|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

| Financial Humor | News | Casino Capitalism Dictionary | Famous quotes of John Kenneth Galbraith | Lord Keynes | The Roads We Take | Humor | Quotes | Etc |

| 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 |

Due to the size financial skeptic dictionary is now converted to a separate page

|

|

Switchboard | ||||

| Latest | |||||

| Past week | |||||

| Past month | |||||

, )

, )  )

) | Last | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 |

| Jan | Feb | Mar | Apr | May | June | July | Aug | Sep | Oct | Nov | Dec |

A quick calculation… The 2010 Wall Street bonuses

were equal to 2.88 million $50,000 jobs.

Zero Hedge

Zero Hedge

12/24/2013 | Zerohedge...

Whatever one thinks of the New Normal economy, one sure can't say there is a shortage of flipping opportunities.

Zero Hedge

Presented with no comment...(h/t Sunday Funnies via The Burning Platform blog)

Oct 24, 2013 | YouTube

Jon Stewart does not often dip into the shenanigans of the financial world, but when he does, it's certainly something to see. And he set his sites Wednesday night on financial networks CNBC and Fox Business Network for their incredibly hyperbolic outrage over JP Morgan paying a settlement fine of $13 billion.

Business analysts are calling the settlement a "shakedown and a jihad." Stewart took it one step further, suggesting "it's like if the Holocaust had sex with slavery while the last ten minutes of Human Centipede watched!"

Stewart pointed out how JP Morgan anticipated potential litigation issues and set aside a rainy day fund. "And guess what? It's raining, motherfucker!" He mercilessly mocked the two networks for their unqualified defense of anyone and everything in the business world, and ended the segment with an impassioned "Fuck all y'all!"

Oct 14, 2013 | Zero Hedge

The fine upstanding people at the NASDAQ noticed something odd this morning with SBAC:

*POTENTIALLY ERRONOUS 'SBAC' TRANSACTIONS BEING PROBED

After some discussion, they have decided that it is indeed erroneous that, as Nanex notes, SBA Communications (a $10 billion market cap company) should see its stock price jerk from $80 to $299.73 in the space of a few seconds. NASDAQ will be canceling these trades on behalf of the participants involved (we suspect the "buying" algorithm is more relieved than the "seller")

Oct 12, 2013 | zerohedge

We commend Senator Schumer for being the first Senator to openly step up and admit that the worst case scenario in the whole Congressional 3D IMAX farce is not about keeping the economy afloat, is not about preserving jobs, but merely keeping the stock market at or near its all time highs:

- Schumer Says He Worries About Monday Stock Drop on Default Risk. "This is playing with fire," Sen. Charles Schumer, D-N.Y., tells reporters. Says he worried whether "the stock market will go down"

For those confused, Schumer has merely admitted what the vast majority of the Senate, where two thirds are millionaires, and nearly half the House, think: don't you dare let the manipulated precious, which at last check was just 1% below its all time Fed-balance sheet derived highs, drop.

Slashdot

rainmouse

surprise (Score:3, Insightful)

US politicians, bent you say? Surely not!

Anonymous Coward writes:

Of course not, they're thoroughly folded in half.\

oodaloop

Re:surprise (Score:5, Funny)

Surely not one from Chicago!

Zero Hedge

The Hippocratic Oath is one of the most widely known Greek medical texts. It requires a new physician to swear upon a number of healing gods that he will uphold a set of professional ethical standards. The premise of the original Oath, which supposedly started out like this is clear: First, do no harm. Over the last several years, a new oath has appeared in the world of finance as global investment banks have been hauled in front of Senate committees, Congressional panels, various regulatory bodies, and (what always used to be the harshest of judges) the public: the Hypocritic Oath. It begins thus: First, admit no wrong.

The Hypocritic Oath has been adopted by a multitude of banks in recent years and, like the Fifth Amendment, once it was rolled out, it seems to have been accepted absolutely without question...

August 22, 2013 | naked capitalism

C:

The other day Goldman Sachs announced that they lost a few hundred million (chump change really) due to a computer error. They are, at least according to one article I read, demanding that the money be returned thus shorting the people they were trading with.

I wonder if this is part of that. Perhaps the error is larger than originally disclosed or has been repeated. In any case if NASDAQ were to choose to screw over people to benefit one big player my money would be on Goldman.

AbyNormal:

GS wants it ALL back…pull up any naz chart an you can see the swings began yesterday at 2pm

i saw this same battle on China's mkt a couple yrs ago…GS started backing out of a huge futures mistake and while it became immediately clear they were screwed …GS called foul and told China they wouldn't honor the trade. the chinese added an extra R to gofukyourself…last i could track was GS calling on the IMF and poof all went quiet on the western front

Canceling Erroneous Trades: You're Asking The Wrong Questions http://kiddynamitesworld.com/

GS will Always attempt the impossible…because we made it possible.

Glen:

So sitting here in my house, reading about this, I come to the conclusion that as dramatic as this has to be for the FIRE sector, it means absolutely doodle squat to the lives of the 99%.

What am I missing?

diptherio:

Schadenfreude

LucyLulu:

"Not exactly seeing high frequency trading on my equity trading software today lol."

Awesome! Finally, a feature, not a bug, for the 99%. Who said God doesn't have a sense of humor?

Doug Terpstra:

Doing the Lloyd's work: Goldman made another FUBAR trade and the NASDAQ just needs to break it out of the queue.

Just the usual free market efficiency. Mistakes were made. Move along please. Nothing to see here.

curious wrote on Thu, 8/22/2013 - 4:41 pm (in reply to...)

Rob Dawg wrote:

What would be the consequences if the aviation sector were run and reported like the financial sector?

Amtrak would be incredibly profitable?

black dog:

the top percentile can always buy third, fourth, fifth, sixth, seventh...homes.

did McCain ever figure out many homes he (er, wife) owns?

1 currency now -yog

I come to praise Bernanke, and spread the Word of Goldman Sachs, and sell a few banner ads for Ameritrade. I have no 'political' agenda. Politics is a charade. Economics is a science.

dryam

Is the FED buying homes?

Richard Chesler

Home Realtor = Used House Salesman

"We have to turn the page on the bubble-and-bust mentality that created this mess," President Obama stated authoritatively in his weekend radio address...

Feb 28, 2013

George Denis Patrick Carlin (May 12, 1937 -- June 22, 2008) was an American stand-up comedian, social critic, satirist, actor, and writer/author who won five Grammy Awards for his comedy albums. Carlin was noted for his black humor as well as his thoughts on politics, the English language, psychology, religion, and various taboo subjects. Carlin and his "Seven Dirty Words" comedy routine were central to the 1978 U.S. Supreme Court case F.C.C. v. Pacifica Foundation, in which a 5--4 decision by the justices affirmed the government's power to regulate indecent material on the public airwaves.

The first of his 14 stand-up comedy specials for HBO was filmed in 1977. From the late 1980s, Carlin's routines focused on socio-cultural criticism of modern American society. He often commented on contemporary political issues in the United States and satirized the excesses of American culture. His final HBO special, It's Bad for Ya, was filmed less than four months before his death. In 2004, Carlin placed second on the Comedy Central list of the 100 greatest stand-up comedians of all time, ahead of Lenny Bruce and behind Richard Pryor. He was a frequent performer and guest host on The Tonight Show during the three-decade Johnny Carson era, and hosted the first episode of Saturday Night Live. In 2008, he was posthumously awarded the Mark Twain Prize for American Humor

Whatever your view on this, there is no doubt that tax law generates an enormous amount of innovation in avoiding it.

"[T]hanking the Fed for avoiding another Great Depression is a little like thanking a doctor for successfully removing a malignant tumor after misdiagnosing it and letting it grow for many years." -- Sheila Bair's

Nemo

Maybe the Fed should try lowering interest rates

Sebastian

And the star-spangled awesome-est economy in the world muddles steadily along, laughing at us all.

ResistanceIsFeudal

Nemo wrote:

Maybe the Fed should try lowering interest rates

As we know the youth are eschewing debt and protesting ridiculous housing prices by moving back in with mom and dad or renting with roommates. They're also voluntarily going without vehicles to protest the ridiculous prices of vehicles, and less are going on to higher education because of not only ridiculous prices, but also because they realize it's a sham and they can start in the factory tomorrow. They're also nobly refusing jobs with unsustainable benefits and pension arrangements because they realize these can't in the long run be paid for and don't wish to burden future generations with the obligation. The rise in the price of food and other essentials is illusory and the result of speculation.

black dog

nothing screams recovery better than businesses willing to hold/increase inventory

june consensus +0.2%

actual 0.0%

may revised from +0.1% to -0.1%

adornosghost

KarmaPolice wrote:

Mongolia is 100 percent natural resources. It's kinda like Saudi Arabia and Texas.

You forgot about Saudi America-- that country that shale production is making it energy independent--- The Bakken is now supplying 1/18th of our daily use (well, a little less). Energy independence can't be far off.

