nation's central bank would act as a stock jobber for the S&P 500?).Still, is Mr. Bernanke's asset-bubble strategy any different from what Mr. Greenspan did following the dotcom whump-and-dump of 2000-02? Oh, not really - except that Uncle Alan chose housing and crappy mortgages, while Brother Ben's choices are shares and Treasurys.

The Big Picture

karen

Yes, in our mark to make believe world, where debt is monetized, unemployment is conservatively +10% but you can live rent free and die before paying off your maxed out dozen or so credit cards, I guess the recession really is over.

...since the holiday season is about to kick off, for the hedgie on your list, the Brooks Brothers Wired collection is certain to be all the range amongst the 2 and 20 crowd. (Credit: Josh Brown )

Honey we need to talk about your dual mandate ...

The above is in response to the dual mandate of the Fed to produce price stability and maximum employment. The Fed has failed at both.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Congressional Members' Personal Wealth Expands While National Economy Sours

The Baseline Scenario

Shrub already handed them out to all his war + torture buddies, as well as Greenspan – and Daddy Shrub gave one to the teabaggers' favorite faux-economist (Hayek) and to Darth Cheney, so I'd say the reputation of the medal is pretty much already in the sewer.

We have Wall Street oligarchs instead of party-state magnates, Bubbleklatura instead of a nomenklatura, Goldman Sachs instead of a Politburo, Fox News instead of Pravda, a trillion dollar military we don't need and can't afford versus a hundred billion dollar military they didn't need and couldn't afford, and an insane failed colonial war on Afghanistan instead of their insane failed colonial war on Afghanistan.

Quantum Nucleonics:

...the BAB's are gone. The chances that they get renewed are about the same as Obama and Palin running in 2012 as the national unity ticket.

CalculatedRisk

Rob Dawg:

Rajesh wrote:

Let's see, lead by communists, lead by communists, lead by communists. Not much choice there.

You misspelled oligarchs.

Byzantine_Ruins:

Outsider wrote:

Is the bottom 98% going to continue to just roll over and play dead while they are being trampled by the 2% who have all the assets?

How long can they convince themselves that the person with $10 is robbing them when they have $20 and the leader has $20,000,000?

History suggests it can be a LONG time. Your identity lies where you perceive to to, not where your actual economic interests lie. People want to be part of the Establishment, the Ruling Class, the Upper Crust, the Aflluent Up-And-Comers. .

Byzantine_Ruins:

mp wrote:

I never thought I'd see the day Republicans supported China's Politburo in the interest of ensuring that Obama is a one-term president.

Never underestimate the ability of a political faction to play against the interests of the polity for short term gain. Ultimately, faction leaders take the majority of the spoils and this shapes faction policies. It helped the British Empire immensely. .

Vonbek777:

Juvenal Delinquent wrote:

What is Glenn Beck economics?

Primarily composed of onions, bright lights, and lots of crocodile tears? .

Byzantine_Ruins:

Unfortunately the "we" is not the Commetariat or we could detail a working group, get down to the serious red-faced screaming, execute or exile a few people and get moving forward. "We" is the American electorate, and the capacity for self-deception there is endless.

naked capitalism

"Fox is a non-reality based belief system"

Uh, no

The only way the poor can survive is by day trading?billb

"Why wasn't a financial transaction tax part of the Bowles-Simpson deficit reduction proposal?"Perhaps because Erkine Bowles is paid $335,000 a year by Morgan Stanley?

If you think you are disappointed in this "reformer" the next one will probably make you want to take the gas pipe.

Nov 13, 2010 | zero hedge

chopper read:the music has stopped. have you got your chair (and popcorn)?Dollar Bill Hiccup:

The Bernank will save us all. I'm going online to buy 5 iPhones, just so I can leave them in different pockets and such. If I default on my Mortgage that is note-less I can stay in my house and save on those pesky and stressful mortgage payments.

I just drank a liter of Coke for breakfast. My diabetic onset will be cured and paid for by the government as well it should be since the government devised corn as industrial agriculture's kernel. Nothing like high fructose corn syrup in the morning, it smells like victory. Insulin shock is providing me with wonderful poetic insights though I'm about to pass out.

No worries, the cafeine will be kicking in shortly. Just in time for the shopping channel to come on again. October retail sales are better ...

November 13, 2010 | naked capitalism

F. Beard:

It's the principle of not ever cutting the principal that is the principle reason the banks won't cut the principal.

Oliver South:

Extend and Pretend is a lot of fun, once you get the hang of it and abandon your reservations as to the moral of it all.

Financial Armageddon

Amid the economic wreckage that surrounds us, sometimes all you can do is laugh. In fact, I was nearly crying with laughter while watching "Quantitative Easing Explained," a devastating (but very funny) YouTube video cartoon smackdown of the Federal Reserve and its dangerously misguided efforts to get the economy moving again. Here are two brief snippets:

Woman: So, why do they call it the "quantitative easing"? Why don't they just call it printing money?

Man: Because the printing money is the last refuge of failed economic empires and banana republics, and the Fed doesn't want to admit this is their only idea.... ... ...

Woman: Who put the Ben Bernanke in charge?

Man: The Ben Bernanke was first appointed by the President Bush, then he was reappointed by the President Obama.

Woman: But wasn't the President Obama supposed to bring the change?

