|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 |

|

|

Switchboard | ||||

| Latest | |||||

| Past week | |||||

| Past month | |||||

|

|

Some interesting facts:

Thursday, CNBC aired a documentary by it business reporter David Faber called "Untold Wealth: The Rise of the Super Rich". It highlights what some are calling the "New Gilded Age". The documentary highlighted some interesting facts:

- In 1985 there were 13 US billionaires- today there are more than a 1,000.

- The richest 1% of Americans control more wealth than 90% of the U.S. population-combined.

- 80 percent of the people with a net worth exceeding $30 million say they plan to spend more in 2008 than they did in 2007. (Prince Associates)

- 2007 was the first year that making Forbes magazine's list of 400 richest Americans required more than $1 billion. (The cutoff was $1.3 billion.)

- There are roughly 150,000 households in the United States with a net worth of at least $20 million.

- In 2004, the last time the Fed provided data, there were 649,000 American households worth $10 million or more, a nearly 300 percent jump since 1992.

- About 51 percent of the individual giving and philanthropy is from the 10 percent of households in the highest income groups.

- The earners in the top 1 percent in income distribution bracket make 20% of the money.

- Private jet travel is the fastest growing luxury market segment. Over 15% of all flights in the U.S. are by private jet. There are more than 1,000 daily private jet flights in key markets such as South Florida, New York and Los Angeles.- (Elite Traveler Magazine).

- More than 49,000 Americans are said to have more than $50 million.

- 125,000 more households in the $25 million to $50 million range.

- In 2005, the top 400 earners in America collectively piled up $214 billion, more than the GDP of 149 nations.

- The average American salary is $26,352.

Over the last 25 years, the income of the bottom 20% of wage earners has barely kept up with inflation, while the 400 richest Americans-as measured by the Forbes 400-have increased their wealth by 500%. There is no doubt that the gap between the super rich and low income earners has increased while the middle class has thinned. As the country descends into recession, the super wealthy will lose money, but when people in the middle class are losing their jobs and homes, public psychology will have a backlash- maybe by changing tax policy by electing Barack Obama. A well functioning democracy depends on a strong middle class. When inequity rises, at extremes, it causes social unrest. Inequity must be weighted against the unparalleled wealth creation-for all citizen- that capitalism has given this country over the last 100 years.

Even now, delusional, usually conservative commentators like to harp on about how wonderful things are in this country -- the greatest story never told! That is despite the fact that everywhere you look, there are numerous signs that things aren't going well for ordinary Americans. Aside from those who can't afford to have health insurance, fill up the tank with gas, or own a home, there seems to be a growing number of individuals who are having a hard time satisfying basic needs. In "New Breed of American Emerges in Need of Food," USA Today's Richard Wolf details a disturbing development.

Philomena Gist understands why it hurts so much to be on food stamps. After all, she's got a master's degree in psychology.

"There's pride in being able to take care of yourself," says the Columbus, Ohio, resident, laid off last year from a mortgage company and living on workers' compensation benefits while recovering from surgery. "I'm not supposed to be in this condition."

Neither are many of the 27.5 million Americans relying on government aid to keep food on their tables amid unemployment and rising prices. Average enrollment in the food stamps program has surpassed the record set in 1994, though the percentage of Americans on food stamps is still lower than records set in 1993-95. The numbers continue to climb.

Gist, 51, is the new face of hunger in the USA. She says she spent most of her adult life working as a mental health counselor before deciding to try real estate. "I'm a professional person," she says.

As economists nationally debate whether the country is in recession and policymakers discuss ways to drive down gas prices, a new category of Americans combats hunger.

Since 2006, soaring food and fuel prices have combined with lost jobs and stagnant wages to boost the number of Americans needing food aid. More than 41% of those on food stamps came from working families in 2006, up from 30% a decade earlier, according to the latest Agriculture Department data.

They are real estate agents and homebuilders hit by the housing slump, seniors on Social Security, parents of students whose free breakfast and lunch programs don't solve the problem of dinner. Increasingly in recent months, they have signed up for food stamps and shown up at food pantries, trying to make ends meet.

"This last year's been the worst," says Gladys Pearson, 76, a retired corrections officer, as she leaves a Bread for the City food pantry in Washington, D.C., a three-day supply of staples in the basket of her walker. She likens it to the 1950s, when her husband would come home with a small can of milk for their newborn daughter because a big one was too expensive.

Officials on the front lines say the need is growing.

At food stamp offices, employees are "seeing people from various occupations that they have never seen before," says Vic Todd, administrator of Oregon's Office of Self-Sufficiency Programs.

At food banks, demand is up 15% to 20% over last year. Pantries are serving "folks who get up and go to work every day," says Bill Bolling, founder of the Atlanta Community Food Bank. "That's remarkably different than the profile of who we've served through the years."

In schools, the school breakfast and lunch programs are serving more than 31 million students, which soon will give way to summer programs that serve just 3 million.

Kindergarteners in Baton Rouge are hoarding part of their lunches to eat later at home, says Mike Manning, president of the Greater Baton Rouge Food Bank.

In Reading, Pa., Peg Bianca, executive director of the Greater Berks Food Bank, sees demand soaring for "weekenders" - backpacks of food intended to help students stay nourished until Monday.

Americans 'are really hurting'

"People are hurting," says Kitty Schaller, executive director of the MANNA FoodBank in Asheville, N.C., where one in six people get emergency food assistance. "They are really hurting in a way that I think may well be unprecedented."

Hunger in America isn't new. The latest government data for 2006 show that 10.9% of households were "food insecure," a bureaucratic term meaning they did not have enough food for a healthy lifestyle at some point in the year. In 4% of households, no bureaucratic jargon was needed; someone was going hungry.

Families with enough to eat spent 31% more on food than those who didn't have enough.

The federal food stamps program has grown, shrunk and grown again since its creation in 1964. It was cut by Republicans when they took control of Congress in 1995. It has expanded during the past eight years, fueled by two economic slumps, relaxed rules regarding assets and an outreach campaign to sign up eligible families.

The program is restricted to households with incomes below 130% of the federal poverty level, or $27,560 for a family of four. They cannot have more than $2,000 or, in some cases, $3,000 in assets, not including homes and, in most states, cars. The average benefit is about $3 a day per person. Cost to the government: $38 billion, rising to $40 billion in 2009.

It's the largest weapon in the U.S. government's 15-program food aid arsenal, which now costs about $60 billion, up 76% since 2001. "We do have a strong safety net available to help families in times of economic distress," says Kate Houston, deputy undersecretary for food, nutrition and consumer services at the Department of Agriculture.

