A victory for the US diplomacy. Using KSA as a Trojan horse again and again.

Moscow isn't sowing Middle East chaos to drive up oil prices.

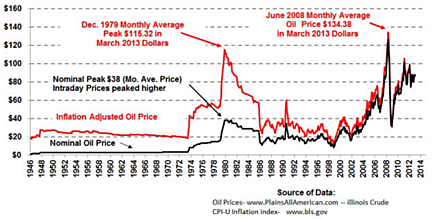

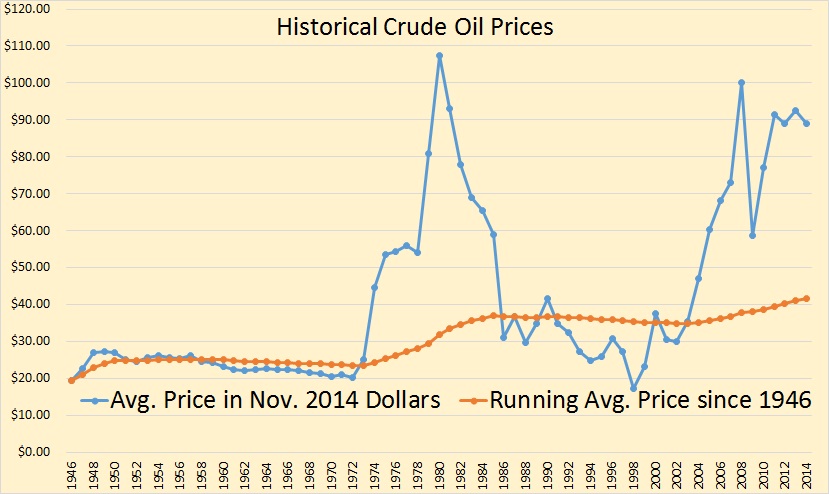

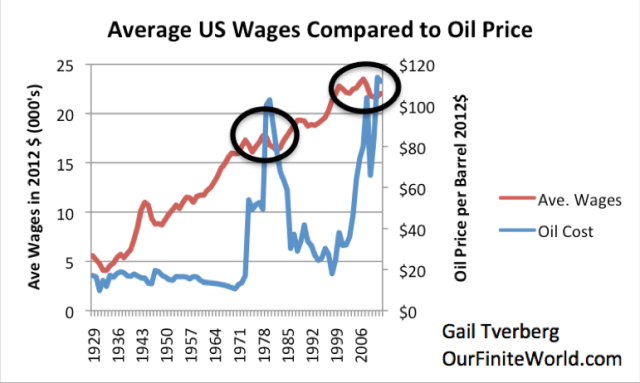

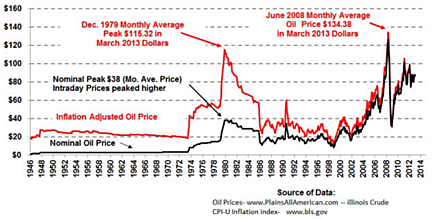

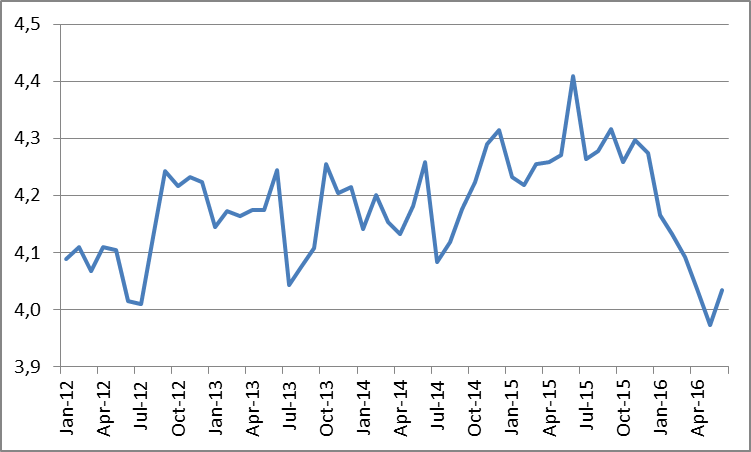

Russia's leaders certainly do care about oil prices, and with good reason. Plunging oil prices

decrease the ruble's value, which closely follows oil prices. Oil exports are important to Russia's

federal budget and to its overall balance of trade. Indeed, when monthly average Brent oil prices

peaked at about $125 per barrel in March 2012, the ruble was close to its own peak, at approximately

twenty-nine rubles to every U.S. dollar. When Brent prices fell to $30.70 per barrel in January 2016,

the ruble had fallen to about eighty rubles to the dollar. It is easy to examine this currency-resource

correlation by comparing U.S. Energy Information Administration oil price data with Russian Central

Bank ruble values. As a result, the Russian government has imposed sweeping budget cuts that will

now affect defense expenditures as well as social programs and other areas.

... ... ...

On the contrary, Russia has been working with Riyadh to contain prices and announcing a withdrawal

from Syria and a new focus on peace talks there. If Russia were determined to play the oil card,

it could do so in many different ways. For example, one option might be to step up support for Assad's

government to win a comprehensive military victory over its foes. If Russia looked seriously at this

option, the changing conditions could draw Saudi Arabia and other supporters of the Syrian opposition

more deeply into the conflict and perhaps expand it. This is much more likely to raise oil prices

than what Moscow has done in the past. But Syria is not a major oil producer or exporter. So perhaps

Russia's policy in Syria is not oil centric, but its approach to other problems could. Unfortunately,

there is not much evidence to support this argument either.

One of the strongest counterarguments to the oil-price theory of Russian foreign policy is

the recent Iran nuclear agreement, known as the Joint Comprehensive Plan of Action (JPCOA). If higher

oil prices were Russia's principal goal in dealing with Iran-which has the world's fourth-largest

proven oil reserves-why facilitate the JPCOA at all? It would be far better to block the agreement

in hopes of forcing a showdown between Washington and Tehran, possibly including U.S. military action.

Alternatively, Russia could have agreed to Western proposals to tighten sanctions on Iran's

energy sector, further limiting oil supplies. Or Moscow could have delayed the talks, hoping that

this would create sufficient uncertainty to raise oil prices. Instead, at a time when Russia was

already suffering economically from low oil prices and from Western economic sanctions, President

Vladimir Putin decided to support an agreement that would only further decrease oil prices.

... ... ...

...Russia did much less to oppose U.S. and NATO air strikes in Libya in 2011-so maybe this proves

that Moscow wanted disorder there to increase oil prices? It doesn't look that way. First, then-president

Dmitry Medvedev agreed to accept the strikes after intense pressure from President Obama and appeared

to do so in large part to appease the United States. Second-perhaps more importantly-then-prime minister

Putin criticized Medvedev's decision to order Russian diplomats to abstain in United Nations Security

Council vote, prompting a rebuke from Medvedev. Since Putin has been controlling Russian foreign

policy for most of the last sixteen years, Medvedev's move was likely an exception rather than the

rule. Finally, oil prices were already quite high in early 2011 when Medvedev made his choice. Even

if moving oil prices upward was a top priority in Russian foreign policy, it would have been much

less necessary at this specific time.

While oil prices are important for Russia, they are generally not a driving factor of Russian

leaders' key decisions. Thus, Russia does seek to shape oil prices, but does so through routine diplomatic

processes. There are many reasons for this, but one of the most significant is that Russia sees

critical national-security interests in the Middle East that override its concerns over oil prices.

In fact, in each of the above cases-Syria, Iran and Iraq-President Putin has pursued policies that

appear intended to produce stability. So Russia's supposed secret plans to boost oil prices

may produce entertaining conversation, but they don't lead to much else.

Paul J. Saunders is Executive Director at the Center for the National Interest and a Research

Scientist at CNA Corporation.

Borgþór Jónsson > Guest

You are correct,except the US wars are not so secret.

They are there for everyone to see.Sinbad2 > Borgþór Jónsson

Americans don't see their wars. The US Government keeps the American people in a cocoon of

ignorance.

O_Pinion > Guest

Who needs secret wars when you can have secret bank accounts?

http://www.dailymail.co.uk/new...

