, )

, ) | Financial Humor | News | Casino Capitalism Dictionary | Famous quotes of John Kenneth Galbraith | Lord Keynes | The Roads We Take | Humor | Quotes | Etc |

| 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 |

Due to the size quotes were moved to the Casino Capitalism Dictionary

|

|

Switchboard | ||||

| Latest | |||||

| Past week | |||||

| Past month | |||||

, )

, ) | Jan | Feb | Mar | Apr | May | June | July | Aug | Sep | Oct | Nov | Dec |

Economist's View

The Atlantic says:

There are just over 526,000,000 Christian kids under the age of 14 in the world who celebrate Christmas on December 25. In other words, Santa has to deliver presents to almost 22 million kids an hour, every hour, on the night before Christmas. That's about 365,000 kids a minute; about 6,100 a second. Totally doable.On the "totally doable" point, an old post (2005) gives the physicist's view:

Is there a Santa Claus? - a physicist view : Consider the following:

1) No known species of reindeer can fly. But there are 300,000 species of living organisms yet to be classified, and while most of these are insects and germs, this does not COMPLETELY rule out flying reindeer which only Santa has ever seen.

2) There are 2 billion children (persons under 18) in the world. BUT since Santa doesn't (appear) to handle the Muslim, Hindu, Jewish and Buddhist children, that reduces the workload to 15% of the total - 378 million according to Population Reference Bureau. At an average (census) rate of 3.5 children per household, that's 91.8 million homes. One presumes there's at least one good child in each.

3) Santa has 31 hours of Christmas to work with, thanks to the different time zones and the rotation of the earth, assuming he travels east to west (which seems logical).

This works out to 822.6 visits per second. This is to say that for each Christian household with good children, Santa has 1/1000th of a second to park, hop out of the sleigh, jump down the chimney, fill the stockings, distribute the remaining presents under the tree, eat whatever snacks have been left, get back up the chimney, get back into the sleigh and move on to the next house.

Assuming that each of these 91.8 million stops are evenly distributed around the earth (which, of course, we know to be false but for the purposes of our calculations we will accept), we are now talking about .78 miles per household, a total trip of 75-1/2 million miles, not counting stops to do what most of us must do at least once every 31 hours, plus feeding and etc.

This means that Santa's sleigh is moving at 650 miles per second, 3,000 times the speed of sound. For purposes of comparison, the fastest man- made vehicle on earth, the Ulysses space probe, moves at a poky 27.4 miles per second - a conventional reindeer can run, tops, 15 miles per hour.

4) The payload on the sleigh adds another interesting element. Assuming that each child gets nothing more than a medium-sized lego set (2 pounds), the sleigh is carrying 321,300 tons, not counting Santa, who is invariably described as overweight.

On land, conventional reindeer can pull no more than 300 pounds. Even granting that 'flying reindeer' (see point #1) could pull TEN TIMES the normal amount, we cannot do the job with eight, or even nine.

We need 214,200 reindeer. This increases the payload - not even counting the weight of the sleigh - to 353,430 tons. Again, for comparison - this is four times the weight of the Queen Elizabeth.

5) 353,000 tons traveling at 650 miles per second creates enormous air resistance - this will heat the reindeer up in the same fashion as spacecraft re-entering the earth's atmosphere. The lead pair of reindeer will absorb 14.3 QUINTILLION joules of energy. Per second. Each.

In short, they will burst into flame almost instantaneously, exposing the reindeer behind them, and create deafening sonic booms in their wake. The entire reindeer team will be vaporized within 4.26 thousandths of a second.

Santa, meanwhile, will be subjected to centrifugal forces 17,500.06 times greater than gravity. A 250-pound Santa (which seems ludicrously slim) would be pinned to the back of his sleigh by 4,315,015 pounds of force. In conclusion - If Santa ever DID deliver presents on Christmas Eve, he's dead now.

(NOTE: This appeared in the SPY Magazine (January, 1990) )

Of course Santa, like markets, is magic and that is not accounted for in this analysis.

The United States depends on "free trade" for continued expansion - whether in the shape of opium pushed on China or as no less destructive derivatives forced on the rest of the world.

...On its face, derivatives are brilliant. As a postindustrial move, derivatives are not constrained by natural resources, not limited by labor, and restricted only by the salesmen's ability to sell. Upside growth looks unlimited, as "derivatives trading" is based solely on the "ingenuity" of the new-fangled breed of financial engineers.

The salesmen do not even need to explain (and very often cannot) the convoluted "contracts". Instead they rely on the age old "trust me" confidence games. The number of "contracts" is not constrained by anything in the real world. As long as you can find new suckers (buyers), you are set to profit, so the belief goes

Like opium, derivatives cost very little to "manufacture"; the profits are humongous, and it is hugely destructive. In the 1800s, Anglo Americans (Google "Delano" and "opium") forced opium on China, and in one generation or two caused China's economy to drop from being the world's No1 or 2, to below No 100. Just like opium, this time around this new "drug" is also pushed as part of "free trade". Demands are made on all nations that want to do business that they must open their banking industry and relevant markets to the derivatives trade.

Except the difference this time is that it is done backwards. The opium trade was supposed to plague foreigners, and to be banned domestically. But the swashbuckling "traders" this time around are so greedy they have no qualms about profiting from the pain of their own brothers and sisters and even grandmothers - and they did. The derivatives drug is so potent, it took down the Anglo American societies and economies before they could kill the Chinese economy.

ResistanceIsFeudal:

Outsider wrote:

That's a :greenchute: , you have to admit.

Dammit, if we have an actual economic recovery I'm going to be living a relatively stable middle class life with very little debt and a surplus of cash plus the dumber investments in my retirement accounts will probably go up in value. This can't be allowed, I need that damn collapse.

Cobradriver:

And just what are those qualifications that no one seems to have?

I still like the guy who walked out of our interview when he found out that he would have to mop the floor(ETA..take out the trash also) as a job duty. Yep, he was unemployed at the time(no idea now).

We still haven't filled the position. I guess rural Georgia isn't agreeable to most.

Chris

ResistanceIsFeudal :

Former Idealist wrote:

Willingness to work for next to nothing with no benefits while losing foodstamps.

Sounds good for employers! It's lucky for us that debtors, not creditors, are in control of the machinery of our government. Can you imagine what a boon a deflationary environment could be to companies with little to no debt and plenty of cash, plus a surplus of qualified workers?

NOTaREALmerican:

Sure, but what is needed isn't growth, it's optimism about the future.

The peasants will be happy if they have hope. The elite will be happy if they maintain their power.

naked capitalismAmericans roll from a holiday that has come to be about overeating to a day where merchants hope to seduce customers into an orgy of overspending.

In an interesting bout of synchronicity, Michael Thomas just sent me a link to this George Carlin video. It may help steel the will of Black Friday conscientious objectors. I'm also looking forward to Carlin's characteristic crudeness offending the Proper Discourse police (this clip is tame compared to The Aristocrats).

postmodernprimate says: Bill Hicks is another comic genius who would be having a field day with the obscenely target-rich satire bounty modern America has become.

"By the way if anyone here is in advertising or marketing… kill yourself. I'm just trying to plant seeds. Maybe one day, they'll take root – I don't know. You try, you do what you can. Seriously though, if you are, do. I know all the marketing people are going, "he's doing a joke…" there's no joke here whatsoever. Suck a tail-pipe, hang yourself, borrow a gun – I don't care how you do it. Rid the world of your evil machinations. I know what all the marketing people are thinking right now too, "Oh, you know what Bill's doing, he's going for that anti-marketing dollar. That's a good market, he's very smart…"

Sock Puppet says: George Carlin on the American Dream: http://www.youtube.com/watch?v=acLW1vFO-2Q

Finance Addict says: Also consider this on Black Friday: a research paper with a claim of hard evidence that television led to increased debt in the U.S.

http://financeaddict.com/2011/11/black-friday-television-and-debt/

So they demand that they outsource it to the private sector, which means all kinds of extra overhead. Private contractors, being driven by the profit motive, will turn in crappy work unless you spend huge amounts of effort clarifying precisely what's required, followed by meetings to ensure that they have done it. Just the product spec meeting cost more than the time spent actually doing it. All because the Government is Bad.

itwbennett writes "How much does it cost to make a phone app to tell local temperature and suggest how not to get heatstroke, such as drink water and avoid alcohol? If you're the U.S. Government, it'll cost you a pretty penny. Using MuckRock to file a Freedom of Information Act, Rich Jones of GUN.IO discovered the Department of Labor, Occupational Safety and Health Administration paid $106,467 for the Android version; $96,000 for the iPhone version, and an additional $40,000 for a BlackBerry app that never got distributed."