August 09, 2013 | The Guardian

Kevin_byDesign

When we start using the NSA records against Politicians & Banks to expose fraud, THAT is when you will see laws curtailing its use.

Submitted by Tyler Durden on 08/12/2013 - 18:21

While there are a fair-share of descriptive statistics that show the USA is no longer the "Number 1" that so many believe it to be; Pando Daily put together the following infographic that reveals the Top Ten nations and Top Twenty states that serve up the most illicit content... and the winner is U-S-A! 66% of the pron hosted in the US comes from California and interestingly only 0.62% of all porn sites use the ".xxx" domain name. Of course, hard numbers are tough to come by, but as ExtremeTech illustrates, Xvideos - the largest porn site on the web - gets a stunning 4.4 billion page-views per month - 3x the size of CNN or ESPN. Ironically, the biggest difference is 'duration' - typical news sites are visited for 3 to 6 minutes; while the average time spent on a porn site is between 15 and 20 minutes... Overall, porn websites are estimated to receive a whopping 30% of total internet traffic around the world.

"Unfortunately we live in the real world, and politics trumps reality."

KarmaPolice

"Unfortunately we live in the real world, and politics trump reality"

Reality? Oh shit....perhaps realty.

85 percent of Americans believe in God™

sum luk

KarmaPolice wrote:

85 percent of Americans believe in God

.... yeah, but for most it's just a hedge.

Paul Solman: The most financially savvy country and western crooner in America, Merle Hazard, returns to the Making Sen$e Business Desk with the release of a new economics chart-topper: "The Great Unwind," produced by Nashville Public Television (WNPT-TV).

Merle's real-life alter ego, money manager Jon Shayne, prefaces the video with a bit of background. We'll follow in our next posts with reactions to the song and subject from economists Ken Rogoff, Jamie Galbraith, Arthur Laffer, Simon Johnson, Greg Mankiw, John Taylor and Justin Wolfers. And Jon/Merle will get a chance to respond at week's end.

Jon Shayne: Paul asked me to comment on what the heck inspired my musical alter-ego, Merle Hazard, to put together the music and video for "The Great Unwind."

Well, my muse was Warren Buffett, also known as the Wizard of Omaha, who runs Berkshire Hathaway Inc. Specifically, what got me was an interview Buffett gave on CNBC in March. The topic was central bank policy, which, to a money manager, is nearly as interesting as pickup trucks, whiskey and boot scootin' boogies.

... ... ...

azurite wrote on Fri, 8/9/2013 - 11:10 am

Page not found | The Baseline Scenario

Title of post: the problem w/401(k)s

MarketWatch

In other words, the Bureau of Labor Statistics did not report that payrolls grew by 162,000 - it reported that the BLS was 90% confident that payrolls increased by 162,000 plus or minus 90,000. The best estimate was that payrolls increased between 72,000 and 252,000, and even that wide range wouldn't be wide enough about 10% of the time.

The dirty little secret of financial journalism is that most of the frantic trading around economic indicators - and most of the commentary on the Street and in the media - is based on a fundamental misunderstanding of the accuracy of these statistics.

Zero Hedge

Is this the first 'greater' depression in world history where the populace is suffering from being fatter than fat obese instead of starving?

Zero Hedge

JPM=Juggling Precious Metals?

Zero Hedge

I feel the invisible hand searching for something in my pockets

Chanos: "Cheating [in finance, business, etc.] is now a fiduciary duty."

And it involves (surprise) derivatives, especially.

Calculated Risk

Rob Dawg

Rickkk wrote:

Part-Time Work Made Up More Than 65 Percent Of New Jobs Created In July

Nice to see HuffPo reads ZH.

lawyerliz:

hi guys, Hi NSA

Rob Dawg

adornosghost:

The Puffington Host is a bit New Age for me.

Vegan Progressivism.

ResistanceIsFeudal

Rob Dawg:

Vegan Progressivism.

Vegan Progressivism secretly owned and operated by a meat-packing plant?

Rob Dawg

ResistanceIsFeudal wrote:

Vegan Progressivism secretly owned and operated by a meat-packing plant?

Eloi Gardens, LLC, proud subsidiary of Morlok Industries.

No more crazy than an anti-oil, America first crusader selling out to an Arab SWF.

Tommy Vu :

adornosghost wrote:

Clearly we are all about the Fed now, as capitalism died in 2007.

August 15, 1971. Later in life, Dick claimed that was his biggest regret.

Rob Dawg

sportsfan wrote:

Ronald Reagan: Growing National Debt 1981-1988

8 years of Reagan = 15 months of Obama.

robj

1 currency now -yogi wrote:

Rob Dawg wrote:

the Ds own every bit of where we are today.

Bush and the thugs corralled the ponies in the stable for 8 year, fed them a double portion of hay, then after the crash opened the stable door. Obummer and the Senate now "owns" the stable, all right. Or owns what the ponies left in the stable. I thought the big mistake was the focus on health care rather than stimulus--should have done the New Deal and jobs corps first thing. And arrested Geithner and Paulson.

One might expect huge deficits in the biggest crash since the Depression, just like Reagan's original deficits in the first three years of the Volcker crash, only much worse, given the size of the crash. If one actually bothered to model deficits against macrocrashes. And yes we need stimulus in the form of infrastructure, but until the GOP has one of their own in the White House, the House won't vote for it. It's no accident that public jobs creation under Obama has been the inverse of the Bushes and Reagan -- that's engineered purposefully by the House GOP.

Although some House GOPers are just now starting to squirm about the military cuts, which is the only stimulus they can stand besides farm and ethanol.

sum luk

Blackhalo wrote:

Sequester #2. + Boehner rule. i.e. spending cuts must equal debt ceiling increase.

..... but, but, but since BEN buys most of it AND returns all profit, the debt APPEARS to be bigger than it really is. Since the govt is borrowing from itself and returning the profits, how could this go wrong ?

robj

Mook wrote:

Meanwhile, certain other gub'mint data series received updates today, to a lot less fanfare: Graph: Velocity of MZM Money Stock (MZMV) Vintage: 2013-07-31 - ALFRED - St. Louis Fed,

I'm thinking MZM needs prostrate surgery.

Yoringe

1913 Statue of Liberty

2013. Statue of National Security. NSA is nothing more than a control freak's paradise and a ticket to early retirement for government contractors.

Zero Hedge

While we know that the Fed will be forced to taper in the short-term as it desperately avoids the 'appearance' of outright monetization that a falling deficit will create, Marc Faber sums up the endgame perfectly in this clip: "I don't think they will come to their senses for the simple reason that insane people don't realize that they are insane."

sum luk :

KarmaPoliceOutsider wrote:

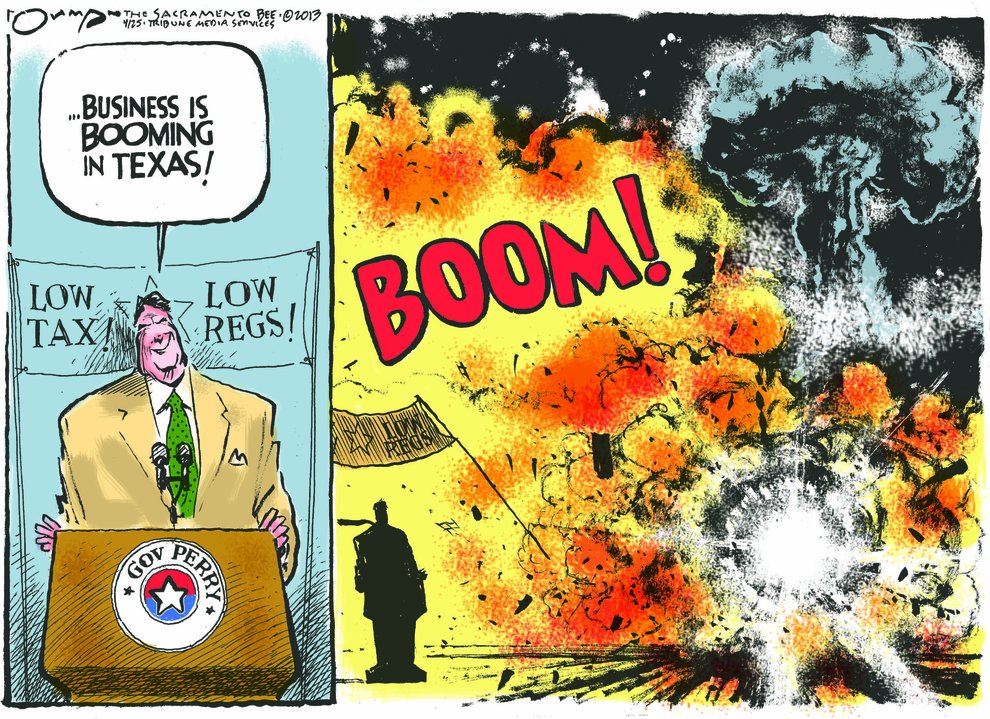

Isn't Texas one of the stronger economies?

