Secular Stagnation Bulletin, 2015

|

Contents | Next

- 20161227 : Suicide rates rise after jobs move overseas, study finds ( Dec 27, 2016 , economistsview.typepad.com )

- 20161227 : Trump should say, Thanks, Obama! ( Dec 27, 2016 , www.nakedcapitalism.com )

- 20161227 : The government's 20th century growth as a factory underestimates service sector growth and our continued share shrink in 20th century ( Dec 27, 2016 , economistsview.typepad.com )

- 20161227 : On Krugman And The Working Class - Tim Duys Fed Watch ( Dec 27, 2016 , economistsview.typepad.com )

- 20161227 : How Americans Spent Their Money In The Last 75 Years (In 1 Simple Chart) Zero Hedge ( Dec 27, 2016 , www.zerohedge.com )

- 20161226 : Neoliberalims led to impoverishment of lower 80 pecent of the USA population with a large part of the US population living in a third world country ( Dec 26, 2016 , economistsview.typepad.com )

- 20161226 : Someone needs to buy Paul Krugman a one way ticket to Camden and have him hang around the devastated post-industrial hell scape his policies helped create. ( Dec 26, 2016 , economistsview.typepad.com )

- 20161226 : Vehicle Sales Forecast: Sales Over 17 Million SAAR Again in December, On Track for Record Year in 2016 ( Dec 26, 2016 , www.calculatedriskblog.com )

- 20161226 : Wolf Richter: New Census Data Shows Why the Job Market is Still "Terrible" (as Trump said) ( Dec 26, 2016 , www.nakedcapitalism.com )

- 20161226 : IBM Promises To Hire 25,000 Americans As Tech Executives Set To Meet Trump ( Dec 26, 2016 , politics.slashdot.org )

- 20161223 : The Case for Protecting Infant Industries ( Dec 23, 2016 , economistsview.typepad.com )

- 20161223 : Top Ex-White House Economist Admits 94% Of All New Jobs Under Obama Were Part-Time ( Dec 23, 2016 , www.zerohedge.com )

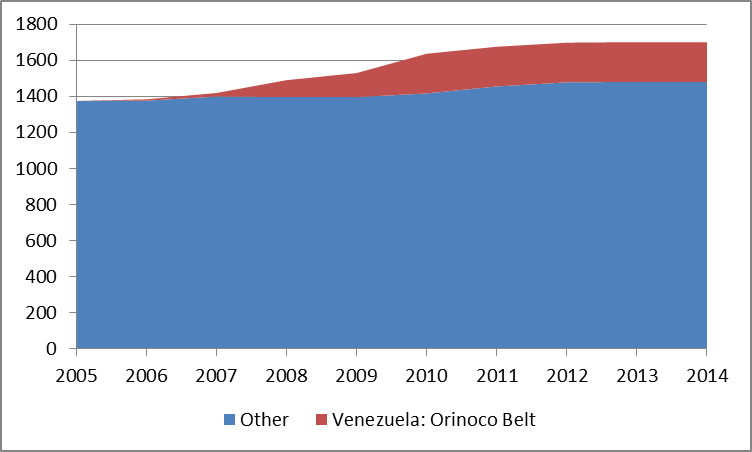

- 20161222 : Oil Consumption Is Immune To A Transport Transformation ( oilprice.com )

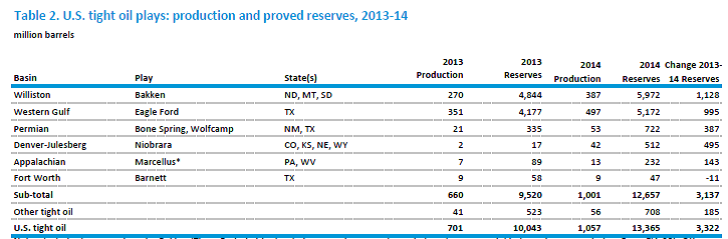

- 20161222 : Huge Decline In U.S. Proved Oil And Gas Reserves ( oilprice.com )

- 20161221 : The reason Trump won the GOP nomination was exactly because he claimed to reject traditional GOP policies and approaches ( Dec 21, 2016 , economistsview.typepad.com )

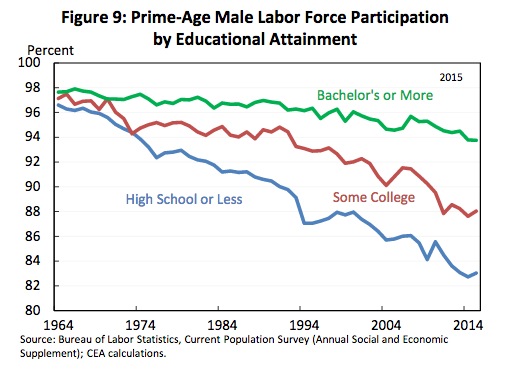

- 20161221 : Bad News for America's Workers ( Dec 21, 2016 , economistsview.typepad.com )

- 20161221 : Michigan Lame Duck Legislature ( Dec 21, 2016 , angrybearblog.com )