When the Bush administration proposed its 2008 budget in February 2007, it projected that an average of 26.2 million people would get food stamps this year. By the time the fiscal year began in October, however, enrollment already was 27.2 million and growing. For next year, the administration plans for an average of 28 million.

Even so, only 65% of eligible recipients are enrolled. Among working families, only 57% of those eligible for food stamps have signed up.

Gist joined the ranks of recipients after losing her job as a loan officer. She says she was fired the day before she was to be paid her $27,000 share of the closing costs for four loans she negotiated. The mortgage company is now out of business and, in an unfortunate twist, her home is in foreclosure.

She learned she was eligible for food stamps while having her taxes done for free. "It's embarrassing," says Gist, who still hopes to stay in her home despite a scheduled sheriff's sale Friday. "It's humbling."

'Regular Joes' on food stamps

Yet it's not unusual. Kevin McGuire, executive director of Maryland's Family Investment Administration, which runs antipoverty programs, says many new food stamp clients are "regular-Joe working Americans." His state saw enrollment rise 13.8% in the past year, fourth-highest in the USA.

When they get on food stamps, these new recipients find that the program doesn't keep up with prices. The inflation rate for items they're encouraged to buy under the "thrifty food plan" is 5.6% - more than the average 4.7% for food. Prices for basic items such as bread and milk pushed food prices up by almost 1% in April alone; bread costs 14.1% more than it did a year ago, milk 13.5% more.

Families with less than $10,000 in pre-tax income spend a larger share of their income on food - 17.1% compared with a U.S. average of 12.6%, according to a report last month by the Congressional Research Service. Inflation hits them harder.

"Many of the people who are turning to food pantries today are reporting that their food stamps aren't even lasting two weeks out of every month," says Lisa Hamler-Fugitt, executive director of the Ohio Association of Second Harvest Foodbanks.

The farm bill passed overwhelmingly by Congress last week partially addresses those issues. It would invest $10.4 billion over five years in the food stamps program and food banks. President Bush has vowed to veto the bill because of its subsidies to wealthy farmers, but the House and Senate votes indicate Congress is likely to override him for only the second time.

In the meantime, more Americans will cut corners.

It doesn't "stretch as far as they say it does," says Brenda Tanner, 45, of Asheville, N.C., who raises two teenage daughters on $623 a month in disability payments and $289 a month in food stamps. She buys in bulk and no longer goes out to eat. "Milk is as high as gas," she says. "That's crazy."

Near the Capitol, no more cereal

Even with one in every 11 Americans receiving food stamps, millions who don't qualify also need help. They are joining food stamp recipients at food pantries nationwide, where they receive bags of food intended to last a few days. "Many people are in desperate financial straits who are not eligible for food stamps," says House Speaker Nancy Pelosi, D-Calif., who pushed to pass the farm bill.

Second Harvest, the nation's largest network of food banks, says demand is up an average of 15% to 20% from a year ago.

More than 80% of its food banks reported in a survey completed this month that they could not meet demand without trimming operations or reducing the amount of food given out.

Donations are down, particularly from the federal government as well as private companies. Farmers are selling their crops on the open market at record prices, rather than giving them to the government through price-support programs.

To compensate, the Agriculture Department has traded raw commodities for finished goods that can be provided to food banks. Earlier this month, it chipped in with $50 million in frozen pork patties.

Costs are up, particularly for diesel fuel needed to deliver food to pantries by truck. Nearly half of the food banks now buy some of their food or are considering doing so, rather than relying on donations.

"It's really a perfect storm," says Maura Daly, Second Harvest's vice president of government affairs.

At Bread for the City in Washington, less than 2 miles from the White House and the Capitol, food and clothing director Ted Pringle can't buy cereal anymore because of the price of grain, wheat and corn. Fresh fruit jumped by 3.2% nationally in April. "It scares me to buy fruit," Pringle says.

Food banks across the country are on the front lines as demand increases and supply dwindles:

In Oakland, the number of monthly calls into the Alameda County Community Food Bank has risen 28% from last year. Since July, each month has set a new record.

In Tyler, Texas, the East Texas Food Bank has stopped buying rice and pinto beans in bulk quantities because they're too expensive. Some of the pantries it serves no longer can drive up to two hours to the central food bank because of a 64% increase in fuel costs.

In Detroit, executive director Augie Fernandes is seeing more seniors on fixed incomes "who are very proud" come into the Gleaners Community Food Bank of Southeastern Michigan.

In Ponca City, Okla., the local food pantry is serving more than 500 people a month, a 20% increase from last year. As a result, it's had to cut their monthly allotments from three bags of food to two.

In Nashville, program services manager Kelli Garrett sees former volunteers and donors arrive as clients at Second Harvest Food Bank of Middle Tennessee. "They feel a certain level of shame having to ask for help," she says.

In Alaska, 15 remote food pantries have closed because they lacked sufficient government commodities. "At one point, we were down to vegetarian beans," says Susannah Morgan, executive director of the Food Bank of Alaska. Things are better now: They have grape juice, green beans and frozen apricot cups.

In Orlando, Dave Krepcho of the Food Bank of Central Florida has eight trucks and a tractor-trailer on the road full time, picking up food from grocery stores. He worries about low-income children home from school this summer.

Krepcho, the food bank's executive director, has been in the business 16 years.

"This is the worst that I've ever seen it," he says, "by far."

The Financial Times reports on a FT/Harris survey found a surprising consensus across eight countries in Europe and Asia, as well as in the US, that increasing income disparity was undesirable. Not surprisingly, respondents favored increasing taxes on the rich.Of course, this poses an interesting conundrum for politicians, given the sway of multinational corporations and Big Finance. As Jean Colbert observed, "The art of taxation consists in so plucking the goose as to get the most feathers with the least hissing." And those at the top of the food chain know to hiss loudly. So unless the public at large figures out how to get more vocal, any moves to address these sentiments are likely to be symbolic.

And the survey participants appear to understand that dynamic well. For the most part, they expect inequality to worsen in the next five years.

From the Financial Times:

Income inequality has emerged as a highly contentious political issue in many countries as the latest wave of globalisation has created a "superclass" of rich people...According to the latest FT/Harris poll, strong majorities in five European countries ranging from 76 per cent in Spain to 87 per cent in Germany consider that income inequality is too great.

But 78 per cent of respondents in the US, traditionally seen as more tolerant of income inequality, also think the gap is too wide....