... is it Republicans that create oil or the luck of having oil that creates Republicans ?

sum luk wrote:

.. is it Republicans that create oil or the luck of having oil that creates Republicans

Before oil, Saudi Arabia was a dumpy desert with a big church. Similarities?

vtcodger:

There Are 4 Million U.S. Job Openings: Why Are The Positions Unfilled? - Forbes

Riiiiiight ... And World War II started when Poland invaded Germany.

AFAICS, Forbes is one of the better paying markets for authors of short fiction.

Outsider

the recovery we paid for was FIRE.

You're FIREd!

sum luk

HomeGnome wrote:

Fed's Bernanke should testify in AIG bailout lawsuit: judge

.... very sorry, but bankers are exempt from judicial process

Yoringe:

Is Manufacturing Poverty a economic activity ????

poicv2.0

"I back up my gmail locally... onto a single, aging hard drive... My Head Just Exploded"

I print mine out, and store it in a tin-foil/lead lined drawer under-ground in the backyard that has motion sensors around it.

One can never be too safe. Tinfoil Hat

arthur_dent

poicv2.0 wrote:

One can never be too safe.

you do realize the NSA already has a copy.

Investors behavior demonstrates perfect conformance with Cartoon Laws of Physics

Cartoon Law I

Any body suspended in space will remain in space until made aware of its situation.

Daffy Duck steps off a cliff, expecting further pastureland. He loiters in midair, soliloquizing flippantly, until he chances to look down. At this point, the familiar principle of 32 feet per second per second

takes over.Cartoon Law II

Any body in motion will tend to remain in motion until solid matter intervenes suddenly.

Whether shot from a cannon or in hot pursuit on foot, cartoon characters are so absolute in their momentum that only a telephone pole or an outsize boulder retards their forward motion absolutely. Sir Isaac Newton called this sudden termination of motion the stooge's surcease.

... ... ...

Cartoon Law IV

The time required for an object to fall twenty stories is greater than or equal to the time it takes for whoever knocked it off the ledge to spiral down twenty flights to attempt to capture it unbroken.

Such an object is inevitably priceless, the attempt to capture it inevitably unsuccessful.

Cartoon Law V

All principles of gravity are negated by fear.

Psychic forces are sufficient in most bodies for a shock to propel them directly away from the earth's surface. A spooky noise or an adversary's signature sound will induce motion upward, usually to the cradle of a chandelier, a treetop, or the crest of a flagpole. The feet of a character who is running or the wheels of a speeding auto need never touch the ground, especially when in flight.

dryfly wrote on Thu, 7/25/2013 - 2:54 pm (in reply to...)

ResistanceIsFeudal:

Luckily for Bernanke, he will not be at the helm when we do what becomes politically expedient.

No and maybe if we are lucky the finger prints left on the corpse will be Larry's. That alone almost makes me hope he is the next Fed chair.

ResistanceIsFeudal:

Would be interesting and therapeutic to see one of the aristocrats eat what they cooked for once.

poicv2.0:

Stop Yellin about Yellin!!!!!!!!!!!

Whiskey:

Apparently "brilliant economist" is an oxymoronic term for a man who wrecked the finances of Harvard and the economy in Latvia.

blinkered:

why summers for fed chair? Why not corzine?

Comrade Kristina:

Summers ranks right up there with Phil Gramm so far as I'm concerned. Another criminal.

Yoringe

Since Larry destroyed everything he touched so far, why not support him for Fed Chair??

Comrade Kristina

Stupid women. Always so emotional.

Yoringe

Emotional Women, always so stupid...

Calculated Risk

robj wrote on Sun, 7/21/2013 - 9:31 pm (in reply to...)

poicv2.0 wrote:

How come I never read any articles on ZeroBrain about people who took the erudite members of Zero Brain's advice and lost 40% on Gold in 6 months?

That's because they don't charge a fee. They just effluviate into the atmosphere for free, like gnomes.

sdtfs wrote on Sun, 7/21/2013 - 9:34 pm (in reply to...)

poicv2.0 wrote:

and lost 40% on Gold in 6 months?

Because gold only goes up. Duh.

March 04, 2013 | Cassandra Does Tokyo

So, there you have it: the prescient and growing on-line financial buccaneer encompasses investment, trading, gambling, entertainment, gaming and partying online all rolled into one - though not necessarily in that order. To reorder them in terms of likely target customer profile it might be: Gambling, gaming, entertainment, trading, partying, and that's it. Sadly, FWIW, we don't see the word Investment too much in their website.

Some years ago (before most of you were born), the technical buzzword within the financial industry was "convergence". This primarily meant the narrowing of differences between between traditional banking and securities markets. What they (BOTH Banks and securities firms) completely missed was the other convergence: that between trading and entertainment/gambling. Perhaps, if Schwab, e-Trade or ScottTrade had been more imaginative, adding modern casino-like sound effects (F16 turbothrusters when you place a trade; ka-ching! when an open trade ticks in your favor or a rhinoceros fart when it moves against) along with more dramatic visual GUIs, they potentially could have have squashed the usurpers in their tracks. Perhaps they were too busy hanging out in the comfort zones. But the real convergence, still, is yet to come, as frankly I am waiting for elephants - like Steve Wynn or Sheldon Adelson - those with the most comprehensive knowledge of how to inebriate, hypnotize, and seduce the punters while stealing their wallet, to expand into the online spread-betting business before I open my account.

All this begs the question: how will banks and securities firms respond to customers' seeming demands for entertainment and hedonism while investing? There is nothing worse than than the slow and painful torture of watching one's customers drift away without effective response. Bear Stearns (and others) have tried hiring entertainers (at least that's what they called former Fed Governor Wayne Angell when he was their lead currency strategist). I leave that one open for you to provide the requisite "strategic advice"...

March 07, 2013 | Cassandra Does Tokyo

Being permanently bearish on equities definitely pays.

Just ask Zero-Hedge. Unfortunately, for wool-dyed pessimists and the other overly-skeptical black sheep of the thundering herd, it pays apocalyptic newsletter writers' paychecks, and Zero-Hedge/Tyler Durden's Manhattan bar tabs rather than those who permanently position against market priapism. And it's worse than zero-sum because those who are optimistically-challenged often pay for the bad advice - whether directly in subscriptions, inflated margins on retail bullion products, or indirectly via page-views and click-throughs AND then they get hosed by the market.

The first step to improving behaviour toxic to one's own self interest is admit one has a problem. As an aid to help those who have difficulty in distinguishing "a bearish trade" from "the lead boots of anger and pessimism", I've devised a little something I call the Zero-Hedge Test to determine more precisely whether readers objective realities are sufficiently paranoid, pessimistic, anti-social and rantingly angry to warrant more serious help.

Instructions: Circle the letter that best describes the adjacent image:

a. a glass of water

b. glass of water, half-empty

c. glass of water, half-full

d. glass of errrr ummm , Grey Goose vodka? (NB: ed. choice)

e. The US Government must have stolen half of a glass of water.

a. First black elected (and first to be re-elected) President of the USA

b. Barack Hussein Obama

c. A Former Senator from Illinois

d. tall guy who used to like to sneak a cigarette now & then

e. Jezebel, dark Sith Lord Vader Emperor & Chief of the Plunge Protection Team. Odious non-American african muslim responsible for taking away our world-beating healthcare, encouraging the immigrants and foreigners who took our our jobs, and formulating a secret plan to put two-dads in every home .

a. Something that still buys a 12oz can of Coca-Cola

b. A greenback, worth a dollar, which, on average, an American is paid each 4 minutes of work

c. A US Federal Reserve Banknote almost universally accepted in exchange for goods and services the world over

d. A cocaine hoovering apparatus c1978

e. Worthless fiat toiletpaper, so useless that bric-a-brac, watches, baseball cards or bitcoin should be more preferred than this P.o.S. that forms part of the elders of Zion grand plan to steal your labour savings before eating your babies.

a. six would-be wedding bands

b. 1oz novelty of pure gold smelted by JM

c. Au = element #79 on Periodic Table

d. Reward for a 9.59 sec 100m

e. The solution to all our financial problems...changer of men from liberal faggot zionist atheist swine into god-fearing hardworking people of fortitude and rectitude...curer of cancer, balancer of budgets....purifier of all our precious bodily fluids and divinely-given laws....come, my preciousssss...

a. ummm Europe?

b. Site of the war which was believed to be the war to end all wars (excepting the worse one that immediately followed)

c. Continent with mix of culture, cuisine, history, engineering, and civilized living standards

d. A place for Brits to go on holiday

e. Socialist commie cesspit of looney bureaucrats, unworkable financial alliances, gulag-healthcare systems, leading the world in obstinate unions, lazy workers, regulatory morass and geographical epi-center of the soon-to-be-arriving disintegration of civilized life on earth.