ShavedOrangutan

It was actually $467 for the Android version

... plus $106,000 for change management.

mwvdlee:

You know as well as I do that you can't function as a developer unless you spend at least half your day reporting progress to management. If the six layers of management above you don't know what you're doing, how could you?

Samantha:

Summary can't add

The iPhone version was $56,000. The Blackberry version was $40,000. Together, they were $96,000. It says this very clearly in the original scan.

dredwerker

The iPhone version was $56,000. The Blackberry version was $40,000. Together, they were $96,000. It says this very clearly in the original scan.

It doesn't sound that much once you have dealt with specs and tenders with govt orgs.

ResistanceIsFeudal:

Rob Dawg wrote:

The police have always carried machine guns.

Banks have always used deposit accounts for leveraged speculation and traded against their own client books.

Comrade Kristina:

Bruce in Tennessee:We have always been at war with Oceania

I am proposing a new economic index..the Involuntary Austerity Index...IAI

This would be the amount you need to spend to meet expenses/the amount you actually have available...

Gallup polling would be done monthly..

the IAI should always be <1.

IAI 1.5 would be recession....

IAI 2.0 would be a depression...

IAI of >3, you sleep under a bridge...

The book that Quiggin should have written is the one describing how the zombies took over economics. This is the more interesting story I think. The zombies in Economics are different than the zombies in other fields, where they are mostly insane or senile. In Economics, the zombies have made a conscious choice to be zombies. They have, in effect, sold their own brains. I think this subject is ripe for economic analysis.

The wealthy have benefited enormously from the ideas put forth by the zombies (the rich should always pay less taxes for example) and they have showered money on the fresh water zombies and their schools. It would be interesting to examine how much return they have achieved on their investment.

One of the most salient features of our culture is that there is so much bullshit. Everyone knows this. Each of us contributes his share. But we tend to take the situation for granted. Most people are rather confident of their ability to recognize bullshit and to avoid being taken in by it. So the phenomenon has not aroused much deliberate concern. We have no clear understanding of what bullshit is, why there is so much of it, or what functions it serves. And we lack a conscientiously developed appreciation of what it means to us. In other words, as Harry Frankfurt writes, "we have no theory."

Frankfurt, one of the world's most influential moral philosophers, attempts to build such a theory here. With his characteristic combination of philosophical acuity, psychological insight, and wry humor, Frankfurt proceeds by exploring how bullshit and the related concept of humbug are distinct from lying. He argues that bullshitters misrepresent themselves to their audience not as liars do, that is, by deliberately making false claims about what is true. In fact, bullshit need not be untrue at all.

Rather, bullshitters seek to convey a certain impression of themselves without being concerned about whether anything at all is true. They quietly change the rules governing their end of the conversation so that claims about truth and falsity are irrelevant. Frankfurt concludes that although bullshit can take many innocent forms, excessive indulgence in it can eventually undermine the practitioner's capacity to tell the truth in a way that lying does not. Liars at least acknowledge that it matters what is true. By virtue of this, Frankfurt writes, bullshit is a greater enemy of the truth than lies are.

November 05, 2011 | Economist's View

Paul Krugman has a question for you:

Genuine Hypocrisy, And Attitudes Thereto, by Paul Krugman: Not sure how much blogging I can do this weekend... But here's an item that caught my eye, given what I wrote about hypocrisy yesterday:Deadbeat Rep. Joe Walsh, Who Owes $100k In Child Support, Receives 'Pro-Family' Award From Family Research Council.Now that's real hypocrisy - and if the past is any indication, it won't matter at all for Rep. Walsh's career.There's a big difference between the left and the right in such matters, one that I don't fully understand, although I'm trying. Here's how it goes: if a liberal politician is caught behaving badly - enriching himself while preaching the need to help the poor, or just in general showing himself less than admirable by having an affair, visiting call girls, whatever - his career is over.But if a conservative politician who preaches stern traditional morality is caught engaging in actions that are at odds with what he preaches - buying sex, taking wide stances in restrooms, or, in this case, stiffing his family even while preaching family values - he may well ride right through the scandal. Witness what's going on now with Herman Cain.How can this be? Here's what I understand: on the right, "moral values" are considered to be, literally, God-given principles. And a politician is well-regarded for advocating those values, no matter what he does personally. Instead of his personal behavior devaluing his political position, his political position excuses his personal behavior; a philandering politician who preaches the sacred bond of marriage is considered a good man because of what he says, no matter what he does.And I sort of understand the logic of that position; if the cause is what matters, the flaws of those who serve that cause can be overlooked.In a way the liberal attitude is more puzzling. Why don't people like me show an equal willingness to overlook the sins of those who espouse ideas we like? And we don't. I'm willing to cut some slack; it really matters not at all whom FDR may have turned to for solace, but I can't imagine forgiving a liberal politician who behaved like Walsh.The answer may lie in a greater degree of openness, which makes the principles less absolute and therefore gives greater weight to the personal attributes of the messenger. But I'm not entirely sure. Discuss.I am not sure about this, but let me give another explanation a try anyway. The right believes that the need for government programs derives from the lack of morals of the lower classes. That is, the reason some people are asked to give up a portion of their income to support others -- a redistribution of income the right abhors -- is because these people make poor choices. If they had the necessary morals, if they behaved better, we wouldn't have to take so many resources from those who are successful and waste them on people who could do better if they only had the right value structure.

A successful politician, businessperson, etc. obviously doesn't have these problems. They are successful and their transgressions won't, in the end, result in someone else having to give up income to bail them or their families out. They are not the problem the right is trying to solve. If a poor person takes drugs, endangers their family, drinks too much, etc. the result is a strain on social services and hence on the successful. But when a successful person doesn't live up to the moral code in every way, there's no danger that it will cost others anything -- there are no social externalities to worry about as there are with the poor.

The moral code for the right is really about finding a way to stop asking the good, hard-working people to support people who could support themselves, but make bad choices the hard-working who care about their families would never make. Everyone makes mistakes and people who are basically moral -- and have proven they must be by their success -- should be forgiven when they step over the line, politicians included, it's the fundamentally immoral people that are the problem.

The left, of course, believes social conditions rather than exogenous personal choices have a lot to do with economic outcomes, and that part of this is due to the moral transgressions of those who are better off exploiting the vulnerable. Thus, moral transgressions by the powerful are harder to forgive -- they are a sign that the powerful have no respect for those who are less powerful (e.g. sexual harassment). A tax cheat probably cheats on wages, safety, etc. too, their morals matter for the economic outcomes of the less fortunate, and transgressions are harder to forgive.

But surely you'll have better explanations in comments...

October 31, 2011 | naked capitalism

Cynthia:

There once was a prick named Corzine

His firm looked sick but he said it was fine

Then he finally went broke

Client funds went up in smoke

With any luck he'll be doing some time

H/T: Red Pill at Zero Hedge

The Onion

WASHINGTON-A team of leading archaeologists announced Monday they had uncovered the remains of an ancient job-creating race that, at the peak of its civilization, may have provided occupations for hundreds of thousands of humans in the American Northeast and Midwest.According to researchers, these long- forgotten people once flourished between western New York state and Illinois, erecting highly distinctive steel and brick structures wherever they went, including many buildings thought to have held hundreds of paid workers at a time.

"It's truly fascinating-after spending a certain number of hours performing assigned tasks, the so-called 'employees' at such facilities would receive monetary compensation that allowed them to support themselves and their families," said archaeologist Alan H. Mueller, citing old ledgers and time-keeping devices unearthed at excavation sites in the region. "In fact, this practice seems to have been the norm for their culture, which consisted of advanced tool users capable of exploiting their skills to produce highly valued goods and services."

"It's a complex and intriguing set of rituals we're still trying to fully understand," Mueller added. "But it appears as if their entire society was centered around creating, out of thin air, actual jobs that paid an actual living wage."