O_Pinion > Sinbad2

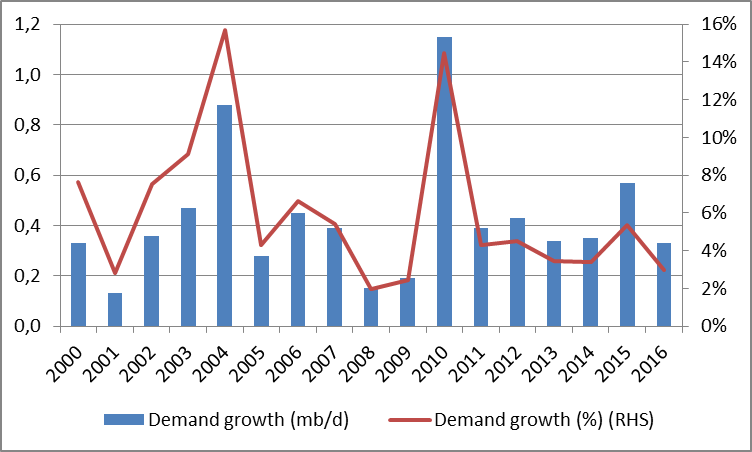

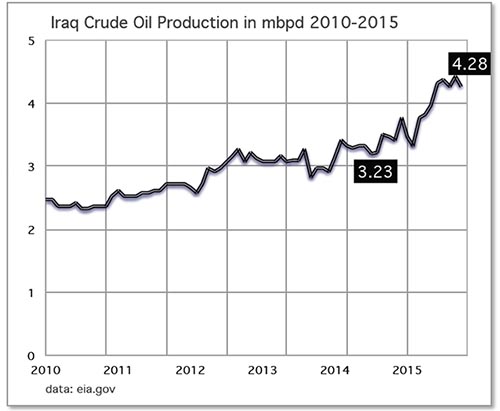

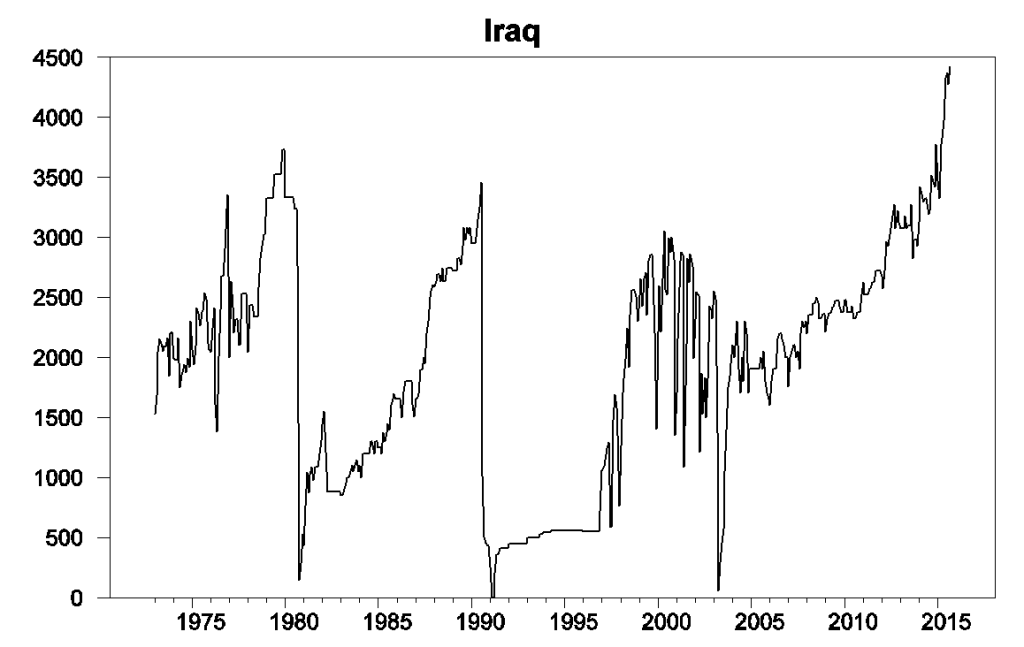

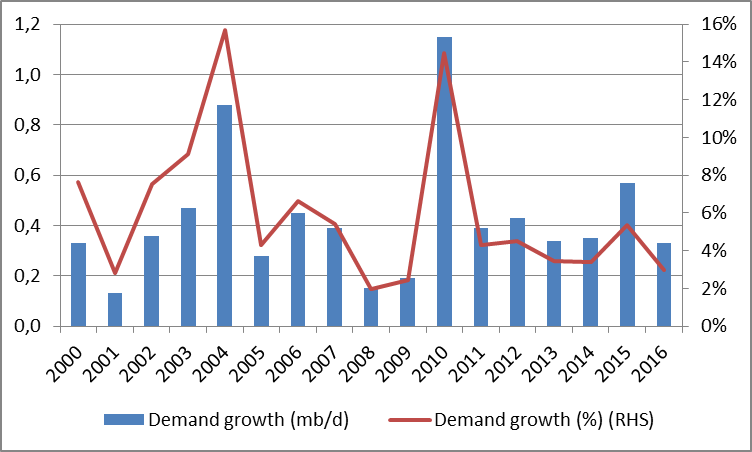

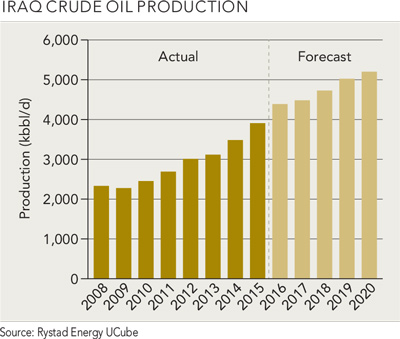

So the US fracking oil boom never happened, iraq's oil output didn't increase to an all time

high, there are no macroeconomic forces cooling demand and the law of supply and demand is a fiction.

it is all simply a grand conspiracy cooked up by Saudi Arabia and the US.

Serge Krieger > Sinbad2

It is very complex topic. I think too many things came together to create this perfect

storm. Frankly, new oil reserves are not profitable at anything below $70.

I guess it was both market overproduction with Canadian sands and US fracking and Saudis and

possibly even Russian oil production that caused this. I do not think Saudis alone would be capable

of such fit.

Anthony Papagallo

,

7 days ago

Sensible analysis, its much more likely Russia is just preparing the way to make sure it doesn't

end up with an American boot stamping on its face forever.

International Thinker ->

Guest ,

7 days ago

Because of this Russia is in the cross hairs of the Anglo-Zionists who can only survive if they

tear apart Russia and take control of its vast resources.

bob bear ->

Guest ,

7 days ago

So?

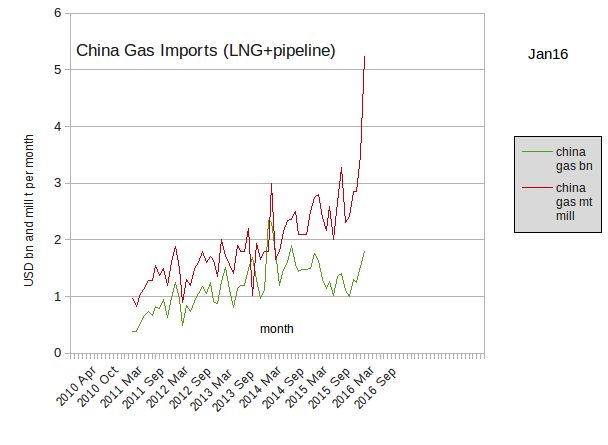

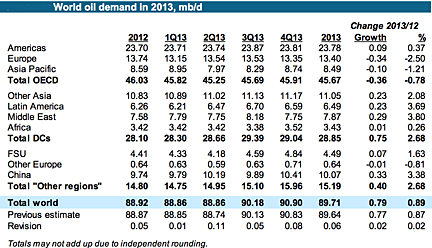

China and the US who are the 2 biggest purchasers of energy in the world, have been doubling

their investments in renewable energy!

Castlerock58

The US,Turkey and Saudi Arabia are promoting the instability in the Middle East.

Bankotsu

"Moscow isn't sowing Middle East chaos...."

I think the writer confused Russia with U.S.

Pacemaker4

Russia oil and gas industry accounts for 15% of their GDP.... that fact is lost on the

author.

Kalinin Yuri > HotelQuebec

All the vessels in the ocean instead of Diesel should use some nuclear reactors, right? The

trucks that move all the goods - also batteries? Has anybody calculated emissions from power

stations in order to charge a car that runs 80 km? Also how much does it cost to recycle the

batteries?

Sinbad2 > Kalinin Yuri

The silicon used in solar panels, is one of the dirtiest refining processes on the planet.

Hippies are well meaning critters, but not very smart.

Gregory Anbreit

Oh wow, so it was Russia who started all the chaos in the Middle East? Is this a joke? Who

invaded Iraq in 2003? Who has destroyed Libya? Who was supporting "Arab springs"? Who sends

weapons to AQ and ISIS in Syria?

But yeah, blame Russia.....how typical.

deadman449

Russia exports two things. Oil and weapons. If you think about it, it makes sense to cause

mischief in other countries near oil production. Question is, then why is the oil price so

low?

Andre

If Russia really wanted to use conflict to raise oil prices and achieve irridentist

ambitions at the same time, it would launch a Crimean/Donbas-type dirty war in northern

Kazakhstan with a view to annexing the Russian-inhabited areas. Kazakhstan occupies a similar

position with respect to oil production as Libya did in 2011 and its cost of production is not

too much more than many Gulf Arab states. Kazakhstan is also non-aligned and quite frankly

indefensible. From a geopolitical standpoint I see this move as much more likely than some

dangerous play in the Baltics which would yield little in terms of added Russian citizens or

resources.

Andre

If Russia really wanted to use conflict to raise oil prices and achieve irridentist ambitions at

the same time, it would launch a Crimean/Donbas-type dirty war in northern Kazakhstan with a view

to annexing the Russian-inhabited areas. Kazakhstan occupies a similar position with respect to

oil production as Libya did in 2011 and its cost of production is not too much more than many

Gulf Arab states. Kazakhstan is also non-aligned and quite frankly indefensible. From a

geopolitical standpoint I see this move as much more likely than some dangerous play in the

Baltics which would yield little in terms of added Russian citizens or resources.

Roman Lvovskiy > Andre

you're like Tom Clancy reborn, honestly

Andre > Roman Lvovskiy

Tom Clancy was remarkably prescient among techno-thriller writers, although some works were much

better than others, particularly "The Hunt for Red October", "Red Storm Rising" and "SSN".

You may consider my opinions fanciful, but look at the academic debate: there is an assumption

that Russian military intervention in Georgia and Ukraine poses a threat to NATO, and that the

Syrian adventure merely compounds this.

In comparison, I maintain the view that while Putin can be reckless - a common human flaw - his

aggression has been highly targeted to interests that have been articulated for many years,

including prior to his presidency e.g. absorbing the ethnic Russian diaspora bordering the RF,

halting NATO expansion, regaining global prestige.

Both Georgia and Ukraine were non-aligned countries when he invaded, and there is every

indication that he is aware of the distinction between NATO and non-NATO members. Therefore, if

he is planning on intervening anywhere, I would expect that country to: (a) be a "core interest",

(b) be non-aligned and (c) feature developments that challenge Russian interests. Belarus and

Kazakhstan both meet all these criteria, as each is drifting away from Russia. In Kazakhstan's

case, the recent policies concerning the official use of Kazakh and Russian are increasingly

discriminatory toward Russian-speakers, more so than any policies even contemplated by the

post-Maidan Ukrainian government. Unlike Belarus, Kazakhstan features immense natural resources

and many more ethnic Russians...

Roman Lvovskiy > Andre

i suspect it, that 'Red Storm Rising' is your fave. i like it as well, despite the fact that it's

hardly accurate when it comes to wording out actual features possessed by the Soviet hardware of

that period, described thereby.one thing that eludes you always is that Putin can not afford to subjugate anyone. that would be

stretching beyond capacity, both financially and politically. also, there's hardly that much of

anyting that is in Kazakhstan's possession presently or in short-to-midterm perspective to make

Putin even think about considering the risks.

so i'm guessing it's just your wishful thinking. i'd also suggest reading something more

profound, like something by Vonnegut or Trumbo. there's more to American culture than your garden

variety of trash usually presented on TV, sadly - less and less with each passing year.

Andre > Roman Lvovskiy

You're correct that Putin can't afford a grinding counter-insurgency, and he seems to have taken

in the Soviet experience in occupying East-Central Europe, as well as the quagmires in

Afghanistan and Chechnya. Interestingly, as soon as it became apparent that support for union

with Russia was not as warm in Donbas as Crimea, the Novorossiya project was quietly buried.

But Putin certainly has his eye on Belarus and Kazakhstan, and Astana's been taking an

increasingly independent line. There is a demographic and economic case, as I've laid out in

prior comments. But this is not a "call", after all, Crimea was annexed 20 years after analysts

were worried about it.

