|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

There are signs that in Q1 of 2016 oil prices reached temporary cyclical bottom caused mainly by casino capitalism factors (future markets games and Saudis predatory pricing) , not production factors ("oil glut"). Among arguments in favor of this hypothesis are

Prices below $80 now represent a "dead zone" for the US shale oil industry. IMHO shale oil optimists should try to understand a very simple statement: Prices below $80 now represent a "dead zone" for shale in which companies will not get the level of financing they are used to and which allowed them drilling like mad and service their debts and other obligations while having negative cash flow.

The same is generally true for Canadian oil sands.

Consumption continues to grow as Earth population continued to grow.

Depletion of traditional oil fields continues unabated

Capital expenditures into development of new fields are radically slashed everywhere in the world and most probably will say low in 2017 and 2018.

Speculators who control oil price via futures can change their behaviors on a dime and run it up.

New oil deposits generally require oil price above $60 to be economically viable.

Geopolitical factors that stimulated oil crash (the desire of certain countries to hurt Russian and Iran economies) might slightly change with the end of the term for Obama administration, especially if he will be replaced not by another neocon(Hillary Clinton) but by less jingoistic and more pragmatic Donald Trump.

In my previous article Why the Bakken Boomed, I discussed the shale oil boom that has had such a dramatic impact in North Dakota's Williston Basin over the past decade. But throughout the U.S. shale boom there have been those who doubted that the production gains would prove anything other than fleeting. Those doubts were grounded in the fact that shale oil production is more complex and expensive than conventional oil production, and the fact that cash flow has been consistently negative for virtually all shale oil producers.

While the doubts are based on fact, the story is more complex than it may appear. Isn't that always the case though? Things are never quite as simple as they seem. Superficially, the narrative for many has been "Shale oil isn't economical. The wells deplete too quickly. Just look at the negative cash flow."

But it's just not quite that simple. Let's dig a little deeper to gain a better understanding of what has happened, what is happening, and what is likely to happen moving forward.

First it's important to understand that the oil industry is cyclical, and more importantly to understand the reason that it is cyclical. The long history of the oil industry has been one of boom and bust cycles. During the booms we hear about windfall profits, but during the downward part of the cycle, oil companies lose a lot of money and many people lose their jobs.

So why is the oil industry cyclical? It's not complex. It is a function of the capital-intensity of the business, and the multi-year lag time in getting projects executed. If you just want the executive summary, here it is. I have arbitrarily started this at the bottom of the cycle, and the 5 stages I have described here could be described at a more granular level with more stages:

Keep in mind that some of these steps overlap in time, partially because the oil industry is made up of so many different companies with many different management styles. One company may still be investing heavily while another has already slashed spending in anticipation of falling prices.

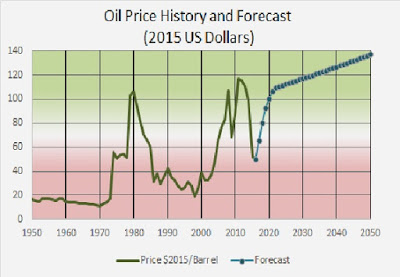

We were at Stage 1 of the cycle in the late 1990s, when oil prices were bouncing between $20 and $30/bbl. In response to low prices, oil companies were conservative in their capital expenditures leading up to the early 2000s. In 2002 the price of oil slowly began to rise as demand growth outpaced new supplies and reduced the world's spare capacity cushion. We were entering Stage 2.

Source: Energy Information Administration

We spent the early part of the past decade in Stage 2, but then most of 2005-2010 was spent in Stage 3. In 2005, the price of West Texas Intermediate (WTI) averaged $56.64, rising to an average of $66.05/bbl in 2006, $72.34/bbl in 2007, $99.67/bbl in 2008, but then falling back to $61.95/bbl in 2009.

Demand in the developed world started to decline in earnest in 2008. This marked the early stages of Stage 4, which was drawn out because of strong demand growth in developing countries (which kept global demand growing). But new production was coming online at a rapid pace in response to $100/bbl oil, and a supply cushion began to once again expand. In mid-2014, we entered Stage 5 as the price of oil began to collapse.

In 2005, most oil companies generated solid operating cash flow - defined as the cash generated by a company related to core operations. But as the shale boom accelerated, and with prices remaining high, oil companies went on a spending spree to get new projects implemented. Prices got so high that oil companies were investing every cent they could get their hands on to capitalize on the opportunity.

It's easy to understand why they do it. Imagine you are running a business, and making very hefty margins on the products you are selling. You would likely want to plow your profits back into the business to grow sales as long as the margins are strong. If you are getting higher prices for your products each year, you are going to continue to plow that money back into growing the business. But this may very well put your business in a negative cash flow position even when prices are high.

As long as margins are good, you can grow your business rapidly. But what happens if prices collapse? It depends. If you grew by highly leveraging your business - in other words if you borrowed lots of money to grow it even faster – then you could be in trouble. If, on the other hand you don't have a lot of debt to service and are able to slash your capital spending, you may be able to generate profits even though prices have collapsed.

As the spending spree ensued, cash flow turned solidly negative by 2009, even though the price of oil was higher than it was in 2005. A recent graphic by Oppenheimer tells the tale:

When oil prices began to fall in mid-2014, companies began slashing capital expenditures. But they are slashing from capital expenditures that a year earlier were based on $100/bbl oil. Oil prices have fallen so far, so fast that essentially all oil and gas companies are still in a negative cash flow position despite the cuts they have made (except of course the refiners, who benefit from low oil prices). And they are slashing based on projections of where they think oil prices will be in the future. Different companies will have different ideas of where oil prices are headed and different levels of indebtedness, so they will naturally differ in how aggressively they will prune capital expenditures.

History argues that, even if oil prices remain near $50/bbl for an extended period of time, some companies will be able to rein in costs enough to generate free cash flow as they did in 2005. Of course the counterargument is that it costs more to produce oil in 2015 than it did in 2005, when companies had positive cash flow with WTI at $56.64/bbl. After all, it took higher prices to enable the shale oil boom, and therefore it stands to reason that it will take higher prices to keep it going.

Let's first consider the economics of producing oil from a shale play. (For a more detailed explanation, see Art Berman's recent Forbes article Only 1% Of The Bakken Play Breaks Even At Current Oil Prices).

Broadly speaking, the economics of oil production hinge on the cost to drill and complete the well, and the amount of oil, gas, and natural gas liquids that are obtained from the well. There are also other expenses involved, such as operating costs, taxes, exploration costs, etc. But let's focus on the cost to drill and amount of oil produced.

If an oil producer spends $5 million to drill and complete a well, but only recovers 100,000 barrels of oil from that well, then that's $50/bbl just on the drilling and completion costs. If, hypothetically they could produce 1 million barrels from that well, then it's just $5/bbl on drilling and completion costs. Thus, the amount of oil ultimately recovered has a huge impact on the cost of production.

In the early days of the shale oil learning curve, the wells were more expensive to drill and complete relative to the production levels that were being achieved. As operators gained more experience by experimenting with the number of fracking stages, the amount of sand, etc., they lowered their cost of production. A 2009 filing by Brigham Exploration - later acquired by Statoil (NYSE: STO) - demonstrates how oil well economics improved as more hydraulic fracturing stages were introduced to horizontal wells:

Source: Brigham Exploration SEC filing

This shows that within four years or so this company was able to reduce the cost of producing a barrel of oil in the Bakken by more than $25/barrel of oil equivalent (BOE). (Note that this is only the cost to produce; it doesn't include operating costs, etc.). Thus, what may have only been economical at $100/bbl in 2006 could have been economical at $75/bbl by 2010. By 2014, many were claiming that the break even cost had fallen to $60/bbl or even lower.

But that's an industry wide estimate. As Art Berman explains in his article, there are a few Bakken wells that are breaking even with Bakken oil prices in the low $30s (and WTI in the mid-$40s). But those wells are the most productive wells in the Bakken Formation, which drives down the cost per barrel for drilling and completion.

Industry wide, it's probably going to take WTI prices of at least $60/bbl before the average Bakken well breaks even. Of course that's an average; some operators will still be in trouble at that price while others will start to generate positive cash flow.