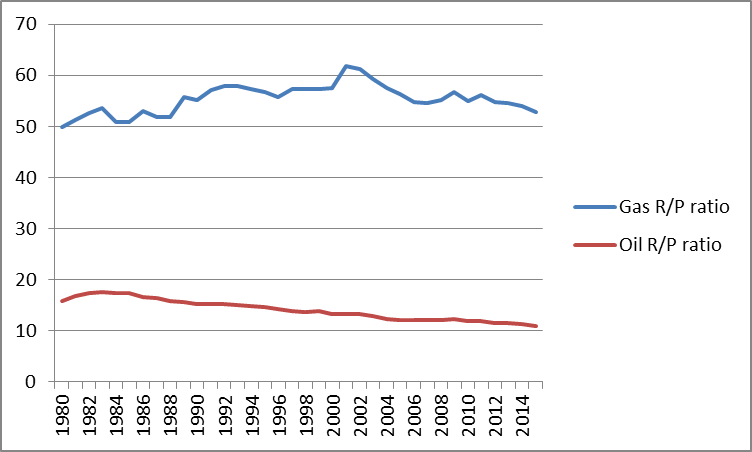

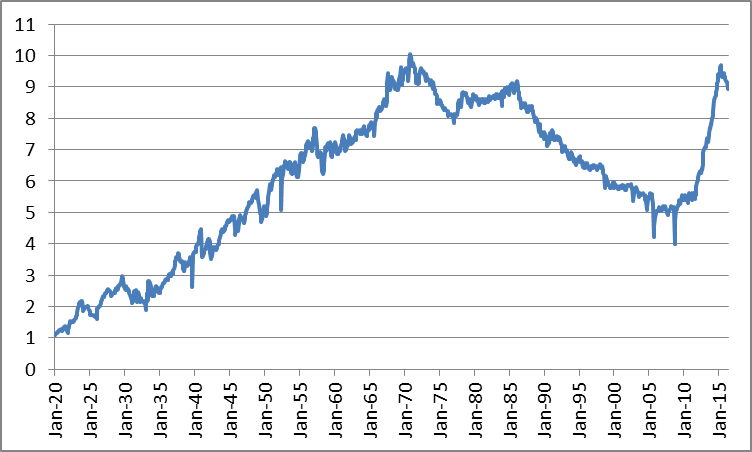

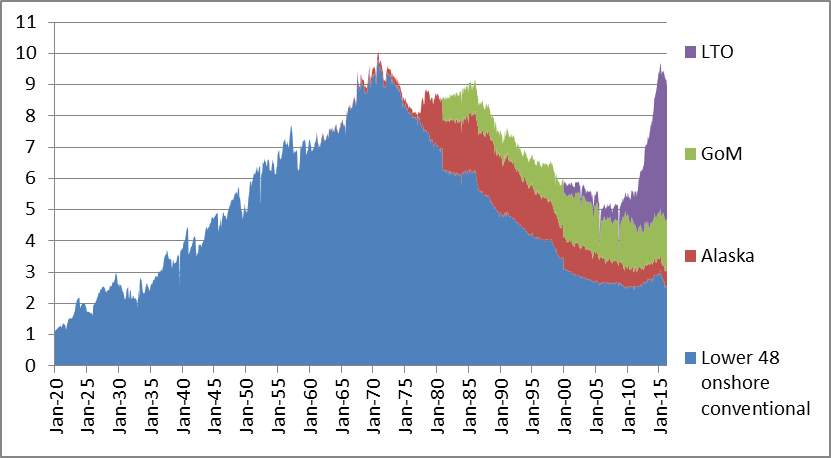

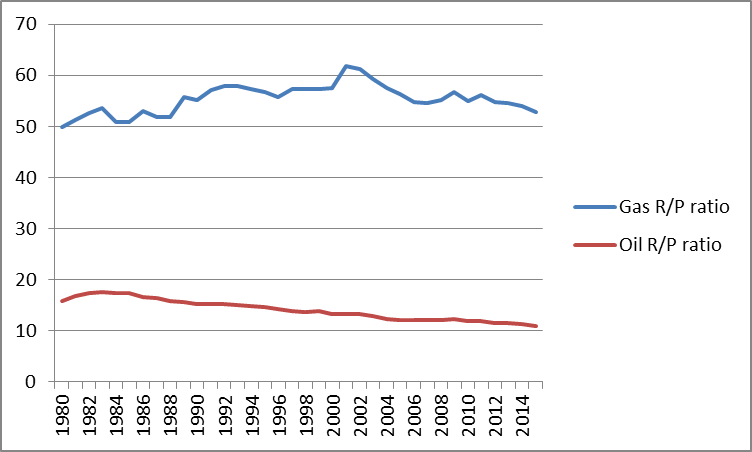

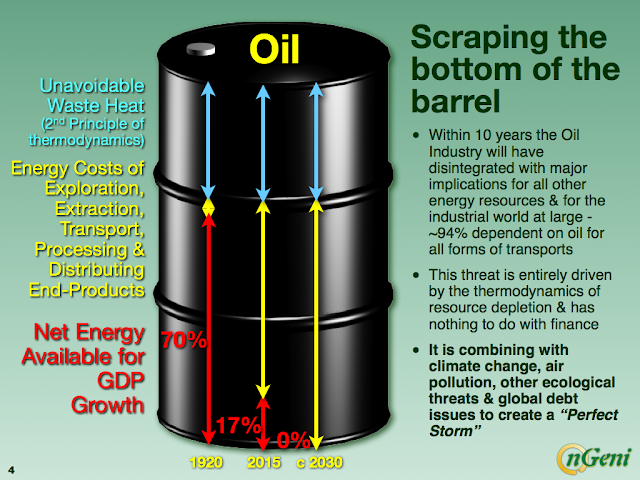

- 20161220 : What's shocking about that chart AlexS is that even with the sharp price increases of oil between 2000 and 2014, the oil R/P ratio has still steadily declined. With investment having been crushed in the last few years, looks like we are facing a Seneca cliff ( Dec 20, 2016 , peakoilbarrel.com )

- 20161219 : Michigan unemployment agency made 20,000 false fraud accusations – report ( Dec 18, 2016 , www.theguardian.com )

- 20161216 : Deplete America first as national policy. The US is wasting its precious oil deposits like there is no tomorrow ( Dec 16, 2016 , peakoilbarrel.com )

- 20161215 : 12/14/2016 at 7:41 pm ( Dec 15, 2016 , peakoilbarrel.com )

