|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

cushing storage glut media nyth is closely related to the Great condensate con was aptly formulated by Jeffrey Brown in this

econbrowser.com post (

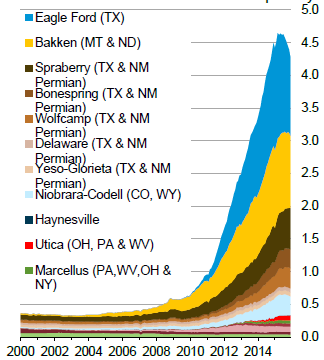

http://econbrowser.com/archives/2016/01/world-oil-supply-and-demand#comment-194595My premise is that US (and perhaps global) refiners hit, late in 2014, the upper limit of the volume of condensate that they could process, if they wanted to maintain their distillate and heavier output–resulting in a build in condensate inventories, reflected as a year over year build of 100 million barrels in US C+C (Crude + Condensate) inventories.

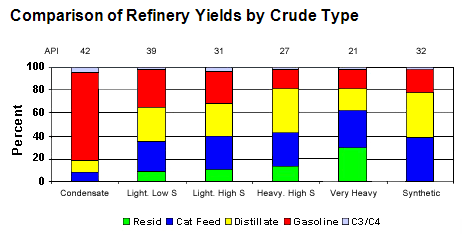

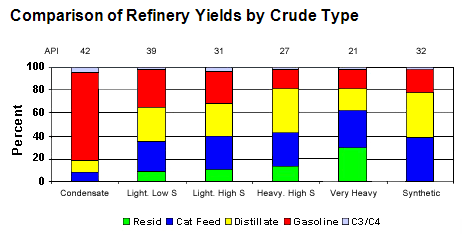

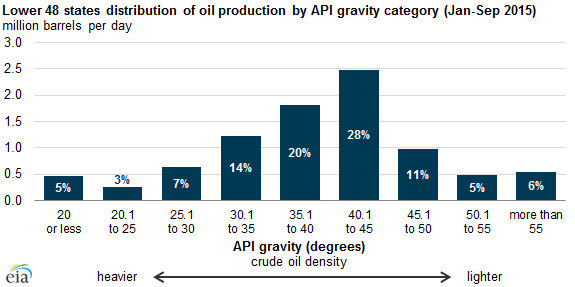

Therefore, in my opinion the US and (and perhaps globally) C+C inventory data are fundamentally flawed, when it comes to actual crude oil inventory data. The most common dividing line between actual crude oil and condensate is 45 API gravity, although the distillate yield drops off considerably just going from 39 API to 42 API gravity crude, and the upper limit for WTI crude oil is 42 API. . . .

Note that (in 2015) 22% of US Lower 48 C+C production consists of condensate (45+ API gravity) and note that about 40% of US Lower 48 C+C production exceeds the maximum API gravity for WTI crude oil (42 API).

Similar observations can be found in

http://www.reuters.com/article/2015/03/23/us-usa-refiners-trucks-analysis-idUSKBN0MJ09520150323In a pressing quest to secure the best possible crude, U.S. refiners are increasingly going straight to the source.

Firms such as Marathon Petroleum Corp and Delek U.S. Holdings are buying up tanker trucks and extending local pipeline networks in order to get more oil directly from the wellhead, seeking to cut back on blended crude cocktails they say can leave a foul aftertaste. . . .

Many executives say that the crude oil blends being created in Cushing are often substandard approximations of West Texas Intermediate (WTI), the longstanding U.S. benchmark familiar to, and favored by, many refiners in the region.

Typical light-sweet WTI crude has an API gravity of about 38 to 40. Condensate, or super-light crude that is abundant in most U.S. shale patches, ranges from 45 to 60 or higher. Western Canadian Select, itself a blend, is about 20.

While the blends of these crudes may technically meet the API gravity ceiling of 42 at Cushing, industry players say the mixes can be inconsistent in makeup and generate less income because the most desirable stuff is often missing.

The blends tend to produce a higher proportion of fuel at two ends of the spectrum: light ends like gasoline, demand for which has dimmed in recent years, and lower-value heavy products like fuel oil and asphalt. What’s missing are middle distillates like diesel, where growing demand and profitability lies.

For example as recently as February 2016 Art Berman argued in Forbes that the price of oil is controlled by the level of storage at Cushing. This hypotheses (or more precisely media myth) was also propagated by US MSM several time in 2015. Here is a relevant discussion:

oldfarmermac , 02/29/2016 at 6:01 pm

http://www.forbes.com/sites/arthurberman/2016/02/29/what-really-controls-oil-prices/#3aca881b71e4likbez , 02/29/2016 at 7:51 pmHere is a short excerpt from this article, in which Berman basically argues that the price of oil is controlled by the level of storage at Cushing. I agree at least to the extent than the price correlates closely with storage at Cushing.

For oil prices to increase, Cushing inventories must fall. That means that both U.S. tight oil production, chiefly from the Bakken play, and Canadian light oil production brought by pipeline to Cushing must decline.

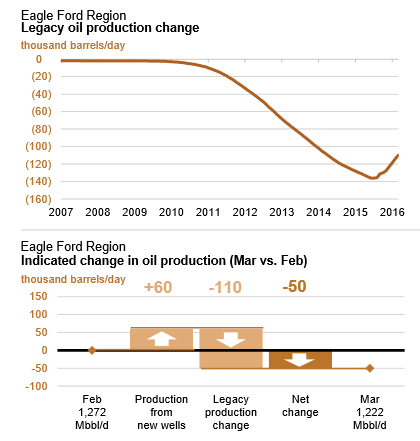

Bakken production was consistent in 2015 at about 1.2 million barrels per day. Canadian oil imports to the U.S. decreased from April through July 2015 and may have contributed to the fall in Cushing inventories that lead to a $15 per barrel increase in WTI prices. At the same time, decreased production from the Eagle Ford and Permian basin tight oil plays would free up storage in the Gulf Coast that might allow more oil to flow out of Cushing.

... ... ...

OFM,oldfarmermac, 02/29/2016 at 6:21 pmFrom the previous Ron's post discussion:

http://peakoilbarrel.com/oil-price-and-its-effect-on-production/#comment-561326

See also a more valuable Art Berman presentation (PDF)

IMHO this presentation is more valuable then his interview.

http://peakoilbarrel.com/oil-price-and-its-effect-on-production/#comment-561368

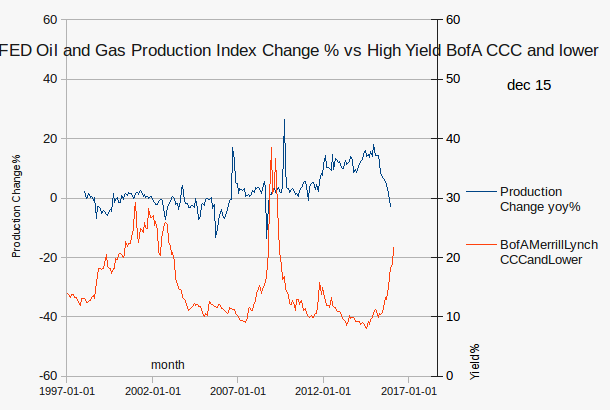

One interesting take from Art Berman presentation is that he ignores "Great condensate Con" (and grossly overplays Cushing "storage glut" MSM meme). He also thinks that without OPEC cut $30 oil price range will last for the whole 2016:

• Energy markets have been characterized by low oil prices and over-supply since mid-2014.

• Supply deficit before Jan 2014, supply surplus after

• Prices fell from 2011-2013 average of $111 per barrel to average of $52 in 2015.

• Without an OPEC cut, 2016 prices will probably be in the $30 per barrel range.

… … …

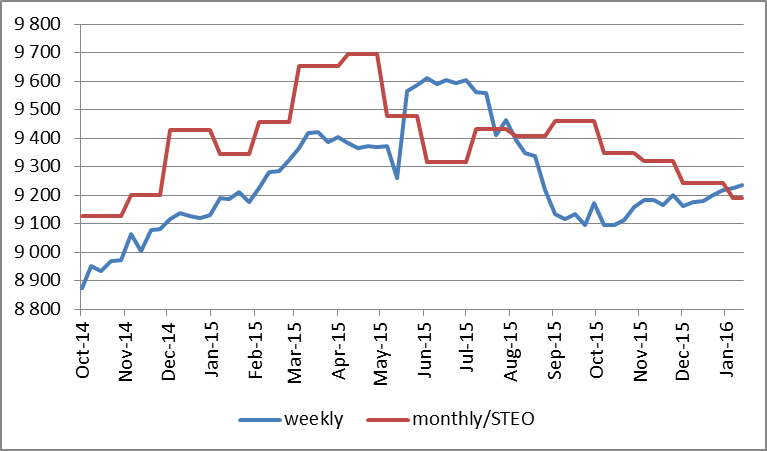

U.S. crude oil produc4on has declined about 570,000 bopd since the peak in April 2014,

about 60,000 bopd per month.