Man: Yes.

Woman: How has putting in charge the same fool who has been wrong about everything "the change"?

Man: Well, under the President Bush, the Ben Bernanke only blew up the American economy. Under the President Obama, he is working on blowing up the entire global economy.

Woman: That does not sound like the change we can believe in.

Man: Definitely not.Admittedly, the dialogue loses a bit of their hilariously sardonic edge when translated into written form, which is why I'd advise you to watch the video:

Ambac Financial Group has just filed for Chapter 11, using a filing which is so fresh it even forgot to lock the input forms (see attached). The case is 10-15973 in Southern District of New York. The actual filing is not surprising, as we noted earlier that Ambac was likely going to file imminently.

What is also not surprising is that the form 1, erroneously, lists assets of between 0 and $50,000 and liabilities of over $1 billion, even as Exhibit A clarifies assets as $394.5 million and liabilities of $1.6824 billion. Obviously someone was in a rush.

Keep in mind this is a stock that Cramer was previously pitching to his very few viewers.

NYT

Doing It Again, by Paul Krugman, Commentary,

Eight years ago Ben Bernanke ... spoke at a conference honoring Milton Friedman. He closed his talk by addressing Friedman's famous claim that the Fed was responsible for the Great Depression, because it failed to do what was necessary to save the economy.

"You're right," said Mr. Bernanke, "we did it. We're very sorry. But thanks to you, we won't do it again." Famous last words.Foppe De Haan:

But why is the Fed/Bernanke enabling those idiots in congress to do nothing

Lafayette:

LA-LA LAND

{All I can say ... is that the hypocrisy is so thick you could cut it with a knife.}

Perhaps. But it would take an ax to cut through the economic ignorance.

This must be one of the most shameful passages in the economic history of the nation. The blind are leading the blind.

LaLaLand extends from coast to coast.

The Boston Globe

DaveVonNatickII:

Proof that Republicans know what's best for the economy:

1) To get out of the recession, we need a humungous war.

2) Unlike the pansy pacifists (A.K.A.) democrats, the Republicans are always itchin' for an excuse to start a good war.

3) If we give control to the Republicans we could be invading North Korea and Iran in no time. And our economy will be humming along like a well tuned machine.

zerohedge.com

Just because a red close in the only index the Department of Wealth Effects tracks, the Dow, would seem oddly suspicious in a market that is now entirely controlled by Benny army's of Hewlett Packard inkjets, we get news from two trading desks that the SPY just went HTB in the last ten minute of trading, coupled with some forced buy-ins for good measure.

AlterNet

Lots of people rail against the excesses of American consumerism, but no one seems to actually DO anything about it. The Great American Apparel Diet wants to change that.

TGAAD, as the website calls itself, is a self-help group of mostly women and a few men who have decided to completely stop buying new clothes for a entire year.

The "diet" started on September 1 and continues until August 31, 2011 – although people can join the effort at any time. The diet is now in its second cycle.

The Daily Show with Jon Stewart

Thanks to the Democrats' conservation efforts, Republicans can flourish and repopulate the plains of Congress.

The Daily Show With Jon Stewart Mon - Thurs 11p / 10c Who Wants It More? - Endangered Republicans www.thedailyshow.com

Daily Show Full Episodes Political Humor Rally to Restore Sanity

Sometime in the future..."And now, ladies and gentlemen, if you'll just follow me over in this direction, I'd like to show you one of our rarest and most reviled species here at The Human Zoo – it's the proverbial 'Reagan Democrat'.

"Most of your younger visitors here at the Zoo have no idea what a Reagan Democrat could be, so I always like to take the time to explain it to them. Indeed, most of them don't even know what Reagan was, except that they keep hearing the people who wrecked Old America talk about this wrinkled prune faced guy with the Gumby hair as if he were some sort of deity. I get a lot of questions about how someone could actually have done things that don't sound even remotely plausible, but I generally leave that for the historians to explain, other than to remind people that injecting religious dogma into politics doesn't just mean stupidity only when it comes to policies related to sexuality, war, taxation, the economy or the environment.

"But already I digress... The Reagan Democrat (technically, Imbecelicus politici) was always the strangest and most contemptuous of species from the habitat of American politics, as you've perhaps already heard. Try to imagine another example from the animal kingdom that could be so readily counted upon to bring harm upon itself and others. There are some of course, but usually they are simply ignorant animals, often with very limited cranial capacity.

"The Reagan Democrat, on the other hand, was simply obnoxiously greedy, and took great pains to aggregate to itself as much stuff as was possible, including even meaningless psychological affirmations of its existential worth. It wasn't very long, of course, before another animal in the jungle noticed this tendency, and established a parasitic relationship with the Reagan Democrat. These others were known as The Wealthy (Plutocratus illegitimi), and they got very rich – though they could still never seem to achieve happiness – by exploiting the opportunities provided to them by the Reagan Democrat. A very mean-spirited and deceitful group of marketing gurus like Lee Atwater and Karl Rove were generally the weapon of choice for accomplishing this.

"Anyhow, before we enter the exhibit, perhaps I should stop now and take any questions. Yes, you, young lady, what can I tell you?"

"Well, sir, you've never quite defined what a Reagan Democrat is. And, especially, why someone associated with Mr. Reagan would be a Democrat. Wasn't he from that other party, the, uh..., the... Regressocans? ...the Degenocrats?"

