|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

|

|

One important aspect of neoliberalism is globalization of finance flows. The best overview of history of this issue that I have found is the article by Gordon K Douglass Controlling speculation in world financial markets written for World Alliance of Reformed Churches Progressive Christians Uniting in November 9, 2002. Here is an annotated copy (it is reformatted for Softpanorama readers):

| "During my whole career at Goldman Sachs - 1967 to 1991 - I never

owned a foreign stock or emerging market bonds. Now I have hundreds of millions of dollars in

Russia, Brazil, Argentina and Chile, and I worry constantly about the dollar-yen rate.

Every night before I go to bed I call in for the dollar-yen quote,

and to find out what the Nikkei is doing and what the Hang Seng Index is doing. We have bets

in all these markets. Right now Paul [one of my traders] is long [on] the Canadian

dollar. We have bets all over the place. I would not have worried about any of these twenty

years ago. Now I have to worry about all of them." Leon Coopermann, hedge fund manager1 |

|

|

Economic globalization is probably the most fundamental transformation of the world's political and economic arrangements since the Industrial Revolution. Decisions made in one part of the world more and more affect people and communities elsewhere in the world. Sometimes the consequences of globalization are positive, liberating inventive and entrepreneurial talents and accelerating the pace of sustainable development. But at other times they are negative, as when many people, especially in less-developed countries, are left behind without a social safety net. Globalization undermines the ability of the nation to tax and to regulate its own economy. This weakens the power of sovereign nations relative to that of large transnational corporations and distorts how social and economic priorities are chosen.

Economic globalization is most often associated with rapid growth in the flow of goods and services across international borders. Indeed, the economic "openness" of a nation is often measured by the value of its exports, imports, or their sum when compared to the size of its economy. Economic globalization also involves large investments from outside each nation, often by transnational corporations. These corporations often combine technology and know-how with their investments that enhance the productive capacity of a nation. Previous position papers of the Mobilization, contained in Speaking of Religion & Politics: The Progressive Church Tackles Hot Topics2, have dealt with globalization primarily in these terms.

But international trade and investment are only part of the openness that has come to be called globalization. Another part, and arguably the most important, is the quickening flow of financial assets internationally. While a small portion of this flow is directly associated with the "real" economy of production and exchange, its vast majority is composed of trades in the "paper" economy of short-term financial markets. This paper economy is enormous: The value of global financial securities greatly exceeds the value of annual world output of goods and services. Moreover, the paper economy often contributes to crises in the real economy. Thus it is important to the well being of humanity and the planet as a whole, yet it is little understood by most people. This essay undertakes to provide a basic understanding of this paper economy, especially as its more speculative features have multiplied during the last two or three decades, so that Christians and others concerned about what is happening in our world can join in an intelligent discussion of how the harmful consequences of financial markets can be controlled.

To better understand this paper economy, one first needs to know something about foreign exchange markets, international money markets, and "external" financial markets.

In an open economy, domestic residents often engage in international transactions. American car dealers, for example, buy Japanese Toyotas and Datsuns, while German computer companies sell electronic notebooks to Mexican businessmen. Similarly, Australian mutual funds invest in the shares of companies all over the world, while the treasurer of a Canadian transnational corporation parks idle cash in 90-day Bank of England notes. Most of these transactions require one or more participants to acquire a foreign currency. If an American buys a Toyota and pays the Japanese Toyota dealer in dollars, for example, the latter will have to exchange the dollars for yens in order to have the local currency with which to pay his workers and local suppliers.

The foreign exchange market is the market in which national currencies are traded. As in any market, a price must exist at which trade can occur. An exchange rate is the price of a unit of domestic currency in terms of a foreign currency. Thus, if the exchange rate of the dollar in terms of the Japanese yen increases, we say the dollar has depreciated and the yen has appreciated. Similarly, a decrease in the dollar/yen exchange rate would imply an appreciation of the dollar and a depreciation of the yen.

Foreign exchange markets can be classified as spot markets and forward markets. In spot markets currencies are bought and sold for immediate delivery and payment. In forward markets, currencies are bought or sold for future delivery and payment. A U.S. music company, say, enters into a contract to buy British records for delivery in 30 days. To guard against the possibility of the dollar/pound exchange rate increasing in the meantime, the company buys pounds forward, for delivery in 30 days, at the corresponding forward exchange rate quoted today. This is called hedging.

Of course, there has to be a counterpart to the music company's forward purchase of pounds. Who is the seller of those pounds? The immediate seller would be a commercial bank, as in the spot market. But the bank only acts as an intermediary. The ultimate seller of forward pounds may be another hedger, like the music company, but with a position just its opposite. Suppose, for example, that an American firm or individual has invested in 30-day British securities that it wants to convert back into dollars after the end of 30 days. The investor may decide to sell the pound proceeds forward in order to assure itself of the rate at which the pounds are to be converted back into dollars after 30 days.

Another type of investor may be providing the forward contract bought by the music company. This is the speculator, who attempts to profit from changes in exchange rates. Depending on their expectations, speculators may enter the forward market either as sellers or as buyers of forward exchange. In this particular case, the speculator may have reason to believe that the dollar/pound exchange rate will decrease in the next 30 days, permitting him to obtain the promised pounds at a lower price in the spot market 30 days hence.

The main instruments of foreign exchange transactions include electronic bank deposit transfers and bank drafts, bills of exchange, and a whole array of other short-term instruments expressed in terms of foreign currency. Thus, foreign exchange transactions do not generally involve a physical exchange of currencies across borders. They generally involve only changes in debits and credits at different banks in different countries. Very large banks in the main financial centers such as New York, London, Brussels and Zurich, account for most foreign exchange transactions. Local banks can provide foreign exchange by purchasing it in turn from major banks.

Although the foreign exchange market is dispersed in many cities and countries, it is unified by keen competition among the highly sophisticated market participants. A powerful force keeping exchange rate quotations in different places in line with each other is the search on the part of market participants for foreign exchange arbitrage opportunities. Arbitrage is the simultaneous purchase and sale of a commodity or financial asset in different markets with the purpose of obtaining a profit from the differential between the buying and selling price.

When foreign exchange is acquired in order to engage in international transactions involving the purchase or sale of goods and services, it is said that international trade has taken place in the real economy. When international transactions involve the purchase or sale of financial assets, they are referred to as international financial transactions. They constitute the paper economy.

Financial markets are commonly classified as capital markets or money markets. Capital markets deal in financial claims that reach more than one year into the future. Such claims include shares of stock, bonds, and long-term loans, among others. Money markets, on the other hand, deal in short-term claims, with maturities of less than one year. These include marketable government securities (like Treasury bills), large-denomination certificates of deposit issued by banks, commercial paper (representing short-term corporate debt), money market funds, and many other kinds of short-term, highly liquid (easily transferable) financial instruments. It is these short-term money market securities that account for most of the instability in the global paper economy.

Buying or selling a money market security internationally involves the same kind of foreign exchange risk that plagues buyers or sellers of merchandise internationally. If one wishes to guard against the possibility of an increase or decrease in the foreign exchange rate, one can insure against such fluctuations by "covering" in the forward market. By the same token, the decision about whether to own domestic or foreign money market securities is not simply a comparison of the rates of interest paid on otherwise comparable securities, because one must also take into account the gain (or loss) from purchasing foreign currency spot and selling it forward. Thus, choosing the security with the highest return does not necessarily imply the one with the highest interest rate.