• EIA forecast is for a total decline of 1.4 mmbpd by September 2016 ( ~100,000 bopd per month) before increasing again based on $43 per barrel WTI by year-end 2016 and $58 by year-end 2017.

• Price deck has WTI at $43 per barrel by December 2016 & $58 by December 2017.

• Forecast suggests that the oil market is sufficiently in balance now for prices to increase but that production will not respond to price signals until later in 2016-very optimistic.

… … …

Little chance that oil prices will increase beyond the head-fakes and sentiment-driven price cycles of 2015 and early 2016 until U.S. crude oil storage begins to decrease.

• Oil stocks are currently 152 million barrels above the 5-year average and 128 million barrels above the 5-year maximum.

… … …

• Cushing and Gulf Coast storage make up almost 70% of U.S. working storage.

• These areas are currently at 84% of capacity. Cushing at 89%.

• As long as storage volumes remain above 80% of capacity, oil prices will be crushed.

• Until U.S. oil production declines substantially, storage will remain near capacity.This article is a little on the long side, for those of us who are into sound bites, but folks with more patience will find it illuminating, and maybe even find a little something in it to improve their personal morale, if they are feeling really down about the future.likbez, 02/29/2016 at 8:08 pmhttp://www.scientificamerican.com/article/world-s-richest-man-picks-energy-miracles/

A note on "OMG Cushing is filling up hysteria" or negative correlation of oil price with Cushing recently discovered by Art Berman:http://www.forbes.com/sites/arthurberman/2016/02/29/what-really-controls-oil-prices/#3aca881b71e4

Here is a short excerpt from this article, in which Berman basically argues that the price of oil is controlled by the level of storage at Cushing. I agree at least to the extent than the price correlates closely with storage at Cushing.

… … …

That's what happens when good people get into bad company due to lack of employment opportunities caused by shale oil price crush :-)

I wonder whether this is Erik "know everything" Townsend (a retired software entrepreneur turned hedge fund manager; see http://www.macrovoices.com/podcasts/MacroVoices-2016-02-25-Art-Berman.mp3 ) or somebody else ;-)

rockman on Sat, 27th Feb 2016 7:56 am

And to add to some of the good points made: Cushing contains only 20% of total US oil storage capacity. Notice they don't mention the fill level of that total: last time I looked it was about 65%. That means 35% of the 450+ MILLION BBL CAPACITY is still empty.

And why are we still importing oil: lack of sufficient domestic AVAILABILITY…not production. The vast majority of oil going into Cushing IS NOT do to a lack of buyers as the import numbers indicate. It's largely do to speculators hoping to take advantage of f increases in future oil prices. The net effect is that these speculation OIL BUYERS are competing with the refiners for domestic production.

Which, again, explains why we still import a huge volume of oil despite the constant and foolish use of the word "glut". IOW if we are still importing oil how can there be a glut of domestic oil: the US lacks sufficient oil production to satisfy the demand from the refineries AND speculators.

rockman on Sat, 27th Feb 2016 9:39 am

A few more FACTS to offset the "OMG Cushing is filling up" hysteria. First, Cushing is in PADD 2 as they point out. But it isn't the only tank farm in that midwest district: it only holds 60% of that total capacity.

And now compare the 88 mm bbl capacity to the PADD 3 (essentially Texas and LA. where the bulk of the refineries are) capacity of 260 mm bbls. Between the speculator purchases and the smaller number of refineries combined with the large volume of Canadian imports seeing Cushing filling up is no surprise.

And we're just talking about tank farm storage.

So again compare the 88 mm bbl capacity at Cushing to the total storage capacity at US refineries: 179 mm bbls. No: the volume of oil held at refineries is not part of the total TANK FARM capacity. So how much is the Cushing storage capacity compared to tank farms + refinery storage: 13%.

|

|

Switchboard | ||||

| Latest | |||||

| Past week | |||||

| Past month | |||||

Apr 21, 2020 | www.moonofalabama.org

juliania , Apr 21 2020 15:43 utc | 61On the previous thread, Piotr Berman @ 417 did bring up the subject of this post by b, and had the following final comment: "...Actually, the most acute pain is among the clever folk who provided the so-called hedges, namely who sold the obligations to buy oil at a certain price. They are losing hundreds of billions -- my guess. Now they are forced to buy AND store, hence the negative price."

Thanks, Piotr. Some of what is happening makes a bit more sense to me as far as the strange dealings in the stock market are concerned.

Also, just above at 416, karlof1 had this to say: "...Was the West ever on the path to making its goal the improvement of the Common Man as advocated by Wallace and his political allies?..." His answer is NO (exclamation point.)

My answer is YES (exclamation point.) Even if you only progress as far as the creation of the UN, with the leadership of Eleanor, that is an important pivotal moment for mankind which we cannot ignore. But I will state uncategorically that the JFK administration had similar idealistic goals and would have carried them out, had it not been for divisive powers plotting against it. That such dastardly powers succeeded does not negate the previous effort.

And even the example of China proves that this is not an impossible dream for mankind in general. As also is the example of Russia. We are fortunate in this generation to have two role models instead of one.

I don't have the Frost poem at hand so I will thusly mangle the last lines (sorry)

Two paths lay in the woods, and I

Took the one less travelled by

And that has made all the difference.I've mangled it, but the meaning is there, I think. (I'll go find the correct version, and point of reference, I was a college student when Robert Frost came to Johns Hopkins and I heard him read his poems. He did so also at Kennedy's inaugural.)

gm , Apr 21 2020 10:36 utc | 8

What -$37/bbl oil means to you:arby , Apr 21 2020 12:10 utc | 17Oil futures paper contracts market (in normal times of stable->rising oil prices and plenty of tank storage capacity a simple safe "buy low, hold, sell high" investment vehicle used heavily by investment banks, hedge funds, ETFs and teachers', municipal employees', etc, retirement/pension funds) explained in 5 minutes by Chris Martenson starts at ~minute 35:00:

Emily, We may still be at or around peak oil. That does not mean that all of the heavily indebted countries and oil companies won't pump what's left as fast and hard as they can.William Gruff , Apr 21 2020 12:10 utc | 18Now you have to stir in a massive plunge in demand to the equation. Seems to me that all newer oil discoveries are deep sea or shale. All of which require much more energy to produce then say thirty years ago.

When it takes the equivalent of one barrel of energy to produce one barrel of energy it will be lights out.

dan of steele @2Emily , Apr 21 2020 12:56 utc | 24The petrodollar was not in and of itself the mechanism that the US used to "export debt" and enrich itself off global trade. Rather, the petrodollar was the mechanism used to lock-in the US$ as the global reserve currency. If you wanted oil, you needed US$. After that it was just convenient to use US$ for other internationally traded commodities as well. Of course, this made even more sense way back in the distant past of the middle of last century because most of the international trade in manufactured goods was for American products, for which you'd have to use dollars to buy anyway.

The empire fanbois will cook up all kinds of explanations for why the dollar will remain the Global Reserve Currency in order to reassure themselves of the empire's continued hegemony, but the fact is that all of the "locks" locking other countries into that regime are now gone. Countries can choose to walk away now whereas in the past that would mean giving up access to oil and no longer importing all of those awesome things that the US used to make. That is not a barrier anymore.

Arby 17.gm , Apr 21 2020 13:19 utc | 27

Thank you for taking the time to reply.

But something to ponder

Forbes

https://www.forbes.com/sites/michaellynch/2018/06/29/what-ever-happened-to-peak-oil/

Yergin

https://www.technologyreview.com/2011/09/22/191161/peak-oil-debunked/

Well good news for those of us who agree with Edgar Cayce.

'Russia is the hope of the world'.

Russia has 60 years worth left and thats with its known reserves.

Hasn't touched the Arctic yet.....

https://www.worldometers.info/oil/russia-oil/US/Western financial markets are a "musical chairs" game, where right now more chairs are being pulled out from the game faster than the FED and the central banks can 'digitally print' new chairs to keep the game going.Peter AU1 , Apr 21 2020 14:27 utc | 39Looks like energy dominance will get a bail out.juliania , Apr 21 2020 14:36 utc | 41

"We will never let the great US Oil & Gas Industry down. I have instructed the Secretary of Energy and Secretary of the Treasury to formulate a plan which will make funds available so that these very important companies and jobs will be secured long into the future!" Trump said via Twitter.

https://sputniknews.com/us/202004211079043543-trump-instructs-treasury-energy-depts-to-devise-plan-to-fund-us-oil-gas-industry/Is this a result of all the lockdowns? A sort of automotive general strike occasioned by the virus, aided and abetted by government enforcement of restrictions on industry, travel, general hulabaloo?Trisha , Apr 21 2020 15:27 utc | 56Peace has descended upon a weary world. Nature has commanded us to cease and desist from gigantic insults upon the earth. Stop digging! she says, Leave it in the ground! Cease and desist making war for oil!

What does it profit a man? It profits him nothing! I have no idea where this leads, but it is a delicious moment. Look, see the power we have to bring everything to a standstill, even when we only do it because we are forced to! What if we did it willingly?