a. a bull market

b. an uptrend

c. a squiggly line

d. reflection of long-term (nominal) growth

e. an accident waiting to happen caused by insane, stupid, or insanely stupid people, or conspirators doing insane and stupid things that will end very very badly with the dystopian destruction of the civilized economy as we know it and reversion to an economic life of warlords and barter using nuggets of gold and silver as portrayed in that film with Kevin Costner, "The Postman"....

a. beginning of a 5-year bull market

b. beginning of an uptrend

c. a squiggly-line

d. technical reversal of severely oversold position

e. an obvious orchestrated short-squeeze caused by the elders of zion and their 0.1% lackeys controlling the Soros-Rubin-Banker-Fed-Axis pulling the levers at the Fed Plunge Protection Team for the sake of enriching their cabal whilst duping and hiding the truth of how the rich steal money from hardworking ordinary Americans

a. a pooled investment in Gold

b. a low-cost alternative to buying, holding, storing & insuring physical commodities

c. an easy liquid way to bet on the price of gold

d. useful asset allocation tool for diversification

e. a conspiracy to defraud honest hard-working speculative investors who've put their hard-earned savings into physical bullion held at secure vaults outside the USA, who have been cheated by the depressing influence these instrument have on the physical gold price by diluting the buying power which would otherwise raise the price of Gold benefitting all the other paranoid gold-bugs and survivalists who've already bought physical bullion in the form of coins at significant premiums or for delivery in a secure vault outside the USA.

a provider of goods for the shelves of Walmart

b. ambitious nation that has (for the moment) successfully lifted hundreds of milllions of her citizens out of poverty

c. future demographic bomb resulting from 1-child policy

d. one of the oldest civilizations who made fine silks when most europeans were donning animal skins

e. yellow peril mercantilist currency manipulator who took our jobs (please watch -C.) who are taking the places of children of hard-working americans at our top universities and the trading rooms on Wall Street, and who are taking over ownership of our country

a. a man with a beard

b. Nobel-prive winning economist

c. Princeton Prof & contentious NYT columnist

d. Consistent proponent of the view that it is better to try to grow rather than austerity our way out of economic depression.

e. A liberal faggot anti-christ he-Devil, devoted to Keynes and insulting to the spirit of the greatest economist of all time: Ludvig von Mises causing vilifiers to wonder why the USA Govt can increase its credit card bill, when if they do it (individually), they just get mean letters from Capital One or the card-services department at their bank; just wants to take the money of hardworking Americans and give it to entitlement-cheats who make babies to collect welfare and food stamps so they can buy drugs and Fritos (in that order).

a. impractical fashion trend

b. An accessory when listening to late-night radio

c. a joke from ser. 6, ep. 6 of Big Bang Theory

d. art project c.1977 gone very wrong

e. an important tool in preventing aliens and the American government from influencing your thoughts and controlling your brain which is one of the best kept secrets along with the PPT, George Soros' role as the leader of the conspiracy by the Elders of Zion to take over the world financial system and rule the world and keep the hard-working man dumb and stupid and rig the system against hard-working Americans.How to Score:

a=1pt; b=1pt; c=1pt; d=1pt; e=5ptsInterpreting the results:

0 - 11 - Surely a grad from an effeminate liberal east-coast university

12 - 22 - Got some financial redneck potential in you

23 - 33 - Wishing you had a Kazcynski-cabin of your own?

34 - 44 - Likely owner of guns, ammo, & survivalist subscriber

45 - 55 - Honorary Fight Club Member; NB: The NSA is watching you...

Zero Hedge

Yesterday's move confirms what everyone suspected, that Ben Bernanke is more of a CNBC stock market cheerleader than a Fed Chairman...

Indeed, it is almost impossible to make the case that stocks are starting another major move up here. We have, in no certain order:

1) A collapse in corporate earnings

2) The collapse in US GDP

3) The European banking crisis back

4) The European sovereign crisis back (Portugal's 10 year spiked above 8%)

5) China's hard landing (electrical consumption is up just 2.3%)

6) A Fed that is literally beginning to mutiny with calls to end QE growing louder by the week

arthur_dent wrote:

be warned, there is a scheduled injection of Fed psycho-babble at 2:45 today

ResistanceIsFeudal

(in reply to...) Rob Dawg wrote:

I guess all time wall street highs don't mean as much on main street.

(snooooooort!) nope...

sum luk:

Yoringe wrote:

And HE spoke: There will be profits....

So profits appeard....

Book of Ben, 2018 A.C.... never been a better time to be part of the right crowd

Former Idealist wrote

Lawrence Summers passes the Federal Reserve litmus test.... stringent requirements that they are.... be Jewish.

Prior taco sales experience is not required.

ResistanceIsFeudal

The next administration, under Summers as Chairman of the Federal Reserve, and Jamie Dimon as Sec of Treasury, is bound to be interesting... all we needs us is a patsy to sit in the Oval Office

Today the Securities and Exchange Commission approved a rule that would allow hedge funds to advertise publicly for the first time in 80 years. The ban had been intended to protect unsophisticated investors from the risky, barely regulated investment pools that now control more than $2 trillion in assets; the commission approved the change by a 4-to-1 vote. "Without common-sense protections, general solicitation will prove be a great boon to the fraudster," Democratic Commissioner Luis Aguilar, the lone dissenter, said in a statement. "Experience tells us that this will lead to economic disaster for many investors."

While the fund industry is taking its time focus-testing new marketing plans, the wiseguys on Twitter wasted no time offering up suggestions for hedge fund slogans that might appeal to the masses:

Everywhere you want to be (and a few places you dont!) #hedgefundslogans

- Barry Ritholtz (@ritholtz) July 10, 2013What's-Left-Of-Your-Money Back Guarantee#HedgeFundSlogans

- Ivan the K™ (@IvanTheK) July 10, 2013Creating Alpha since, well, mostly never #hedgefundslogans

- Barry Ritholtz (@ritholtz) July 10, 2013You'd be better off with an index fund #hedgefundslogans

- Matt O'Brien (@ObsoleteDogma) July 10, 2013Snitches Get Stitches #HedgeFundSlogans

- Ivan the K™ (@IvanTheK) July 10, 2013High-water mark, what high-water mark…… #Hedgefundslogans

- InterestArb (@InterestArb) July 10, 2013Because What's The Worst Thing That Can Happen #HedgeFundSlogans

- barnejek (@barnejek) July 10, 2013We are not on the SEC's most wanted list. #HedgeFundSlogans

- Matt (@MattVATech) July 10, 2013You want a friend? Get a dog #hedgefundslogans

- Eric Jackson (@ericjackson) July 10, 2013

Zero Hedge

Caviar Emptor

Reagan proved that deficits don't matter

Obama proved that debt doesn't matter

Bernanke will soon prove that the currency matters less and less and less

Zero Hedge

The Fed may have finally taken speaking out of all sides of its mouth a step too far. Enter GMP's Adrian Miller with the best roundup of the sheer indecipherable gibberish just excreted by the Fed:

- "We are not sure how you can go from 'many' needing to see labor gains before tapering begins to half seeing bond buying ending by year end. At the same time, 'many' other Fed officials saw bond buying into 2014"

- "We are pretty good at math, but we are having trouble adding up the 'many,' 'several' and 'about half' to equal 100%

- FOMC members appear to have ''decided to cover every possible scenario," and "left us with no clear picture as to what the group is thinking"

July 7th, 2013 | The Reformed Broker

Investment Newsletter Mauldin Economics

Taper: ta■per:

v. a) to gradually decrease, as in action or force

b) to grow gradually lean

"Committee - a group of men who keep minutes and waste hours."

– Milton Berle

"Consistency requires you to be as ignorant today as you were a year ago."

– Bernard Berenson

"If it were done when 'tis done, then 'twere well

It were done quickly."

– William Shakespeare, Macbeth: Act I, Scene VII

Taper: ta■per:

n. a long, waxed wick used especially for lighting fires

... ... ...

What we SHOULD get from the FOMC is a statement that looks something like this:

The committee feels that the economy is moribund and growth is faltering despite our best efforts at reviving it. We have kept rates at zero for the last several years and will be forced to do so for the foreseeable future - likely several years if the bond markets allow us to.

We fully realize that at some point we will have to work out how to wean the world off freshly printed money, but that day is a long way off; and so, for now, there is absolutely no need to worry about that eventuality.

We have said that we will begin to wind back QE once unemployment falls at least to 6.5%, but we very carefully said "at least" so that we had some wiggle room, because the chances are that, should we reach that target, things won't actually be in a state where we can withdraw stimulus, and then we will need to change our language.

The Committee has decided to confiscate your savings through ZIRP and inflation so you will be forced to invest your money in risky assets, which policy we hope - oh how we hope - will stimulate some growth. We understand that you may think you have the right to live off the interest on the nest egg you have so carefully saved over your working life, but right now the needs of the many outweigh your own.

