|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

| Home | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 1900 |

For the list of top articles see Recommended Links section

|

|

Switchboard | ||||

| Latest | |||||

| Past week | |||||

| Past month | |||||

Peak Oil Barrel

Jeffrey J. Brown, 12/30/2015 at 4:16 pm

I suspect that we actually have a condensate glut, at least in the US, and perhaps globally.

Javier, 12/30/2015 at 4:33 pm

The possibility of a global recession in 2016 must be taken into account in any scenario, given how weak is the economic situation of the world.

A global recession in 2016 probably means the peak [reached in] oil [ production] in 2015 will last for at least 10 years, and probably forever.

Stavros Hadjiyiannis, 12/30/2015 at 5:23 pm

Is this the 545289658th time that someone has claimed that Russian oil production has peaked?

In any case, oil production is a function of primarily price. If the price is right, then there will be oil for many decades ahead. Oil production is also a function of geopolitics. Also a function of technology and also a function of alternatives. Ron seems to be missing the point that for decades, oil rich countries have no choice but to defer to a great extent to Western oil production. Those that are included in the Western security and financial system (GCC) have an extra incentive to do so, saving their oil for the future.

Ron Patterson, 12/30/2015 at 6:31 pm

Is this the 545289658th time that someone has claimed that Russian oil production has peaked?

Don't be a fucking smart ass. Make your point without stupid exaggerations.

In any case, oil production is a function of primarily price.

Really? Look at the chart above marked "The Rest of the World". Now tell me, at what point did very expensive oil increase production.

Oil production is also a function of geopolitics.

Bullshit! Oil production is affected by geopolitics. But it is not a function of geopolitics. Oil production is a function of the cost of production versus the price of oil… but the most important function is the availability of oil in the ground to produce. If the oil is not there then geopolitics or the price of oil counts for nothing. And that is what Stavros fails to understand.

Ron seems to be missing the point that for decades, oil rich countries have no choice but to defer to a great extent to Western oil production.

What in the hell are you talking about? Since when has Saudi Arabia deferred to Western oil production?

Those that are included in the Western security and financial system (GCC) have an extra incentive to do so, saving their oil for the future.

Give me a break. Every country is producing every barrel they possibly can. Which country was holding back when oil was over $100 a barrel? Saving oil for the future? They are in recession right now. Most of them anyway. No one is hording oil. A lot of oil is not being produced because of the very low price of oil but everyone is still trying desperately to meet their budgets by producing every barrel they possibly can at the cost they can afford.

Dec. 30, 2015 | WSJ

The price rout has caused oil companies to cut deeply into investment. With the world awash in crude, the oil industry is contemplating a new problem the oversupply could tee up: an oil shortage.

oilprice.com

08 December 2014 | OilPrice.com

Not long ago, I wrote Ten Reasons Why High Oil Prices are a Problem. If high oil prices can be a problem, how can low oil prices also be a problem? In particular, how can the steep drop in oil prices we have recently been experiencing also be a problem?Let me explain some of the issues:

Issue 1. If the price of oil is too low, it will simply be left in the ground.

The world badly needs oil for many purposes: to power its cars, to plant its fields, to operate its oil-powered irrigation pumps, and to act as a raw material for making many kinds of products, including medicines and fabrics.

If the price of oil is too low, it will be left in the ground. With low oil prices, production may drop off rapidly. High price encourages more production and more substitutes; low price leads to a whole series of secondary effects (debt defaults resulting from deflation, job loss, collapse of oil exporters, loss of letters of credit needed for exports, bank failures) that indirectly lead to a much quicker decline in oil production.

The view is sometimes expressed that once 50% of oil is extracted, the amount of oil we can extract will gradually begin to decline, for geological reasons. This view is only true if high prices prevail, as we hit limits. If our problem is low oil prices because of debt problems or other issues, then the decline is likely to be far more rapid. With low oil prices, even what we consider to be proved oil reserves today may be left in the ground.

Issue 2. The drop in oil prices is already having an impact on shale extraction and offshore drilling.

While many claims have been made that US shale drilling can be profitable at low prices, actions speak louder than words. (The problem may be a cash flow problem rather than profitability, but either problem cuts off drilling.) Reuters indicates that new oil and gas well permits tumbled by 40% in November.

Related: Who Comes Out On Top After Oil Pandemonium?

Offshore drilling is also being affected. Transocean, the owner of the biggest fleet of deep water drilling rigs, recently took a $2.76 billion charge, among a "drilling rig glut."

3. Shale operations have a huge impact on US employment.

Zero Hedge posted the following chart of employment growth, in states with and without current drilling from shale formations:

Figure 1. Jobs in States with and without Shale Formations, from Zero Hedge.

Clearly, the shale states are doing much better, job-wise. According to the article, since December 2007, shale states have added 1.36 million jobs, while non-shale states have lost 424,000 jobs. The growth in jobs includes all types of employment, including jobs only indirectly related to oil and gas production, such as jobs involved with the construction of a new supermarket to serve the growing population.

It might be noted that even the "Non-Shale" states have benefited to some extent from shale drilling. Some support jobs related to shale extraction, such as extraction of sand used in fracking, college courses to educate new engineers, and manufacturing of parts for drilling equipment, are in states other than those with shale formations. Also, all states benefit from the lower oil imports required.

Issue 4. Low oil prices tend to cause debt defaults that have wide ranging consequences. If defaults become widespread, they could affect bank deposits and international trade.

With low oil prices, it becomes much more difficult for shale drillers to pay back the loans they have taken out. Cash flow is much lower, and interest rates on new loans are likely much higher. The huge amount of debt that shale drillers have taken on suddenly becomes at-risk. Energy debt currently accounts for 16% of the US junk bond market , so the amount at risk is substantial.

Dropping oil prices affect international debt as well. The value of Venezuelan bonds recently fell to 51 cents on the dollar , because of the high default risk with low oil prices. Russia's Rosneft is also reported to be having difficulty with its loans .

There are many ways banks might be adversely affected by defaults, including

- Directly by defaults on loans held by a bank

- Indirectly, by defaults on securities the bank owns that relate to loans elsewhere

- By derivative defaults made more likely by sharp changes in interest rates or in currency levels

- By liquidity problems, relating to the need to quickly sell or buy securities related to ETFs

After the many bank bailouts in 2008, there has been discussion of changing the system so that there is no longer a need to bail out "too big to fail" banks. One proposal that has been discussed is to force bank depositors and pension funds to cover part of the losses, using Cyprus-style bail-ins. According to some reports , such an approach has been approved by the G20 at a meeting the weekend of November 16, 2014. If this is true, our bank accounts and pension plans could already be at risk.1

Another bank-related issue if debt defaults become widespread, is the possibility that junk bonds and Letters of Credit2 will become outrageously expensive for companies that have poor credit ratings. Supply chains often include some businesses with poor credit ratings. Thus, even businesses with good credit ratings may find their supply chains broken by companies that can no longer afford high-priced credit. This was one of the issues in the 2008 credit crisis.

Issue 5. Low oil prices can lead to collapses of oil exporters, and loss of virtually all of the oil they export.

The collapse of the Former Soviet Union in 1991 seems to be related to a drop in oil prices .

Figure 2. Oil production and price of the Former Soviet Union, based on BP Statistical Review of World Energy 2013.

Oil prices dropped dramatically in the 1980s after the issues that gave rise to the earlier spike were mitigated. The Soviet Union was dependent on oil for its export revenue. With low oil prices, its ability to invest in new production was impaired, and its export revenue dried up. The Soviet Union collapsed for a number of reasons, some of them financial, in late 1991, after several years of low oil prices had had a chance to affect its economy.

Many oil-exporting countries are at risk of collapse if oil prices stay very low very long. Venezuela is a clear risk, with its big debt problem. Nigeria's economy is reported to be "tanking." Russia even has a possibility of collapse, although probably not in the near future.

Even apart from collapse, there is the possibility of increased unrest in the Middle East, as oil-exporting nations find it necessary to cut back on their food and oil subsidies. There is also more possibility of warfare among groups, including new groups such as ISIL. When everyone is prosperous, there is little reason to fight, but when oil-related funds dry up, fighting among neighbors increases, as does unrest among those with lower subsidies.

Issue 6. The benefits to consumers of a drop in oil prices are likely to be much smaller than the adverse impact on consumers of an oil price rise.

