|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

| “Where ideas are concerned, America can be counted on to do one of two things:

take a good idea and run it completely into the ground, or take a bad idea and run it completely

into the ground.” —George Carlin Oh what a tangled web we weave, When first we practice to deceive!" Walter Scott, Marmion, Canto vi, Stanza 17 |

|

|

|

|

This society faces the dilemma unlike anything experienced in the last two centuries. George Carlin had a rather salty and somewhat pessimistic explanation for the lack of reform and recovery (Caution language). In any case MSM tried to downplay the problem and government try to continue "business as usual" or as this behaviour is called in "waiving the dead chicken". The bought talking heads (aka MDM pundits) are pontificating that the economy will soon fully recover. All is quiet in the Pax Americana. The natives are, if not completely happy, at least blissfully uninformed. And they are entertained by dark tales of the evil Russians.

Confidence! This is the word, this is the goal. Let's talk 24 by 7 that we have the best markets, financial system, gargets and news media, ever. And if we talk non-stop for a long time about those things, people will believe that this is the reality ("we create our own reality" famously said President Bush) and as the result of this mass psychosis those good things will eventually materialize. At least for members of the top one percent.

But brainwashing by MSM aside, few things arouse more passions (and wars) these days then oil. It started deeply affects the geopolitical situation in the world and, especially countries which have oil deposits, which got in the hair lines of rich countries and some of them recently experienced the "regime change". the latter is a politically correct wording of the violent overthrow of the government with the help and financial and/or military support of foreign powers. See Color revolutions and Neoliberalism as a New Form of Corporatism

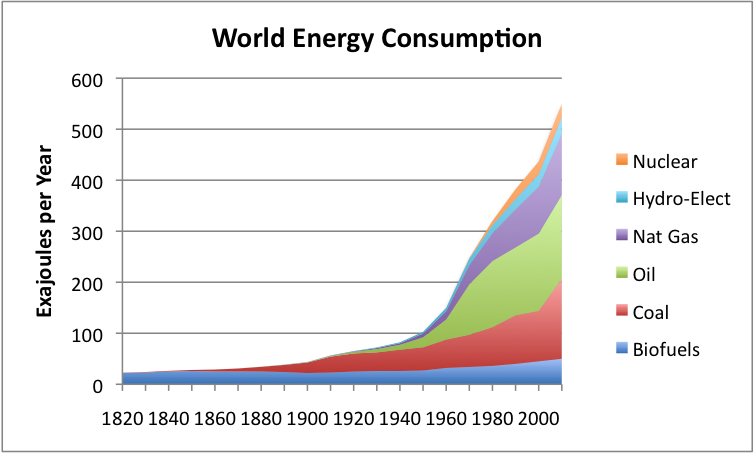

The problem we face now is somewhat incorrectly named "Peak Oil". In reality "Peak Oil" should probably more correctly be called "Peak Cheap Oil", or "Plato Oil". But the nature of the phenomenon does not really depends on the name. The essence of the problem is that as planet itself is limited, there are limits on stored hydrocarbons (no matter what is their origin), which make current pace of extraction unsustainable in a long run.

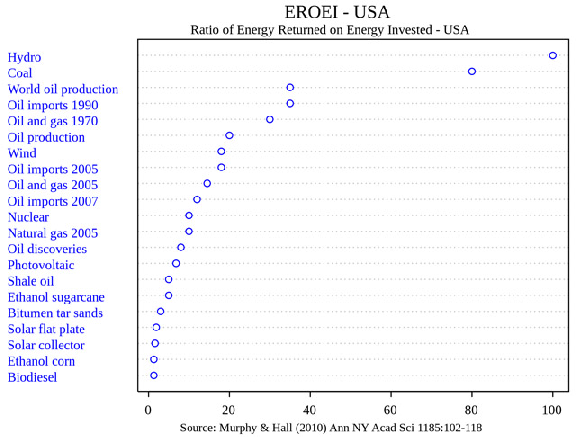

Which means that Energy returned on energy invested (ERoEI) will continued to drop. Here there is no reversal in sight. But this does not necessary means that the price of oil will continually rise. Dropping demand due to stagnation can lower the price considerably. Rising energy efficiency of cars is another (albeit minor) factor. The oil price is also reversely correlated with the strength of the dollar, so strong dollar means lower oil prices.

But it already had risen enough to serve as a powerful inhibitor of economic activity (aka Secular Stagnation) and at some point it might even cause system disruption. In other words, at some point iether political or financial system or both might break. The Etp Model, Q & A Peak oil studies, reports & models - Peak Oil News and Message Boards

Let's say you want to buy a gallon of gasoline, and it cost $1 (that was called the good old days). Were does the dollar come from? You may have a job, or business that earns that dollar for you, but in general that dollar had to come from the economy in which you live (which is now planet earth). To produce that dollar it took energy, labor, capital, and any other quantity you want to include.

The amount of energy it took to produce that dollar can be found from Graph#12: http://www.thehillsgroup.org/depletion2_008.htm . In 2014 that was, on average, 5,860 BTU.

If you had less than 5,860 BTU you couldn't generate enough economic activity to buy a $1's worth of gasoline.

The high risk is definitely associated with the massive, high-cost arctic and deep-water oil explorations, as well as the shale-oil-fracking. The latter also function simultaneously as high-yield bond printing machine so shale oil producers actually have two streams of inputs (energy and steel tubing, making them sensitive to the price of steel) as well as two streams of output: oil (or gas) and junk bonds.

The decline rates with respect to shale oil production per drilling is as precipitous as 60% per annum after the first couple of years. And if you lose around 60% of output in three years, then such companies constantly need fresh capital to continue drilling. They just can't stop. That's the matter of survival. If they stop they are dead in three to four years as their revenue stream will drop dramatically. That's why recently they became the major suppliers of junk bonds on the financial market.

With recent developments in the Middle East, civil war in Libya, Syria and Iraq, as well as recent coup d'état in Ukraine and "estrangement" of Russia from Western oil extracting technologies, it looks likely oil prices are about to increase in the near future. But counter intuitively they decreased in 2014. Which in not that strange if you look at ERoEI metric more closely. It might simply mean that the return on capital at current oil prices became so low that demand started to drop despite growth of the population:

Steven Kopits from Douglas-Westwood said the productivity of new capital spending has fallen by a factor of five since 2000. “The vast majority of public oil and gas companies require oil prices of over $100 to achieve positive free cash flow under current capex and dividend programmes. Nearly half of the industry needs more than $120,” he said.