For the first time, the FT/Harris poll surveyed opinion in Asia. In China, which has experienced three decades of helter-skelter development, 80 per cent of respondents think income inequality is too great.

However, Japan recorded the lowest figure of all countries surveyed, with 64 per cent....

Clear majorities in all countries agree that taxes should be raised on the rich and lowered on the poor. In Britain, 74 per cent of respondents think that those on low incomes should be taxed less, helping to explain the furore that surrounded the Labour government's decision to abolish the 10p income tax rate...

US respondents were the most resistant to the idea of lowering taxes on the poor, with 27 per cent agreeing with the proposition that taxes should be kept at current levels.

Note that Japan has one of the most equal distributions of income, if you believe the UN Gini coefficient ranking, although the CIA Factbook Gini points to a very different conclusion. But the Japanese are keen observers of very small status differences (the legacy of having once had extremely strict sumptuary laws), so their sensitivity to income disparity is considerable.

Bruce Bartlett and I disagree about the size of government. He would starve the beast, I would want it healthy and thriving, but I have no disagreement with his view of the general lack of character Republicans have displayed on the budget issue:

The GOP's bait-and-switch tax strategy, by Bruce Bartlett, Commentary, LA Times: It is an article of faith among Republicans that tax cuts are the cure for every problem the economy faces, and that tax increases are the equivalent of economic poison. Any hint by Democrats that the current administration's tax cuts should be revisited in light of changing economic or fiscal conditions is met with charges that they are proposing the largest tax increase in history.

The truth is that President Bush's tax cuts didn't do much good for the economy; they were mostly giveaways to GOP political constituencies and were little different conceptually from pork-barrel spending...

The fact is that the massive tax increase Republicans claim the Democrats are proposing is entirely the result of the GOP's ... policies. Rather than expend the effort to make their tax cuts permanent in the first place, they attached expiration dates to every major provision. ... The alleged tax increase that would result is simply a consequence of the tax system returning to what it was before 2001...

In other words, no one is proposing new taxes... It is simply a matter of allowing the law that Republicans enacted to follow the course that they chose in the first place.

Republicans respond that they ... didn't have the votes to enact permanent tax cuts, so it was temporary cuts or nothing. This is not true. They could have made them permanent, but that would have required bipartisanship and more political capital than Republicans were willing to spend. So they took the easy way out, figuring that Democrats wouldn't dare oppose extending the tax cuts when the time came, lest they be accused of favoring a vast tax increase.

But this isn't even the worst of the Republican dishonesty. That goes to projections from the Congressional Budget Office showing a sharp reduction in budget deficits after 2010. But these lower deficits result largely from the expiration of the tax cuts and the higher revenues that would result. Thus, Republicans are trying to ... blame Democrats for advocating higher taxes while implicitly using those higher taxes to make future deficits smaller.

This sort of political game may be fun for Republicans who think that they have boxed Democrats into a corner. But this game has had real economic consequences. Because the tax cuts are not permanent, their economic impact has been severely diminished. All economists know that permanent tax changes have far more effect than temporary ones because people won't change their behavior significantly unless they have some assurance that the tax regime will be in effect for the long term. ...

There is little doubt that the economy would have been stronger with permanent tax cuts. But that would have meant fewer tax cuts and thus fewer opportunities to buy votes. It also would have forced Republicans to deal with the true budgetary consequences of their actions. ...

Tax policy is an important campaign issue, and it would be good to get agreement on the post-2010 tax code as soon as possible. Current law makes it impossible to plan for the future with regard to taxes. Whatever is done should be done permanently to the greatest extent possible.

He believes tax cuts promote economic growth to a much larger degree than I do, but there is some common ground. He wants taxes to be efficient, i.e. to promote maximum growth given the size of government that taxes must support, and I do too. Thus, to the extent that we can make the tax code more efficient through budget neutral tax changes without compromising equity, we shouldn't resist doing so. A budget neutral shift in taxes can promote economic growth in the same way that a tax cut does if the shift eliminates or substantially reduces economic distortions, though as I noted above tax changes are not the first place I would look if enhanced growth was the goal.

What this means is that instead of letting all the Bush tax cuts expire, there is the possibility of retaining some of the existing tax cuts while enacting new ones to replace them so that the revenue implications are the same, but the economic and equity properties are the same or better. However, given that this would be played as Democrats enacting new taxes, the politics that are involved make such a shift in taxes unlikely even though it would bring about the very thing Republicans claim they want, higher economic growth. I think Bruce Bartlett is honest in his belief that permanently lowering taxes has a significant effect on economic growth and that this belief corresponds to his small government philosophy, my difference on this issue is over the magnitude of the growth effect relative to what you must give up in terms of key government programs when taxes are cut. But for many Republicans, it seems as though the growth argument is merely an excuse to attain their real goal, smaller government, and their support of pretty much any tax cut that is proposed is evidence that growth is not the primary concern. Paul Krugman puts it this way:

Since the 1970's, conservatives have used two theories to justify cutting taxes. One theory, supply-side economics, has always been hokum for the yokels. Conservative insiders adopted the supply-siders as mascots because they were useful to the cause, but never took them seriously. The insiders' theory - what we might call the true tax-cut theory - was memorably described by David Stockman, Ronald Reagan's budget director, as "starving the beast." ... Starve-the-beasters believe that budget deficits will lead to spending cuts that will eventually achieve their true aim: shrinking the government's role back to what it was under Calvin Coolidge.

And when taxes have been cut recently, who has benefited most from what is "little different conceptually from pork-barrel spending" is worth thinking about as well.

Posted by Mark Thoma on Tuesday, April 22, 2008 at 02:34 AM in Budget Deficit, Economics, Politics, Taxes

April 22, 2008Is reduced progressivity of taxes responsible for the rise in inequality in recent decades?

Tax Progressivity and the Rise in Inequality, by Lane Kenworthy: Income inequality in the United States has increased sharply since the 1970s. How much of this is due to reduced tax progressivity?

A key element of the rise in inequality has been the dramatic jump in incomes among the top 1% of the population. According to calculations from IRS data by Thomas Piketty and Emmanuel Saez (available here), this group's share of total income more than doubled during the 1980s and 1990s.

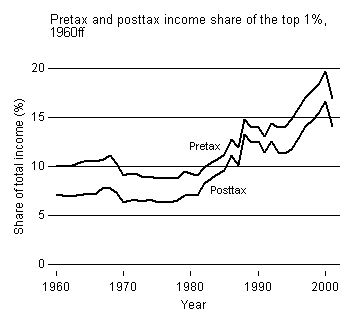

This is due in part to the fact that in recent decades taxes have done less to reduce the top 1%'s income share. The following chart shows the pretax and posttax income share of this group from 1960 to 2001, according to the Piketty-Saez calculations. Between 1960 and 1979, its posttax income share was 70% of its pretax share. In the period from 1980 to 2001 that increased to 84%.