When oil prices rose, businesses were quick to add fuel surcharges. They are less quick to offer fuel rebates when oil prices go down. They will try to keep the benefit of the oil price drop for themselves for as long as possible.

Airlines seem to be more interested in adding flights than reducing ticket prices in response to lower oil prices, perhaps because additional planes are already available. Their intent is to increase profits, through an increase in ticket sales, not to give consumers the benefit of lower prices.

In some cases, governments will take advantage of the lower oil prices to increase their revenue. China recently raised its oil products consumption tax, so that the government gets part of the benefit of lower prices. Malaysia is using the low oil prices as a time to reduce oil subsidies .

Most businesses recognize that the oil price drop is at most a temporary situation, since the cost of extraction continues to rise (because we are getting oil from more difficult-to-extract locations). Because the price drop is only temporary, few business people are saying to themselves, "Wow, oil is cheap again! I am going to invest a huge amount of money in a new road building company [or other business that depends on cheap oil]." Instead, they are cautious, making changes that require little capital investment and that can easily be reversed. While there may be some jobs added, those added will tend to be ones that can easily be dropped if oil prices rise again.

Issue 7. Hoped-for crude and LNG sales abroad are likely to disappear, with low oil prices.

There has been a great deal of publicity about the desire of US oil and gas producers to sell both crude oil and LNG abroad, so as to be able to take advantage of higher oil and gas prices outside the US. With a big drop in oil prices, these hopes are likely to be dashed. Already, we are seeing the story, Asia stops buying US crude oil . According to this story, "There's so much oversupply that Middle East crudes are now trading at discounts and it is not economical to bring over crudes from the US anymore."

LNG prices tend to drop if oil prices drop. (Some LNG prices are linked to oil prices, but even those that are not directly linked are likely to be affected by the lower demand for energy products.) At these lower prices, the financial incentive to export LNG becomes much less. Even fluctuating LNG prices become a problem for those considering investment in infrastructure such as ships to transport LNG.

$80 Oil By Christmas – Do NOT Be Fooled By The Mainstream MediaThe current market turmoil has created a once in a generation opportunity for savvy energy investors.

Whilst the mainstream media prints scare stories of oil prices falling through the floor smart investors are setting up their next winning oil plays.Click here for more info on successful oil investing

Issue 8. Hoped-for increases in renewables will become more difficult, if oil prices are low.

Many people believe that renewables can eventually take over the role of fossil fuels. ( I am not of the view that this is possible. ) For those with this view, low oil prices are a problem, because they discourage the hoped-for transition to renewables.

Despite all of the statements made about renewables, they don't really substitute for oil. Biofuels come closest, but they are simply oil-extenders. We add ethanol made from corn to gasoline to extend its quantity. But it still takes oil to operate the farm equipment to grow the corn, and oil to transport the corn to the ethanol plant. If oil isn't around, the biofuel production system comes to a screeching halt.

Issue 9. A major drop in oil prices tends to lead to deflation, and because of this, difficulty in repaying debts.

If oil prices rise, so do food prices, and the price of making most goods. Thus rising oil prices contribute to inflation. The reverse of this is true as well. Falling oil prices tend to lead to a lower price for growing food and a lower price for making most goods. The net result can be deflation. Not all countries are affected equally; some experience this result to a greater extent than others.

Those countries experiencing deflation are likely to eventually have problems with debt defaults, because it will become more difficult for workers to repay loans, if wages are drifting downward. These same countries are likely to experience an outflow of investment funds because investors realize that funds invested these countries will not earn an adequate return. This outflow of funds will tend to push their currencies down, relative to other currencies. This is at least part of what has been happening in recent months.

The value of the dollar has been rising rapidly, relative to many other currencies. Debt repayment is likely to especially be a problem for those countries where substantial debt is denominated in US dollars, but whose local currency has recently fallen in value relative to the US dollar.

Figure 3. US Dollar Index from Intercontinental Exchange

The big increase in the US dollar index came since June 2014 (Figure 3), which coincides with the drop in oil prices. Those countries with low currency prices, including Japan, Europe, Brazil, Argentina, and South Africa, find it expensive to import goods of all kinds, including those made with oil products. This is part of what reduces demand for oil products.

China's yuan is relatively closely tied to the dollar. The collapse of other currencies relative to the US dollar makes Chinese exports more expensive, and is part of the reason why the Chinese economy has been doing less well recently. There are, no doubt, other reasons why China's growth is lower recently, and thus its growth in debt. China is now trying to lower the level of its currency .

Issue 10. The drop in oil prices seems to reflect a basic underlying problem: the world is reaching the limits of its debt expansion.

There is a natural limit to the amount of debt that a government, or business, or individual can borrow. At some point, interest payments become so high, that it becomes difficult to cover other needed expenses. The obvious way around this problem is to lower interest rates to practically zero, through Quantitative Easing (QE) and other techniques.

(Increasing debt is a big part of pumped up "demand" for oil, and because of this, oil prices. If this is confusing, think of buying a car. It is much easier to buy a car with a loan than without one. So adding debt allows goods to be more affordable. Reducing debt levels has the opposite effect).

QE doesn't work as a long-term technique, because it tends to create bubbles in asset prices, such as stock market prices and prices of farmland. It also tends to encourage investment in enterprises that have questionable chance of success. Arguably, investment in shale oil and gas operations are in this category.

As it turns out, it looks very much as if the presence or absence of QE may have an impact on oil prices as well (Figure 4), providing the "uplift" needed to keep oil prices high enough to cover production costs.

Figure 4. World "liquids production" (that is oil and oil substitutes) based on EIA data, plus OPEC estimates and judgment of author for August to October 2014. Oil price is monthly average Brent oil spot price, based on EIA data.

The sharp drop in price in 2008 was credit-related , and was only solved when the US initiated its program of QE started in late November 2008 . Oil prices began to rise in December 2008. The US has had three periods of QE, with the last of these, QE3, finally tapering down and ending in October 2014. Since QE seems to have been part of the solution that stopped the drop in oil prices in 2008, we should not be surprised if discontinuing QE is contributing to the drop in oil prices now.

Part of the problem seems to be the differential effect that happens when other countries are continuing to use QE, but the US not. The US dollar tends to rise, relative to other currencies. This situation contributes to the situation shown in Figure 3.

QE allows more borrowing from the future than would be possible if market interest rates really had to be paid. This allows financiers to temporarily disguise a growing problem of un-affordability of oil and other commodities.

The problem we have is that, because we live in a finite world, we reach a point where it becomes more expensive to produce commodities of many kinds: oil (deeper wells, fracking), coal (farther from markets, so more transport costs), metals (poorer ore quality), fresh water (desalination needed), and food (more irrigation needed). Wages don't rise correspondingly, because more and more labor is needed to provide less and less actual benefit, in terms of the commodities produced and goods made from those commodities. Thus, workers find themselves becoming poorer and poorer, in terms of what they can afford to purchase.

QE allows financiers to disguise the growing mismatch between what it costs to produce commodities, and what customers can really afford . Thus, QE allows commodity prices to rise to levels that are unaffordable by customers, unless customers' lack of income is disguised by a continued growth in debt.

Once commodity prices (including oil prices) fall to levels that are affordable based on the incomes of customers, they fall to levels that cut out a large share of production of these commodities. As commodity production drops to levels that can be produced at affordable prices, so does the world's ability to make goods and services. Unfortunately, the goods whose production is likely to be cut back if commodity production is cut back are those of every kind, including houses, cars, food, and electrical transmission equipment.

Conclusion

There are really two different problems that a person can be concerned about:

1. Peak oil : the possibility that oil prices will rise, and because of this production will fall in a rounded curve. Substitutes that are possible because of high prices will perhaps take over.

2. Debt related collapse : oil limits will play out in a very different way than most have imagined, through lower oil prices as limits to growth in debt are reached, and thus a collapse in oil "demand" (really affordability). The collapse in production, when it comes, will be sharper and will affect the entire economy, not just oil.

In my view, a rapid drop in oil prices is likely a symptom that we are approaching a debt-related collapse–in other words, the second of these two problems. Underlying this debt-related collapse is the fact that we seem to be reaching the limits of a finite world. There is a growing mismatch between what workers in oil importing countries can afford, and the rising real costs of extraction, including associated governmental costs. This has been covered up to date by rising debt, but at some point, it will not be possible to keep increasing the debt sufficiently.