The Onion - America's Finest News Source

In the 800-page volume, titled O Say Have I Seen: The Real Truth Behind The Red, White, And Blue, the president renders in explicit detail numerous shocking revelations about the United States, including its inability to manage its finances, its struggles with oil addiction, its willful ignorance of the issues that affect it most deeply, and its frequent battles with obesity.

"Anyone with even a passing interest in the nation is going to want to read all the juicy tidbits the president offers up here," publicist Armand Neal said of the book that draws from Obama's firsthand experiences as well as candid conversations with millions of U.S. insiders. "Nobody has had as much firsthand access to America's demons as the president, and he dishes dirt on everything from the nation's self-destructive, codependent relationship with the pharmaceutical industry to its habit of repeatedly borrowing and spending its way into massive amounts of debt. I promise you, he spills everything-everything-about the United States."

November 2, 2011 | The Nation

Andy Borowitz channels Bank of America as it tries to make nice after dropping plans to charge costumers $5 a month to use their debit cards.

"Dear Valued Costumer," BofA writes. "We are writing to you today with a simple message: 'Our bad.' And to tell you that we are refunding the $5 to you, effective immediately. All you have to do is pay a simple, one-time $10 refund fee."

The Big Picture

- Levered 40:1.

- "The ultimate result of shielding men from the effects of justice is to fill the financial world with criminals."

Economistsview

Jeff Sachs does not like TV:

the mental-health effects of TV viewing might run even deeper than addiction, consumerism, loss of social trust, and political propaganda. Perhaps TV is rewiring heavy viewers' brains and impairing their cognitive capacities

Economistsview

Suzy Khimm poses a question to the Perry campaign:

1) How will the new tax breaks for the wealthy be paid for?Perry campaign: The purpose of this bold tax proposal is to give the economy the jumpstart it needs to get people back to work. ... Gov. Perry is confident that the economic growth that results from this plan will generate the necessary revenue to balance the budget by 2020.So the tax cuts will pay for themselves? Greg Mankiw:

I used the phrase "charlatans and cranks" in the first edition of my principles textbook to describe some of the economic advisers to Ronald Reagan, who told him that broad-based income tax cuts would have such large supply-side effects that the tax cuts would raise tax revenue. I did not find such a claim credible, based on the available evidence. I never have, and I still don't.

Calculated Risk

skk wrote on Sat, 10/29/2011 - 6:58 am (in reply to...)

dilbert dogbert wrote:Common event here in the eastern foothills of the CVBB. Got a good nights sleep at least.

ahhh sleep.. a precious commodity. what was it that Shakespeare said :

O sleep! O gentle sleep!

Nature's soft nurse, how have I frighted thee,

That thou no more wilt weigh my eyelids down

And steep my senses in forgetfulness?

Why rather, sleep, liest thou in smoky cribs,

Upon uneasy pallets stretching thee,

And hush'd with buzzing night-flies to thy slumber,

Than in the perfum'd chambers of the great,

Under the canopies of costly state,

And lull'd with sound of sweetest melody?

Delong blog

Eric Boehlert:

Twitter: @EricBoehlert Eric Boehlert:

great job Boehner: 71% of Americans don't think GOP has clear plan to create jobs; http://nyti.ms/udVDyp

[But this means that 29% of Americans are completely bonkers...]

October 24, 2011 FT Alphaville

To be fair to Mehta, he does provide an alternative, "irrational explanation", which we hope is told with tongue lodged firmly in cheek:A Sri Lankan diplomat close to Rajaratnam told me that she'd met him shortly before he was convicted. "He'd gone to the ola-leaf readers. They told him he'd be acquitted." Ola-leaf readers are Sri Lankan astrologers. They believe that 3,000 years ago, seven Indian sages decided to write down the horoscopes of every person yet to be born, on a series of palm leaves. A skilled reader can read the leaves to present a complete life story of an individual, including his future. So on a subsequent meeting with Rajaratnam, I ask him about the ola leaves. "A friend did it for me," he says, startled that I know. The friend took his (and his wife's) date and time of birth to a leaf reader in Sri Lanka, who sat before a sheaf of leaves and asked a series of questions to which the friend answered yes or no, as at a deposition.

"Is his name Vijay?"

"No."

"Is his name Karun?"

"No."

"Is his name Raj?"

"Yes."

Then the correct ola leaf was picked out by the astrologer and Rajaratnam's fortune read. The astrologer chanted into a tape for 45 minutes. The recording said there was a government case against Raj, that he was in the stock business, that he was world-known. That he had to close his business down.

"So I don't generally believe in fortune tellers and astrologers," Rajaratnam says. "But the ola leaves were written thousands of years ago. In those days there was no share business. I found it interesting." The leaf reader also divined that his wife was born in "some Southeast Asian country." Asha was born in the Philippines.

There were other unorthodox influences on Rajaratnam. "Two or three years ago, before all of this stuff happened, my sister Vandani was in Singapore-she's into all this stuff. She called me one day and said, 'Raj, I met this person who said you'll be betrayed by an Indian woman with a mole on her face.'?" He didn't pay much attention to this prophecy. "Then I got indicted, and I saw a photo of Roomy Khan, with a huge mole on her face. The picture was from a few years ago. She had it surgically removed."

And at the end of the ola-leaf reader's tape, the astrological conclusion heartened him. "He said that eventually I would prevail." It fueled his conviction that he should fight the case all the way. It explains his puzzling insistence that he is innocent, in spite of the massive wiretap evidence to the contrary.

This was his edge; this was inside information that no one else had.

Related links:

The outsider – The Daily Beast

A dirty business – The New Yorker

The Big Picture

The Big Picture

A Brief 1987 Recap – Even if there had been no "October Surprise", the year 1987 would have been a remarkable one for Wall Street. The Dow started the year below 2000 and ran to 2722 by early Fall. (A gain of nearly 38%.) The rally was breaking all the old rules. A group of guys in Chicago came up with a new rule called Portfolio Insurance ( or Dynamic Hedging) which might be synopsized as buy strength/sell weakness (we'll explain another day). The U.S. dollar was weak and the subject of controversy. There was some conflict and confrontation in Iran (U.S. bombing Iranian oil platforms). The President's wife and right hand had gone into the hospital for a rumored cancer operation. And there was a new SEC chairman who was misquoted in the midst of the free-fall suggesting that maybe markets should close. The misquote greased the skids.

Okay, that's enough background. Now – "The Insurer" (after the jump)

Once upon a Monday dreary

Traders waited worn and weary

As they gazed upon news tickers

warning of the day in store

Foreign markets were imploding

sending senses of foreboding

With positions overloading

sellers would be bringing more

To dump upon a bloody floor

October now had past its middle

as investors faced this riddle

With their Quotrons they would fiddle

looking for The Bull of yoreGreenback's value falling quickly

trade deficit behaving sickly

And with Iran, relations prickly

raised the specter of a war

Ahead a day that promised goreSo on the open there came selling

much faster than the tape was telling

While in Chicago they were yelling

"Dynamic hedging" is no more!Specialists were inundated

as futures prices unrelated

Kept the selling unabated

stocks once eight now sell at fourFutures dipped below the cash now

and insurers made a dash now

Trying not to be the last now

rushing for the exit doorThen news reporters often shrewder

began misquoting Chairman Ruder

A trading halt?…a new intruder

caused yet more panic on the floorBethesda had a guest named Nancy

an operation somewhat chancy

Helped to make the markets antsy

adding to our selling loreThroughout the day as prices melted

brokers, dealers all got pelted

And bank accounts not safety-belted

were blown away forever moreThe bell, it rang to end the sorrow

while traders ran to banks to borrow

To have an ante for tomorrow

not knowing what it held in storeTwo dozen years have since gone by *

with circuit breakers now we try

To tame computers gone awry

and restore calm upon the floorThe Dow now stands full six times higher *

than when it closed that day so dire

despite two wars and terror fire

the Bull arose to run some moreThis anniversary, headlines new *

dwell upon that day we rue

They ask us veterans to review

a time that left us scared & soreYet chills we get from déjà vu *

fear that banks may run askew

While trading partners threaten too

as in that sad October yore.But keep your faith it's a new day *

though there are hints that skies may turn gray

We'll hope such clouds won't bring a blue day

let's hope the Bull returns once more!!