"Ah, fine questions, indeed, and you're quite right that I've been remiss in not explaining those fundamentals so far. It's an occupational hazard, I suppose. We zoo curators get so caught up in admiring our own erudition that we sometimes we forget to do our jobs properly!

"Speaking of which, where were we...? Oh, yes, I was going to answer your questions about the meaning of this term. First of all, let's get that political party name straight. Reagan was a Republican. That's what makes the creature we're about to see so interesting. It came from working class roots, often recently arrived just a generation earlier from some very poor Eastern European country or such. Its local social unit had only recently been elevated to the middle class, and this achievement had everything to do with the progressive policies the Democratic Party. For the first time ever, and because of these policies, it had a good job, a house in the suburbs, two cars, and it could send its offspring to institutions of higher education which had previously been reserved exclusively for elites, as represented by Mr. Reagan's party.

"But it was very, very greedy, and thus differentiated itself off into a new species which was marked by the fact that it could have its underdeveloped psychology readily appealed to for purposes of exploitation by Republican operatives, representing the economic elite species. In fact, it was actually pretty easy to do. All they had to do was throw some line about an evil foreign bogeyman down to the Reagan Democrat, or perhaps a story about uppity darker skinned members of the genus, or some televised ruse about how very, very bad people were out to destroy Christmas, the silly religious holiday of yore... Anything like that would generally work.

"It really didn't matter very much what ploy was chosen, though the more naked the appeal to greed or vanity, the better. For instance, a handful of elites could carve out for themselves massive chunks of the commonwealth's (formerly) common wealth, but as long as they tossed a few pennies in the direction of the Reagan Democrat at the same time, the latter was sure to support what amounted to his or her own financial undoing, every time. Likewise, since the Reagan Democrat tended to be the most fearful and the most self-loathing of animals in the human sphere, the basest appeals to its vanity could also buy votes en masse, and on the cheap, too. You just had to make him feel a little bigger than someone else – women, foreigners, brown people, homosexuals – it didn't really matter. Then you could get his vote and pick his pocket."

Amusingly the Fed Chairman does mention that the Fed alone cannot control the economy. I can't wait for the tea-party fanatics to put a bounty on him slapshot-style. - Nic Lenoir

Truthdig

The Democratic Party has the bad habit of coming on to voters like the neighborhood mafia extortion team. The Democrats have the incurably bad breath of reliably broken promises. They collar and corner us with mobster charm, they pick our pockets while pretending to pick our brains.

Then as the big election day draws near, they lean heavily upon us and whisper an almost romantic confession: "Sure, we spit in your faces and ask you to pretend it's rain. But the other guy is a real brute and would also break your arms."

zero hedge

deadparrot:

Economics is a social science that uses some simple math and graphs to pretend it is a hard science. Frankly speaking, the broad assumptions that markets are efficient and market participants are rational are the functional equivalent of early "scientists" operating under the assumption that the earth is flat and is also the center of the universe.

Moonrajah:

Didn't you hear? Under Palin most current posts will be cancelled and new ones will be created:

- Chief of Stuff (Treasury)

- Chief of Huff (Propaganda)

- Chief of Puff (Military)

- Chief of Muff (Free Porn for sheeple)

- Chief of Duh (Attorney General)

trav7777 :

you are just threatened by powerful women

jm:

Austrian economics is only truly valid in a free market and we have never had one and probably never will.

So it's fucking worthless, right?

Sean7k:

Within the current restraints of the system, yes, except for the purpose of providing an alternative viewpoint. Which allows us to see just how criminal monetarism is.

AnAnonymous:

...Abrahamic religions have this in common: they are the only true religion at the exclusion of others.

Thanks to your efforts, it appears austrian followers share the same convictions.

zen0:

I asked an economist for her phone number.

…She gave me an estimate.

A man was sent to Hell for his sins. As he was being processed, he passed a room where an economist he knew was having an intimate conversation with a beautiful woman.

"What a crummy deal!" The man complained. "I have to burn for all eternity and that economist spends it with that gorgeous woman."

An escorting demon jabs the man with his pitchfork and shouts, "Who are you to question that woman's punishment?"

"Everything that can be invented has been invented."

-Charles H. Duell, Commissioner, U.S. Office of Patents, 1899.

My buddy was a young guy who'd come up working on the derivatives desk of one of the more dastardly American investment banks. After a few years of that he decided to take a step up morally and flee to the Middle East to go to work advising a bunch of sheiks on how to spend their oil billions.

Aside from the hot weather, it wasn't such a bad gig. But on one of his trips home, we met in a restaurant and he mentioned that the work had gotten a little, well, weird.

"I was in a meeting where a bunch of American investment bankers were trying to sell us the Pennsylvania Turnpike," he said. "They even had a slide show. They were showing these Arabs what a nice highway we had for sale, what the toll booths looked like . . ."

I dropped my fork. "The Pennsylvania Turnpike is for sale?"

He nodded. "Yeah," he said. "We didn't do the deal, though. But, you know, there are some other deals that have gotten done. Or didn't you know about this?"

As it turns out, the Pennsylvania Turnpike deal almost went through, only to be killed by the state legislature, but there were others just like it that did go through, most notably the sale of all the parking meters in Chicago to a consortium that included the Abu Dhabi Investment Authority, from the United Arab Emirates.

treemagnet :

friends don't let friends go long.