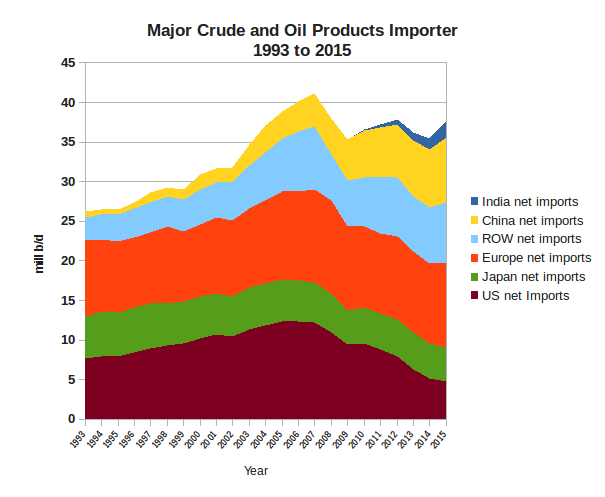

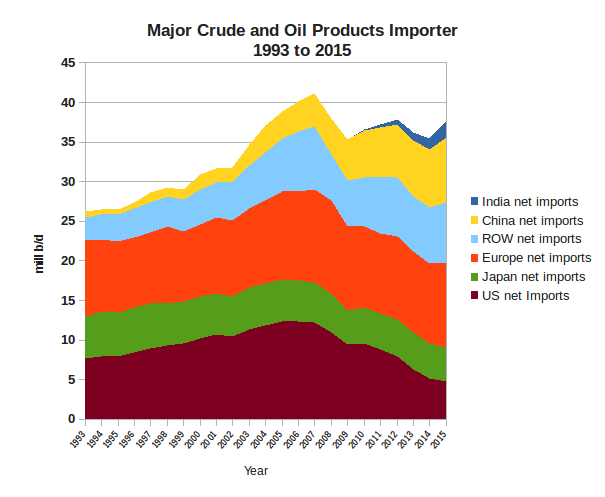

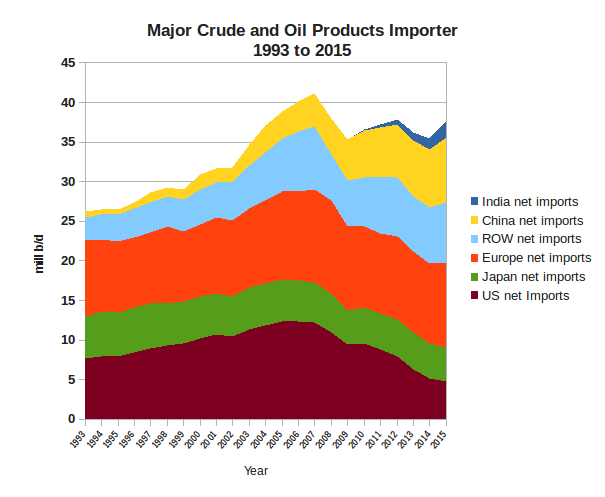

- 20161213 : Both China and India experienced record crude oil demand in November ( Dec 13, 2016 , peakoilbarrel.com )

- 20161213 : IEA ups oil demand forecast for 2017, says next few weeks are 'crucial' for markets after OPEC deal ( finance.yahoo.com )

- 20161213 : OPEC Monthly Oil Market Report ( Dec 13, 2016 , www.opec.org )

- 20161211 : Comic Book Hayek The Planners Promise Utopia ( Dec 11, 2016 , angrybearblog.com )

- 20161211 : The solution to limited Earth resources is to substitute redistribution for growth. A refinement is to redefine standard of living, so it isnt just standard of consumption but measures quality of life ( www.nakedcapitalism.com )

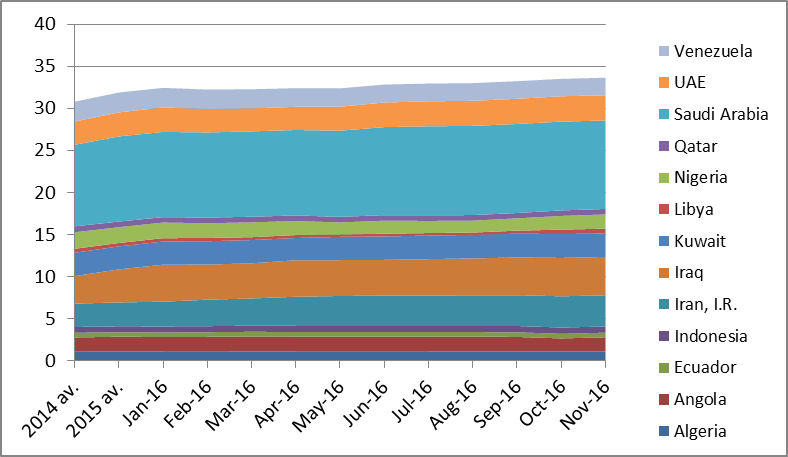

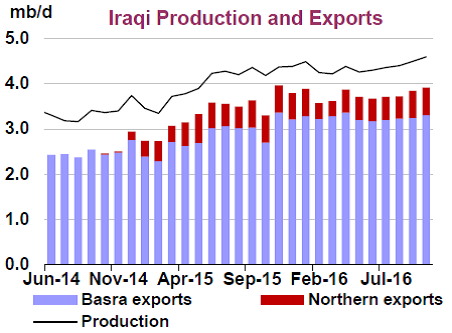

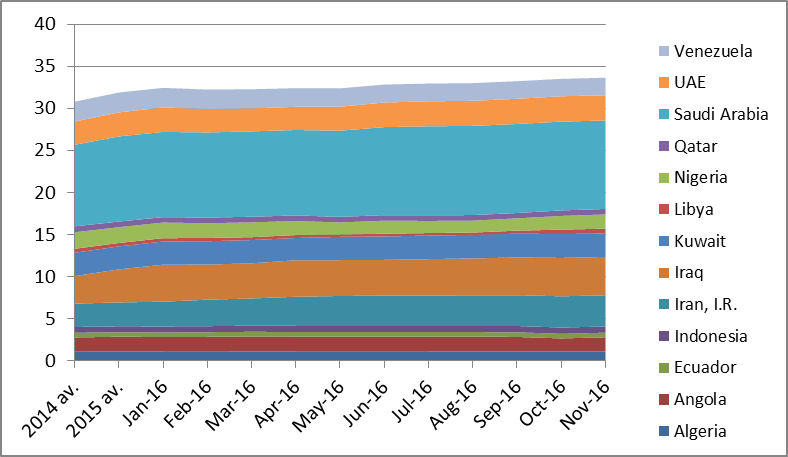

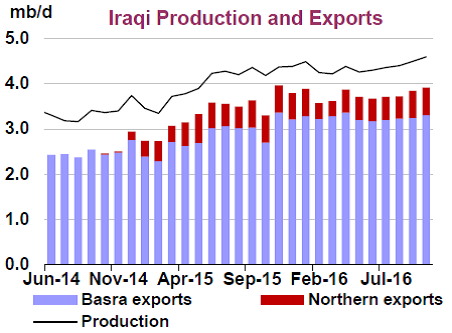

- 20161211 : 2016 should see a new record for OPEC exports due to ramp-up in production and exports from Saudi Arabia, Iran and Iraq. ( Dec 11, 2016 , peakoilbarrel.com )

