Financial Skeptic Bulletin, September 2008

Prev |

Contents | Next

- 20080930 : French and German anger misses the fact by Charles Wyplosz ( September 29 2008 19:14 , FT.com )

- 20080930 : Are Banks Too Big to Save ( Are Banks Too Big to Save, Sep 30, 2008 )

- 20080929 : As the storm rages, only governments can save us by Gerard Baker ( September 29, 2008 , Times Online )

- 20080927 : Fat cats fall to earth as golden parachutes jettisoned Business ( guardian.co.uk )

- 20080927 : US treasury secretary begged Democratic leader on one knee to save his plan to rescue Wall Street Business ( The Guardian )

- 20080927 : Roubini- Why the Treasury TARP bailout is flawed ( Roubini- Why the Treasury TARP bailout is flawed, Sep 27, 2008 )

- 20080927 : "Even Hank Paulsons bail-out plan cannot detox global banking" ( "Even Hank Paulson's bail-out plan cannot detox global banking", Sep 27, 2008 )

- 20080927 : Junk Bond Spreads Are Distressed for First Time in Six Years by Alan Goldstein and Bryan Keogh ( Junk Bond Spreads Are Distressed for First Time in Six Years, Sep 27, 2008 )

- 20080926 : German Finance Minister Blames US for Financial Crisis Germany ( Sep 25, 2008 , Deutsche Welle )

- 20080926 : German Minister: US Over as Financial Superpower ( German Minister: US Over as Financial Superpower, Sep 26, 2008 )

- 20080926 : Tim Duy: Economy Downshifting, Bailout or No ( Tim Duy: Economy Downshifting, Bailout or No, Sep 26, 2008 )

- 20080925 : "Asia Needs Deal to Prevent Panic Selling of U.S. Debt" ( naked capitalism )

- 20080925 : Marc Faber Calls the Fed a "Liquidity Drug Dealer" ( Marc Faber Calls the Fed a "Liquidity Drug Dealer", Sep 25, 2008 )

- 20080925 : Congress delay on Paulson rescue plan hits money markets - Times Online ( Congress delay on Paulson rescue plan hits money markets - Times Online, Sep 25, 2008 )

- 20080924 : Asia Times Online Asian news and current affairs ( Asia Times Online Asian news and current affairs, Sep 24, 2008 )

- 20080924 : Online The end of an [another] gilded age by By Steve Fraser ( Online The end of an [another] gilded age, Sep 24, 2008 )

- 20080923 : Another Mad Rush To Judgment ( Another Mad Rush To Judgment, Sep 23, 2008 )

- 20080923 : Inky99 ( Inky99, Sep 23, 2008 )

- 20080923 : More Questions than Answers ( More Questions than Answers, Sep 23, 2008 )

- 20080923 : 14 Questions for Paulson & Bernanke by Barry Ritholtz ( 14 Questions for Paulson & Bernanke, Sep 23, 2008 )

- 20080923 : How much financial CEOs got paid to ruin their companies - Network World ( How much financial CEOs got paid to ruin their companies - Network World, Sep 23, 2008 )

- 20080921 : Paulson Missed the Bubble and Understated the Financial Crisis at Every Point ( Paulson Missed the Bubble and Understated the Financial Crisis at Every Point, Sep 21, 2008 )

- 20080921 : NY Times Makes a Funny Statement ( NY Times Makes a Funny Statement, Sep 21, 2008 )

- 20080920 : Decades of greed and hubris. A week of shock and panic. But what comes next ? by Peter Koenig ( Decades of greed and hubris. A week of shock and panic. But what comes next ?, Sep 20, 2008 )

- 20080920 : Think Progress " The Fish Oil Salesman McCain Pushes Offshore Drilling Because Fish 'Love To Be Around' Oil Rigs ( Think Progress " The Fish Oil Salesman McCain Pushes Offshore Drilling Because Fish 'Love To Be Around' Oil Rigs, Sep 20, 2008 )

- 20080920 : The Business Desk with Paul Solman PBS ( The Business Desk with Paul Solman PBS, Sep 20, 2008 )

- 20080920 : #1 - Osama Bin Laden, #2 - Alan Greenspan ?? ( The mess that greenspan made )

- 20080920 : Rescue Plan Seeks $700 Billion to Buy Bad Mortgages ( Rescue Plan Seeks $700 Billion to Buy Bad Mortgages, Sep 20, 2008 )

- 20080919 : The "New" New Deal by Barry Ritholtz ( September 19, 2008 , The Big Picture )

- 20080919 : Bond Insurers Are Facing Downgrades ( Bond Insurers Are Facing Downgrades, Sep 19, 2008 )

- 20080919 : M of A - McCain and Cox ( M of A - McCain and Cox, Sep 19, 2008 )

- 20080919 : Heckuva job, Greenie ( Heckuva job, Greenie, Sep 19, 2008 )

- 20080919 : Hirsh Greenspans To Blame for Wall Street Woes Newsweek Voices - Michael Hirsh Newsweek.com ( Hirsh Greenspan's To Blame for Wall Street Woes Newsweek Voices - Michael Hirsh Newsweek.com, Sep 19, 2008 )

- 20080919 : Congressional Leaders Stunned by Warnings - NYTimes.com ( Congressional Leaders Stunned by Warnings - NYTimes.com, Sep 19, 2008 )

- 20080919 : Kondratiev wave - Wikipedia, the free encyclopedia ( Kondratiev wave - Wikipedia, the free encyclopedia, Sep 19, 2008 )

- 20080918 : FT Alphaville " Blog Archive " So what's the biggest risk faced by global financial insitutions ( FT Alphaville " Blog Archive " So what's the biggest risk faced by global financial insitutions, Sep 18, 2008 )

- 20080918 : How SEC Regulatory Exemptions Helped Lead Banks to Collapse ( How SEC Regulatory Exemptions Helped Lead Banks to Collapse, Sep 18, 2008 )

- 20080917 : John McCain Made the World Profitable for Canadians? ( John McCain Made the World Profitable for Canadians?, Sep 17, 2008 )

- 20080917 : Wall Street turmoil changes campaign fortunes as Palin factor is devalued ( Wall Street turmoil changes campaign fortunes as Palin factor is devalued , Sep 17, 2008 )

- 20080917 : Times Online ( Times Online, )

- 20080917 : The Big Picture Bailout Nation, Soviet Style Russian Trading Halt ( The Big Picture Bailout Nation, Soviet Style Russian Trading Halt, Sep 17, 2008 )

- 20080917 : Barack Obama is going to win. Its the economy, stupid by Iain Martin ( Barack Obama is going to win. It's the economy, stupid, Sep 17, 2008 )

- 20080917 : A tribunal must tell us what to fix. And whom to punish Comment is free The Guardian by Simon Jenkins ( A tribunal must tell us what to fix. And whom to punish Comment is free The Guardian, Sep 17, 2008 )

- 20080917 : Henry Paulsons Frankenstein - Mergers, Acquisitions, Venture Capital, Hedge Funds -- DealBook - New York Times ( Henry Paulsons Frankenstein - Mergers, Acquisitions, Venture Capital, Hedge Funds -- DealBook - New York Times, Sep 17, 2008 )

- 20080917 : Scott Adams Blog What Good are Economists 08-22-2008 ( Scott Adams Blog What Good are Economists 08-22-2008, Sep 17, 2008 )

- 20080916 : A Sense That Wall St.'s Boom Times Are Over - NYTimes.com ( A Sense That Wall St.'s Boom Times Are Over - NYTimes.com, Sep 16, 2008 )

- 20080915 : Brace for the Tsunami- Fitch, S&P Downgrade AIG (Updated) ( Brace for the Tsunami- Fitch, S&P Downgrade AIG (Updated), Sep 15, 2008 )

- 20080914 : U.S. banking woes seen hitting Wall St. Financial News - Yahoo! Finance ( U.S. banking woes seen hitting Wall St. Financial News - Yahoo! Finance, Sep 14, 2008 )

- 20080914 : Lehman may face failure, Merrill may be bought U.S. Reuters ( Lehman may face failure, Merrill may be bought U.S. Reuters, Sep 14, 2008 )