(Note: The Piketty-Saez data end in 2001, so they don't reflect the Bush tax cuts. Calculations by the Congressional Budget Office suggest that from 2002 to 2005 the top 1%'s posttax income share was 85% of its pretax share, very similar to what the Picketty-Saez data indicate for 1980-2001. I don't use the CBO data here because they go back only to 1979.)

What effect has this had on inequality?

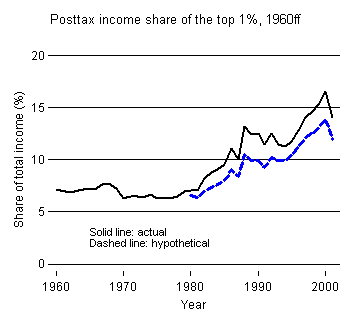

The chart makes clear that most of the rise in the top 1%'s posttax income share is due to the increase in its pretax share rather than to changes in tax progressivity. The next chart offers another way to see this. The solid line in the chart shows the top 1%'s share of after-tax income since 1960. The dashed line shows what the top 1%'s share of income would have been had taxes reduced it to the same degree as in the 1960s and 1970s. It's lower, but not massively so. Changes in taxation have mattered, but they have not been the main reason for the rise in the top 1%'s income share.

If reducing inequality is an aim of the next administration, increasing the progressivity of our tax system would surely help. But this is only one piece of the puzzle.

April 22, 2008

Puzzled, by Menzie Chinn: I have been puzzled by the proposal for a tax holiday for gasoline purchases running from Memorial to Labor day (see [0], [1], [2]), with the objective of spurring the economy. First, the Federal tax is quite low, either in real or in relative terms. Second, the benefits that would accrue to consumers are probably pretty small, under reasonable assumptions.

Going to the first point... As one can readily verify, in inflation adjusted terms, the tax has been eroded over time to levels not seen since the early 1990's. This is true regardless whether one deflates by the CPI-all or the CPI-ex. energy and food.

In relative terms, the total Federal tax has been shrinking as a share of gasoline prices, as gasoline prices have headed north (March = $3.293, all grades, inclusive of taxes). As of March 2008, the Federal tax accounted for 0.056% of that price. ...

So this is the measure to jump start the economy? I think this measure would give relief to somebody. But I also think it's a pretty blunt instrument by which to provide assistance...

Now, I'm not a microeconomist by training. Nor do I play one on TV. But it seems to me that if the supply of gasoline is price inelastic, and the demand is similarly price inelastic, then the incidence of the current Federal gas tax must be about evenly balanced. A tax holiday is then a holiday to both consumers and producers. ...

The proposed gas tax holiday was for a short duration of months. In this case, the short run price elasticity of supply is near zero, and the demand elasticity is plausibly near zero as well.

Assume both supply and demand are equally price inelastic, and this means the incidence of the Federal tax is about 50-50. Eliminating the gasoline tax for a short duration gives a windfall to both consumers and producers, of about equal proportion. (By the way, this conclusion is not true of state gasoline taxes; see Chouinard and Perloff (2004)). Now, giving a windfall to refiners and providers of feedstock for gasoline production might be a worthy goal, but I don't believe that was the stated goal. If those corporations get a windfall then either it gets stored away to be spent on investment in a new refinery or addition to an old refinery sometime in the future, or it leaks out to overseas oil producers.

Oh, and by the way, to the extent the lower price spurs gasoline consumption, this should increase the petroleum and petroleum products component of U.S. imports, and thence putting further upward pressure on the price of oil...

Matthew Yglesias (March 16, 2008) - Sunday Financial Meltdown Blogging (Domestic Policy): Every now and again, and then increasingly as things start looking worse, I get a comment like "how can you write about [thing that's not earth-shatteringly important] when the economy is [something terrible happening in the economy]."... I try to focus write blog posts that I think are going to be good posts rather than just posts on objectively important topics. I don't, in general, have any opinions about the problems in the financial markets that go beyond the utterly obvious -- bad things seem to be afoot and I'm worried....

But speaking strictly as an ideologue, I don't necessarily have a problem with the government intervening to bail a bunch of rich guys out when their own bad decisions blow up in their faces if that's what's needed for the health of the overall economy, but this sort of thing is one of several reasons why I think the very rich should pay high tax rates and we shouldn't be happy about the prospect of ever-growing inequality. At a certain level, the game is rigged and you're not really bearing any risk...

March 16, 2008 at 03:57 PM in Moral Responsibility, Philosophy: Moral, Political Economy, Sorting: Front Page, Sorting: Pieces of the Occasion | Permalink | Comments (0) | TrackBack (0)

Economist's ViewIn case you hear otherwise (and you will):

Have the 2001 and 2003 Tax Cuts Made the Tax Code More Progressive?, by Aviva Aron-Dine, CBPP: Summary Supporters of extending the 2001 and 2003 tax cuts claim that these tax cuts' benefits have been broadly and fairly distributed. Some argue that the tax cuts have actually made the tax system more progressive, pointing to Congressional Budget Office (CBO) data showing that the share of total federal income taxes paid by the top 1 percent of households rose modestly after the tax cuts were enacted.

The claim that the tax cuts are fairly distributed and have made the tax code more progressive does not withstand scrutiny. Whether measured in dollar terms or as a share of household income, the tax cuts going to high-income households are much larger than those going to all other households.

When fully in effect, the tax cuts will boost after-tax income by more than 7 percent among households with incomes of more than $1 million, but just 2 percent among middle-income families... A progressive tax cut, like a progressive tax system, is one that reduces inequality. But, as these data show, the tax cuts enacted in 2001 and 2003 are widening the gap in after-tax incomes, which was historically large even before the tax cuts were enacted.

In 2010, when the tax cuts are fully in effect, the average household earning more than $1 million a year will receive $158,000 in tax cuts, according to the Tax Policy Center; the average middle-income household will receive $810.

The same CBO data cited by the tax cuts' supporters show that the top 1 percent of households pay almost 5 percent less of their income in federal personal income taxes than they did in 2000, before the tax cuts. No other group got a tax cut nearly as large.