So what about the notion that fracked wells deplete too quickly, and that is why they can't be economical? I have heard this justification repeated many times, but again reality is more complex. First, it isn't a mystery to the companies drilling these wells that they deplete quickly. What they are interested in is the estimated ultimate recovery (EUR).

If you are familiar with the time value of money, you would like to have your investment paid back as quickly as possible. So if I have a well that is going to produce 500,000 barrels during its lifetime, do I want a slow and steady depletion to zero? No. As an operator, I want to get that oil out as quickly as I can without damaging the well and reducing its ultimate production.

Where some see fast depletion as a problem, another way to look at it is that you got most of the available oil out quickly. (Note that some operators are experimenting with throttling wells early on to determine whether that increases the EUR).

The history of the oil industry has been one of cycles, from nearly the beginning of the industry in the 1850s through today. In the down cycle that we are currently experiencing, demand rises due to low prices, even as oil producers begin to cut capital expenditures. U.S. shale production has already begun to decline as very little shale oil production is currently profitable. The end result is very predictable, even if the timing is not. While there is broad agreement that a great deal of U.S. oil production is currently unprofitable, some feel like oil prices need to fall further to make a bigger dent in production because crude oil inventories are still quite high. I feel like with the continued growth in global demand, we can already see the supply/demand picture tightening on the horizon. When that becomes broadly obvious, oil prices will again rise, bringing profits to the industry and higher capital spending on new projects. How long that process takes will determine how many oil companies are left standing to reap those profits.

|

|

Switchboard | ||||

| Latest | |||||

| Past week | |||||

| Past month | |||||

Feb 13, 2017 | peakoilbarrel.com

Seppo Korpela says: 02/10/2017 at 8:33 pmThe report by the Hills Group claims to rely on thermodynamics arguments to predict oil's price-volume trajectory going forward. If does not stand up to scrutiny.Rune Likvern says: 02/10/2017 at 10:34 pmThermodynamic analysis of engineering systems is typically based on the first law of thermodynamics together with mass balances.

The second law of thermodynamics introduces the entropy as a thermodynamic property and the related concepts of reversible processes and reversible heat transfer.

Irreversibilities in real processes are taken into account by assigning a value of experimentally determined efficiency to equipment such as pumps, compressors and turbines and

this way the reversible processes are related to the actual ones.A relatively recent development has been to develop a systematic use of an exergy balance to examine where in a complex energy system irreversibilities

take place. Exergy is defined as the maximum theoretical work that can be obtained from a system and its environment as the system comes to equilibrium

with its environment. By combining the first and second laws of thermodynamics an exergy balance can be written down.Rudimentary exergy analysis can be found in the 1941 book Thermodynamics by Joseph Keenan. It was called availability analysis at that time. The most systematic development of the exergy analysis is in the textbook Fundamentals of Engineering Thermodynamics by M. Moran, H. Shapiro, D. Boettner and M. Bailey, 7th ed. John Wiley, 2011.

Although the entropy balance equation can be used (although typically only for steady state systems) to determine the entropy production, to carry it out requires that sufficient number of thermodynamic properties and interactions are known at the system boundaries. Since such a calculation needs to be carried out after the thermodynamic analysis has been completed, it is seldom carried out in engineering practice because the knowledge of the same properties allows the efficiency of the machine or system be determined.

The advocates of exergy accounting claim that knowing where the exergy destruction takes place in a system is a good way of allocating development money to improve it.

This kind of analysis has not taken hold in industry either, simply because, manufacturer, say of turbines know that the irreversibilities are quantified by measuring the efficiency of the turbine, and they direct their efforts toward understanding how the blades of the turbine can be shaped in order to reduce the irreversibilities. Such a task is based on aerodynamic calculations. Compressors and pump are by the nature of the flow through them machines with lower efficiency and their improvement requires again experts with fluid dynamic knowledge to improve them. Similarly improving the heat transfer in a heat exchanger is carried out by making improvements in the heat exchanger surfaces and reducing pressure losses.If these improve the heat transfer, the entropy production is reduced. Here the expertise of a heat transfer specialist rather than a thermodynamicists is needed.

One interesting application of exergy analysis is to calculate the second law efficiency. A high second law efficiency means that the source of energy is well matched with the application.

Thus heating shower water with a thermal solar heater is a good match as unfocused solar energy raises the water temperature high enough to serve as shower water, but not nearly so high as to create superheated steam to power a steam turbine. Thus the most important insight to be obtained is to match the source of energy to the application, and once this insight is internalized, calculation of the second law efficiency adds only marginally to understanding. For this reason it is seldom used in industry. To be sure, optimization of a system's second law efficiency is still worth while, but using other metrics this can be done with topics based on heat transfer, fluid dynamics, stress analysis and the like.

Where thermodynamic analysis is helpful is in seeing how a thermodynamic efficiency of a system such as a coal or nuclear power plant can be improved by increasing the maximum steam temperature of the plant in which the turbine is but one component. This requires that blades are made of materials that withstand the stresses generated at these temperatures. Such developments have increased the maximum temperature of these power plants to about 1000 F, but further improvements have now stalled over the last half a century. For gas fired power plants combustion temperature is higher and and turbine designers implement both cooling technology for the blades and use high temperature materials, that today are made of single crystals, that withstand the hot combustion gases. Interestingly exergy analysis shows that most of the exergy

destruction takes place in the combustion of the fuel, but there is not much one can do to reduce this destruction. For this reason a naive application of exergy analysis may lead the poor allocation of development funds.The report by the Hills Group proposes to use the second law of thermodynamics as the starting point. The unsteady entropy balance for a control volume with one exit and no inlet is given as

dS_cv/dt= Q^dot_j/T_j – m^dot_e s_e = \sigma^dot_cv

Next comes the assumption that at all times dS_cv/dt = m^dot s_e$. It is based on the observation that because at the end of oil production when the reservoir has been completely depleted the flow will stop and nothing much takes place, then both of these terms are zero. After cancelling these terms the entropy production is seen to be related to the heat transfer. But his assumption is clearly unjustified while the oil is being extracted and these two terms do not cancel each other. The neglect of the terms leads to an equation that omits the entropy production that is caused by the irreversibilities of the oil flow through the permeable reservoir rock.

The incorrect canceling leads to the equation

dot Q^dot_j/T_j = sigma^dot_cv or sigma^dot_cv= Q^dot_j/T_j

and this can be cast in these two forms, depending which term is known and which is unknown. The report by Hills Group does not tell the reader which is a known quantity and which is to be calculated. In fact, there is no indication in the report how the heat transfer is calculated? In thinking about the heat transfer, for a control volume that includes the reservoir only, it appears that the heat interaction between the system and the surroundings is mainly caused by the geothermal gradient. That is, heat enters from the lower boundary and leaves across the upper boundary. This is a passive process.

The fact that the oil and water in the reservoir have some average temperature in the geological setting only influences the viscosity of the fluids and thus how well they move through the reservoir, but from the energetic standpoint the sensible energy is not important. That is, there is no attempt made to extract this energy in a heat exchanger, nor is the high pressure used to extract energy in an expander. Rather the oil and water mixture flows through a set of throttling valves, in which the exergy is destroyed.

If the entropy production were known independently, then this equation could be used to calculate the heat transfer, but the answer would be incorrect because entropy production is caused by both heat transfer and irreversible processes taking place inside the control volume. For the control volume consisting of the reservoir, entropy production takes place mainly in the pores of the permeable reservoir rock as the flow is forced out.

This takes place by local viscous dissipation and although it can be calculated in principle, in practice such a calculation is nearly impossible to carry out from first principles. The entropy production rate for the system would then be calculated by integration of the local values over the entire reservoir.

Next in the analysis is a calculation of E_Tp. It is defined as the total production energy, or the total work required to extract, process, and distribute a volumetric quantity (a gallon) of crude oil. The report offers the equation

E_Tp = [(m_c C_c + m_o C_o ) (T_R-T_O)]/[m_c]

as a way to calculate it. But this is the energy of the sensible part of the oil-water mixture above the reference temperature T_O. It does not include the chemical energy of the crude oil and the formula cannot be reconciled with the definition of E_Tp.