Related: A Glimmer Of Hope In Current Oil Price Slide?

The timing of collapse may not be immediate. Low oil prices take a while to work their way through the system. It is also possible that the world's financiers will put off a major collapse for a while longer, through more QE, or more programs related to QE. For example, actually getting money into the hands of customers would seem to be temporarily helpful.

At some point the debt situation will eventually reach a breaking point. One way this could happen is through an increase in interest rates. If this happens, world economic growth is likely to slow greatly. Oil and commodity prices will fall further. Debt defaults will skyrocket. Not only will oil production drop, but production of many other commodities will drop, including natural gas and coal. In such a scenario, the downslope of all energy use is likely to be quite steep, perhaps similar to what is shown in the following chart.

Figure 5. Estimate of future energy production by author. Historical data based on BP adjusted to IEA groupings.

Notes:

[1] There is of course insurance by the FDIC and the PBGC , but the actual funding for these two insurance programs is tiny in relationship to the kind of risk that would occur if there were widespread debt defaults and derivative defaults affecting many banks and many pension plans at once. While depositors and pension holders might try to collect this insurance, there wouldn't be enough money to actually cover these demands. This problem would be similar to the issue that arose in Iceland in 2008 . Insurance would seem to be available, but in practice, would not pay out much.

[2] LOCs are required when goods are shipped internationally, before payment has actually been made. They offer a guarantee that a buyer will be able to "make good" on his promise to pay for goods when they arrive.

By Gail Tverberg

Source - http://ourfiniteworld.com/

More Top Reads From Oilprice.com:

peakoilbarrel.com

Heinrich Leopold , 12/31/2015 at 4:10 am

... condensate has one of the steepest decline rates – at least in Texas. As November and December 2014 production has been very high, the rates are very likely much steeper in November and December 2015, reaching record decline rates of 50% (see chart below).

peakoilbarrel.com

Ves , 12/25/2015 at 2:23 pmSteve,Cacerolo , 12/10/2015 at 12:00 am

I agree with your post about market dynamics between customers having to pay through their purchasing power in order to retire loans created by financial industry for oil companies. But there are a few things that make this oil crash little bit "strange" to say at least:1) OPEC (and mainly Saudis + GCC) did actually something by not doing anything and that is refusing to cut their production. Well that is "man made" decision as Oman oil minister said and not decision by invisible hand of market. I interpret this mainly as political decision and not economical.

2) Second. Wall Street was pretty much shocked if not pissed by that Saudi decision. I interpret that to be political reaction as well.

3) There is no worldwide collapse of demand that justify 65-70% fall of the oil price. I am sorry but Wall Street is creating ninja loans for cars, student loans, mortgages from the thin air with the same speed in the US. I would say that is political decision as well. Worldwide collapse is not happening as of now either that would justify 65-70% drop of price. Contraction is happening in Europe but very very gradually except in some marginal countries like Greece, and war torn countries in ME and Africa. But these marginal countries did not even have any big consumption to begin with.

4) Shale oil producer based on their balance sheet were bankrupt from Day 1. Why LTO even got the loans to begin with? That is also political decision and not an economic. Why are we waiting even a year after low prices for any major mergers, buyouts or bankruptcies? I am sorry but 100% of LTO are bankrupt so why Wall Street is extending and pretending and keeping them on a life support? Well it is again political decision.

So yes there are some market dynamics around this oil crash but there are a lot of political dynamics as well.

This is my first post in this blog.Clueless , 12/10/2015 at 5:13 amThere has been a lot of talk regarding the oil glut, but according to EIA crude inventories there is only 105.1 million more barrels of crude than a year ago. That is just 6.4 days of refineries inputs. It does not seem a lot, even less to justify a 60% decrease in the oil price. Oil must be the only commodity industry where one week of extra inventory produce such a price correction.

It is even worse if we consider that gasoline inventories are just 0.4% higher than a year ago. The most important product which represents 46% of the refineries output is at 2014 level. Where is the glut?

There is a glut in distilite fuel oil, residual fuel oil, propane/propylene and fuel ethanol. It seems that there is a big problem in the industrial part of the demand or maybe there is a big unbalance between what refineries can produce and what the market needs.

Warm weather promotes more driving, so we could start spring 2016 with gasoline inventories quite reduced and we could face a high gasoline price environment while we still have this huge oil glut that the media talks all day long.

I have no idea if what eia states in its inventory report as crude and other oils ( the two mayor inventory items by quantity) can be completely used as inputs to produce gasoline or if there are some technical limitations ( not any type of crude can be used to product any type of output). Maybe, and just maybe we have a glut of some types of oil and condensate that nobody needs in the quantities it has been produced since the shale boom.

It is basic economics when it comes to any commodity. If there is a shortage, the price can rise rapidly to the amount that the most critical user will pay. Ask yourself "at what price would the hospitals, ambulances, fire trucks, police cars, offshore drilling rigs [which are being leased for up to $600,000/day], say the price is too high, we will just shut down?" With a small surplus, the price of a commodity will drop like a rock, as buyers see no need to have high inventories and shop around for the lowest price, looking for a seller that has to sell at any price.oldfarmermac , 12/10/2015 at 7:56 amA game analogy. Musical chairs with 20 players and only 19 chairs (only short by 1), and two other rules: The person without a chair gets killed, but there is one chair for sale and anyone can buy it to guarantee their safety. How high would the bidding go? Up to the point of the person with the most money.

Same game with 20 players and 21 chairs (only 1 extra). How high would the bidding go? Zero, as everyone can see that there is more than enough for everybody.

You can easily see this play out even more frequently by looking at charts for agricultural products such as: wheat, corn, soybeans, etc.Prices can double quickly if there is a crop surplus, and fall by over 50% just as quickly if the next crop has a surplus.

Clueless, you are not when it comes to commodity prices. I wish I had thought of the musical chairs analogy myself. But you got in a little bit of a hurry in his last sentence and should have said prices can double quickly if there is a crop SHORTAGE.Clueless , 12/10/2015 at 4:35 pmCommodity food prices are not nearly so inelastic as oil prices, because there are generally plenty of substitutes for any GIVEN food that might be in short supply. But the price can still double in the event of a short crop, it happens.

There are NO short term substitutes for oil.

Thanks OFM. However, my error was not due to being in a hurry, it was due to being 4:13 am my time, and I was still half asleep.Nick G , 12/10/2015 at 4:44 pmThere are NO short term substitutes for oil.Patrick R , 12/10/2015 at 5:11 pmI know what you mean, but that's a little strong. Driving slower, driving your small car instead of your SUV, mass transit, carpooling: there are a lot of short term substitutes.

None of them are perfect substitutes for dirt cheap oil…but that's different (and, of course, dirt cheap oil doesn't really exist if we take into account externalities).

The US just needs to price driving accurately and a huge amount of low value wasteful trips would suddenly become understood as unnecessary. Furthermore the uplift this would give to all alternatives; not just EVs (you guys are so stuck in autodependency), but Transit, active modes, and, most importantly of all; the rise of the local, would huge. And please note, this is not subsidy, simply user pays, just price driving for all its costs, direct and external. Sorted.Also always remember that proximity trumps mobility; that's why cities exist!

Sprawl topia is doomed, but I guess that's hard to grasp when it's all people have ever known. And getting real about actual cost allocation is the mechanism to get North America out of the current stuck pattern. Climate change and all other pollution mitigation isn't about personal choice it's about rational cost allocation; by all means choose to stink, just actually pay the whole cost and there will be more rational actors than old contrarians.

Jeffrey J. Brown , 12/10/2015 at 7:40 amThe craziest thing is that otherwise libertarian freemarketers are violently committed to the Soviet style socialism that is your taxpayer funded driving amenity and no-price driving system. What kind of crisis will it take for reality to be grasped in this area? Cos I suspect you'll get it sooner or later.

Meantime: Keep on truckin'…

Dennis Coyne , 12/10/2015 at 9:06 amThere has been a lot of talk regarding the oil glut, but according to eia crude inventories there is only 105.1 million more barrils of crude than a year ago

What the EIA calls "Crude oil" is actually Crude + Condensate (C+C).