Where are your trillions now, moghuls?

The earth has spoken. We should all listen. Me, I am going out to plant potatoes.

Peak shale has arrived. The energy inefficiency of fracking - directly related to the economic efficiency of producing shale - killed it off. This would have happened even without COVID-19.The same will (eventually) happen with oil. The global economy - already teetering - has now been pushed over the edge by COVID-19. The demand side of capitalist growth has been temporarily (and in some cases permanently) crushed - which is a good thing for the planet - as workers are idled for the foreseeable future, and many out of a job forever.

Bottom line is that we live on a finite world which capitalism treats as an infinite resource.

Nov 10, 2017 | peakoilbarrel.com

Energy News says: 11/08/2017 at 12:18 pm

EIA weekly change in ending stocks (crude+products).George Kaplan says: 11/08/2017 at 4:26 pmOverall stocks down 0.56%, pretty much inline with recent trends, crude up 2.2 mmbbls, gasoline down 3.3 and distillate down 3.4. But the only number that matters to the traders is the crude and because it is up price falls and it's reported we must be back in a glut. Bonkers.FreddyW says: 11/09/2017 at 3:55 amI think we are in refinery maintenance season now, so crude stocks should increase normally. Interesting to note is that gasoline and distillate stocks are back to normal levels. So they will have to draw a lot more from crude stocks going forward.Guym says: 11/09/2017 at 10:30 amSame principle drives lemmings, I think. They have to be over the cliff, before they will recognize it is there.

May 30, 2017 | peakoilbarrel.com

Mike says: 05/30/2017 at 6:35 pmGot it tee-tee; America is still a net importer of crude oil. That's some good investigative reporting there.Look, inventory levels are still at an all time high in America and the bulk of that is light tight condensate. The export ban has been lifted in the US for over three years now; nobody afar wants to import LTO, or much of it, and we still can't lower those inventories. The price of oil is low, and volatile. In the mean time all those big wells you own in Oklahoma are just making the problem worse. And while all this is going on, hold onto your knickers .oil imports into America are going UP, not down. Google it.

Canada is the 10th largest oil consuming nation in the world, Mexico the 11th and the UK the 18th. America, on the other hand, is the largest oil consuming nation in the world, by a wide margin. We do not have the LTO resources to achieve, nor sustain, hydrocarbon independence. Forget the costs, and the additional burden that attempting to achieve hydrocarbon independence would place on our national debt, it can't be done. There is not enough of it.

I dislike the American shale oil industry, in general, because it cannot function without borrowed capital and it no longer has the ability, in my opinion, to pay back the hundreds of billions of dollars it owes. I understand that doesn't bother you, and I understand why.

I also dislike the lying the shale oil industry engages in that convinces other stupid people that we have all the shale oil we ever need in America, enough for ourselves, and anybody else in the world that wants to buy it.

Personally, I would rather sell my oil for a higher price than current prices, but then again I have to pay to get it out of the ground, unlike yourself, I am sure, who gets it free and clear of all costs.

I also embrace oil price stability as that leads to employment stability and a healthier oil industry for America's future. I also believe it is important to conserve our remaining hydrocarbon resources in America and to otherwise develop what is left of those resources at a pace that is commensurate with the world crude oil market.

Again, I understand completely why you don't get that. I can't help you.

Watcher says: 01/09/2017 at 3:02 pmJan 11, 2017 | peakoilbarrel.com

SPR Drain - Buy High – Sell Low ?

http://www.zerohedge.com/news/2017-01-09/us-sell-8-million-barrels-oil-strategic-petroleum-reserve

Why? To fund the pumps and stuff that have rusted away.Boomer II says: 01/09/2017 at 5:53 pm

Even if the money is needed for repairs and infrastructure, why sell when prices are low? Why didn't they sell when the prices were high?Watcher says: 01/09/2017 at 6:10 pm

More SPR things:Fernando Leanme says: 01/10/2017 at 9:44 am720 million barrels in the US SPR when full. It's usually not 100% full and when it is (last happened Dec 2009) it's not really full because you can't recover 100% of what you store. Oil gets into pores in the rock and won't come out. Just like less than 100% recovery of oil from an oil field.

The usual calculation is 720 / 20 mbpd US burn = 36 days of consumption storage. With US production at about 8.5 mbpd that number seems to rise to a little less than double - call it 70 days.

But not true. Maximum extraction rate is only 4.4 mbpd (takes 13 days from the word go for the first barrels to enter the system). Not 11.5. So the total embargo of imports scenario because Canada wants to save it for their grandkids means the country goes from 20 mbpd consumption to 12.9 mbpd - for 160ish days (720/4.4) and then just the 8.5 is all we have to function.

Gonna have to compute oil consumption required to haul/deliver food to stores and for people to drive to stores to get it. Tricky for the haulage from central america (fruits).

Salt dome storage caverns don't have pores. They're caverns.Fernando Leanme says: 01/10/2017 at 9:51 am

The Venezuela figure is BS. The reserves outlook gets grimmer by the year, because the current development strategy is incompatible with enhanced recovery. The areas under development are mostly the "sirloin steak" in the Orinoco heavy oil belt, and these high graded areas are now being gutted by pdvsa and partners. They are going after quick kill primary recovery, ruining the reservoirs. This means that not only is the 300 billion barrel figure a poor number, the "real number" is gradually degrading as they continue to lower reservoir pressures and allow water to penetrate the developed reservoirs.Dennis Coyne says: 01/10/2017 at 4:11 pm

Hi Fernando,Based on what you know I think your estimate for URR for Orinoco is about 100 Gb, if I remember correctly, due to the poor development you outline above.

Please correct me if I am remembering incorrectly. Thanks.

Jan 08, 2017 | peakoilbarrel.com

Ron Patterson says: 01/02/2017 at 1:20 pmSW, just curious but what do you think will cause this turnaround. That is from the current glut to demand outstripping supply. US storage is near its all time high and OECD storage is 300 million barrels above its 5 year average.Javier says: 01/02/2017 at 8:49 pmOECD commercial inventories fell in October for the third month in a row. They have drawn 75 mb since reaching a historical high in July, but remain 300 mb above the five-year average. Product stocks have fallen twice as quickly as crude during that period. Preliminary data show stocks falling further across the OECD in November.

How much confidence do we have on oil storage accounting? According to Art Berman much of it is unaccounted for oil. Looks like a very good way to manipulate oil prices.Ron Patterson says: 01/03/2017 at 7:08 amMy take is that the powers of the world are very much afraid of what a new global recession could do to the shenanigans they have been running at the Central Banks to keep the system from imploding and are very much decided to do everything on their power to prevent a new global recession, and a very important part of it is to keep oil price affordable to prevent the economy from stalling. They cannot control neither production nor demand except by staging a war, but as price is determined by the effect of the production/demand ratio on oil storage, they can control price by rigging the storage reporting. Unaccounted for oil could be the tool to do that.

For most of the world's oil storage, there is no reporting. We have only the USA and a wild ass guess at OECD storage. We have nothing for Eastern Europe, Africa or Asia.Don Westlund says: 01/03/2017 at 12:33 pmWTI jumps up and down a few cents when the US storage figures come out each week, but that's about it. And when that happens the price very quickly reverts to what the actual supply and demand dictates.

If there were actually storage reporting for most of the world's oil, then your conspiracy theory might hold water. But there is not and it does not.

https://www.energyaspects.com/company/events/amrita-sen-ons-2016-conference-appearance?utm_medium=bannerMatt Mushalik says: 01/03/2017 at 3:33 pmThis is a presentation by Amrita Sen at Energy Aspects a few months ago. At the 4:30 minute mark she discusses worldwide crude draws. She is claiming the only place in the world we are getting builds is in the U.S. Not sure where they are getting their information.

Our post was NOT about conspiracy theories. It has number crunching on the statistical fact that there is a huge discrepancy between US crude oil production, imports, exports and refinery intakes.Javier says: 01/04/2017 at 7:28 am8/10/2016

U.S. Storage Filling Up with Unaccounted-For Oil

http://crudeoilpeak.info/u-s-storage-filling-up-with-unaccounted-for-oilMatt,AlexS says: 01/02/2017 at 9:09 pmI know the article said nothing about intentional overreporting of crude oil stocks. It just occurred to me that if intentional it could have a clear effect on oil prices.

Ron,

That USA is the only one reporting crude oil stocks makes it easier to manipulate them, not harder.

Is the following correct?:

How do we know that there is a huge global excess in crude oil?

We know there is some excess from multiple sources, but we only know that there is a large excess from USA reported oil storage.Where is that large excess in USA crude oil storage coming from?

We don't know as 4 out of 5 barrels in USA crude oil storage are from unaccounted-for oil.I think the situation demands an explanation as large unaccounted-for oil is a new phenomenon that started when oil prices were very high.