- 20080914 : The Big Picture Weekend Bailouts and Subsequent Market Reactions ( The Big Picture Weekend Bailouts and Subsequent Market Reactions, Sep 14, 2008 )

- 20080914 : Roubini and the Bail-in this weekend ( Roubini and the Bail-in this weekend, Sep 14, 2008 )

- 20080912 : Angry Bear ( Angry Bear, Sep 12, 2008 )

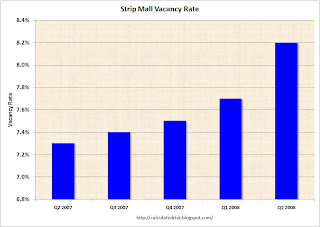

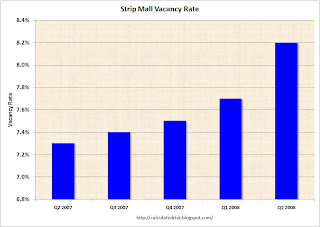

- 20080912 : CRE: More on the Mall Glut by CalculatedRisk ( CRE: More on the Mall Glut, )

- 20080910 : Wages are Falling for Just about Everybody ( Wages are Falling for Just about Everybody, Sep 10, 2008 )

- 20080910 : Europe predicts UK will fall into recession ( Europe predicts UK will fall into recession, Sep 10, 2008 )

- 20080909 : Washington Wants Oil Down, Stocks Up Before Election, Harrison Says ( Washington Wants Oil Down, Stocks Up Before Election, Harrison Says, Sep 09, 2008 )

- 20080908 : Welcome to the U.S.S.R. (United States Socialist Republic) ( Welcome to the U.S.S.R. (United States Socialist Republic) , Sep 08, 2008 )

- 20080908 : US Is More Communist than China Jim Rogers Financial News - Yahoo! Finance ( US Is More Communist than China Jim Rogers Financial News - Yahoo! Finance, Sep 8, 2008 )

- 20080905 : Unemployment Hits 6.1% ( Unemployment Hits 6.1%, Sep 5, 2008 )

- 20080905 : Gabelli Says Theres Reason to Worry About Earnings (Update1) by Eric Martin and Carol Massar ( Gabelli Says There's Reason to Worry About Earnings (Update1) , Sep 5, 2008 )

- 20080904 : A Whiff of Panic Returns to Wall Street - Floyd Norris - Business - New York Times Blog ( A Whiff of Panic Returns to Wall Street - Floyd Norris - Business - New York Times Blog, Sep 4, 2008 )

- 20080902 : Quote du Jour ( Quote du Jour, Sep 2, 2008 )

- 20080902 : More Bank Woes- Spreads on Credit Card Securitizations Rise ( Sep 2, 2008 )

- 20080902 : Kirk Shinkle ( Kirk Shinkle, Sep 02, 2008 )

- 20070928 : From Enron to the Financial Crisis, With Alan Greenspan in Between - US News and World Report ( From Enron to the Financial Crisis, With Alan Greenspan in Between - US News and World Report, Sep 28, 2007 )

- 20070928 : The Economy Why It's Worse Than You Think by Daniel Gross ( June 16, 2008 , Newsweek.com )

| Capital must protect itself in every way... Debts must be

collected and loans and mortgages foreclosed as soon as possible.

When through a process of law the common people have lost their

homes, they will be more tractable and more easily governed

by the strong arm of the law applied by a central power of leading

financiers. People without homes will not quarrel with their

leaders. ... By dividing the people we can get them to expend

their energies in fighting over questions of no importance to

us except as teachers of the common herd.?

J.P. Morgan a private communication to a group of US Bankers

in 1934 |

September 29 2008 19:14 | FT.com

Anger runs deep. It is aimed at financiers, who first earned huge

and conspicuous bonuses and now successfully force taxpayers to pay

for their mistakes. It is also aimed at financial markets, whose merits

have been oversold.

The mantra that financial markets always allocate resources better

was never true. Financial markets suffer from very serious failures,

chiefly information asymmetry. The subprime saga started with beneficial

risk diversification until it became a channel for contagion. The saga

also revealed the depth of herding among financial institutions – the

exact opposite of risk diversification among them. Having followed the

same strategy, they all suffered simultaneous losses.

Financial operations are about risk-taking, which means uncertainty

and, occasionally, crashes.

On this ground, anger is universal. US congressmen compete with themselves

to lash out at the financiers who created this mess. But, outside the

Anglo-American world, we see an outburst of resentment against the US

and British approach to finance and banking. With people angry and scared

at what may happen next, political leaders find it more difficult than

usual to resist populist tendencies and seek to distance themselves

from a possibly serious downturn. With market failures crudely in the

limelight, they feel pressed to reassert the role of government. Nationalism

is always a convenient spare wheel for difficult times.

Once again, Anglo-American capitalism is a bad word and globalisation

is next in line. Speeches at this year's United Nation General Assembly

by leaders from every continent reveal the depth of contempt that has

been lying low, buried underneath the apparent success of the globalisation

process.

A first reason for this backlash is the delicate balance between

individualism and solidarity. Americans are famously known to encourage

and practise individual responsibility. In many other countries, solidarity

is more highly valued and individualism is seen as the other side of

egoism. Generous welfare states do not just reflect this view, they

also create incentives to support collective insurance arrangements,

even if they are inefficient. Adam Smith's invisible hand, the assertion

that individualism delivers the common best, is not popular: we know

that his assertion is only approximately correct because it assumes

that markets are perfect, which is not the case in practice.

Where individualism is considered a virtue, deviations from the ideal

outcome are seen as a regrettable side-effect. But in most parts of

the world, where individualism is considered morally wrong, the law

of the market is tolerated as long as it delivers prosperity. When it

fails, its legitimacy is soon questioned. The world's major financial

markets are in New York and London. No wonder, then, that anger is aimed

at Anglo-American capitalism.

The second reason is related to the way financial markets operate.

The US and the UK have championed arm's-length finance, the financing

of corporations through issuance of shares and bonds to anonymous stakeholders.

Continental Europe – and south-east Asia – has long favoured face-to-face

deals between entrepreneurs and bankers. Deals can be shoddy and cliquish,

but they provide for some stability. Over the past two decades, arm's-length

finance has made headway in continental Europe, beating back the old

boys' networks. No wonder that the old boys are now hitting back.

Strikingly, Nicolas Sarkozy, the French president, and Peer Steinbrück,

the German finance minister, have both announced

the end of Anglo-American financial supremacy. It is not clear what

their prediction is based upon.

They have denounced excesses, such as bonuses, but that does not

even begin to address the root cause of the crisis. They have described

financial markets as unregulated. This is simply wrong. Financial markets

are tightly regulated. The problem is not just that the regulation is

inappropriate, but also that supervisors have not enforced it.

We knew of the hundreds of billions of dollars in dubious claims

parked off bank balance sheets in a clear effort at circumventing existing

regulations. Regulatory arbitrage, as this is called, has gone unchecked

for years.

Both leaders had harsh words for "speculation", but this misses the

fact that finance is speculation. Both zeroed in on short selling. Short

selling is like cars. Drivers can be reckless; disciplining them seems

more reasonable than banning cars. Denouncing market short-termism runs

against evidence that markets better predict companies' long-term performance

than their own managers.

Mr Sarkozy and Mr Steinbrück may be simply captured by their own

old boys, but the fate of Fortis, the Belgo-Dutch banking and insurance

group, may give them second thoughts. Pain is travelling across the

Atlantic and could hurt more good European banks. Mr Sarkozy promised

that no French depositor would ever suffer any loss from any French

bank. He might soon find the price tag pretty steep.

So will Anglo-American capitalism fade away? Maybe, but that will

be decided in Washington, not Paris and Berlin. One thing is sure, neither

France nor Germany can mount a serious challenge, at least as long as

their people and leaders mistrust and misunderstand finance.