People who trade in international money markets, moreover, need to take into account many other variables, including the costs of gathering and processing information, transaction costs, the possibility of government intervention and regulation, other forms of political risk, and the inability to make direct comparisons of alternative assets. Speculating in international money markets is a risky proposition.

International money markets involve assets denominated in different currencies. External financial markets involve assets denominated in the same currency but issued in different political jurisdictions. Eurodollars, for example, are dollar deposits held outside the United States (offshore), such as dollar deposits in London, Zurich, or even Singapore banks. The deposits may be in banks owned locally or in the offshore banking subsidiaries of U.S. banks. Deutsche mark deposits in London banks or pound sterling deposits in Amsterdam banks also are examples of external deposits. They are referred to as eurocurrency deposits. (The advent of a new common currency in the European Community - the Euro - will require the development of new nomenclature for external financial markets)

External banking activities are a segment of the wholesale international money market. The vast majority of eurocurrency transactions fall in the above $1 million value range, frequently reaching the hundreds of millions (or even billion) dollar value. Accordingly, the customers of eurobanks are almost exclusively large organizations, including multinational corporations, government entities, hedge funds, and international organizations, as well as eurobanks themselves. Like domestic banks, eurobanks that have excess reserves may make loans denominated in eurocurrencies, expanding the supply of eurocurrency deposits. The eurocurrency market funnels funds from lending countries to borrowing countries. Thus, it performs an important function as global financial intermediator.

The origins of what Karl Polanyi3 called haute finance can be traced to Renaissance Italy, where as early as 1422 there were seventy-two bankers or bill-brokers in or near the Mecato Vecchio of Florence.4 Many combined trade with purely financial business. By the middle of the fifteenth century, the Medici of Florence had opened branches in Bruges, London and Avignon, both as a means of financing international trade and as a way of marketing new kinds of financial assets. Many banking terms and practices still in use today originated in the burgeoning financial centers of Renaissance Europe.

By the early seventeenth century, the Dutch and East India Companies began issuing shares to the public in order to fund imperial enterprises closely linked to Holland and Britain. Their shares were made freely transferable, permitting development of a secondary financial market for claims to future income. Amsterdam opened a stock exchange in 1611, and shortly thereafter, the British government began issuing lottery tickets, an early form of government bonds, to finance colonial expansion, wars and other major areas of state expenditure. A lively secondary market in these financial instruments also emerged.5

Throughout these early years, financial markets were anything but riskless and stable. Consider the famous Dutch tulip mania of 1630, for example. This speculative bubble saw prices of tulip bulbs reach what seemed like absurd levels, yet "the rage among the Dutch to possess them [tulips] was so great that the ordinary industry of the country was neglected." Some investors in Britain and France shared this "irrational exuberance," though it was centered mostly in Holland. Then, not unlike speculative bubbles of more recent vintage, prices crashed6, pushing the economy into a depression and leaving many investors angry and confused.

Paris developed into an early financial center in the eighteenth century, but the Revolution of 1789 dissipated its power. The New York Stock Exchange was formally organized in 1792 and the official London Stock Exchange opened in 1802. The expansion westward of the railroads in the U.S. offered the financial community opportunity to sell railway shares and bonds that quickly became dominant in the financial markets. Indeed, the bond markets of London, Paris, Berlin, and Amsterdam were vehicles for collecting massive amounts of European savings and transferring it at higher returns to the emerging markets of the U.S., Canada, Australia, Latin America and Russia in the century preceding World War I.

Forward markets soon developed, especially in the U.S., in order to counter the impact of long distances and unpredictable weather. As capital and money markets expanded, other new financial instruments came into use. Joint stock companies were formed, enabled by legislation that clarified the distinction between the owners and managers of corporations. This, in turn, helped stimulate the growth of the American stock market in the late nineteenth century. To be sure, financial markets did not grow continuously in the nineteenth century. Lending to the emerging markets was interrupted by defaults in the 1820s, 1850s, 1870s and 1890s, but each wave of default was confined to a relatively small number of countries, permitting growth of financial flows to resume.7

In the four decades leading up to World War I, a truly worldwide economy was forged for the first time, extending from the core of Western Europe and the U.S. to latecomers in Eastern Europe and Latin America and even to the countries supplying raw materials on the periphery. Central to this expansion of trade and investment was an expanding system of finance that girded the globe. The amount was enormous: between 1870 and 1914 something like $30 billion,8 the equivalent in 2002 dollars of $550 billion, was transferred to recipient countries, in a world economy perhaps one-twelfth as large as today's.

During this "Gilded Age" of haute finance, the risks of participating in international trade and investment were generously shared with governments and the banking system. The reason is that foreign exchange rates were kept reasonably stable by the commitment of most governments to the "high" gold standard. In this way, businesses and individuals engaging in international transactions were reasonably certain that the value of their contracts was not going to change before they matured. Their exchange risk was shared with government by its willingness to buy or sell gold in order to keep the exchange rate constant. Because of this assurance, financial flows were reasonably free of regulation.

They were not immune from crises, however. When the sources of financial capital temporarily dried up, capital-importing countries occasionally found they could not expand export earnings sufficiently to avoid suspending interest payments on their debts or abandoning gold parity. On two occasions, the United States faced this possibility. The first was in 1893, when it switched in a sharp economic downturn to bimetallism (which caused William Jennings Bryan to denounce the "cross of gold"), and the second was in 1907, which led to the creation of the Federal Reserve System, handing to the government the function of lender of last resort previously carried out by Wall Street banks under the tutelage of J. Pierpont Morgan.

In his magisterial book The Great Transformation, Karl Polanyi reflected on the pervasive influence of haute finance on the policies of nations even in this "Gilded Age." The globalizing financial markets and the gold standard, according to Polanyi, left very little room for states, especially smaller ones, to adopt monetary and fiscal policies independent of the new international order. "Loans, and the renewal of loans, hinged upon credit, and credit upon good behavior. Since, under constitutional government ..., behavior is reflected in the budget and the external value of the currency cannot be detached from the appreciation of the budget, debtor governments were well advised to watch their exchanges carefully and to avoid policies which might reflect upon the soundness of budget positions." Thus, even one hundred years ago the then-dominant world power, Great Britain, speaking as it did so often through the voice of the City of London, "prevailed by the timely pull of a thread in the international monetary network.9

Following World War I, the United States emerged not merely as a creditor country but as the primary source of new international financial flows. At first, the principal borrowers were the national governments of the stronger countries, but as the boom in security underwriting developed in the U.S, numerous obscure provinces, departments and municipalities found it possible to sell their bonds to American investors.10 Just as domestic construction, land, and equity markets went through speculative rises in the 1920s, so too did the U.S. experience a speculative surge in foreign investment. In the aftermath of successive defaults by foreign debtors in 1932, the Senate Committee on Banking and Currency concluded:

The record of the activities of investment bankers in the flotation of foreign securities is one of the most scandalous chapters in the history of American investment banking. The sale of these foreign issues was characterized by practices and abuses that violated the most elementary principles of business ethics.11