*Updated Revisions

PBS

Our favorite country-western money manager, Harvard-trained Nashville econo-crooner Merle Hazard, has collaborated with brilliant lyricist Marcy Shaffer to produce his slickest video to date: the tuneful tale of a would-be banker who travels to Charlotte, N.C., to meet up with a mogul of modern-day finance, "Diamond Jim."

'The Ballad of Diamond Jim' Lyrics

by Merle Hazard, Marcy Shaffer and Curtis ThreadneedleI was visiting Charlotte, a town I knew well.

The sunset was scarlet. I fell under its spell.

At the hotel bar, in the back of the place,

I saw a strangely familiar face:

Diamond Jim.I knew Diamond Jim from accounts in the press.

He ran a New York bank with skill and finesse.

They say he had brains, but lacked a heart.

J.P. Morgan himself was only half as smart

As Diamond Jim.

Chorus:

Diamond Jim,

Diamond Jim.

Oh, oh, Diamond Jim.Diamond Jim raised a toast, in a bankerly way,

To his massively outsized Wall Street pay.

"Our game is diseconomy of scale.

The key is to be too big to fail,"

Said Diamond Jim.

He mocked risk control, called it a sham.

He said there's no need when you have Uncle Sam.

I thought back to my days at the F.D.I.C.,

And I knew I'd need to confront this S.O.B.,

Diamond Jim.

So I said, "Diamond Jim, there's a problem to prevent.

Banks aren't safe with capital of just a few percent.

They need more like thirty percent, or higher.

That's what Simon Johnson has said they require,

Diamond Jim."

Chorus

Diamond Jim, "Son, do you know who I am?"

I said, "You're Diamond Jim. And you know what's a scam?

The crime's not what's criminal. The crime is what's legal.

You'd be buyin' fewer diamonds if we still had Glass-Steagall,

Diamond Jim."

"Low blow!" he cried. "You're naive, and a fool.

You have thrown down the gauntlet. OK, let's duel!

There are weapons to use in these banking law cases.

Securities lawyers at thirty paces!"

Said Diamond Jim.

So at noon the next day, hired guns at our side,

We met, and let our corporate lawyers collide.

They fired their mouths off, a few times at least.

My counsel fell down, desisted, deceased,

Because of Diamond Jim.

Chorus

"You lose," Diamond Jim said. "You could never win it."

With a scoff, he rode off, in a New York minute.

Well, at least I had tried. Yet, still, my heart sank.

I started to wonder: am I really a better man than Diamond Jim? Maybe not.

Because I had come to Charlotte to meet with investors, and to try to start up what

I hoped, deep down, would some day be my very own, high-paying, too-big-to-fail bank.Oh, curse you, Diamond Jim!

Chorus

P.S.One of the inspirations for the sound of this song was Dimitri Tiomkin. His most famous composition is the theme to Rawhide. Tiomkin also wrote the scores for many of the great Hollywood westerns, including High Noon, Gunfight at the OK Corral and Giant. He is known as the great composer for the Hollywood westerns, in other words.

What makes it really interesting is that he wasn't American by birth. He was Russian, of Jewish descent, and educated at the St. Petersburg Conservatory. Even more interesting, while in Russia, he helped stage Communist festivals. So when you hear those cowboy choruses of men singing, and they sound like a Russian military chorus, it's not accidental. That's what they really are, apparently, in Tiomkin's mind.

And to cap it off, his Academy Award acceptance speech in 1955 is absolutely priceless. Instead of thanking his agent and his family, he thanks Brahms, Beethoven, Rimsky-Korsakov, Gershwin, etc., and gets guffaws from the audience.

NEW YORK - The following is a letter released today by Lloyd Blankfein, the chairman of banking giant Goldman Sachs:

Dear Investor:

Up until now, Goldman Sachs has been silent on the subject of the protest movement known as Occupy Wall Street. That does not mean, however, that it has not been very much on our minds. As thousands have gathered in Lower Manhattan, passionately expressing their deep discontent with the status quo, we have taken note of these protests.

And we have asked ourselves this question: How can we make money off them?

The answer is the newly launched Goldman Sachs Global Rage Fund, whose investment objective is to monetize the Occupy Wall Street protests as they spread around the world. At Goldman, we recognize that the capitalist system as we know it is circling the drain - but there's plenty of money to be made on the way down.

The Rage Fund will seek out opportunities to invest in products that are poised to benefit from the spreading protests, from police batons and barricades to stun guns and forehead bandages. Furthermore, as clashes between police and protesters turn ever more violent, we are making significant bets on companies that manufacture replacements for broken windows and overturned cars, as well as the raw materials necessary for the construction and incineration of effigies.

It would be tempting, at a time like this, to say "Let them eat cake." But at Goldman, we are actively seeking to corner the market in cake futures. We project that through our aggressive market manipulation, the price of a piece of cake will quadruple by the end of 2011.

Please contact your Goldman representative for a full prospectus. As the world descends into a Darwinian free-for-all, the Goldman Sachs Rage Fund is a great way to tell the protesters, "Occupy this."

Sincerely, Lloyd Blankfein Chairman, Goldman Sachs

Antifa:

Herman Cain is on CNN this afternoon, explaining how his 9-9-9 tax plan will benefit even the working poor. It's that third 9, you see. The 9% national sales tax. That's where an American family can win or lose.

Herman says your future prosperity all depends on whether you buy new or used. Buy used stuff and you pay no tax. Insist on buying everything new, and you pay sales tax. You won't feel the benefit of his plan that way.

So be smart, and buy used stuff only.

There is an empty big box store in my town. I'm going to rent it, and sell smart Americans used gasoline, used heating oil, used propane, used electricity, used bath water, used food, used toilet paper, used medicine, used diapers - the list is just about endless.

If Herman's right, I'll prosper right along with my smart American customers!

ResistanceIsFeudal :

Former Idealist wrote:

The $1trillion hit is wearing off and the junkie is demanding $500 billion more. Now. Before its too late!

This time, I promise, this will be my last one... just one more, to get me through... I swear...

black dog:

i own a discretionary spending store in virginia. One of my former customers (now deceased) had the same biz on long island. We oftened talked shop. One time he told me of one his customers - a vanderbilt heir. Tried to sell her something at $1200 ... she liked it but wouldn't bite after he told her the price ... too low. He quickly discerned ... found something similar (and in price) but told her $8000 ... SOLD.

ResistanceIsFeudal:

black dog wrote:

needs to explain how his QE induced business/household margin squeeze good for employment.

1.Print money and give it to TBTF banks

2.Banks hold on to money instead of making crappy loans in a bad economy to people with no money

3.??

4.Job creation

Cinco-X:

Juvenal Delinquent wrote:

This is the stan box and this is how it runs

One is for fighting and one is for funds

LOL; did you do a stint in the Army?

The Chronicle of Higher Education

Economist's View

Fred C. Dobbs:

Fool us once, fool us twice,

um, er, just keep on foolin' us.So, why, in our democracy, do we

keep electing these GOP assh*les?Please, sirs, may we have another?

Fred C. Dobbs said in reply to Fred C. Dobbs...

http://www.youtube.com/watch?v=sVXBWXlktbU&feature=player_embedded

Herman Cain's 9.99 Pizza Deal, with a side order of Ron Paul.

Fred C. Dobbs:

And if you like lame 'Late Night' Letterman Top-Ten lists...

David Letterman - Herman Cain Top Ten http://youtu.be/8aanJlZw8eg

ZeroHedge

WHO KILLED THE ECONOMY

(Who Killed Davey Moore, Bob Dylan)

WilliamBanzai7 BlogWho killed the Economy,

Why an' what's the reason for?"Not I," says Greenspan and Bernanke,

"Don't point your finger at me.

We could've stopped it before it was too late

An' maybe kept the markets from this fate,

But the crowd would've booed, I'm sure,

At not gettin' their bubble's worth.

It's too bad it had to pop,

But there was a pressure on we two, you know.

It wasn't we that made the economy fall.

No, you can't blame we at all."Who killed the Economy,

Why an' what's the reason for?"Not us," says the short selling bear market crowd,

Whose screams deflated the subprime cloud.

"It's too bad the economy tanked that September night

That Lehman was left to its sorry plight.

We didn't mean for Fuld's bank to meet its death,

We just meant to see some sweat,

There ain't nothing wrong in that.