But that does not mean that oil prices will stay high. Loss of demand can well lead to lower oil prices, when customers revenue stream is destroyed and they can't buy oil even at discount, undermining and destroying in turn attempts to increase production by using more expensive source of oil like Canada tar sands and shell oil. This is what is called in chess zugzwang. In this case this is "oil zugzwang". Lower oil prices do not necessarily boost consumption or strengthen economic growth. Quite the contrary. Weaker demand is a sign that deflationary pressures are building and stagnation is becoming more entrenched.

What is rising continuously is not oil price, but the cost of extraction per barrel of oil leading to continuous drop of ERoEI (energy return on energy invested) of oil extraction. And this process started long ago and continues uninterrupted. When ERoEI reaches single digits, people often talk about "energy cliff".

But in any case when ERoEI drops below certain threshold, the modern civilization enter the period of profound changes. For example transatlantic shipping will become less affordable, suburbia might experience crisis due to transportation costs (and that means that prices of houses in suburbia might never fully recover after 2008), etc.

It is unclear what is the threshold that launch the drastic economic changes (ERoEI now is lower, probably around 40, and that might the reason why the world economy entered secular stagnation period), but at some point quantity turns into quality.

Please note that both shale oil and tar san oil has ERoEI in single digits. There are some claims that the EROEI of shale oil extraction is about 3 meaning it takes one unit of energy to produce 3 units of oil. The EROEI on Canadians tar sand extraction is about 5. The most optimistic estimate for both are high teens (Oil shale economics - Wikipedia ):

A measure of the viability of oil shale as a fuel source is the ratio of the energy produced to the energy used converting it (Energy Returned on Energy Invested - EROEI). The value of the EROEI for oil shale is difficult to calculate for a number of reasons. Lack of reliable studies of modern oil shale processes, poor or undocumented methodology and a limited number of operational facilities are the main reasons.[20] Due to technically more complex processes, the EROEI for oil shale is below the EROEI of about 20:1 for conventional oil extraction at the wellhead.[20]

If ERoEI drops to single digits our civilization might experience a profound change. Not necessary a collapse as doomsday authors predict but a profound change.

And continuous drop in ERoEI from 70th is the trend that is very difficult to dispute. We can argue only about the real form of the curve and the threshold at which quantity turns into quality. The current world oil production has ERoEI between 20 and 40. In other words at ERoEI 40 you extract forty times as much of energy is extracted from the Earth then you spend for extraction.

ERoEI started to drop approximately two decades ago. We are now, probably, reached global ERoEI in 20-30 range.

The picture above assumes that what ERoEI drops to single digits the society might experience a profound shock as energy available for consumption start dropping with accelerating trend. You can increase volume of oil extracted but with low ERoEI for example 5 say, 20% of it will be used to maintain the extraction level. That means the absolute volume of extracted oil does not mean much. You also need to know how much oil and electricity oil industry consumes to produce this volume of shale oil.

Please note that the pace of dropping of ERoEI is disconnected with the dynamic of oil price. Oil price is result of complex interplay of political and economic factors. There can be local crisis of "overproduction" when too much investment has flow into oil extraction business because of high prices and then prices collapsed and weaker player are wiped out (along with many 401K investors, who were attracted by high oil price to oil ETFs).

Moreover there is some additional resilience in modern econ0my which allow it limping forward (Secular Stagnation). As soon as oil temporary broke magic $100 per barrel despite all predictions of reputable economics the US economy can't survive the price of oil above $70-$80 we did not experience a profound shock. So the situation might be not as bad.

Also the oil price is somewhat disconnected with ERoEI, especially on a short run. We see this affect in Dec 2014 and Jan 2015. For example in late 2014 we see an attempt to revive the world economy by lowering oil prices which might be also connected to political decision to isolate and weaken Russia. That does not mean that ERoEI suddenly increased.

It means that the system became unstable and oil price can fluctuate widely and ranges that can be completely disconnected with ERoEI. Moreover as oil price is a powerful geopolitical tool the USA, Saudi Arabia and other countries might also plays it again potential competitors like Russia. Low oil price was probably instrumental in collapse of the USSR in 1991.

The key problem is that ERoEI of most conventional oil substitutes (with the exception of hydroelectricity and coal) is dramatically lower then ERoEI of "conventional" oil. for most substitutes ERoEI is lover magic level of 10.

For example, ERoEI of shale oil is in single digits or lower teens (you need a lot of energy to extract a barrel of such oil) and common assumption is that shale oil producers generally need the price per barrel to remain approximately above $80 just to stay in business. That means that the prices at the end of 2014, if sustained, will drive many of them into bankruptcy in three to five years.

Moreover shale oil producers are large players at junk bond market so it might shake junk bond market too.

Some new oil discoveries have ERoEI only around 10 (bitumen oil sand ERoEI is in single digits, moreover it highly dependent on the price of natural gas which is a limited resource too ). Again, this is a dramatic, society transforming change as up late 90th ERoEI of oil discoveries was around 100. In a very fundamental way decrease of ERoEI, not shortage of oil per se, is driving dynamic behind Peak (or more correctly Plato) Oil.

Is increase of ERoEI is the source of the current "Secular Stagnation" with its well known disconnect between the purchasing power of money and the resources available to back them up:

2012 2013 2014 2015 WTI Crude Oila

dollars per barrel94.12 97.91 97.72 94.58 Brent Crude Oil

dollars per barrel111.65 108.64 104.42 101.67 Gasolineb

dollars per gallon3.63 3.51 3.45 3.38 Dieselc

dollars per gallon3.97 3.92 3.85 3.80 Heating Oild

dollars per gallon3.79 3.78 3.79 3.65 Natural Gasd

dollars per thousand cubic feet10.69 10.31 11.09 11.13 Electricityd

cents per kilowatthour11.88 12.12 12.48 12.69 aWest Texas Intermediate.

bAverage regular pump price.

Note: Italics indicate forecast.

Source: Short-Term Energy OutlookcOn-highway retail.

dU.S. Residential average.Updated Data Series

Please note that for all renewable energy sources (with the exception of wind and hydro) ERoEI is also in single digits. In other words renewable fuels are not as rich source of energy as oil and their production is not as scalable. At least not yet.