Speculation in the stock markets leading up to 1929 offers still another window on the instability of short-term financial flows. A speculative market can be defined as one in which prices move in response to the balance of opinion regarding the future movement of prices rather than responding normally to changes in the demand for and supply of whatever is priced. Helped by the willingness of Wall Street to allow people to buy stocks on margin, people were only too ready to bet prices would rise as long as others thought so too. Day after day and month after month the price of stocks went up in 1927. The gains by later standards were not large, but they had an aspect of great reliability. Then in 1928, the nature of the boom changed. "The mass escape into make-believe, so much a part of the true speculative orgy, started in earnest.12

Following World War I, the gold standard itself took on new form. Nations were allowed to hold their international reserves in either gold or foreign exchange. This worked for a while in the 1920s, but as speculation mounted and balances of payments disequilibria grew, fears of devaluation led central banks to try to replace their foreign-exchange holdings with specie in a "scramble for gold." The worldwide result of these shifts in central bank portfolios was an overall contraction of the supply of money and credit that sapped aggregate demand and forced prices to fall and output levels to shrink. Thus, it can be argued - persuasively in our view - that the Great Depression of the 1930s was as much, if not more, the result of mismanagement of money and credit as it was the result of protectionist policies. Protectionist policies were more likely the result of slowed growth and stalled trade. Countries that broke with the gold-exchange standard early, such as Britain in 1931, and pursued more expansionary monetary policies fared somewhat better.

During the darkest days of World War II, a radically new economic architecture was designed for the postwar world at a New Hampshire ski resort called Bretton Woods. With the competitive devaluation and protectionist policies of the 1930s still fresh in their minds, the mostly British and American delegates to the conference wanted most of all to design a system with fixed exchange rates that did not rely on national gold hoards to keep exchange rates stable. They decided to depend instead on strict controls of international financial movements. In this way, they hoped to allow countries to pursue full-employment policies through appropriate monetary (money and credit) and fiscal (tax and spending) policies without some of the anxieties associated with open financial markets. The role of monetary and financial stabilizer was given to the International Monetary Fund (IMF), which was provided with modest funds to assist nations to adjust imbalances in their external payments obligations. The International Bank for Reconstruction and Development (IBRD, later the World Bank) assumed the task of helping to finance post-war reconstruction.13

The IMF as it emerged from Bretton Woods had inadequate reserves to advance money for the long periods that many countries require for "soft-landings" from big current-account deficits. It would make only short-term loans. To make sure that borrowing nations were constrained, "conditionality" attached to IMF loans became standard practice, even in the early years of the Fund's operation. Policy limitations and "performance targets" tied to credit lines advanced under "standby agreements" began in the middle 1950s and were universal by the 1960s, long before the notions of "stabilization" and "structural adjustment" came into common parlance.

The Bretton Woods agreement also imposed a foreign exchange standard by which exchange rates between major currencies were fixed in terms of the dollar, and the value of the dollar was tied to gold at a U.S. guaranteed price of thirty-five dollars per ounce. By devising a system that controlled financial movements and assisted with the adjustment of countries' balances of payments, the new system succeeded in keeping exchange rates remarkably stable. They were changed only very occasionally, e.g., as when the value of sterling relative to the dollar was reduced in 1949 and again in 1966. This meant that companies doing business abroad did not need to worry constantly about the risk of exchanging one currency for another.

Among the reasons for this remarkable stability was the willingness of the central banks of other countries to hold an increasing proportion of their official reserves in the form of U.S. dollars. It was an essential part of the system that the dollars held by other countries would be seen as IOUs backed the 1960s, there were more and more U.S. dollars held by other countries, and this so-called "dollar overhang" became disturbingly large.15 General de Gaulle called it "the exorbitant privilege," meaning that the Americans were paying their bills - for defense spending to fight the Vietnam War among other things - with IOUs instead of real resources in the form of exports of goods and services.

Strict control over financial movements began to weaken as early as the 1950s, when the first eurodollar (later eurocurrency) deposits were made in London. At first a trickle, limited originally to Europe, these offshore banking operations soon expanded worldwide. The American "Interest Equalization Tax" (IET) instituted in 1963 raised the costs to banks of lending offshore from their domestic branches.16 The higher external rates led dollar depositors such as foreign corporations to switch their funds from onshore U.S. institutions to eurobanks. Thus, the real effect of the IET was to encourage the dollar to follow the foreigners abroad, rather than the other way around. Eurobanks paid higher interest rates on deposits and loaned eurocurrencies at lower rates than U.S. banks could at home. Still another large inflow of eurodeposits occurred in 1973-74 as the Organization of Petroleum Exporting Countries (OPEC) began "recycling" their surplus dollar earnings through eurobanks. Because of their existence, a country such as Brazil could arrange within a reasonably regulation-free environment to obtain multimillion-dollar loans from a consortium of offshore American, German and Japanese banks and thereby finance its oil imports. Net eurocurrency deposit liabilities that amounted to around $10 billion in the mid-1960s, grew to $500 billion by 1980.

These eurocurrency transactions taught the players in financial markets how to shift their deposits, loans, and investments from one currency to another whenever exchange rates or interest rates were thought to be ready to change. Even the ability of central banks to regulate the supply of money and credit was undermined by the readiness of commercial banks to borrow and lend offshore. Hence, the effectiveness of regulatory mechanisms that had been put in place to implement the Bretton Woods agreement - interest rate ceilings, lending limits, portfolio restrictions, reserve and liquidity requirements - gradually eroded as offshore transactions started to balloon.

The world economy developed at unprecedented rates during the roughly twenty-five years immediately following World War II. Growth and employment rates during these years were at historic highs in most countries. Productivity also advanced rapidly in most developing countries as well as in the technological leaders. These facts suggest that the system devised at Bretton Woods worked reasonably well, despite occasional adjustments. To be sure, it helped to sow the seeds of its own destruction by failing to retain operational control of international financial flows. But the twenty-five years of its survival leading up to August 15, 1971, when President Nixon closed the gold window, have nonetheless come to be called by some economic historians the "Golden Years."

Fixed exchange rates did not last long after the U.S. stopped exchanging gold for claims on the dollar held by foreign central banks. The pound sterling was allowed to float against the dollar in July, 1972. Japan set the yen free to float in February, 1973, and most European currencies followed suit shortly thereafter. The Bretton Woods gold-dollar system was doomed.

The fact that exchange rates no longer were fixed meant that companies doing business in different countries had to cope with the day-to-day shifts in the dollar's rate of exchange with other currencies. The risks of unexpected changes in the value of international contracts suddenly had shifted from the public to the private sector. Corporate finance officers now had to hedge against possible exchange losses by buying a currency forward and investing the equivalent in the short-term money market, or by investing in the eurocurrency market. The corporations' banks, in turn, tried to match each foreign currency transaction with another contrary transaction in order not to leave each of the banks exposed to foreign exchange risk overnight. Since no single bank was likely to balance its foreign exchange positions exactly, the need arose to swap deposits in different currencies in order to match corporate hedging transactions and to square the bank's books.

The price of this forward cover on inter-bank transactions - that is to say, the premium or discount on a currency's spot value - has tended to accord with the differences between interest-rates offered for eurocurrency deposits in different currencies. This is the connection between the foreign exchange market and the short-term credit markets, between exchange rates and interest rates. Whenever exchange rates move up or down, therefore, their influence is immediately transmitted through the eurocurrency markets to the credit markets.