It wasn't us that made Lehman fall.

No, you can't blame us at all."Who killed the Economy,

Why an' what's the reason for?"Not me," says the Politician,

Puffing on a big cigar.

"It's hard to say, it's hard to tell,

I always thought Wall Street was a bottomless well.

It's too bad for our wives an' kids the Bull is dead,

But if he was sick, someone else should have said.

It wasn't we that made him fall.

No, you can't blame me at all."Who killed the Economy,

Why an' what's the reason for?"Not me," says the gambling man,

With his 401k Statement still in his hand.

"It wasn't me that knocked the Bull market down,

My hands never touched it none.

I didn't commit no ugly sin,

Anyway, I put all my money on it to win win win.

It wasn't me that made it fall.

No, you can't blame me at all."Who killed the Economy,

Why an' what's the reason for?Not us said the clowns over at AIG

We sell insurance to those in need

Our risk models run infallibly

It was a financial tsunami worse than any natural calamity

How big is our hole we just can't see

We're too big to fail

So bail us out Uncle Sam if you please]Who killed the Economy,

Why an' what's the reason for?"Not me," says the feckless financial news writer,

Pounding print on his digital typewriter,

Sayin', "CNBC ain't to blame,

There's just as much danger in the finance game."

Sayin', "Wall Street greed is here to stay,

It's just the old American way.

It wasn't me that made it fall.

No, you can't blame me at all."Who killed the Economy,

Why an' what's the reason for?"Not me," said the Wall Street conman whose securitized risks

Laid the markets low in an opaque cloud of toxic mist,

Who came here from some Ivy League door

Even though Ponzi scheming ain't allowed no more.

"We scammed and we scammed them, yes, it's true,

But that's what we are paid the big bucks to do.

Don't say 'fraud,' don't say 'steal.'

It was destiny, it was God's will."Who killed the Economy,

Why an' what's the reason for?

The Rude Pundit

... ... ...

- We can say, with certainty, that certain executives in various firms were responsible either directly for or directed others to engage in the reckless investment schemes that resulted in firms going bankrupt or in need of a bailout from the federal government. Under this condition, we can target [name redacted] of [firm redacted] who concealed $50 billion in loans in order to inflate the firm's value while at the same time personally taking several hundred million dollars in compensation. We know this occurred. We have evidence that it occurred. We know that [redacted]'s actions, in part, led directly to the financial crisis of 2008-2009.

- If the targeted killing of American citizens is justified in our ongoing war with terrorists above and beyond any previous congressional authorization, and if the military has previously been involved in the ongoing war on drugs, then we can say with confidence that the proposed targeted attacks on financial executives falls under the purview of the "War on Poverty," which was declared by President Lyndon Johnson in 1964 and which, like the ten-year war on terrorists and the forty-year war on drugs, has not been successfully concluded. This might seem to strain legal justification, but we are talking about criminals who have done grievous harm to the nation.

... ... ...

The total use of Predator drones against financial industry executives would most likely be minimal. After several strikes, we anticipate that others will turn themselves in to authorities for prosecution out of fear for their lives.

... ... ...

Respectfully submitted,

[name redacted]

April 28, 2010 | Zed244's Blog

In the left-hand-side column you find a translation of the original Moral Code of The Builder of Communism [1] which you can compare with the newly formulated Code on the right hand side. With this arrangement the unquestionable superiority of the latter can be clearly seen and appreciated. For non-monolingual people – ref. [2] contains the original text of the Code in Russian.

PS. On a (slightly) more serious note – I am not a communist, have never been one and most likely will never be – because I haven't yet met sufficiently large number of people ready to live strictly by the rules in the left-hand-side column above. "Sufficiently large" – to form a party, that's it. Perhaps, this shortage was the reason why the "communism" as economic system had never worked as intended. But neither did pure ("wild") capitalism – as Russian experience of 90s demonstrated all too clearly.

Moral Code of the Builder of Communism Moral Code of the Builder of Capitalism 1. Devotion to the cause of Communism, love of the socialist Motherland and of the socialist countries. Devotion to the cause of capitalism, love of the capitalist Motherland and of the other capitalist countries. 2. Conscientious labor for the good of society: he who does not work, neither shall he eat. Conscientious effort to obtain a direct government assistance, the government contracts or any other form of public money: those who don't receive government funds, will only find themselves funding the government. 3. Concern on the part of everyone for the preservation and growth of public property. Concern on the part of everyone else for the preservation and growth of public property by them for you to use 4. High sense of public duty; intolerance of actions harmful to the public interest. High sense of capitalistic public duty and sanctity of (your) private property; intolerance of actions by others harmful to your private business interests. 5. Collectivism and comradely mutual assistance: one for all and all for one. Individualism and readiness to fight for your piece of pie: each one for himself, against everyone. Remember: the only goal of any business is to make the owner richer than other people, so the others might be permitted to benefit only if it cannot be avoided. 6. Humane relations and mutual respect between individuals: man is to man a friend Show humility and do respect the potential strength of others – up until you have measured them up: human humanum lupus est. Remember: competition is the primary driving force of capitalism. Elimination of the competition is the fastest road to your financial success. 7. Honesty and truthfulness, moral purity, unpretentiousness and modesty in social and private life. Public display of appearance of honesty and truthfulness, libertarian moral purity Friedman-style, unpretentiousness and modesty in social and private life (so as not to disturb the plebs too much). 8. Mutual respect in the family, concern for the upbringing of children. Mutual respect in the own family – proportional to the individual contributions to the family budget, concern for the upbringing of your own children in accordance with this code. Remember that your family are just people – they are as much after your money as anyone else. 9. Irreconcilability towards injustice, parasitism, dishonesty, careerism, and profiteering. Irreconcilability towards unjust distribution of unearned income to others, including social benefits. Fight dishonesty, careerism and all other attempts of profiteering by hired labor force. 10. Friendship and brotherhood among all peoples of the USSR, intolerance of national and racial hatred. If and when – and only if & when – this helps your business – open and public display of friendship and brotherhood among all people, intolerance of national and racial hatred. In other cases you will be a fool not to use such inexpensive tool as racism to efficiently reduce the cost of hired labor. 11. Intolerance towards the enemies of communism, peace, and freedom of nations. Intolerance towards the enemies of capitalism, enemies of peace (if you are not in defense industry) and enemies of the freedom of other nations to follow your nation's understanding of economic liberty principles appropriate for them. 12. Fraternal solidarity with the working people of all countries, and with all peoples. Fraternal solidarity with capitalists of all countries up until you see a chance to rip them off dry.

Zed244's

this is not written by zed244 - it is a translation of the text in Russian at http://www.avanturist.org/blog/post/28 . More of the same author here http://tinyurl.com/43b9pmy (in Russian) – highly recommended.

For those who want a touch of reality – as of 21 of September 2011 – it is here

Quote"..To support a stronger economic recovery and to help ensure that inflation, over time, is at levels consistent with the dual mandate, the Committee decided today to extend the average maturity of its holdings of securities. The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less.."

Let say we – I, You and Chronoscopist – were on a plane across the Pacific Ocean. While on board, we consumed substantial amount of absinthe, kicked up a row and in the process tore off a door to the toilet. For our noble deeds we were promptly thrown out of the plane via emergency exit. Luckily, next to where we plunged into the water, was a small nameless Polynesian island. After we climbed on its soil, we held a short council and decided to name the island The United States of Absinthe (USA).

Naturally, when we were thrown out of the plane, they forgot to return us our luggage. As the result, all our tangible and intangible assets consisted of the toilet door, which You forgot to leave on the plane and a single $100 note which You discovered in your wallet. Thus all non-financial assets of our USA consist of one toilet door, and all financial, aka "money supply", of a single $100 note. This is all our country has. Since we have nothing else, it can also be said that our material assets – the toilet door, supports (secures) the money supply of $100. Or, in other words, our door costs $100.

Still under the influence of absinth, we decide that we need to start getting the things organised. The Chronoscopist, proved to be the shrewdest – he announces that he opened a bank and is ready to accept deposits from the island's population and promises to pay 3% interest annually. You give him your $100 and he writes it under "Liabilities" -> "Deposit Accounts" in his book.