The following equation also appears in the report

E_Tp = integral_{t_1}^{t_2} T_0 \sigma^dot_cv dt\]

Thus there are two equations to use for calculating E_Tp and there is no mention what the independent variables are and what is calculated using these equations.

If the value of E_Tp is calculated this way then how is the previous equation used? The only unknowns are the reservoir temperature T_R and the oil-water ratio, if the total flow rate is determined from the depletion rate equation. The reservoir temperature can be measured, so the unknown seems to be the water oil ratio. However, the report makes use of an empirical equation for the oil/water ratio as a function of the percent depletion of the reservoir.Finally last equation can only be used to calculate the change in exergy, and this would necessitate a new symbol to be introduced for exergy, and this is not the same as energy.

The report next presents calculation of the oil extraction trajectory that is based on Hubbert's methodology. The calculations are in close agreement what others have found., with cumulative production 2357 Gb that is somewhat larger than what Campbell and Laherrere's value 2123 Gb. It is now well known that the in the calculations based on logistic equation there is a slow drift to large values of the ultimate production as more data has been included in the calculations with the passing of the

In the same section is also a discussion of the surface water cut as a function of the percent of oil extracted from a reservoir. The curve is then rotated in order to satisfy two criteria set by the authors. Now a rotation of a curve is a mathematical transformation and a curve cannot be arbitrarily rotated without destroying the underlying mathematical theory. Furthermore, the report states that E_Tp cannot exceed E_G, the crude oil's specific exergy. The terminology is again used loosely applied to both energy and exergy.

Returning to the calculation in Section 4.1 of the report for calculating $E_{Tp}$ by the equation

E_Tp = [(m_c C_c + m_o C_o ) (T_R-T_O)]/[m_c]

The statement on top of page 19 suggests that the water cut is an input parameter, in which case the value of E_Tp depends only on the reservoir temperature.

The reservoir temperature in turn is a function of the depth of the well, owing to the geothermal gradient. This would allow this equation to be used to calculate the sensible energy of oil-water mixture. But what purpose does this serve?

The sensible heat of the crude oil is not used in any significant way. The crude oil cools as it enters the ground facilities and it cools further as it is transported in the pipelines. No power is generated from the sensible part of the crude oil's energy. Only the chemical energy is valuable upon combustion. The rest of the report relates to how prices are linked to the energy delivered. There is no theory to predict how prices adjust to either temporary surplus or deficit.

From what has been discussed above, the thermodynamic analysis is incorrect and therefore any calculations and graphs based on this analysis must also be unreliable. Readers have noted that the so called analysis predicts a peak in oil production during the 2017-2018 time frame and troubles by 2023. That this coincides with the time others have judged the difficulties to appear, seems to give the report a superficial credibility.

If the authors have a better handle on how much energy is expended in oil production, they can form the EROIE ratio and it would constitute an independent check on the work of Hall and his coworkers on EROEI. Such an independent analysis would have some value

Seppo,

+1 000 000!

I am (and many others) now awaiting Hills rebuttal to this.

peakoilbarrel.com

texas tea , 07/16/2016 at 4:58 pm

Art also had this article out last month.I like Art and now he thinks and writes but I also think that he as some Dennis Gartman blood in him, he holds many ideas at the same time and he can argue any of them very well. These articles seem to contradict each other a bit, but they are at least thoughtful..

and now for something completely different:

https://www.donaldjtrump.com/press-releases/an-america-first-energy-plan"Two years into the global oil-price collapse, it seems unlikely that prices will return to sustained levels above $70 per barrel any time soon or perhaps, ever. That is because the global economy is exhausted" ~A.Berman ca. July. 2016Fernando Leanme , 07/16/2016 at 8:06 am"But from 2008 to 2015, oil production actually fell in 27 of 54 countries despite record high price. Thus, while peak oil critics have been proven right in North America they have been proven wrong in half of the World's producing countries" ~ E. Mearns ca. July, 2016

It looks like my posts at this fine blog for the past 2 – 2.5 years are finally being read and understood …..

Maybe one day even Dennis will get the message…….

……one can only hope….."…while indeed initiated by geology, this time "PEAK" shall be by the way – and in the form of low prices…" ~ Petro's main theme for the past 2 years on POB

Be well,

Petro

P.S.: a little hubris and arrogance is healthy now and then….

Here's my forecast

Javier , 07/16/2016 at 9:22 am

Unlikely, Fernando. I see very high volatility in oil prices heading our way.Sustained high prices are only possible with a very good economy or with a very low production (you only sell to the elites).

On the other hand the value of money could tank with a monetary crisis, and oil prices could rise to millions of dollars per barrel.

Stavros Hadjiyiannis , 07/16/2016 at 12:42 pm

I totally agree with you. I see the oil price rising well over 100 bucks per barrel before the end of the decade.shallow sand , 07/16/2016 at 6:07 pmAs for the persistent fantasies that Russian oil output will decline. The exact opposite will happen in the long-term. Russian oil reserves easily dwarf anybody else's.

The concluding paragraph on the oil reserves of the Bazhenov formation in SW Siberia reaches an unequivocal conclusion:

"Giant recoverable oil reserves contained in the fractures suggest that the Jurassic reservoir is a primary oil accumulation which has no analog all over the world. Therefore, we believe that Russia has the largest hydrocarbon reserves in the world."

Any info on how the first wells in this play are performing. Seems it is difficult to find much information online about them.Javier , 07/16/2016 at 4:53 amPetro,Dennis Coyne , 07/16/2016 at 10:29 amIt is fine and dandy that you show some arrogance when the data is starting to support your hypothesis, however I must point out that a lot of people have been coming to the same conclusions at about the same time. There are a lot of clever people in the world.

Ron Patterson has been onto oil decline for a very long time from studying oil production data. He was about the first to realized that LTO was not a solution to the Peak Oil conundrum. He probably realized about the 2015 Peak long before he put it on writing. He can tell us. I seem to recall reading his prediction within the first half of 2015.

Euan Mearns seems to be reaching the same conclusion from the same background, his geological expertise, but only now have I read him put it on writing.

Art Berman has come to the same conclusion from a very different background, the energy investment field. This is also the first time I read him say it so clearly, but he probably reached his conclusion some time ago and only now he dares to write something so strong in his influential blog.

Myself I reached the conclusion that Peak Oil was imminent in September 2014, from economic insight after I clearly saw that the oil price crash was really bad news for the consumer long term, while most people thought (think) that is great news for the consumer. I studied oil production data and saw my fears confirmed. That is when I started my oil (and climate) blog, and my first prediction on writing of a 2015 Peak Oil is from November 2014, and again February 2015.

My understanding of macroeconomy is not as good as yours, but is good enough to understand that we are facing the end of the road and the can kicking will not continue much longer. Central Banks are buying some time through desperate measures that will make the fall harder while the elites hasten their preparations. We are contemplating the Peak of our civilization (in my opinion Peak Civilization took place in the early 70's) and its unraveling is going to be a very long stressful one.

Hi JavierJavier , 07/16/2016 at 11:09 amI only disagree on the timing of the peak and never believed lto would have much effect on the peak.

I disagree with an analysis that suggests oil prices under $75/b for the 3 year average oil price forever.

Volatility is a good guess though Fernando's price scenario might be roughly correct for 5 year average oil prices.

Dennis,You might be right and I might be wrong. What it is clear is that we see more or less the same situation but a completely different outcome.

Two things separate completely my analysis from yours:

The first is that I see a monetary crisis as unavoidable in the not too distant future. Most of the planet's wealth is in the form of electronic money (derivatives and financial instruments). The folly of Central Banks is hugely increasing those that are in the hands of the financial elite so there is less and less real wealth (land, resources, and productive industries) to support that virtual wealth. At some point the bubble is going to be so big and the leverage so high that there is going to be a run of that virtual wealth to become real at any cost and that is going to destroy every currency you can buy something of value with. Over here in Europe I am already seeing some worrying signs of what is coming, as payments in cash are being limited to ridiculously low amounts and governments are trying to force everybody to have their money in the banks. With a monetary crisis the price of oil in dollars has no point of reference and predictions have little value. The US has no experience for generations on monetary crisis, so that is going to be a real shock.