The CBO finding cited by the tax cuts' supporters does not change these facts. High-income households now pay a modestly larger share of federal income taxes not because the tax cuts are somehow tilted against them - to the contrary, the tax cuts are tilted decisively in their favor - but instead because (1) their incomes have risen much faster than other households,' and (2) the tax cuts have significantly shrunk the total revenue "pie."

The Tax Cuts Widened Income Gaps

A progressive tax code is one that makes the distribution of after-tax income more equal than the distribution of pre-tax income. (This definition is accepted by analysts across the political spectrum.) Hence, one tax code is "more progressive" than another if it has a larger effect in reducing income inequality. For the 2001 and 2003 tax cuts to have made the tax code more progressive, after-tax incomes would have to be less unequal today than if the tax cuts had not occurred. In fact, the tax cuts have made the distribution of after-tax income more unequal.

There's been quite a bit of denial about this from the crowd that believes that tax cuts for the wealthy are the answer time, make taxes more progressive. Here's the entire report. [On changes in the distribution of income, see the graphs and discussion in this post from Lane Kenworthy.]

"Can a recent history of the U.S. economy read a bit like a crime story? Yes, in the hands of Michael Perelman" - Seth Sandronsky, Sacramento News & Review

"The Confiscation of American Prosperity is a highly readable work that offers equal servings of serious economics and controlled anger. Michael Perelman is outraged by 30 years of deepening disparities in the U.S. economy, and by the fact most economists either ignore the reality before them or worse, provide academic firepower on behalf of a more unequal and unstable society. Read Perelman, and prepare to be challenged, both intellectually and morally."

--Robert Pollin, Professor of Economics and Co-Director of the Political Economy Research Institute (PERI), University of Massachusetts-Amherst"This book gives an original perspective on the changes in the country over the last three decades. It documents how the wealthy have managed to structure the economy so that they could monopolize the gains from growth over this period. It shows how the resulting growth in inequality is undermining economic stability and productivity growth, creating an economy and society that will not be sustainable in the long-run."

--Dean Baker, Co-Director, Center for Economic and Policy Research"Michael Perelman is author of a long series of important works on the history and theory of capitalism. In his latest book The Confiscation of American Prosperity, he offers an integrated account of economic and political developments in the postwar period that could not be more timely. Going beyond moral denunciation of the ever-worsening distribution of income and wealth, he shows the way in which an ascendant far right used the levers of power to counter declining profitability, but, in the process of assaulting American living standards and further enriching the wealthy, ended up weakening the mainsprings of the economy and preparing the ground for devastating crisis. This is a story that economic orthodoxy cannot tell but one that everyone needs to hear."

--Robert Brenner, Director, Center for Social Theory and Comparative History, UCLA"In this age of ever-increasing concentrations of power and wealth, economists have been quick to attribute changes in inequality to factors such as globalization and technological change, while paying much less attention to the social and political forces that have shaped the outcome. With its analysis of the political, economic, and social forces behind recent changes in the distribution of power, wealth, and income, this book takes important steps to fill this void. Beginning with its analysis of the right wing's exploitation of the discontent from the unraveling of the Golden Age as a means to promote free-market ideology, continuing with its analysis of later efforts to further free-market ideology in the political and public arenas, and ending with its characterization of where we are now, this book helps us understand how we attained the level of inequality we have today, and where we might be headed next."

--Mark Thoma, Associate Professor of Economics, University of OregonBook Description

This book argues that the right-wing revolution in the United States has created deepening inequality and will lead to economic catastrophe. The author makes the case that over the past three decades the rich have confiscated wealth and income from the poor and middle class to a far greater extent than many realize, and he explores in detail important but commonly unmeasured dimensions of inequality. He also takes aim at the economics profession, criticising the analytical blinders that leave economists incapable of seeing the coming crisis.

| ReutersNew rules have lifted the veil on how big companies reward their part-time board members. The average pay is nearly $200,000 a year, and an elite group earns $1 million or more.

How would you like to earn $21,000 an hour for a part-time job?

In 2006, the latest year for which numbers are available, 85 corporate directors took home more than $1 million, according to analysis by The Corporate Library, a corporate-governance research firm. They typically get this juicy pay for attending about 10 meetings a year, joining in on some conference calls and sometimes consulting on projects.

Many members of this elite group are founders or former executives, or serve as chairmen of the board, and some argue they deserve those checks.

Board members are supposed to represent shareholders' interests in guiding a company. Instead, as the numbers show, they're often enriching themselves at shareholders' expense.

'A dream job for any American'

Take real-estate magnate Sam Zell, who ranks 158th on Forbes' list of the world's billionaires. He's worth an estimated $5 billion.Thanks to his part-time position as chairman of the board at Equity Residential (EQR, news, msgs), an apartment-building developer that he helped found, Zell continues to accumulate wealth. In 2006, Equity Residential rewarded Zell with $3.2 million worth of options and restricted stock.

The Equity Residential board held nine meetings that year. Assuming they were full-day meetings and throwing in a few weeks for prep time, Zell earned about $21,000 per hour for this position. That's a well-paid gig even as chairmanships go. Directors at Fortune 500 firms who were also chairmen got a median of $288,000 in 2006, according to Equilar, an executive-compensation research firm. That was more than five times the median income that U.S. households brought home that year.

The Countrywide CEO's potential pay if his company is acquired rankles critics.By Kathy M. Kristof, Los Angeles Times Staff Writer

January 11, 2008Countrywide Financial Corp. founder Angelo Mozilo, one of the nation's highest-paid chief executives, stands to reap $115 million in severance-related pay if his troubled company is acquired by Bank of America Corp., regulatory filings show.Free rides on the company jet are also included in Mozilo's departure deal, and the company will pick up his country club bills until 2011.

Other executives, including Home Depot Inc.'s jettisoned CEO, Robert Nardelli, have garnered bigger going-away packages. But critics say Mozilo's arrangement is especially nettlesome given the losses that Countrywide investors have suffered in the last year. Company shares rallied Thursday to $7.75, up $2.63, but that's still down 82% from their high last year.

"This is a failed chief executive -- a failed and overpaid chief executive -- who has driven his company to the brink of bankruptcy," said Daniel Pedrotty, director of the office of investment at the AFL-CIO. "I think shareholders are going to be especially outraged if he walks away with another pay-for-failure package."

Neither Mozilo nor Countrywide officials returned calls for comment.

Bank of America is in talks to acquire Countrywide and a deal could be announced as early as today, according to people with knowledge of the talks.

If Countrywide is acquired, Mozilo could potentially stay on with the company. But he could probably make more money by leaving, compensation experts say.

For one thing, Bank of America is unlikely to pay Mozilo more than its own chief executive, Kenneth Lewis.