We will try to let you know when we are serious about pulling back on the monetary throttle; but in the meantime, get out there and spend, spend, spend.

Please.

Apr 12, 2010

In an article reporting on the debate over extending unemployment insurance benefits the Washington Post told readers: "on Wednesday, Federal Reserve Chairman Ben S. Bernanke warned that growing budget deficits imperiled the economy's long-term stability."

It is worth noting that in his capacity as a Federal Reserve Board governor from 2002 to 2005, chief economic adviser President Bush, and then Fed Chair since January of 2006, Bernanke never raised any concerns about the housing bubble and the threat it posed to the economy. Based on this history, readers may question Mr. Bernanke's ability to assess threats to economic stability. The Post should have informed readers of Bernanke's record on this issue.

--Dean Baker

June 21, 2007 | Bloomberg.com

"Granddad Benny, is it true that central bankers used to believe they could steer the global economy with quarter-point twitches in overnight rates?''

Granddad looked up from his GoogleSoft iSpreadsheet, where a flashing red ``health care'' box was blocking 2027's planned expenditure from matching the income cell.

``Yes, Joel. For about a decade we all believed central banks could ensure people had jobs, and could afford food and housing and such. That all changed after the Gigantic Global Bubble Burst of 2008.''

Joel put down his Mandarin dictionary.

``That's what my socio-economics teacher says we'll learn about next week. She called it the Giglobubu. What happened in 2008, Granddad?''

``We're still not sure, Joel,'' Granddad said. ``At the time, some accused the New Zealand central bank, some said it was the bond market, while others blamed the aftershocks of a slump in the U.S. housing market. If she's smart, your teacher will probably spend a lot of time talking about China.''

Martial

Helicopter Ben is now bladeless.

GVB

So he did EJECT?

Frastric

Helicopters don't have ejector seats, if they did the blades would shred the pilot! That's why you're fucked if a helicopter goes down uncontrollably.

Calculated Risk

Vonbek777 wrote on Fri, 6/21/2013 - 7:17 am

And lo the people in the pits cried out to the Manna Maker: "Oh mighty Manna Lord, please send us a leader! Thouest did show us the way with your servant the historian with mighty technical analysis, but we still seem to be lost in this desert."

And then the Manna Maker spoke, "As sure as Summer follows Spring, your wanderings are drawing to a close. And yay my humble bearded academic will not follow you into the promised land of easy money and 2 martini lunches. His task is done."

And the people in the pits cheered and said: "Lo the Mighty Manna Maker has not forsaken us, let us build a golden bull to commemorate his fidelity!"

The Manna Maker looked down and bellowed one last quip:

"My new champion will be a force of leadership and command, heed my servant well, for thy promised land is currently occupied, might even say entrenched, at the least heavily defended. Once more into the breech, and all that my servants, wear thy red shirts."

adornosghost wrote on Fri, 6/21/2013 - 7:25 am (in reply to...)

ResistanceIsFeudal wrote:

I think the housing religion is a uniquely American cultural trait.

"Studies conducted by psychology professor Paul Piff found those who drive luxury cars were less likely to stop for pedestrians, those with more money were more likely take candy from children, and the wealthiest among us were more likely to cheat in a game with a $50 cash prize. Researchers at UC Berkeley have also found lower-class individuals are more physiologically attuned to the suffering of others than their middle- and upper-class counterparts."

merchants of fear

scams are profitable... enforcement is very selective and fines are reasonable

The Silence of the Lambs

Dr. Hannibal Lecter (Anthony Hopkins): A census taker once tried to test me. I ate his liver with some fava beans and a nice Chianti.

Paul Krugman (as himself): Hmmm … I didn't realize surveys had such a large multiplier. Remind me to write about the overwhelming case for more census workers.The Gambler

Axel Freed (James Caan): I'm not going to lose it. I'm going to gamble it.

Jamie Dimon (as himself): Wrong either way, Ax. Repeat after me – you're not gambling, you're hedging.The Color of Money

Eddie Felson (Paul Newman): Money won is twice as sweet as money earned.

Ben Bernanke (as himself): If you think those are the only two choices then try hanging with me, Ed. I'll show you sweet!Taxi Driver

Travis Bickle (Robert De Niro), talking to himself in mirror: You talkin' to me? Then who the hell else are you talkin' … you talkin' to me? Well, I don't see anyone else here.

Bickle's phone and computer (in unison): Check again, Trav.E.T. The Extra-Terrestrial

E.T.: E.T. phone home.

Barack Obama (as himself): Not so fast, alien guy. You'd better hook up that phone thing to our network first.Liar, Liar

Cop: Why don't we just take it from the top?

Fletcher Reede (Jim Carrey): Here it goes: I sped. I followed too closely. I ran a stop sign. I almost hit a Chevy. I sped some more. I failed to yield at a crosswalk. I changed lanes at an intersection. I changed lanes without signaling while running a red light and SPEEDING!

Cop: Is that all?

Fletcher: No … I trolled comment threads and bought embarrassing stuff on eBay.Apocalypse Now

Lieutenant Colonel Bill Kilgore (Robert Duvall): Napalm, son. Nothing else in the world smells like that. I love the smell of Napalm in the morning.

Paul Krugman (as himself): And just think of the added environmental clean-up costs! It's hard to find an expense that keeps the stimulus flowing for years and years.Jaws

Police Chief Martin Brody (Roy Scheider), aiming his rifle at an oxygen tank lodged in the shark's mouth: Smile you son of a BITCH!

Eric Holder (as himself): Lower the gun, Chief Brody.

Brody: Huh?!?

Holder: New policy, Chief. We let the big fish get away.Trading Places

Billy Ray Valentine (Eddie Murphy): Okay, pork belly prices have been dropping all morning … which means that the people who own pork belly contracts are saying "Hey, we're losing all our damn money, and Christmas is around the corner, and I ain't gonna have no money to buy my son the GI Joe with the Kung Fu grip! … So they're panicking … they're screaming "SELL! SELL!" to get out before the price keeps dropping. And then Hilsenrath hits the tape and the price shoots right back up. They called it a put and swore not to scream "SELL!" again.

Escape from New York (no dialog changes necessary)

The Duke (Isaac Hayes in the original, replaced by Lloyd Blankfein in our version): What did I teach you?

President (Donald Pleasance in the original, replaced by Barack Obama in our version): You are the… Duke of New… New York. You're A-Number One.

The Duke: I can't hear you!

President: You… You are the Duke of New York! You're A-Number One!Animal House

Bluto (John Belushi): What? Over? Did you say "over"? Nothing is over until we decide it is! Was it over when the Germans bombed Pearl Harbor?

Paul Krugman (as himself): No, man, that was just the beginning of America's great fiscal stimulus experiment. We über-Keynesians know that wars are the quickest route to full employment. Wait, did you say Germans?Austin Powers: International Man of Mystery

Austin Powers (Mike Myers): Finally those capitalist pigs will pay for their crimes, eh?

Congressperson (any Congressperson): Now, by "pay," you mean more campaign contributions, right?The Crying Game

Fergus (Stephen Rea), on his way out after discovering Dil's little secret: I'm sorry.

Dil (Jaye Davidson in the original, replaced by the aptly-named Jean-Claude Juncker in our version): When it becomes serious, you have to lie.Ghostbusters

Dr. Raymond Stantz (Dan Aykroyd): You don't know what it's like out there. I've worked in the private sector. They expect results.

Timothy Geithner (as himself): I know, I know, I worked for the private sector, too. Well, indirectly I mean, but those Goldman and Citi execs expected results and I delivered.Field of Dreams

The Voice: If you build it, he will come.

Paul Krugman (as himself): But it doesn't really matter if he comes or not. The important thing isn't the success of the venture – it's the extra dollars spent!Titanic

Jack Dawson (Leonardo DiCaprio): I'm king of the world!

Ben Bernanke (as himself): Not exactly, Jack.Raising Arizona

H.I. McDunnough (Nicholas Cage): Edwina's insides were a rocky place where my seed could find no purchase.

Ben Bernanke (as himself): My-my, H.I., you don't know about the latest unconventional measures??? Your liquidity injections might just need a little, umm, oomph … some forward guidance and twisting should do the trick.Selected Comments

achmachat

I was so expecting the "Field of Dreams" quote!

it's as Krugman as it gets.

Fleecer

"I'll be takin' these huggies and whatever cash you have in the drawer."

--H.I. McDunnah (panty-hose over his head)... or

--TBTF banker (regarding deposits... aka "post TARP/QE now un-needed excess reserves... aka prop desk fodder)

duo

"This economy is going to see a disaster of Biblical proportions..."

Mayor: "What do you mean, Biblical proportions?"

"Real old-time Keynsian sutff. Cash and bonds coming down from the sky."