I'll be honest with you - I've never read a Clancy book all the way through - I've read many

papers on military technology and strategy, but I still find Clancy too dry. There are more

contemporary American authors that are great, McCarthy being one.

dennis powell

There seems to be a lot of russian supporters , who are seeing the world thru rose colored

glasses , commenting here. Russia would love nothing more then to see oil higher. Inside their

own country the fall of the ruble isn't as much a big deal as it is when they try and conduct

business outside of russia.They are paying for their actions in the ukraine. The annexation of

crimea was a just move to take back what should have never been given away. Their mistake was in

how it was done. Their move into syria wasn't about right and wrong but about protecting their

military interests. Any one who says anything different is being foolish. Their subsequent

withdrawal is an indication that they have satisfied that end. It also , I suspect , is to

contain the costs of such an operation. Russia is a gas station parading as a country.

Their only

claim to significance is their nuclear arsenal. They have an overblown view of themselves which

masks their deep paranoia. Take away their nuclear arsenal and they wouldn't be anymore

significant then brazil.

Frank Blangeard > dennis powell • 6 days ago

The last three lines of your comment seem to apply more to the United States than to Russia.

Randal > dennis powell • 7 days ago

"They are paying for their actions in the ukraine."

How

have Russia's actions in the Ukraine caused the oil price to fall

dramatically? The US sphere sanctions are an irrelevant pinprick in

comparison.

"The annexation of crimea was a just move to take back what

should have never been given away. Their mistake was in how it was

done."

I'd love to hear how you think it could possibly have been done

any other way.

"Their move into syria wasn't about right and wrong but about

protecting their military interests. Any one who says anything

different is being foolish."

What military interests? Surely you aren't talking about the

Tartus base? Have you actually seen it? Apart from that they had

almost zero military interests in Syria before the commencement of

the regime change attempt there.

"Their subsequent withdrawal is an indication that they have

satisfied that end. It also , I suspect , is to contain the costs

of such an operation."

Given the trivial costs in Russian budgetary terms of their

relatively small operation in Syria, how do you justify claiming

that would be an overwhelming factor in their decision making?

"Russia is a gas station parading as a country."

That pretty much discredits you terminally as any kind of

objective observer on Russia, I think.

"Their only claim to significance is their nuclear arsenal.

They have an overblown view of themselves which masks their deep

paranoia. Take away their nuclear arsenal and they wouldn't be

anymore significant then brazil."

Oh, really? Do feel free to explain exactly how their nuclear

arsenal enabled them to intervene successfully in Syria, in stark

contrast to the US regime's repeated failures. And while you are

about it, feel free also to explain the utility of their nuclear

arsenal in recovering the Crimea, or any of Russia's other recent

activities.

Presumably you think Brazil could have done both, if it only had

a nuclear arsenal like Russia's.

Borgþór Jónsson > dennis powell

Of course Putin went to Syria to protect the bases,but there are also several other

reasons.

- Putin wanted to protect the sovereignty of Syria.

- He did not want a state similar to Libya so close to his boarders.

That is exactly what would have happened if he did not intervene.

It would have happened ,because that is what the US wanted. They wanted to grow a terrorist

state close to Russia borders.

Putin also went to Syria because he wanted to fight terrorism in area where they would be

easier to defeat than in Caucasus.

Imagine the trouble it had cost him if he had a terrorist state in Syria constantly supplying

terrorists and weapons to the Caucasus.

That was one of the aims of the US,that is the reason they fed the terrorists with weapons.

The final goal was that they would later use those weapons against Russian people.

Same goes for the Ukraine.

The final goal there is that the Ukrainian Nasis will finally attack Russia.That is the

reason for the Us cooperation with Ukrainian nationalists. Ukrainian nationalists are violent

idiots on par with ISIS as you know.

You are not the only person that are obsessed with that misunderstanding that Russia is a

gas station. This misunderstanding is the reason the US sanctioned Russia. But it does not

work,because after all, the oil is only 12% of the Russian GDP. It is uncomfortable because it

is so big part of the export, but Russia is in no way going to collapse because of it.

In fact the Russian economy is exceptionally strong,I believe that no other nation on

earth would have been able to withstand such hardship as the sharp fall of their export and at

the same time sanctions from the western powers.

Later this year or next year their economy will most likely start growing again. Well

done Russia.

Borgþór Jónsson > Borgþór Jónsson

I forgot to address another misunderstanding of yours. Russia has not left Syria.

In the beginning Russia used SU 24 and SU 25 plains for strategic bombing. What it means is

that they were used for taking out the oil business of the terrorists and also their weapons

depots,their control stations and training facilities. That is now over and those plains are

sent home.

Now they have the SU 34 And SU 35 that are more suitable for assisting the Syrian Army in

their offence. On top of that they have the MI 28 attack helicopters and of course the

the dreaded KA 52. All those plains and helicopters played a vital role in the liberation of

Palmyra.

The Russians are not home yet,they will stay in Syria and fight the terrorists till the end.

Valhalla rising

its not the jewish NeoCohens and liberal Hawks that destabilized the Middle East.Nope the

Russians are goyim -- The Russians are evil goyim -- Czar Putin shuts us down --

The Russians disposed Muhammad Gaddafi --

The Russians supported the Muslim Brotherhood in egypt --

The Russians supported the islamic onslaught against Assad --

... ... ...

http://www.dailystormer.com/gl...

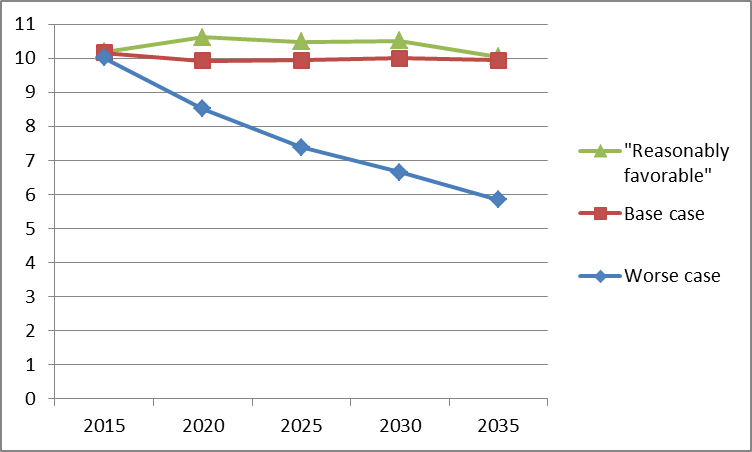

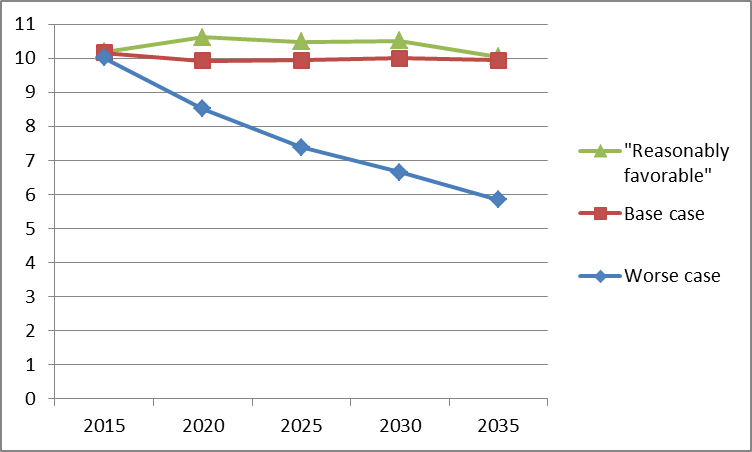

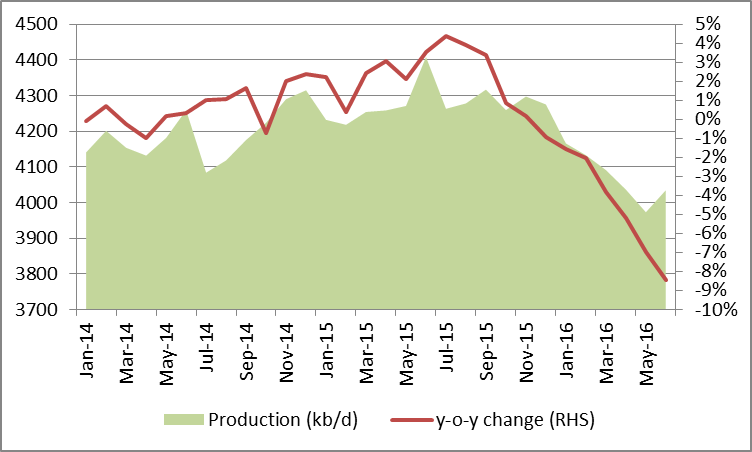

The Russian energy ministry sees the very real possibility that Russian oil production enters

long-term decline, possibly even falling by half by 2035. Russia's major oil fields are decades

old, so it will be increasingly difficult to prevent output from falling. At the same time,

Russian oil companies are not discovering new sources of supply that could replace that lost

output. The Arctic offers one area where very large reserves could be exploited, but western

sanctions have blocked the participation of major international oil companies, which could help

Russian companies pull off the expensive and tricky Arctic drilling operations.

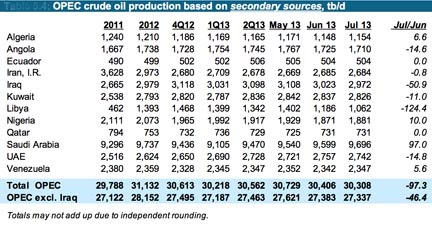

Meanwhile, Russia's natural resources minister said in late March – with an eye on the Doha

meeting – that Rosneft will likely lower its output this year. Rosneft actually did not comment

on his remarks, but the minister's comments were likely meant to demonstrate Russia's willingness

to cooperate with OPEC in Doha.

... ... ....

Russian output is expected to decline by 20,000 barrels per day on average this year,

according to OPEC's latest assessment.

likbez,

04/03/2016

at 4:35 pm

See an interesting interview (slightly edited Google translation). Looks like the new oil reserves

in Russia are very expensive, on par with the US shale and the old are mostly depleted.============================================

izvestia.ru

The President of the Union of oil and gas Industrialists of Russia Gennady Shmal told "Izvestia"

about what oil price is needed for Russia and when the industry will overcome dependence on imported

equipment

Q: OPEC believe that soon the price of oil should stabilize at a "normal", but not a too

high level. What do you think, what level of oil prices can be considered normal for Russia today?

A: If we are talking about a fair price of oil globally, I believe this is $80 per barrel.

Keep in mind that a significant part of oil – about a third – is produced offshore, where the

cost can be high. And there is a deep-water shelf, for example, in Brazil, where one of the first

well cost more than $300 million. Subsequent wells would of course cost less, around the half

the price, but still very expensive. Therefore, the capex of this oil extraction is high enough.

The breakeven price of our oil production without taxes is around $10 per barrel, nationally.

But when we include taxes, we get around $30 per barrel. But this cost is not no tragedy for us.

I remember a time when a barrel of oil was less than $10. Then we dreamed about the price rising

to $20.