It is this scramble to avoid private risk that accounted for the dramatic rise in international financial movements following the demise of the Bretton Woods system. By 1973, daily foreign exchange trading around the world varied between $10 and $20 billion per day. This amount was approximately twice the value of world trade at the time. Bank of International Settlements data suggests that the daily average of foreign exchange trading had climbed by 1980 to about $80 billion, and that the ratio between foreign exchange trading and international trade was more nearly ten to one. The data for 1992 was $880 billion and fifty to one, respectively; for 1995, $l,260 billion and seventy to one; and for 2000, almost $1,800 and ninety to one.

There is very little doubt, therefore, that the lion's share of international financial flows is relatively short-run. Indeed, about eighty percent of foreign exchange transactions are reversed in less than seven business days. Only a very small proportion is used to finance international trade and direct foreign investment. The vast majority must be used with the expectation of gain or to avoid losses that may result from changes in the value of financial assets. In general terms, they are speculative, made in hope of capital gain or to hedge against potential capital loss, or to seek the gains of arbitrage based on slight differences in rates of return in different financial centers.

Foreign exchange markets and markets for money and credit seem remote and abstract to most people. This section introduces the real institutions that operate these markets and assesses the nature of their power.

According to recent work by political scientists, the power of these financial actors is based in part on a complicated "process of multiplication" of loans, assets and transactions. Many investors in financial markets buy financial instruments on very thin margins, based on loans obtained by pledging the assets as collateral. This is called "leverage" in the jargon of financial markets. In turn, the borrowed funds are invested in other financial assets, multiplying the demand for credit and financial assets. As demand rises, more sophisticated financial assets are invented, including many forms of financial derivatives. A major portion of the accumulated debt remains serviceable only as long as the prices of most assets will rise or at least remain relatively stable. If prices turn down, they easily can lead to a chain-reaction. If investors respond instinctively like a herd, they will bring a far-reaching collapse that constitutes a crisis.

As the flow of financial assets climbs, some bankers, brokers, and managers of financial institutions become prominent players in the competition for investor dollars. Some become known for picking profitable places to invest and for promoting their selections successfully. This can influence markets if people have confidence in their advice. A notorious example of the influence of prominent players was the attack on British sterling in 1992 by George Soros' Quantum Fund. Believing that sterling was overvalued, the Fund quietly established credit lines that allowed it to borrow $15 billion worth of sterling and sell it for dollars at the then "overvalued" price. Its purpose, of course, was to pay back the loan with cheaper pounds after they had depreciated. Having gone long on dollars and short on sterling, Soros decided to speak up noisily. He publicized his short-selling and made statements in newspapers that the pound would soon be devalued. It wasn't long before sterling was devalued; he made $1 billion in profit.

The point can be made more generally: financial markets are subject to manipulation because they have become socially structured. Market leaders and financial gurus are admired and followed (at least until very recently). The heavyweights thus dominate the business. An obvious consequence of this is that there is a strong tendency in financial markets for further concentration of resources.

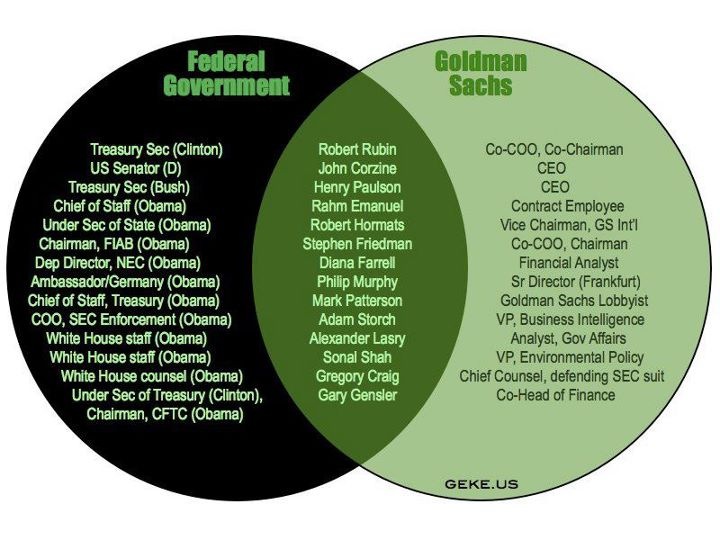

Another source of the power of financial actors is their obvious affinity for the rampant free-market philosophy of neo-liberalism. The freedom with which they move financial capital around depends, of course, on the market-friendly policies of the so-called Washington Consensus.19 As long as they are seen as part of the governing coalition, they derive special powers to regulate themselves rather than be controlled by an independent government agency or civil society. Their power also is reinforced by the activities of several collective associations of financial actors,20 which lobby on their behalf.

One more source of power for the financial actors is their knowledge that if they are big enough and sufficiently interlaced with other financial actors, then the "system" will keep them from failing. Consider the case of Long-term Capital Management, a hedge fund partnership started in 1994. It was able to borrow from various banks the equivalent of forty times its capitalization in order to make bets on changes in the relative prices of bonds in the U.S. and abroad. When the Russian government announced a devaluation and debt moratorium in August, 1998, it produced losses that the fund could not sustain. Nor could some of the banks that had loaned large amounts to the fund. Accordingly, the Federal Reserve Bank of New York, fearful that the risk to the entire system was too high, orchestrated a private rescue operation by fourteen banks and other financial institutions, which re-capitalized the company for $3.5 billion.

Financial actors also have the power indirectly to influence non-financial actors such as firms or states. By providing economic incentives to gamble and speculate on financial instruments, global financial markets divert funds from long-term productive investments. In all probability, they also encourage banks and financial institutions to maintain a regime of higher real interest rates that reduce the ability of productive enterprises to obtain credit. The volatility of global financial markets, moreover, brings uncertainty and volatility in interest rates and exchange rates that are harmful to various sectors of the real economy, particularly international trade.

The above stories about George Soros and Long-term Capital Management are good illustrations of the consequences for non-financial factors of actions by financial actors. Both episodes are examples of games that are basically zero-sum, at least in the short-run. Nothing new was produced; no new values were created. In the 1992 case about speculating against sterling, the Quantum Fund's profits were at the expense of the British government, especially the Bank of England, and British taxpayers. In 1998, the losses suffered by Long-term Capital Management came out of the pockets of the stockholders of the banks that bailed it out, as the stock-market value of their shares depreciated. Hence, the financial system tends to feed itself by drawing more resources from other sectors of the economy, undermining the vitality of the real economy.

The dominant economic ideology of the last twenty-five years has been embodied in the so-called Washington Consensus. It is a "market-friendly" ideology that traces its roots to longstanding policies of the IMF that encourage macroeconomic "stabilization;" to adoption by the World Bank of ideas in vogue in Washington early in the Reagan period concerning deregulation and supply-side economics; to the zeal of the Thatcher government in England for privatizing public enterprises; and perhaps most of all to the neo-liberal tendencies of the business community and the economics profession in the U.S. The implementation of these policies of economic "reform," by first "stabilizing" the macro-economy and then "adjusting" the market so that it can perform more efficiently, are supposed to pay off in the form of faster output growth and rising real incomes

Among these policy prescriptions is financial liberalization in both the developed and the developing countries. Domestically it is achieved by weakening or removing controls on interest and credit and by diluting the differences between banks, insurance and finance companies. International financial liberation, on the other hand, demands removal of controls and regulations on both the inflows and outflows of financial instruments that move through foreign exchange markets. It is the implementation of these reforms that is perhaps the single most important cause of the surge in global financial flows. To be sure, the influence of technological advances has broken the natural barriers of space and time for financial markets as twenty-four hour electronic trading has grown. The fact that throughout most of the 1980s and 1990s the developed countries suffered from over-capacity and overproduction in manufacturing may also have led the owners of financial capital to look for alternative profit opportunities.