An excellent comment in the Financial Times by Wolfgang Munchau discusses

how the gold standard for handling banking crises, the Swedish model,

would take even more discipline to implement in the US and how we are

dong the reverse of what is needed.It is a levelheaded analysis which

stands in stunning contrast with a

bit of advocacy masquerading as economics from Larry Summers in

the same section of the FT today.

But in the course of his discussion, Munchau makes the observation that

none have dared face up to: the financial system is too big for governments

to rescue. We've given the weaker form of that argument: the US, or

even the US plus all the world's central banks, cannot keep a massive,

multi-market asset bubble from deflating. But not only can the current

financial system not be saved, it shouldn't be saved. The debt binge

means it is at an unsupportable, bloated scale. It needs to be trimmed

down to a more viable size, and only that level should get government

support.

From

Munchau:

Last week's dramatic events hold two transatlantic lessons in opposite

directions, one from Europe to the US and one the other way. The

first comes from Sweden, which suffered its own financial crisis

during the early 1990s. The Swedish

lesson is that bank bail-outs should be handled conservatively and

should come in the form of direct capital injections.

As in the US, the Swedish financial crisis was also preceded by

a property bubble, which was pricked by a rise in real interest

rates. Severe stress in the financial

system and the economy were to follow. In each of the three years

1991, 1992 and 1993 Swedish gross domestic product fell in real

terms, at an accumulated rate of about 5 per cent.

In response, the Swedish government set up an agency to recapitalise

the financial sector. Bank shareholders were not compensated. But

the Swedish government did not bail out all banks, only a subset.

They used a microeconomic model to determine which of the banks

had a chance to survive, and which did not. Those that did not were

liquidated or merged. And those that were bailed out had to write

off their bad debts first. All depositors were covered by an explicit

government promise of compensation. The goal was to minimise the

cost to the taxpayer, and it succeeded. It turned out as one of

history's most successful financial system bail-outs.

There are naturally important differences between the situation

in Sweden then and the US today. The most important is that our

most recent bubbles surpassed anything we have ever seen before.

We do not only have to deal with a bursting property bubble,

but also with the huge leverage effects through the credit markets.

The US has a much bigger problem today than Sweden did then. Like

Sweden, the US needs to shrink its financial sector before saving

it. The difference is that the US needs to shrink it a lot more,

and wants to shrink it a lot less.

In this context, Daniel Gros and Stefano Micossi last week made

an astute observation on these pages: several European

banks have become so large that their

governments could no longer save them. Banks once

considered as too big to fail have become too big to save. Unlike

the German government, the US administration is in a position to

save its largest bank, but is not big enough to save its entire

financial system...

The US is already in a recession that, even if financial conditions

returned to normal today, would still be very unpleasant. In the quarter

that ends tomorrow, it seems almost certain that US total output declined.

Consumer spending and investment have been alarmingly weak in the past

two months. On Friday we are quite likely to get another depressing

report on the labour market, expected to show the ninth straight month

of job declines in September. The housing market still seems to be getting

worse, with sales falling faster than new construction, adding to the

excess supply.

Worrying about inflation in times like

these is like worrying about how you're going to borrow the money you

need to get out of town when the hurricane hits. If you wait too long,

you may not survive in any case.

... ... ...

It is already too late to avoid a period of real economic misery.

But there may still be time to avoid a catastrophe.

401K donors will be paying for Wall Street excesses... They are caught

in the middle of massive asset depreciation and will be hurt on three fronts:

direct losses in 401K, lousy job market, rising cost of living.

If there's one silver lining on an otherwise unremittingly bleak

cloud over the economy, it is the possibility that the crisis will change

the obscene culture of self-enrichment among the top echelons of financial

institutions. Both on Wall Street and in London's square mile, soaraway

remuneration has closely correlated with a shift towards reckless financial

"innovation" over the last decade.

The figures are absurd - when Merrill Lynch's Stan O'Neal was ditched

last year for encouraging a culture of risk which led to $12bn (£6.6bn)

of losses on mortgage-related securities, he took $161m of stock and

options with him into retirement.

Citigroup's Chuck Prince, who went a similar way, took $39.5m. Even

Lehman's Dick Fuld, whose bank has actually gone bust, received $35m

to reward him for his wonderful work last year.

About the only one who could truly claim he had a successful year was

Goldman Sachs' boss, Lloyd Blankfein, who duly scooped $68.5m, as the

bank profited by betting that lots of struggling families would lose

their homes.

True to its laissez-faire philosophy,

the Bush administration has been extremely reluctant to do anything

about this. This reluctance must have a little bit to do with the fact

that both Paulson and the White House chief of staff, Joshua Bolten,

are former senior executives at Goldman Sachs.

At Congressional hearings this week, some of the wriggling on the

issue was truly ludicrous. At one point, the Senate banking committee's

Democratic chairman, Christopher Cox, asked the Federal Reserve's chairman

why pay limits weren't in the government's initial draft of its plan

to buy up distressed assets from struggling banks.

"We can't impose punitive measures on institutions which choose to

sell assets," replied Bernanke. "That would discourage companies from

participating and it would cause the program to fail."

Let's analyse that for a moment. Bernanke

was suggesting that senior bankers might jeopardise the future of their

organisations by refusing to participate in a rescue plan simply in

order to protect their personal pay packages. What worse indictment

could there possibly be of the habit of doling out big bonuses?

Given that the banking sector has been highly instrumental in wrecking

the US economy, it has become impossible to defend nonsensical pay policies.

The US Chamber of Commerce gave up - its vice-president of government

affairs, Bruce Josten, admitted this week that remuneration would need

to be addressed. He told the Wall Street Journal: "If we're taking huge

infusions of your money and my money, there's got to be some limitations."

... ... ...

Tim Johnson, a fellow Democratic senator, said the government's bail-out

should not simply be a "gift". It was right and proper, he argued, to

ask for something in return: "When you make mistakes, as many of these

companies have, you should be held responsible for those decisions."

In the face of scepticism, Paulson, Bernanke

and the White House's press secretary, Dana Perino, have kept up a constant

(albeit deliberately vague) mantra about the "dangerous" and "devastating"

economic consequences of failing to act quickly.

To some, it was an all too familiar message from an administration

which has cried wolf before. Luis Gutierrez, an Illinois congressman,

said it reminded him of the all-out propaganda war waged by the White

House to bully Congress into backing the Iraq war.

"It's hard being trusting," he said.

"You feel like you're always getting hoodwinked, because they say the

consequences if you don't do it is a complete demise and collapse of

the system."

So did HSBC's chairman, Stephen Green, who told the BBC: "There has

been far too much focus on payments that are very short-term focused,

people who pick up the tab for short-term profits, without having to

bear the costs of long-term impairments."

Anger about Wall Street's excesses has been palpable for years -

and it spilt over this week. Sherrod Brown, a Democratic senator from

Ohio, demanded: "Why are we bailing out

companies whose leaders got rich while gambling with our economy?"

Maybe men don't bite dogs, but banks do rob people. New York Times

columnist Bob Herbert put it nicely. "Does anyone think it's just a little

weird to be stampeded into a $700 billion solution by the very same people

who brought us the worst financial crisis since the Great Depression?"

It was, according to accounts filtering out of the White House, an

extraordinary scene. Hank Paulson, the US treasury secretary and a man

with a personal fortune estimated at $700m (£380m), had got down on

one knee before the most powerful woman in Congress, Nancy Pelosi, and

begged her to save his plan to rescue Wall Street.

... ... ...

"This sucker could go down," Bush is

said to have told the group - referring to the teetering US economy.

... ... ...

By yesterday afternoon, angry Democrats were accusing McCain of sabotaging

the deal to further his own presidential campaign - and even some Republicans

were inclined to agree. "Clearly, yesterday, his position on that discussion

yesterday was one that stopped a deal from finalising," the Republican

whip, Roy Blunt, told reporters.

Christopher Whalen of Institutional Risk Analytics, a brave conservative

critic, put it plainly: "The joyous reception from Congressional Democrats

to Paulson's latest massive bailout proposal smells an awful lot like yet

another corporatist lovefest between Washington's one-party government and

the Sell Side investment banks."