I suspect that most of the 2015 build in US and global C+C inventories consists of condensate, and I frequently cite a Reuters article earlier this year that documented case histories of refiners increasingly rejecting blends of heavy crude and condensate that technically meet the upper API limit for WTI crude (42 API gravity*), but that are deficient in distillates.

In any case, based on the most recent four week running average data, US refineries were dependent on net crude oil imports for 43% of the C+C processed in US refineries (7.1/16.5) versus 44% a year ago (7.1/16.2). If we had so much (generally cheaper than imported) actual crude oil on hand in the US, why are refiners importing the same amount of crude oil as they did last year?

*Most common overall dividing line between crude & condensate is 45 API

The market for oil is a World market, look at IEA reports for a better look at the International market. Last time I checked, st0rage levels in the OECD were about 250 million barrels above the 5 year average level. There is a limited number of places to put the oil that has been produced, and storing oil costs money, so when there is an excess prices fall. In theory this should increase demand at any given level of World GDP and it should reduce supply as higher cost production is less profitable at lower prices. It takes some time for this adjustment to take place (people don't go out and buy a gas guzzler right away and oil producers try to outlast their competitors, hoping the other guy stops producing as much). So far it has been about 12 months since oil prices dropped sharply, it may take another 12 months, maybe more for production to slow down and excess inventories to be used up.Heinrich Leopold , 12/10/2015 at 4:17 amIf there is not a severe recession worldwide in the next 24 months, I would be surprised if oil prices are not above $60/b, 18 months to 36 months from now, possibly they will be much higher.

It depends on how quickly the oil business can ramp back up after the downturn over the next 1 to 2 years. The longer it takes, the higher oil prices will go, but at some point there may be a major recession, due in part to inadequate oil supply two or three years in the future.

Chart below with the Reference Oil Price case for Brent Oil in 2013$ from the EIA's Annual Energy Outlook published in April 2015.

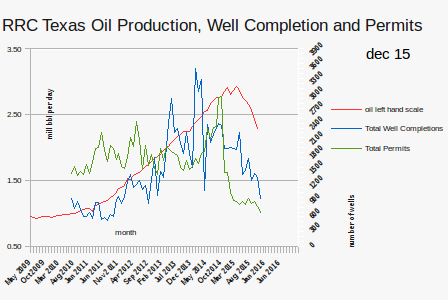

Given the recent discussions about where US oil and gas production is headed, I have tried to find some forward looking indicators. Well permits and well completions seem to give reasonable indicators for future production. Below chart indicates that at least Texan oil and gas production will steeply slump over the next months. Well permits declined fivefold to a six year low and well completions are not far behind. It will be interesting to see the consequences of this trend.Dennis Coyne , 12/10/2015 at 9:10 am

Given the recent discussions about where US oil and gas production is headed, I have tried to find some forward looking indicators. Well permits and well completions seem to give reasonable indicators for future production. Below chart indicates that at least Texan oil and gas production will steeply slump over the next months. Well permits declined fivefold to a six year low and well completions are not far behind. It will be interesting to see the consequences of this trend.Dennis Coyne , 12/10/2015 at 9:10 am

The RRC Production data is very bad for the most recent 18 months. Texas output has in fact been relatively flat from Nov 2014 to Sept 2015. Perhaps the completion data suffers from the same reporting problems. Permit data is just not very useful.

The RRC Production data is very bad for the most recent 18 months. Texas output has in fact been relatively flat from Nov 2014 to Sept 2015. Perhaps the completion data suffers from the same reporting problems. Permit data is just not very useful.

peakoilbarrel.com

likbez , 12/30/2015 at 9:50 pm

Glenn Stehle , 12/31/2015 at 9:43 amRon,

OK. Let's assume there is no geopolitics here. But then why Saudis are damping oil at such a low price.

In 2015 they exported over 7.3 Mb/d and got 118 Billions. In 2012 they exported something between 7.658 Mb/d (CIA, probably crude only) and 8.42 mb/d (Bloomberg, probably crude and refined products) and got 336.1 billion.

http://www.bloomberg.com/news/articles/2013-07-29/saudi-arabian-2012-oil-export-revenue-gained-5-as-iran-fell-12-If they just cut 1 Mb/d and that allows to preserve 2014 average price of oil (not even 2013 average price) they would get 125 billions (and preserve 12 Mb from their depleting wells for moment of higher prices which will eventually come.)

In any case they managed to achieve almost 3 times drop of revenue from 2012. Three times --

Now they have almost $100 billion budget deficit in 2015 (and almost the same, 86 billions estimate of deficit for 2016) and only around 600 billions in reserves.

Questions:

1. Why they rocked the boat?

2. Where is the logic in their actions, unless we assume that they want to destroy Iran (and hurt Russia) ?

3. Why MSM spread all this BS about Saudis defending their market share ? Does it look like they are defending something else ?

One theory afloat is that the US and Saudi Arabia are allies in an economic and political war against their enemies. According to this narrative, the intent of Saudi Arabia dramatically increasing oil production during a world oil glut, and sending oil prices into a tailspin, is to shipwreck the economies (and the polities) of US and/or Saudi enemies - e.g., Venezuela, Iran, and Russia.

"Obama's foreign policy goals get a boost from plunging oil prices"

https://www.washingtonpost.com/business/economy/as-crude-oil-prices-plunge-so-do-oil-exporters-revenue-hopes/2015/12/23/ed552372-a900-11e5-8058-480b572b4aae_story.htmlThe war, however, is not being conducted without inflicting significant damages on US allies - e.g., Mexico, Canada, Saudi Arabia, Colombia - and domestic US production as well.

Ambrose Evans-Pritchard, for instance, published an article a couple of days ago about the immense economic damage being inflicted on Saudi Arabia's economy and polity:

"Saudi riyal in danger as oil war escalates"

http://www.telegraph.co.uk/finance/economics/12071761/Saudi-riyal-in-danger-as-oil-war-escalates.htmlWe'll see who blinks first, or who is left standing after all the bloodletting takes place.

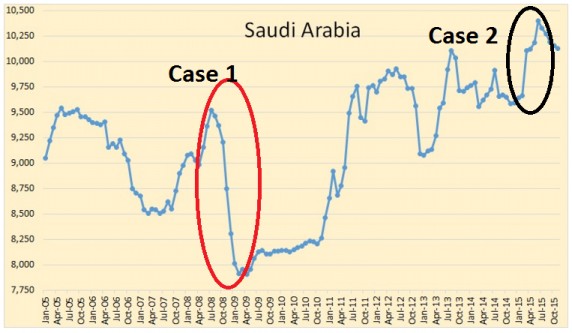

Peak Signs , 12/31/2015 at 10:32 am

"According to this theory, the intent of Saudi Arabia dramatically increasing oil production during a world oil glut…"

Saudi Arabia hasn't dramatically increased oil production. Their most recent peak in June of 2015 was only a couple hundred thousand barrels per day more than the previous peak back in mid-2013. That's about 2-3% increase over two years. I wouldn't call that, dramatic.

Glenn Stehle , 12/31/2015 at 11:00 am

I think you're arguing semantics.

Would you also argue that the Saudi response to the glut in 2009 was the same to its response to the glut in 2015?

Ablokeimet , 12/31/2015 at 3:07 am

oldfarmermac , 12/30/2015 at 11:23 pmRon is basically correct. The people who think that oil production is a function of the price are assuming that the oil is there to produce. Now, unless there are a few supergiant fields out there, already discovered and waiting for some State Oil Company or some multi-national oil company to make a Final Investment Decision, that assumption is incorrect. There is a handful of locations which could potentially have supergiant oil fields that are so far undiscovered, I'm not that confident that they are there to find, since discovery in the last couple of decades has been a long way short of consumption, even after the price went sky high and everybody and their dog was spending big on exploration.

What interests me is the bit from the previous post, where OPEC projected prices based on their estimate of what it cost to produce the marginal barrel. I think that is a good line to take, until it reaches the point where governments of OPEC countries decide that, with Peak Oil passed and production in irreversable decline, they are going to start hoarding production and make the rest of the world go short.

The thing to realise with projecting prices based on the cost of production of the marginal barrel is that it should be taken as a tendency working on a 5 year or even decadal scale. In time periods short of that, you can get price wars sending prices down below the marginal cost and price spikes producing windfall profits even for the highest cost producers. The price wars lead to national and multi-national oil companies cutting back on capital expenditure, which eventually leads to stagnating or declining production and a recovery in prices. Price spikes lead to huge resources being spent on exploration and development as everybody wants to cash in.