The second thing is that during economic crisis wealth gets distributed more unequally. The middle classes and low classes lose their savings and everything of value they have while some elite class fare quite well even if they lose part of their nominal wealth. This has several dire consequences. It can lead to bloody revolutions like the French or Russian revolutions. And in any way it leads to most people not being able to consume much. There won't be enough customers for oil, making your price predictions useless.

My own personal thought is that the current pricing system for oil based on margin pricing will have to be abolished once the shit hits the fan. It will simply not work. They'll think of something to avoid total collapse of oil production.

OilPrice.com

Citigroup is "especially bullish" on commodities in 2017, the bank says.

"The oil market is treading water for now, but the oil price overshot to the downside earlier this year and this is clearly setting the stage for a bullish end to the decade," Citi analysts, led by Ed Morse, wrote in a research note published on July 11.

There is a quite a bit of volatility in commodity markets, especially for oil, but global demand continues to grow at a steady pace. Prices have crashed on oversupply, but with oil production going offline, particularly in the U.S., the markets could over-correct, creating the conditions for higher prices next year.

finance.yahoo.com

Rebounding after a two-year collapse, it's only this month that oil prices have pushed up past $50 a barrel, but Raymond James & Associates says this is just the beginning for higher prices.

In a note to clients, analysts led by J. Marshall Adkins say West Texas Intermediate will average $80 per barrel by the end of next year - that's higher than all but one of the 31 analysts surveyed by Bloomberg.

"Over the past few months, we've gained even more confidence that tightening global oil supply/demand dynamics will support a much higher level of oil prices in 2017. We continue to believe that 2017 WTI oil prices will average about $30/barrel higher than current futures strip prices would indicate."

The team went on to lay out three reasons for their bullish call, all of which are tied to global supply - the primary factor that precipitated crude's massive decline.

Here's how the rebalancing of the global oil market will be expedited from the supply side, according to the analysts:

- First, the analysts see production outside the US being curbed by more than they had previously anticipated, which constitutes 400,000 fewer barrels of oil per day being produced in 2017 relative to their January estimate. In particular, they cite organic declines in China, Columbia, Angola, and Mexico as prompting this downward revision. "When oil drilling activity collapses, oil supply goes down too!," writes Raymond James. "Amazing, huh?"

- Adkins and his fellow analysts also note that the unusually large slew of unplanned supply outages will, in some cases, persist throughout 2017, taking a further 300,000 barrels per day out of global supply.

- Finally, U.S. shale producers won't be able to get their DUCs in a row to respond to higher prices by ramping up output, the team reasons, citing bottlenecks that include a limited available pool of labor and equipment.

Combine this supply curtailment with firmer than expected global demand tied to gasoline consumption, and Adkins has a recipe for $80 crude in relatively short order.

"These newer oil supply/demand estimates are meaningfully more bullish than at the beginning of the year. Our previous price forecast was considerably more bullish than current Street consensus, and our new forecast is even more so."

The only analyst with a higher price forecast for 2017, among those surveyed by Bloomberg, is Incrementum AG Partner Ronald Stoeferle. He sees West Texas Intermediate at $82 per barrel next year. The consensus estimate is for this grade of crude to average $54 per barrel in 2017.

Over the long haul, however, Raymond James' team sees WTI prices moderating to about $70 per barrel.

Read Raymond James: Get Ready for $80 Oil on bloomberg.com

Related Stories

peakoilbarrel.com

shallow sand , 06/16/2016 at 11:15 amTT. I read that.texas tea , 06/16/2016 at 1:42 pmNot too happy to see prices are headed back down in the face of what appears to be strong demand and falling production. Strong dollar, negative rates. Ouch.

Petro. Are all commodities doomed, or just energy? How about grain?

I am going out on a limb here and say food and energy and precious metals will see money flow and the government will print money to make sure we have food and energy. Folks can do with out a lot but the streets will fill without food and energy. With respect to who will be right about US seeing past highs in C+C production, I have my doubts under normal business conditions, but i can envision that it could happen, but it would be under a "emergency" type all hands on deck scenario. Unlikely but possible, our industry has surprised doubters in the past in our ability to get the job done for the American people. lets make america great againHR , 06/16/2016 at 6:09 pmCrude traders following Fibonacci rules. That's all. They took out the stops around 51, made their profits then went short. Pretty soon they'll go the other way again. Third quarter they'll go long and stay there. Guys already taking options on 100 a barrel. WTI will probably retest a 42 handle before it starts a steady climb. In the sixties in three months or so. Better dollars next year.shallow sand , 06/16/2016 at 11:40 amWe just have to keep starving for a few more months. Oil in storage isn't helping much either. By the end of the year, we should have a couple of reasons to smile for a change.

Cheers gentlemen, keep a stiff upper lip!

Petro.clueless , 06/16/2016 at 3:35 pmOne other thought. I take it you see major deflation on the horizon? So, if both crude price AND operating costs deflate, what is the difference, unless one has debt?

If one only has plugging liabilities, in a highly deflationary scenario, those liabilities also deflate (cost of labor and cement) in relation to cash on hand. Further, those with plugging liabilities and cash with no debt will, in my view, at least, have high leverage with state agencies as to negotiating a long term P & A agreement.

The US has over 1 million wellbores, if there is a "royal flush" of E & P's, due to massive deflation + high long term debts, I'd say anyone who agrees to P & A a few wells per year will be looked on favorably. 3/4 or more of the well bores will be abandoned and thrown on the backs of state governments if WTI and nat gas prices persist or go lower.

At some point, there will be a rapid reversal, commodities become scarce, prices rocket up? One thing for sure, 1980s university finance professors never envisioned the kind of stuff going on. Crazy times. Hard to change long held views.

Shallow Sand – Here is the clueless take on things.Dennis Coyne , 06/16/2016 at 12:12 pmIn general: Low interest rates are deflationary; High interest rates are inflationary. But, they are used to fight the opposite problem. Inflation rising: raise interest rates. Deflation on the horizon: print money and lower interest rates to cause inflation. However, at the extremes, eventually the desired result is obtained.

In the 1970's they kept raising interest rates to fight inflation. Result, more inflation – until we got to 14% annual inflation and 18% interest on a home mortgage. Then a recessionary collapse, and inflation was killed. Now we are in the reverse position – including negative rates in Europe, and everyone printing money. Result, deflation becoming more of a worry. At some future breaking point, likely a SURGE in inflation.

Why is this? Because if you have debt, when interest rates rise, you have NO choice. You must raise prices to pay it . There are no productivity gains; better way of doing things; more efficiency, etc. to solve the problem. If you have debt and interest rates rise, generally you HAVE to raise prices to pay the interest.

Now the reverse. Suppose long-term interest rates go to zero. You want to build a restaurant. You borrow the total cost of $2 million for 20 years. No interest, just a balloon payment at the end of 20 years. Okay, you can build your restaurant for zero cost of capital. For 20 years, you just have to cover the variable costs – food, labor, utilities and insurance. So, for 20 years, you can undercut the price of anybody that does have a cost of capital. Your restaurant is a booming success for 20 years, until you declare bankruptcy, since you have taken all of the profits as your salary and have no money to pay back the debt. Meanwhile you have lowered the cost of eating out in your market area for 20 years.

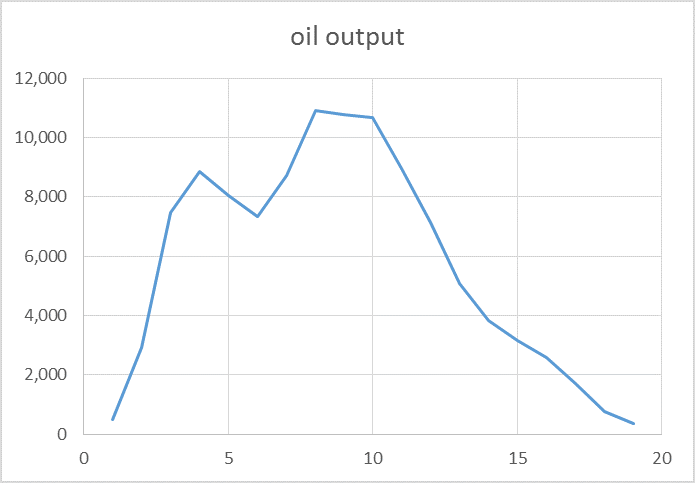

Hi Petro,Dennis Coyne , 06/16/2016 at 12:16 pmA mini model illustrating how the simple oil model works in chart below.