"OECD storage is 300 million barrels above its 5 year average."SW says: 01/04/2017 at 9:44 amWhen the IEA and all other oil market observers compare current storage levels with 5-year average they miss two important things:

1) Global oil demand continues to increase. Therefore, in relative terms (inventories as % of annual demand) the volume of oil in storage is not as big as if we compare absolute volumes for this year and previous years.

Thus, according to the IEA, global oil demand in 2017 should average 97.51 mb/d. This is 7.94 mb/d higher than in 2011 (89.57 mb/d) and 5.39 mb/d higher than 5-year (2011-2015) average (92.12 mb/d).

7,94 mb/d = 2898 million barrels/year

5.39 mb/d = 1966 million barrels/year

Now compare this with the 300 mbbls surplus in crude inventories vs 5-year average.2) There are two "market buffers" that were always used as a measure of over/under supply in the oil market.

The first are crude and product inventories. They are indeed above 5-year average.

The second is OPEC spare capacity, which is well below historical averages.OPEC output cuts will result in decreasing inventories, but spare capacity will increase.

I was simply commenting on the chart at the top of the post. Perhaps I misread it?

naked capitalism

Robert HahltegnostPerhaps the true purpose of financial austerity is to reduce oil consumption world wide.

Robert Hahlindeed perhaps, as our financial overlords have such clear benevolent foresight and care about people, not profits or perhaps demand has never recovered from $4/gal gas in 2007 and it's much simpier than that but perhaps the $4/gal gas was done on purpose in order to kill demand and reduce oil consumption, first by high price and then by austerity, perhaps they just wanted to find out what price of gas (apparently $4/gal) would crash the economy so they could save the world through austerity, but first they wanted to get some money in the bank so they could survive his "austerity period" because their kids can't take out student loans because they create an austerity rich environment that the children of the world benefit from but their kids were brought up right so they don't need austerity to be good global citizens, or perhaps crows communicate through quantum vibration and that's why we can't understand the meanings in their throaty calls .

rjsIf peak oil is a problem, austerity is a solution.

ambritit's not a demand side problem; it's supply, which built up as refinery margins were near record highs and contango made it profitable to store products

Isotope_C14Local fuel prices show a more 'nuanced,' which is business speak for rent extraction oriented, situation. Sunday, we went to Laurel, a town some twenty miles north of Hattiesburg. The cheapest gasoline in Hattiesburg cost $1.99 per gallon. Laurel had gasoline selling for $1.76 per gallon, all over town, not in isolated pockets. This price disparity was consistent across brands and types of location. Laurel does not have it's own refineries.

The Oil business has a few rules of it's own, which lowly consumers are not privy to.MLSSeeing as Hattiesburg is in the northern part of Forrest County, and Laurel is in Jones County, could the price disparity be a component of county taxes?

Also, EPA requirements include a variety of fuel formulations depending on desired pollutant reduction in a given air-space. Some formulations are for reduced volatile organics and they may have varying prices.

Chauncey Gardinerday-to-day fuel prices are heavily influenced by all sorts of factors like local tax rates, the cost of operating any convenience store or auto service on premises (local ordinances regarding wages, for example), the volume of business they do, whether a particular city or county has a specific ordinance relating to gasoline formulations, the cost of transporting the fuel from refinery to the station (generally speaking farther = more expensive), and so on. That you're seeing different prices 20 miles apart is not necessarily evidence of rent extraction.

NeqNeqPuzzling that the price of ethanol, a lower btu and more corrosive fuel that is added to and blended with petroleum-based gasoline by refineries, has been maintained in a tight price range since late 2015 and is currently priced near its all-time highs. This while the price of gasoline has fallen. Why?

ambritWasn't there a post a few days ago which showed the US EIA' weekly data was not lining up with actual monthly numbers? Meaning that there were large revisions being made to prior (2) month volumes?

Why should last weeks EIA inventory numbers be considered as anything but a noisy estimate subject to lots of revisions?

NeqNeqThe more cynical among us wonder in what direction the 'revisions' should really go.

PwelderI get that. And I am sympathetic. That doesn't change the fact that any prognostication (on the supplied info) is mood affiliation. Using your gut is fine. Hell, it might be instrumentally better than reasoned argument in certain situations. No need to claim its something other than your gut though. Unless, you are trying to sell something. Then its probably useful to engage in post-hoc rationalization.

a different chrisTwo points to remember about "glut" chatter in the Oil and Gas space:

1) The IEA – and to a lesser extent, the EIA – work for governments of nations which are net importers of crude and products. These governments prefer low prices. This doesn't mean that their published data is deliberately bad. It does mean that if there's a number that lends itself to a bearish interpretation, they'll make sure you know about it.

2) One way to generate such numbers is to shift inventories from jurisdictions with low transparency on storage levels (e.g. the Persian Gulf) to jurisdictions where reporting is somewhat better (US, Western Europe.) The Saudis have been doing quite a bit of this, as part of their war on Iranian/Russian oil revenues. This will be coming to an end within a year or so, as realities of supply and demand overwhelm operations aimed at "painting the tape".

>The Saudis have been doing quite a bit of this

Funny how oil has gotten so messed up – the major producers want to broadcast the fact that there is a glut. Ah Capitalism in all its contradictions

Something to point out to the goldish bugs – the people who just have to have currency attached to something physical, since gold is a hilarious currency anchor in this day and age* they have been switching to recommending oil as the baseline. Wonder how they will spin this?

*think about explaining to an intelligent and even sympathetic-to-backed-currency alien, without any historical reference, why you would pick gold

Jun 14, 2016 | Bloomberg

Crude inventories fell by 933,000 barrels last week, according to the U.S. Energy Information Administration. A 2.33 million barrel decline had been projected by analysts in a Bloomberg survey ahead of the release. The American Petroleum Institute was said to report Tuesday that inventories rose 1.16 million barrels.

Crude output dropped to the lowest level since September 2014, the EIA data show

... ... ...

Nationwide crude supplies fell to 531.5 million barrels in the week ended June 10, according to the EIA. Stockpiles climbed to an 87-year high of 543.4 million barrels in the last week of April, EIA data show.

Oil-market news:

- Completion of drilled but uncompleted wells in the U.S. will accelerate at a WTI price of $50 a barrel, while $60 oil will trigger an increase in the rig count, according to a report from Citigroup Inc.

- The global market will be almost balanced next year as demand continues to rise faster than output, while the current glut is much smaller than previously thought, the International Energy Agency said.

- Venezuela and the U.S. will begin talks to normalize relations as President Nicolas Maduro said he's ready to exchange ambassadors.

OilPrice.com

Official data released early on Wednesday confirms expectations of a U.S. crude oil inventory draw, with the Energy Information Administration (EIA) showing inventories down by over 3.2 million barrels for the week ending 3 June.

The EIA's latest weekly status report, released at 10:30am EST, reported a 3.226-million draw on U.S. crude inventories, while the consensus had called for a drop between 2.7 million to 3.4 million barrels. The new data puts U.S. crude oil inventories at 532.5 million barrels-a figure that is still historically high for this time of year.

The EIA's report follows Tuesday's inventory report from the American Petroleum Institute (API), which shows a draw of 3.56 million barrels, slightly more than the official figures just released.

Oil rose above $50 on Tuesday, following the API report, and was holding steady, close to $52 in early Wednesday trading prior to the EIA's weekly status report release.

The Weekly Petroleum Status Report showed gasoline inventories with a build of +1.01 million and distillate inventories with a build of +1.754 million.

U.S. Crude refinery inputs averaged 16.4 barrels per day, according to Wednesday's numbers. That number is 211,000 barrels per day more than the previous week's average. Refineries were at 90.9% of their operable capacity this past week, and gasoline production increased, averaging over 10.1 million barrels per day.

Related: India Putting Floor Beneath Oil Prices As Demand Continues To Soar

U.S. crude oil imports averaged 7.7 million barrels per day last week, which was down by 134,000 barrels per day from the week before. Total motor gasoline imports averaged 815,000 barrels per day. Distillate fuel imports averaged 167,000 barrels per day last week.

Total commercial petroleum inventories increased by 3.2 million barrels.

The EIA notes that total motor gasoline inventories increased by 1.0 million barrels last week, and are well above the upper limit of the average range.

By Lincoln Brown for Oilprice.com

peakoilbarrel.com

shallow sand , 04/04/2016 at 12:12 amAlthough it makes little sense, US stocks make a huge impact on the worldwide oil price. Until US inventories meaningfully drop, the oil price will stay low, sub $50.Dennis Coyne , 04/04/2016 at 11:05 amNot seeing a sign of that happening yet. Hopefully will soon.

Hi Shallow sands,Ovi , 04/04/2016 at 8:19 pmIt is strange that anybody pays attention to US crude stocks, for the past 4 weeks average net imports of crude have been about 7.6 Mb/d, there are about 200 Mb of excess crude stocks (above normal levels), reduce imports by 1.6 Mb/d and the excess stocks are drawn down to normal levels in 125 days (about 4 months).

It would make more sense to look at the change in refinery inputs and US crude output.