OPEC's production assumptions are a lot less sensible than their price projections. They assume two things:

(a) That the oil is there to increase global production; and

(b) Most of that oil, from 2020 to 2040, will come from OPEC countries.

Conventional crude oil production is flat out right now and, as I said above, unless someone is hiding a few undeveloped supergiant fields somewhere, it's got nowhere to go but down. Let's look at unconventional sources, then.

1. Polar and deepwater oil. A huge amount has been spent exploring for this and the results have been underwhelming. Sure, they've found oil, but not in anywhere near the quantities needed. Shell recently pulled out of the Arctic because of the combination of environmental protests and poor exploration results. If they were discovering heaps, they'd just tough out the protests – as anybody who knows the first thing about corporate capitalism could tell you.

2. Canadian tar sands. Production of these has been expanding, but it hasn't been to the rate that one might imagine from the published resource data. This is because the rate of production is subject to certain limits, due to inputs. The relevant inputs in this situation are water and natural gas – and it is water which is the harder limit. Basically, they can't produce more oil from the tar sands than the rivers of the region can support. These limits will sooner or later, and I believe sooner, put a ceiling on Canadian production. Absent a huge shift in consumption caused by climate change mitigation action, it will keep at that limit for many decades to come, but it won't exceed it.

3. Venezuelan extra heavy. This is the factor about which I know least, but there doesn't appear to be a lot of it on the market yet. There seem to be a lot of obstacles in the road of high production.

4. Tight oil. One thing that everybody who is knowledgeable admits is that there is a lot of "oil in place" in this category. The question is how much of this is recoverable in a practical sense. This industry has developed in the US, primarily because it brings a number of environmental hazards with it and, outside the US, landholders are blocking exploitation because of environmental concerns. In the US, landholders have a financial interest in ignoring these concerns, because mineral royalties are vested in the landowner.

Tight oil has been developed in the US on the basis of unrealistic projections of ongoing production, due to depletion rates being vastly higher than admitted when spruiking to investors. Sooner or later, it was bound to run into problems. These problems have arrived sooner, as opposed to later, due to OPEC's price war, which is aimed at sending the tight oil industry broke. Producers have cut back on drilling and concentrated with increased intensity on "sweet spots", where production is likely to be highest. They have also introduced technological progress that has cut the price of drilling substantially and thus cut the break-even price for a well of a given production level, but the industry is still losing money. A loss-making industry is unsustainable and, therefore, will not be sustained. Something has to give.

Eventually, the price of oil will recover to be equal to or greater than the marginal cost of production. At this point, what will be relevant is just how extensive the sweet spots in the tight oil formations are. Having been burnt once, investors will be working on much more careful examination of likely decline rates and won't support drilling wells just to keep production up, if those wells won't recover their costs within the time frame of the investment horizon.

The $64 thousand dollar question, therefore, is how long the US tight oil industry is going to be able to keep finding sweet spots where they can extract sufficient tight oil to pay back the cost of drilling.

What's going to happen in other countries? Not a great deal, I predict. Opposition from the local population, led by local landholders, will delay and minimise production from tight oil reservoirs. It won't completely prevent a tight oil industry developing in many other countries, but it will ensure that it never develops the dimensions of the current oil industry. Tight oil production will be a buffer for production on the way down, but it won't counteract the declines caused by the depletion of conventional oil fields.

In summary, the price of production of the marginal barrel of oil is going to go higher – a lot higher, but the marginal barrels won't be additional ones. Rather, rising prices will cause demand destruction. It is already doing so in OECD countries, and it will start doing it in Third World countries too, as existing fields deplete and have to be replaced by new and extraordinarily expensive oil.

Door number two looks damned good from where I sit in the audience, lol.In addition to putting a hurting on Russia and Iran, the Saudis are also no doubt getting the message across to other exporters, in and out of OPEC, that they will not carry the load alone, if and when they eventually decide to cut.

There is little doubt in my mind that secret negotiations about cuts are going on every day, day after day, between diplomats from other oil exporters and the Saudis. When the Saudi government gets what it wants, iron clad promises of cooperation, THEN they might be more inclined to cut.Maybe.

Sometimes something that walks like a duck, and quacks like a duck , and looks like a duck, is never the less not a duck .. Sometimes the resemblance is merely coincidental. Sometimes coincidences are highly advantageous to two or more parties involved.

Consider for instance that many or most well informed people consider that the House of Saud has managed to accumulate and hang onto the biggest fortune in the world only because the country is a client state of the American empire.

Otherwise all those princes and princesses would be dead, or in dungeons, or refugees.

I am NOT saying the Obama administration is colluding with the Saudis, secretly, to keep the price of oil down. I AM saying Uncle Sam is no doubt perfectly happy about oil selling for peanuts, because peanut oil prices are a damned good economic tonic. There must be fifty people happy about cheap gasoline for every one person hurting because he lost his ass or his job in the oil business. Fifty to one. No politician in his right mind can afford to overlook that sort of thing.

I'm ready to bet the farm that no documentation ever comes to light proving Uncle Sam is trying to force oil prices up at this time. OTOH, Uncle Sam and the Saudis share some very heavy duty common interests when it comes to Iran and Russia.

Hey guys, it ain't nothing but zero's in computers, in the last critical analysis, to the House of Saud. They have more than they can spend (on themselves ) anyway.

Suppose any one of you happened to have a personal fortune of say ten million bucks, and you discover you are at high risk of having a fatal heart attack. I doubt any of you would hesitate to spend a third or even half of that fortune to avoid that heart attack. You will never have eat beans and rice unless LIKE beans and rice, so long as you still have five million bucks. ( Unless maybe your physician insists!)

In the minds of the Saudis, the Russians and the Iranians may well represent a literal existential threat .

Telegraph

Saudi Arabia is burning through foreign reserves at an unsustainable rate and may be forced to give up its prized dollar exchange peg as the oil slump drags on, the country's former reserve chief has warned.

"If anything happens to the riyal exchange peg, the consequences will be dramatic. There will be a serious loss of confidence," said Khalid Alsweilem, the former head of asset management at the Saudi central bank (SAMA).

"But if the reserves keep going down as they are now, they will not be able to keep the peg," he told The Telegraph.

His warning came as the Saudi finance ministry revealed that the country's deficit leapt to 367bn riyals (£66bn) this year , up from 54bn riyals the previous year. The International Monetary Fund has suggested Saudi Arabia could be running a deficit of around $140bn (£94bn).

Remittances by foreign workers in Saudi Arabia are draining a further $36bn a year, and capital outflows were picking up even before the oil price crash. Bank of America estimates that the deficit could rise to nearer $180bn if oil prices settle near $30 a barrel, testing the riyal peg to breaking point.

Dr Alsweilem said the country does not have deep enough pockets to wage a long war of attrition in the global crude markets, whatever the superficial appearances.

Concern has become acute after 12-month forward contracts on the Saudi Riyal reached 730 basis points over recent days, the highest since the worst days of last oil crisis in February 1999.

The contracts are watched closely by traders for signs of currency stress. The latest spike suggests that the riyal is under concerted attack by hedge funds and speculators in the region, risking a surge of capital flight.

A string of oil states have had to abandon their currency pegs over recent weeks. The Azerbaijani manat crashed by a third last Monday after the authorities finally admitted defeat.

The dollar peg has been the anchor of Saudi economic policy and credibility for over three decades. A forced devaluation would heighten fears that the crisis is spinning out of political control, further enflaming disputes within the royal family.

Foreign reserves and assets have fallen to $647bn from a peak of $746bn in August 2014, but headline figures often mean little in the complex world of central bank finances and derivative contracts.