Basically well profile times number of wells added and add it all up.

Note that the well profile changes over time it is not fixed. Before 2008 there was a lower well profile, it increased and remained relatively stable from 2008 to 2013, the well profile increased in 2014 and 2015.

All of the well profiles and number of wells added each month from 2005 to 2016 (April), we don't know what the future well profile will be. All of this information is in the spreadsheet I linked earlier.The minimodel is in the link below and illustrated in the diagram below.

https://drive.google.com/file/d/0B4nArV09d398ejQzek9Bem0yalU/view?usp=sharing

Hi Petro,clueless , 06/16/2016 at 3:53 pm

Hi Petro,clueless , 06/16/2016 at 3:53 pmChart that goes with spreadsheet above is below, shows a dual peak scenario, it is all about the number of wells completed, the peak only occurred because the number of completions fell from 200 per month to 45 per month in the ND Bakken/Three Forks.

An open truly clueless question. For many years, much of the gas in the Bakken was flared. During that time, was measurement of gas as accurate and complete as when flaring no longer allowed and it is now being sold?Toolpush , 06/17/2016 at 4:12 am

An open truly clueless question. For many years, much of the gas in the Bakken was flared. During that time, was measurement of gas as accurate and complete as when flaring no longer allowed and it is now being sold?Toolpush , 06/17/2016 at 4:12 amThe reason that I ask, is to assess if historical gas/oil ratios are meaningful.

Clueless,If you read the ND govt reports, you will see oil and gas figures per well each month. Yes gas produced has been counted all the way though. Gas captured and sold, is a separate number.

peakoilbarrel.com

texas tea , 06/17/2016 at 5:05 pm

http://www.rigzone.com/news/oil_gas/a/145084/Pioneer_CEO_60_Oil_Needed_for_US_Shale_Industry_to_Grow_Productionshallow sand , 06/17/2016 at 6:13 pm"I think the world is going to need Permian Basin oil production, and it's not going to grow until you get to $60 long term," he said. "When oil moves toward $60 per barrel, I believe a good $10 of it for a lot of companies will go toward paying off debt, or they'll start selling assets at decreased divesture prices. That extra $10 will be a huge difference for companies that have great balance sheets today. That's why I'm a firm believer we're in a $60 long term oil price environment."

Seems to have changed his tune somewhat. But $60 does not get in done in most LTO plays. PDX's production may be able to grow in the $60(60-69) but elsewhere not so much. But of course I will take 69 over $48 anyday

PXD smart moves. Hedging better than most. Issuing shares as opposed to incurring more debt. Still not convinced Spraberry is superior to Bakken/EFS.As I recall, only 11% of PV10 is in PUD per 2015 10K, despite 600,000+ acres which supposedly have multi stacked pays.

peakoilbarrel.com

AlexS , 06/15/2016 at 12:11 pm

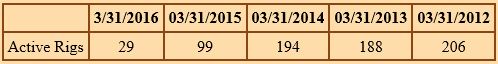

I remember Lynn Helms predicting a sharp drop in production for March. In fact, in March Bakken output declined only 8 kb/d, but was down 69 kb/d in April.likbez , 06/17/2016 at 11:26 pmApril number for ND Bakken is down 6.6% vs. March, 10.9% vs. April 2015 and 15.2% (176 kb/d) from the peak reached in December 2014.

Average output for January-April 2016 is 1044 kb/d, down 6.9% year-on-year.As CLR's Harold Hamm and several other E&P CEOs are saying, $50 is a trigger for increased completion of the DUCs.

Rig count has also bottomed, but significant increase in drilling activity is unlikely until WTI reaches $60.Nonetheless, it seems that we will see further declines in LTO output in the next several months due to delayed impact of low oil prices.

Alex,While oil prices will definitely reach $60 at some point and shale is still doomed at the current price range, there are some contrarian tendencies visible now. If the world economy slows down considerably the rise of oil prices will slow down even more. Let's hope for the best and prepare for the worst.

www.cnbc.com

Until the capital markets open up and allow U.S. oil companies to spend outside of their cash flow, production will not increase and crude prices will continue to rise, Tapstone Energy CEO Tom Ward said Thursday."There's no increase in the capital spending, the debt side of the business is closed, and so until we have something fairly dramatic happen like maybe a doubling of the rig count, I don't think we can grow production in the U.S.," he said in an interview with CNBC's "Power Lunch."

Therefore, "I wouldn't be surprised at all if we saw above $60 or even $70 [a barrel] by the end of the year," added Ward, the co-founder of Chesapeake Energy.

His comments come on the heels of American oil billionaire Harold Hamm's prediction that oil will likely hit $69 to $72 per barrel by year's end.

... ... ...

Tapstone Energy currently has three rigs online, down from four, and Ward said there are no plans to add more rigs. It's the same across the industry, he said, because of the lack of access to capital markets."I think prices will have to move up even higher than we're talking about for there to be a big change in the rig count," said Ward. "We can't change the decline of the oil production in the United States without more capital, and right now that's just not available."

That said, as soon as funds open up, Ward plans to start spending.

"We will spend whatever you give us. As long as there is money to be had through the capital markets, then we'll use that to grow production, because that's what we're paid for."

peakoilbarrel.com

Ron Patterson, 06/03/2016 at 6:32 am

Oil Price Poised For A Boost From A Big Fall In U.S. ProductionRon Patterson , 06/03/2016 at 6:37 amU.S. oil production has entered the end game with output forecast to plummet as drilling dries up and banks foreclose on oil companies teetering on the brink of insolvency.

Long predicted as a natural development after the 2014 start of the collapse in the oil price the inevitable has been delayed by drillers squeezing every drop out of their wells, but that game is all but over.

From a peak of more than 9.5 million barrels a day early last year current output has slipped to 9.1mb/d but if a fresh forecast is correct the number could be 8.5mb/d by July and possibly below 8mb/d in the September quarter…

Saudi Smiles

The Saudi view has consistently been that the oil market will fix itself with low prices forcing high cost producers out of business, leading to a sustainable price recovery.

What the ANZ has done with its report released earlier today is reinforce the Saudi position with the headline telling the story: "Declines in U.S. oil output set to accelerate".

And here is that story: Declines in US oil set to accelerateOldfarmermac , 06/03/2016 at 7:02 amLondon, 2 June 2016

A lack of drilling is about to catch up to US oil output. To maintain current production levels in the US requires 439 rigs, compared to the 280 in operation, according to ANZ Research. "If that trend persists, we could see production fall below 8.5mb/d by July," comments Daniel Hynes, commodity researach analyst.

Financial stress could exacerbate this. Oil producers with sub investment grade debt maturing this year produced approximately 1.3mb/d of oil. We have also seen more downgrades of credit ratings in 2016 than over the past three years.

This should see oil prices remain well supported over the next six months.

It has always seemed perfectly obvious to me that the price would HAVE to go back up, and it has , quite a bit already.The thing that surprised me is that it has taken as long as it has for the high cost producers to start falling by the wayside. In other industries, the blood would have been in the water MUCH quicker.

Does anybody have a figure for the "typical or average " cost of storing crude per barrel per year? How has the price of storage varied for the last couple of years?

peakoilbarrel.com

AlexS ,

06/09/2016 at 4:32 amshallow sand,texas tea , 06/09/2016 at 5:09 am"hope this rally isn't a repeat of last year."

I'm sure it isn't.

Short-term downward corrections are possible, but the general trend is upward.I tend to agree, but it will not surprise me to get a soft patch in prices late summer, if it is shallow, no pun intended, we will have the episode be hide us and I would look at it as a time to add to pub co stocks. By then the production trends as highlighted in the work presented here will be very much in place. Who knows Dennis might have to adjust his trend lines on the C+C chart by that time and will need to use peak flow as the starting point.Dennis Coyne , 06/09/2016 at 9:57 amShallow you do not need to tell me, of the hundreds of thousands of people who work in oil an gas extraction the number of them "barons" would fit on one of the those new electric buses.