It now is time to ask whether the implementation of all these reforms, on balance, has produced good or bad results. The focus of this section will be mostly on the consequences of large and expanding international financial flows. After all, they are the main concern of this essay. But first, we should ask whether or not the policies of growth and rising real incomes promoted by the Washington Consensus have borne fruit.

There is little doubt that the introduction of the Washington Consensus' policy mix expanded the volume of interna ries' share of trade has risen from 23 to 29 percent. Increasing numbers of firms from developing countries, like their industrial-country counterparts, engage in transnational production and adopt a global perspective in structuring their operations. The flow of foreign direct investments and foreign portfolio investments has multiplied even more rapidly than trade, despite the financial instability experienced in Asia, Brazil, Russia, and elsewhere in recent years.

The effects of liberalization have not been uniformly favorable, however. After at least ten full years of experience with the Washington Consensus, several recent studies have begun to assess the consequences for developing countries of this experiment in more open markets.21 Except for the years of crisis in a number of the countries studied, most developing countries achieved moderate growth rates of gross domestic product in the 1990s - considerably higher than in the l980s in Africa and Latin America during the debt crisis, but remarkably unchanged in most other regions. Moreover, average annual growth in the 1990s was slightly lower than in the twenty-five years preceding the debt crisis when a strategy of substituting domestic production for imports was in fullest use. When population growth rates are taken into consideration, the growth rate of per capita income in the developing countries studied during the 1990s also was somewhat lower than in the 1960s and 1970s. Toward the end of the 1990s, growth tapered off in many countries due to emerging domestic financial crises or external events. There is little evidence in these figures, therefore, to suggest the strategy of liberalization boosted growth rates appreciably.

Nor did the distribution of income improve in most developing countries in the 1990s. On the contrary, virtually without exception the wage differentials between skilled and unskilled workers rose with liberalization. The reasons for this varied widely among countries, but one of the most important reasons was the fact that the number of relatively well-paid jobs in sectors of the economy involved with international trade, though growing, was insufficient to absorb available workers, forcing many workers into more precarious and poorly paid employment in the non-traded, informal trade, and service sectors or where traditional agriculture served as a sponge for the labor market. Between the mid-1960s and the late-1990s, the poorest 20 percent of the world population saw its share of income fall from 2.3 to 1.4 percent. Meanwhile, the share of the wealthiest quintile increased from 70 to 85 percent.22

While all markets are imperfect and subject to failure, financial markets are more prone than others to fail because they are plagued with three particular shortcomings:

Asymmetric information is a problem whenever one party to an economic transaction has insufficient information to make rational and consistent decisions. In most financial markets where borrowing and lending take place, borrowers usually have better information about the potential returns and risks associated with the investments to be financed by the loans than do the lenders. This becomes especially true as financial transactions disperse across the globe, often between borrowers and lenders of widely different cultures.

Asymmetric information leads to adverse selection and moral hazard. Adverse selection occurs when, say, lenders have too little information to choose from among potential borrowers those who are most likely to use the loans wisely. The lenders' gullibility, therefore, attracts more unworthy borrowers. Moral hazard occurs when borrowers engage in excessively risky activities that were unanticipated by lenders and lead to significant losses for the lender. Yet another form of moral hazard occurs when lenders indulge in lending indiscriminately because they assume that the government or an international institution will bail them out if the loans go awry.

A good illustration of asymmetric information is the story of bank lending following OPEC's large increase in oil prices following 1973. Awash in cash, the oil exporters deposited large amounts in commercial banks that then perfected the Euro-currency loan for developing countries. Eager to put excess reserves to use, the banks spent little time discriminating among potential borrowers, in part because they believed host governments or international agencies would guarantee the loans. At the same time, developing countries found they could readily borrow not only to import oil, but also to increase other kinds of expenditures. This meant they could use borrowed funds to maintain domestic spending rather than be forced to adjust to the new realities of higher prices for necessary imports. There is considerable evidence that moral hazard also was present in the Mexican crises in 1982 and 1994, and in the Southeast Asian crises in 1997-8.

Yet another illustration of asymmetric information is the tendency of financial firms, especially on Wall Street and in the City of London, to invent ever more complex derivatives to shift risk around the financial system. The market for these products is growing rapidly, both on futures and options exchanges (two of the several places where derivatives are traded). A financial engineer, for example, can take the risk in, say, a bond and break it down into a series of smaller risks, such as that inflation will reduce its real value or that the borrower will default. These smaller risks can then be priced and sold, using derivatives, so that the bondholder keeps only those risks he wishes to bear. But this is not a simple task, particularly when it involves assets with risk exposures far into the future and which are traded so rarely that there is no good market benchmark for setting the price. Enron, for instance, sold a lot of these sorts of derivatives, booking profits on them immediately even though there was a serious doubt about their long-term profitability. Stories of huge losses incurred in derivative trading are legion. The real challenge before central banks and regulatory bodies is to curb speculative behavior and bring discipline in derivative markets.

A second source of risk in financial markets is the tendency of borrowers and lenders alike to engage in herd behavior. John Maynard Keynes, writing in the 1930s, suggested that financial markets are like "beauty contests." His analogy was to a game in the British Sunday newspapers that asked readers to rank pictures of women according to their guess about the average choice by other respondents. The winner, therefore, does not express his own preferences, but rather anticipates "what average opinion expects average opinion to be." Accordingly, Keynes thought that anyone who obtained information or signals that pointed to swings in average opinion and to how it would react to changing events had the basis for substantial gain. Objective information about economic data was not enough. Rather, simple slogans "like public expenditure is bad," "lower unemployment leads to inflation," "larger deficits lead to higher interest rates," were then the more likely sources of changes in public opinion. What mattered was that average opinion believed them to be true, and that advance knowledge of, say, more public spending, lower unemployment, or larger deficits, respectively, offered the speculator a special advantage.

A financial market that operates as a beauty contest is likely to be highly unstable and prone to severe changes. One reason for this is that people trading in financial assets, even today, know very little about them. People who hold stock know little about the companies that issued them. Investors in mutual funds know little about the stocks their funds are invested in. Bondholders know little about the companies or governments that issued the bonds. Even knowledgeable professionals are often more concerned with judging how swings in conventional opinion might change market values rather than with the long-term returns on investments. Indeed, since careful analysis of risks and rewards is costly and time consuming, it often makes sense for fund managers and traders to follow the herd. If they decide rationally not to follow the herd, their competence may be seriously questioned. On the other hand, if fund managers follow the herd and the herd suffers losses, few will question their competence because others too suffered losses. When financial markets are operated like a beauty contest, everyone wants to sell at the same time and nobody wants to buy.

The financial markets behaved as predicted shortly after several industrial countries, including the U.S. and Germany, abolished all restrictions on international capital movements in 1973. The new system proved to be highly volatile, with exchange rates, interest rates, and financial asset-prices subject to large short-term fluctuations. The markets also were susceptible to contagion when financial tremors spread from their epicenter to other countries and markets that seemingly had little connection with the initial problem. In less than five years, it already was clear that both the surpluses and the deficits on the major countries' balance of payments were getting larger, not smaller, despite significant changes in the exchange rates.