Lewis, whose company has a market capitalization of $174 billion, earned $27.9 million in 2007, according to regulatory filings. Mozilo earned $48.1 million last year, and Countrywide's market capitalization is $4.5 billion.

If Mozilo is fired or resigns voluntarily, his employment contract guarantees him three times his base salary, plus a cash payment equal to three times the amount of whichever is greater: his average bonus over the last two years or his bonus from the previous year.

That combined total would be $87.9 million, according to Countrywide's most recent proxy statement.

In addition, Mozilo has two pensions that his severance pact gives him the right to receive as a lump sum upon his departure. Those pensions were worth $24 million as of December 2006, the last time the company was required to report their value.

Finally, Mozilo would be eligible for accelerated payment of stock options and stock grants if the buyout goes through. Those are worth at least $3 million at current market prices, estimated Richard Ferlauto, director of pension and benefits policy at the American Federation of State, County and Municipal Employees.

Add it all up, and the severance package is potentially worth $115 million.

"He has driven the stock price into the ground and the company has been destroyed," Ferlauto said. "Their customers have lost their homes and he is potentially walking away with more than $100 million. For us, that's unconscionable enrichment."

In the past, Countrywide has defended Mozilo's pay, saying that shareholders had reaped vast riches thanks to the leadership of the company's founder, who has served as its chief executive since 1998. Until it was struck by rising loan defaults last year, the company had been profitable and its stock price had handily beaten market averages.

Mozilo has also defended his sale of company stock options, which are now the subject of an inquiry by the Securities and Exchange Commission.

The Times reported last year that Mozilo made changes to his stock-trading arrangements that allowed him to ramp up his sales of company stock before Countrywide shares went into a tailspin.

In October 2006, shortly before the severity of the mortgage crisis became understood to investors, Mozilo adopted a stock-trading plan allowing him to sell 350,000 shares of Countrywide stock each month.

He launched a second trading plan in December 2006 and then revised it in February, when the stock was at a 52-week high, to vastly increase his stock sales. Those changes helped enable Mozilo to sell $145 million in Countrywide stock between Nov. 1, 2006, and Oct. 12, 2007. Although executives are allowed to trade shares in their companies under so-called 10b(5) agreements, industry experts said it was highly unusual to revise and add plans in short succession.

SEC officials will not discuss continuing investigations, but people within the agency have confirmed that Mozilo's stock sales are being scrutinized.

Combining those sales with pay and previous gains on the sale of stock, Mozilo has taken more than $650 million out of Countrywide over the course of the last 10 years, Ferlauto said. Add in potential severance payments and the Calabasas-based company would have enriched Mozilo to the tune of three-quarters of a billion dollars.

"Compensation abuse has been a recurring travesty with this company," said William Patterson, director of CtW Investment Group in Washington. "The company has been run into the mud. Should Mozilo be able to walk away with this additional cash? Clearly not. I think it becomes the latest in a series of outrages."

Stagflation: The Epic Battle Between Labor and Capital

January 10, 2008

Now that 25 years of high growth and benign inflation appears to be ending, the term stagflation--stagnant economic growth coupled with stubborn inflation--is once again in the news.

For a novel and perceptive interpretation of stagflation, we turn to frequent contributor Albert T.:

What is stagflation really? High inflation and low growth is what we hear but why? The truth is stagflation is the battle between labor and capital for the share of the economic pie--wage share of income as we call it in one of my classes. (emphasis added--CHS) This story is the trend in my view:Thank you, Albert, for a very insightful and deeply provocative interpretation. Now I get to add my three cents. (It used to be two cents but costs have risen.)Italians Dressed in Sunday Best Forced to Dine in Soup Kitchens

Dressed in his best Sunday suit, Fausto Cepponi took his wife and seven-year-old son out for dinner -- at a soup kitchen.The problem with inflation is that repricing of contracts (labor contract being one of them) is problematic unless you have leverage. Hence the writers strike and stagehands strikes (both have tremendous leverage).``I never thought I would be in this position,'' said Cepponi, 45, a security guard, dining in an 800-seat charity cafeteria near Rome's main train station. ``I have a job, I had a car, but everything has become so expensive and what I earn just isn't enough. I panic every third week of the month.''

With salaries on hold, prices for staples such as pasta and bread rising and mortgages soaring, efforts to keep up appearances -- ``fare la bella figura'' in Italian -- can no longer disguise that thousands of job-holding Italians are failing to make ends meet. They've been labeled ``The New Poor,'' the title of a book published this year.

Inflation is in essense a gambit of attacking your costs by raising prices, assuming your own costs will rise but fall short of the net benefit between the two increases. Unfortunately for capital in this battle my guess is the writers will win out in the end. However that doesn't mean that labor won't lose out to capital in other areas.

I personally think the coming bankruptcy of small cities and towns will make them merge and eliminate work force, ergo "civil servants" and those people will rejoin the world of the living.

You think large corporations got great tax breaks before for shifting new businesses to one state or another, just wait. We will see deals of the century; I am sure offers of 99 years without taxation perhaps even decades of subsidy and tax free bonds financing. Ergo capital for capital that is intensive will become very very low cost but labor will be driven into a state of frenzy so high that it will force politicians to compete to placate it's plight.

Imagine having a tough time buying food like the people in the story above and I am sure any wage where you can buy food will look good. That is what we call subsistance wage in one of my classes. Subsistance wage is where you cover your necessities but have no money at all for savings--just like the U.S. wage earner on average--many Americans now live paycheck to paycheck.

Although some of us are thriftier and do choose to save, that choice will soon be gone for the majority. The wonderful point about subsistance wage is that is where the capital return is highest for capital.

It might seem odd that everything is falling around us but if we think about it the world is making perfect sense. Assets are repricing because they are being sold off by those whom aren't capital holders. People who are laid off by the job cuts in banks etc will probably sell off any 401k they managed to bulk up to pay for the mortgage or daily expenses until they get a job. I would be very reluctant to go to a lower paying job until all my savings were gone too, or if I didn't live with my parents. Prices take a long time to adjust.

Italy truck strike ends -- for now

The short end of the story is basically truckers in Italy stoped all traffic for about 3 days + with food shortages and store shelves going empty along with gas pumps, etc... To get higher wages ofcourse because their income hasn't kept pace with inflation.

Germany: Train Drivers Strike Again

German train drivers brought local rail services across the country to a standstill to press their demand for higher wages. The railway has refused to meet the union▓s demands for a wage increase of as much as 31 percent.Train strike brings Germany to standstillFrench rail authority says labor unions announce plan for 36-hour strike next week

(French and German unions have struck before and continued to strike until their wages were bumped up or some other economic benefit is provided to keep pace with inflation.)