From Professor Nouriel Roubini:

Why the Treasury TARP bailout is flawed

Specifically, the Treasury plan does not formally provide senior

preferred shares for the government in exchange for the government

purchase of the toxic/illiquid assets of the financial institutions;

so this rescue plan is a huge and massive bailout of the shareholders

and the unsecured creditors of the firms; with $700 billion of taxpayer

money the pockets of reckless bankers and investors have been made

fatter under the fake argument that bailing out Wall Street was

necessary to rescue Main Street from a severe recession. Instead,

the restoration of the financial health of distressed financial

firms could have been achieved with a cheaper and better use of

public money

Moreover, the plan does not address the need to recapitalize

badly undercapitalized financial institutions: this could have been

achieved via public injections of preferred shares into these firms;

needed matching injections of Tier 1 capital by current shareholders

to make sure that such shareholders take first tier loss in the

presence of public recapitalization; suspension of dividends payments;

conversion of some of the unsecured debt into equity (a debt for

equity swap).

The plan also does not explicitly include an HOLC-style program

to reduce across the board the debt burden of the distressed household

sector; without such a component the debt overhang of the household

sector will continue to depress consumption spending and will exacerbate

the current economic recession

Thus, the Treasury plan is a disgrace: a bailout of reckless

bankers, lenders and investors that provides little direct debt

relief to borrowers and financially stressed households and that

will come at a very high cost to the US taxpayer. And the plan does

nothing to resolve the severe stress in money markets and interbank

markets that are now close to a systemic meltdown.

They are trying to get us to pay twice for this mess: first via taxes

and then via inflation.

- Some readers would have a go at me whenever I'd post articles

by the Telegraph's Ambrose Evans-Pritchard. Although he has a tendency

to hyperventilate and sometimes oversimplifies, he regularly points

to data and research that I haven't seen covered elsewhere.

More important, his major calls this year have been correct.

He predicted the oil price decline, was vehement that deflation,

not inflation was the risk to the global economy, and pointed to

evidence of near zero money supply growth in major economies, an

early warning that the credit crunch was intensifying.

Today, Evans-Pritchard and the Financial Times editorial page

are in agreement on the the dangers of the debt crisis and the need

for swift action, although Evans-Pritchard spends more time on the

long-term outlook.

First, from the

Financial Times (boldface ours):

- Banks are not to be trusted.

This is not just the view of the public and policymakers, but

that of the banks themselves. Spreads on unsecured

inter-bank lending have reached unprecedented levels, particularly

in dollars and, to a lesser degree, sterling. Such stresses

cannot continue for long, without serious damage to both the

financial system and the economy...

Comments

- Richard Kline said...

-

-

The stated fact that the top 20 US

banks have $3T worth of 'assets' to offload is exactly why buying

these assets is an exceedingly stupid and unproductive way to deal

with the capital erosion and in many cases insolvency of those firms.

Which is better, $150B of public equity infusion and/or seizure

for control with no purchase, or $3T of expense with zero (0) guarantee

of the improvement of any significant vector in the US financial

economy besides insider profits? The Paulson Bullrush is an attempt

to roll the US Government, but it is not a credible engagement with

our problems: that is perhaps its worst aspect, its copious delusion

where cool heads and shrewd schemas are needed.

Don't bail 'em, fail 'em.

From

Times article on the same theme "As a result, the economy would

be virtually stalled over the next year, we forecast that the unemployment

rate will rise to at least 7% in 2009, and therefore core inflation is likely

to fall next year. On a "cash-deficit" basis, the budget deficit is likely

to soar to USD1.2trn for 2009, we estimate."

Sept. 27 | Bloomberg.com

Yields on speculative-grade bonds rose to distressed levels for the

first time since 2002 as the turmoil sweeping Wall Street led investors

to shun all but the safest government bonds.

Investors demand 10.25 percentage points more in yield to own junk-rated

securities than Treasuries, according to Merrill Lynch & Co.'s U.S.

High Yield Master II index. Bonds that trade at a so-called spread of

10 percentage points or more are considered distressed.

The last time spreads were so wide was in the aftermath of Enron

Corp.'s collapse earlier this decade. Now, a slowing economy and failures

of some of the largest U.S. financial institutions are driving investors

away. Distressed bonds default within one

year 22 percent of the time, compared with 1 percent for non-distressed

junk bonds, according to Fridson Investment Advisors in New York.

``Any credit perceived as exhibiting a higher level of default risk

is at risk of significant price depreciation,''

Peter Acciavatti, a credit strategist at JPMorgan Chase & Co. in

New York, wrote in a report yesterday. Acciavatti was the top- ranked

high-yield strategist in Institutional Investor magazine's annual poll.

High-yield spreads have climbed 1.89

percentage point this month, the steepest monthly rise since September

2001, as the government seized the two largest U.S. mortgage-finance

companies, Fannie Mae and Freddie Mac; Lehman Brothers Holdings Inc.

was forced to file for bankruptcy; Merrill Lynch agreed to sell itself

to Bank of America Corp.; American International Group Inc., the nation's

biggest insurer, was taken over by the Treasury; and

Washington Mutual Inc. was seized by regulators in the biggest U.S.

bank failure in history.

Rescue Plan

Congressional leaders pressed toward a deal on a $700 billion financial

rescue plan proposed by Treasury Secretary Henry Paulson. President

George W. Bush said yesterday any disagreements would be resolved.

High-yield, high-risk, or junk, bonds

are rated below Baa3 by Moody's Investors Service and BBB- by Standard

& Poor's.

Financial industry failures are causing ``massive'' amounts of debt

to be downgraded, S&P said in a report yesterday.

``Although credit-quality erosion can be expected during cyclical

downturns, the enormity of debt amounts affected is disconcerting,''

Diane Vazza, the head of S&P's fixed income research group in New

York, said in a statement.

Default Rate

The default rate among high-yield, high-risk,

non-financial borrowers may rise to 23.2 percent by 2010, the highest

since 1981, S&P said in a report Sept. 25. The ``worst-case

scenario'' estimate suggests 353 junk-rated borrowers outside the financial

sector may default in the next two years, S&P said.

Spreads on junk bonds widened 38 basis

points yesterday, according to the Merrill high-yield index. A basis

point is 0.01 percentage point.

Yields over benchmark rates on investment-grade bonds also widened

yesterday, climbing 23 basis points to a record 459 basis points, according

to Merrill's U.S. Corporate Master index.

High-yield new issuance this month has fallen to $845 million, from

$5.9 billion in the same month last year, according to data compiled

by Bloomberg. Since Aug. 1, seven issuers have tapped the high-yield

market.

German Finance Minister Peer Steinbrueck deemed the US banking

crisis an "earthquake" that will cost the US its role as a superpower

of the world financial system. He stressed that German banks can cope

with losses.

"Wall Street and the world will never again be the way they were

before the crisis," said Steinbrueck in a speech to the German parliament,

the Bundestag, on Thursday, Sept. 25. Write-downs and write-offs of

bad credit spawned by "a blind drive for double-digit profits" have

so far totaled $550 billion and no end to the crisis is in sight, he

added.

The world financial system will consequently become more "multi-polar,"

he predicted.

Steinbrueck told the Bundestag that the Group of Seven (G7) finance

ministers would be meeting in Washington next month to discuss how to

tighten regulation of capital markets.

The German federal government, meanwhile, would continue efforts

to trim spending, but would also make some moves to stimulate the economy.

He reiterated Germany's refusal to set up its own bank bail-out scheme,

saying the crisis was principally a US problem.

Irresponsible moves

Reiterating Berlin's push for tighter regulation, Steinbrueck accused

the US of blunders.

"The cause of the crisis was the irresponsible exaggeration of the

principle of a free, unrestrained market," he told the Bundestag.

Washington has been reluctant to increase minimum equity rules and

has too many competing regulators over US investment banks.

"This system, which in many ways is inadequately regulated, is now

collapsing," he said, adding that Germany's banking system remained

"relatively robust," with German regulators confident they can absorb

losses.

"New rules of the road" for the financial markets were needed, he

said.

Plans to be debated when the finance ministers of the G7 meet will

include tightening cooperation between the International Monetary Fund

(IMF) and the Financial Stability Forum (FSF).