September 2, 2010 | The Oil Drum

This week a study on peak oil by a German military think tank was leaked on the Internet. The document shows that the German government is closely studying the issue of peak oil, and is aware of the potential for serious consequences as oil production declines. The study is reminiscent of the Hirsch Report, commissioned by the U.S. Department of Energy, that warned of the risks posed by peak oil.The document warns of the potential for regional shortages, market failures, and a shift in political power toward those capable of exporting oil. This report describes potential outcomes that require planning and preparation. The scenarios outlined in the paper are exactly the kinds of drivers that lead me to advocate for greater regional energy self-sufficiency. The report clearly lays out just how vulnerable Europe will be because of its continuing dependence upon Russia for both oil and gas, and notes that Russia will be in a very strong political bargaining position as a result.

The report can be accessed from the popular German paper Der Spiegel in this story: Bundeswehr-Studie warnt vor dramatischer Ölkrise. The report is so far only available in German, and while Ich spreche ein wenig Deutsch (I speak a little German), I am not fluent enough to capture the essence of the report. (Der Spiegel has summarized the report in English now: Military Study Warns of a Potentially Drastic Oil Crisis).

However, I have a friend who is both fluent in German (his native tongue) and passionate about peak oil outreach. Given a week, I could probably translate the report. My friend (who didn't want to be identified) did it overnight. Below is his translation of the major points in the report.

Peak Oil

Implications Of Resource Scarcity On (National) Security

Center for German Army Transformation, Group for “Future Studies”

July 2010

1. Introduction

The focus of the document is on the topic of finite resources, using Peak Oil as an example. The report is part of a series of publications focused on the long term (30 years) with the intent to enable the Ministry of Defense to take action early.

In the past, resources have always triggered conflicts, mostly of regional nature. For the future, the authors expect this to become a global problem, as scarcity (mainly of crude oil) will affect everybody.

The authors confirm multiple views on Peak Oil timing and concede that there will be Peak Oil eventually. The study isn’t about positioning the problem on a timeline, but instead about the consequences of a peak. They expect major consequences with a delay of 15-30 years after the peak has hit.

The report refers to the uncertainty of reserve statements mainly in OPEC countries based on the quota allocation method within OPEC but also refers to the possibility of better extraction technologies.

They suggest that it has become urgent to understand those consequences of an eventual peak now in order to have enough time to adapt.

2. The Importance of Oil

2.1 Oil as a driver of globalization

95% of all industrial outputs is dependent on oil as a fuel and/or as a chemical base for polymer production etc. Oil has become a key driver of modern lifestyle and globalization.

Substantial oil price increases poses a systemic risk, not just for obvious things like transportation, but equally for other subsystems.

Thus, internationally, but equally nationally, there is a vital interest in securing access to oil, which is currently possible on world spot markets, with OPEC being cooperative due to a mutual dependency between key actors (and a massive presence of the U.S military in the Gulf region).

Yet, on the other hand, regional conflicts can always at least partially be attributed to resources, such as in the Caucasus region, the Middle East or in Nigeria. They may also fuel conflicts due to the wealth they create (such as in Africa).

The report sees – within a timeframe until the year 2040 – a changed international security layout based on new risks (including transport risks for fuels) and new roles of actors in a possible conflict around the distribution of increasingly scarce resources.

2.2 German energy security.

The term is defined narrowly as “reliable energy supply”, and then extended to include environmental objectives, technology transformation of societies, planning for energy demand and the long-term planning of a national strategy, tied in with international organizations.

This expansion of the view is seen as required based on the globalization of energy markets. However, the report then narrows in scope again to the possible risk from a supply shock, focusing on the key suppliers of oil: Russia, Norway and the U.K. It is noted that both European partners are already past their peak and that Germany is increasingly dependent on Russia, which currently is reliable but not necessarily so in the long term. Given the expected decline in German energy consumption, the Russian share will likely be 40% by 2025, with the Middle East, Africa and sources around the Caspian Sea making up for the increasing gap from declining European production.

3. Possible Scenarios After Global Peak Oil

This chapter looks at gradual changes (3.1.) and the risk of disruptive changes (3.2) past a certain tipping point.

3.1 General interdependencies driven by Peak Oil

3.1.1 Oil as a deciding factor in international relationships

With increasing scarcity, producers are increasingly in an advantageous position, both from high revenues and access to cheaper oil when compared to spot market prices. This partly reverses the trend to free oil markets which took place after the '70s shocks, and gives those countries more control over the supply chain, with a risk of monopolies and nationalizations, and of “political pricing.”

Further, oil producers use increasing amounts of their production internally at lower prices, which increases domestic consumption and inefficiencies, accelerating the problem. [The authors miss out on the fact that high oil prices also bring more wealth to the country which AGAIN increases resource consumption].

The report then looks at increasing “strategic” moves by key actors including the Chinese CNPC (China National Petroleum Corporation), which tries to grab the sources that are still available (particularly in Asia and Africa), but often at relatively unattractive conditions.

Overall, the authors expect a reduction of “free market” mechanisms in oil trade, and a rise in more protectionism, exchange deals, and political alliances between suppliers and customers, which could lead to significant geopolitical shifts. Equally, the authors expect this interdependency to shape foreign affairs of oil importers, making them more tolerant towards rogue behavior of suppliers out of sheer need.

Overall, higher volatility and loss of trust are seen as possible outcomes in a world where oil supplies are limited, increasing the need for “oil related diplomacy” and thus increasing the risk of moral hazard among all actors, which in turn decreases overall global supply security.

The report then refers to already existing actions of the German government to tie close economic relationships with energy suppliers, and to the tendency of consuming countries to reduce oil dependency, trying to steer clear of risks of future supply shocks.

The Middle East is identified as a very dangerous region with high external involvement from many players and thus a very unstable overall situation.

Overall, the report expects a reduction of the importance of “Western values” related to democracy, and human rights in the context of politically motivated alliances, which increasingly are driven by emerging economies such as China – likely leading to double standards. Emerging economies are equally expected to receive higher recognition in international organizations, particularly those with strength in resources (such as Russia).

3.1.2 New security risks based on additional/alternative energy resources

New conflicts are potentially arising from oil exploration in international or disputed ocean waters, where multiple issues arise, particularly around the Arctic Circle, with further geopolitical risks for conflict.

Also, the shift to natural gas is reviewed as an extension of the “oil age”, because it might be able to replace crude oil as a bridging source until new solutions are found. The risks for problems from transporting gas (pipelines) and the related issues (as seen between Russia and its neighbors during the past years) are highlighted.

Equally, nuclear power as a potential source is highlighted – emphasizing the risk for safety and the proliferation of nuclear technology. This would also require an increasing shift towards electricity.

Equally, the competition between biofuel and food production is highlighted, showing the limits of biofuel outputs to compensate for reductions in oil availability, and also showing risks for water supply and soil degradation from excessive use.