Hi texas tea,If we substitute Dean's better estimate for Texas into the EIA's US estimate (removing the EIA's Texas estimate from the US total) and use the data from the peak in April 2015 to the most recent monthly data point of March 2016 and fit a trend line using the method of least squares we get production decreasing at an annual rate of about 200 kb/d over the most recent 12 months.

See https://en.wikipedia.org/wiki/Least_squares

This is the method used by a spreadsheet when a linear trend line is fit to the data.

Reply

oilprice.com

Middle East oil producers turn to debt markets. Oman sold $2.5 billion in bonds on Wednesday, as it seeks to improve its financial position. The Gulf state oil producer, who is not a member of OPEC, went to the debt markets for the first time in more than twenty years, a sign of how badly it has been damaged from low oil prices. The move comes after some of Oman's neighbors issued new bonds earlier this year – Qatar sold $9 billion in debt and Abu Dhabi sold $5 billion. Saudi Arabia is also expected to turn to the bond markets, perhaps selling as much as $15 billion worth of bonds. But the IMF warns that the Gulf States are going to need to do a lot more to cut spending in order for them to hold onto their currency pegs.Speculators gamble on $100 oil. Bloomberg reports that some oil traders are buying contracts that will only pay out if oil surpasses $100 per barrel at some point in the next few years. The contracts do not suggest that such an outcome is necessarily likely, but only that some traders view it as a potential profitable position. The fact that traders are buying up these kinds of contracts suggests that the markets are starting to believe that today's severe cutbacks in exploration and development will create the conditions for a supply shortage somewhere down the line.

By Evan Kelly of Oilprice.com

OilPrice.com

According to consulting firm McKinsey, the current oil futures market is pointing to a coming balance between demand and supply-a balance which has the potential to render most oil and gas investments uneconomical.The futures market is often a reliable guide to forcasting the future direction of oil prices, and analysts rely on both contangos or backwardation when determining their forecasts.

During a supply glut, a contango is typically observed. This is a condition where the spot price for future contracts is far higher than the current price for nearby contracts. This means that people are willing to pay more for a commodity sometime down the road than the actual price for the commodity.

Backwardation is noticed when the current demand is higher than the supply, thereby making the nearby contracts costlier compared to future contracts.

(Click to enlarge)

Until around 2005, backwardation was the normal condition, as seen in the charts. But since 2005, contango has become the normal condition, reports Reuters . Experts differ on their views regarding this shift.

Large contango is indicative of market bottoms. During the 2008-09 crude oil crash, the oil market witnessed a super-contango, when the price difference between the first month and the seventh month contract had reached up to $10 per barrel.

Similarly, during the current crisis, the contango reached $8 per barrel twice, once in February of 2015 and again in February of 2016, as shown in the chart below, after which, the markets bottomed out.

(Click to enlarge)

Related: Aviation Giants To Ramp Up Biofuels Usage

During the 1985-2004 period, the average backwardation was $1.07 per barrel, and during the 2005-2014 period, the average contango was $1.50 per barrel as shown in the chart below. The current contango hovers around $2 per barrel, which is close to the average during the 2005-2014 period.

(Click to enlarge)

The current oil crisis is unlike the oil crisis of 2008-2009, as there is no demand destruction this time. Demand for oil is on the rise and is likely to increase by 1.5 million barrels per day, both in 2016 and 2017, according to the latest Short-Term Energy Outlook by the U.S. Energy Information Administration.

In the short-term, the supply outages to the tune of 3 million b/d have supported oil prices by easing the supply glut and restoring the balance between supply and demand. If supply is restored, the oil markets will again return to a surplus, putting pressure on prices.

Due to low oil prices, billions of dollars in investments have either been scrapped or postponed. As and when the markets shift from surplus to deficit, new supply will find it difficult to catch up with increased demand. Markets need higher prices for investments to start trickling into the industry.

However, consulting firm McKinsey believes that oil demand will peak around 100 million barrels per day by 2030 from the current levels of 94 million barrels per day.

Related: Why Did Natural Gas Prices Just Rise 25% In Two Weeks?

"This change is driven by three factors: first, overall GDP growth is structurally lower as the population ages; second, the global economy is shifting away from energy-intense industry towards services; and third, energy efficiency continues to improve significantly," McKinsey's Occo Roelofsen said. "Peak oil demand could be reached around 2030", reports The Telegraph.

If oil demand behaves according to Mckinsey's expectations, most new investments into oil will be uneconomical due to weak demand in the future.

Though the long-term is slightly uncertain, balance is maintained in the short-term. Unless we see supply outages restored, prices are likely to remain in a small range following an impressive run.

By Rakesh Upadhyay of Oilprice.com

finance.yahoo.com

The oil price is making a fool of everyone. That's according to Steve Schwarzman, cofounder of private-equity giant Blackstone. The billionaire investor was speaking at the Bernstein Thirty-Second Annual Strategic Decisions Conference 2016 on Thursday, and talked about the volatile oil price.

He said:

Let's just take energy first because it's in the news a lot. And talk about a crazy business where there's almost not one person who knows what they're doing, right? At $120, it was going to $140 a barrel. When you were at $80, it was going to stabilize at $60. And when you're in $60, you didn't quite know, but maybe it would be $50 to $70. And then when it went to $24, everybody is a bozo, right? And then it was going to stay there, sort of $25 to $35 or maybe $40 for the next year or two, and now it's $50.

We've seen crazy swings in oil prices this year, largely driven by slowing demand, increased supply, and speculation over a potential coordinated cut in the production of oil. US oil prices ended slightly lower on Thursday after briefly rising above $50 a barrel in intraday trading.

Schwarzman said that his favorite person to talk to when trying to make sense of the oil market was Exxon CEO Rex Tillerson. He said:

When the price's around $60, I asked Rex, "What do you think?" He said, "Well, it's going to be between $20 to $120, and we're set up for all of those environments. I think it'll go a little lower than higher, but what do I know? I've just been doing this my whole life." And I thought, he's kidding, but he really wasn't.

naked capitalism

PlutoniumKun , May 31, 2016 at 4:27 amrjs , May 31, 2016 at 7:33 amIts interesting – I've been baffled by the apparent confidence of the markets in rising prices, and so far it seems they've been right. But I think we'll only know for sure later in the year. I suspect $50 will be the signal for a lot of struggling tight oil operators to open up their fracked but sealed wells, so there might be an unpleasant surprise for the bulls in the US market, if not elsewhere.

likbez , June 1, 2016 at 9:11 pmoil bulls were saved by the Fort McMurray wildfire and the Niger Delta Avengers; see the graphic from Goldman here: http://focusonfracking.blogspot.com/2016/05/update-on-oil-prices-whats-moving-them.html

I suspect $50 will be the signal for a lot of struggling tight oil operators to open up their fracked but sealed wells

Most probably you are wrong. LTO producers lost access to unlimited financing from Wall Street. They can't finance expansion from their cash flow (which is still negative), so they are cooked. Wells you are talking about were drilled, but not fracked. Drilling is only one third of the total cost of the well. So those two-thirds that are needed to complete the well is a problem. And will the particular well generate positive cash flow if oil price remains in $50-$60 range is another problem. Money spend on drilling are debt. Most shale wells will not compensate with their total production the amount of debt and interest.

They need around $80 per barrel to revive their operations.

oilprice.com

If the whims of oil speculators are anything to go by, then another oil price downturn looks increasingly unlikely.Oil prices have gained more than 80 percent over the past three months, bouncing off of $27 lows in February to hit $50 last week. Those sharp gains raised the possibility of another crash in prices because the fundamentals still appeared to be bearish in the near term.

By early May, oil speculators had built up strong net-long positions on oil futures, extraordinary bullish positions that left the market exposed to a reversal. Speculators had seemingly bid up oil prices faster than was justified in the physical market.

But the physical market got some help. The massive supply outages in Canada (over 1 million barrels per day) and Nigeria (over 800,000 barrels per day) provided some support to prices, erasing some of the global surplus.

Related: When Will Solar Overtake Oil?