Commodity markets boiling, 40 years of 8% gains, earthquakes pushing up the yen"

GM rising from the grave...

Seniors sacrificed, Krugman and Bernanke sleeping together, mass hysteria!"

IridiumRebel

Mayor: is this true?

ZH: Yes it's true....Bernanke has no dick.

tom a taxpayer

Baha men: Who let the dogs out?

Bernanke: Me.

buzzsaw99

Ron Paul: That bernankinator is out there. It can't be bargained with. It can't be reasoned with. It doesn't feel pity, or remorse, or fear. And it absolutely will not stop, ever, until we are all dead.

ZH: Can you stop it?

Ron Paul: You can't stop him! He'll wait for you, reach down your throat, and pull your fucking heart out!

Freddie

Field of Dreams

The Voice: If you build it, he will come.

Obama: You didn't built that.

Atlantis Consigliore

Free Markets: (Bernank laughing) http://youtu.be/zdJ8x6lyrfo

TheFuture_MrGittes

Ned Beatty (Arthur Jensen) might be a better rewrite for Network.

"You have meddled with the primal forces of central banking, Mr. Bernanke, and I won't have it!! Is that clear?! You think you've merely hinted at tapering QE. That is not the case. The banks have fearlessly gambled with trillions of fiat dollars in derivatives, and now they must be made whole! It is ebb and flow, tidal gravity! It is economical balance!

You are an old man who thinks in terms of a recovery, a return to risk and reward. There is no recovery! There are no risks. It is all reward. There are no losses. There are no write-downs. There are no jubilees. There is only one holistic system of systems, one vast and immane, interwoven, interacting, multivariate, multinational dominion of debt-based fiat dollars. Petro-dollars, electro-dollars, multi-dollars, Euros, RMB, rubles, pounds, and shekels.

It is the international system of fiat currency which determines the totality of balance sheets on this planet. That is the 'new' natural order of things today. That is the atomic and subatomic and galactic structure of things today! And YOU have meddled with the primal forces of central banking, and YOU WILL ATONE!

Am I getting through to you, Mr. Bernanke?

You get up on your little thirty-six inch screen and howl about America and recovery. There is no America. There is no recovery. There is only Goldman Sachs and JP Morgan and UBS and HSBC, Barclays, Credit Suisse, and NM Rothschild. Those are the nations of the world today.

What do you think the Bankers talk about in their councils of state -- Milton Friedman? They get out their linear programming charts, statistical decision theories, minimax solutions, and compute the price-cost probabilities of their transactions and investments, throw them in the bin and front-run the Fed, just like we do.

We no longer live in a world of nations and ideologies, Mr. Bernanke. The world is a college of expropriations, inexorably determined by the highly mutable bylaws of central planning. The world is an oligarchy, Mr. Bernanke. It has been since man first crawled to the state . And our children will live, Mr. Bernanke, to see that perfect world in which there's war or famine, oppression or brutality, whatever we need -- one vast and ecumenical holding company, for whom all lesser men will work to serve our profit, in which all men will hold an overvalued share of stock, all necessities expensive, all anxieties medicated, all boredom amused.

And I have chosen you, Mr. Bernanke, to preach this evangel."

Bernanke: "But why me?"

Jensen: "Because you're the Fed Chairman, dummy"

Bernanke: "I have seen the face of God"

Jensen: "And now, like us, you must do God's work."

Zero Hedge

and as we have previously noted (via William Banzai),

The Fool's Prayer, Edward Roland Sill, 1841-1887

Cleverly Adapted by WilliamBanzai7THE ROYAL FEAST WAS DONE; the Chairman sought some new monetary trick to banish care,

And to his jester cried: "Sir Fool, Kneel now, and make for us a Keynesian prayer!"The jester doffed his cap and bells,

And stood the mocking court before;

They could not see the bitter smile

Behind the fractional reserved grin he wore.He bowed his head, and bent his knee

Upon the desperate Chairman's silken stool;

His pleading voice arose: "O Lord,

Be merciful to me, a Keynesian fool!"No pity, Lord, could change the heart

From red with debt to darkened wool;

The markets must heal the sin: but Lord,

Be merciful to me, a Keynesian fool!"'T is not by gilt the downward steep

Of truth and right, O Lord, we stay;

'T is by our follies that so long

We hold titled men of fraud away from Dante's fate."These clumsy feet, still in the economic mire,

Go debasing common wealth without end;

These duplicitous hands we thrust

To pull the heart-strings of our bankrupt friends."The ill-timed truth we might have kept--

Who knows how sharp it pierced and stung?

The word we had not sense to say--

Who knows how grandly it had rung!"Our faults no tenderness should ask.

The chastening jail stripes must cleanse them all;

But for our fiat blunders -- oh, in shame

Before the eyes of market heaven we shall fall."Earth bears no balsam for mistakes;

Men crown the knave, and scourge the tool

That did his will; but Thou, O Lord,

Be merciful to me, a Keynesian fool!"The room was hushed; in silence rose

The Chairman, and sought his gardens cool,

And walked apart, and murmured low,

"Be merciful to me, a Keynesian fool!"

Claiming that enough time had surely passed since they last caused a global economic meltdown, top executives from the U.S. financial sector told reporters Monday that they are just about ready to completely destroy the world again.

Representatives from all major banking and investment institutions cited recent increases in consumer spending, rebounding home prices, and a stabilizing unemployment rate as confirmation that the time had once again come to inflict another round of catastrophic financial losses on individuals and businesses worldwide.

"It's been about five or six years since we last crippled every major market on the planet, so it seems like the time is right for us to get back out there and start ruining the lives of billions of people again," said Goldman Sachs CEO Lloyd Blankfein. "We gave it some time and let everyone get a little comfortable, and now we're looking to get back on the old horse, shatter some consumer confidence, and flat-out kill any optimism for a stable global economy for years to come."

"People are beginning to feel at ease spending money and investing in their futures again," Blankfein continued. "That's the perfect time to step in and do what we do best: rip the heart right out of the world's economy."

According to sources, the overwhelming majority of investment bankers are "ready to get the ball rolling" by approving a host of complex and poorly understood debt-backed securities that are doomed to quickly default, as well as issuing startlingly high-risk loans certain to drive thousands of companies into insolvency.

Top-level executives also told reporters that when it comes to depleting the life savings of millions of people and sending every major national economy into a tailspin, they feel "refreshed and raring to go."

"The other day I actually overheard someone on the sidewalk utter the words 'I'm saving up for retirement,' and right away I thought to myself, 'Well, time to get down to work,'" said Morgan Stanley chairman James P. Gorman, adding that the increasing number of individuals entertaining ideas of starting their own businesses or buying houses was the financial sector's cue to set off another devastating global recession. "We're definitely thinking on a huge scale again, because we all really enjoy toying with the livelihoods of millions of people overseas and forcing them to wonder why reckless, split-second decisions made thousands of miles away dictate their whole country's socioeconomic future."

"Plus, it'll be nice to finally wipe out the Euro once and for all this time," Gorman added.

While most private equity firms, investment banks, and hedge funds are reportedly still undecided on the precise route to take in order to torpedo the job market and crash all international stock exchanges, sources confirmed they are nearly in position to resume gambling away trillions of dollars belonging to the American populace.

"We've got a lot of options on the table; it's just a matter of picking which one we want to use to paralyze every single sector of the world economy," said Capital One executive vice president Peter Schnall. "We already burst the dot-com and housing bubbles, so this time we can maybe mix it up by popping the education bubble and shattering the lives of everyone with outstanding student loans. Or maybe we'll artificially inflate prices of stocks in social media companies and then pull the rug out, bankrupting every investor tied to companies like Facebook and Twitter. Or do both."

"On second thought, maybe we'll wipe out the housing market again too, just for the hell of it," Schnall quickly added. "Might as well, right?"

According to a recent survey of Wall Street officials, 82 percent said they were "excited to shake off the rust" and send the Dow and NASDAQ into another freefall. Additionally, 75 percent of respondents admitted they have been "champing at the bit" for months to wholly undermine the nation's local banks and money market accounts, leaving Americans too terrified to leave their savings anywhere.

Moreover, the chief financial officers from Bank of America, Citigroup, JPMorgan Chase, and Wells Fargo unanimously told reporters that it has been "way too long" since they last saw the utterly dejected faces of American families whose homes had just been foreclosed on due to circumstances totally beyond their control.

"Now that the public's efforts to curtail questionable Wall Street trading practices have all but ceased, it's time for us to bring the world to its knees again," said AIG CEO Robert Benmosche. "There are still plenty of opaque financial derivatives, high-frequency trading operations, and off-balance sheet transactions out there, all with virtually no federal regulation. Trust me, we can definitely work with that. And if anything, we can always just lobby for further concessions and deregulation in Washington-which, by the way, is so, so easy to do-and then we can cause as much damage as we want."