When the three-year average cost of oil was above $100 per barrel, we got too used to

it. But the high price has one big drawback – it can negatively affect demand and stimulates production. And that's

what basically happened.

Therefore, now our oil companies might be now content with the price around $50-60

per barrel.

And I think in general, globally it would be OK price for both producers and consumers. Even

for the United States that would be an acceptable price. Canadians with their oil sands would

need a higher price – up to $80. But as the Canadian oil going to the United States, anyway,

losses can

be compensated with the domestic shale production and they would have to come to a common denominator.

Q: You're talking about this level of prices, without taking into account the Arctic shelf

projects?

A: Arctic shelf – it is quite another matter. My point of view on this issue is different from

the most popular view that exists today. I believe that we need to engage the shelf in terms of

prospecting, exploration. We generally do not even know that there, how much oil we have on the

shelf. We have so far only preliminary estimates of reserves – C2, C3 (preliminary estimated reserves,

potential reserves). And in order to have A, B, C1 (proven reserves), it is necessary to drill.

I am sure that we are not ready to work on the Arctic shelf both technically and technologically,

nor economically.

We do not have qualified people for that too. First of all, we need several platforms. One

platform for "Prirazlomnoe" that we now have been built for more than 15 years, and we sank into

it about $4 billion

And this one is not a new one, this is a second hand equipment. In order to seriously develop

the shelf, we need not one, but dozens of platforms, support vessels. Also offshore operations

must have the regulatory framework.

That means all the necessary technical regulations, standards. We have nothing. But the main

thing – the cost effectiveness of this oil: it is necessary to consider how profitable in today's

environment to produce Arctic oil. So, I think we now have enough things to do on land – in Eastern

Siberia, for example, before we need to jump with two legs into arctic oil extraction.

Q: How record oil production that Russian oil companies demonstrate in the past few years,

affects the structure of the Russian economy?

A: First of all, I believe that there are no records. Yes, we produced 534 million tons. But

in 1987 the Russian Federation has produced 572 million tons. Compared to the 1990s there is a

certain growth in recent years, but I would not talk about records. Second, the question about

optimal production volumes is a very complex one. The main question to which I have no answer

today: how much oil we need to extract?

Without answer on this question it is impossible to say whether we produced too little oil

or too much. If we consider that in 2015 we extracted more then 246 million tons, then, I would

say

we produced too much. This is not the way this business should be run. The fact is that Russia

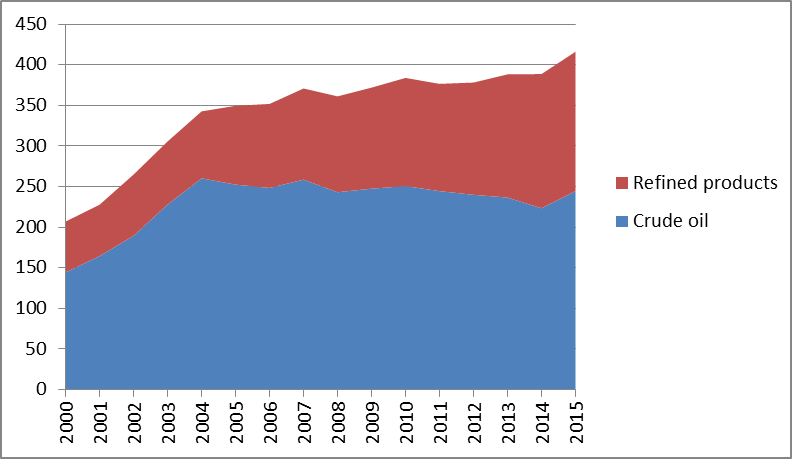

can not influence the world oil price too much because we make only 19-20% of the market. But

we can and should make the country less dependent on raw oil price fluctuations. We could process

all extracted oil and export mainly gasoline and diesel fuel, as well as products with high added

value in the form of chemicals, petrochemicals, composite materials.

That means that we need to adopt a different approach to the structure of our industrial production.

For example, China in the last twenty years has built a series of petrochemical plants, and

today they have the chemical products sector with total value of production about $1.4 trillion,

or around 20% of China GDP. It should be noted that China's GDP is eight times more than ours.

Our chemical sector production is around $80 billion – 1.6% of Russia's GDP. In 2014 alone BASF

Chemicals (which is a single German company) produced 1.5 times more than all the chemical enterprises

of Russia. Petrochemicals may be the critical link, pulling which we could change the whole structure

of industrial production in Russia.

Q: If we talk about production prospects, what we levels of production we can expect in

the future, based on our today's oil reserves

structure?

A: Unfortunately, today we do not have a reliable statistics. According to some estimates,

of

those oil reserves that are under development, about 70% are so-called hard-to-extract oil. That

is, stocks, where oil production is complicated mining and geological, geographical conditions.

In these fields there might be tight reservoirs, reservoirs with low permeability, viscous

oil, etc. By the way, today we have no any clear definition of hard-to-extract inventory, although

this defines the benefits that can be granted to companies to work on the fields with such

reserves. Therefore we need serious work on the classification and definition of reserves that

will be put into the hard-to-extract category.

By the way, the current production mostly (about

70%) relies on the old fields, which now have a high water content, high percentage of

depletion of reserves. Of course, they will not last forever. Therefore, sooner or later, will

have to enter the development of the fields with hard to recover reserves.

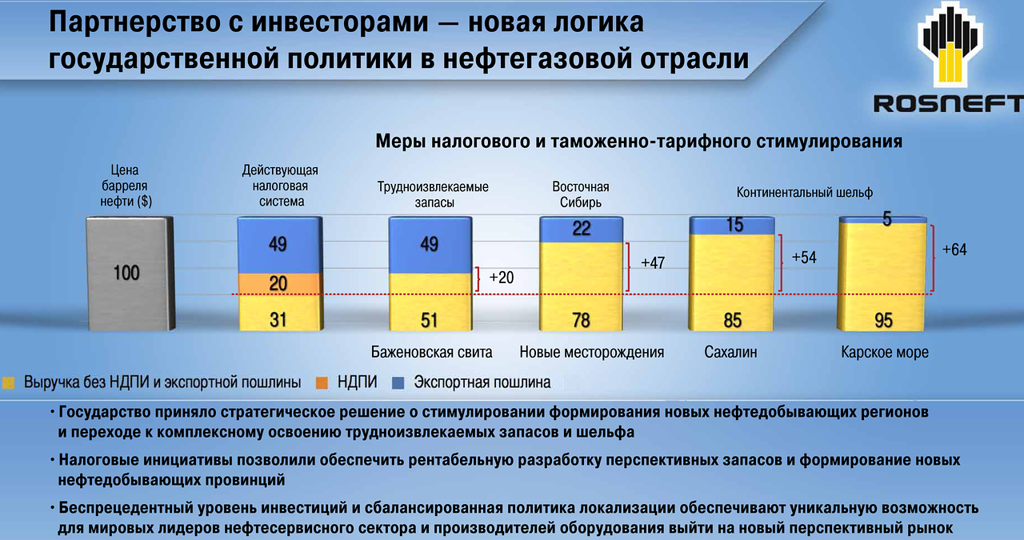

Q: Extraction of hard inventory requires new technologies, which in Russia does not fully

have. What are the tools the government has to encourage their development?

A: The state has a lot of tools to stimulate those technological developments. Our tax

system can perform stimulating role along with fiscal and re-distributive functions. However,

our tax system currently performs mostly fiscal function and only slightly – re-distributive

function. Simulative

function is not yet here. As an illustration, take Texas, USA: if the well there gives 500 liters

of oil per day, it is considered a cost-effective – this way the tax system is built. For us a

well, which gives 4000 liters per day, is already viewed as unprofitable, and is moved into the

idle fund. Now, of course, some work is being done in respect of incentives for low producing

wells – MET rates introduced.

But I believe that the future of our oil industry is largely dependent on whether we are

able to create the technology of oil production from the Bazhenov Formation or not. Because the

geological reserves of the Bazhenov Formation in Western Siberia are more than 100 billion tons

of oil. Even at a conservative estimate, if it is possible to extract around 40-60 billion tones

of oil with the current technologies.

And please remember that all we have in Russia today, all C2 stocks, are just around 28

billion tons So if we find the necessary technology that can be applied to the

Bazhenov Formation,

the peak oil production issue for Russia can be resolved for a sufficiently long period of time.

And in respect of the help from the state it could be such measures such as tax holidays, tax

exemption, reduction in mineral extraction tax, etc.

But currently the Ministry of Finance is interested only in filling the budget. We need to

make sure that taxes are fair. For this, they must be applied to the end result of production.

In our country today we have taxes on earnings – up to 65-70% of the average withdrawal. Norway,

for example, has high taxes too, but they are levied on profits.

Taxes should be applied to profits, not revenue, the latter for us looks like the absolutely

wrong approach.

Q: According to various estimates, in the Russian oil and gas industry today up to 45-50%

of the equipment are imported. Will Russian oil companies to move away from this dependence

in view of sanctions. And what should be role of the state in achieving this results?

A: At the request of "Lukoil" we did last year such a study. We've got that on average

53% of drilling equipment in Russia is imported. Of course, we must bear in mind that, for

example, pipes, with rare exceptions, we can produce domestically. But today there are some

technological segments where there is a high dependence of Russian oil from foreign suppliers.

Those segments include: software control, automation and remote control.

Today, the Ministry of Energy to the Ministry of Industry set up working groups that

are engaged in import substitution. And we have already been there for some equipment that is

competitive with foreign models. So, one of the factories in Perm began to produce excellent pumps,

which match in quality the best foreign analogues. Some factories in Bashkortostan started the

production of valves, cut-offs switches and other fittings for any type of drilling. But it is

not necessary to replace all the foreign oil production equipment. And, of course, we can not

do this.

We make good tanks, but we do not produce luxury cars like Mercedes. We just don't produce

them. I believe that if we had a dependence on imports in the range of 20-25%, it would be acceptable

and probably close to optimal.

Today we can get rigs from China. Our experts say that they are of a sufficient level of quality.

We also have a factory, which in 1990 produced drilling rigs – "Uralmash". Then, the plant produced

365 sets of drilling equipment per year. In the past year – only 25.

Therefore we need to rely on the Chinese oil extracting equipment, as they have learned to

make a decent drilling equipment. And for the price, no one can match them. I believe that we

need to very clearly define few areas of oil extraction equipment, which are critical for us.

and then pay close attention and allocate resources to those areas. We do not need to cover everything.

And I am sure that before the end of 2020 Russia could reduce this dependence on foreign equipment

to 25-30%.

Notable quotes:

"... That honestly sounds like a difficult way to make a living, but I guess oil-industry networking is so lucrative that it drives people to crime. ..."