Now speculators who had started to short oil in May have retreated, pushing short bets down to an 11-month low. "If you've been short since February this has been a very painful ride," Kyle Cooper, director of research with IAF Advisors and Cypress Energy Capital Management, told Bloomberg in an interview. "There are always a few die-hards but otherwise you'd want to get out. This is indicative of the improving fundamentals."

peakoilbarrel.com

Heinrich Leopold , 05/25/2016 at 9:48 am

The weekly status report for last week is out:likbez , 05/25/2016 at 1:53 pm

http://ir.eia.gov/wpsr/overview.pdfProduction fell just 24 000 b/d and week. However, the previous number has been revised downwardly by around 50 000 b/d and the recent number is down over 70 000 b/d, which is enormous and contributes very much to the recent oil price rise. US production is down by over 6.4% and net product exports fell considerably. This is exactly the right thing to do to bring oil prices up again.

US oil production is now in its freefall phase and this makes me very optimistic about future oil prices.

Ron Patterson , 05/25/2016 at 3:08 pmUS oil production is now in its freefall phase and this makes me very optimistic about future oil prices.Not so fast.

I am pretty positive that the worst days for the conventional oil are over, and "carpet drilling" days for LTO are also history.

But the health of the USA economy in late 2016 and 2017 is a big open question and it might provide the celling for the oil prices. One of the key factors that prevented sliding of the US economy into the continuation of Great Recession in 2014 was the dramatic drop of oil prices, which started in the second half of 2014. So in 2014-2016 the resilience of the US economy was partially due to this "low oil price" factor.

But the effect was pretty small; due to this the FED was not able to "normalize" interest rates (they made only one hike) and now can face the new phase of the recession with all the ammunition already fired.

Impoverishment of the low 80% of population makes the recovery impossible; neoliberalism makes the redistribution of gains in favor of lower 80% impossible (most of the gains go to the top 0.1% - the financial oligarchy; top 20% probably hold their own; everybody else are gradually sliding into poverty). So this is a deadlock situation.

Ves wrote something about his views on this subject in this thread and as far as I recall he thinks that without artificially low interest rates the game is over.

So when oil price recovers to $80-$100 price band the stimulating role of low oil prices on the economy will be gone. From this point it might be a bumpy ride…

The EIA's Monthly Energy Review is out today with production data for April. US C+C production fell 123,000 barrels per day in April to 8,915,000 barrels per day. US lower 48 fell 100,000 bpd while Alaska fell 23,000 bpd.This data matches the weekly data very close. 8,915 K barrels per day is the average for April, not the production on the last day or the last week. The EIA has production for the third week in April at 8,767 K barrels per day. So it looks like US production will fall about the same amount in May as it fell in April, about 125,000 barrels per day.

US C+C production has fell 779,000 barrels per day since peaking one year ago in April.

peakoilbarrel.com

WTI and Brent spread has closed quite a bit lately. Anybody heard what the crooks at the tbtf mega banks are giving as an excuse?

Citi just announced that crude was headed to 50 a barrel in Q3, that's a pretty amazing call seeing as how it's pushing 49.50 right now. Those "analysts" probably will get a huge bonus for making that call right?Anybody got a handle on overall accurate storage stats? I believe that we are heading into a period that oil in storage and market sentiment will be more important than production at some point. At least I'm hoping we are getting there. That'd be a great idea for a new post Dennis. Oil in storage. But there are no stats on private storage in the lower 48 right? Hell, me and my two best business buddies have 25 thousand barrels in our tank farms right now. And we are small fry compared to the gangster bank backed shale guys.

oilprice.com

There have always been three routes out of the unsustainably low prices: natural decline/growth of supply/demand, collaboration constraints on supply, and military conflict. Since January, while the talk of a growth freeze had no effect whatsoever on actual supply, the natural decline/growth did reduce the overhang by a couple of hundred thousand barrels of oil per day. Meanwhile, two little-discussed and less-understood military interventions took a combined 900,000 bopd out of supply in a virtual instant.

The history of attacks by rebels on oil infrastructure in the Niger Delta and the coincident prosecution of a former rebel superficially suggested that this attack was another in protest. On the other hand, responsibility for the attack was first claimed two months after the fact and by a group not previously known to exist, namely the Niger Delta Avengers. Moreover, the sophistication of the attack diverges from the historical airboat-and-AK style of rebels in the region.

A similarly mysterious outage affected 600,000 bopd out of northern Iraq. Located in a region of multi-lateral conflict and poor transparency, this interruption could be easily dismissed. Nevertheless, the fact remains that the exact cause of this major supply interruption was not publicly claimed or understood by any of the parties.

oilprice.com

Goldman Sachs ... pronounced that the oil market is shifting into a deficit 'much earlier than expected', as a fourth Nigerian crude grade, Qua Iboe, comes offline due to a damaged pipeline. As demand growth continues to show strength, and outages start to add up, Goldman Sachs suggests that the market has shifted into a deficit this month:

OilPrice.com

On May 11th the U.S. Energy Information Administration (EIA) reported that U.S. crude oil production declined by 206,000 barrels per day over the six weeks ending May 5, 2016. In the same weekly report:

- U.S. crude oil inventories unexpectedly fell by 3.41 million barrels during the week ending May 6, 2016

- Gasoline inventories declined by 1.231 million barrels

- Distillate stockpiles fell by 1.647 million barrels

• The International Energy Agency (IEA) say the annual summer spike in demand for transportation fuels has begun.

When the oil markets are oversupplied, the speculators which control the oil futures markets tend to ignore supply outages that they consider short-term. For example, the forest fires in Alberta that shut-in more than a million barrels per day of Canadian heavy oil products in early May did not seem to have much impact on the price of oil. As supply and demand move back into balance, an outage of that size will send the NYMEX strip prices sharply higher. The oil sands projects shut in by the fires are now coming back on-line, but it will take months before production is fully restored.

Nigeria has much bigger problems

On Friday, May 13 an explosion closed a second Chevron facility in Nigeria, Africa's biggest oil producer. The explosion was the result of an attack by militants who are upset with their government. 70 percent of Nigerians live on less than $1/day. They see the "Top 1 Percenters" living like kings, while they have trouble finding enough food to eat. Apparently, they have money enough for guns and explosives.

Exxon Mobil also reported on May 13 that a drilling rig damaged a pipeline, shutting off more production of crude. Nigeria's oil production was already down 600,000 barrels per day before these two incidents, primarily the result of militant attacks. Shell is now evacuating workers from its offshore Bonga oilfield following a militant threat. Shell's Forcados export terminal has been shut down since a February bombing. To say Nigeria is a mess is an understatement.

Adding to the country's problems is the fact that they are over a year behind in paying invoices for oilfield services. Schlumberger Ltd. (SLB) has pulled personnel and equipment out of Nigeria, apparently tired of running up the bad debts.

Venezuela: Another OPEC nation on steep decline

Latin American oil production is now down close to 500,000 bpd from year ago levels.

On May 6, Bloomberg reported that Halliburton (HAL) has joined rival Schlumberger in curbing activity in Venezuela due to lack of payment during the oil industry's worst financial crisis.

"During the first quarter of 2016, we made the decision to begin curtailing activity in Venezuela," Halliburton, the world's second-largest oil services provider, said May 6th in a filing with the U.S. Securities and Exchange Commission. "We have experienced delays in collecting payment on our receivables from our primary customer in Venezuela. These receivables are not disputed, and we have not historically had material write-offs relating to this customer," the company said.

Halliburton's receivables in Venezuela rose 7.4 percent in the first quarter to $756 million compared to the end of 2015, representing more than 10 percent of its total receivables, the Houston-based company said. If you own Halliburton stock, prepare yourself for a big bad debt expense later this year.

On the demand side of the equation, May is the beginning of an annual spike in demand for hydrocarbon based liquid fuels. In their monthly Oil Market Report dated May 12, 2016 the International Energy Agency (IEA) forecasts that demand will increase by 1.66 million barrels per day from the first quarter of this year to the third quarter.