But I am too not just out of the woods – indeed, after so many years I spent investigating economic swindles, I now know how to expropriate your door and your $100. I offer You 5% interest on your $100. I tear off a sheet of paper from my notebook and write "Bond Certificate of USA. Issued for the amount $100 at 5% interest, paid annually". You feel that You have drawn a full hand. You withdraw your money from the deposit account You have with the disappointed Chronoscopist and give it to me in exchange for my Bond. I take your $100 and immediately deposit it into my account with now smiling Chronoscopist.

Ideally, we could have stopped right here and then, and start doing something real, say, shake the palm tree or try to collect shell fish – to eat our bread in the sweat of our faces, so-to-speak. But you all know that I am indefatigable financial genius, and I am not interested in the petty things such as coconuts and oysters. After a refreshing tour of our island – 50 steps from South to North and 30 from West to East, I invent an ingenuous combination. I approach You and offer You to earn an additional 1% annually. You should take a loan in Chronoscopist's bank at 4% and use it to buy from me another USA Bond at 5% interest. This second Bond Certificate for $100 I have just written, and now I wave it in front of your nose. Immediately You rush to the bank and borrow $100 there, using my first Bond as a security. The Bank has the money – I put it there on my deposit account. You give me the $100 You have borrowed and put the second USA Security Bond into your wallet. Now You have $200 worth of USA Bonds. I put $100 in the Bank – now I have $200 on my deposit account. Chronoscopist jumps from joy – his credit business is growing up!

Do you really think I am going to stop there? Hold your horses – I have already written a third USA Bond for You. You rush to the Bank to borrow another $100, secured this time with my second Bond. Closer to the night, got tired of running around the island with this single $100 note and having used all pages in my diary to write USA Bonds, we have the following results: You have $5,000 worth of USA Bonds, while I have $5,000 deposited on my account.

Now I feel that this is the right time to expropriate your toilet door. I offer to buy it from You for $100. But You do not want to sell the only toilet door on the island for $100 and ask $1,000. Well, I agree – after all I have $5,000 on my deposit account. I use the last page left in my diary to write a Payment Order to Chronoscopist to transfer $1,000 from my account to yours – and take your door.

If this accounting is given to an American economist, he or she will inform you that our USA had $1,000 in assets in the form of toilet door and $10,000 financial assets in bank deposits and USA Bonds. Which means that our combined wealth increased 110 fold in one day. Well, a less refined and educated observer, might say that we are the three idiots, because by the end of the day we still have nothing but the same one toilet door and $100, and that only complete imbeciles could have spent the whole day tearing sheets out of their diaries to write nonsense, instead of collecting coconuts or shell fish. Who of the two is correct –you, the Reader, should decide yourself.

2008

www.dailysquib.co.uk

NEW YORK - USA - The global recession is finally over and millions of people around the world are celebrating the end of the largest recession in the world's history.

There were mass street celebrations all over the world including cities like Sidney, Vienna, Phnom Penh and even in London.

Millions of people took to the streets to celebrate the end of the recession.

Banks were happy too, and were giving away unsecured loans to anyone without so much as a form being filled in.

"I walked into a branch of Midland bank and they sat me down on a chair and gave me a loan for £10,000 at a dirty low interest rate and a 130% mortgage. They just said, you can pay it back whenever you want," Larry Jagger, 25, from Hartlepool, England, told the BBC.

Global stock markets jumped up 46% on Tuesday as the news headlines streamed the glorious announcement.

Not only have the banks opened up again, so have the car manufacturers who are doing buy one get one free deals. Both Ford and GM are giving away brand new SUV's if you buy a mid size luxury car.

Supermarkets were giving away free food to people in the streets and Apple stores were literally shedding ipods in malls all across the Western world.

Credit card companies all over the world immediately started promoting 0% APR credit cards.

Consumers all over the world rejoiced: "We're out of the recession. I feel like a black cloud has been lifted from the land and I can breathe again. I can spend, spend, spend, again without the old fear creeping around the corner for awhile. I think I just had a multiple cash orgasm all over the shopping mall," Dana Kurvinski, 23, from Daytona Beach, Florida told CBS.

Sep 29, 2011 | FT Alphaville

Yogi Berra, 1973:

"It's not over til it's over."

Timothy Geithner, 2006:

"In the financial system we have today, with less risk concentrated in banks, the probability of systemic financial crises may be lower than in traditional bank-centered financial systems

naked capitalism

Per Yasha Levine and Ames in the Nation:IHS vice president George Pearson (who later became a top Koch Industries executive) responded three weeks later, conceding that it was all but impossible to arrange affordable private medical insurance for Hayek in the United States. However, thanks to research by Yale Brozen, a libertarian economist at the University of Chicago, Pearson happily reported that "social security was passed at the University of Chicago while you [Hayek] were there in 1951. You had an option of being in the program. If you so elected at that time, you may be entitled to coverage now."

A few weeks later, the institute reported the good news: Professor Hayek had indeed opted into Social Security while he was teaching at Chicago and had paid into the program for ten years. He was eligible for benefits. On August 10, 1973, Koch wrote a letter appealing to Hayek to accept a shorter stay at the IHS, hard-selling Hayek on Social Security's retirement benefits, which Koch encouraged Hayek to draw on even outside America.

September 23, 2011

readerOfTeaLeaves

...In other words, "we're *so* guilty that if the shit storm of liability claims is unleashed against all the leverage we did at 30:1+ odds, the entire economy will crater for five generations."

JustAnObserver:

A quick slash of Occam's Razor … and we get to the simpler conclusion that the BofA execs might be such dim bulbs that they actually truely believe that BK'ing Countrywide really *is* the solution to all their problems.

Yahoo! Finance

The market cheered news that Apotheker might get canned, but the idea of Whitman as HP CEO was greeted with laughter and derision in Silicon Valley.

... ... ...

Remarkably, when the 12-member board voted to name Mr. Apotheker as the successor to the recently ousted chief executive, Mark Hurd, most board members had never met Mr. Apotheker.

"I admit it was highly unusual," one board member who hadn't met Mr. Apotheker told me. "But we were just too exhausted from all the infighting."

Taken to Task/Daily Ticker - Yahoo! Finance

All the taking low traders like free market capitalism traders on Wall Street and believe in the principles in unfettered capitalism evaporate instantly when situation became hot. Now bailout, any bailout is the prayer of each and every trader.

It look like champions of free market capitalism on Wall Street like free market capitalism only when market are rising.

"Like there is no atheists in foxholes there is no libertarians on Wall Street" [at the time of the crisis]

This weekend, traders are hoping for some plan - ANY plan - to deal with Greece, whether it comes from the ECB, the IMF, the World Bank, Poseidon or Zeus. ... a generation of traders has been conditioned to believe the Fed - or some other institution - will come riding to their rescue if things get really dicey, or even just a little bit uncomfortable.

Just like there are no atheists in foxholes, there really are no libertarians on Wall Street.[at the time of the crisis] The only ideology traders believe in is making money and if that means more government intervention, bring it on! Someday, maybe, we'll get back to something approaching a free market. But if such a thing ever really existed, it was a long time ago in a galaxy far, far away.

The American Congress (Parliament) a den of thieves, megalomaniacs and jackarses as the world has rarely seen, except maybe in the final days of the Roman Senate, are about to help their owners, the super bankers, to become the biggest owners of improved property, in the world.

How is this?

Very easy. The American government organizations of HUD, Fanni Mae and Freddie Mac have become the primary owners of the vast majority of American "distress" property.

September 21, 2011 | naked capitalism

Tertium Squid:

"this reduces the profitability of the basic operation of banking, which is maturity transformation (borrowing short and lending long)."

Wow – are there any banks out there that still do that? I thought they were all equity casinos right now.

Jim Haygood

What El Bernanko has done with his deranged caper is to buy the exact freaking top of a thirty-year secular bull market in bonds.

Maximilien:

"I am beginning to believe there is some concerted effort on foot to utilize the stock market as a method of discrediting my Administration. Every time an Administration official gives out an optimistic statement about business conditions, the market immediately drops." -–Herbert Hoover

naked capitalism

MyLessThanPrimeBeef:

Can we financialize worker wages?

Make it a commodity and let the pension funds speculate and drive it up to 5 standard deviation away from trend.

Actually, workers are already a commodity. What we do is we will financialize their wages in the form of futures contracts.