Overall, the authors see a trend to increase the energy autonomy of entire regions from external supplies, both in the ability to generate alternative fuels (from biofuels and coal), but particularly in electricity generation.

3.1.3 A shift in roles between private and public actors

Based on the increasing importance of oil, governments are becoming more relevant in securing the benefits of oil, both on the supply and on the demand side. This puts a higher emphasis on political negotiations and deals, and increases the risks for nationalizations of resources and key exploration activities.

Exploration licenses are seen as a key area where bidding wars (including non-financial commitments) might emerge. Equally, increasing pressure to renegotiate or revoke already existing licenses might emerge. Ultimately, each country will try to secure sufficient oil to maintain its standard of living.

On the other hand, private enterprises are seen on the rise in protecting infrastructure and ensuring production and transportation security in less developed regions, particularly if weaker countries become unable to keep their own services up.

The dependency on oil-related infrastructure (pipelines, refineries, harbors, key pathways on oceans) will increase, and thus the risk. Damaging infrastructure through hostile acts (sabotage, war) might become an attractive target for groups or countries with a tendency to use violence. The same is expected for electricity and natural gas-related infrastructure – they all might require higher protection.

Generally, the focus of risks is expected in the region which the authors consider the “strategic ellipse” (a term used for the region East of Europe reaching from Saudi Arabia in the South to Russia and former Soviet Union countries in the North), because a majority of oil reserves are located in this area.

3.1.4 Economic and political crises as a consequence of the transition to “post-fossil” societies

A number of risks of higher oil prices are seen for modern economies, particularly in transportation. Security risks are seen in resulting systemic crises.

A first direct consequence of higher oil prices and lower availability of fossil fuels is a possible reduction in transportation capacity, equally in individual transportation and in freight forwarding. This might lead to another “mobility crisis” for societies that heavily depend on cars and trucks.

Higher cost in commercial transportation markets might severely affect current supply chains, and no alternatives are in sight (electric trucks don’t exist yet). Food particularly might become a critical issue for countries that are a) highly dependent on imports and b) are susceptible to price-increases of food products, particularly affecting Africa, parts of Asia and Latin America, and the Middle East.

High oil prices would further affect almost all aspects of society, as it will also influence the cost of chemicals and all products derived from them, which might substantially alter the nature of value chains and make certain things uneconomical – ultimately leading to higher unemployment during a transformational phase away from an oil based economy. This might particularly affect the German car industry.

Limits in availability might also strengthen regulatory efforts, encourage the allocation of energy (oil) by rationing schemes and possible other actions limiting free markets.

Additionally, the changes and likely reduction in standard of living might render societies less stable and make them more attracted to extremist political positions and even trigger changes in government systems, as trust into key actors in politics will diminish. This might be a particular risk for the relatively young democratic countries in Eastern Europe.

3.1.5 More selective intervention – key actors overwhelmed

Overall, more expensive transportation and increasing problems “at home” might reduce the ability of larger countries to intervene internationally (politically and/or with military action), and also lower the readiness to provide help to poorer countries. The focus will be more on a country's (energy) interest for itself and not so much on an ideal of transferring Western values. The gap will likely not be filled by NGOs, as they will be affected by similar limits.

Overall, international institutions will be weakened, as they will have less resources to provide help and support, and it becomes equally possible that help will be attached to direct (energy) needs of the donors.

3.2 Systemic risks after reaching a “tipping point”

In addition to the gradual risks, there might be risks of non-linear events, where a reduction of economic output based on Peak Oil might affect market-driven economies in a way that they stop functioning altogether, leaving the possibility of a relatively steady downward trajectory.

Such a scenario could develop through an initially slow decline of trade and economic activity, combined with higher stress on government budgets from lower tax income, higher social cost and growing investment into alternative technologies.

Investment will decline and debt service will be challenged, leading to a crash in financial markets, accompanied by a loss of trust in currencies and a break-up of value and supply chains – because trade is no longer possible. This would in turn lead to the collapse of economies, mass unemployment, government defaults and infrastructure breakdowns, ultimately followed by famines and total system collapse.

4. Challenges for Germany

4.1 Risk of new dependencies for Germany

Oil as a new factor of global power would create significant dependencies for Germany, and in order to avoid supply issues, strong ties with suppliers are a must, but equally a diversification of supply relationships, taking into account that a supplier might intentionally reduce capacity to accomplish political objectives.

Among the key supplier countries is Russia (supplying 35% of German oil imports), where reliability risks are prevalent, given past experience. Natural gas, as a possible temporary substitute, bears the same risk (37% comes from Russia). Thus, a diversification becomes essential.

4.2 Focus of politics on supply relationships

Germany needs strong and reliable ties to Russia and other Caspian Sea countries. This might create some challenges in international relations, particularly with smaller Eastern European countries [like Poland]. Thus, intensifying relationships to the Middle East might be equally relevant. However, all those relationships have an inherent risk of being instruments in conflicts, which puts a certain limit on treating all foreign partners the same.

4.3 More pragmatic foreign policy

The need to mitigate supply risks might require some compromises on foreign affairs topics (such as human rights). Equally, more active diplomatic efforts will be required with a focus of energy security in mind. This is more difficult given Germany’s reluctance to engage in political power play due to its history, but needs to be tackled in order to deal with the challenges ahead. The authors don’t want to encourage military solutions, but suggest a strong preventive development of political and diplomatic initiatives to tackle the problem.

4.4 Importance and freedom of industrial nations reduced

All industrial nations that depend on energy imports will become more dependent on new partners, both in emerging economies and supplier countries. This requires a new focus in foreign affairs, sometimes giving up standards in negotiations with countries that have different cultures and political systems.

4.5 Help in stabilizing supplier countries at risk

Some supplier countries (and surrounding regions) might be destabilized by the force of higher resource prices. This is an area where Germany needs to help by providing support for nation building and conflict resolution on the national and international level. This is in conflict with the lower economic power likely to result from Peak Oil, which might make interventions less likely and requires new approaches of “stabilization with lower effort.”

4.6 Growing conflict potential concerning the Arctic Circle

Germany might have to take positions in case of an upcoming conflict regarding resources in the Arctic Circle, where multiple countries (including Russia) have open claims for accessing oil and gas fields. This requires further research.

4.7 Nuclear technology proliferation

The risk for nuclear technology proliferation and thus more countries with the potential for nuclear weapons (and the risk for terrorists having access to nuclear material) is growing due to the proliferation of nuclear technology for energy generation. Equally, risks for terrorist attacks and accidents on German soil are rising. Both scenarios require more surveillance, intelligence and preventive action.