Albert makes some key macro points. The first is what he calls labor leverage. Albert's example is the current Hollywood writers strike. The writers have leverage because the production companies are bound by contract to hire union writers. Legally, they cannot just go hire new screenwriters from Bollywood for a hundred bucks a movie/TV show. There is also a fraternal system in Hollywood which does not lend itself to outsourcing of creative material.

In other words, the writers have leverage. Eventually the media companies run out of new content and their advertisers go away. Corporate income drops, the stockholders scream, the head honchos' heads roll, and new management cuts a deal to restore profitability. If labor has a stranglehold on corporate revenue/profits, they can actually win. That's leverage. If not, they lose.

(NOTE: I think you can guess where my sympathies lie in this dispute. Recording artists receive income for decades from their original material, yet writers are supposed to give up their electronic (future) rights for nothing? Gee, I wonder why the media corporations are fighting so desperately for 100% of future electronic profits.)

The opposite of leverage is wage arbitrage. This is the term for moving factories and call centers to places with lower labor costs. Thus the factory moves from the U.S. to China, from Dusseldorf to Bulgaria, from Italy to Sri Lanka, and so on--in an endless chain which eventually leads--and has already led in some cases--to factories in "high cost" China being moved to "low cost" Vietnam.

How many jobs in the U.S. are vulnerable to wage arbitrage? A lot. Manufacturing jobs in the U.S. total about 14 million now, while China has about 110 million factory jobs. In one sense, this makes China far more vulnerable to wage arbitrage than the U.S. All the U.S. manufacturing jobs which could be shifted to cut costs have already been moved; those 14 million manufacturing jobs still here are here for a reason.

Like what? Like the materials are too heavy and the labor costs too small a percentage of the final cost to make offshoring the plant worthwhile. Examples include glass (heavy and brittle, often requires high-tech coatings better done here by robots), lumber products and various pharmaceuticals. (Pirating in China has destroyed many brands and pharmaceutical products' markets, so why bother even making stuff there?)

Meanwhile, we have friends whose family business manufactures specialty steel products. They have already moved their factory from China to Vietnam, and they are not alone. There are plenty of stories about wages rising in China to the point that wage abritrage is now a factor in China's growth as well.

Albert makes repeated mention of labor union strikes in Europe--especially those in transport. Municipal labor unions have plenty of leverage over public transport and services, as we all know. Subway/train and garbage strikes are usually quickly resolved in the unions' favor.

But as Albert points out, what happens on a macro level when cities and public agencies go bankrupt? As readers know, I have been forecasting just such a tidal wave of public bankruptcies for several years.

The problem for public unions is they don't control or even influence the revenue side of public agencies' ledgers. The basic model for the past 25 years of union contracts has been this: when unions strike, the easiest way to lower the pain (public outcry at the disruptions, etc.) for agency managers has been to cave in and agree to higher wages/benefits. Then the agency raises ticket prices or taxes. The public has grumbled but never revolted.

That will change once people find they can't afford food by the third week of the month. Their sympathy for well-paid transit and public union workers will vanish, and they may, for the first time, refuse to pay the higher ticket prices or higher property taxes.

If politicians start losing elections for trying to raise taxes, then agency heads will also roll. Bottom line: it's the politicians who control the revenue stream, and the public has the ultimate leverage on them.

If we wander back down memory lane, we can recall that President Reagan was faced by what appeared to be a union with tremendous leverage: the air traffic controllers. Now the air traffic control system is in dire need of a complete (and costly) overhaul, and I am not knowledgeable enough to say whether the union being busted was a good thing for the nation or not.

My point is simply this: public officials can stand up to public unions when pushed beyond a certain point--and when the public supports the officials. Europe and the U.S. have a different mix of public and private labor. About 40% of the French workforce is public or semi-public employees. That's a high enough percentage that they can practically control elections and vote in tax increases as a policy of self-interest.

But at some point, the private corporations and businesses who are paying the high taxes may rebel, and either close down (in the case of cafes and small businesses) or leave for more hospitable climes--wage and tax arbitrage, another issue Albert raised so preciently.

If public revenue (taxes) cannot keep pace with public union demands, then something will have to give. I would anticipate a situation in which transit/rail workers go on strike, demanding higher wages. This is a strategy which has worked exceedingly well for 60 years (since 1945). But alas, they will be told by bankrupt public authorities there simply is no more money. The unions will have a difficult time grasping this strangulation of the public revenue stream. But can't you raise taxes on someone, somewhere? No; all the productive businesses have left, exploiting global wage and tax arbitrage.

Many observers in California have noted the flow of jobs from California to other states--that is, wage and tax arbitrage within the U.S. Businesses and jobs leave California for lower-cost states. At an even finer-grained level, businesses leave high-cost San Francisco for lower cost suburbs. Like water flowing to the lowest level, businesses flow to the areas with the lowest wages and taxes. In many cases, they really have no choice; their competitors are already reaping the benefits of lower wages and taxes, and they can cut prices and increase profits as a result.

So the question for each of us becomes: how much leverage do we really have?

Readers Journal has been updated! An important new essay and many excellent comments on Can a Fragmented Culture Find Common Ground? and inflation/deflation.

Thoughts on a Common Culture (Chuck D.)

NOTE: contributions are humbly acknowledged in the order received.Thank you, Jennifer K. ($10), for your most-welcome support of this humble site. I am greatly honored by your contribution and readership. All contributors are listed below in acknowledgement of my gratitude.

If you find this site offers you something not found elsewhere, then perhaps you'd like to offer support in real terms, i.e. cash, as in

April 22, 2008

The Best Thing that Didn't Happen During The Bush Administration, by Robert Reich: The best thing to have occurred during the Bush administration is something that did not happen. We did not privatize Social Security.

Had we done so, boomers facing retirement over the next few years would be even worse off than they are today. Now they're struggling with pension plans worth less than they counted on, and home values that are tanking. At least they can rely on a monthly Social Security check.

But had we privatized, they'd be totally reliant on the stock market. And look what's happened to the market: Compared to stock values ten years ago, the S&P 500 has risen a little over 1 percent a year, adjusted for inflation. Even Treasury bonds have done better. Go back nine years and there's been no gain at all. Go back eight years and the market has been off an average of 1.4 percent a year.