Here is to the coming bubble in worker wages!

naked capitalism

…we read newspaper reports about Japan, where what seems to be a relatively moderate deflation…has been associated with years of painfully slow growth, rising joblessness, and apparently intractable financial problems in the banking and corporate sectors

I believe that the chance of significant deflation in the United States in the foreseeable future is extremely small, for two principal reasons. The first is the resilience and structural stability of the U.S. economy itself….A particularly important protective factor in the current environment is the strength of our financial system: Despite the adverse shocks of the past year, our banking system remains healthy and well-regulated, and firm and household balance sheets are for the most part in good shape.

The second bulwark against deflation in the United States… is the Federal Reserve System itself… I am confident that the Fed would take whatever means necessary to prevent significant deflation in the United States and, moreover, that the U.S. central bank, in cooperation with other parts of the government as needed, has sufficient policy instruments to ensure that any deflation that might occur would be both mild and brief.

-- Bernanke, 2002 FOMC speech

September 15, 2011 | naked capitalism

rd:

On FDR:

1. Clearly stated goals and reasons for legislation.

2. Clearly stated limitations of the legislation and reasons why.

3. A tax increase.

4. Congratulating Congress for a job well done.

5. A "signing statement" that actually supports the legislation and effectively promises to administer it.What was this man thinking?

He clearly did not spend enough time working with focus groups, pollsters, campaign strategists, and "expert" lobbyists. He must have left a ton of potential campaign donation money on the table. He clearly did not understand the proper role of a modern era politician.

September 9th, 2011

The ever ironic former Fed Chairman Alan Greenspan on whether government intervention can create moral hazard:

"There were unintended consequences to almost every action I was involved in" as Fed chairman, said Mr. Greenspan, who himself cut interest rates to help stave off a bond-market crisis in 1998, and later was accused of helping inflate the stock bubble of the late 1990s. "If we anticipated the unintended consequences that were going to happen we might have changed the policy," he said, but he added that it is impossible to forecast all the consequences of government action.

Please make it stop . . .

September 9, 2011 | naked capitalism

Claudia:

Instead of bashing Ben Bernanke…an excellent economist, a dedicated public servant, and a decent person…why don't you write something constructive about how to help the economy? The Fed is not the enemy here. They used up there usual ammo to help the economy quite quickly and have been working hard to write a new and expanded play book. The Fed as made mistakes but they have not sat idly by doing nothing. I dare you to find a person who is a student of the Great Depression and who grew up in a small town in the South (like Ben) and who does not recognize the immense costs of high unemployment…I am fairly certain Ben Bernanke gets it. His job constrains what he can say in public, he would never say 'Let the Eat Cake.' You are the one telling dumb jokes (in my opinion).

Jim Haygood

At the center of this web of regulatory nonfeasance was none other than the Chauncey Gardiner of finance, Al 'Blind Magoo' Greenspan.

Although to ward off recession by placating the gods, it certainly would not hurt to hurl Greenspan into the caldera of a volcano as a human sacrifice. Spare the virgins - sacrifice Magoo!

Aug 16, 2011 | Zerohedge

Perhaps the most surreal fact about the case of 35 year old Bryan Gardner who back in 2009 sent CitiMortgage a $353,000 money order "drawn on the account of the 'Secretary of the Treasury Hank M. Paulson, Jr." in order to satisfy the final payment for a property in Bowie, Md, is that.... he succeeded.

Fox Biz has more: "CitiMortgage erroneously accepted the document and credited Gardner's mortgage account in full," according to a Secret Service affidavit. Within months, Gardner sold the property for $254,900 and then "distributed the proceeds to others," according to public records and the Secret Service affidavit.

Seasmoke :

looks like is a member of Friends of Hank

SMG:

Good thing they caught the "criminal imposter" Hank Paulson who stole $353,000 and not the "honest real" Hank Paulson who stole $850,000,000,000 for his banking friends.

Caveman93 :

It's so easy to do it's scary. Get Social Security check acct# and ABA#, get printer and check stock. Complete info and mail in. When I was in bank operations we would lose hundreds of batched checks and sometimes whole cash letters. We'd then have to go to film and re-create these items and process them "photo in lieu of original" with an indemnification stamp because the originals were missing or destroyed. I bet this check was one of those.

These banks are so large they have no way to clean up the millions of exceptions they have each year and probably wrote off the whole missing items or item in the batch of work. You should see what happens when a $3.00 check gets encoded for $30K and deposited. LOL!

http://www.youtube.com/watch?v=JqgDzEqdvb0&feature=player_embedded

August 12th, 2011

From John DeFeo at TheStreet.com, comes these 10 Myths That Politicians Want You to Believe (but you shouldn't)

10. Quantitative Easing Helps the Economy

Yes, quantitative easing is "printing" money. No, it won't help the economy. Make no mistake, quantitative easing is a gift to bankers and nothing else. The Federal Reserve is giving bankers risk-free trading profits and causing food and gas prices to surge (making it even harder for Americans to get out of debt).9. Republicans Are Fiscal Conservatives

From 1946-2010:Democratic President

* Total Years: 29

* Average Inflation Adjusted Deficit: $150.73 billionRepublican President

* Total Years: 36

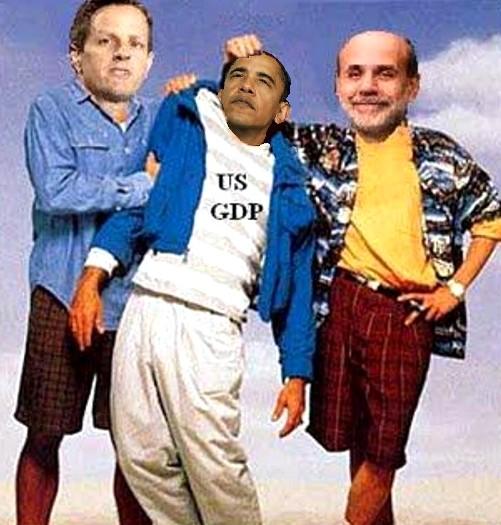

* Average Inflation Adjusted Deficit: $202.28 billion8. President Obama Is an Enemy of Wall Street

* The two men who served as principal negotiators for banking deregulation: Gene Sperling and Larry Summers.

* The two men who President Obama appointed to become his top economic advisers: Gene Sperling and Larry Summers.

* Two guys who happen to be paid millions of dollars in consulting and speaking fees by "too big to fail" banks: Gene Sperling and Larry Summers.7. The Financial System Is Safer Today Than in 2008

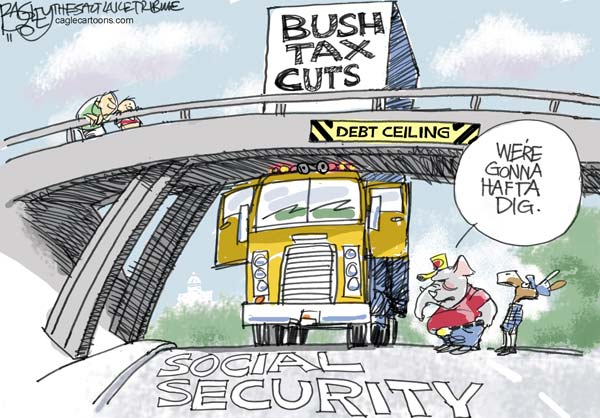

The majority of "too big to fail" banks are even bigger. Meanwhile, high-frequency trading is alive and well and the causes of the Flash Crash have not been addressed.6. The 'Bush Tax Cuts' Increased Tax Revenue

Washington has always had a spending problem, but since the "Bush Tax Cuts," we have a revenue problem as well. From 1990 to 2000, U.S. tax revenue had a period of exceptional growth. Following the 2001 tax cuts, revenue plummeted - then recovered - then plummeted again.5. 'No One' Could Have Seen the Financial Crisis Coming

No one - except for everyone who did. TheStreet has interviewed numerous economists and money managers who have been pounding the table for years.4. If You Support Capitalism, You Support Big Business

Can a corporation be socialist? Corporations and governments are very similar entities, and both can have capitalist or socialist leanings. If a politician praises big business while chastising big government, or the other way around, be skeptical.3. Republicans Are a Bunch of Fat-Cat Millionaires

The average congressperson is a millionaire, and if you break down the 50 richest members of Congress by political party, here's the split:

Republican: 22

Democrat: 282. The U.S. Has the Highest Standard of Living in the World

According to the United Nations' most recent Human Poverty Index (from 2008), the U.S. standard of living ranks 17 of 19 among developed countries. The ranking is a composite of life expectancy, literacy, long-term unemployment and income equality - while this data is over three years old, it's not unthinkable that our situation has worsened in the aftermath of the Great Recession.1. U.S. GDP Is Growing

U.S. GDP has increased by 4.26% from 2007 to 2010, according to data compiled by the U.S. Bureau of Economic Analysis. In the same period of time, the U.S. national debt has increased by 61.6%, according to the U.S. Treasury. Looking at these numbers, you don't need to be an economist to see that something is very, very wrong.

stunney:The only solution we see is in sensible policies being proposed by Presidential candidates, proposals that seek the middle ground.