4.8 Higher conflict potential regarding critical infrastructure

Energy delivery infrastructure for all sources including electricity will have a higher importance in an oil constrained world, thus, securing its reliability, security and availability becomes mission-critical. International cooperation is needed to secure large international supply paths (pipelines, sea routes).

4.9 Larger “energy regions” change international alliances

The expectation of stronger connections between suppliers and consumers across continents creates different settings for current international alliances and security risks. DESERTEC (a large power production system in Northern Africa based on CSP) would require different settings even for military strategies.

4.10 Peak Oil for armed forces

Armed forces would also be significantly affected by fossil fuel limits, as they are very dependent on oil products. Significant investments in alternative energy procurement technologies (biofuels, coal-to-liquids - Fischer-Tropsch) and applications (electric and hybrid vehicles) would be required, with long transition times. Further, local energy-independence of stationary troop infrastructure (like military bases) using more renewable sources would be beneficial. The long term objective would be to fully convert Germany’s armed forces to only use renewable energy sources by 2100.

4.11 Crude Oil as a systemic risk

For scenarios which end with a complete destabilization of societies, Germany is at a significant risk given its strong participation in a globalized economy. Being still able to act requires a number of basic infrastructures to keep functioning, both for the country and its armed forces. Work is required to look into redundancy, high-resilience of infrastructure and local self-organization approaches.

5. Summary

The report sees significant risks arising from an unavoidable peak in oil production, which go beyond gradual shifts in energy systems and economies. This will likely lead to economic change and new geopolitical risks that affect much more than just what we can anticipate. The overall ability to describe exact outcomes is very limited, as many scenarios are possible, and further research is required.

Overall, more emphasis needs to be put on understanding and shaping international relationships with respect to energy security, anticipating and integrating the ongoing shift to different players in a resource-constrained world.

In any case, Germany has to identify and implement alternatives to the current transportation technologies that require oil, and put a similar emphasis on avoiding other dependencies, for example concerning rare earths.

For armed forces, Peak Oil creates significant risks, both from a mobility standpoint as well as from dependencies on other societal services. Understanding those risks requires further analysis and likely a very different approach in the future.

In general, more preparation is required for society and the army to make sure that problems are recognized and solutions are actively implemented.

That's why it desirable to have an honest and balanced debate on energy policy. If not to help governments (procrastination, limited competence and degradation of political establishment dealing with this issue is well documented), then at least to take more or less informed decisions for ourselves. It looks like baby boomers are the most lucky generation in the world history; they probably will manage to drive into sunset relatively undisturbed. Their children might be less lucky.

Instead of launching an all-out drive to reduce Americans' high consumption of oil for personal transportation (you can't do much to improve efficiency of large tracks other then shipping goods by rail) and demanding from all new personal cars the level of fuel efficiency on the level of Toyota Prius (but notice that cost of the battery eats considerable chunk of fuel economy if you compare the price of Prius with the price of Corolla). In a sense experimentation should be driven by luxury cars, as for them constrains on introduction of new technology are less, that in mass produced models. But it looks like, current plato allows auto industry more gradual transition to higher efficiency. But what we see in reality is a counterproductive trend of mass switching to SUVs

Many consider Iraq war as a confirmation that the US government knows what is about to happen to global energy supplies and tries to secure the country position in the coming "new normal".

The key question is what we would experience if the hypothesis about gradual exhaustion of cheap fossil fuel reserves is true:

It is bewildering that national government has done so little to address Peak ERoEI (aka Plato Oil). Western government including the USA did almost nothing other then to invade some oil producing countries and stage color revolutions in others. In the USA we have the following sad picture:

We watched how 2008 credit bubble collapse morphed into a global financial crisis. Now, we might be close to the collapse of the 50 year old Cheap Oil Bubble that could have far greater ramifications. As someone in the Oil Drum forum pointed out, recently, most of our problems are caused by solutions. Here is one insightful comment (adamx on April 14, 2012)

"Both parties are being rapidly discredited" - yes, but there is a space between being discredited and being pushed out.

I am taking a course on Japanese Edo literature. Literature during the Edo period is known for it's satirical elements and for the commercial aspect - although people tend to talk about "feudal" Japan, Edo era Japan was sort of proto-capitalist.

Speculators worked financial markets and real estate markets, money was an everyday concern, businesses flourished and their owners became rich (despite being officially on the bottom of the caste system)... Even for people in the country, it was not exactly classically feudal. This created a tension as the old feudal caste system and closed country policy were in tension with realities of the society.

However, one aspect that shows within the satire is that most people pretty much accepted that the system couldn't be changed. There were banned books and true subversives, but for the most part, it was like people watching South Park today - they laughed at the messed up system and hypocrisy, but laughed knowing they weren't going to try to overthrow it.

I think that both parties are long since discredited, but on the whole there is not enough strain within the system to create revolutionary fever. I do wonder, though, if peak oil will be the strain, like Perry's boats were in Japan, that leads to a radical change in the system.

Looks like oil should go up for many reasons of which limited supply is just one factor. Increase in price of oil is a modern world inflation which somehow became partially detached from currencies due to complexity of civilization.

By Craig Stern (Flagstaff, AZ USA) The Truth is Out There, March 25, 2004

I first ran across this book referenced in a footnote about three years ago and tried to track it down. First I tried to purchase it, but found that it was out of print and used copies were going for $100.00+ on the internet. I found this curious since it was relatively recent (1993) and, given its topic, was certainly of tremendous interest to US readers, even before the events of 9/11 and the subsequent Gulf War II. I was fortunate to find it in my university library and have since read it several times. I am tempted to go 'on and on' about this book, especially since it is not easily available for people to read. Nor does anyone seem to feel that they can (or are able to?) republish what should be a 'best seller' in the current geopolitical climate and circumstances. Engdahl, whose personal background includes engineering and law (Princeton), working in Texas oil industry, and international economics (University of Stockholm), does a penetrating and eloquent job of sorting out the complex web that connects the controlling interests of international politics with the goals and objectives of global oil and financial interests, these having merged in the last century into the powerful and dominant hegemony of an Anglo-American consortium.