The agencies were created by western nations as an early warning

system.

Steinbrueck also renewed his call for fusion across Germany's state

bank sector. The country's big commercial lenders, the so-called "Landesbanken,"

have been hard hit by the financial crisis.

The next move needs to be made by the individual states, as co-owners

of the leading state banks, said the Social Democrat minister: "They

need to overcome regional political pride and embrace pan-regional co-operation."

This, he said, would strengthen the German banking system and boost

its sustainability.

"Financial support from the government in mopping up problems in

this sector should not be expected," he added.

Given that past attempts to fuse the "Landesbanken" have failed,

Steinbrueck proposed a redefinition of their business models in order

to avoid excessive risk and to increase returns.

The financial crisis has, however, shown that both savings banks

and cooperative banking institutions are stable and reliable, said Steinbrueck.

"Injecting throughout the world financial

system their bogus and unregulated financial instruments, like collateralized

debt obligations and credit-default swaps, the big New York financial houses

have taken the world economy hostage. The president and Congress should

strive to save the hostages, not the kidnappers."

The unravelling that started with the Freddie and Fannie conservatorship

has exacted a toll not just on dollar-denominated paper but on financial

assets around the world. As they have fallen, so too has the standing

of the US, which zealously promoted liberalized capital markets and

saw US firms establish dominant positions when those rules were adopted.

America already had few friends thanks to our prosecution of the

war in Iraq, and our reputation is testing new lows. From the

Telegraph:

In a remarkable outburst at the German parliament, Mr Steinbrück

said the world would never be the same after "Black September".

He demanded a sweeping code of regulations to "civilise the financial

markets" and clamp down on speculators.Mr Steinbrück announced

a swingeing eight-point plan to reorder the global markets - which

will heighten fears in the City of London of interference by the

European Commission.

"The US will lose its superpower

status in the global financial system," he said,

predicting a new multi-polar order where power is spread across

the globe.

"The financial crisis is above all

an American problem. The other G7 financial ministers

in continental Europe share this opinion," he said, a pointed turn

of phrase that excludes Britain's Alistair Darling.

"This inadequately regulated system

is now collapsing, with far-reaching consequences for the US financial

market and contagion effects for the rest of the world,"

he said....

Senior politicians in France and Germany have in recent weeks

called for a radical shake-up of the market system. A powerful EU

faction that has always been hostile to the City of London –

which is known in Brussels as "the casino"

– see this crisis as a rare chance to ram through irreversible changes.

"They want to regulate the capital levels of every firm and partnership,

limit takeovers and regulate asset stripping. In short, they want

to regulate the Anglo-Saxon version of capitalism out of existence,"

said John Whittacker, MEP and UKIP's economic spokesman.

Mr Steinbrück said the deft response

of the world leaders in recent days had averted catastrophe. "Crisis

management worked. We did not have a collapse of the international

financial system," he said.

Mr Steinbrück said the drive for short-term profit and huge bonuses

in the Anglo-Saxon world was the root cause of the gravest crisis

in decades. "Investment bankers and

politicians in New York, Washington and London were not willing

to give these up," he said.

Update 3:45 AM: More on the same

speech from the

Financial Times:

He later told journalists: "When we

look back 10 years from now, we will see 2008 as a fundamental rupture.

I am not saying the dollar will lose its reserve currency status,

but it will become relative."The minister, who

has spearheaded German efforts to rein in financial markets in the

past two years, attacked the US government for opposing stricter

regulations even after the subprime crisis had broken out last summer.

The US notion that markets should remain as free as possible

from regulatory shackles "was as simplistic as it was dangerous",

he said.....

The US, Mr Steinbrück said, had failed in its oversight of investment

banks, adding that the crisis was an indictment of the US two-tier

banking system and its "weak, divided financial oversight".

He blamed Washington for refusing to consider proposals Berlin

had made as it chaired the Group of Eight industrial nations last

year. These proposals, he said, "elicited mockery at best or were

seen as a typical example of Germans' penchant for over-regulation"....

Mr Steinbrück's proposals include

a ban on "purely speculative short selling"; a crackdown

on variable pay for bank managers, which had encouraged reckless

risk-taking; a ban on banks securitising more than 80 per cent of

the debt they hold; international standards making bank managers

personally responsible for the consequences of their trades; and

increased co-operation between European supervisors.

Tim Duy at Economist's View tells us that

the economy is slowing down markedly, and that that will lead to

a lot of false causality. Whether the bailout plan gets

done in some reasonable form or not, the slowdown will be blamed on

its failure, or the fact that the rush to get it done meant an ineffective

program was put in place.Duy also addresses one of our pet issues:

a slowdown is inevitable because US consumption has been at an unsustainable

level. Lowering consumption will reduce growth, and with the economy

at barely above a stall, any further reduction means recession. But

in America, recessions are not supposed to be inevitable. Permanent

growth is our God-given right. But it looks like we have fallen out

of divine favor of late.

===

Vijay said...

It has been conventional wisdom that China, Japan, and other countries

that run trade surpluses with the US, which means they fund our overconsumption

by buying assets like US Treauries, would never restrict the flow of

credit to us because it would lower their exports and hurt their growth.

We've long been leery of the idea that unsustainable trends will have

a life eternal, and Brad Setser has a simple reason why this process

is self-limiting. Our foreign funding sources aren't just lending us

money to buy their goods;

they are also providing

the funding for interest on the loans extended for past imports.

At a certain point, the interest payments become so large relative to

the value of the exports that the deal no longer makes sense.

The day of reckoning may be approaching well before Setser's tipping

point. And the trigger is much simpler. We look like a lousy risk. The

Freddie/Fannie conservatorship, the Lehman bankrutpcy, and the rescue

of fallen Asian powerhouse AIG has, not surprisingly, lead to a reassessment

of the US's creditworthiness.

Was Greenspan a drag dealers boss ?

Anyone nicknamed Dr. Doom is likely to be a man after my own heart,

and Marc Faber is no exception. The Swiss investor has a good record

of market calls (for instance, he was a staunch commodities bull till

late in the spring, when he reversed his view) and perhaps as important,

has a broader historical perspective than most of his peers and a propensity

to be blunt.

... ... ...

Other sources of funding, such as

foreign reserves of resources-rich countries, are also likely to

dry up, Faber said. "I think sovereign wealth funds are going to

be very busy supporting their own markets, they won't have much

money to buy assets around the world."

Volatility comes from the fact that, as the private sector tightens

lending conditions to adjust its risk management, central banks

are injecting liquidity in the money markets to grease the system,

he said, adding that banning short-selling will not contribute to

reducing volatility and was a "stupid measure."

"Short sellers are not responsible for current problems. The

current problems are caused by the US Fed (Federal Reserve), that

was sitting there and letting credit growth go out of bounds," Faber

said.

"We have to see very clearly that the cause of the problem was

excess leverage. The biggest hedge funds were Fannie Mae, they had

the leverage of one over 150 and under the eyes of Congress, under

the eyes of the SEC and everybody… and nobody did anything about

it. Then, people go and bitch about the short sellers," he added.

The fact that the rules on short-selling are changing nearly

daily, with new names added to the list of securities in which short-selling

is banned or with specific rules regarding hedging and confidentiality

contributes to adding uncertainty, he said.

The problem is also exacerbated by the fact that nobody knows

how long the emergency measure will last or what is next.

"The next emergency measure will be that Americans are not allowed

to buy foreign currency and transfer money overseas, and the next

measure will be not permitting Americans to buy gold and so on and

so forth…. It creates even more uncertainty in the market place

when you continually change the rules," Faber said.

Buying opportunity for bonds or a trap ?

Global money markets were racked by fresh convulsions yesterday as

Henry Paulson, the US Treasury Secretary, and Ben Bernanke, Chairman

of the Federal Reserve, struggled to persuade America's sceptical lawmakers

to pass their $700 billion (£378 billion) bailout plan for Wall Street.

However, Mr Buffett sounded a warning that markets remained in a

"dangerous situation". "I am, to some extent, betting on the fact that

the Government will do the rational thing and act properly," he said.