See also

Black Swan

""He is drawing on a McKinsey study – 'Beyond Oil' -

that sketches how the country can break its unhealthy dependence on

crude, and double GDP by 2030 with a $4 trillion investment blitz across

eight industries, from petrochemicals to metals, steel, aluminium

smelting, cars, electrical manufacturing, tourism, and healthcare""McKinsey's advice to the Saudi suckers proves that global financial companies are crooks. Pray tell from where will Saudi Arabia get people to run the industries recommended by Mckinsey ? There is already global excess in the industries.

crudeoilpeak.info

matt , December 29, 2015The media is full with news that there is a global oil glut.There are now more than 3bn barrels of excess oil in the world

Record oil glut stands at 3bn barrels

13/11/2015

http://www.bbc.com/news/business-34808487It was parroted by the Australian public broadcaster ABC TV, using this (unsuitable) opportunity to take a swipe at peak oil:

Peak oil losing credibility as renewables shift accelerates

24/12/2015

"With the world awash with too much crude oil at the moment, the fear of an economic catastrophe when fossil fuels start running out is quietly fading in the background."

http://www.abc.net.au/news/2015-12-24/peak-oil-losing-credibility-as-shift-to-renewables-accelerates/7052196These stories go back to the IEA's Monthly Oil Market Report (OMR), November 2015 which reads:

"Stockpiles of oil at a record 3 billion barrels are providing world markets with a degree of comfort. This massive cushion has inflated even as the global oil market adjusts to $50/bbl oil."

https://www.iea.org/oilmarketreport/reports/2015/1115/So how much is 3 bn barrels?

Let's have a look at the statistics in the latest IEA OMR of December 2015. It's only about OECD stocks, not the whole world.

peakoilbarrel.com

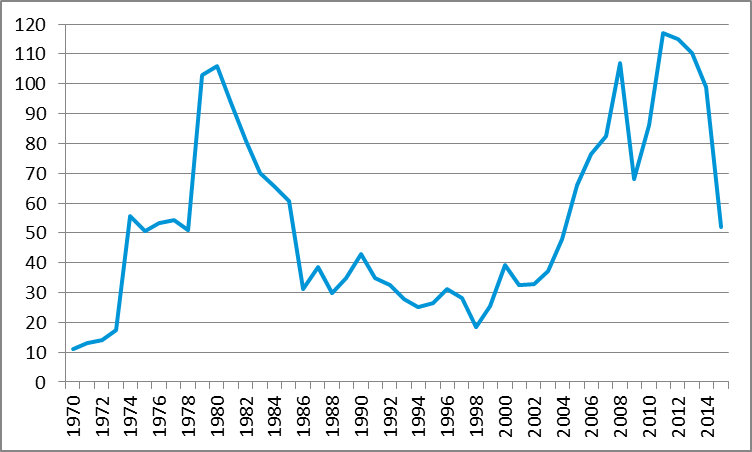

AlexS , 12/26/2015 at 2:27 pm$15-20 for a long period of time?likbez , 12/26/2015 at 2:43 pmLet's look at it from a historical perspective.

In today's dollars (adjusted for inflation) annual average oil prices have not been below $20 since 1998 ($18.5), and below $15 since 1972.

Brent oil price in 2014 dollars, 1970-2015

Source: BP Statistical Review of World Energy June 2015, my estimate for 2015

Everything is possible in the world where the price of oil is determined by Wall Street (despite some people having illusions about supply and demand equilibrium; this is just a factor and probably not the decisive factor).

Everything is possible in the world where the price of oil is determined by Wall Street (despite some people having illusions about supply and demand equilibrium; this is just a factor and probably not the decisive factor).But I think even at $40 per barrel the US shale production will be decimated in a year or two. They managed to get financing for 2016, but that's about it. And that's over 3 Mb/d. Additional cars that were bought in the US, India and China in 2015 will be on the road for another 10 years or so.

In this sense EIA prediction of $50 average in 2016 does not look completely outlandish. But to achieve such average from low start of $38 per barrel and typically low prices in the Q1 you need at least half of the months to be above $50 by $10. Thats looks less probable now.

AlexS, 12/26/2015 at 3:04 pm

Unlike $35-40, $20/barrel is below cash operating costs for many conventional producers worldwide.That means that, at that price, not only upstream investments would be severely cut, but also a large number of the currently producing wells will be idled.

$20 is almost twice as low as the current price, and supply-side response will be much stronger than what we are seeing now.

Oil price may temporarily touch $20, as Goldman predicts (although this is not their base scenario), but it will not stay at these levels for long term.

likbez, 12/26/2015 at 4:19 pm

"Oil price may temporarily touch $20, as Goldman predicts (although this is not their base scenario), but it will not stay at these levels for long term."

Thank you. That's exactly my point.

The key consideration here is that the Wall Street instruments create a strong positive feedback loop that destabilized the system and amplifies any price movements. So oscillations became more and more powerful creating more and more moments with absurd prices. Right now on the down side.

$20 per barrel is such an absurd in the current circumstances price, but it is not that outlandish estimate of a short time minimum possible in the destabilized system, especially in Q1.

peakoilbarrel.com

Ron Patterson, 12/21/2015 at 10:49 am

So as the price of oil continues lower, oil production will continue to increase.Arceus, 12/21/2015 at 10:56 amOh don't be silly. Just because Saudi Arabia has increased production in order to meet their budget does not mean the world will increase production because of cheap oil. (Iraq would have increased production regardless.)

No, upstream investment will, or has, dropped dramatically. This will cause production decline down the road.

Yes, I should have added "in the short term" to that, but then it wouldn't have sounded as glib.canabuck, 12/21/2015 at 3:49 pmAnd what is "short term"?Huckleberry Finn, 12/21/2015 at 6:35 pm

12 months, or maybe 3-4 years.If the world is 2 Mbbl/day oversupplied right now, and decline rates are 6%, and there is only minimal new oil wells. (so, overall decline rate is 2% ?). We should see the oversupply disappear in a year or so.

Looks closer to 10% in some cases. From previous thread.Fernando Leanme, 12/23/2015 at 8:46 amThe low prices are taking their toll.

http://www.newswire.ca/news-releases/ecopetrol-announces-us48-billion-investment-plan-for-2016-561775541.htmlEcopetrol, the largest Colombian producer announced that it will produce 755,000 barrels a day in 2016 vs 760,000/day in third quarter of 2015.

That does not sound like much a of drop, until you realize that Ecopetrol will be taking over the Rubiales field from a joint venture by not extending their partners contract.That will add 70,000 barrels a day to their production.Or about 35,000 barrels day annualized since it happens mid-year. So adjusted for this their production will decline from 795,000 barrels to 755,000 barrels per day, or a drop of 5%. And that is after spending 4.8 Billion USD. So I am guessing their base decline rate is closer to 10%I don't think the oversupply is 2 mm. My guess it's less than 1.2 mm in December.

peakoilbarrel.com

Sarko, 12/26/2015 at 6:16 amTechnology is great but what happened with technology development when companies are cash flow negative? True, most of today fracking technology come online during 2003-2008 period, when price go from $25 to $140 per barrel.shallow sand, 12/26/2015 at 9:21 amAlso, do you believe is there over 100 billion barrels in US oil reserves? I don't know, i ask you, because i see you are in industry on some way and OPEC and EIA future projections for production in mb/d suggest just that.

Coffee.We've discussed tech v economics a lot, of course. If you have answered this before, and I have forgotten, I apologize.

Do you own an interest in any oil and/or gas wells? Do you own any stocks or bonds in any E & P companies?

If the tech is working wonders, why is $38 WTI and $2 Henry Hub so devastating?

I wish you would at least focus on the whole of well productivity, and not just the record setting stuff.

Per NDIC, the highest Bakken per well barrels of oil per day field wide was 11/08 at 146. 143 per day was achieved 10/12. 10/15 it is now down to 108.

108 x .75 = 81. 81 x 365 = 29,565 barrels of oil per year to the WI owners.

29,565 x $28 = $827,820.00.

Subtract $82,782 for production taxes. Subtract $268,000 for OPEX. Subtract $75,000 for G & A.

The average well nets $402,000 in the above scenario.

Say you borrowed $5 million of the cost of this average well at 6% interest. It comes due in 2020. $300K interest. You now have $102,000 left to put towards principal of $5 million. Thus far, you likely haven't put any of that meager amount towards principal, if you are US shale. You are still putting it towards trying for a record setting well.

You have likely sold your conventional production for 1/3 of what it would have brought in 2013, also to achieve said record setting well.

Coffee, I hope someday you realize that high IP is really not that important.

I also hope you understand why those of us who actually own an interest in US oil production grow tired of hearing about the supposed technological wonders.