The Obama Administration is entirely predictable. It ever and always sides with large corporate interests, while trying to create the impression that it is actually concerned for the welfare of the average citizen. Admittedly, the occasionally tough talk with little follow through feeds a perverse spectacle of plutocrats sulking, pouting, and claiming that they are really, really badly treated.

Roger BigodWhy should I waste my beautiful mind on something like this? It will all be taken care of after the election in the Homeland Property Title Rectification and Forward-Looking Rule of Law Act of 2010.

Always look ahead, for looking back may force you to think about the consequences of your actions and that is Unamerican. Forwards always, may the bridges you burn light your way into the future.

A headhunter firm is either helping GETCO build the 21st century equivalent to the atom bomb, clustering every single HFT trader under one roof for the most destructive group of momo lemmings ever assembled, or the Obama recovery is truly working... for those who know nothing but how to frontrun what remaining traders are left.

October 21, 2010 | The Big Picture

oh what a fabulous story!!!Unsympathetic :….In a nod to his foreclosure work, according to the acquaintance, Mr. Stern mused about possibly naming the larger yacht Su Casa Es Mi Casa - "Your House Is My House." But his wife and others cautioned against it, according to this acquaintance, and Mr. Stern named the boat "Misunderstood." Mr. Stern denies that he considered the "Su Casa Es Mi Casa" name.

http://www.nytimes.com/2010/09/05/business/05house.html?_r=1&pagewanted=5

Barry, he will not be spending any time in jail.

He will, however, buy late-night TV infomercial time describing how you can get rich quick using his tried and true techniques.

b_thunder:

My odds on David Stern's future:

5% – he'll pay at most 10% of his gains as a fine, and will lose law license for at most 3 years w/out admitting anything

25% – he'll become a billionaire suing evil banks on behalf of foreclosed homeowners

20% – he'll become a billionaire AND in 4 years will be elected the Governor of Florida

60% – he will be the next CFTC judge;

A third-year Boston College Law School student facing dismal job prospects and a mountain of student loan debt has offered the prestigious Hub institution a unique deal: Keep the degree ... and give me back my tuition!

In an open letter to BC Law's Interim Dean George Brown posted on EagleiOnline- an online student-run newspaper at BC's law school - the anonymous dissatisfied customer said soon-to-be grads are about to enter "one of the worst job markets in the history of our profession" and an "overwhelming majority" of them can't find jobs.

"We are discouraged, scared, and in many cases, feeling rather hopeless about our chances of ever getting to practice law," the student wrote.

The law school student's missive then proposed a "solution to this problem."

The student offered to leave law school without a degree at the end of the semester in exchange for a full tuition refund - a move the erstwhile aspiring attorney says would help BC's US News ranking because it wouldn't have to report another graduate's state of unemployment.

BC Law is not warm to the idea.

In my best Ron Popeil (Billy Mays RIP) voice over:

We've all heard of inflation, deflation, stagflation, hyperinflation, and thanks to the ZH community "Biflation"...

Well, now we are proud to bring to you a cutting edge, state of the art 'flation that will blow all of the others away..BUYflation.

Yes, that's right, BUYflation. Why BUYflation, you ask...

It is the culmination of an incompetent governments policy to embrace paper liabiliities to buy all of the shit no one else wants in an effort to prop up deteriorating values forever. That's right...FOREVER.

But wait, there's more, buying crap like MBS and UST was just not enough, nooooo... Now, this entity, locally known as the Treserve, is buying other crap like public stocks all in an effort to kill the dollar and inflate its way out of many decades of bad, bad monetary and fiscal decisions.

And the best part is there is no payment needed as all the costs will be passed onto the U.S. taxpayer. You heard that right...YOU.

No rush to order because the stink is being shipped to you directly and will keep coming and coming and coming...the Treserve knows where you live bitchez.

Legal disclaimer: Due to strict patent rights and some other bull, BUYflation cannot be sold outside the good ol' USA since nearly every other country has its own dungpile to pass on to its citizens as they have been working on BUYflation for quite some time already. As all of this global shit is collecting in one big dung pile, the race to the bottom will be competitive.

The Big PictureMinnItMan

Countrywide Home Loans had the subsidiary Full Spectrum Lending which in 07-08 benefitted greatly from the subprime shutdowns. As competitors closed their doors, FSL kept rolling up record production months. It actually bought out local mortgage brokers and made the head an employee at a guaranteed salary for 6 months to a year. As production everywhere else was drying up, it was an easy sell. In part attempting to avoid the fate of Ameriquest and its practical shutdown by its settlement with state AGs, CHL began funding as much as it could through Countrywide Bank, fsb, so as to have state regulation (primarily cease and desist powers) pre-empted because it was a nationally chartered bank. It dropped the FSL name. When the SHTF in August 2007, CHL completely re-organized the retail structure, shutting down most of its branches and centralized operations into a few regional operating centers. The recent business model of originating 3-point plus fee subprime and alt-a loans quickly changed into originating FHA loans when the market for sub and alt-a paper collapsed. CHL coudn't survice without a fed charter once it became identified as the boiler-room successor to Ameriquest (whose trademark was originating 4-point plus fee subprime and alt-a loans). "Seven Minute abs, man!"