Take the Republican debate tonight, for example. These candidates exhibited genuine centrism in their proposals to abolish the capital gains tax and at the same time to abolish unemployment benefits, because, as we all know, median real earnings have grown at such breakneck speed that even lower paid employees can easily afford their own unemployment insurance. Which they'll really need because, let's face it, those losers will be looking for a job pretty soon if we cut spending like we mean to.

The key to all this prosperity? Simple. Don't increase taxes! Even if Islamic terrorists surround the Capitol and threaten to toss 100 new-born American babies into a pool of molten steel every ten minutes unless Congress passes a bill raising taxes on the richest ten Americans by a dollar a year, these Republican candidates want those babies to die screaming rather than raising JOB-DESTROYING taxes in this great, utterly batshit-crazy country of ours.

And talking of terrorism, surely it is time for moderate people of reason and sound judgement from all sides to come together and agree to hunt down and kill every last EPA official in America. Let their epitaph be a warning to all future generations:

THEY DARED TO RAISE THE COST OF DOING BUSINESS

This has been a presentation by The Republican National Committee.

Additional funding has been provided by the Koch brothers, and by other ordinary conservative psychos like you.

EMichael said in reply to stunney...

To paraphrase Mark Twain, it's not the things I do not understand about Michelle Bachmann that bothers me, it is the things I do understand that bother me.

http://www.newyorker.com/reporting/2011/08/15/110815fa_fact_lizza

August 11, 2011 | The Big Picture

Peter Barnes "Is there a risk that the United States could lose its AAA credit rating? Yes or no?"

Geithner's response: "No risk of that."

"No risk?" Barnes asked.

"No risk," Geithner said.

McGraw-Hill: meet Chicago-style negotiations. And there, in one sentence, is all that is broken with this country. The reason for the beyond ridiculous horse trade, according to CNN: S&P analysis of U.S. revenue, deficit picture was questioned. Presumably S&P ignored to add the $10 quintillion dollars that were saved by America not declaring war on Tatooine and its most infamous Hutt resident: Larry Summers. Indeed, again according to CNN, S&P acknowledged some errors in its analysis. Isn't it amazing what being threatened with having your NRSRO license can do for motivation to double check your work, eh you pathetic sellouts? Who would have thought that last week's farce debt ceiling would continue and develop into a national pastime. Below, for the sake of S&P's non-existent conscience and incompetence, are their own guidelines for what constitutes an AAA-rated credit. Readers can decide if the US is one.

In other news, in USSAAA, government downgrades rating agency.

Economist's View

stunney:

Clearly, the markets have given a massive thumbs down to the centrally planned, state-owned economies of Europe, while giving a COLOSSAL, simply GIGANTIC thumbs up to the Boehner War on Federal Debt.

The only reason markets tanked in the US is because the president rattled investors with his Obama Plan to raise JOB-OBLITERATING TAXES on the hyper-wealthy and his SECRET TERRORIST plan to commit atrocities against the military-industrial complex!!!

This has been a presentation of:

Statements So Dumb That Michele Bachmann Might Actually Have Made Them In A Conference Call With Conservative Activists

August 4, 2011 | naked capitalism

rps:

Down 512.76. "To the Batcave."

- Robin (Geithner): "If we close our eyes, we can't see anything."

- Batman (Bernanke): "A sound observation, Robin."

MyLessThanPrimeBeef:

If no one is around, does a falling market make a sound?

Dave of Maryland:

You mean, the sound of bankers jumping from tall floors with a single bound?

No, I didn't hear any of those, either.

Dreiser

"The Night of The Living Dead"- 1969 movie, the Zombies were a metaphor for the implosion of American capitalism, the cannibalism was a metaphor for a society...

Although zombie cannibals were inspired by Matheson's I Am Legend, film historian Robin Wood sees the flesh-eating scenes of Night of the Living Dead as a late-1960s critique of American capitalism.

Wood asserts that the zombies represent capitalists, and "cannibalism represents the ultimate in possessiveness, hence the logical end of human relations under capitalism." He argues that the zombies' victims symbolized the repression of "the Other" in bourgeoisie American society, namely civil rights activists, feminists, homosexuals and counterculturalists in general"..

August 2, 2011 | naked capitalism

Max424

The Dow is down 265.87. What's up with that?

Maybe it just dawned on Mr. Market; if everybody is busted, including Mother Milk Cow,* there will be no one left to rob.

And if Mr. Market can't rob, he can't gamble, and if he can't gamble, he gets depressed.

In answer to the generic question regarding President Obama's actions regarding the debt ceiling, I am re-posting this from 2/25/09. In comments of the original I stated that cutting the deficit by 1/2 seemed to "optimistic" for me.

***************************Ok, here are my basic issues with the substance of President Obama's speech. First, may I remind everyone

that as of 11/08 I declared my divorce successful. Has it become my mission accomplish moment?I heard this:

"And we will expand our commitment to charter schools. but as a father when I say that responsibility for our children's education must begin at home."And thought: 2 tier education system/vouchers, no thank you. Education begins at home when home means one parent has the time to spend at home oppose to both working.I heard this:

"And we must also begin a conversation on how to do the same for Social Security, while creating tax-free universal savings accounts for all Americans."And thought: Are you freak'n kidding me! In this time of financial collapse we're still going to talk about turning an insurance for the masses against the follies of finance into some form to include finance? The entire reason we want to create jobs is because we have suddenly realized that the vast, vast majority do not earn their money from money. Tax free? Has he not heard of 401K, IRA and all it's versions, HSA, higher education accounts? Italy?I heard this:

"Yesterday, I held a fiscal summit where I pledged to cut the deficit in half by the end of my first term in office."And thought: Yeah, how'd that work for the last administration who made such a declaration? Did he have to say "in half"? Has his advisors not taught him about the blip during the FDR recovery? Only one way I can think of doing this: Raise taxes where the money is and whack the defense budget in half and I mean take a swipe at all moneys related to security. Are we really $1 trillion dollars worth of paranoid?

08/01/2011

Three weeks ago Putin called Bernanke a hooligan. Since that remark came from the (allegedly) largest oil producing country in the world, it provoked nary a peep from America's foreign department. Today, he decided to ratchet up the rhetoric, and in a speech to a Kremlin youth group told his listeners what the bulk of the rest of the world thinks of America: ""They are living beyond their means and shifting a part of the weight of their problems to the world economy," Putin told a Kremlin youth group while touring its summer camp north of Moscow. "They are living like parasites off the global economy and their monopoly of the dollar."" Russia has not made its distrust of America clear in the past, and while others (ahem China) have been jawboning about selling Treasurys even as they continue buying US one-ply paper, Russia has been actively dumping its Treasury paper to the lowest in years. The reason for the unprovoked outburst? The insanity in Congress. "Thank god," Putin said, "that they had enough common sense and responsibility to make a balanced decision." The former KGBer's solution? Other, and more deserving, reserve currencies.

angrybearblog.com

Mark Thoma, who supported (and probably voted for) the man during the primaries, is much more gracious than I am:A vague promise from Democrats about the future is all but worthless right now, we've had too many promises broken already. Obama's promises in particular mean nothing.The nicest thing I can do is describe this as BarryO's "Only Nixon could go to China moment." ...Obama's version is selling out Democrats and Middle-Class and Aspiring Middle-Class Americans.

...Democrats may still run someone against Obama from the left, though Timothy McVeigh is unavailable.