Added Benmosche, "And while we're at it, we'll make sure we once again come away from this whole thing scot-free and far wealthier."

(Source: the Onion)

sold2u CT

Hey, the confidence fairy arrived. Without a new New Deal.

How about that?

Joker Gotham

She flew in on Ben's helicopter

Jesse's Café Américain

This contains some interesting background on then State Senator Obama and his sudden entrance into the national spotlight.

Billionaire Bankster Breaks into Obama's Cabinet

By Greg Palast

May 2, 2013....Today, Obama has named Penny Pritzker Secretary of Commerce. As the President says, It's a milestone: the first female fraudster to hold that post. No longer will criminal bankers have to lobby the administration - because now they'll have one of their own in the Cabinet.

The following is taken from the Chapter, "Penny's from Heaven?" you'll find in my bestseller, Billionaires & Ballot Bandits.

"We never heard of this guy Barack Obama until 2004. Less than three years before taking the presidency, he was in the Illinois state senate, a swamp of scammers, backhanders, and party machine tools - not a stellar launch pad for the White House. And then, one day, state Sen. Barack Obama was visited by his fairy godmother. Her name is Penny Pritzker.Read the rest here.Pritzker's net worth is listed in Forbes as $1.8 billion, which is one hell of a heavy magic wand in the world of politics. Her wand would have been heavier, and her net worth higher, except that in 2001, the federal government fined her and her family $460 million for the predatory, deceitful, racist tactics and practices of Superior, the bank-and-loan-shark operation she ran on the South Side of Chicago.

Superior was the first of the deregulated go-go banks to go bust - at the time, the costliest failure ever. US taxpayers lost nearly half a billion dollars. Superior's depositors lost millions and poor folk in Sen. Obama's South Side district lost their homes.

Penny did not like paying $460 million. No, not one bit. What she needed was someone to give her Hope and Change. She hoped someone would change the banking regulators and the Commerce Department so she could get away with this crap.

Pritzker introduced Obama, the neophyte state senator, to the Ladies Who Lunch (that's really what they call themselves) on Chicago's Gold Coast. Obama got lunch, gold and better - an introduction to Robert Rubin. Rubin is a former Secretary of the Treasury, former chairman of Goldman Sachs and former co-chairman of Citibank. Even atheists recognized Rubin as the Supreme Deity of Wall Street.

Rubin opened the doors to finance industry vaults for Obama. Extraordinarily for a Democrat, Obama in 2008 raised three times as much from bankers as his Republican opponent...

April 30, 2013 |The Big Picture

wally

It's just as bad to kill people by illegally storing explosive fertilizer as by deliberately bombing them. The laws are broken by the actions you take, not by the thoughts you harbored when you did those things. In the Texas case it apparently wasn't lack of regulations, it was lack of enforcement. That seems to be a common cause of disasters these days.

Crocodile Chuck :

I reckon its deeper than this-it wasn't even lack of enforcement, as regards the zoning laws-there weren't any in the first place (the school and nursing home sited close to the munitions magazine, erm, fertiliser plant). And no one in the community ever even thought about this, let alone raised an alarm, as these were being built.

Mike in Long Island

CalculatedRisk wrote:

The FOMC is begging for help. Congress will never listen.

Clearly they should hire Paulson as a consultant. He managed to get some $$ from Congress....

Rajesh

Nemo wrote:

Congress should start making Five-Year Plans to get the economy back on track.

That's such a good idea. Why don't they make four Five-Year Plans, that way we could get four times as much done?

ResistanceIsFeudal :

Nemo wrote:

Congress should start making Five-Year Plans to get the economy back on track.

.... if yer mommie is a commie, then you gotta turn her in

ResistanceIsFeudal :

Rajesh wrote:

That's such a good idea. Why don't they make four Five-Year Plans, that way we could get four times as much done?

The four alternative Five-Year Plans could compete in the free marketplace of ideas, and naturally the superior market-based solution would thus be able to emerge, resulting in a single best-of-breed Five-Year Plan.

Former Idealist :

So it's rather alarming to see NYSE margin debt just shy of its all-time high as of the March reading.

It's not like they HAVE to pay it back anyway.

Rob Dawg:

FedGov pumping $2 billion per day. Fed pumping $1.5 billion per day. $3.5 billion per day is $10 per person. Think you are being taken to lunch? More like the cleaners.

black dog

October 15th, 2007:

Bernanke: As I indicated in earlier remarks, it is not the responsibility of the Federal Reserve -- nor would it be appropriate -- to protect lenders and investors from the consequences of their financial decisions.

black dog:

may 2011

[former eurozone finance minister] jean claude juncker: "When it becomes serious, you have to lie."

sm_landlord:

dirty_juheesus wrote:

Deregulate intellectual property and they'd have more economic activity. Half of the Los Angeles entertainment industry would try leaping out their first story office windows as this would appear to be the end of their world. Similarly, most of Silicon Valley would leap out of their second story office windows.

Hey, what have you got against government-granted monopolies? Steve

Don't forget the drug companies, their executives would have have to hire a space ship to get to a high enough place to jump from.

Outsider:

FTL: "NYSE Margin Debt Approaches All-Time High"

So it's rather alarming to see NYSE margin debt just shy of its all-time high as of the March reading. My guess is we've actually already surpassed the all-time high though we won't officially know until April data is released. Fun times knowing we live in a world that is built on such a fragile foundation.

I have a nagging sense of foreboding, and this isn't helping.

Apr 07, 2013 | Calculated Risk

ResistanceIsFeudal wrote on Sun, 4/7/2013 - 11:59 am (in reply to...)

sm_landlord wrote:

We know that only dull tools stand a chance of getting elected.

I just assumed that politicians' brain material made the best substitute for silicone in breast implants, at least among the savvier plastic surgery boutiques. Kind of a 'secret sauce' if you will.

Externalized Costs:

Adversity makes for interesting folk. Americans have had it easy for a long while. Though that is changing recently. The tremendous decline of veterans serving in congress from 1976 to now might influence the quality of leadership we enjoy.

- 1976 379 veterans in congress

- 2013 104 veterans in congress

Interesting considering the last decade of constant war.

Veterans In New Congress Fewest Since World War II

sdtfs wrote on Sat, 4/6/2013 - 12:47 pm (in reply to...)

greenchutes wrote:

The 1955ers are the scary ones, the most brilliant yet most damaging and ruthless

I always said I'm like a sociopath except with a few more friends.

Apr 07, 2013 | Calculated Risk

Whiskey:

It isn't just a jobs problem; temporary, low paid employment is at or near a peak.

Temporary employment and work without benefits is likely also a growth area for the economy. Next comes work without pay!

... ... ...

Whiskey:

No, no, no. Prisoners make 11 cents per hour.

"..Crude oil prices are determined largely in an international marketplace by the balance between production in OPEC and non-OPEC nations and demand. In the reference case, the average lower 48 crude oil price is projected to be $23.61 per barrel in 2010 and $26.72 per barrel in 2025 (Figure 93). In the high world oil price case, the lower 48 crude oil price increases to $32.80 per barrel in 2010 and $34.90 per barrel in 2025. In the low world oil price case, the lower 48 price generally declines to $16.36 per barrel in 2010, then rises to $16.49 per barrel in 2025..."

April 2nd, 2013 |

vavoida

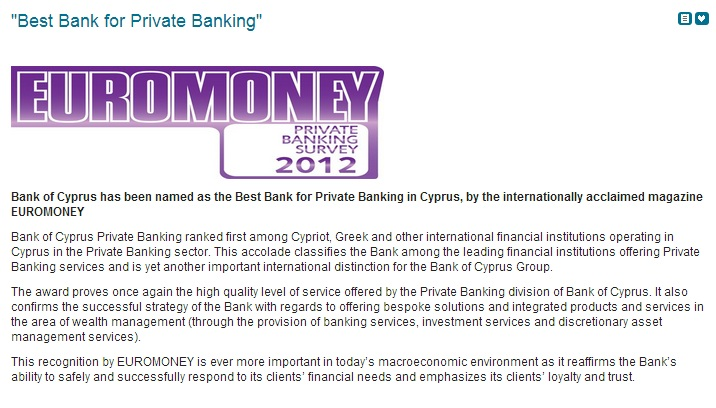

well in Cyprus as everywhere – "In the country of the blind the one-eyed man is king."

btw. list of further awards:

http://www.economicpolicyjournal.com/2013/03/must-read-great-super-fantastic-bank-of.html

Sep 26 2012 – Bank of Cyprus has been awarded the '2011 Citi Performance Excellence Award'

constantnormal:

I suspect that the Bank of Cyprus is holding out for an adequate offer from Euromoney magazine to get them to change it …

3/31/2013

Mr Slippery

NY Times wrote:

Particularly successful at luring Russians, Cyprus has built up a large infrastructure of lawyers, accountants and other professionals schooled in the arts of tax avoidance.