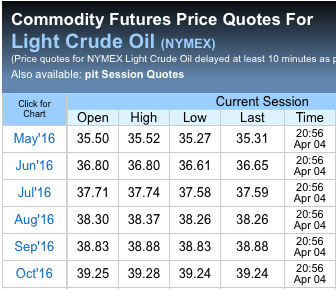

I also do not understand the focus on inventory. Inventory change is a function of "Crude in less crude out". Inventory can be manipulated by importing more and as a consequence keep pressure on price.likbez , 04/04/2016 at 11:15 amWhy does inventory keep going up? It is related to the contango in the oil futures market. In the attached table the front month contango is $1.34, today. If an investor owns storage, he can take delivery today and sell one month forward for a gain of $1.34 less about 50¢ for storage costs. As long as the front month contango stays above $1, inventory will continue to grow.

Although it makes little sense, US stocks make a huge impact on the worldwide oil price.

Although it makes little sense, US stocks make a huge impact on the worldwide oil price.Very true.

At this stage of oil price cycle I do not think that the size of inventories is a material factor, affecting the oil price. It is played as such by Wall Street, but that's just reflects the power of "paper oil" producers. They can choose something else (S&P transportation index readings, for example) and use it to depress the oil price.

What it probably reflects at this stage of the cycle is the level of pure greed.

fuelfix.com

4) The drop of 4.5 million barrels for gasoline inventories was split betwixt PADD 1 (East Coast) and PADD 3 (Gulf Coast). While the drop can in part be attributed to winter blend stocks being drawn down, the driving force (pardon the pun) has been rising demand. On the more-reliable, less-noisy four-week moving average, gasoline product supplied is up 7% year-on-year. Robust.

peakoilbarrel.com

Rush of demand for oil storage while oil is available at below $40 prices:With available storage facilities for oil filling up in Houston, Fairway Energy Partners said the time is right for the 11 million barrels of crude storage space it's currently developing.

Fairway Energy Partners plans to convert three salt dome caverns more than 2,000 feet under Southwest Houston into crude oil storage. The company, which is backed by Haddington Ventures, is targeting a completion date of late 2016.

… … …

The Texas Gulf Coast has about 128 million barrels stored at refineries and terminals. It's also about 60 percent full, Genscape said.

… … …

"We're seeing storage levels that we've never seen across the U.S.," Hilgert said. "Crude is piling up everywhere, Cushing is effectively full, and that's started to domino down to the Gulf Coast."

I think frenzied hoarding of oil in anticipation of higher prices is the phenomenon that MSM does not cover. They try to sell it under "oil glut" banner.

peakoilbarrel.com

Gaurav , 03/06/2016 at 11:29 pmRon, I am a regular reader of your blog and find it very insightful. I have not seen much written about Oil super contango and reasons for oil storage at multi decade high so would like to highlight below.When there is a temporary over supply, it fills up storage, as more and more storage get filled up it leads to an increase in storage cost. This in turn lead to a contango, meaning future oil prices being at premium. Currently premium stands at 20% for 1 year forward contract. This is super contango and a bonanza for oil traders. If you can find a place to store oil you can make risk free returns of 20% – (storage cost). So, why storage space are filling up so fast its because commodity traders are scrambling to make this trade. It's a positive feedback loop. It can only end when supply falls below the consumer demand.

So, bottom line is, filling up of oil storage early in the cycle is an indicator of oversupply. But in the current late cycle of low oil prices [1.5 yrs already] it is a useless indicator of future oil price movement, oil demand or supply.

January 20, 2015 | finance.yahoo.com

Traders are in a mad dash to rent some of the world's biggest oil tankers so they can store crude while prices remains in record-low territory.

The Wall Street Journal reports that TI Oceania, which has been booked by oil traders Vitol, is stationed off Singapore and is likely to remain there for most of 2015.

China's Unipec booked Oceania's sister ship, TI Europe, way back in September, when oil prices dropped below $100 per barrel (let's hope they didn't buy the oil then).

The ships are giant. Here's the TI Europe, for example:

Christelle Hall, YouTube

As oil prices continue to plunge amid a supply glut and weaker demand, companies reckon they can make more money from simply hoarding the oil and selling it at later date, when prices rebound.

This phenomenon is known as "contango," a term for when the price of commodity futures is higher than the current price. In this case, traders believe there is more money to be made from simply sitting on oil, if they can bear the costs of storing it.

Euronav

Oil prices will stay low if there continues to be space to store it. However, once storage is full, producers will finally be forced to slow output because there will not be anywhere to put the surplus. From that point, the price has a chance to rebound, assuming demand doesn't keep falling.

According to Goldman Sachs, however, that turnaround probably won't happen as quickly while more firms decide to store rather than sell oil. The investment bank is expecting a slow "u-shaped" recovery, rather than a rapid "v-shaped" bounce in prices:

Not only has the US expanded storage capacity significantly, but Europe has also shuttered refining capacity that can be used as storage, and the global crude tanker fleet has grown by 100 million dwt since 2008 - while oil at sea has remained stagnant given the dominance of onshore drilling. We believe at least a 1.0 million barrel per day surplus can be maintained for a year before any significant problems would arise.

Goldman Sachs

NOW WATCH: This Video Of The Largest Breakage Of Ice From A Glacier Ever Filmed Is Absolutely Frightening

peakoilbarrel.com

Amatoori, 02/28/2016 at 11:31 amA good but long podcast with Art Berman, not so much new stuff for the people here but gives a great over all picture on the oil market right now.http://www.macrovoices.com/podcasts/MacroVoices-2016-02-25-Art-Berman.mp3

peakoilbarrel.com

Amatoori , 02/25/2016 at 11:40 am

http://in.reuters.com/article/oil-demand-kemp-idINL8N1644QUJef , 02/25/2016 at 6:28 pmNice piece of the puzzle Amat. Distillates is the glut.likbez , 02/25/2016 at 8:25 pmSO diesel demand has been tanking but gas remains strong. The economy is tanking but people are still driving around in circles.

Amatoori,Toolpush , 02/25/2016 at 10:40 pmVery good --

Some (albeit vague) support for a growing day-by-day "glut deniers" movement :-) . The newer part of the the argument revolves on fixed ratio of gasoline to distillate in refining process. Which supposedly caused a growth of distillate inventories due to weather induced low demand :

In the last year, U.S. refiners have been fairly successful in matching gasoline production and stockpiles with demand. Gasoline production remains at the centre of their operational planning.

Crude stocks have continued to increase, reflecting worldwide oversupply, though stockpiles are rising somewhat more slowly than at the start of 2015.But refiners lost control of distillate stocks in the second half of 2015 as freight demand slowed and El Nino ensured a warmer than normal winter across the United States and other parts of the northern hemisphere.

Winter heating demand across the United States has been around 17 percent below average, according to the National Oceanic and Atmospheric Administration.

And by the end of 2015, the volume of freight being moved across the United States by road, rail, pipeline, barge and air had fallen by more than 2 percent compared with the same period at year earlier.

Over the last four weeks, U.S. implied distillate consumption has averaged just 3.5 million barrels per day, which is 12 percent below the long-term average and 16 percent below the same period in 2015.

The fact that refiners have lost control of distillate stocks should come as no surprise because distillate is essentially a by-product of gasoline production.

Refineries have operated to maximise gasoline production but in the process created an enormous and growing oversupply of distillate.

There is some limited flexibility in the refining system to switch from distillate production to gasoline but it is typically only on the order of a few percentage points.

Massive overproduction of distillate has pushed gross refining margins for the fuel to the lowest level since 2010.

But refining margins for gasoline have been much healthier, at least until recently, which has encouraged refiners to continue maximising crude throughput.

As long as gasoline demand remains strong, refiners will continue to meet it, which is why the outlook for U.S. gasoline consumption is so critical for the oil market in 2016.

Amatoori,likbez , 02/25/2016 at 11:46 pmIt always surprises me, that when people talk about the year on year drop in diesel consumption, nobody mentions the fact of 1000 less drilling rig working, plus the lower demand from less fraccing, the transport of train loads of sand per well, etc.

I would have thought, the EROI boys would be all over it. As I feel this is where the theory of EROI being very low for unconventional oil and gas, actually starts to show up in day to day numbers.

Hi Toolpush,It always surprises me, that when people talk about the year on year drop in diesel consumption, nobody mentions the fact of 1000 less drilling rig working, plus the lower demand from less fraccing, the transport of train loads of sand per well, etc.

You made a very good point -- Thank you.

As EROEI boys are lazy bunch let me fill in. Let's assuming EROEI 10 for shale oil (which might be charitable; some sources claim 3-5)

https://en.wikipedia.org/wiki/Oil_shale_economics#Energy_usageA 1984 study estimated the EROEI of the different oil shale deposits to vary between 0.7–13.3:1.[21] More recent studies estimates the EROEI of oil shales to be 1–2:1 or 2–16:1 – depending on if self-energy is counted as a cost or internal energy is excluded and only purchased energy is counted as input.[20][22] According to the World Energy Outlook 2010, the EROEI of ex-situ processing is typically 4–5:1

So we need 4.2 gallon per bbl.