- 20161209 : It looks like shale oil is a USA phenomenon with no appreciable production anywhere else in the world but the shale oil phenomenon has given the entire world the illution the peak oil does not exist, an idea that had no valid support in the real world ( Dec 09, 2016 , peakoilbarrel.com )

- 20161209 : EIAs Short-Term Energy Outlook Peak Oil Barrel ( Dec 09, 2016 , peakoilbarrel.com )

- 20161205 : Neoliberalism has only exacerbated falling living standards ( Aug 07, 2016 , www.nakedcapitalism.com )

- 20161202 : Since 2014 The US Has Added 571,000 Waiters And Bartenders And Lost 34,000 Manufacturing Workers Zero Hedge ( Dec 02, 2016 , www.zerohedge.com )

- 20161128 : I think oil prices are a long way away from being high enough to save the shale oil industry. ( Nov 28, 2016 , peakoilbarrel.com )

- 20161128 : IEA expects oil investment to fall for third year in 2017 ( Nov 28, 2016 , peakoilbarrel.com )

- 20161128 : Oil companies shoulder pain of downturn with lower output ( Nov 28, 2016 , peakoilbarrel.com )

- 20161119 : 11/16/2016 at 3:49 pm ( Nov 19, 2016 , peakoilbarrel.com )

- 20161119 : Why Economic Recovery Requires Rethinking Capitalism ( Nov 19, 2016 , www.nakedcapitalism.com )

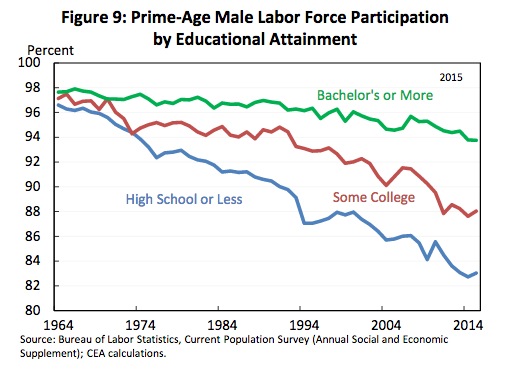

- 20161119 : Men arent interested in working at McDonalds for $15 per hour instead of $9.50. What they want is... steady, stable, full-time jobs that deliver a solid middle-class life ( Nov 19, 2016 , profile.theguardian.com )

- 20161119 : We should not use the term capital when referring to credit/lending that is not related to economically real outputs ( Nov 19, 2016 , www.nakedcapitalism.com )

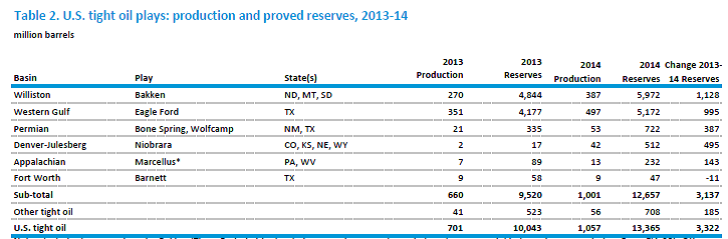

- 20161119 : Wolfcamp oil reserves ( Nov 19, 2016 , peakoilbarrel.com )

- 20161119 : Helicopter money by Stefan Gerlach ( www.project-syndicate.org )

- 20161119 : That 20-billion-barrel oil "deposit" in Texas, isn't. ( Nov 19, 2016 , www.nakedcapitalism.com )

- 20161116 : Being now a party of Wall street, neolibral democrats did not learn the lesson and do not want to: they attempt to double down on the identity politics, keep telling the pulverized middle class how great the economy is ( Nov 16, 2016 , crookedtimber.org )

- 20161116 : We need the adoption of a federal job guarantee, a policy that would insure the option for anyone to work in a public sector program, similar to what the Works Progress Administration established in the 1930s. ( Nov 16, 2016 , www.nakedcapitalism.com )

- 20161116 : It looks like this month (Nov.) will probably be a new global oil supply record barring major disruptions anywhere ( Nov 16, 2016 , peakoilbarrel.com )