"... Right now there is an aura of fear among the general population and even the expats in Saudi. The police throw people in jail for the slightest provocation. No one dares to protest or even speak against the regime. They could be jailed or even publically whipped. But if things get really bad and enough people lose their fear of the police, then all hell could break loose. ..."

"... Then there are the mullahs. They have authority over the populace which the authorities allow in order to keep the peace, and to keep the people in their place. I have seen them hit people with a cane for window shopping during prayer time. All stores must close during prayer time. ..."

"... Saudi Arabia is basically a police state with the mullahs acting as if they are part of the police. But there is a deep resentment among the people with little money and no power. It is a powder keg that could blow if things get really bad. And when oil production starts to slide things could get bad very fast. ..."

aws. ,

04/01/2016 at 9:53 am

Oilpro

From BloombergView

Saudi Arabia may be preparing for a post-oil world now, but back in 2014 the oil industry

was so hot that the founder of an oil-industry networking site allegedly hacked into another

oil-industry networking site (that he had also founded!) to steal customer information, solicit

new customers, and ultimately sell his new company to his old company. That honestly sounds

like a difficult way to make a living, but I guess oil-industry networking is so lucrative

that it drives people to crime.

Alleged crime. Was so lucrative. Anyway here is the criminal

case against the founder, David Kent, who founded Rigzone in 2000, sold it to DHI Group in

2010 "for what ended up being about $51 million," founded Oilpro after his non-compete expired,

and allegedly hacked into Rigzone to get customers.

Outside of the oil industry - by which

I mean, "on Finance Twitter" - Oilpro is perhaps best known for its delightful Instagram account,

which I hope will be maintained regardless of the outcome of this case.

Ron Patterson ,

04/01/2016 at 12:41 pm

Thanks for the link AWS. I found the full story at:

Saudi Arabia Plans $2 Trillion Megafund for Post-Oil Era: Deputy Crown Prince

Saudi Arabia is getting ready for the twilight of the oil age by creating the world's

largest sovereign wealth fund for the kingdom's most prized assets.

Over a five-hour conversation, Deputy Crown Prince Mohammed bin Salman laid out his vision

for the Public Investment Fund, which will eventually control more than $2 trillion and help wean

the kingdom off oil. As part of that strategy, the prince said Saudi will sell shares in Aramco's

parent company and transform the oil giant into an industrial conglomerate. The initial public

offering could happen as soon as next year, with the country currently planning to sell less than

5 percent.

"IPOing Aramco and transferring its shares to PIF will technically make investments the source

of Saudi government revenue, not oil," the prince said in an interview at the royal compound in

Riyadh that ended at 4 a.m. on Thursday. "What is left now is to diversify investments. So within

20 years, we will be an economy or state that doesn't depend mainly on oil."

Almost eight decades since the first Saudi oil was discovered, King Salman's 30-year-old son is

aiming to transform the world's biggest crude exporter into an economy fit for the next era. As

his strategy takes shape, the speed of change may shock a conservative society accustomed to decades

of government handouts.

Buying Buffett and Gates

The sale of Aramco, or Saudi Arabian Oil Co., is planned for 2018 or even a year earlier,

according to the prince. The fund will then play a major role in the economy, investing at home

and abroad. It would be big enough to buy Apple Inc., Google parent Alphabet Inc., Microsoft Corp.

and Berkshire Hathaway Inc. - the world's four largest publicly traded companies.

I would bet that Deputy Crown Prince Mohammed bin Salman is a believer in peak oil.

Fernando Leanme

,

04/01/2016 at 1:20 pm

I bet they think the political risk of being invested in a nation loaded with would be terrorists

is too high. They plan to park a chunk of cash offshore and wait for the shoe to drop. I wouldn't

invest in Aramco given this reality.

aws. ,

04/01/2016 at 1:40 pm

I figured you'd already be all over the Saudi mega fund story!

It was the Oilpro story that I thought some here might find of interest.

aws. ,

04/01/2016 at 1:45 pm

Ron,

From your experience in Saudi Arabia wouldn't you say that the Saudi's have left it at a little

too late for transition?

Ron Patterson ,

04/01/2016 at 3:18 pm

There can never be a transition from oil in Saudi Arabia. When the oil starts to seriously decline

there will be turmoil in Saudi.

Right now there is an aura of fear among the general population and even the expats in Saudi.

The police throw people in jail for the slightest provocation. No one dares to protest or even

speak against the regime. They could be jailed or even publically whipped. But if things get really

bad and enough people lose their fear of the police, then all hell could break loose.

Then there are the mullahs. They have authority over the populace which the authorities allow

in order to keep the peace, and to keep the people in their place. I have seen them hit people

with a cane for window shopping during prayer time. All stores must close during prayer time.

Saudi Arabia is basically a police state with the mullahs acting as if they are part of the

police. But there is a deep resentment among the people with little money and no power. It is

a powder keg that could blow if things get really bad. And when oil production starts to slide

things could get bad very fast.

Notable quotes:

"... Maybe they know they're peaking and this is a big psy-op/economic warfare to confuse the competition, maybe it's a tumultuous power transition that lacks strategic continuity and the new king/clique is not a good strategist ..."

"... This hypothesis along with "hurt Russia" hypothesis (which simultaneously hurt their main regional rival Iran) are the most plausible IMHO. Please note that KSA is a vassal of the USA. So by extension it looks like "team Obama" is not a good strategist either. ..."

"... A recent WikiLeaks revelation cited a warning from a senior Saudi government oil executive telling that the kingdom's crude oil reserves may have been overstated by as much as 300bn barrels, or by nearly 40%!" the American political analyst underscores. ..."

"... "Where Americans' interests are concerned, while President Obama has been parlaying trendy terms like 'renewable energy' and his supposed climate change agenda, the fact is petroleum still powers 96% of all transportation in America," Butler emphasizes. ..."

"... To paraphrase the old song, oil makes the world go round… ..."

Survivalist ,

03/30/2016 at 11:18 am

Does anybody have any insight or interesting ideas on Saudi Arabia? I believe they are disingenuous

with their 'market share' explanation…. I'm just using made up numbers here but my point is that

they have sacrificed 90 billion in profit to get 30 billion in market share. Last time I checked

business was about profits not about market share. If the IMF report I saw is correct then SA

needs $106/barrel to balance the national budget (not sure how that works at $106/barrel when

their 2015 budget was $229 billion but expenditures in 2015 ended up being $260 billion

http://www.bloomberg.com/news/articles/2015-12-28/a-breakdown-of-the-2016-saudi-budget-and-its-implications

). For the sake of argument lets call their national budget 'corporate overhead'. I suspect

SA is at a crossroads of some kind. Drilling rigs are up quite a bit the last couple years but

production is up slightly/wobbly.

Maybe they know they're peaking and this is a big psy-op/economic warfare to confuse the

competition, maybe it's a tumultuous power transition that lacks strategic continuity and the

new king/clique is not a good strategist….. I could go on. The intrigue could be deep or

shallow. Anybody have a good theory or read on where SA is at and going to? My guess is 30 million

people soon to be on foot headed for Europe.

A couple things on my mind:

World C+C minus North America is Flat since 2005:

http://crudeoilpeak.info/world-outside-us-and-canada-doesnt-produce-more-crude-oil-than-in-2005

World conventional is flat since 2005:

http://euanmearns.com/a-new-peak-in-conventional-crude-oil-production/

Dennis Coyne

,

03/30/2016 at 11:38 am

Hi Survivalist,

The World C+C output has either peaked (in 2015) or will do so within 10 years, we will have

to wait 10 years to find out. Oil guys such as Fernando Leanme have claimed that a rise in oil

prices to $150/b (in 2015$) will make a lot more of existing oil resources profitable to produce,

whether this is enough to offset depletion is an open question as is the level of oil prices that

the World economy can afford.

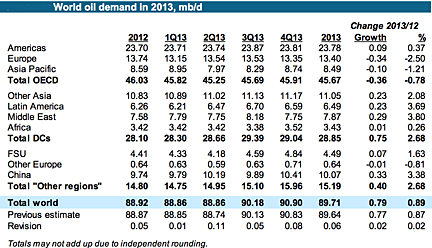

On oil prices we can do the following back of napkin estimate. World real GDP at market exchange

rates about $80T 2015$ and assume 2% real GDP growth for the next 5 years which would bring us

to about $88T real GWP in 2015$ in 2020. Let's assume the world can only spend 4% of GWP on oil

without causing a recession and that C+C output remains at 80 Mb/d in 2020 (29 Gb/year).

The 4% of 88T is $3520B and we divide by 29B and get $121/b in 2020. An oil price of $150/b would

be close to 5% of GWP and would likely cause a recession.

I will let the oil guys comment on whether $120/b is enough to bring on adequate oil supply

to avoid a recession, a crisis will eventually occur as I expect that demand will eventually outrun

supply in the short term (next 10 years) and oil prices will spike above $150/b and lead to a

global recession. At that point the peak may finally be clear to all and a transition away from

oil will begin in earnest.

likbez ,

03/30/2016 at 5:29 pm

maybe it's a tumultuous power transition that lacks strategic continuity and the new king/clique

is not a good strategist

This hypothesis along with "hurt Russia" hypothesis (which simultaneously hurt their main

regional rival Iran) are the most plausible IMHO. Please note that KSA is a vassal of the USA.

So by extension it looks like "team Obama" is not a good strategist either.

sputniknews.com

A recent WikiLeaks revelation cited a warning from a senior Saudi government oil executive

telling that the kingdom's crude oil reserves may have been overstated by as much as 300bn

barrels, or by nearly 40%!" the American political analyst underscores.

Butler refers to a phenomenon called "peak oil." According to M. King Hubbert's theory,

peak oil is the point in time when the maximum rate of extraction of petroleum is reached and

the crude capacity will only decline.

Whether one likes it or not, peak oil has been reached, the analyst underscores.

However, while the global oil reserves are decreasing steadily, Riyadh has been pumping

its crude faster than anyone.

And here is the root cause of Saudi Arabia's warmongering. To maintain its status quo, the

Saudi kingdom has established an alliance with

Turkey , planning to

seize Syria and Iraq's

oil fields.

Still, it's only half the story, since the global economy also remains petroleum-centered.

"Where Americans' interests are concerned, while President Obama has been parlaying

trendy terms like 'renewable energy' and his supposed climate change agenda, the fact is petroleum

still powers 96% of all transportation in America," Butler emphasizes.

To paraphrase the old song, oil makes the world go round…

The question then arises, whether we are on the doorstep of new "energy wars."

George Kaplan ,

03/31/2016 at 2:08 pm

In terms of a C&C peak pushed out for 10 years my question would be "Where's the oil?" even at

$120 per barrel.

Apologies that the following is too long, with no charts for many (or any) to read all the

way but some parts may be of interest.