The EIA estimates in the Annual Energy Outlook 2015, that about 4.2 million barrels per day of crude oil were produced directly from tight oil resources in the United States in 2014.

So we are talking about 0.4 Mb/day of diesel consumption. Which is respectable 10% out of 4 Mb/d total US distillates consumption. So 2% drop (which amount to 20% drop of diesel consumption in oil patch) might be fully attributable to the lower activity of shale patch.

In other words you are right --

peakoilbarrel.com

Amatoori , 02/25/2016 at 11:40 am

http://in.reuters.com/article/oil-demand-kemp-idINL8N1644QUJef, 02/25/2016 at 6:28 pmNice piece of the puzzle Amat. Distillates is the glut.likbez, 02/25/2016 at 8:25 pmSO diesel demand has been tanking but gas remains strong. The economy is tanking but people are still driving around in circles.

Amatoori,Very good --

Some (albeit vague) support for a growing day-by-day "glut deniers" movement :-) . The newer part of the argument revolves around the fixed ratio of gasoline to distillate in refining process. Which supposedly caused a growth of distillate inventories due to the weather induced low demand :

In the last year, U.S. refiners have been fairly successful in matching gasoline production and stockpiles with demand. Gasoline production remains at the centre of their operational planning.

Crude stocks have continued to increase, reflecting worldwide oversupply, though stockpiles are rising somewhat more slowly than at the start of 2015.But refiners lost control of distillate stocks in the second half of 2015 as freight demand slowed and El Nino ensured a warmer than normal winter across the United States and other parts of the northern hemisphere.

Winter heating demand across the United States has been around 17 percent below average, according to the National Oceanic and Atmospheric Administration.

And by the end of 2015, the volume of freight being moved across the United States by road, rail, pipeline, barge and air had fallen by more than 2 percent compared with the same period at year earlier.

Over the last four weeks, U.S. implied distillate consumption has averaged just 3.5 million barrels per day, which is 12 percent below the long-term average and 16 percent below the same period in 2015.

The fact that refiners have lost control of distillate stocks should come as no surprise because distillate is essentially a by-product of gasoline production.

Refineries have operated to maximise gasoline production but in the process created an enormous and growing oversupply of distillate.

There is some limited flexibility in the refining system to switch from distillate production to gasoline but it is typically only on the order of a few percentage points.

Massive overproduction of distillate has pushed gross refining margins for the fuel to the lowest level since 2010.

But refining margins for gasoline have been much healthier, at least until recently, which has encouraged refiners to continue maximising crude throughput.

As long as gasoline demand remains strong, refiners will continue to meet it, which is why the outlook for U.S. gasoline consumption is so critical for the oil market in 2016.

Toolpush, 02/25/2016 at 10:40 pm

likbez, 02/25/2016 at 11:46 pmAmatoori,

It always surprises me, that when people talk about the year on year drop in diesel consumption, nobody mentions the fact of 1000 less drilling rig working, plus the lower demand from less fraccing, the transport of train loads of sand per well, etc.

I would have thought, the EROI boys would be all over it. As I feel this is where the theory of EROI being very low for unconventional oil and gas, actually starts to show up in day to day numbers.

Hi Toolpush,It always surprises me, that when people talk about the year on year drop in diesel consumption, nobody mentions the fact of 1000 less drilling rig working, plus the lower demand from less fraccing, the transport of train loads of sand per well, etc.

You made a very good point -- Thank you.

As EROEI boys are lazy bunch let me fill in. Let's assuming EROEI 10 for shale oil (which might be charitable; some sources claim 3-5)

https://en.wikipedia.org/wiki/Oil_shale_economics#Energy_usageA 1984 study estimated the EROEI of the different oil shale deposits to vary between 0.7–13.3:1.[21] More recent studies estimates the EROEI of oil shales to be 1–2:1 or 2–16:1 – depending on if self-energy is counted as a cost or internal energy is excluded and only purchased energy is counted as input.[20][22] According to the World Energy Outlook 2010, the EROEI of ex-situ processing is typically 4–5:1

So we need 4.2 gallon per bbl.

The EIA estimates in the Annual Energy Outlook 2015, that about 4.2 million barrels per day of crude oil were produced directly from tight oil resources in the United States in 2014.

So we are talking about 0.4 Mb/day of diesel consumption. Which is respectable 10% out of 4 Mb/d of the total US distillates consumption. So 2% drop (which amount to 20% drop of diesel consumption in oil patch) might be fully attributable to the lower activity of shale patch.

In other words you are right --

peakoilbarrel.com

Watcher, 02/23/2016 at 3:02 pmYes, has anyone noticed swimming pools filled with oil in their neighborhood?Dennis Coyne , 02/23/2016 at 3:41 pmI haven't.

Why would anyone let oil go on a tanker and leave port unless they were paid for it? Answer: They wouldn't. They get paid for it because they had an order for it and filled the order. Why would they cut output and refuse to fill customer orders?

So who placed an order for oil they weren't going to sell to someone else who would then burn it? Answer: No one did. They had customers and the customers placed orders for it because they needed to burn it, and then took possession of it and burned it.

Why contort thinking on this? It's simple and clear.

Hi Watcher,AlexS , 02/23/2016 at 4:05 pmYes it is very clear that there is an excess of oil being produced and that is why prices are so low, to everyone except you.

Watcher , 02/23/2016 at 5:22 pm"Why would anyone let oil go on a tanker and leave port unless they were paid for it? "This is a common practice. The tankers leave ports and can several times change directions as the owner/seller of oil is trying to find the best buyer.

Interesting. How about offloading? That ever happen without paying the producer? Because if the theory proposed here is all the storage is in tankers, you're going to have to find about a billion barrels sitting unpaid for - all whilst KSA says they produce what they have orders for.AlexS , 02/23/2016 at 5:46 pmRead, for example, this article:Watcher , 02/23/2016 at 6:18 pmWhy oil speculators are turning to ships as floating storage

The Globe and Mail, Monday, Feb. 22, 2016

http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/why-oil-speculators-are-turning-to-ships-as-floating-storage/article28846311/Other recommended reading:

IEA Oil Market Report, January 2016, p.33

AlexS , 02/23/2016 at 7:14 pmAbout 20 to 25 of the world's 650 supertankers, which can hold two million barrels and are called very large crude carriers, are in use as floating storage,That's 2 X 25 = 50 million barrels. The alleged oversupply of 3 mbpd for 20 mos (since June 2014) is 20 X 30 X 3 = 1.8 billion barrels.

Do they offload without paying the producer?

There was never 3 mb/d oversupply, not to say for 20 months. The oversupply peaked at 2.2-2.4mb/d in 2Q15, according to various estimates (see the chart below).Watcher , 02/23/2016 at 9:52 pmFrom IEA OMR, January 2016:

"A notional 1 billion barrels of oil was added to global inventories over 2014 – 2015 and our latest supply and demand balances suggest builds will persist with up to 285 mb expected to be added to stocks over the course of 2016. Despite estimations of current space storage capacity and the outlook for significant capacity expansions over 2016, this stock build will likely put midstream infrastructure under pressure and could see floating storage become profitable. "

The volume in floating storage is a small part of total global inventories. It can belong to producers (particularly, the NOCs) or to large traders.

One more time. Do they offload without paying the producer? "I don't know" is an entirely solid answer.AlexS , 02/23/2016 at 10:41 pmWho "they"?likbez , 02/23/2016 at 10:50 pm

One more time. Do they offload without paying the producer? "I don't know" is an entirely solid answer.AlexS , 02/23/2016 at 10:41 pmWho "they"?likbez , 02/23/2016 at 10:50 pmOil stored in tankers may belong to:

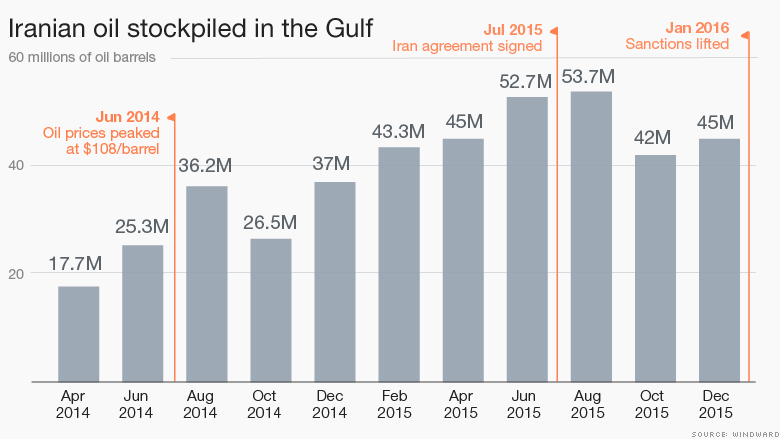

- Oil producers, particularly the NOCs (national oil companies). For example, Iran's ~40 million barrels of crude and condensate stored in tankers belongs to the Iranian national oil company.