Mr. Mozilo was entrepeneurial. CHL originated loans at least twice (maybe 4 times) as efficiently as the norm in the industry. While it never matched Ameriquest in turn-around time for getting money in its borrowers' hands (about 11-12 days), it came close, like 17 or so, until it couldn't sell anything but agency loans. Unlike Ameriquest, CHL at least pretended to keep underwriting and sales separate (although commissioned underwriting seems like a dubious quality control). Also, unlike Ameriquest, you had to get above the branch level to really make big money. Branch managers at AMC frequently made more than $500K, but CHL/FSL branch managers made less than half that.

Hitchhiker: You heard of this thing, the 8-Minute Abs?

Ted: Yeah, sure, 8-Minute Abs. Yeah, the excercise video.

Hitchhiker: Yeah, this is going to blow that right out of the water. Listen to this: 7… Minute… Abs.

Ted: Right. Yes. OK, all right. I see where you're going.

Hitchhiker: Think about it. You walk into a video store, you see 8-Minute Abs sittin' there, there's 7-Minute Abs right beside it. Which one are you gonna pick, man?

Ted: I would go for the 7.

Hitchhiker: Bingo, man, bingo. 7-Minute Abs. And we guarantee just as good a workout as the 8-minute folk.

Ted: You guarantee it? That's – how do you do that?

Hitchhiker: If you're not happy with the first 7 minutes, we're gonna send you the extra minute free. You see? That's it. That's our motto. That's where we're comin' from. That's from "A" to "B".

Ted: That's right. That's – that's good. That's good. Unless, of course, somebody comes up with 6-Minute Abs. Then you're in trouble, huh?

[Hitchhiker convulses]

Hitchhiker: No! No, no, not 6! I said 7. Nobody's comin' up with 6. Who works out in 6 minutes? You won't even get your heart goin, not even a mouse on a wheel.

Ted: That – good point.

Hitchhiker: 7′s the key number here. Think about it. 7-Elevens. 7 dwarves. 7, man, that's the number. 7 chipmunks twirlin' on a branch, eatin' lots of sunflowers on my uncle's ranch. You know that old children's tale from the sea. It's like you're dreamin' about Gorgonzola cheese when it's clearly Brie time, baby. Step into my office.

Ted: Why?

Hitchhiker: 'Cause you're fuckin' fired!This guy an entreneur, too.

Mark Thoma: "A willingness to sacrifice jobs for political gains is the opposite of leadership...

Goldilocksisableachblonde said in reply to bakho...

"Bush poisoned the well for the GOP...."

"Obama has done the same for the Dems..."

In that case, my advice to both parties: Drink Up !!

10/15/2010 | Angry Bear

by Mike Kimel

Discouraging Greg Mankiw From Working Would be Good for the Economy

Cross posted at the the Presimetrics blog.A few days ago Greg Mankiw had an op ed piece in the NY Times talking about how even small increases in the marginal tax rate would keep him (and by extension, other talented folks like him) from working.

For a laugh, I pulled data on the top marginal tax rate from the IRS and real GDP per capita from the BEA's NIPA tables. Data on the latter goes back to 1929, and the tax rate info goes back further.

More below the fold...

99er:

(Reuters) - Former Countrywide chief Angelo Mozilo agreed to a settlement of $67.5 million to resolve charges that he duped the home loan company's investors while reaping a personal windfall, but Bank of America will pick up two-thirds of the bill.

Rainman:

The Beauty of American Justice !! Who said this crony capitalism ain't a great gig ?? Dude made off with .........$ 139M (-minus) $ 44.5M = $ 94.5 M. Beats the shit out of shakin' down the pizza parlors.

Named in honor of Charles Darwin, the Darwin Awards commemorate those who improve our gene pool by accidentally removing themselves from it. I therefore propose the 'Nobel Award in Darwin Economics'. The recipient of the award would graciously be asked to remove (just) their 'economic genes' from our economic gene pool. If they teach economics, they'd be asked to cease and desist, if they were the Secretary of the Treasury, the Chairman of the Federal Reserve, or the President of the United States they'd be asked to resign.

I'll let you the reader decide who should be nominated to receive this years 'Nobel Award in Darwin Economics'.

Last week, bond prices were so high that a two-year government note yielded a miniscule 0.43%. To get more than one percent interest, you have to accept the five-year Treasury note yield of 1.32%. The ten-year yield? 2.60%. The 30-year long bond? A laughable 3.78%! Hahaha! This is insane!

And, as astronomically high as bond prices are, money is still flowing out of equity funds and pouring into bond funds, which has a lot to do with the price of bonds rising so high that they produce such pathetic, less-than-inflation yields.

It all reminds me of an old cartoon I once saw, which I adapt here. A guy is strapped down on the floor of the desert, baking in the sun. Behind him is a sign that says, "Bond Investor One-Day Training Course." The guy is looking up and says, "Wow! That sun's so hot it will bake your brains out in less than a day!" Hahaha!

chopper readNo market is well-functioning that drives out participants in such mass numbers. as on May 6th, liquidity will disappear when it is needed most because 'liquidity providers' have been driven out of business by HFT cannibals. most likely, HFTs will cannabilize each other while the rest of us wait patiently on the sidelines to capitalize on 1 or 2 major 'flash crashes' per year.