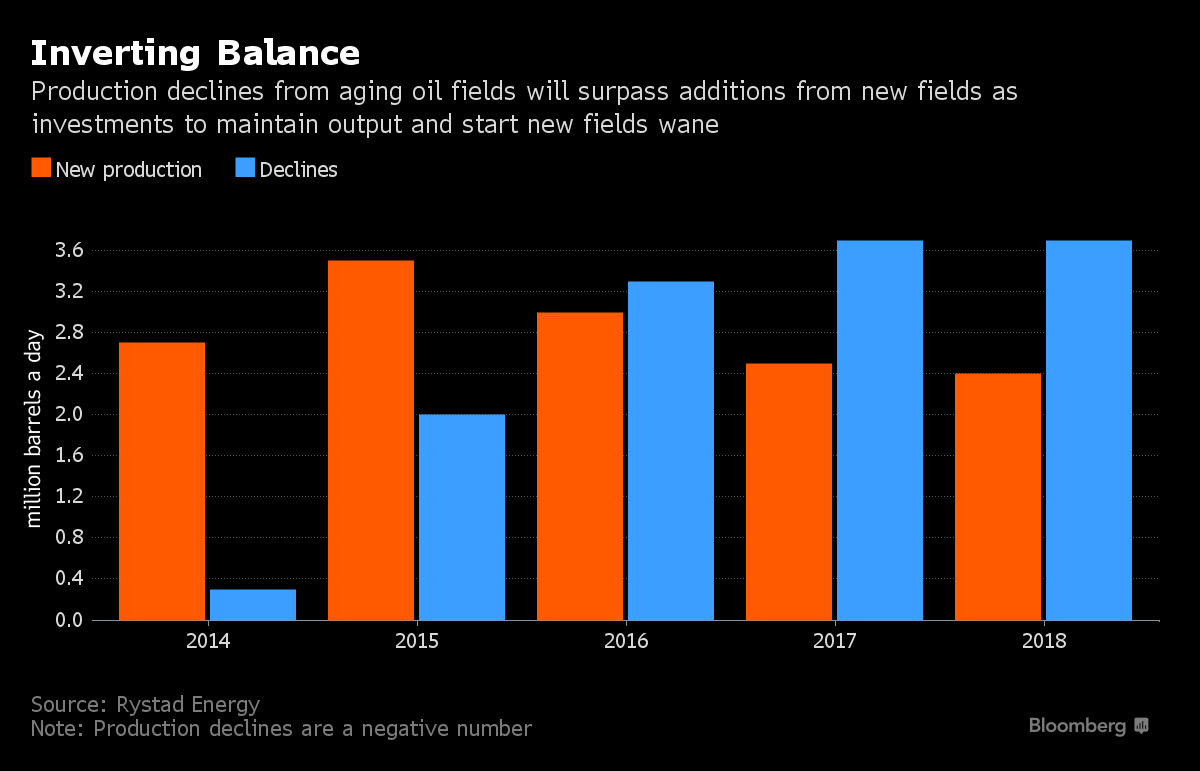

- 20161116 : The cuts in maintenance and brownfield work, exhaustion of marginal in-fill drilling benefits and extended use of horizontal drilling over the last 15 years will mean that decline of existing fields is likely to accelerate ( Nov 16, 2016 , peakoilbarrel.com )

- 20161116 : OPEC increased production in October defying its own policy of cutting one million barrel a day. But steep deline of KAS production is probably in cards as they abuse infill drilling ( Nov 16, 2016 , peakoilbarrel.com )

- 20161116 : If the unsecured credit lines that make the payments system function smoothly are liquidity, then are these credit lines also money? ( Nov 16, 2016 , www.nakedcapitalism.com )

- 20161116 : It would appear that perhaps a lot of infill drilling is taking place in Saudi Arabia, Kuwait and UAE in order to achieve these recent oil production values. It'll be interesting to see how this infill drilling might one day impact the decline side of the curve. ( Nov 16, 2016 , peakoilbarrel.com )

- 20161115 : Trump in the White House by Noam Chomsky ( Nov 15, 2016 , www.defenddemocracy.press )

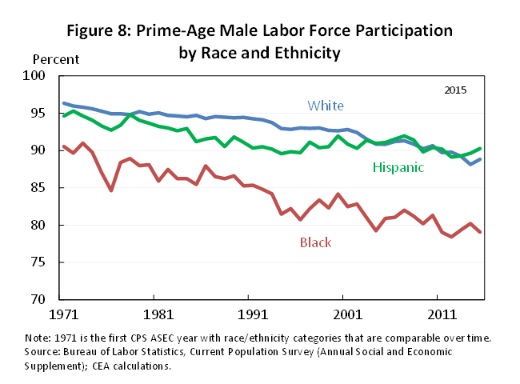

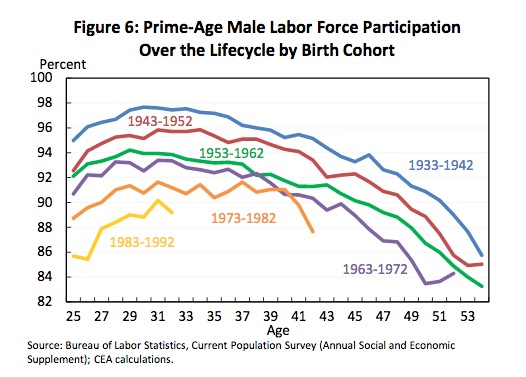

- 20161113 : As any macro economist will demonstrate, working lower/blue-collar men, predominantly white, born from the 1960s to 1980s have experienced virtually no prosperity, no 'American dream'. ( Nov 13, 2016 , discussion.theguardian.com )

- 20161031 : Taylor v. Summers on Secular Stagnation ( Economist's View )

- 20161030 : During the next upturn in the price things will be different, most of the easy oil was developed during the last high price cycle ( Oct 30, 2016 , peakoilbarrel.com )

- 20161029 : Jeffrey Frankel overestimates how good the recent recovery has been. No wonder, he was once on Clintons council of economics advisers. ( Oct 29, 2016 , economistsview.typepad.com )

- 20161029 : Those economists who deny that unemployment can drive people into crime are idiot jerks. ( Oct 29, 2016 , economistsview.typepad.com )

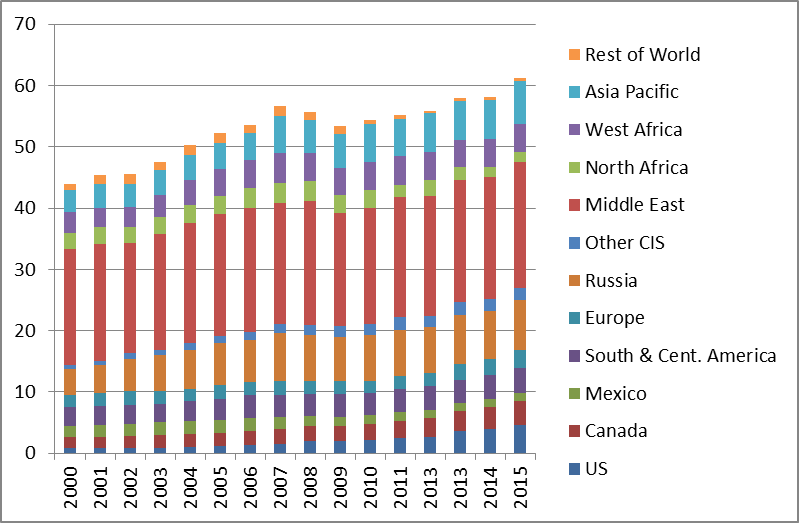

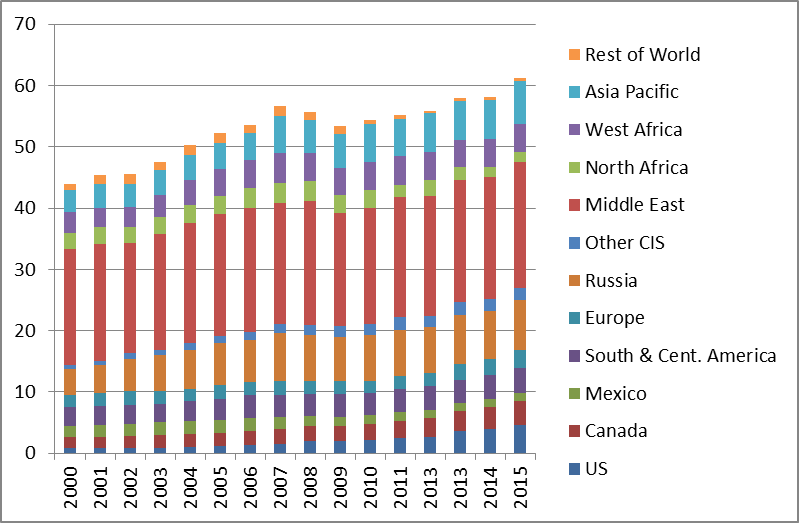

- 20161028 : World Oil Reserves ( Oct 28, 2016 , peakoilbarrel.com )