This is now a national disaster for the United States. The centrality

and import of inexpensive and available credit to America's function

is total.

We have moved well beyond a subprime crisis. We have moved well beyond

a financial industry crisis. The position of the US economy is in jeopardy

and the employment security and wealth of the nation is now very much

in play.

Like the nations of East Asia in the aftermath of the Asian financial

crisis of 1997-8, or Eastern Europe after the collapse of the Soviet

Union in 1991, our way of economic life - warts and all - is imperiled.

No matter what happens as the week comes to a close our lives have changed.

Shock waves are emanating out from the debt collapse ground zero. US$3.6

trillion in global stock market wealth has evaporated this week. The

job losses and macro effects are not far off.

Over the past 14 months one assumption after another has been proven

unsound. Why? We have been waiting and working

toward a return of normality. The normalcy of the past six years is

illusion. Credit conditions designed to keep the macro-economy

and asset prices at peak levels filtered into balance sheet leverage,

government debt and consumer debt levels well beyond prudence. This

happened because credit easing does not and cannot substitute for earnings,

wages or tax revenues.

Well beyond the US's oft-discussed addiction

to oil is its never-mentioned addiction to foreign credit.

In 2007, America imported 49% of total global reported imported capital,

the lowest US percentage in several years. Thus, our 25% reported share

of oil consumption is much lower than our share in imported capital.

We became addicted to debt - especially foreign debt - and that addiction

becomes an illness in a credit constriction.

Leading US banks and financial firms grew large and reaped huge

profits writing, packaging, trading and rewriting, repackaging and retrading

all that borrowed money. Thus, the boom created the bust.

To move forward we need coherent national policy from leading firms,

regulatory agencies and pundits. We need to move forward toward lower

debt, higher earnings and sustainable government spending. We need drastic

and proactive reform of regulatory bodies. We have a patchwork of overlapping

regulation in some areas with giant gaps of under-regulation and absent

regulation. This has created a situation where actions are piecemeal

and graceless in the midst of a crisis.

What is sad is that institutional memory was wiped out and recklessness

returned in volume that probably exceeded the previous gilded age. Institutional

memory lasted just two political generations. After that policymakers forgot

that "Wall Street, after all, had been convicted in the court of public

opinion of reckless, incompetent, self-interested, even felonious behavior

with consequences so devastating for the rest of the country that government

was licensed to make sure it didn't happen again."

Asia Times

President Franklin D Roosevelt's New Deal did, as a start, engage

in some bail-out operations. The Reconstruction Finance Corporation,

actually created by president Herbert Hoover, continued to rescue major

railroads and other key businesses, while some of the New Deal's efforts

to help homeowners also rewarded real estate interests.

The main emphasis, however, now switched to regulation. The Glass-Steagall

Banking Act, the two laws of 1933 and 1934 regulating the stock exchange,

the creation of the Securities and Exchange Commission, and other similar

measures subjected the financial sector to fairly rigorous public supervision.

This lasted for at least two political generations. Wall Street,

after all, had been convicted in the court of public opinion of reckless,

incompetent, self-interested, even felonious behavior with consequences

so devastating for the rest of the country that government was licensed

to make sure it didn't happen again.

The times call for a new departure. The next administration, which

will surely enter office under the greatest economic pressure in memory,

must confront reality. The financial system is out of control and has

led the economy into a wildly turbulent sea of heavily leveraged speculation.

It's time for a reversal of course. Stringent

re-regulation of FIRE is not enough any more. Washington's mission may,

at this late date, be an even greater one than Roosevelt's New Deal

faced. The government must figure out how to deploy its power to shift

the flow of investment capital out of the minefields of speculative

paper transactions and back into productive channels that will help

meet the material needs of American society.

Real value must be created in place of chimeras. In

the meantime, we all have ringside seats - in fact, far too close to

the action for comfort - as another gilded age is ending. What comes

after is, in part, up to us.

Mish's Global

Economic Trend AnalysisMarketWatch is reporting "Echoes

of Iraq in Bush handling of mortgage crisis"

News analysis: Another 'trust me' remedy is getting rushed before

lawmakers."You can draw some valid parallels between the prosecution

of the war under the Bush regime and the way the financial sector

has operated in recent years," said Tom Schlesinger, head of the

nonprofit research group Financial Markets Center in Howardsville,

Va."It fails the most basic test of democratic accountability,"

Schlesinger said.

It boils down to "give me the money and trust me," Schlesinger

said. James Angel, a professor of finance at Georgetown University,

said the White House appears to be "flying by the seat of their

pants."

[Sep 23, 2008] Ben Stein almost lets out the Big Secret by

Inky99

Ben Stein, a man whose character and politics I find to be despicable,

has a column today that I noticed on Yahoo Finance. A good buddy

of mine, who stays closely abreast of these kinds of financial shenanigans,

told me the other day that Ben Stein, in spite of his character flaws,

had some really astute observations on this whole mess. So out

of curiosity today, I clicked on the link.And I have to admit, I

am astounded by what he said. And even more by what he didn't

say. The Big Question he leaves unanswered. It's seriously

mind-blowing.

Here is the article:

Everything You Wanted to Know About the Credit Crisis But Were Afraid

to Ask

And here is the meat of his article, which leads to the huge gaping

hole which he leaves unfilled:

The crisis occurred (to greatly oversimplify) because the financial

system allowed entities to place bets on whether or not those mortgages

would ever be paid. You didn't have to own a mortgage to make the

bets. These bets, called Credit Default Swaps, are complex. But

in a nutshell, they allow someone to profit immensely - staggeringly

- if large numbers of subprime mortgages are not paid off and go

into default.

The profit can be wildly out of proportion to the real amount

of defaults, because speculators can push down the price of instruments

tied to the subprime mortgages far beyond what the real rates of

loss have been. As I said, the profits here can be beyond imagining.

(In fact, they can be so large that one might well wonder

if the whole subprime fiasco was not set up just to allow speculators

to profit wildly on its collapse...)

These Credit Default Swaps have been written (as insurance is

written) as private contracts. There is nil government regulation

of them. Who writes these policies? Banks. Investment banks. Insurance

companies. They now owe the buyers of these Credit Default Swaps

on junk mortgage debt trillions of dollars. It is this liability

that is the bottomless pit of liability for the financial institutions

of America.

Did you see that bolded section?

In fact, they can be so large that one might well wonder

if the whole subprime fiasco was not set up just to allow speculators

to profit wildly on its collapse...

Many of us have already said that, including a LOT of prominent economists

like

Michael Hudson. These people knew the loans they

were making were bad loans. They knew the money wouldn't

be paid back. Which has always bothered me -- why did they make

bad loans on purpose? For short term gain? Well, yes, at

least as far as some of the people involved go, like mortage agents

in banks who worked on commission. But the people in charge were

letting them make these loans. Why?

Now that is what leads to the real meat of what he's saying, the

"Elephant in the Room", That Which Shall Remain Unspoken:

They now owe the buyers of these Credit Default Swaps

on junk mortgage debt trillions of dollars. It is this liability

that is the bottomless pit of liability for the financial institutions

of America.

Somebody, somewhere, is blackmailing the economy. Because somebody,

somewhere, is owed these TRILLIONS of dollars. And it is THEY

who are holding a gun to the economy and demanding payment, and all

of Wall Street, and even the Fed, cannot pay this debt.

So WHO is this Tony Soprano-like world figure? Who are these

people? Why are we not identifying them, and talking to them,

and negotiating with THEM, whoever they are, to keep from bankrupting

the American economy in their favor?

Somebody, somewhere, is blackmailing the entire United States economy.

Somebody, somewhere, has a gun to our head. And to the head of

the American government.

I want to know who they are. I want them identified.

Who are they? And why are we willing to bankrupt the entire

country in order to pay them off?

Somebody, somewhere, has way more power than they should have.

Who?

Financial Armageddon

The oldest technique for the usurpation of power by the executive

from the legislative is the manufacture of a state of emergency.

Sep 23, 2008 | The Big Picture

Treasury Secretary Hank Paulson and Federal Reserve Chairman Ben

Bernanke are scheduled to testify today before Congress on their massive

bailout program.