Bob:

NASDAQ and the NYSE have failed to protect their franchise . . .

That's it. Hubris in the context of full regulatory capture got them cocky and thinking they were untouchable. Good old greed, they just couldn't leave a good enough thing alone.

chopper read

yep. they used to just "sell Levi's" (gain their transaction fees) as speculators rushed in for equity market gold. But the lure of HFT transaction fees paying them much more quickly than 'joe speculator' has now resulted in a total boycott of their exchanges.

speculators have always understood that the markets exist to take our money, not the other way around.

Cognitive Dissonance

When the mainstream media (MSM), aka the fawning corporate press, get their teeth into an issue, I become very worried. There is little doubt that just as Congress and the regulators have been completely captured, so is the MSM. In fact, the MSM has been playing ball for decades. And I could make a coherent argument its been centuries.

So what's going on here? How are they going to spin this? What straw man are they setting up to take the fall? Who's the patsy in this one? Because that's the sole purpose of the MSM as the appointed spin doctors for the Powers That Be. To pre-condition the public mind and direct public opinion away from the real fire and towards the diversionary blazes they set alight.

Oct 09, 2010 | Angry Bear

I just can't resist this story of moralizing and posturing for the cameras by MBA and matter of fact dailey business practice. Out loud, in the open, in your face...and no surprises, but are we really that disconnected from ourselves?

The Daily Show With Jon Stewart Mon - Thurs 11p / 10c Mortgage Bankers Association Strategic Default www.thedailyshow.com

Daily Show Full Episodes

The Onion

Citing a desire to gain influence in Washington, the American people confirmed Friday that they have hired high-powered D.C. lobbyist Jack Weldon of the firm Patton Boggs to help advance their agenda in Congress.

Known among Beltway insiders for his ability to sway public policy on behalf of massive corporations such as Johnson & Johnson, Monsanto, and AT&T, Weldon, 53, is expected to use his vast network of political connections to give his new client a voice in the legislative process.

Weldon is reportedly charging the American people $795 an hour.

"Unlike R.J. Reynolds, Pfizer, or Bank of America, the U.S. populace lacks the access to public officials required to further its legislative goals," a statement from the nation read in part. "Jack Weldon gives us that access."

"His daily presence in the Capitol will ensure the American people finally get a seat at the table," the statement continued. "And it will allow him to advance our message that everyone, including Americans, deserves to be represented in Washington."

Weldon says he hopes to spin the American public, above, as a group worth Congress' time.

The 310-million-member group said it will rely on Weldon's considerable clout to ensure its concerns are taken into account when Congress addresses issues such as education, immigration, national security, health care, transportation, the economy, affordable college tuition, infrastructure, jobs, equal rights, taxes, Social Security, the environment, housing, the national debt, agriculture, energy, alternative energy, nutrition, imports, exports, foreign relations, the arts, and crime.

Sources confirmed that Weldon is already scheduled to have drinks Monday with several members of the Senate Appropriations Committee to discuss saving the middle class.

"If you have a problem, say, with America's atrocious treatment of its veterans, you can't just pick up a phone and call your local congressman," Weldon told reporters from his office on K Street Monday. "You need someone on the inside who understands how democracy works; someone who knows how to grease the wheels a little."

Weldon said that after successfully advocating on behalf of Goldman Sachs and BP, he is relishing the opportunity to lobby for the American people, calling it the "challenge of a lifetime." The veteran D.C. power player admitted that his new client is at a disadvantage because it lacks the money and power of other groups.

"The goal is to make it seem politically advantageous for legislators to keep the American people in mind when making laws," Weldon said. "Lawmakers are going to ask me, 'Why should I care about the American people? What's in it for me?' And it will be up to me and my team to find some reason why they should consider putting poverty and medical care for children on the legislative docket."

"To be honest," Weldon added, "the American people have always been perceived as a little naïve when it comes to their representative government. But having me on their side sends a clear message that they're finally serious and want to play ball."

According to Washington heavyweights, hiring Weldon is an immediate game changer and should force politicians to take citizens' concerns seriously for the first time in decades. Moreover, sources said, Weldon will be able to help lawmakers see the American people as more than just a low-priority fringe group.

"Jack is very good at what he does," said Joseph Pearlman, a headhunter for the McCormick Group who specializes in placing lobbyists. "He can take an issue that is nowhere on the congressional radar, like the pursuit of happiness, for example, and make it politically relevant. The next time Congress passes a bill dealing with civil rights or taxes, I wouldn't be surprised if the U.S. populace is mentioned somewhere in the final language."

Though Weldon has only been on the job for three days, legislators have already seemed to take notice.

"Before today, I'd actually never heard of this group," Rep. Eric Cantor (R-VA) told reporters. "But if Jack says they're worth my time, I'll take a look and see if maybe there are some areas where our interests overlap."

"But I'm not making any promises," he added. "I'm a very busy man."

Wealth DailyWithout comment, here is Jon Stewart's take on the developing mess.

The Daily Show With Jon Stewart Mon - Thurs 11p / 10c Foreclosure Crisis www.thedailyshow.com

Daily Show Full Episodes Political Humor Rally to Restore Sanity The sad part is that it's all true and you have no idea how bad they screwed you.

The US is a Potemkin Village economy with the appearance of prosperity hiding the rot of fraud, oligarchy, and political corruption.