There are so many revelations that are so well documented that one has to slow down and completely reorientate his or her conception of and attitude toward recent history. His tone is neither particularly vindictive nor is it conspiratorial. It looks at people and events and provides plausible motives and methods that are not part of the conventional awareness. For example, (fact) the British navy decided in the late 19th century to change their primary fuel source from coal to oil, thereby (objective) needing to secure access to oil reserves, basically in perpetuity. (result) British agreements for oil resources with the Sheikh of Kuwait date from 1899. (fact) Oil then comes to supplant coal as the primary energy source for all of the industrializing world, and a decade later Germany threatens to become the leading industrialized nation in Europe and (objective) needs a secure source of oil, so they begin construction on the Berlin to Baghdad railway intending to capitalize on agreements to import Iraqi oil. (question) How does Britain meet this emerging geopolitical threat. (objective) Block Germany's access to Middle East oil. (result) Curiously WWI begins with an out-of-the-way assassination in Croatia that just happens to occur near the route of that railway. War ensues and not only is the B-to-B railway cut off, but Germany loses all colonial power in the Middle East.

Shortly after WWI the leaders of the seven major western oil companies meet and agree to not compete with each other but to cooperate, and in 1928 drew up the Red Line agreement that gave virtually control of virtually all Middle East oil to the Anglo-American cartel. Even France's portion was minimalized to Turkish reserves. The Anglo-American consortium came to be known as the Seven Sisters and over the course of the ensuing decades become more and more infused with global banking and financial interestes, i.e., Rockefeller, J.P.Morgan, the Warburgs, the Rotheschilds, Brown Harriman, etc., coming to dominate the world economy by controlling the primary energy source. It is "all about oil" and has been since the turn of the century.

Engdahl's references are extensive and substantiate his disturbing interpretation of history, like the intentional suppression of the German Mark after WWI and the intentional manipulation of the OPEC oil embargo of the 1970s as a premise to artificially inflate global energy costs (a Bilderberg target objective), thereby making BritPetr North Sea oil exploration efforts solvent and bankrupting the debt burdened Third World.

Engdahl's revelatory insights go up through Gulf War I and one can only speculate as to his thoughts on the current Bush administration's economic/tax policies, the Iraq intervention, and their relationship to consolidating control of the global economy into the hands of a few staggeringly wealthy individuals and corporations. This book should be IN PRINT and TODAY!

Luc REYNAERT (Beernem, Belgium) Full spectrum dominance, April 1, 2006

H. Kissinger has said: 'control energy and you control the nations.' W. Engdahl explains the all importance of oil in world domination, and more specifically its geopolitical, military, economic and financial impact.

Oil became for the first time an important raw material during World War I, when air, mobile tank and swifter naval warfare held the upper hand.

After WWI the British sought to secure their petroleum supplies, by creating the League of Nations, which was only a facade of international legitimacy to a naked imperial seizure of territory. British imperial power was based on 3 pillars: control of world sea-lines, of world banking and finance and of strategic raw materials. Through its free trade policy (liberalism) it tried to preserve and to serve the interests of an exclusive private power: a tiny number of bankers and institutions of the City of London.

Its hegemony was attacked and replaced by the US after WWII, confirmed by the Bretton-Woods Agreements with the creation of the IMF and the World bank. The new hegemon was (and is ) built on 2 pillars: military power and the dollar, but those pillars are fundamentally intertwined with one commodity: petroleum, the basis of the world economy's growth engine.

10% of the Marshall aid to Europe after WW II served to buy US oil. The big US oil companies asked top dollars for their exports and obtained also that the aid could not be used to build refineries.

The Vietnam war constituted a massive diversion of the US industry into the production of defense goods (pillar 1). The first oil shock of 1973 made the US banks the giants of world banking and the oil companies the giants of world industry: 'The artificial oil price inflation was a manipulation of the world economy of such a hideous dimension that it created an unprecedented transfer of the wealth of the entire world into the hands of a tiny minority. It was no less than a global world taxation through petrodollars.' (pillar 2, confirmed by Sheikh Zaki Yamani). The oil companies also took the 'blossom of the nuclear rose'.

A cardinal goal of US foreign and military policy is control of every major existing and potential oil source. Such control would permit it to decide who gets how much energy and at what price: 'a true weapon of mass destruction'.

William Engdahl's brilliant but frightening analysis puts in the same framework Iraq, the Balkan wars, the collapse of the Soviet Union and the emergency of the oligarchs, the financial crises across Asia, the civil wars in Africa, the IMF and World bank policies, the fall of the Shah (after the collapse of the negotiations with BP), as well as the murders or 'accidental' deaths of W. Rathenau, I. Krueger, E. Mattei, J. Ponto and A. Moro.

At the start of the new millenium, the US has a near monopoly on military technology and might, commands the world's reserve currency and is able to control the assets of much of the industrial world. It fights for a near monopoly on future energy resources; in other words, for 'full spectrum dominance'.

William Engdahl has written an eye opening, fascinating but extremely dark book.

A must read. Help other customers find the most helpful reviews Was this review helpful to you? Yes No Report abuse | Permalink Comment Comments (2)

Joanneva12a (USA): Never have so few, taken so much, from so many, July 7, 2006

This book tells the hidden history of oil and money, and how they have been the underlying cause of almost every conflict since WWI. At the turn of the century oil became the new fuel to power naval fleets and provide energy. Ever since, the Anglo-American powers and their cohorts have never ceased to interfere in the affairs of other nations. In the cold calculating hands of a few, they have become the strategic weapons of choice to extend their sphere of global hegemony and domination.

The first few chapters lay the groundwork showing how early British `balance of power' politics produced a long and bloody history of colonial subjugation of developing nations and her subsequent steps taken to insure a war against an economically rising Germany who had embarked on a Berlin to Baghdad rail project. Maneuvered out of her isolationism, the United States joined WWI just as Britain, seeing a colossal opportunity at colonialism and control over oil, issued her mysteriously timed Balfour Declaration to Zionist Lord Rothschild during the darkest days of the war, and secured her foothold in Palestine by means of secret agreement.

The decades after, saw an increasingly close association of U.S. and British interests (among others), with many current US organizations being born out of their British counterparts who brought their Malthusian and social intelligentsia views along with them. So close in fact would this relationship become, that Henry Kissinger once admitted in his own words: "I kept the British Foreign Office better informed and more closely engaged than I did the American State Department"

Mr. Engdahl then takes us on a journey to show how the politically rich and powerful along with their accomplices in the private sector have created chaos out of order and used the depravity of each situation for their own ends as they played out their Faustian fantasies on the world. With their organized looting of nations, each new cataclysm preceded the charade of loaning `new money" to pay "old debts" and is ongoing to this day.