Some would say tax compliance instead of tax avoidance. How much did GE pay in federal taxes last year? Skilled tax compliance.

sm_landlord:

lawyerliz wrote:

isn't it better to pay some taxes and be able to get your money

Well, a 70% haircut in France is not as bad as a 40% haircut in Cyprus.

Somebody really worked hard to squeeze out that new high in S&P500, even on very light volume.

There is no mess quite so bad that eurocrat intervention won't make even worse. They make a desert out of Cyprus and called it the solution I think I already head about "ultimate solution" from one previous German government

all € are equal, but some € are more equal than others.

stevefest

...Financial Advertising is showing up more and more each day on paid advertising outlets. Give the smart money 6-12 months to transfer stocks at a good profit to the dumb money. All the "last buyers" will be in. The bottom drops out, dumb money loses a quick 30% and vows never to buy stocks again.

This story repeats over and over again...

Why Does No One Speak of America's Oligarchs?

One of the striking elements of the demonization of Cyprus was how it was depicted as a willing tool of Russian money launderers and oligarchs. But notice another implicit part of the story: that Russia's oligarchs and "dirty money" are distinctive national creation. Do you ever hear Carlos Slim or Rupert Murdoch or the Koch Brothers described as oligarchs?

Second Best said...

What?! The beginning of the Arab Spring was actually the inception of the Economic Winter?!

25th March 2013 | BBC Worldnews.com

spit

Could someone wiser than I am please enlighten me? We were told that Russians laundered their money in Cyprus so most deposits are tainted, yet less than 24hours after the bailout agreement banks from Germany (sic), the Andoras and other countries are flying post haste to Cyprus offering these very same Russians a bank account no questions asked. Is this a case of some pigs are more equal??

Bill Walker

Given the latest news that the Cyprus levy may be taken as a template for further bailouts, then it might be a good business opportunity for our financial institutions to open up a chain of safety deposit boxes across southern Europe. Safer than cash under the mattress. At least when burglars nick your cash they spend it boosting the local economy instead of the German one.

Andy in Leeds

Defenders of the EU often cite the fact that it has prevented conflict on the European continent these past 50 years. I've never bought that. Can anyone think of anything that could have possibly made Germany more resented across the continent than the euro?

TomGa:

Damn, I should have paid more attention to last week's email!

Dear prestigious associate,

I am the esteemed Finance Minster of the Russian Republic. Recently we have discovered undocumented funds held by us in special accounts in Cyprus. WE solicit your help in receiving 30 BILLION EUROs to an account which you establish for our mutual benefit. For your assistance you will be awarded 10% of the amount transferred. Please respond with your account details so that we may direct our agents to transfer the cash proceeds for our mutual benefit.

Best regards,

Dr. Ripthefuckyouoff\

Russian Foreign Minister of Finance

RafterManFMJ

"Sometimes I wonder whether the world is being run by smart people who are putting us on or by imbeciles who really mean it." -mark Twain

caconhma

EU assholes bureaucrats want to create European Soviet Union.

Shit, these Russians had this shit for almost 70 years. So, they know how to play this game.

A Nanny Moose

It's all fun n' games, till someone loses an eye.

The bank manager with a gun held to his childs head: "Yes sir, no pin neccessary. How much did you need transferring?.. certainly".

Aztec Warrior

Frack-tional Reserve Banking

Fix It Again Timmy

I understand that Putin sent a copy of this to Schaeuble - "Troika Banking For Dummies"....

Fuh Querada

ZH should support Cyrillic text display, in order give due weight to these important trendsetting developments --- suki !

Economist's View

Second Best said...

It's the economy stupid!

No. It's the finance stupid!

DrDick said in reply to Second Best...

It is the stupid finance dominated economy, stupid!

Mar. 18th, 2013 | papasha_mueller

Update. Cypriots are not coming: moved to Wednesday. Our with Cyprus did even better - raising his eyebrows, spread his arms wide and said "please come the next day."

It seems, though, my esteemed readers should write me a check for my amazing insight.

Hey, I was joking, I do not need money, I prefer names and dates of who, what, when...

But let's talk about more important matters: strategic findings about what's coming next inevitably.

- Days of Cyprus as a tax haven (and as any other haven) are over. And this "over" will last for a very, very long time.

- It is undeniable that this nice and prudent initiative of "highway robbery" belongs to the EU and, above all, to Russia best friend in EU -- Germany. And that should temper all the rumors about the level reliability of the European banking system and the equality of all before the law. Yes, all animals are equal - but some animals are more equal than others.

And those no so equal Russian pigs should not try to pretend to be equal to esteemed EU citizens. This dream is now off limits. In short, please don't be surprised if money will leave EU banks in a certain direction. And all this because of a stupid desire to "punish" Russia for showing lack of agreeability to help poor EU to get out of its deep structural financial crisis.

- Separately we should thank our Liebe Frau Merkel . If I remember correctly Germany paid millions to a hacker for the list of tax dodgers - but is there just a list, they must still work and work on each entry individually. And now she gave such a grand free present to her Dear Vladimir. So now Mr. Putin does not need even promise any tax amnesty: those dodgers will now bring everything to him on a silver plate and will thank him many times for taking taxes.

And the benefits of this mass exodus of the capital to its historical motherland might greatly outweigh the costs that would be required for his return. Incidentally, the fairy tale about thirty, or twenty billion of Russian money looks extremely shaky, If the amount had been more than five, Germans would not ask us for ten billion EU help. In short, I propose to give her some high award, like this old jerk Gorbachov got on his birthday. And just hint to dear frau Merkel: if she did not flirt with us in such a strange way we might agree to help EU, but now sorry Parteigenosse Merkel...

Also it looks like now Germany (with paint sniffing Euro Commissioners) totally bomb into stone age this nice, but now remarkably Iceland-like Cyprus. And this sad fact should probably firmly register in the mind of the elite of any nation who until recently desperately wanted to join EU.

Also for Russia to give any money to Cypress bankers look like an extreme stupidity. It's simpler to give some money those who were bankrupted by said bankers directly in Russia. In this case chances to get those money back are higher and also return might be quicker.

This Gennosse Putin is one lucky bustard. Should not we all now glorify him by wearing medals with his canonical profile like amulet ?

And now I with your permission will go to a freezer to empty a couple of bottles of Stoli. What else to expect of those horrible and criminal Russians.

Oh, yes !

fuck it dude, let's go bowling

"Yes, the planet got destroyed. But for a beautiful moment in time we created a lot of value for shareholders."

November 29, 2010 | The New Yorker

...A few months ago, I came across an announcement that Citigroup, the parent company of Citibank, was to be honored, along with its chief executive, Vikram Pandit, for "Advancing the Field of Asset Building in America." This seemed akin to, say, saluting BP for services to the environment or praising Facebook for its commitment to privacy.

..."I facilitate, justify, and advise parties to M&A transactions, when I am not advising against them."

If you think the middle class has it too good, too much security, taxes aren't high enough, not enough fear of unemployment, too much help for education, and so on, while the wealthy haven't been coddled enough in recent years, not enough tax cuts, too little upward redistribution of income, not enough bank bailouts, etc., etc., then [this proposal] should make you happy.

March 9, 2013

The Zero-Hedge Test

Being permanently bearish on equities definitely pays.

Just ask Zero-Hedge. Unfortunately, for wool-dyed pessimists and the other overly-skeptical black sheep of the thundering herd, it pays apocalyptic newsletter writers' paychecks, and Zero-Hedge/Tyler Durden's Manhattan bar tabs rather than those who permanently position against market priapism. And it's worse than zero-sum because those who are optimistically-challenged often pay for the bad advice – whether directly in subscriptions, inflated margins on retail bullion products, or indirectly via page-views and click-throughs AND then they get hosed by the market.

The first step to improving behaviour toxic to one's own self interest is admit one has a problem. As an aid to help those who have difficulty in distinguishing "a bearish trade" from "the lead boots of anger and pessimism", I've devised a little something I call the Zero-Hedge Test to determine more precisely whether readers objective realities are sufficiently paranoid, pessimistic, anti-social and rantingly angry to warrant more serious help.

Instructions: Circle the letter that best describes the adjacent image:

a. a glass of water

b. glass of water, half-empty

c. glass of water, half-full

d. glass of errrr ummm , Grey Goose vodka? (NB: ed. choice)

e. The US Government must have stolen half of a glass of water.

a. First black elected (and first to be re-elected) President of the USA

b. Barack Hussein Obama

c. A Former Senator from Illinois

d. tall guy who used to like to sneak a cigarette now & then

e. Jezebel, dark Sith Lord Vader Emperor & Chief of the Plunge Protection Team. Odious non-American african muslim responsible for taking away our world-beating healthcare, encouraging the immigrants and foreigners who took our our jobs, and formulating a secret plan to put two-dads in every home .

a. Something that still buys a 12oz can of Coca-Cola