Here are some questions I would like to hear asked:

5. You have said that "The Housing

correction is the root cause of market stability." What about

leverage -- how significant was that as a root cause?

6. Your initial estimates for the

cost of this were $700 billion dollars. Yet you also asked for a

blank check, an unlimited ability to spend more "as needed."

What is your worst case scenario for the total costs of this bailout?

7. The original version of this

bailout package requested no judicial, administrative, or budgetary

review of the spending of this bailout, What was the thought process

behind that extraordinary, extra-constitutional request?

8. In 2004, your former firm, Goldman

Sachs, along with 4 other brokers, received a waiver of the net

capitalization rules, allowing these firms to dramatically exceed

the 12-to-1 leverage rules. How much was this waiver responsible

for the current situation?

... ... ...

10. The Securities and Exchange

Commission has been AWOL during much of the problems we now face.

What do you think is the proper role for the SEC in terms of supervising

or regulating securities markets? Doesn't your plan usurp

SEC authority and move it to the Treasury?

11. How significant are derivatives

and credit default swaps to the current crisis? Why weren't they

regulated the way other insurance products are?

12. The current proposal has the

US bailing out foreign banks. Has the USA become the insurer of

the worlds financial assets?

Another sign of the return of populism...

09/18/08 | Network World

Wall Street fat cats: How much they made last year

With the

failures of Lehman Brothers, Fannie Mae and Freddie Mac this month,

reams of Wall Street IT executives are out of work or soon will be.

While financial services CIOs and their staff polish their resumes and

ponder what's left of their retirement savings, we thought it might

be interesting to look at how much money their bosses made last year.

Read on to find out what 9 Wall Street chiefs cost their companies in

2007, once their salaries, bonuses, stock awards and more are added

together.

It does not matter that Paulson exaggerates things. That's part of the

job description of the Secretary of Treasury. More important question is

"Can Paulson deal with a pile of immense interlocked, incestuous borrowing

?" In Stephen King opionin

"The Paulson plan is, in effect, a taxpayer

bailout designed to protect the US banking system from the consequences

of foreign aversion towards US assets."

"Bad money" (bad capitalism) destroyed good money (good, technological

advantage capitalism). Enormous transformation of the USA with raise of

financial sector to became "the economy". Since 1980th the financial

sector gradually hijacked the American economy with explicit government

support. Greeenspan turned on the spigots. During Greenspan tenure total

credit market debt quadruped and Greenspan would do nothing to disturb finance

industry. Essentially he gave finance industry what they wanted under the

smoke-screen of statistical cover-ups. That was very bi-partial destruction

of US economy with Clinton continuing policy of Reagan and Bush I (Clintonites

were in the pocket of Wall Street). Financial services displaced manufacturing

as a share of gross domestic product... And Treasury Secretary Henry Paulson's

clearly knew about the government's "numbers racket" with everything including

inflation numbers manipulated on a large scale "to look good". Paradoxically

a part of Obama support base are Chicago and Wall Street financial moguls

(he got quite a bit of money from Fannie Mae and Freddie Mac)

Beat

The Press The American Prospect

Treasury Secretary Henry Paulson is telling Congress that if it doesn't

give him a $700 billion blank check the financial system is going to

collapse. It would be reasonable for reporters discussing this request

to present some background on the track record of the person asking

for this enormous blank check.In March of 2007, after the first shock

waves of the housing meltdown had already hit, the

Associated Press reported Mr. Paulson's view that the credit difficulties

linked to the housing slump would be limited.

In August of last year, after the second round of financial shock

waves disrupted markets worldwide, Paulson

commented, "We have the strongest global economy I've seen in my

business lifetime."

Just last March

he warmly endorsed a reduction in the capital requirements for Fannie

Mae and Freddie Mac, saying "additional capital [invested in mortgages

by Fannie and Freddie] will enable the companies to help more homeowners

and will strengthen the underlying fundamentals of the mortgage market."

At every point along the way, Secretary Paulson has failed to see

the extent of the crisis resulting from the collapse of the housing

bubble. This raises serious questions about his judgment. Reporters

should be discussing Paulson't track record in the context of this bailout

proposal.

--Dean Baker

Comments

One way to pay off the assumed debt would be a tax on wealth, which

has been the most direct beneficiary of the bailout. Aggregate family

net worth is about $56 trillion per Federal Reserve. A 1% tax on that

would retire the debt in 1-2 years.

Since aggregate family net worth is about 7 times aggregate personal

income, servicing and paying off the assumed debt through the income

tax would a much bigger burden--as well as being a misplaced burden.

This is not an end of the world but this can well be became a bailout

at the expense of taxpayers. Some think that "It is nothing less than a

coup d'êtat for the class that FDR called

banksters. " Financial capitalism has taken over the economy

and replaced the industrial capitalism.

From David Herszenhorn at the NY Times:

$700 Billion Is Sought for Wall Street in Massive Bailout

The ultimate price tag of the bailout is virtually impossible to

know, in part because of the possibility that taxpayers

could profit from the effort, especially if the market

stabilizes and real estate prices rise.

emphasis added

I hope you laughed. I did. A little gallows humorComments

Bush/Cheney Doctrine for Idiots- Preemptive Bailouts/Preemptive

Wars/Deficits Don't Matter. We can't take a chance, debate, or think

this thru, things have gotten worse so quick!!! Anyone remember

Katrina or Saddam Hussein.

If we buy into this, I think these are the results: Greatest

Ever Destruction of American Freedoms and Way of Life, Lower Standard

of Living (except for the rich), Higher Inflation and Interest Rates

, and Two to Three More Generations of American Debt Slaves(your

kids and your kids' kids). We get what we vote for. The Fed can't

control deflation; therefore they have to inflate to regain control.

They were the cause of the problem, and we stupidly trust them for

the solution....their proposed solution is a blank check from the

govt after they just blew $800 billion of their own reserves. Of

course it only took their predecessors a hundred years to build

it up. Let's slow down and debate this!!!!!

I'm an American Tax Prayer, and I approved this message

cesqy | 09.20.08 - 5:38 pm |

#

Aleister Perdurabo

writes:

There is no sincere plan by this administration

to help America or Americans. There is only a plan to slow the financial

collapse until after the November elections by throwing a politically

palatable amount of money at it and a plan to continue to blame

it on a housing bust.

If we, the American people, allow this to happen,

we're enablers to the unintelligent design model. Before one more

penny of our taxes are spent on this ruse, we must demand a seat

at the table (I think Ralph Nader should occupy that seat) to discuss

breaking up Wall Street, crushing this model, innovating a sensible

model that serves the individual investor and deserving businesses,

and promises our children a future of more than a banana republic.

http://www.counterpunch.org/ mart...ns09202008.html

Aleister Perdurabo |

09.20.08 - 5:38 pm |

#

Moderator writes:

I am from the government. I am here to help you moderate your

opinions.

There is no problem. The economy is strong. Very strong. Shopping

is good for you.

Moderator | 09.20.08 - 5:39 pm |

#

John Stark writes:

Many months ago, Dr. Hamilton at Econbrowser wrote of his frustration

that so many in government and the press were talking as though

the Fed could find some safe course to guide the economy through

the storm, by charting the safe course between inflation and recession.

He suggested that, in the wake of so many billions in real losses,

there may not be any safe course that avoids significant economic

distress.

I suspect that Paulson and Bernanke know this to be true. Maybe

the first, necessary step that has NOT been taken is the political

step: Tell us the friggin' truth. Stop trying to reassure us as

if we were children. Stop pretending that Daddy will make sure everything

is okay.

John Stark | 09.20.08 - 6:03 pm |

#

Anonymous writes:

It's a Bull Market in Government Intervention

It's worth repeating the reality that prices want to fall and

interest rates want to rise. It's not clear that the government

can change that reality. And while the government theoretically

has access to unlimited amounts money to throw at problems, in practice

there's a limit if only because the dollar is regularly valued vis

a vis other currencies and gold.