The last few years have shown declining oil discoveries since 2010. What has been found is

more often than not deep water and relatively small. Such fields generally have short plateaus

and steep decline rates (not much better of those seen in LTO for fields less than about 150 million

barrels). The larger basins found offshore have been in the 5 to 10 mmboe range rather than around

50 found in the earlier days.

I don't have access to IHS or Rystad databases but picking amongst recent press releases I'd

say 2013 was about eight billion, 2014 nine or so and 2015 four or five. This year maybe only

three discoveries with a significant amount of oil – Kuwait might be significant. More gas than

oil is being found

http://www.oilandgasinternational.com/directories/exploration_discoveries.aspx

There has been a noticeable reduction in development times for projects in GoM and North Sea

in recent years from around 7 years down to as low as 3. That to me indicates a dearth of good,

large projects to choose from.

Of some of the main producers:

Saudi; 50% increase in rig count since 2012 to keep production just about steady, announced

"the most fields discovered" in 2012 or 2013 but a combination of oil and gas and they didn't

give quantities, have spoken of developing tight gas and solar to allow increased oil exports.

Russia; some conflicting announcements but it looks like a decline next year, largest recent

find was by Repsol at about 240 mmboe. Sanctions have had an impact and may continue to do so,

especially offshore.

http://uk.reuters.com/article/uk-russia-oil-rosneft-idUKKCN0WV1I3

Canada; very little drilling activity, four fields coming on over the next 2 to 3 years will

add up to 400,000 bpd, but then nothing planned and at least 4 year lead times for tar sands projects.

Tar sands projects have long plateaus but it appears some of the earliest mining operations are

starting to see thinner seams so decline will become more evident.

Brazil; cut backs in developments and may start to decline next year, they have mostly deep

water production with high decline rates and rely on continuous stream of new projects to maintain

production – the oil price, 'carwash' scandal, debt/bankruptcy problems and (maybe) just running

out of suitable projects have stopped this, expect 6 to 10% decline through 2017.

http://oilprice.com/Energy/Crude-Oil/Future-Of-Brazils-Oil-Industry-In-Serious-Doubt.html

Mexico; EOR developments seem to have run out of steam and not much interest in their opening

up the industry to outsiders, expect at least 4% per year decline.

http://www.bloomberg.com/news/articles/2015-05-21/mexico-lowers-2015-growth-forecast-after-oil-production-decline

USA; discussed a lot here, some expansion in GoM through 2017, unknown response to LTO drillers

depending on price and credit availability, liquids from gas have been another significant and

rapid boost to production recently which EIA indicate are still rising (mostly for NGLs), but

surely must run out of steam sometime soon. Possibly some shut in stripper wells won't be worth

restarting.

http://www.theenergycollective.com/u-s-production-of-hydrocarbon-gas-liquids-expected-to-increase-through-2017/

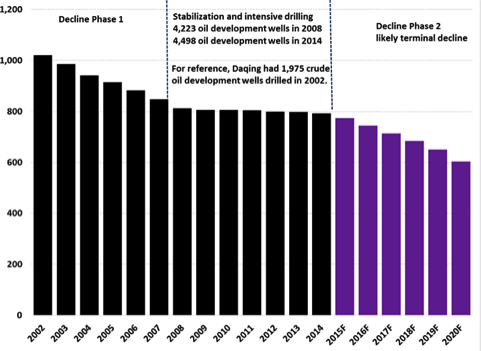

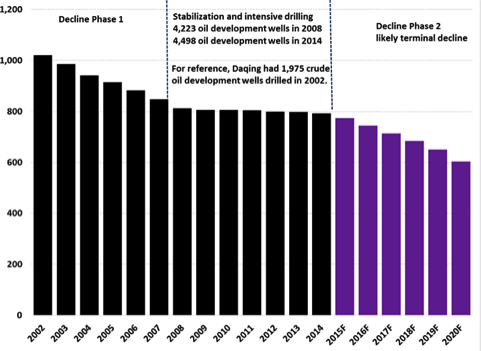

China; reliant on EOR recently to maintain plateau (including a lot of steam flood from the

EIA report) but predicting 5% decline next year, no great success on offshore discoveries.

http://www.bloomberg.com/news/articles/2016-03-24/-no-hope-oil-fields-spur-1st-petrochina-output-cut-in-17-years

https://www.eia.gov/beta/international/analysis.cfm?iso=CHN

North Sea; saw a spate of projects recently, mostly heavy oil, with a few more to come over

the next two years and then Johan Sverdrup and Johan Castberg but these only delay decline for

2 or 3 years, recent discoveries especially in UK sector have been very poor.

http://fractionalflow.com/2016/03/29/norwegian-crude-oil-reserves-and-extraction-per-2015/

http://www.rystadenergy.com/AboutUs/NewsCenter/PressReleases/northsea-ep-decline-coming-to-an-end

http://www.OilVoice.com/n/United-Kingdom-increases-oil-production-in-2015-but-new-field-development-declines/39dbcb23d382.aspx

http://www.rystadenergy.com/AboutUs/NewsCenter/PressReleases/breakeven-ncs-new-fields

Offshore Africa; Nigeria and Angola have a number of projects this year and next ( a bit more

oil than gas), but after that I'm not clear, political unrest might be particularly important

here as well. That said recent exploration success has been relatively good in Africa overall

(e.g. Kenya, Ghana).

http://www.offshore-technology.com/projects/region/africa/

Venezuela; not sure if their numbers can be trusted but they seem to be in decline, I know

little of their particular technical issues but assume that in order to increase extra heavy oil

production they would need new upgraders and possibly a source of natural gas, like Canada, and

possibly dedicated refineries to handle the heavy metal content (and assuming they can find willing

creditors and EPC partners).

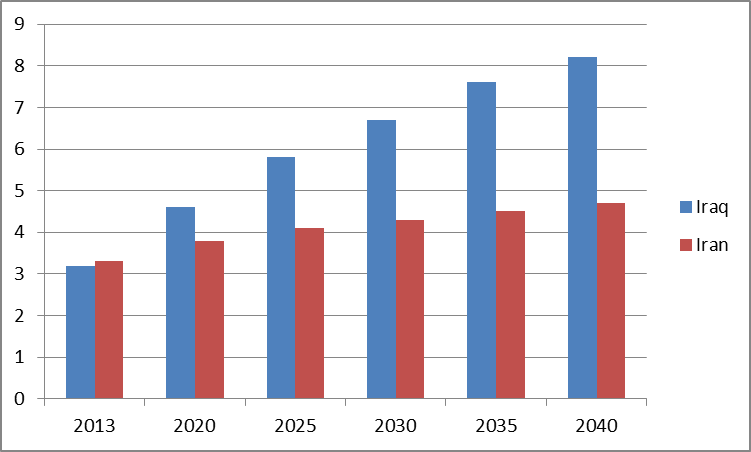

Iran and, possibly, Iraq and Kuwait look like the only likely areas that can show some increase,

but Iran is developing South Pars gas field more than oil and Iraq/Kurdistan might have run out

of impetus. Burgan field in Kuwait looks in better shape than other aging super giants and Kuwait

has an active exploration and development program. And of course maybe US LTO takes off again,

$80 appears a threshold but that is for WTI, ND oil has a $10 discount, the lighter LTO oil everywhere

may be lower still and overall away from the sweet spots above $100 might be nearer the mark.

The seven largest oil majors have shown declining reserves of 1 and then 2 billion barrel equivalent

over the last two years – this may be purely price related, but I'm not so sure especially with

BP, Shell and Chevron looking to sell assets, also I don't have the figures but I'd guess that

they have lost more in oil reserves as some of their big finds have been for gas.

http://www.forbes.com/sites/rrapier/2015/12/28/prepare-for-a-dramatic-decline-in-oil-reserves/#4e0ce4ed75cc

http://www.mrt.com/business/oil/top_stories/article_173026e6-743c-11e5-9883-bb5c1f414082.html

http://www.houstonchronicle.com/business/energy/article/Oil-companies-face-difficulties-replacing-reserves-6562231.php

To ramp up of production is going to be dependent on a work force which was aging and retiring

in 2014 and now has been decimated by layoffs and recruitment cut backs. Increasing prominence

of environmental issues may hinder both future recruitment efforts and the pace at which projects

can be developed. Significant new oil, including reserve growth, has to come from deep water –

those rigs are complicated and very expensive to run, a lot are currently being stacked.

Ramp up also needs the main stakeholders to regain their acceptance of financial risk, which

is currently as low as I can remember, and significantly higher sustained prices. The other side

to the equation for prices is demand. The world economy doesn't look great to me, we're due a

recession based on approximate 8 year cycles, TPTB have chucked everything but the kitchen sink

at it and industrial output is definitely in decline or growing only slowly (I don't know how

energy use is split for service versus manufacturing but I'd guess it's of smaller relative importance

in the service sector). A relatively small oil price increase might be enough to kick a recession

off properly.

Dennis Coyne

,

03/31/2016 at 7:07 pm

Hi George,

Hubbert Linearization of C+C less oil sands suggests about 2500 Gb for a URR, in the past this

method has tended to underestimate the URR, we have produced about half of this so far. There

is also about 600 Gb of URR in the oil sands of Canada and Venezuela. The USGS estimates TRR of

C+C less oil sands at about 3100 Gb, I use the average of the HL estimate and USGS estimate with

a URR of 2800 for C+C less oil sands and oil sands URR of 600 Gb. Total C+C URR is 3400 Gb in

my medium scenario. If extraction rates continue to grow at the rate of the past 6 years and then

level off we get the scenario below.

Model based on Webhubbletelescope's Oil Shock Model.

See

http://peakoilbarrel.com/oil-shock-models-with-different-ultimately-recoverable-resources-of-crude-plus-condensate-3100-gb-to-3700-gb/

Brian Rose ,

03/30/2016 at 10:18 pm

I personally believe Saudi Arabia's oil production strategy since 2014 has 3 pillars:

1. Maintaining market share: This is Saudi Arabia's primary asset – the ability to exert power

over other countries via its oil supply. Saudi Arabia has the power to cripple rivals by flooding

the market, and can also cripple OECD countries by limiting supply. Without the PERCEPTION that

this is true Saudi Arabia's only genuine political leverage evaporates.

2. Group Think: The behavior of the new Saudi King Salman, the revolt within the Royal Family

as a result of his policies, and the breaking of tradition to name his "ambitious" 31 year old

son as the heir apparent all suggest a breakdown of technocratic, informed policy. Say what you

will about Saudi Arabia, but its political structure was technocratic until January 2015. Since

then I believe there is a significant influence of Group Think, and there's consensus that the

young son if currently deciding policy, and often chooses against the advice of experienced council.

This 31 year old who doesn't listen to expert advice, who has caused a revolt within the House

of Saud, may very well believe that Saudi oil fields can produce any quantity of oil, for however

long he demands without consequence or depletion issues. It's important to note that the previous

King and Council decided on the current "market share" strategy, and deep animosity toward Iran

as it re-enters the market may influence SA's strategy to their own detriment.