In the meantime, and contrary to what CNBC was misrepresenting on national TV, the 22 weeks of consecutive outflows now amount to $76 billion in capital taken out by retail investors from domestic stock funds, and $75 billion YTD. And here is the scariest statistic for the administration, the Fed, and bankers around the world: in September $20 billion was pulled out from domestic stocks. This occured despite the nearly 9% surge in stocks. Which means that the bankers, the HFTs, the Fed, and whoever else may be accumulating stocks in expectation of retail jumping in for the latest round of passing the hot potato, is out of luck.

zero hedge

"The number one performing stock market in the last ten years has been Zimbabwe - in nominal terms" - that is the most memorable soundbite of Kyle Bass' presentation to David Faber at the Bearfoot Summit, because unfortunately, in real terms investors have lost all their money.

Top 10 Ideas for Goldman Sachs New Ad Campaign

10. With the President as our junior partner, imagine what we can do for you!

9. We get the gold, you get the sack.

8. Government Bailout: $29 billion, SEC Settlement: $550 million. Doing God's work? Priceless.

7. Lobbying to bring "Don't Ask, Don't Tell" to a whole new level.

6. Goldman Sachs: America's 401K Investor Tax Collector

5. Claim everything, Explain nothing, Deny everything.

4. Like we give a fuck what you think about us . . .

3 Vote for anybody you want, they all work for us.

2. Behind every great fortune lies a great crime. Behind that crime lies Goldman Sachs.

And the number 1 advertising slogan for the new Goldman Sachs ad campaign:

1. The illegal we can do immediately. The unconstitutional takes a little longer

The Big Picture

As soon as Dealbook reported the plan, we just knew had to help Goldie with such a noble undertaking. So we asked readers to contribute ideas, and soon 100s of suggestions came pouring forth for the new GS ad campaign. These included ad slogans and tag lines, lots of variations of existing campaigns, quotes from movies (especially the Godfather). Oh, and the word Fuck. Lots and lots of uses of the word fuck.

We culled down the entries to a Top 10 list>

Top 10 Ideas for Goldman Sachs New Ad Campaign

10. Under Buffett's protection since 2008

9. Putting the zero in zero-sum game.

8. Government Bailout: $29 billion

SEC Settlement: $550 million

Doing God's work? Priceless.7. Helping you forget about Bernie Madoff one CDO at a time

6. Goldman Sachs: America's Counterparty

5. Let us do for you what we did for Greece.

4. Like we give a fuck what you think about us . . .

3. Goldman Sachs: There are some things money can't buy. For everything else, there's JPMorgan.

2. The Rothschilds were Pussies

And the number 1 advertising slogan for the new Goldman Sachs ad campaign:

1. We put the douche in fiduciary

Barry Ritholtz:

5 Runners up

- Doing God's work, since 1869.

- "To Serve Man"… (I really wrestled with this one from the Twilight Zone but I feared it might be too obscure )

- The meek shall inherit the earth - and we'll finance it.

- Lobbying to bring "Don't Ask, Don't Tell" to a whole new level.

- Goldman Sachs. No, we won't call you afterwards.

Honorable Mentions

- We get the gold, you get the sack.

- Goldman Rapes, Pillages & Sachs

- The illegal we do immediately. The unconstitutional takes a little longer

- Leverage: It's what's for dinner.

- Claim everything, Explain nothing, Deny everything.

- Adapt and Exploit

- Vote for anybody you want, they all work for us.

- "What happens on Wall Street, stays on Wall Street."

- Dude! You're getting a deal!"

- Between greed and madness lies Goldman.

- Got Greed?

- Behind every great fortune lies a great crime. Behind that crime lies Goldman Sachs.

- We're rich as hell and we're not going to take this anymore!

- We make money for you, or against you, or sometimes both."

- Goldman Sachs keeps going and going and going.

- It's not personal, Sonny. It's strictly business.

- Vampire Squids rule!

- Greed Sanctioned.

- We're not crooks, we're profit optimizers.

VennData:

Ringo Starr, singing:

We would be so happy you and me

No one there to tell us what to do

I'd like to be under the sea

In an octopus' garden with you.JohnnyVee :

"We follow the golden rule… The one with the gold makes the rules."

MakingtheDrop :

Spinal Tap's Big Bottom as per Goldman

The bigger the cushion, the sweeter the pushin' That's what we say The looser the regulation-band, the deeper the quicksand Or so I have read

The financial system fits me like a flesh tuxedo I'd like to sink her with my gold torpedo

Big bottom, big bottom We'll still be here, but you'll be forgotten Big bottom drive me out of my mind Who's turn next in the Presidential Advisory line?

My love gun's loaded, the next bubble in my sights Big game is waiting there inside the market's tights, yeah

Big bottom, big bottom We'll still be here, but you'll be forgotten Big bottom drive me out of my mind How could I ever leave this human vs corporate paradigm?

And by the way, our's goes to 11… that's one louder.

Mysticdog :

"People love to hate on them, but when you get ready to sell your company or need serious investment banking, they are the guys you hire. Funny isn't it?"

Well, when I need to do that, I'll keep them in mind. But as long as I'm like the other 99.9% of americans though whose other car isn't a yacht, I'll just keep hating them for their part in ruining our country.

Freestate :

That was the most fun this blog has had in awhile. Now let's do one for Zero Hedge.