At some point, cranking up the printing presses to bail out Acme

Finance is self-defeating because the marginal gains of injecting

liquidity are more than offset by a slump in the purchasing power

of the buck.

http://seekingalpha.com/article/...nt- intervention

Anonymous | 09.20.08 - 6:20 pm |

#

"Bank for International Settlements warned

that the next decade could parallel the great slumps of the 19th and 20th

centuries. ". ..."ignore Friday's relief rally in the stock

markets: it's overdone." " Isn't the root cause of the problem, the culture

of de-regulated buccaneer capitalism, which all of these political parties

have supported, celebrated and even courted?" Ordinary workers had

been "left to carry the can" by banking executives.

On Tuesday, in the middle of the worst financial panic since the

Great Depression, the kings of Wall Street held their last jamboree.

... During these few days, the global financial market has been fundamentally

reordered. If the new system fails, some fear we could face another

Great Depression.

... ... ...

"The best thing would be for people to stay home next week. Avoid

making investment decisions. Wait a while and review the situation with

a cold eye. An end to financial shocks, if it is the end, doesn't mean

the downturn is over. There are deep-seated problems in the Western

economies. It's impossible to say how long

it will take to sort them out."

Senility, incompetence or corruption ? We report you decide ;-)

Yesterday in his town hall meeting with Gov. Sarah Palin (R-AK), Sen.

John McCain (R-AZ) advocated offshore oil drilling by pushing three

myths: 1) Hurricanes won't damage oil rigs, 2) Fish love oil rigs, and

3) Cuba is allowing China to drill near the U.S. coast:

McCAIN: An oil rig off of the Louisiana coast. It survived

hurricanes. It is safe, it is sound, and to somehow -

And by the way, on that oil rig - and I'm sure you've probably

heard this story - you look down, and there's fish everywhere! There's

fish everywhere! Yeah, the fish love to be around those

rigs. So not only can it be helpful for energy, it can be helpful

for some pretty good meals as well. […]

As far as China and Cuba are concerned, we continue to hear that

there is negotiations or conversations or - I'm not exactly

sure what the state of play is, but it's not a healthy thing, obviously.

MYTH #1: Hurricanes won't damage oil rigs. The U.S.

Minerals Management Service estimates that Hurricanes Katrina and Rita

destroyed

113 offshore oil platforms and

caused 124 offshore spills for a total of 743,700 gallons. In fact,

damage to offshore producers accounted for

77 percent

of the oil industry's storm costs. In the wake of Hurricane Ike,

there are at least

three offshore oil rigs missing and "presumed to be total losses."

MYTH #2: Fish love oil rigs. McCain is pushing an

oil industry talking point. While marine biologists have seen fish congregating

around oil rigs, it doesn't mean they are good for wildlife. "That's

like taking a

picture

of birds on a telephone wire and saying it's essential habitat,"

said the Environmental Defense Center's Linda Krop. Without the platforms,

fish would likely return to natural reefs.

MYTH #3: Cuba is allowing China to drill near the U.S. coast.

The Congressional Research Service has unequivocally concluded that

Cuba has not permitted

China to drill near the U.S. coastline in the Gulf of Mexico. Even

Vice President Cheney has

admitted this talking point is false.

McCain's second claim is especially silly. Not too long ago, conservatives

were also trying to argue that the United States should start drilling

in Alaska's Arctic National Wildlife Reserve because oil pipelines would

"become a meeting ground and 'coffee

klatch' for caribou." (HT:

AMERICAblog)

Crisis explanation for dummies. questions are really good, but

as for explanations your mileage can very. Despite drift of PBS to

the right, at least they have honesty to mention market fundamentalism as

the source of the problems.

In throwing Lehman to the dogs, Hank Paulson is stated clearly that

all Greenspan's and other Fed cowards dire warnings of "contagion", "systemic

risk" and "domino effect" are little more than special pleading from fake

Masters of the Universe who would like the taxpayer to save their over-priced

skins and skins of Wall street bankers they represent (as in Fed --

Wall Street insurance corporation). It is quite a punt.

Across the political spectrum in Europe, the former fed chief's name

keeps popping up when the discussion turns to "root cause", and Italy's

finance minister sets the bar quite high, putting the world's most famous

terrorist in the same company as the world's most famous central banker,

as

reported in the LA Times.

It's a rare day when finance officials, leftist intellectuals and

ordinary salespeople can agree on something. But the economic meltdown

that wrought its wrath from Rome to Madrid to Berlin this week brought

Europeans together in a harsh chorus of condemnation of the excess

and disarray on Wall Street.The finance minister of Italy's conservative

and pro-U.S. government warned of nothing less than a systemic breakdown.

Giulio Tremonti excoriated the "voracious selfishness" of speculators

and "stupid sluggishness" of regulators. And

he singled out

Alan Greenspan, the former chairman of the U.S. Federal Reserve,

with startling scorn.

"Greenspan was considered a master," Tremonti declared. "Now

we must ask ourselves whether he is not,

after [Osama]

bin Laden, the man who hurt America the most. . . . It is

clear that what is happening is a disease. It is not the failure

of a bank, but the failure of a system. Until a few days ago, very

few were willing to realize the intensity and the dramatic nature

of the crisis."

Krugman: "We look for weak economy for the next year."

The Bush administration is asking Congress to let the government

buy $700 billion in toxic mortgages in the largest financial bailout

since the Great Depression, according to a draft of the plan obtained

Saturday by The Associated Press.

The plan would give the government broad power to buy the bad debt

of any U.S. financial institution for the next two years. It would raise

the statutory limit on the national debt from $10.6 trillion to $11.3

trillion to make room for the massive rescue. The proposal does not

specify what the government would get in return from financial companies

for the federal assistance.

''We're going to work with Congress to get a bill done quickly,''

President Bush said at the White House. Without discussing details of

the plan, he said, ''This is a big package because it was a big problem.''

... ... ...

In a briefing to lawmakers Friday, Paulson and

Federal Reserve Chairman

Ben Bernanke painted a grave picture of an economy on the edge of

a major recession and telling them that action was urgent and imperative.

In a session with House Democrats, they described a plan where the government

would in essence set up reverse auctions, putting up money for a class

of distressed assets -- such as loans that are delinquent but not in

default -- and financial institutions would compete for how little they

would accept for the investments, said Rep. Brad Sherman, D-Calif.,

who participated in the conference call.

''You give them good cash; they give

you the worst of the worst,'' Sherman said. A critic of the plan, he

complained that Bush and his economic advisers were trying to panic

lawmakers into rubber-stamping it.

"To paraphrase

Floyd

Norris, we have become Marxists, but of the Groucho, not Karl, variety

. . . "

I am having a hard time keeping up with all of the bailouts and special

facilities created for dealing with this crisis. Am I missing

any?

- Bear Stearns

- Economic Stimulus progam

- Housing Bailout Program

- Fannie & Freddie

- AIG

- No Short selling rules

- Fed liquidity programs (Term Lending facility, Term Auction facility)

- Money Market fund insurance program

- Special Loans for GM & Ford

- New RTC type program

MBIA and the Ambac Financial Group may have their debt rankings cut

several grades by the credit ratings company Moody's Investors Service

after Moody's raised its forecast for losses on securities backed by

subprime mortgages.

Syncora Guarantee, the Financial Guaranty Insurance Company and CIFG

Assurance North America will also be evaluated for the effect of the

higher loss projections, Moody's said.

... ... ...

MBIA, based in Armonk, N.Y., and Ambac are the two largest bond insurers.

Five of seven formerly AAA-rated bond insurers have been stripped of

their top rankings this year after straying into securities backed by

subprime mortgages from backing the debts of cities and states.

Throwing friends under the bus is time honored political tradition,

but here McCain forgot his own role in Enron debacle ;-)

CHRIS Cox for VP?

Former conservative colleagues in the House of Representatives

are Christopher Cox, chairman of the Securities and Exchange

Commission since 2005, boosting to be Sen. John McCain's

vice presidential running mate.

ROBERT D. NOVAK - Syndicated Columnist, March 18, 2008

---

Republican presidential candidate John McCain, in remarks prepared

for delivery Thursday, said he thought Christopher Cox,