- 20161028 : Anybody notice the stimulus of low gasoline prices didnt improve GDP? ( Oct 28, 2016 , peakoilbarrel.com )

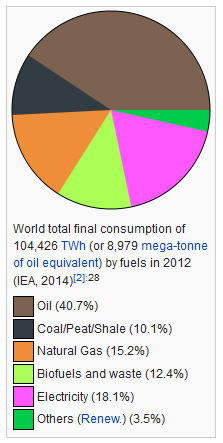

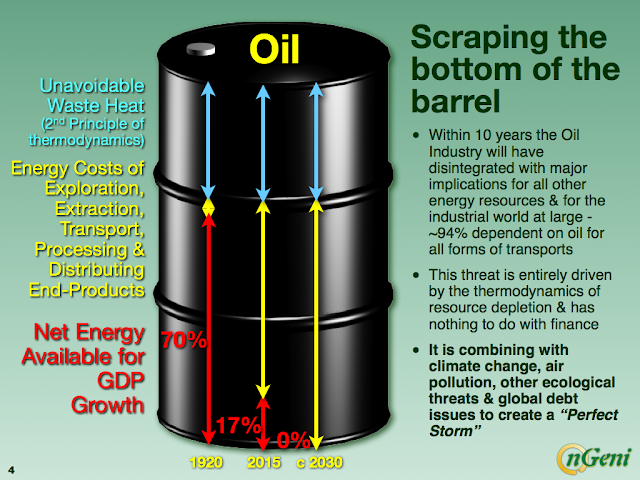

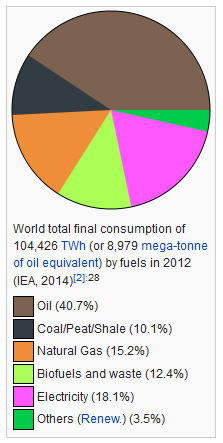

- 20161028 : the engineer in me cannot be blinded by the physics of logistics underlying the quintessential challenge posed by oil: how to replace the 560 exajoules of energy that is required every year to keep the world turning ( Oct 28, 2016 , peakoilbarrel.com )

- 20161028 : Banks sell public money as their product and they extract interest for doing so. They thus act as a transfer agent of wealth from the real economy to rentiers. ( Oct 28, 2016 , economistsview.typepad.com )

- 20161028 : IMFDirect - futures markets point to slight gains in oil prices to 60 dollars per barrel ( Oct 28, 2016 , economistsview.typepad.com )

- 20161027 : In late 2007, before the recession started, the prime-age employment-to-population ratio in the U.S. was about the same as in other Group of Seven developed nations (which also include Canada, France, Germany, Italy, Japan and the U.K.). The U.S., however, experienced a much larger decline during the recession, and remains much farther from undoing the damage. ( Oct 27, 2016 , economistsview.typepad.com )

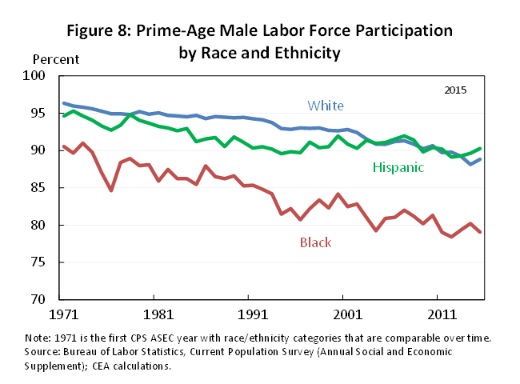

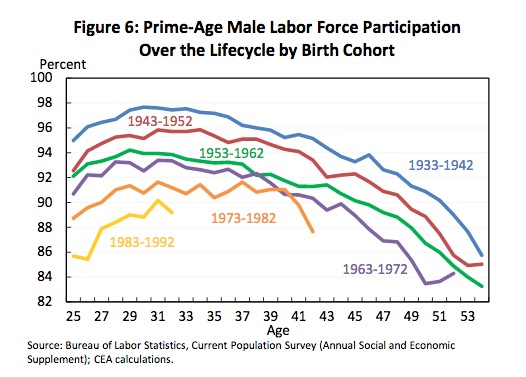

- 20161025 : The Problem with unemployed men in the USA ( Oct 25, 2016 , economistsview.typepad.com )

- 20161023 : Why money should not be considered to be a fuel for economics ( Oct 22, 2016 , www.nakedcapitalism.com )

- 20161022 : Volcker and Peterson: Ignoring the Lack of Demand Problem ( Oct 22, 2016 , economistsview.typepad.com )

- 20161009 : The IMF, Globalization, and All The Other Losers ( Oct 09, 2016 , www.nakedcapitalism.com )

- 20161009 : Economic Recovery Feels Weak Because the Great Recession Hasnt Really Ended ( Oct 09, 2016 , www.nakedcapitalism.com )

- 20161008 : Possible demographic factor in secualr stagantion ( Oct 08, 2016 , economistsview.typepad.com )

- 20161001 : The ruling class has figured out that a happy and productive population with free time on their hands is a mortal danger ( Oct 01, 2016 , www.nakedcapitalism.com )

- 20160928 : Wolf Richter Negative Growth of Real Wages is Normal for Much of the Workforce, and Getting Worse – New York Fed naked cap ( Sep 28, 2016 , www.nakedcapitalism.com )

- 20160928 : The Consequences of Long Term Unemployment - NBER ( Sep 28, 2016 , www.nber.org )