"On a long enough timeline all conspiracy theories come true"

polizeros :

With the President as our junior partner, imagine what we can do for you!

Laws? We don't have to follow no steekin' laws.

ckeating :

"Screw you and ethics too!"

WASHINGTON-Some sort of tax cut or earnings or money or something was reported in economic news this week in further evidence that a lot of financial-related things have been going on lately.

According to numerous articles and economics segments from major media outlets, experts on banks and such have become increasingly concerned over a new extension or rates or a proposal or compromise that could signal fewer investments, and dollars, and so on.

The experts confirmed that the stimulus has played a role.

"This is a clear sign of a changing cycle," some top guy at one of the big banks in New York said of purchasing power parity or possibly rate of return during a recent interview on CNN. "Which isn't to say that a sustained drop in wages couldn't still occur, even if the interest paid on reserves is lowered."

"In short, it's possible but not probable that growth could outpace our initial expectations," added the banking guy, who went on to say other money things, too. "It depends on investor sentiment."

"This is a clear sign of a changing cycle," some top guy at one of the big banks in New York said of purchasing power parity or possibly rate of return during a recent interview on CNN. "Which isn't to say that a sustained drop in wages couldn't still occur, even if the interest paid on reserves is lowered."

Juvenal Delinquent:

I'm beginning to think that economics is Dismal Scientology...

patientrenter:

Kruggles points out the obvious, a point that some commenters need to understand.

Economics Is Not A Morality Play - NYTimes.com

I have this very complicated equation here, and it tells me that if I screw you in this particular way, you won't even notice who did it to you, and I will be so happy that it will offset your sadness.

"Yes, the worst, most deviate kind of pr0n is Econ chart pr0n!"

black dog:

I must have an inner bankster since I'm kinda partial to zombie movies.

RobotTraderI guess there remains an acute shortage of shopping malls, office buildlings, retail centers, etc.

zero hedge

Mad Max:

New bumper sticker:

"I VOTED FOR A SOCIALIST MUSLIM COOL GUY AND ALL I GOT WAS THIS PATHETIC VAIN BANKSTER PUPPET"

Mark Noonan:

...Obama doesn't seem smart enough to triangulate his way out of this mess. Clinton could do it because, let's face it, he had no principles other than self aggrandizement

weinerdog43:

We're doomed. Obama is as incompetent as Bush and as sleazy as Clinton. What a combination

the grateful un... :

problem is who is going to suck his dick in the oval office, if he is Clinton, and what new war can he start if he is Bush.

hedgeless_horseman :

It amazes me how few people notice the strings rising from all of our presidents and disappearing up into the shadows above the stage.

jesus :

Vote Christine O'Donnell, she will save us all!! (from masturbating)

ABC News

When it came time for his testimony, Colbert offered to submit a video of his colonoscopy into the congressional record as evidence that produce is "a necessary source of roughage."

As for the labor pool, "this is America," the comedian said. "I don't want a tomato picked by a Mexican. I want it picked by an American, then sliced by a Guatemalan and served by a Venezuelan in a spa where a Chilean gives me a Brazilian. Because my great-grandfather did not travel across 4,000 miles of the Atlantic Ocean to see this country overrun by immigrants."

Still, "after working with these men and women picking beans, packing corn for hours on end, side by side in the unforgiving sun, I have to say - and I do mean this sincerely - please don't make me do this again," Colbert added. "It is really, really hard."

"Maybe this AgJobs bill would help," he concluded. "I don't know. Like most members of Congress, I haven't read it."

Sep 26, 2010 | Daily Kos

Wall Street is upset. Sure, they were handed a trillion dollars. Sure, their industry was pulled from the toilet, propped up, dried off, and allowed to return to its never-ending party. Sure, they're looking forward to what may be the biggest bonus year ever while the rest of us are dealing with a little thing called a recession. But hey, they are upset that people have been talking mean about them. They don't like that.

05/20/2010Osama Bin Hidden

NWO IS REAL

"I was not involved in the September 11 attacks in the United States nor did I have knowledge of the attacks. There exists a government within a government within the United States. The United States should try to trace the perpetrators of these attacks within itself; to the people who want to make the present century a century of conflict between Islam and Christianity. That secret government must be asked as to who carried out the attacks. ... The American system is totally in control of the Jews, whose first priority is Israel, not the United States. -Osama bin Laden

God's WorkReader "Tin Hat" sends a list of notable quotes:

Tin Hat quips "Tell me Munger, which god might that be? The Man Upstairs, Lloyd Blankfein or Lucifer?"

- Goldman Sachs' CEO Loyd Blankfein says "We're doing God's work."

- BP's chairman says "We care about the small people."

- Lord Griffiths, vice-chairman of Goldman Sachs International, says the British public should "tolerate the inequality as a way to achieve greater prosperity for all".

- Now Munger thinks we should "suck it up and cope." And "thank god" for the bailouts.

Let Them Eat Cake

I received numerous Emails similar to the following

Hello Mish,Great job. Has Charlie Munger become this generation's Marie Antoinette? Let them eat cake!

Steve

longtimelurker:

Is Phil Gramm free?

alley_boy:

How much money did Summers lose at Harvard? I read somewhere @ $1.8 billion. Why do they want him back?

Barley:

Maybe Kramer will take the job