- Oil traders, who have bought that oil and are storing it in tankers in a hope that they could sell it later at a higher price.

Alex,AlexS , 02/23/2016 at 11:35 pmCan you please explain how in oversupplied Europe Iran suddenly found customers for more then 0.3 Mb/d (Italy, Greece and France; Spain is next).

You should see inventories rising by the same amount because according to the "oil glut" theory this oil can't be consumed, don't you ? And 0.3Mb/d is 9 Mb/month. Most large oil contracts are long term and you can't break them without penalties.

Also in the USA no producer with reasonably good quality oil ("sweet" with reasonable API gravity) has any difficulties selling any volume he can produce. Moreover buyers ask for additional volumes. Note the word "selling", not putting in storage at his own expense.

Theoretically within "oil glut" framework there is no place for this oil to go other then in storage. And storage costs now are very high in Continental US so there should be reasonable attempts to minimize losses due to large amount of stored oil, which should limit "new" oil buying.

So it looks like "glut theory" (which is essentially an extension of neoclassical supply/demand model) has some serious holes in it.

Ves , 02/24/2016 at 12:12 am"Can you please explain how in oversupplied Europe Iran suddenly found customers for more then 0.3 Mb/d (Italy, Greece and France; Spain is next). "Iran is selling its oil in Europe at a big discount trying to regain its market share in this region. The customers are happy to buy Iranian oil at a lower price than the Saudi or Russian oil. The market is oversupplied, therefore part of oil supplies goes to storage.

"You should see inventories rising by the same amount because according to the "oil glut" theory this oil can't be consumed, don't you ? And 0.3Mb/d is 9 Mb/month."

1) Inventories in Europe are rising. Thus, according to the IEA, in December, even prior to the restart of Iranian exports, they have increased by 0.29 mb/d, or 9 million barrels.

2) Oil exporters are constantly adjusting their geographical mix of oil supplies. So with increasing volume of Iranian oil directed to Europe, Russia and others may have redirected part of their supplies to China.

"Most large oil contracts are long term and you can't break them without penalties."

Oil is not natural gas. Contracts are much shorter than typical take-or-pay contracts for gas supplies. A lot of oil is sold in the spot market. In general, the oil market is very flexible.

"Also in the USA no producer with reasonably good quality oil ("sweet" with reasonable API gravity) has any difficulties selling any volume he can produce. Moreover buyers ask for additional volumes. Note the word "selling", not putting in storage at his own expense."

When a customer in US or any other country buys oil, it may consume (process) it or put in storage. With the current low price of oil and a steep contango, it makes sense to put oil (or refined products) in storage. Therefore, oil and product stocks in the US are increasing.

"Theoretically within "oil glut" framework there is no place for this oil to go other then in storage. And storage costs now are very high in Continental US so there should be reasonable attempts to minimize losses due to large amount of stored oil, which should limit "new" oil buying."

The contango in the oil market justifies storing oil even at a high cost. If not, customers are ready to buy oil only at a lower price. That explains the current downward pressures on the oil price.

"So it looks like "glut theory" (which is essentially an extension of neoclassical supply/demand model) has some serious holes in it."

The oil glut in the market is empirical reality and has nothing to do with the neoclassical theories. You and Watcher are the only ones who deny this.

@likbezSynapsid , 02/24/2016 at 12:44 am"Glut" is emotional word and it is has negative connotation if you are oil producers and very likely it is misused in the press in order to provide certain perception of abundance.

or pick word "Oligarch" or "Businessman" which is more emotional to you?

Better word would be "over-supply" of oil. But the real question is how much of over-supply there is?

AlexS,Watcher , 02/24/2016 at 2:19 amSome of the tankers being used for storage hold gasoline, not crude. (You may already have mentioned this elsewhere.)

This is going circular, despite some good procedural information. The issue is this. Does KSA put oil on a tanker and send it to . . . whatever destination with no order for it. Now that's rhetorical in that the correct question could be Does KSA let oil leave that tanker without being a promise of payment.Dennis Coyne , 02/24/2016 at 11:51 amSimply that, and you seem to be dodging. Is oil coming out of the ground - or if you're happier, coming out of the tanker, without agreement to pay. And again, your reference made clear you're talking about 50 and only 50 lousy million barrels. The decline in prices started June 2014. Quotes of oversupply have been up to 3 mbpd. Even that graph you posted would add up to hundreds upon hundreds of millions of barrels.

You're not making your point. Are you saying KSA and other exporters pumped that much oil out without being paid for it?

Hi guys,The oil of course is paid for, but the price is very low. A "glut" means an oversupply, how do we know there is an oversupply? Because many producers are selling their product at a loss.

For a commodity like oil which does not deteriorate in storage (like apples) there can be oil traders that buy and store oil in hopes of selling later for a higher price.

To make things simple glut=low price.

peakoilbarrel.com

Alberto, 02/24/2016 at 1:36 pm

Every single business in the world must increase its inventory when it increases it sales unless it is somehow able to get more efficient with its inventory turns. When growth is very fast like it has been in the US oil industry over the past few years, inventory turns almost always get less efficient, particularly if there are bottlenecks in product flows due to insufficient infrastructure or logistics which struggles to catch up with that growth. So when you are producing and selling record or near record amounts of a good then your inventory of that good should be at or near record levels. Also, when you build more inventory capacity you are going to carry more inventory particularly if you don't like the price that you can sell that inventory now as is the case in the oil business.The inventory in the US will turn much quicker than people think as the production declines accelerate or more importantly the price goes up. Assuming either of those things ever happen again….

peakoilbarrel.com

Ron Patterson , 02/24/2016 at 12:45 pmThe Weekly Petroleum Status Report came out earlier today. The biggest news is that oil inventory levels increased by another 3.5 million barrels. They are at an all time high.Jeffrey J. Brown , 02/24/2016 at 1:41 pmI understand that there are some folks out there who do not believe that there is currently a glut in the oil supply. I wonder how they would explain this record in stored oil. Of course this is just not in the US, there are similar stories around the world. We are running out of places to store oil. That's not a glut? Then what the hell would you call it.

US crude oil production dropped by 33,000 barrels last week, according to the EIA's algorithm that tries to track production. Understand that this is not an actual measurement of oil produced but a mathematical equation that tries to figure it out.

A glut of condensate?shallow sand , 02/24/2016 at 1:54 pmAs US C+C inventories increased by 100 million barrels from late 2014 to late 2015, US net crude oil imports increased:

http://oilpro.com/post/22276/estimates-post-2005-us-opec-global-condensate-production-vs-actua

The most recent four week running average data (through Mid-February), show that US net crude oil imports increased year over year, from 6.8 million bpd in 2/15 to 7.4 million bpd in 2/16. And US net crude oil imports, as a percentage of C+C inputs into refineries, rose year over year from 44% last year to 47% this year (four week running average data).

And links to articles from last year and this year that discuss refiners' unhappiness with "Synthetic WTI" blends of heavy crude and condensate:

http://www.reuters.com/article/us-usa-refiners-trucks-analysis-idUSKBN0MJ09520150323

https://rbnenergy.com/just-my-imagination-how-full-is-cushing-crude-oil-storage-capacity-really

Ron, do we know what worldwide C + C storage levels have done since 2013?Ron Patterson , 02/24/2016 at 2:29 pmIf I am a US refiner, I would be filling every available inch of storage at sub $30 oil.

Are oil exporters doing the same?

Well we have the OECD storage levels for the last 6 years, courtesy of the IEA Oil Market Report And, as you can see they are at a high since January 2010.Chris , 02/24/2016 at 4:06 pmIf you substract US storage increase from OECD numbers, I think you should see a plateau. So the majority of the increase in oil storage is in the US, at least for OECD.shallow sand , 02/24/2016 at 4:33 pmI have tried in the past to find information about non-OCED and OPEC storage. I have been unable to do so. If anyone has this information (AlexS?) I would appreciate it very much.Urs, 02/24/2016 at 2:54 pmPer IEA, total supply, including refinery gains and biofuels stood at 97.1 million bopd. Of that, OCED was 24 million bopd, with refinery gains and biofuels in OCED making up another 4.6 million bopd.

This means that a little over 70% of world wide supply (production) is non-OCED and OPEC. So, without storage information for non-OCED and OPEC, seems it is a little difficult to obtain a clear picture of how much higher worldwide storage is now than it has been in the past?

It would seem if non-OCED exporters and OPEC desired to sell into this market and draw down crude oil storage inventories, they very well could do so, as refiners in importing countries would be inclined to buy as much oil as they could store, assuming that low prices will not remain forever. OTOH, when oil shot up to $140, clearly refiners in importing countries tried to keep from buying anymore crude than necessary, as there is much more risk in storing $140 oil losing value than $30 losing value.

Also, when we get right down to it, strategic petroleum reserves should be included into the mix. However, what weight they should be given is difficult, given the uncertainty of if and when they would be accessed.