If history repeats itself, the demand spike will be even larger. In 2010, the final year of the last major oil price cycle, the IEA began the year forecasting a 1.0 million barrel per day increase that year. Actual demand growth was 3.3 million barrels per day. The forecast error made in 2010 was that IEA's formula for calculating demand, did not consider the impact of lower fuel prices on demand. I believe they've made the same mistake this time around.

Key points from the IEA report:

- Global oil demand growth for 1Q16 was revised upwards to 1.4 mb/d, led higher by strong gains in India, China and, more surprisingly, Russia. Russia had a cold winter and they still use a lot of oil for space heating.

- Oil inventory builds are beginning to slow in the OECD; in 1Q16 they grew at their slowest rate since 4Q14 and in February they drew for the first time in a year.

- "Changes to the data in this month's Oil Market Report confirm the direction of travel of the oil market towards balance. The net result of our changes to demand and supply data is that we expect to see global oil stocks increase by 1.3 mb/d in 1H16 followed by a dramatic reduction in 2H16 to 0.2 mb/d."

- "We have left unchanged our outlook for global oil demand growth in 2016 at a solid 1.2 mb/d. However, for 1Q16 revised data shows demand growing faster at 1.4 mb/d, in spite of the northern hemisphere winter being milder than usual. This strong 1Q16 performance might raise expectations that demand will remain at this stronger level causing us to raise our average figure for 2016." As you can see by this statement, IEA is already seeing the error in their forecasting model. Like most government agencies, they will never come out and say they screwed up.

During the first quarter, oil prices were under pressure from predictions that China's demand for oil would soften this year. Chinese demand growth has slowed down from the rapid pace of the prior ten years, but it is still going up. This is thanks in part to sales of SUVs that are still climbing in China. Apparently the Chinese people are becoming more status driven (like Americans), owning an SUV in China indicates your family has joined the Upper Middle Class.

Per the IEA report, India is rapidly becoming the leader in global demand growth. Oil demand in India increased by 400,000 barrels per day year-over-year in the first quarter.

Related: Does Tesla Care About Its Stock Price?

(Click to enlarge)

Conclusion: History Repeats Itself

I have worked in the upstream energy sector for 38 years. During my career the industry has survived six major and a few minor oil price cycles. It will survive this one because the products made from crude oil, natural gas and natural gas liquids (NGLs) are critical to the world economy. Our high standard of living depends on a steady supply of oil.

Oil price cycles do not end well. The big ones, and this is one of the biggest ever, overshoot the mark and result in a supply shortage. With OPEC now producing flat out, there is very little excess production capacity in the world. After the end of 2016, when oil supply and demand are back in balance, all significant supply outages (i.e. Canadian fire, Nigerian militants, ISIS attacks in the Middle East, etc.) will send crude oil prices skyrocketing. The Wall Street analysts that are saying we will never see oil over $100/bbl again will be eating those words.

Oil prices do not go up or down in a smooth line, as you can see in the chart above. Investors that can look past the short-term noise and invest in the best companies will harvest market beating gains as this cycle moves back to the long-term trend.

By Dan Steffens for Oilprice.com

peakoilbarrel.com

likbez , 05/05/2016 at | 8:13 pmthere ain't nobody there to fight the good fightGreenbub , 05/05/2016 at 10:09 pmJudging from price action today there are efforts to kill oil rally. I think if banks profits from oil trading can drop like a stone, we collectively will be better off. They desperately try to preserve the unnatural and ultimately destructive level of rent extraction from the oil industry they've managed to create.

Looks like the whole Wall Street is now in "apres moi, le deluge"(after me deluge, https://en.wikipedia.org/wiki/Apr%C3%A8s_nous_le_d%C3%A9luge ) mode.

All these disruptions and oil is still trading down. Don't make no sense.shallow sand , 05/06/2016 at 7:36 amGreenbub. I can only give a sarcastic response.Greenbub , 05/06/2016 at 7:53 amFirst: Tesla is going to sell so many electric cars so soon, based on their CC from yesterday.

Second: Continental Resources announced a wonderful quarter, and apparently $30 oil and $1.75 natural gas is no big deal.

I need to stop reading conference call transcripts. Never have I seen so much happy talk from two companies who are in debt up to their eyeballs and posting losses quarter after quarter.

Oh, I forgot, both are changing the world.

Even with the dollar down, oil is still down. What gives?likbez , 05/06/2016 at 3:03 pmDon't be so silly. Oil price below the cost of production is an anomaly and normalization is inevitable despite all efforts by Wall Street, the US government and EU to slow down this process to preserve neoliberal globalization, which is threatened by high oil prices.likbez , 05/06/2016 at 6:29 pmThey might have a year to run of fumes, but I doubt that more then that. And as a result of their valiant efforts the normalization might happen at the level above $80/bbl. Then what?

It is very easy to destroy an industry. And neoliberals proved to be pretty adept in this task while fattening their valets. In this case the USA oil industry. Generally destruction is a much easier task that building/rebuilding something. Nothing new here, move on.

"After me deluge" mentality might eventually lead to some neoliberals hanging from the lamp posts. They consider themselves to be aristocracy, so that will be pretty fitting.

"Let them eat cakes" did not work too well in the past. Same with oil shortages. "History Does Not Repeat Itself, But It Rhymes" - Mark Twain.

Hi Shallow Sand,Massive debt is now like the sword of Damocles hanging over the whole shale industry. And that created qualitatively new situation with reaction of the industry on rising oil prices delayed and more muted then at times of "carpet drilling". Even money to complete DUCs are now a scarce commodity. Everything goes to debt repayment. In addition many companies will be forced to sell assets like Chesapeake:

Here are thoughts from

http://oilprice.com/Energy/Oil-Prices/Why-Oil-Prices-Will-Rise-And-Many-Pundits-Will-Be-Caught-By-Surprise.html

that pretty well resonate with your line of thinking about the problem.Prices have dropped to levels destroying capital, bankrupting businesses, idling massive amounts of equipment and manpower. The cycle is reversing now. The weekly EIA numbers are showing steady declines in production (this is a balancing item – not real production estimates) and also increasing demand – In the United States.

The IEA is showing the same thing in their monthly report that has a decent look at the G7 countries and attempts to look at the G20. Between these two, there is a large world with little accurate measurement. China for instance jailed a Platts reporter for espionage when he tried to put together a fundamental energy statistics database.

Inevitably, we will have another price shock – or at minimum an upside surprise. It's unavoidable at this point.

Oil never transitions smoothly. Just like all the oil bulls had to be run out during the declining price stage, all the price bears, like Dennis Gartman, will be run out when fundamentals hit them over the head. Gartman, to his credit, will change his tune 180 degrees when he sees the actual data shaping up. That's how he has survived so long and profitably as a trader.

But by then it will be too late, the world will want incremental supplies immediately – yet the industry cannot scale in real time. In order to motivate producers to get busy and provide incremental supplies, prices must increase sharply from current levels.

My prediction – $80/bbl in 18 months, but it won't last very long. I think $60 – $70/bbl is a healthy range.

peakoilbarrel.com

JustSaying , 05/02/2016 at 1:25 pm

"Crude oil ended the month of April with the strongest monthly gain in 7 years, adding 22% to the price. The low price caused "production destruction" and strong demand put the market on a trajectory of market balance.""We have said that oil prices have bottomed and the chief of the International Energy Agency (IEA) agrees. "In a normal economic environment, we will see the price direction is rather upwards than downwards," IEA Executive Director Fatih Birol said on Sunday during a G7 meeting of energy ministers in Japan as reported by Reuters. He took the words right out of my mouth. Barring any unforeseen economic catastrophes, the global oil market is at the low end of the cycle. We have said for some time that now is the time to start positioning for a long term bullish move. The low price that we saw in crude oil earlier this year may be the last time we see that for over a decade. "

"Even as some shale operators say that they may actually bring on rigs after we hit $50 a barrel, the truth is that many of the smaller operators will find it hard to bring rigs back on."

peakoilbarrel.com

AlexS, 05/01/2016 at 7:24 pmRystad's projection for shale oil and gas production has always been more optimistic than forecasts made by the EIA, IEA and OPEC.Rystad's current upbeat outlook can be partially explained by their oil price forecast.

From an article in "Straits Times":

http://www.straitstimes.com/business/oil-tipped-to-rebound-to-us60-this-year