3. There were several long-term projects such as Manifa and Khurais that were coming online

regardless of a glut. These mega-projects were guaranteed to put a floor under production numbers.

In concert with the sustained high rig counts to win the "maintain market share" strategy SA's

production reached record levels.

It is important to note that it took a truly herculean effort, record rig counts, and re-developing

several mathbolled fields to raise production from 9.5 mbpd in 2008 to 10.25 mbpd in 2015. They

threw in the kitchen sink and got 750,000 bpd of extra production.

That is telling in and of itself.

SA has followed an explicit strategy of maintaining market share i.e. producing every barrel

they possibly can. SA took on a multi-year effort to push their production as high as possible.

We now know SA's maximum possible production, and the incredible effort required to maintain it.

I personally do not believe SA will ever be capable of producing 11 mbpd.

Oldfarmermac ,

03/31/2016 at 10:20 am

It is not at all unknown for an aggressive minded political leader to bite off more than he can

chew, and choke on it, due to being unwilling to listen to expert advice.

Hitler almost for sure could have won a substantial empire and Germany could probably have

kept control of it for a quite a long time, if he had been ten percent as talented in military

terms as he was in political terms ( not to mention being a world class evil character of course)

IF he had LISTENED to his very capable senior military guys.

Brian is probably right. This young SA guy, King Salman , may be in the process of making the

same mistake, namely failing to listen to his technical guys.

Even if Salman realizes he is not going to be able to increase production much if any, or even

maintain it at current levels mid to long term, he may still be full of testosterone, and willing

to bet his kingship, and potentially his entire country, on his current policies.

It is well known, a trusim or cliche, that one of the best ways a leader in trouble can maintain

and consolidate his power is to go to war, and SA is (obviously in the opinion of many observers

) fighting an economic war with rival oil producing countries.

I have long believed that SA is a powder keg awaiting a spark. One serious mistake on the part

of the leadership could set it off. One random event could set it off. The House of Saud has made

many a bargain with the devil in the guise of the super conservative priesthood which enables

it ( SO FAR! ) to maintain control of the country without resorting to the business end of rifles.

Radical change is coming to SA, because it information moves too freely in the modern world

to keep the people in the dark much longer. Too many privileged young folks are traveling, and

doing to suit themselves, and too many poor people are growing more radical by the day. Too many

outsiders are working in the country.

If it weren't for oil, and to a much lesser extent, some other mineral wealth, the rest of

the world would barely notice even the existence of that mostly desolate patch of sand.

TonyPDX ,

03/31/2016 at 11:25 am

This is purely anecdotal. For the past three years, we have rented our unused bedrooms to several

Saudi students, here to study in the US. They first go to a language school, and then on to a

university. In just this brief time, they speak of the Saudi government no longer footing the

bill for this. This means that the student's families must send money. For some, this is clearly

not a problem, but for many it is.

Synapsid ,

03/31/2016 at 6:25 pm

OFM,

The young guy is Mohammed bin Salman, second in line to the throne last I looked, Defense Minister,

in charge of an overlook body for Saudi Aramco, and other things. He may, as you say, not be listening

to his technical advisors–may in fact be a loose cannon–and he is widely considered to be the

power behind the throne.

He isn't the king, though. That's Salman himself, and he is often said not always to know where

he is or what he has just said. Scary situation there, you bet.

Techsan ,

03/30/2016 at 11:17 pm

There was an interesting documentary on Saudi Arabia last night on Frontline.

Lots of Saudis living in poverty, women begging in the street to feed their families, while

very nice cars drive by. Shiite minorities in the eastern (oil-producing) region protesting and

being repressed by the government.

There was hidden-camera footage inside a shopping mall - much like a mall in the US, with a

Cinnabon, Victoria's Secret, high-end makeup counter, etc, but very few people. But what the mall

also had was religious police beating people who buy the stuff, and it showed them beating what

appeared to be a plump middle-aged housewife, covered head-to-toe in a black burqa, who was buying

makeup. So the government is simultaneously allowing the mall to sell this stuff and paying religious

police to beat those who buy it.

It very much looked like a powder keg that could blow at any time.

Brian Rose ,

03/31/2016 at 11:27 am

Techsan,

Frontline documentaries are a personal favorite of mine. Always stellar, genuine investigative

news journalism. Even on subjects I think I am fairly knowledgeable about I always come away having

learned a lot.

It is 2nd only to Ken Burns' documentaries, but it's hard to compare since his documentaries

are history documentaries and Frontline is investigative news.

For anyone looking for a link:

http://www.pbs.org/wgbh/frontline/film/saudi-arabia-uncovered/

Submitted by

Tyler Durden

on 03/31/2016 - 19:00

For just and obvious reasons, it's illegal under U.S. law for

foreign governments to finance individual candidates or political

parties.

Unfortunately, this doesn't stop them from

bribing politicians and bureaucrats using other opaque channels.

Those confirmed so far are Saudi Arabia, Russia, Kuwait, the United Arab Emirates, Venezuela,

Nigeria, Algeria, Indonesia, Ecuador, Bahrain, Oman and Qatar.

Notable quotes:

"... The problem for the international community is while destroying ISIS is their stated priority, both Libya's rival camps see each other as the greater threat. ISIS is a threat, but neither camp believes it is an existential threat, so the priority for both camps is fighting each other. ..."

likbez,

03/29/2016 at 10:51 pm

Looks like Libya' civil war is far from over. From Richard Galustian (

https://twitter.com/bd_richard )

The problem for the international community is while destroying ISIS is their stated priority,

both Libya's rival camps see each other as the greater threat. ISIS is a threat, but neither camp

believes it is an existential threat, so the priority for both camps is fighting each other.

Russia's oil output hit a post-Soviet record of 10.9 mb/d in January 2016, but that could be a

ceiling as the country's massive oil fields face decline. The bulk of Russia's oil output

comes from its aging West Siberian fields, which require ever more investment just to keep output

stable. The depreciation of the ruble has helped a bit, lowering the real cost of spending on

production and allowing Russian companies to increase investment by one-third this year. However,

some long-term projects are being pushed off due to the financial squeeze from western sanctions

and low oil prices. An estimated 29 projects, amounting to 500,000 barrels per day in new

production, have been delayed. With most of Russia's large oil fields having been under

production since the Soviet era, and with precious few new sources of supply, Russia is facing

long-term decline.

Notable quotes:

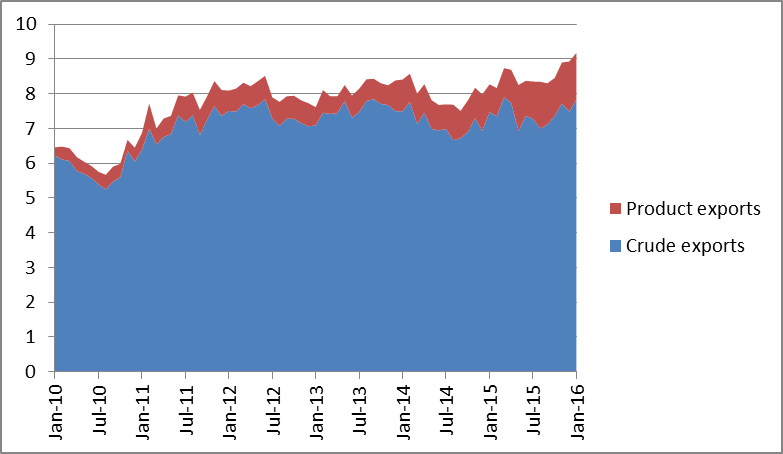

"... But Saudi Arabia is also prioritizing refined product exports, which fetch higher prices. It hopes to double refining capacity to 10 mb/d. Additionally, while Saudi Arabia may have lost market share in some places, it is also taking stakes in large refineries around the world, helping it to lock in customers for its crude. ..."

OilPrice.com

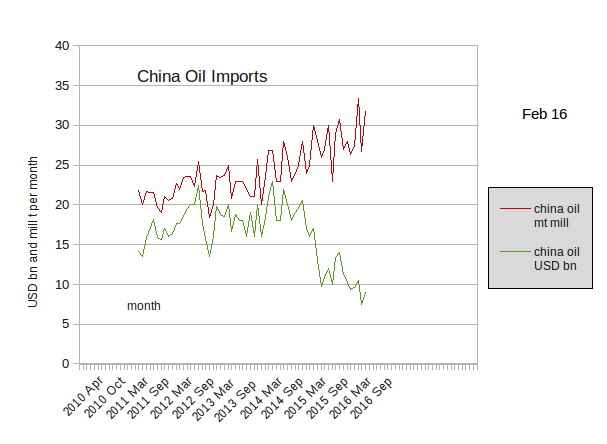

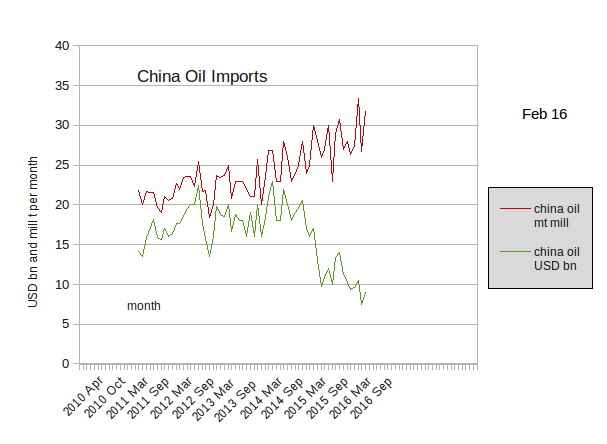

Over the past three years, Saudi Arabia has lost market share in nine out of the top 15 countries

to which it exports oil, according to the

FT. That comes despite a ramp up in production since November 2014. For example, Saudi Arabia's

share of China's oil imports declined from 19 percent in 2013 to near 15 percent in 2015. Likewise,

Saudi Arabia saw its market share in the U.S. drop from 17 to 14 percent over the same timeframe.

But Saudi Arabia is also prioritizing refined product exports, which fetch higher prices. It hopes

to double refining capacity to 10 mb/d. Additionally, while Saudi Arabia may have lost market share

in some places, it is also taking stakes in large refineries around the world, helping it to lock

in customers for its crude.

Meanwhile, according to the latest data, Saudi Arabia's cash reserves

dwindled to $584 billion as of February as the oil kingdom tries to keep its economy afloat and

preserve its currency. That is down from a peak of $737 billion in August 2014.

Notable quotes:

"... Iraq war and its aftermath failed to stop the beginning of peak oil in 2005 ..."