The inventories for countries producing 29.5% of C + C, including refining gains and biofuels, have increased from about a five year average of 58 days, to 65 days supply. I wonder what has happened with regard to storage for the remaining 70.5% of world wide production?

I will give you an example of what I mean through a stripper well oil producer. Stripper well production is separated from water and goes into a stock tank. When the stock tank is full, the tank is picked up by a tanker truck and driven to a refinery.

In January, a stripper well operator may start with 1,000 barrels of oil on hand, produce 1,000 barrels in the month, sell 1,200 barrels in the month, and end the month with 800 barrels on hand. The next month, the operator may start with the 800 barrels, produce another 1,000 barrels, sell just 600 barrels, and end the month with 1,200 barrels on hand.

We know the operator produced 1,000 barrels each month. However, if I had not told you that, you might very well think the operator produced 1,200 barrels in January and 600 barrels in February.

Is it not possible that this game is occurring with regard to large producers for which we have no storage data?

For example, I sincerely doubt KSA suddenly shuts in wells to cut production, or opens up wells to increase production. I assume they have considerable storage, and when they ramped up production greatly, they really didn't, they put a lot of stored oil on the market. I think it would be tough to suddenly increase or decrease production by 1 million bopd. Maybe they do, but I doubt it happens immediately.

Of course, I really do not know the above re KSA for a fact. However, it would be much easier for them, or any other producer, to manage supply, at least in part, through the use of storage.

Please understand, I have no idea what is really going on with worldwide oil storage. But that is my point, unless someone can point me to some good data, no one does. For all we know, storage levels in non-OCED and OPEC could be low?

Hi

Thanks for the weekly graph – always great to see your data presentation.Careful with the increase in crude stocks, because, as you surely know gasoline, distillates (the low sulphur part) and the propane are all down the double,

so that total stocks (bottom line in top part of "data overview table 1" EIA) are DOWN 5 mb last week!I think people are gonna start reacting, 4 week averages are down, yearly cumulative production is down, the tide is turning. And as Mr Brown writes, imports are up too. The show goes on…

Best,

Reuters

According to the U.S. government, there are over 1.3 billion barrels of crude oil and refined products in commercial storage around the United States, an increase of more than 300 million barrels in the last two years.There is a tendency to assume all these barrels of crude and products are "excess" inventories, the result of overproduction, but most of them are held for operational reasons.

The best way to distinguish excess inventories from normal operational stocks is to adjust reported inventories for time of year, consumption of crude by refineries, and consumption of products by end customers.

Other things being equal, the more crude refineries process every day, the more crude they need to hold on site, at tank farms or en route to the refinery in pipelines and on ships to keep their distillation towers supplied.

And the more fuel supplied to customers, the more refined stock refineries, blenders and distributors need to keep on hand to deal with seasonal swings, maintenance and unexpected disruptions in the supply system.

Since the start of 2015, U.S. refineries have been processing record amounts of crude to meet strong demand for gasoline as continued growth, rising employment and cheap fuel prices have encouraged increased driving.

U.S. crude stockpiles are currently 47 percent higher than the average over the last 10 years but if stocks are adjusted for the higher rate of processing the surplus falls to around 34 percent.

The reported surplus in crude stocks over the long-term average is around 162 million barrels but if stocks are adjusted for higher processing the surplus falls to around 128 million barrels (tmsnrt.rs/20WQt9F).

U.S. gasoline stockpiles are currently 11 percent higher than normal for the time of year but if they are adjusted for strong gasoline demand then the surplus shrinks to 7 percent.

The reported surplus in gasoline stocks over the long-term average is 26 million barrels but adjusted for higher demand falls to 17 million barrels (tmsnrt.rs/20WQzhl).

Crude and gasoline stocks are somewhat less excessive than the unadjusted data suggests because refinery processing and gasoline consumption have been so strong.

But distillate demand has been much weaker than normal thanks to sluggish demand from the freight sector and El Nino.

Distillate stocks are much higher than the raw numbers suggest, once they are adjusted for the current weakness in demand.

Distillate stockpiles are currently 24 percent higher than the long-term average but once adjusted for weak consumption they are 43 percent higher than normal for the time of year.

The reported surplus in distillate stocks over the long-term average is 31 million barrels but adjusted for weak demand the surplus surges to 48 million barrels (tmsnrt.rs/20WQE4M).

At this time of year, U.S. gasoline stocks are normally around 26 days worth of consumption, and they are currently a bit higher at 28 days.

Distillate stocks should be around 32 days worth of consumption but are currently at a massive 46 days worth of demand.

CONTINUOUS PROCESSING

Early U.S. oil refineries processed crude in batches, with each batch of oil loaded separately into a still, where it was heated until the distillates were boiled off, condensed and collected for sale.

Early refineries were really just simple distilleries: the equipment would be instantly recognisable to anyone who has been on a tour of a whisky distillery ("A practical treatise on coal, petroleum and other distilled oils", Gesner, 1865).

The first U.S. refineries established during the 1860s and 1870s processed up to 2,000 barrels per day, though most were much smaller and produced less than 1,000 barrels per day ("Early and later history of petroleum", Henry, 1873).

Refineries were geared to produce a middle distillate boiling around 300-600 degrees Fahrenheit which was sold as kerosene or paraffin oil and used for illumination.

Gasoline, with its lower boiling point, was too volatile to be used safely as lamp fuel and was mostly considered a nuisance and waste product.

U.S. oil refineries eventually switched from processing crude in discrete batches to feeding oil into distillation towers and drawing off the fractions in a continuous process.

Modern U.S. refineries process up to 600,000 barrels per day, 300-1200 times as much as the first batch-based plants, though a more typical refinery has capacity of around 100,000 to 200,000 bpd.

The objective has switched from producing kerosene for lighting to producing gasoline for use as a transportation fuel.

In the first decades of the 20th century, electric lighting began to reduce demand for kerosene while the massive expansion in car ownership stimulated consumption of gasoline.

From 1915-1920 onwards, refineries were increasingly geared to produce gasoline as the main product, while middle distillates became a by-product.

With the shift to continuous processing and the prodigious growth in demand for gasoline as a road fuel, the oil industry's need to hold stocks of unrefined crude and refined products surged.

To ensure an uninterrupted flow of oil from the wellhead to the refinery and the end customer, stocks of crude and refined fuels are held at every stage along the supply chain.

Refineries hold substantial stocks of crude to ensure a continuous flow of carefully prepared (de-watered and de-salted) as well as blended crude into their distillation towers.

The industry also needs substantial stocks of refined fuels, lubricants and petrochemicals to ensure a continuous supply to distributors and end users.

Refineries hold crude and refined products to meet routine operational requirements as well as to deal seasonal variations in demand, planned maintenance and unexpected disruptions.

The amount of oil involved is enormous.

At the end of 2013, with the oil market more less balanced, more than 1.05 billion barrels of crude and refined products were being stored at refineries, distributors and oilfields as well as in pipelines and on tank farms.

By February 2015, with the oil market clearly oversupplied, crude and refined products in storage had climbed to more than 1.33 million barrels, according to the U.S. Energy Information Administration ("Weekly Petroleum Status Report", EIA, Feb. 24).

OPERATIONAL PLANNING

In the last year, U.S. refiners have been fairly successful in matching gasoline production and stockpiles with demand. Gasoline production remains at the centre of their operational planning.

Crude stocks have continued to increase, reflecting worldwide oversupply, though stockpiles are rising somewhat more slowly than at the start of 2015.

But refiners lost control of distillate stocks in the second half of 2015 as freight demand slowed and El Nino ensured a warmer than normal winter across the United States and other parts of the northern hemisphere.

Winter heating demand across the United States has been around 17 percent below average, according to the National Oceanic and Atmospheric Administration.

And by the end of 2015, the volume of freight being moved across the United States by road, rail, pipeline, barge and air had fallen by more than 2 percent compared with the same period at year earlier.

Over the last four weeks, U.S. implied distillate consumption has averaged just 3.5 million barrels per day, which is 12 percent below the long-term average and 16 percent below the same period in 2015.

The fact that refiners have lost control of distillate stocks should come as no surprise because distillate is essentially a by-product of gasoline production.

Refineries have operated to maximise gasoline production but in the process created an enormous and growing oversupply of distillate.

There is some limited flexibility in the refining system to switch from distillate production to gasoline but it is typically only on the order of a few percentage points.

Massive overproduction of distillate has pushed gross refining margins for the fuel to the lowest level since 2010.

But refining margins for gasoline have been much healthier, at least until recently, which has encouraged refiners to continue maximising crude throughput.

As long as gasoline demand remains strong, refiners will continue to meet it, which is why the outlook for U.S. gasoline consumption is so critical for the oil market in 2016.

peakoilbarrel.com

Jeffrey J. Brown, 02/24/2016 at 1:41 pm

A glut of condensate?As US C+C inventories increased by 100 million barrels from late 2014 to late 2015, US net crude oil imports increased:

http://oilpro.com/post/22276/estimates-post-2005-us-opec-global-condensate-production-vs-actua