In some cases, a financial crisis can be self-fulfilling. A rumor can trigger a self-fulfilling speculative attack, e.g. on a currency, that may be baseless and far removed from the economic fundamentals (unlike the Soros story above). This can cause a sudden shift in the herd's intentions and lead to unanticipated market movements that create severe financial crises. Consider, for example, the succession of major financial crises that have pock-marked the recent history of international financial markets, including Latin America's Southern Cone crisis of 1979-81, the developing-country debt crisis of 1982, the Mexican crisis of 1994-95, the Asian crisis of 1997-98, the Russian crisis of 1998, the Brazilian crisis of 1999, and the Argentine crisis of 2001-02.

Perhaps the Asian crisis of 1997-98 is the most interesting in this regard, for there were relatively few signals beforehand of impending crisis. All the main East Asian economies displayed in 1994-96 low inflation, fiscal surpluses or balanced budgets, limited public debt, high savings and investment rates, substantial foreign exchange reserves and no signs of deterioration before the crisis. This background has led many analysts to suppose that the crisis was a mere product of the global financial system. But what could have triggered the herd to stampede out of Asian currencies? No doubt several factors were at work. Before the crisis that started in the summer of 1997, there was a rise in short-term lending to Asians by Western and Japanese banks with little or no premiums, a fact that the Bank for International Settlement raised questions about. Alert investors, especially hedge funds, also noticed that substantial portions of East and Southeast Asian borrowings were going into non-productive assets and real estate that often were linked to political connections. In fact, some of the funds pouring into non-productive assets were coming out of the productive sector, mortgaging the longer-term viability of some real economies. Information about the structure and policies of financial sectors was opaque. Thus, opinions began to change among key lenders about the regulation of financial sectors in several Asian countries and their destabilizing lack of transparency. Suddenly, several important hedge funds reduced their exposure by shorting currency futures, followed quickly by Western mutual funds. The calling of loans led quickly to deep depression in several Asian countries. It has been estimated that the Asian crisis and its global repercussions cut global output by $2 trillion in 1998-2000.

Both economic theory and the experience of managing the external financial affairs of nations tell us that it is virtually impossible to maintain (1) full financial mobility, (2) a fixed exchange rate, and (3) freedom to seek macro-economic balance (full employment with little inflation) with appropriate monetary and fiscal policies. Only two of these policy objectives can be consistently maintained. If the authorities try to pursue all three, they will sooner or later be punished by destabilizing financial flows, as in the run up to the Great Depression around 1930 and in the months before sterling's collapse 1992. If a government tries to stimulate its economy with lax monetary policy, for example, and players with significant market power like George Soros sense that at a fixed exchange rate, foreigners will be unwilling to lend enough to finance the country's current account deficit, they will begin to flee the home currency in order to avoid the capital losses they will suffer if and when there is a devaluation. If reserve losses accelerate and more players follow suit, crisis ensues. The authorities are forced to devalue, interest rates soar, and the successful attackers sit back to count their profits.

For nations wishing to retain reasonably independent monetary and fiscal authority in order to cater to domestic needs, the solution is to allow the exchange rate to move up or down as conditions in the foreign exchange markets dictate, or to establish some sort of control over the movement of financial instruments in and out of the country, or to devise some combination of these two adjustment mechanisms. The debate over whether fixed or flexible exchange rates is the wiser policy continues to rage in academic quarters and in finance ministries all over the world. For the most part, the international business community prefers reasonably fixed exchange rates in order to minimize their costs of hedging foreign currency positions. Thus instituting some form of control over speculative financial movements may be an appropriate solution to the "trilemma."

The capacity of a nation to levy enough taxes to finance needed public expenditures is another important reason to retain independent authority. A central function of government has been to insulate domestic groups from excessive market risks, particularly those originating in international transactions. This is the way governments have maintained domestic political support for liberalizing trade and finance throughout the postwar period. Yet many governments are less able today to help citizens that are injured by freer markets with unemployment compensation, severance payments, and adjustment assistance because the slightest hint of raising taxes to pay for these vital public services leads to capital flight in a world of heightened financial mobility.

This is a dilemma. Increased integration into the world economy has raised the need of governments to redistribute tax revenues or implement generous social programs in order to protect the vast majority of the population that remains internationally immobile. At the same time, governments find themselves less able to maintain the safety nets needed to preserve social stability. It seems reasonable to suppose, therefore, that doing things that will bolster the ability of governments to levy sufficient taxes - curbing tax avoidance by transnational corporations, controlling offshore tax havens, regulating capital flight - would help make globalization slightly more democratic.

The people who benefit from speculative financial movements are, for the most part, better educated and wealthier than the vast majority of fellow citizens. They are the elites, whatever the country. As noted above, they have fewer connections to the real economy of production and exchange than most people. And their purpose in trading financial assets, again for the most part, is to make a profit quickly rather than wait for an investment project to mature.

People who do not participate directly in the buying and selling of short-term financial instruments are nonetheless influenced indirectly by the macroeconomic instability and contagion that often accompany interruptions in financial market flows. This is true for people both in developed and developing countries. In developed countries, the voracious appetite of financial markets for more and more resources saps the vitality of the real economy - the economy that most people depend upon for their livelihood. It has been shown that real interest rates rise as a result of the expansion of speculative financial markets. This rise in real interest rates, in turn, dampens real investment and economic growth while serving to concentrate wealth and political power within a growing worldwide rentier class (people who depend for their income on interest, dividends, and rents).23 Rather, the long-term health of the economy depends upon directing investable funds into productive investments rather than into speculation.

In developing countries, attracting global investors' attention is a mixed blessing. Capital market inflows provide important support for building infrastructure and harnessing natural and human resources. At the same time, surges in money market inflows may distort relative prices, exacerbate weakness in a nation's financial sector, and feed bubbles. As the 1997 Asian crisis attests, financial capital may just as easily flow out of as into a country. Unstable financial flows often lead to one of three kinds of crises:

Although these three types of crises sometimes appear singly, they more often arrive in combination because external shocks or changed market expectations are likely to occur simultaneously in the market for government bonds, the foreign exchange market, and the markets for bank assets. Approximately sixty developing countries have experienced extreme financial crises in the past decade.24

The vast majority of people in the developing world suffer from these convulsive changes. They are tired of adjusting to changes over which they exercise absolutely no control. Most people in these countries view Western capitalism as a private club, a discriminatory system that benefits only the West and the elites who live inside "the bell jars" of poor countries. Even as they consume the consumer goods of the West, they are quite aware that they still linger at the periphery of the capitalist game. They have no stake in it, and they believe that they suffer its consequences. As Hernando deSoto puts it, "Globalization should not be just about interconnecting the bell jars of the privileged few."25

Karl Polanyi in The Great Transformation sought to explain how the "liberal creed" contributed to the catastrophes of war and depression associated with the first half of the twentieth century. Polanyi's central argument, which in fact can be traced back to Adam Smith, is that markets do indeed promote efficiency and change, but that they achieve this through undermining social coherence and solidarity. Markets must therefore be embedded within social institutions that mitigate their negative consequences.