- 20160927 : DeLong on helicopter money ( Sep 27, 2016 , economistsview.typepad.com )

- 20160926 : Another way of eliminating employees and forcing the customer to do the work ( Sep 26, 2016 , www.nakedcapitalism.com )

- 20160926 : EconoSpeak All Models are False The Internet-Computer Explanation of Major Recessions ( Sep 24, 2016 , econospeak.blogspot.com )

- 20160926 : countercyclical fiscal policy should be our equivalent of a first responder to recessions, ( Sep 26, 2016 , economistsview.typepad.com )

- 20160926 : In 2015, the work rate (or employment-to-population ratio) for American males ages 25 to 54 was slightly lower than it had been in 1940, at the tail end of the Great Depression. ( Sep 26, 2016 , economistsview.typepad.com )

- 20160926 : Neoliberal prostitute Cowen about unemployment ( Sep 26, 2016 , economistsview.typepad.com )

- 20160916 : There is no alternative to austerity under neoliberalism ( Sep 16, 2016 )

- 20160916 : Secular stagnation The long view The Economist ( Apr 08, 2016 , www.economist.com )

- 20160914 : Yes, Donald Trump is wrong about unemployment. But he's not the only one ( Apr 08, 2016 , The Washington Post )

- 20160912 : The Strong Case Against Central Bank Independence Critically Examined ( Mar 8, 2016 , economistsview.typepad.com )

- 20160912 : Future Economists Will Probably Call This Decade the 'Longest Depression' ( Sep 12, 2016 , economistsview.typepad.com )

- 20160912 : 'It Pays to Work: Work Incentives and the Safety Net' ( Sep 12, 2016 , economistsview.typepad.com )

- 20160912 : Volcker overcorrected and defanged labor to the delight of the wealthy elites. ( September 02, 2015 economistsview.typepad.com )

- 20160909 : Brexit and Americas Growing Nationalism Movement ( Jul 04, 2016 , Fox Business )

- 20160824 : Good jobs disaappered and middle class had shruk dramatically in the USA ( Aug 24, 2016 , www.theguardian.com )

- 20160824 : We cant fix the bridges. We cant get basic healthcare to all our citizens, but somehow we have to update the entire grid in the next 15 years while drastically reducing storage costs. Meanwhile, in the next 10, 20, 30 years we have to be concerned about where we get the remaining 75 or 50 percent of our power. ( Aug 24, 2016 , economistsview.typepad.com )

- 20160816 : Norway oil production in July reached its highest level exceeding previous high by 10 percent ( peakoilbarrel.com )

- 20160815 : Economist's View Paul Krugman Wisdom, Courage and the Economy ( economistsview.typepad.com )

- 20160812 : My personal view is that it is in the hands of Wall Street and US oil producers, where oil prices are heading. ( peakoilbarrel.com )

- 20160812 : Its like filling a car in the socialistic countries in the 80s – you will pay only cheap money, but will have to wait to get some gas. ( peakoilbarrel.com )

- 20160807 : Oil production decline will continue into 2017 ( peakoilbarrel.com )

- 20160807 : No matter what central banks do, their actions will not be able to create the same level of economic growth that we have become used to over the past seven decades ( August 5, 2016 )

- 20160719 : The economy can grow as long as there is surplus affordable energy in that account. The economy stops growing when the cost of energy production becomes unaffordable. ( peakoilbarrel.com )

- 20160719 : Conventional producers no longer can significantly ramp up production when they like ( peakoilbarrel.com )

- 20160719 : E P spending is much lower this year than was expected even after the big cuts initially announced. US independents and Canada in particular are hurting ( peakoilbarrel.com )

- 20160719 : Oil is becoming much harder to find ( peakoilbarrel.com )

- 20160719 : Has depletion finally gained the upper hand? ( peakoilbarrel.com )

- 20160719 : Oil Prices Lower Forever Hard Times In A Failing Global Economy ( www.forbes.com )

- 20160718 : Automatic Braking Systems To Become Standard On Most U.S. Vehicles The Two-Way ( NPR )

- 20160717 : Ron Patterson ( peakoilbarrel.com )

- 20160717 : The Stagnation Capitulation and The Taper Tantrum ( July 12, 2016 , Angry Bear )

- 20160717 : Cassandra's Legacy Some reflections on the Twilight of the Oil Age - part I ( cassandralegacy.blogspot.in )

- 20160716 : China's Oil Output Tanks , Hits 4 Year Low ( Jul 15, 2016 , OilPrice.com )

- 20160705 : New estimate for reserves and resources from Rystad ( peakoilbarrel.com )

- 20160705 : Arthur Berman Why The Price Of Oil Must Rise Peak Prosperity ( www.peakprosperity.com )

- 20160703 : Men Exiting Workforce as Low-Wage Jobs Vanish by Yves Smith ( June 21, 2016 , nakedcapitalism.com )

- 20160702 : Peak Oil in Asia and oil import trends (part 2) ( crudeoilpeak.info )

- 20160701 : The STEO has Colombia production holding at around 1 mmbpd for the next two years, but in fact they are declining at about 12 persen year over year ( peakoilbarrel.com )

- 20160701 : The Monthly Energy Review has US production dropping 212,000 bpd in April and 148,000 bpd in May. ( peakoilbarrel.com )

- 20160701 : Ron Patterson ( peakoilbarrel.com )

- 20160701 : For 2016, the decline is expected to continue increasing with a 700 kbbl/d increase in the yearly decline from the mature oil fields. ( peakoilbarrel.com )

- 20160629 : The fact that imports are rising even faster than production is declining is a sure sign that production is actually falling ( peakoilbarrel.com )

- 20160629 : A decline of 406,000 barrels per day of total liquids in one month is not a decline but a collapse. ( peakoilbarrel.com )

- 20160628 : This new drop in oil price has to do with extreme financial instability and not with supply and demand ( peakoilbarrel.com )

- 20160620 : Year over year declines are leading the actual production data and indicate that the drop in production will march on much further even if drilling resumes ( peakoilbarrel.com )

- 20160619 : Catch 22 in oil production: only a fraction of current oil reserves will ever be recovered and the true amount will never matrialize ( peakoilbarrel.com )