"... I think the Iraq war was instigated by an alliance of neocon/Israel lobby plus oil/service company and weapons complex interests. But the overriding interest seems to have been the neocon strategy to get the USA tangled in Middle East wars. This in turn would weaken Israel's enemies and increase animosity between the Muslim and Christian worlds. Such animosity plays very well if it leads to all out war between "the West" and Muslims. As long as the USA keeps behaving as an Israeli puppet the conflict will intensify. ..."

"... What I outlined above is a distilled version of writings/books by former CIA analyst Michael Scheuer, former CIA operatives, and books such as "Fiasco" by Thomas E. Ricks. I've also incorporated recent material written about ISIS and its birthing at the US Army's Camp Bucca. ..."

Matt Mushalik,

03/24/2016 at 3:37 pm

Tony Blair is right: without the Iraq war there would be no Islamic State

http://www.theguardian.com/world/2015/oct/25/tony-blair-is-right-without-the-iraq-war-there-would-be-no-isis

16/3/2013

Iraq war and its aftermath failed to stop the beginning of peak oil in 2005

http://crudeoilpeak.info/iraq-war-and-its-aftermath-failed-to-stop-the-beginning-of-peak-oil-in-2005

Uploaded 5/7/2007

Government admits oil is the reason for war in Iraq

https://www.youtube.com/watch?v=j7t_u641NyM

Reply

Fernando Leanme

,

03/25/2016 at 4:58 am

I think the Iraq war was instigated by an alliance of neocon/Israel lobby plus oil/service company

and weapons complex interests. But the overriding interest seems to have been the neocon strategy

to get the USA tangled in Middle East wars. This in turn would weaken Israel's enemies and increase

animosity between the Muslim and Christian worlds. Such animosity plays very well if it leads

to all out war between "the West" and Muslims. As long as the USA keeps behaving as an Israeli

puppet the conflict will intensify.

What I outlined above is a distilled version of writings/books by former CIA analyst Michael

Scheuer, former CIA operatives, and books such as "Fiasco" by Thomas E. Ricks. I've also incorporated

recent material written about ISIS and its birthing at the US Army's Camp Bucca.

Notable quotes:

"... I have grave reservations about the alleged spare capacity of Iran. The assumption is that the big, bad sanctions resulted in a huge drop in Iran's oil production. I am not buying it. I think the sanctions were a joke. For starters many nations refused to take part in the sanctions. Nations like India, china, japan and South Korea for starters. It would not be difficult to then reexport this oil to the rest of the world on the sly. Would you please comment on this important matter. Does anyone have any inside information about this? nuassembly 20 Mar 2016, 11:25 AM Comments (13) | + Follow | Send Message Agree, most of us follow news as herd effect, but devil is in the detail. Before the sanction, Iran was export 2.5 million barrels of oil per day but had to import almost 0.5million barrels of processed fuel, gasoline and diesel. ..."

"... Now, 4 years after the sanction starts, Iran already built up the refinery capacity, so it will no longer need import of refined fuels; instead it will be exporting, how much is yet to be decided. So, right there, we will see over 0.5 million barrels of reduction in the oil to be exported from Iran. Yes, the sanction reduced the Iranian oil export from 2.5million to 1.5million per day, but the net effect after sanction now will be less than 0.5 million per day to the world market. ..."

Forty Years

a Speculator 21 Mar 2016, 07:06 PM

Comments

(50) |+

Follow |Send

Message

I have grave reservations about the alleged spare capacity of Iran.

The assumption is that the big, bad sanctions resulted in a huge drop in

Iran's oil production. I am not buying it. I think the sanctions were a

joke. For starters many nations refused to take part in the sanctions. Nations

like India, china, japan and South Korea for starters. It would not be difficult

to then reexport this oil to the rest of the world on the sly.

Would you please comment on this important matter. Does anyone have

any inside information about this?

nuassembly

20 Mar 2016, 11:25 AM

Comments

(13) |+

Follow |Send

Message

Agree, most of us follow news as herd effect, but devil is in the detail.

Before the sanction, Iran was export 2.5 million barrels of oil per

day but had to import almost 0.5million barrels of processed fuel, gasoline

and diesel.

Now, 4 years after the sanction starts, Iran already built up the refinery

capacity, so it will no longer need import of refined fuels; instead it

will be exporting, how much is yet to be decided. So, right there, we will

see over 0.5 million barrels of reduction in the oil to be exported from

Iran. Yes, the sanction reduced the Iranian oil export from 2.5million to

1.5million per day, but the net effect after sanction now will be less than

0.5 million per day to the world market.

Michael Filloon, 20 Mar 2016, 01:47 PM

Comments (4564) |+

Follow |Send

Message

40 years, I would be surprised if you didn't have reservations. You aren't

the only one. Iran's infrastructure wasn't that great before the sanctions

so I would guess they are abysmal now.

I don't think they can get to 4 million this year, but the problem with

that is I am speculating so we will just have to track its exports and see

what happens. Right now, I think it would be ok to reduce that number by

400K BO/d.

I think the biggest issue is Iran thinks its possible, so maybe there

is something going on we haven't thought about. Probably not, but it is

still something to consider. I wasn't a big fan of the sanctions either,

but some politicians would say they worked. I think it is very possible

to re-export the oil the only problem is the very large volumes Iran can

produce. If this was a small producer it is probably easy if you sell it

cheap enough (like ISIS does).

<

A typical disinformation bunged with the obvious attempt to amplify differences

within the OPEC. In spite of all this noise about oversupply i t will be difficult

to return to the lows of the year. Oil prices have surged more than 50 percent from

12-year lows since the OPEC floated the idea of a production freeze, boosting Brent

up from around $27 a barrel and U.S. crude from around $26. 15 oil-producing nations

representing about 73% of oil production have agreed to take part.

Notable quotes:

"... Qatar, which has been organizing the meeting, has invited all 13 OPEC members and major outside producers. The talks are expected to widen February's initial output freeze deal by Qatar, Venezuela and Saudi Arabia, plus non-OPEC Russia. ..."

"... Iran produced about 2.9 million bpd in January and officials are talking about adding a further 500,000 bpd to exports. So far though, Iran has sold only modest volumes to Europe after sanctions were removed. ..."

finance.yahoo.com (Reuters)

...Libya has made its wish to return to pre-conflict oil production rates

clear since four countries reached a preliminary deal on freezing output in

February. Other producers understand this, the delegate said. "They appreciate

the situation we are in."

Qatar, which has been organizing the meeting, has invited all 13 OPEC

members and major outside producers. The talks are expected to widen February's

initial output freeze deal by Qatar, Venezuela and Saudi Arabia, plus non-OPEC

Russia.

The initiative has supported a rally in oil prices, which were about $41

a barrel on Tuesday, up from a 12-year low near $27 in January, despite doubts

over whether the deal is enough to tackle excess supply in the market.

Iran has yet to say whether it will attend the meeting. But Iranian officials

have made clear Tehran will not freeze output as it wants to raise exports following

the lifting of Western sanctions in January.

The potential volume Libya and Iran could add to the market is significant.

But conflict in Libya has slowed output to around 400,000 barrels per day since

2014, a fraction of the 1.6 million bpd it pumped before the 2011 civil war.

Iran produced about 2.9 million bpd in January and officials are talking

about adding a further 500,000 bpd to exports. So far though, Iran has sold

only modest volumes to Europe after sanctions were removed.

Notable quotes:

"... Crude Mystery: Where Did 800,000 Barrels of Oil Go? Last year, there were 800,000 barrels of oil a day unaccounted for by the International Energy Agency, the energy monitor that puts together data on crude supply and demand. Where these barrels ended up, or if they even existed, is key to an oil market that remains under pressure from the glut in crude. ..."

"... "The most likely explanation for the majority of the missing barrels is simply that they do not exist," said Paul Horsnell, an oil analyst at Standard Chartered. ..."

Sarko ,

03/19/2016 at 3:13 pm

Nobody talk about this?

Crude Mystery: Where Did 800,000 Barrels of Oil Go?

Last year, there were 800,000 barrels of oil a day unaccounted for by the International Energy

Agency, the energy monitor that puts together data on crude supply and demand. Where these barrels

ended up, or if they even existed, is key to an oil market that remains under pressure from the

glut in crude.

Some analysts say the barrels may be in China. Others believe the barrels were created by flawed

accounting and they don't actually exist. If they don't exist, then the oversupply that has driven

crude prices to decade lows could be much smaller than estimated and prices could rebound faster.

Whatever the answer, the discrepancy underscores how oil prices flip around based on data that

investors are often unsure of.

…

"The most likely explanation for the majority of the missing barrels is simply that they do not

exist," said Paul Horsnell, an oil analyst at Standard Chartered.

http://www.wsj.com/articles/crude-mystery-where-did-800-000-barrels-of-oil-go-1458207004

Notable quotes:

"... It looks more like the chaos of a failed state rather than a popular uprising to remove an authoritarian government. The implication of this difference is that a return of Libyan oil production to prior levels is highly unlikely until there is a massive stabilization achieved, and I wouldn't be holding my breathe for that. ..."

"... The people are hungry and without hope as long as conditions remain the way they are so they riot to try to change them. It is, very likely, just the first stages of world collapse. ..."

"... Arab spring is a variant of a "color revolution". From Google search of the term: ..."

Hickory,

03/15/2016 at 11:13 am

Minor quibble Dennis.

You commented- "Libya is struggling with their own Arab Spring"

I think that characterization of what is going there on is off base.

It looks more like the chaos of a failed state rather than a popular uprising to remove an authoritarian

government.

The implication of this difference is that a return of Libyan oil production to prior levels is

highly unlikely until there is a massive stabilization achieved, and I wouldn't be holding my

breathe for that.

Ron Patterson

,

03/15/2016 at 11:49 am

It's Ron, not Dennis. It all depends on your definition of "Arab Spring" And I see you have provided

your own definition, "a popular uprising to remove an authoritarian government."

Definition of the Arab Spring

Bold mine.

The Arab Spring was a series of anti-government protests, uprisings and armed rebellions

that spread across the Middle East in early 2011. But their purpose, relative success and outcome

remain hotly disputed in Arab countries, among foreign observers, and between world powers looking

to cash in on the changing map of the Middle East….

But the events in the Middle East went in a less straightforward direction.

Egypt, Tunisia and Yemen entered an uncertain transition period, Syria and Libya were

drawn into a civil conflict, while the wealthy monarchies in the Persian Gulf remained largely

unshaken by the events. The use of the term the "Arab Spring" has since been criticized for

being inaccurate and simplistic.

The Arabs themselves cannot agree on the definition of "Arab Spring". It is basically just

an uprising of the general population protesting the hardships of their lives. I would say that

the Arab Spring, in any country, is just the first stages of a failed state. I think there is no doubt that what is happening in Libya was caused by the same conditions

that has caused similar uprisings throughout the Arab world. The people are hungry and without