The evidence of more recent times suggests that the global spread of free-market policies has been accompanied by the decline of countervailing institutions of social solidarity. Indeed, a main feature of the introduction of market-friendly policies has been to weaken local institutions of social solidarity. Consider, for example, the top-down policy prescriptions of the IMF and World Bank during the developing world's debt crisis in the 1980s. These policies evolved into an intricate web of expected behaviors by developing countries. In order for developing countries to expect private businesses and financial interests to invest funds within their borders and to boost the growth potential of domestic economies, they needed to drop the "outdated and inefficient" policies that dominated development strategies for most of the postwar period and adopt in their place policies that are designed to encourage foreign trade and freer financial markets. Without significant adjustments in the ways economies were managed, it was suggested, nations soon would be left behind.

The list of Washington Consensus requirements was long and daunting:

In a provocative article, Ute Pieper and Lance Taylor point out that market outcomes often conflict with other valuable social institutions. In addition, they emphasize that markets function effectively only when they are "embedded" in society. The authors then look carefully at the experience of a number of developing countries as they struggled to comply with the policy prescriptions of the IMF and the Fund. In almost every case, they demonstrate conclusively that the impact of these efforts was to make society an "adjunct to the market."26

An appropriate balance is not being struck between the economic and non-economic aspirations of human beings and their communities. Indeed, the evidence is mounting that globalization's trajectory can easily lead to social disintegration - to the splitting apart of nations along lines of economic status, mobility, region, or social norms. Globalization not only highlights and exacerbates tensions among groups; it also reduces the willingness of internationally mobile groups to cooperate with others in resolving disagreements and conflicts.

History confirms that free-markets are inherently volatile institutions, prone to speculative booms and busts. Overshooting, especially in financial markets, is their normal condition. To work well, free markets need not only regulation, but active management. During the first half of the post-war era, world markets were kept reasonably stable by national governments and by a regime of international cooperation. Only lately has a much earlier idea been revived and made an orthodoxy - the idea adopted by the Washington Consensus that, provided there are clear and well-enforced rules-of-the-game, free markets can be self-regulating because they embody the rational expectations that participants form about the future.

On the contrary, since markets are themselves shaped by human expectations, their behavior cannot be rationally predicted. The forces that drive markets are not mechanical processes of cause and effect, as assumed in most of economic theory. They are what George Soros has termed "reflexive interactions."27 Because markets are governed by highly combustible interactions among beliefs, they cannot be self-regulating.

The question before us then, is what could be done to better regulate financial markets and to bring active management back into the task of "embedding" markets in society, rather than the other way around? Monetary authorities such as the Federal Reserve System in the U.S. and the central banks of other countries were formed long ago in order to dampen the inherent instabilities of financial market in their home countries. But the evolution of an international regulatory framework has not kept pace with the globalization of financial markets. The International Monetary Fund was not designed to cope with the volume and instability of recent financial trends.

Given the problems outlined above about short-term speculative financial transactions, one might wonder why national policy-makers have not insulated their financial markets by imposing some sort of control over financial capital. The answer, of course, is that some have continued trying to do so despite discouragement from the IMF. For example, some have put limitations on the quantity, conditions, or destinations of financial flows. Others have tried to impose a tax on short-term borrowing by national firms from foreign banks. This is said to be "market-based" because it operates by altering the cost of foreign funds. If such transactions were absolutely prohibited, they would be called "non-market" interventions.

A more extreme form of financial capital controls, one that controls movement of foreign exchange across international borders, also has been tried in a number of countries. This form of control requires that some if not all foreign currency inflows be surrendered to the central bank or a government agency, often at a fixed price that differs from that which would be set in free market. The receiving agency then determines the uses of foreign exchange. The absence of exchange controls means that currencies are "convertible."

The neo-liberal argument opposing financial capital controls asserts that their removal will enhance economic efficiency and reduce corruption. It is based on two basic propositions in economic theory that depend for their proof on perfectly competitive markets in the real economy and perfectly efficient gatherers and transmitters of information in financial markets. Neither assumption is realistic in today's world. Indeed, a number of empirical studies have reported the effectiveness of capital controls in controlling capital flight, curbing volatile capital flows and protecting the domestic economy from negative external developments.

Developing countries have only recently abandoned, or still maintain, a variety of control regimes. Latin American countries traditionally have used market-based controls, putting taxes and surcharges on selected financial capital movements or tying them up in escrow accounts. Non-market based restrictions were more common in Asia until the early 1990s. Many commentators believe that their sudden removal in the early 1990s was a contributing cause to the Asian financial crises in 1997-8. The experience of two countries, Malaysia and Chile, with capital controls is especially instructive.

Malaysia, unlike its Asian neighbors, was reluctant to remove its restrictions on external borrowing by national firms unless they could show how they could earn enough foreign exchange to service their debts. Then when the Asian crises hit, its government imposed exchange controls, in effect making its local currency that was held outside the country inconvertible into foreign exchange. After the ringget was devalued, exporters were required to surrender foreign currency earnings to the central bank in exchange for local currency at the new pegged rate. The government also limited the amount of cash nationals could take abroad, and it prohibited the repatriation of earnings on foreign investments that had been held for less than one year. Thus, Malaysia's capital controls were focused mostly on controlling the outflow of short-term financial transactions. Happily, the authorities were able to stabilize the currency and reduce interest rates, leading to a degree of domestic recovery.28

Chile, on the other hand, tried to limit the inflow of short-term financial transactions. It did so by imposing a costly reserve requirement on foreign-owned capital held in the country for less than one year. Despite attempts to stimulate foreign direct investment of the funds, most of the reserve deposits were absorbed in the form of increased reserves at the central bank. In turn, this created a potential for expanding the money supply, which the government feared would lead to inflation. Rather than allow this to happen, the government "sterilized" the inflows by selling government bonds from its portfolio. But this pushed down the prices of bonds and pushed up the interest rates on them, discouraging business investment. Finally, when prices of copper (Chile's primary export) fell sharply in 1998, the control regime was scrapped.29

A global tax on international currency movements was first proposed by James Tobin, a Yale University economist, in 1972.30 He suggested that a tax of one-quarter to one percent be levied on the value of all currency transactions that cross national borders. He reasoned that such a tax on all spot transactions would fall most heavily on transactions that involve very short round-trips across borders. In other words, it would be speculators with very short time-horizons that the tax would deter, rather than longer-term investors who can amortize the costs of the tax over many years. For example, the yearly cost of a 0.2 percent round trip tax would amount to 48 percent of the value of the traded amount if the round trip were daily, 10 percent if weekly and 2.4 percent if monthly. Since at least eighty percent of spot transactions in the foreign exchange markets are reversed in seven business days or less, the tax could have a profound effect on the costs of short-term speculators.

Of course, for those who believe in the efficiency of markets and the rationality of expectations, a transactions tax would only hinder market efficiency. They argue that speculative sales and purchases of foreign exchange are mostly the result of "wrong" national monetary and fiscal policies. While we readily admit that national policies sometimes do not accord with desired objectives, they nonetheless have little relevance for speculators focused on the next few seconds, minutes or hours.

Tobin did not intend for his proposal to involve a supranational taxation authority. Rather, governments would levy the tax nationally. In order to make the tax rate uniform across countries, however, an international agreement would have to be entered into by at least the principal financial centers. The revenue obtained from the tax could be designated for each country's foreign exchange reserve for use during periods of instability, or it could be directed into a common global fund for uses like aid to the poorest nations. In the latter case, the feasibility of the tax also would depend on an international political agreement. The revenue potential is sizeable, and could run as high as $500 billion annually.