The number of victims in this book is startling, hence the play on words to Churchill's speech. As Bush and his wrecking crew are busily working on a script written long ago, their Iraqi exit strategy is most likely the balkanization of Iraq or imposition of "dollar democracy". Take your pick as either will suffice. And throughout the decades, the mother of all harlots is the system of fiat currency, which is the mechanism by which endless wars are financed while sucking the life of the tax paying middle class dry.

America has been hijacked by minds that have their roots in certain sociopathic ideologies that have gone out of their way to promote policies that lead to exploitation, inequality and despair. We were the first nation to free ourselves from British rule, and sadly in many ways. `A Century of War' shows just how much the former colonies have bought back into the very system our forefathers revolutioned against.

|

|

Switchboard | ||||

| Latest | |||||

| Past week | |||||

| Past month | |||||

29 April 2015 The Guardian

lmost from the start of the international oil boom of the late 19th century, Russia was a major player. The city of Baku, now in Azerbaijan but then a southern outpost of the empire, was producing half the world's oil in 1900, and though it lost market share during the years of revolution and civil war, Russia remained an oil power through the Soviet era. Soviet geologists discovered oil in the Volga-Urals basin and then, most rewardingly, in western Siberia. The Samotlor field, discovered in 1965, was one of the largest in the world, and its oil would subsidise Soviet military and social programmes throughout the period of late socialism, right up until the collapse of world oil prices in 1985. In a lesson about oil dependence that was quickly forgotten, the price collapse was followed by the collapse of the entire country.

Since 1991, two things have happened to Russian oil. First, as the Russian economy was opened up to global competition, hydrocarbons became not less but more important: no one wanted Russian cars or electronics or Russian shoes, but Russian oil was pretty much as good as any other. And so the great post-Soviet fortunes were largely oil fortunes. It was oil that paid for Roman Abramovich's purchase of Chelsea football club, and it was oil that paid for Mikhail Khodorkovsky's attempt to mount a challenge against Vladimir Putin. Most important of all, it was oil that paid for the Russian economic "miracle" of the Putin era, when oil prices rose steadily for years on end, and Russian living standards with them, and Putin got all the credit.

The second thing that happened was that the western Siberian oil fields started to run dry. In fact many of them were past their prime by the late 80s, and it was only aggressive western specialists in "tight oil" (light crude oil found in shale and rock formations), hired by people such as Khodorkovsky, who managed to get everything out of them that they could. Nonetheless, the resource was finite.

One thing that failed to happen was any major new discoveries. In the uncertain legal climate, if you happened to gain control of an oil company, you'd have to be crazy not to pump all the oil you could from existing wells before someone came and took your company away from you. What's more, the Soviets had done a good job of covering the country. There may not be another western Siberia or Baku.

Chinmay -> Bluecloud 5 May 2015 10:32Greenpeace India has been funded by various European organizations who in turn received money from European and North American Governments. The agenda Greenpeace is working on in the developing countries is to stop development so that West can keep on enjoying their dominance over world's resources.

vr13vr -> thesistersofmercy 29 Apr 2015 14:07Did they got the permission for their "peaceful protest" on the foreign rig? If not, it's an attempt of illegal boarding. Russians were right to react.

vr13vr -> alpamysh 29 Apr 2015 14:03

Where is that 80 years old nun that tried to protest around the nuclear station in the US?

A hint: she is still in a Brooklyn prison.

vr13vr 29 Apr 2015 14:01

"The prisoners themselves were pretty nice, but the food was bad... . The fact that most of the Greenpeace activists spoke no Russian didn't help."

No kidding! He didn't have choice to order how he wants his eggs for breakfast? And yes, learning the language could be helpful if they were preparing to go to a foreign prison.

vr13vr 29 Apr 2015 13:56

This is the second article about this book in so many weeks. This starts feeling as a book promotion.

samanthajsutton 29 Apr 2015 11:03For some perspective please remember the action against Rainbow Warrior -- Which resulted in a death.

And no, it wasn't Russia!!

For those of you too young to remember, see:

http://en.wikipedia.org/wiki/Sinking_of_the_Rainbow_Warrior

suzzanalator 29 Apr 2015 10:47What about the risk to those on the oil rig?

Do Greenpeace care about the lives of the workers on the rig?

As to be expected, the actions of Greenpeace in attempting to board the rig caused a response from those on the rig.

What if one of the workers on the rig had fallen into the sea due to the actions of Greenpeace? More or less instant death in those conditions.

Greenpeace needs to think through these stunts and remember that they carry a risk.

In this particular case it seems to me that the risk of injury was high - to the workers on the rig and to the memberso of Greenpeace.

whobailedoutwho -> alpamysh 29 Apr 2015 10:46The definition of the crime of piracy is contained in article 101 of UNCLOS, which reads as follows:

''Piracy consists of any of the following acts:

(a) any illegal acts of violence or detention, or any act of depredation, committed for private ends by the crew or the passengers of a private ship or a private aircraft, and directed:

(i) on the high seas, against another ship or aircraft, or against persons or property on board such ship or aircraft;

(ii) against a ship, aircraft, persons or property in a place outside the jurisdiction of any State;

(b) any act of voluntary participation in the operation of a ship or of an aircraft with knowledge of facts making it a pirate ship or aircraft;(c) any act of inciting or of intentionally facilitating an act described in subparagraph (a) or (b).''

Their actions could be considered "attacking" the rig - ie depredation.

Mordantdude -> Bluecloud 29 Apr 2015 06:09

It sounds absolutely the same as words "independent Western massmedia".

Mordantdude -> james187 29 Apr 2015 05:54

Are Guantanamo basic human rights suit you well?

Albatros18 29 Apr 2015 05:07

Greenpeace should be thankful to the Russian government. If they tried this illegal act on any other country's waters such as the US, France or Israel, they would have been thrown into the sea or got shot. Perhaps this is what they wanted in the Arctic to show how 'evil' Russia is.

Albatros18 -> Bluecloud 29 Apr 2015 05:04

It is not working. The Russian activity in the Arctic doubled, more nuclear energy is being used and more plants opening in Turkey, Britain, Hungary, Iran and soon south America. Greenpeace has no power or credibility to change anything. Greenpeace is itself a rich kids club whose members will end up in boards of global corporations.

davies12 29 Apr 2015 04:30

"Their plan was to climb on to the massive Prirazlomnoye oil platform in the Pechora sea, set up shop, and communicate their message to the world: "Save the Arctic.""