Yes, I know, it's been a rough time. First the tech bubble bursting, then 9/11, then Enron, then the housing bubble bursting, then the credit crunch. But that's my point. We can't necessarily rely on the stock market. ...

Sure, the stock market has done well over the past half century. But there have been decades like the 1970s and this one, so far, where it's been a disaster. That's why we have Social Security so that if your timing is bad and you get caught in a downdraft, you still have something to fall back on in retirement.

If we had privatized, you'd have had nothing to fall back on. You'd crash.

I'm pretty happy the whole permanent Republican majority thing didn't work out so well either.

Society

Groupthink : Two Party System as Polyarchy : Corruption of Regulators : Bureaucracies : Understanding Micromanagers and Control Freaks : Toxic Managers : Harvard Mafia : Diplomatic Communication : Surviving a Bad Performance Review : Insufficient Retirement Funds as Immanent Problem of Neoliberal Regime : PseudoScience : Who Rules America : Neoliberalism : The Iron Law of Oligarchy : Libertarian Philosophy

Quotes

War and Peace : Skeptical Finance : John Kenneth Galbraith :Talleyrand : Oscar Wilde : Otto Von Bismarck : Keynes : George Carlin : Skeptics : Propaganda : SE quotes : Language Design and Programming Quotes : Random IT-related quotes : Somerset Maugham : Marcus Aurelius : Kurt Vonnegut : Eric Hoffer : Winston Churchill : Napoleon Bonaparte : Ambrose Bierce : Bernard Shaw : Mark Twain Quotes

Bulletin:

Vol 25, No.12 (December, 2013) Rational Fools vs. Efficient Crooks The efficient markets hypothesis : Political Skeptic Bulletin, 2013 : Unemployment Bulletin, 2010 : Vol 23, No.10 (October, 2011) An observation about corporate security departments : Slightly Skeptical Euromaydan Chronicles, June 2014 : Greenspan legacy bulletin, 2008 : Vol 25, No.10 (October, 2013) Cryptolocker Trojan (Win32/Crilock.A) : Vol 25, No.08 (August, 2013) Cloud providers as intelligence collection hubs : Financial Humor Bulletin, 2010 : Inequality Bulletin, 2009 : Financial Humor Bulletin, 2008 : Copyleft Problems Bulletin, 2004 : Financial Humor Bulletin, 2011 : Energy Bulletin, 2010 : Malware Protection Bulletin, 2010 : Vol 26, No.1 (January, 2013) Object-Oriented Cult : Political Skeptic Bulletin, 2011 : Vol 23, No.11 (November, 2011) Softpanorama classification of sysadmin horror stories : Vol 25, No.05 (May, 2013) Corporate bullshit as a communication method : Vol 25, No.06 (June, 2013) A Note on the Relationship of Brooks Law and Conway Law

History:

Fifty glorious years (1950-2000): the triumph of the US computer engineering : Donald Knuth : TAoCP and its Influence of Computer Science : Richard Stallman : Linus Torvalds : Larry Wall : John K. Ousterhout : CTSS : Multix OS Unix History : Unix shell history : VI editor : History of pipes concept : Solaris : MS DOS : Programming Languages History : PL/1 : Simula 67 : C : History of GCC development : Scripting Languages : Perl history : OS History : Mail : DNS : SSH : CPU Instruction Sets : SPARC systems 1987-2006 : Norton Commander : Norton Utilities : Norton Ghost : Frontpage history : Malware Defense History : GNU Screen : OSS early history

Classic books:

The Peter Principle : Parkinson Law : 1984 : The Mythical Man-Month : How to Solve It by George Polya : The Art of Computer Programming : The Elements of Programming Style : The Unix Haters Handbook : The Jargon file : The True Believer : Programming Pearls : The Good Soldier Svejk : The Power Elite

Most popular humor pages:

Manifest of the Softpanorama IT Slacker Society : Ten Commandments of the IT Slackers Society : Computer Humor Collection : BSD Logo Story : The Cuckoo's Egg : IT Slang : C++ Humor : ARE YOU A BBS ADDICT? : The Perl Purity Test : Object oriented programmers of all nations : Financial Humor : Financial Humor Bulletin, 2008 : Financial Humor Bulletin, 2010 : The Most Comprehensive Collection of Editor-related Humor : Programming Language Humor : Goldman Sachs related humor : Greenspan humor : C Humor : Scripting Humor : Real Programmers Humor : Web Humor : GPL-related Humor : OFM Humor : Politically Incorrect Humor : IDS Humor : "Linux Sucks" Humor : Russian Musical Humor : Best Russian Programmer Humor : Microsoft plans to buy Catholic Church : Richard Stallman Related Humor : Admin Humor : Perl-related Humor : Linus Torvalds Related humor : PseudoScience Related Humor : Networking Humor : Shell Humor : Financial Humor Bulletin, 2011 : Financial Humor Bulletin, 2012 : Financial Humor Bulletin, 2013 : Java Humor : Software Engineering Humor : Sun Solaris Related Humor : Education Humor : IBM Humor : Assembler-related Humor : VIM Humor : Computer Viruses Humor : Bright tomorrow is rescheduled to a day after tomorrow : Classic Computer Humor

The Last but not Least Technology is dominated by two types of people: those who understand what they do not manage and those who manage what they do not understand ~Archibald Putt. Ph.D

Copyright © 1996-2021 by Softpanorama Society. www.softpanorama.org was initially created as a service to the (now defunct) UN Sustainable Development Networking Programme (SDNP) without any remuneration. This document is an industrial compilation designed and created exclusively for educational use and is distributed under the Softpanorama Content License. Original materials copyright belong to respective owners. Quotes are made for educational purposes only in compliance with the fair use doctrine.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to advance understanding of computer science, IT technology, economic, scientific, and social issues. We believe this constitutes a 'fair use' of any such copyrighted material as provided by section 107 of the US Copyright Law according to which such material can be distributed without profit exclusively for research and educational purposes.

This is a Spartan WHYFF (We Help You For Free) site written by people for whom English is not a native language. Grammar and spelling errors should be expected. The site contain some broken links as it develops like a living tree...

|

|

You can use PayPal to to buy a cup of coffee for authors of this site |

Disclaimer:

The statements, views and opinions presented on this web page are those of the author (or referenced source) and are not endorsed by, nor do they necessarily reflect, the opinions of the Softpanorama society. We do not warrant the correctness of the information provided or its fitness for any purpose. The site uses AdSense so you need to be aware of Google privacy policy. You you do not want to be tracked by Google please disable Javascript for this site. This site is perfectly usable without Javascript.

Last modified: March 03, 2020