Huckleberry Finn, 12/25/2015 at 8:32 am

Does a barrel of NGL have the same BTU as a Barrel of Crude or Condensate?Ron Patterson, 12/25/2015 at 9:06 am

If not, converting all into BTU would show whether total BTUs provided are increasing or static.Rune Likvern says: NGLs have around 60 – 70% of the volumetric energy (heat) content of crude oil.Jeffrey J. Brown, 12/25/2015 at 10:05 amHowever peak oil will happen when oil peaks, not NGLs. Liquid transportation BTUs should not be mixed with other types of BTUs. Otherwise we would need to count BTUs from coal as well.

Some EIA million BTU (MMBTU) conversion factors:Anton Koffield, 12/26/2015 at 12:49 pmhttps://www.eia.gov/forecasts/aeo/pdf/appg.pdf

Of course, what the EIA calls "Crude oil" is actually Crude + Condensate (C+C), and condensate can't be used to meet crude oil contractual obligations at Cushing. I assume that the listed value for gasoline, 5.2 MMBTU, is a pretty good approximation for an average value for condensate.

For the first nine months of 2015, the EIA estimates that the ratio of US Lower 48 condensate* to US Lower 48 "Crude oil" Production, i.e., C+C, was 22%, or 2 million bpd of Lower 48 condensate production:

EIA expands monthly reporting of crude oil production (i.e., C+C) with new data on API gravity:

https://www.eia.gov/todayinenergy/detail.cfm?id=23952These numbers are consistent with some estimates that I used in the following comment, where I tried to come up with an estimate of actual global crude oil production (45 API and lower crude oil, i.e., the stuff that corresponds to the global price indexes), versus global condensate production, using the only available data, some EIA API gravity estimates for the US and EIA/OPEC data for the OPEC countries.

My premie was and is that we have been on an "Undulating plateau" in actual global crude oil production, while global natural gas production and associated liquids, condensate and NGL, have so far continued to increase:

http://peakoilbarrel.com/jean-laherreres-bakken-update/comment-page-1/#comment-534101

After showing similar rates of increase from 2002 to 2005, global NGL production was up by 26% from 2005 to 2014, while global C+C production was up by only 6% over the same time period (EIA).

*Condensate with API gravity of 45 degrees or more

What is condensate used for?AlexS. 12/26/2015 at 12:55 pmmost of condensate is mixed with crude oils as a refinery input;Jeffrey J. Brown, 12/26/2015 at 8:17 pm

some is used as petrochemical feedstockCondensate is basically natural gasoline.Anton Koffield. 12/27/2015 at 1:57 pmMy principal point is not that condensate doesn't produce the full spectrum of refined products that we get from 38 API gravity crude oil; my principal point is that the available data strongly suggest that actual global crude oil production (45 API and lower gravity crude oil) has been on an undulating plateau since 2005, as annual Brent crude oil prices doubled from $55 in 2005 to the $110 range for 2011 to 2013 (remaining at $99 in 2014).

In other words, I think that actual global crude oil production effectively peaked in 2005, while global gas production and associated liquids, condensate and NGL, have so far continued to increase.

Note that based on the following chart, it's very likely that about 40% of 2015 US Crude + Condensate (C+C) production exceeds the upper limit for WTI crude oil (which has an API ceiling of 42):

I take your points.Jeffrey J. Brown , 12/27/2015 at 2:00 pmIf Condensate is basically natural gasoline, can one infer that the amount/effort of refining required to produce retail gasoline is fairly 'easy'?

If this is so, and if gasoline is the primary refined product from crude oil (measured in volume, sales price, and/or 'importance' to the economy) then is this not a 'good' thing? And does this help explain why gasoline prices are rather low in the U.S. presently? Is it not preferable to refine 'natural gasoline'; in to 'retail gasoline' rather than process heavy oils, some perhaps contaminated with sulfur and vanadium or whatnot?

Of course I don't posit that this situation will go on for the long term, not that it is a 'good' thing wrt long-term energy planning (or lack thereof due to short-term thinking referencing current low price signals).

As noted above, my principal point is not that condensate doesn't produce the full spectrum of refined products that we get from 38 API gravity crude oil; my principal point is that the available data strongly suggest that actual global crude oil production (45 API and lower gravity crude oil) has been on an undulating plateau since 2005, as annual Brent crude oil prices doubled from $55 in 2005 to the $110 range for 2011 to 2013 (remaining at $99 in 2014).Anton Koffield . 12/27/2015 at 3:48 pmI take your point.Ron Patterson , 12/27/2015 at 4:41 pmPerhaps either or both of these things have happened since mid-2014:

1) The 'system' has adjusted somehow to effective use the current crude + condensate + NGL ratios being produced at the wellhead.

2) The World economy has become unsound/fragile enough that it cannot support a crude oil price, not for long without lurching into recession or worse, than the current Brent market price of $37.89/bbl.

Perhaps since gasoline comprises some 53% of U.S. finished products from crude oil, then having a goodly amount of condensate which is 'natural gasoline' has contributed to the rather low prices for retail gasoline seen in the U.S. over the past year.

I wonder what the price trends have been over the past years for distillate fuel oil and kerosene and other non-gasoline products? Have they gone up in price (as opposed to gasoline)?

U.S. Petroleum & Other Liquids Product Supplied:

http://www.eia.gov/dnav/pet/pet_cons_psup_dc_nus_mbblpd_a.htm

The bumpy price plateau for Brent (which I take it as a marker for Brent production in your example?) has been a bumpy plateau from Q1 2011 through nmid-2014, after which it nosed-dived to the current $37.89 price.

http://www.nasdaq.com/markets/crude-oil-brent.aspx?timeframe=10y

Surely the actual global crude oil production (45 API and lower gravity crude oil) has not spiked since early 2014, has it? If not, then the Brent price is not a reliable proxy for such production. See my conjectures (#1 & #2) above. There may be other conjectures which may be valid. Of course none of these ideas may be mutually exclusive.

Please note that I am scoping much of my commentary to the U.S. situation…although Brent and WTI and other price constructs are supposedly indicative of the World's supply and demand situation, yes?

Perhaps since gasoline comprises some 53% of U.S. finished products from crude oil, then having a goodly amount of condensate which is 'natural gasoline' has contributed to the rather low prices for retail gasoline seen in the U.S. over the past year.53% is little high.

How many gallons of diesel fuel and gasoline are made from one barrel of oil?Refineries in the United States produced an average of about 12 gallons of diesel fuel and 19 gallons of gasoline from one barrel (42 gallons) of crude oil in 2014. Many other petroleum products are also refined from crude oil. Refinery yields of individual products vary from month to month as refiners focus operations to meet demand for different products and to maximize profits.

However condensate, or naphtha, or natural gasoline, three names for the same thing, is not really gasoline. Gasoline is primarily octane or C8H18. Naphtha is primarily pentane, or C5H12. (Though naphtha does contain a lot of other hydrocarbons.)

Condensate is the lightest liquid petroleum product. That is it is a liquid at sea level pressures and room temperature. You can burn it in your car like gasoline. But your car will knock terribly, and your motor will not likely last very long.

crudeoilpeak.info

JEDDAH: Custodian of the Two Holy Mosques King Salman has ordered that Saudi Arabia's aid and investment package to Egypt should be increased to SR30 billion (US$ 8 bn) in the next five years.The announcement was made by Deputy Crown Prince Mohammed bin Salman at a meeting with Egyptian Prime Minister Sherif Ismail in Cairo on Tuesday, said SPA (Saudi Press Agency)

Prince Mohammed said at the start of the meeting that King Salman ordered the increase in the package - to contribute to Egypt's oil needs for five years and for an increase in traffic for Saudi ships in the Suez Canal.

According to a report in Bloomberg quoting Egyptian Investment Minister Ashraf Salman on Wednesday, the investment of SR30 billion would be through Saudi Arabia's public and sovereign funds, with inflows beginning immediately. Egypt is also set to renew a deal to import Saudi oil products for five years on favorable terms, Ismail said."

http://www.arabnews.com/featured/news/851651

This follows pledges of US$ 12.5 bn aid by Saudi Arabia, Kuwait, the UAE and Oman in March 2015, at an economic conference (EEDC) in Sharm el-Sheikh.

Will that be enough to rescue Egypt?