Followed a little later by.... "arrest of 30 peaceful protesters"

Boarding a drilling rig in a country's territorial waters without permission to "set up shop" or takeover in other words used to have a name and that was piracy. Ah but apparently not when liberal climate changers are doing it. The Russians were quite within their rights to come down hard on them. A lesson that could be learned by us when for example ships are boarded by pirates off Somalia...ah but they are poor souls who are struggling to earn a living.

PlatonKuzin 29 Apr 2015 04:09Greenpeace is no longer an honest environment protector. It is a well organized and well paid organization working for those who pay them. And the justice Greenpeace stands for is strictly fixed by their sponsors.

Google matched content |

...

Society

Groupthink : Two Party System as Polyarchy : Corruption of Regulators : Bureaucracies : Understanding Micromanagers and Control Freaks : Toxic Managers : Harvard Mafia : Diplomatic Communication : Surviving a Bad Performance Review : Insufficient Retirement Funds as Immanent Problem of Neoliberal Regime : PseudoScience : Who Rules America : Neoliberalism : The Iron Law of Oligarchy : Libertarian Philosophy

Quotes

War and Peace : Skeptical Finance : John Kenneth Galbraith :Talleyrand : Oscar Wilde : Otto Von Bismarck : Keynes : George Carlin : Skeptics : Propaganda : SE quotes : Language Design and Programming Quotes : Random IT-related quotes : Somerset Maugham : Marcus Aurelius : Kurt Vonnegut : Eric Hoffer : Winston Churchill : Napoleon Bonaparte : Ambrose Bierce : Bernard Shaw : Mark Twain Quotes

Bulletin:

Vol 25, No.12 (December, 2013) Rational Fools vs. Efficient Crooks The efficient markets hypothesis : Political Skeptic Bulletin, 2013 : Unemployment Bulletin, 2010 : Vol 23, No.10 (October, 2011) An observation about corporate security departments : Slightly Skeptical Euromaydan Chronicles, June 2014 : Greenspan legacy bulletin, 2008 : Vol 25, No.10 (October, 2013) Cryptolocker Trojan (Win32/Crilock.A) : Vol 25, No.08 (August, 2013) Cloud providers as intelligence collection hubs : Financial Humor Bulletin, 2010 : Inequality Bulletin, 2009 : Financial Humor Bulletin, 2008 : Copyleft Problems Bulletin, 2004 : Financial Humor Bulletin, 2011 : Energy Bulletin, 2010 : Malware Protection Bulletin, 2010 : Vol 26, No.1 (January, 2013) Object-Oriented Cult : Political Skeptic Bulletin, 2011 : Vol 23, No.11 (November, 2011) Softpanorama classification of sysadmin horror stories : Vol 25, No.05 (May, 2013) Corporate bullshit as a communication method : Vol 25, No.06 (June, 2013) A Note on the Relationship of Brooks Law and Conway Law

History:

Fifty glorious years (1950-2000): the triumph of the US computer engineering : Donald Knuth : TAoCP and its Influence of Computer Science : Richard Stallman : Linus Torvalds : Larry Wall : John K. Ousterhout : CTSS : Multix OS Unix History : Unix shell history : VI editor : History of pipes concept : Solaris : MS DOS : Programming Languages History : PL/1 : Simula 67 : C : History of GCC development : Scripting Languages : Perl history : OS History : Mail : DNS : SSH : CPU Instruction Sets : SPARC systems 1987-2006 : Norton Commander : Norton Utilities : Norton Ghost : Frontpage history : Malware Defense History : GNU Screen : OSS early history

Classic books:

The Peter Principle : Parkinson Law : 1984 : The Mythical Man-Month : How to Solve It by George Polya : The Art of Computer Programming : The Elements of Programming Style : The Unix Hater’s Handbook : The Jargon file : The True Believer : Programming Pearls : The Good Soldier Svejk : The Power Elite

Most popular humor pages:

Manifest of the Softpanorama IT Slacker Society : Ten Commandments of the IT Slackers Society : Computer Humor Collection : BSD Logo Story : The Cuckoo's Egg : IT Slang : C++ Humor : ARE YOU A BBS ADDICT? : The Perl Purity Test : Object oriented programmers of all nations : Financial Humor : Financial Humor Bulletin, 2008 : Financial Humor Bulletin, 2010 : The Most Comprehensive Collection of Editor-related Humor : Programming Language Humor : Goldman Sachs related humor : Greenspan humor : C Humor : Scripting Humor : Real Programmers Humor : Web Humor : GPL-related Humor : OFM Humor : Politically Incorrect Humor : IDS Humor : "Linux Sucks" Humor : Russian Musical Humor : Best Russian Programmer Humor : Microsoft plans to buy Catholic Church : Richard Stallman Related Humor : Admin Humor : Perl-related Humor : Linus Torvalds Related humor : PseudoScience Related Humor : Networking Humor : Shell Humor : Financial Humor Bulletin, 2011 : Financial Humor Bulletin, 2012 : Financial Humor Bulletin, 2013 : Java Humor : Software Engineering Humor : Sun Solaris Related Humor : Education Humor : IBM Humor : Assembler-related Humor : VIM Humor : Computer Viruses Humor : Bright tomorrow is rescheduled to a day after tomorrow : Classic Computer Humor

The Last but not Least Technology is dominated by two types of people: those who understand what they do not manage and those who manage what they do not understand ~Archibald Putt. Ph.D

Copyright © 1996-2021 by Softpanorama Society. www.softpanorama.org was initially created as a service to the (now defunct) UN Sustainable Development Networking Programme (SDNP) without any remuneration. This document is an industrial compilation designed and created exclusively for educational use and is distributed under the Softpanorama Content License. Original materials copyright belong to respective owners. Quotes are made for educational purposes only in compliance with the fair use doctrine.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to advance understanding of computer science, IT technology, economic, scientific, and social issues. We believe this constitutes a 'fair use' of any such copyrighted material as provided by section 107 of the US Copyright Law according to which such material can be distributed without profit exclusively for research and educational purposes.

This is a Spartan WHYFF (We Help You For Free) site written by people for whom English is not a native language. Grammar and spelling errors should be expected. The site contain some broken links as it develops like a living tree...

|

|

You can use PayPal to to buy a cup of coffee for authors of this site |

Disclaimer:

The statements, views and opinions presented on this web page are those of the author (or referenced source) and are not endorsed by, nor do they necessarily reflect, the opinions of the Softpanorama society. We do not warrant the correctness of the information provided or its fitness for any purpose. The site uses AdSense so you need to be aware of Google privacy policy. You you do not want to be tracked by Google please disable Javascript for this site. This site is perfectly usable without Javascript.

Last modified: June, 18, 2019