There are two other advantages often cited by proponents of the Tobin tax. Tobin's original rationale for a foreign exchange transactions tax was to enhance policy autonomy in a world of high financial capital mobility. He argued that currency fluctuations often have very significant economic and political costs, especially for producers and consumers of traded goods. A Tobin tax, by breaking the condition that domestic interest rates may differ from foreign interest rates only to the extent that the exchange rate is expected to change (see p. 10), would allow authorities to pursue different policies than those prevailing abroad without exposing them to large exchange rate movements. More recent research suggests that this is only a very modest advantage.31

An additional advantage of the tax is that it could facilitate the monitoring of international financial flows. The world needs a centralized data-base on all kinds of financial flows. Neither the Bank for International Settlements nor the IMF has succeeded in providing enough information to monitor them all. This information should be regularly shared among countries and international institutions in order to collectively respond to emerging issues.

The feasibility issues raised by the Tobin tax are more political than technical. One of the issues is about the likelihood of evasion. All taxes suffer some evasion, but that has rarely been a reason for avoiding them. Ideally all jurisdictions should be a party to any agreement about a common transactions tax, since the temptation to trade through non-participating jurisdictions would be high. Failing that, one could levy a penalty on transactions with "Tobin tax havens" of, say, double the normal tax rate. Moreover, one could limit the problem of substituting untaxed assets for taxed assets by applying the tax to forwards, swaps and possibly other contracts.

Tobin and many others have assumed that the task of managing the tax should be assigned to the IMF. Others argue that the design of the tax is incompatible with the structure of the IMF and that the tax should be managed by a new supranational body. Which view will prevail depends upon the resolution of other outstanding issues. The Tobin tax is an idea that deserves careful consideration. It should not be dismissed as too idealistic or too impractical. It addresses with precision the problems of excessive instability in the foreign exchange markets, and it yields the additional advantage of providing a means to assist those in greater need.

The IMF was established in 1944 to provide temporary financing for member governments to help them maintain pegged exchange rates during a period of internal adjustment. With the collapse of the pegged exchange rate regime in 1971, that responsibility has been eclipsed by its role as central arbiter of financial crises in developing countries. As noted above (p. 20), these crises may be of three different kinds: fiscal crises, foreign exchange crises, and banking crises.

Under current institutional arrangements, a nation suffering a serious fiscal crisis that could easily lead to default must seek temporary relief from its debts from three different (but interrelated) institutions: the IMF, which is sometimes willing to renegotiate loans in return for promises to adopt more stringent policies (see above); the so-called Paris Club that sometimes grants relief on bilateral (country to country) credits; and the London Club that sometimes gives relief on bank credits. This is an extremely cumbersome process that fails to provide debtor countries with standstill protection from creditors, with adequate working capital while debts are being renegotiated, or with ways to ensure an expeditious overall settlement. The existing process often takes several years to complete.

There is a growing consensus that this problem is best resolved with creation of a new international legal framework that provides for de facto sovereign bankruptcy. This could take the form of an International Bankruptcy Code with an international bankruptcy court, or it could involve a less formal functional equivalent to its mechanisms: automatic standstills, priority lending, and comprehensive reorganization plans supported by rules that do not require unanimous consent. Jeffrey Sachs recommends, for example, that the IMF issue a clear statement of operating principles covering all stages of a debtor's progression through "bankruptcy" to solvency. A new system of emergency priority lending from private capital markets could be developed, he suggests, under IMF supervision. He also feels that the IMF and member governments should develop model covenants for inclusion in future sovereign lending instruments that allow for priority lending and speedy renegotiation of debt claims.32

At the Joint Meeting of the IMF and the World Bank in September, 2002, the policy committee directed the IMF staff to develop by April, 2003, a "concrete proposal" for establishing an internationally recognized legal process for restructuring the debts of governments in default. It also endorsed efforts to include "collective action" clauses in future government bond issues to prevent one or two holdout creditors from blocking a debt-restructuring plan approved by a majority of creditors. The objective of both proposals is to resolve future debt crises quickly and before they threaten to destabilize large regions, as happened in Southeast Asia in 1997-98.

Member countries rarely receive support from the IMF any longer to maintain a particular nominal exchange rate. Because financial capital is so mobile now, pegged exchange rates probably are unsupportable. But there are special times when the IMF still might give such support during a foreign exchange crisis. International lending to support a given exchange rate is legitimate if the government is trying to establish confidence in a new national currency, or if its currency is recovering from a severe bout of hyperinflation. Ordinarily the foreign exchange should be provided from an international stabilization fund supervised by the IMF.

National central banks usually supervise and regulate the domestic banking sector. Thus, banking crises normally are handled by domestic institutions. This may not be possible, however, if the nation's banks hold large short-term liabilities denominated in foreign currencies. If the nation's central bank has insufficient reserves of foreign currencies to fund a large outflow of foreign currencies, there may be circumstances when the IMF or other lenders may wish to act as lenders-of-last-resort to a central bank under siege. Nations like Argentina that have engaged in "dollarization" are learning about the downside risks of holding large liabilities denominated in foreign currencies. The best way to avoid this problem is for governments and central banks to restrict the use of foreign currency deposits or other kinds of short-term foreign liabilities at domestic banks.

Overall, what is most needed is the availability of more capital in developing countries and much quicker responses, amply funded, to emerging financial crises.. George Soros has argued powerfully that the IMF needs to establish a better balance between crisis prevention and intervention.33 The IMF has made some progress in prevention by introducing Contingency Credit Lines (CCLs). The CCL rewards countries that follow sound policies by giving them access to IMF credit lines before rather than after a crisis erupts. But CCL terms were set too high and there have been no takers. Soros also has recommended the issuance of Special Drawing Rights (SDRs) that developed-countries would donate for the purpose of providing international assistance. Its proceeds would be used to finance "the provision of public goods on a global scale as well as to foster economic, social, and political progress in individual countries."34

A growing number of civil society institutions, however, oppose giving more money to the IMF unless it is basically reformed. They point out that it is a committed part of the Washington Consensus, the application of whose policies have made societies adjuncts of the market. They see the IMF as an instrument of the U.S. government and its corporate allies. The conditions it attaches to loans for troubled countries often do more to protect the interests of first world investors than to promote the long-term health of the developing countries. The needed chastening of speculative investors does not occur under these circumstances. There is evidence that in several major crises, IMF requirements for assisting nations have in fact worsened the situation and protracted the crises. The IMF opposed the policies that enabled Malaysia to weather the crisis in Southeast Asia, for example, while it urged the failed policies of other Southeast Asian nations. The vast literature cited by Pieper and Taylor (p. 22) is a convincing chronicle of earlier missteps. For such reasons as these, some civil society institutions argue that, unless IMF policies are changed, giving the institution more money will do more harm than good.

Fortunately, the IMF's policies are beginning to change, partly as a result of criticisms by civil society institutions, but more through recognition of the seriousness of the problems with the present system. In the wake of recent financial crises, leaders in the IMF as well as the World Bank are looking for ways to reform the international financial architecture. Arguably, their emphasis is shifting away from slavish devotion to the prescriptions of the Washington Consensus and toward more state intervention in financial markets. Joseph Stiglitz, the Nobel Laureate who has been particularly critical of the IMF, nonetheless acknowledges that its policy stances are improving.35