Let's have a look at Egypt's budget. In the previous post we found that Egypt's oil production peaked in 1993. Declining and now stagnating oil production against an ever-growing oil demand of a ballooning population meant that Egypt is a net-oil importer since 2010. How did that impact on the budget? We use IMF data available from this website: http://www.imf.org/external/country/egy/index.htm

www.forbes.com

What about biofuels? The world currently consumes about 92 million barrels of oil per day. The world produces about 1.5 million barrels of oil equivalent (BOE) of biofuels per day. Since 2005, biofuel production in the world has grown by 1 million barrels a day, while crude oil production has grown by nearly 7 million barrels a day. Biofuels are certainly not growing at a fast enough rate to meet world demand – much less cut into petroleum's dominance. Further, there isn't enough available arable land in the world for biofuels to ever make more than a tiny contribution to the world's oil supply. Advanced biofuels which many advocates assured us could deliver us from our oil dependence have failed to deliver.

That brings me to the other primary contender often mentioned as a crude oil killer: the electric vehicle (EV). In theory, as the world switches to EVs, our crude oil consumption will peak and fall. But what is actually happening?

According to Inside EVs, a website that reports on EV sales, through the first 11 months of 2014 there were 110,011 EVs sold in the U.S. This year, sales in the first 11 months have fallen to 102,898 vehicles - a decline of 6.5%. Annual EV sales did grow rapidly from 2011 to 2013, but haven't grown much beyond 2013′s 97,507 vehicles sold.

But 100,000 vehicles per year is nothing to sneeze at, right? Well, let's compare that against overall vehicle sales. According to Automotive News, the first 11 months of 2014 saw overall vehicle sales in the U.S. of 15,015,434 automobiles (cars, light-duty trucks, and SUVs). That means that electric cars sales accounted for about 0.7% of the market. But what's much more revealing is that overall vehicle sales in the U.S. this year through November were 15,826,634 automobiles. Thus, in one year the number of cars sold in the U.S. has increased by 811,200 vehicles.

That's a one-year increase that's more than double the total EV sales of the past 5 years - and almost all of those vehicles run on petroleum.

...there is still nothing on the horizon that signals even the beginning of the end of the oil age.

peakoilbarrel.com

Jeffrey J. Brown, 12/10/2015 at 7:40 amThere has been a lot of talk regarding the oil glut, but according to eia crude inventories there is only 105.1 million more barrils of crude than a year ago

What the EIA calls "Crude oil" is actually Crude + Condensate (C+C).

I suspect that most of the 2015 build in US and global C+C inventories consists of condensate, and I frequently cite a Reuters article earlier this year that documented case histories of refiners increasingly rejecting blends of heavy crude and condensate that technically meet the upper API limit for WTI crude (42 API gravity*), but that are deficient in distillates.

In any case, based on the most recent four week running average data, US refineries were dependent on net crude oil imports for 43% of the C+C processed in US refineries (7.1/16.5) versus 44% a year ago (7.1/16.2). If we had so much (generally cheaper than imported) actual crude oil on hand in the US, why are refiners importing the same amount of crude oil as they did last year?

*Most common overall dividing line between crude & condensate is 45 API

www.bloomberg.com

...And just today the Saudi Finance Minister stated

"Crude demand is expected to rise by 1 million barrels a day every year in this decade, and the world requires more investments in oil to compensate for declining recovery rates, he said. The recovery rate for all the world's oil fields [annually] is decreasing by about 4 million barrels a day, he said."

... The oil market will start to re-balance next year and prices will improve, Matar al-Neyadi, energy undersecretary for the United Arab Emirates, said at the conference.

... Current U.S. shale output is slightly less than 5 million barrels a day and will drop by 900,000 barrels daily in 2016, Paul Horsnell, head of commodities research at Standard Chartered Plc, said at the Bahrain conference. Total U.S. oil production won't recover to its recent peak until at least 2018, he said.

seekingalpha.com

Canada, the North Sea, and (maybe) Russia will see production drop over the next year due to decreased investment in drilling activities

... ... ...

According to the IEA, production levels of light tight oil (LTO as they call it) generally fall by 72% within their first 12 months and by about 82% in the first two years.

... ... ...

Right now, many investors seem fearful of where energy prices are going but I don't think the situation looks all that bad. While it is possible that events such as Iran exporting large amounts of crude (estimates of which are likely overstated) and China's economy collapsing could cause a drop in demand in relation to supply, any scenario outside of these transpiring shows a growingly bullish outlook for oil moving forward.

This is especially true when you consider that the glut that's being experienced isn't all that large at the moment.

mapodga

Very good overview. Just excellent.

So where is the glut? Probablly only in heads of people that follow the mantras of US mass media machine.

If one accident in ME happen all hell can break out.

bently

Very concise but informative coverage of important points! I might add that there is likely to be bullish moves in the energy sector much sooner than people may expect, for the smart money takes their positions based on anticipation of things to come rather than after they are realized -- you know, the buy on the rumor and sell on the news strategy.

We seem to be seeing the start of that now. But the momentum will build slowly; nothing happens overnight - usually.

Robert P. Balan

Mr. Jones,

You wrote:

"Using data presented in a previous article of mine, I figured that, at the time this data was gathered, about 96.4 million barrels worth of this glut was attributable to the U.S. This suggests that the OECD, excluding the U.S., has a glut of just 62.9 million barrels, which amounts to roughly 2.4 days of excess supply for the group."

This chart will provide a scale of just how disruptive the impact of US shale oil production was to the global oil balance, triggering the backlash from the OPEC.

http://tinyurl.com/p36...

Also, you wrote:

"The last piece that investors in the oil space should look at relates to China. I have been bearish on the country for quite some time but one goal they will likely continue to reach for (unless they see a complete economic collapse) is filling up their SPR (Strategic Petroleum Reserve). In the image below, you can see their schedule and estimated storage capacity for the development of storage facilities."

You may have watch for indications of impending domestic currency CNY devaluations. The official oil imports data out of China tends to pick-up about 1 quarter before the CNY devaluation occurs. Talk of front-running . . . the Chinese have mastered the art.

See this chart here:

Trixwd(From Oct OPEC report) OECD commercial oil stocks rose further in August to stand at 2,933 mb. At this level, inventories were around 194 mb higher than the five-year average. Crude and products showed a surplus of around 167 mb and 27 mb, respectively.

In terms of days of forward cover, OECD commercial stocks stood at 63.3 days in August, some 4.5 days higher than the five-year average. http://tinyurl.com/pua ...

mapodga

So OPEC inventory is 8% above normal. Being so after 1 year of glut we can conclude there isn't any glut.

Trixwd

With more US domestic production being used you would expect a new higher normal for oil inventories because that production is in the US already, and not coming on tanker s(Temp storage) in the form of higher imports.In times of high demand you would also expect higher inventories in distillates , gasoline, jet fuel.

It seems a lot of the addition to builds in liquids are from propane. If you look recently at the EIA weekly reports Gasoline , distillate, jet fuel imports to the US have all risen by a large amount compared to last year.

Trixwd

(Also more on China which is a significant bump to import Quota). China has more than doubled its non-state crude oil import quota for 2016 to 87.6 million tonnes, or 1.75 million barrels per day (bpd), as Beijing seeks to boost competition and attract private investment in its oil industry.

The 2016 quota issued by the Ministry of Commerce on Friday compared to this year's figure of 37.6 million tonnes. http://tinyurl.com/owr ...

Kxviswan

I researched into how the inventory build in US was taking place and posted it in Investor Village. Part of the inventory elevation is a) because of tank farm builds to support tight oil increase and b) the way EIA does oil accounting. Oil in ocean is not counted until it clears customs. I am willing to concede that 30-50 MM barrels might be due to these two reasons and this may a new norm inventory levels. See below.

I pursued this topic further and found out that Kinnear is partly right and mostly wrong.

I found a website (see attached) that shows how the crude inventory is divided. Open the excel spreadsheet and you will get the answers.

The inventory is not held in pipelines but in additional tank farms and underground storage that were built to handle additional flow through pipelines.

The refiners are holding utmost 10 MM barrels.

In March 2013, the inventory was 393 MM. In March 2015 it was 475 MM. Most of the additional inventory was held in tank farms and underground storage supporting pipeline.

Also there is much more capacity to store additional oil.

Ben Ten

Kxwisan -

See below the link for an article from September 18th basically discussing the same ideas regarding US inventories you mention above in a different way.

Check out my comments also in the article's reply section if you are interested.