- 20160615 : Seasonal pattern of oil consumption -- going from Q2 to Q3 increases demand by about one and a half million barrels a day ( peakoilbarrel.com )

- 20160615 : Global oil demand remand very strong ( peakoilbarrel.com )

- 20160615 : Production of oil increasing while exports stayed flat due to groqwing demand in oil importing coutries, which like the USA and Canada which are also oil producting countries ( peakoilbarrel.com )

- 20160615 : Oil Industry to Cut $1 Trillion in Spending After Price Fall ( Bloomberg )

- 20160608 : Current cuts in capex will be felt 2-3 years from now. ( peakoilbarrel.com )

- 20160608 : Peak Oil Review - June 6 2016 ( www.resilience.org )

- 20160607 : Short-Term Energy Outlook June 2016 ( U.S. Energy Information Administration (EIA) )

- 20160606 : To me Saudis recent posturing is about setting up excuses for post peak declines, without having to admit they dont have as much oil as theyve stated. ( peakoilbarrel.com )

- 20160606 : The US prediction is for a gentle decline of about 15 percent overall to 2021, but if a lot of the smaller producers get shut down in the near term it might be a bit steeper. ( peakoilbarrel.com )

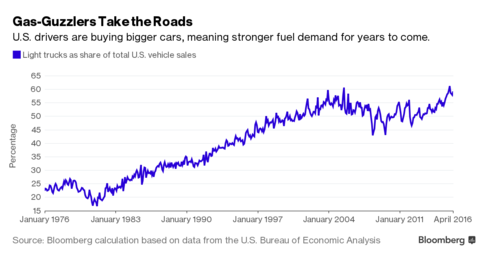

- 20160603 : Oil prices crush lures US drivers back into gas guzzlers ( peakoilbarrel.com )

- 20160602 : Iranian Oil Is Disguising A Significant Decline In Global Production ( OilPrice.com )

- 20160602 : Offshore decline rate can reach 30 percent per yar and that mean that the sudden halt to offshore development will result in big offshore production declines ( peakoilbarrel.com )

- 20160601 : The Offshore Oil Business Is Crippled And It May Never Recover ( oilprice.com )

- 20160530 : The vast majority of large, conventional undiscovered oil and gas fields are offshore and are uneconomical to develop with oil prices below 80 dollars per barrel ( peakoilbarrel.com )

- 20160524 : At The Edge Of Time This is Peak Oil ( blogspot.co.uk )

- 20160520 : Has anything really changed beyond dodgy economics and a slowing economy to prevent oil peak occuring in 2015 ( peakoilbarrel.com )

- 20160518 : Oil Markets Balancing Much Faster Than Thought ( OilPrice.com )

- 20160517 : Nigerian oil production drops after militant attacks ( bakken.com )

- 20160512 : Even if oil prices reach $60 per barrel, a decline of US shale still is imminent ( peakoilbarrel.com )

- 20160509 : Can Iran And Saudi Arabia's Production Claims Be Believed ( OilPrice.com )

- 20160507 : Is This The Biggest Red Herring In Oil Markets ( OilPrice.com )

- 20160507 : Reserves replacement problem resurfaced again ( OilPrice.com )

- 20160507 : Nigeria is suffering a worsening bout of oil disruption that has pushed production to the lowest in 20 years ( peakoilbarrel.com )

- 20160507 : Haliburton following Schlumberger in pulling out of Venezuela: ( peakoilbarrel.com )

- 20160506 : If you think productivity increase is going to compensate for overall depletion and lack of new exploration success then I think you are wrong. ( peakoilbarrel.com )

- 20160505 : Capex cuts ( peakoilbarrel.com )

- 20160505 : Oil production cut by unforseen events ( peakoilbarrel.com )

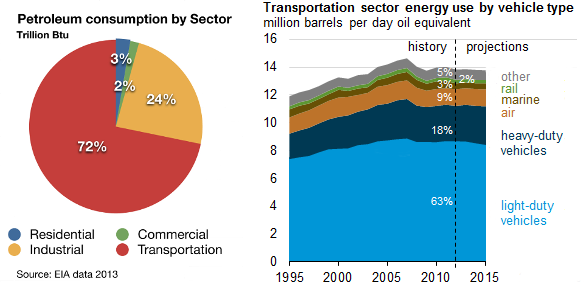

- 20160504 : Of 72 percent of petroleum used is for transportation 63 percent is used by light duty vehicles ( peakoilbarrel.com )

- 20160504 : Peak Fracking, Perpetually Higher Oil Prices by Bill James ( May 2, 2016 , Seeking Alpha )

- 20160504 : A 4.5-Million-Barrel Per Day Oil Shortage Looms Wood Mackenzie by Irina Slav ( May 03, 2016 , OilPrice.com )

- 20160429 : 50 percent of proved oil reserves may have just vanished ( April 27, 2016 , OilPrice.com )

- 20160426 : Oil Bulls Plunge Into Market as U.S. Gasoline Demand Hits Record ( Bloomberg )

- 20160425 : While old supergiants would not all go into terminal decline together most of them are past peak and begin to go downhill fast soon ( peakoilbarrel.com )

- 20160424 : Theres a new parliamentary group in UK on Limits to Growth that had its first meeting this week ( peakoilbarrel.com )

- 20160424 : Oil discoveries have dropped to being almost insignificant over the last 5 years ( peakoilbarrel.com )

- 20160424 : Given that proved reserves are largely a function of price it is inevitable that reserves would significantly drop as price dropped ( peakoilbarrel.com )

- 20160424 : Will the Upheaval in Fossil Fuel Industry Take the Rest of the Economy Down With It? ( April 23, 2016 , nakedcapitalism.com )

- 20160424 : Much broader and flatter Hubert curve is frequently mis-characterized as an undulating plateau ( peakoilbarrel.com )

- 20160424 : Crude Oil Uncertainty about Future Oil Supply Makes It Important to Develop a Strategy for Addressing a Peak and Decline in Oil Production ( US GAO )

- 20160424 : There's a new parliamentary group in UK on Limits to Growth that had it's first meeting this week ( peakoilbarrel.com )

- 20160423 : The end of cheap oil probably means end of neoliberalism ( www.nakedcapitalism.com )

- 20160423 : Sometime between 2018 2020 we will begin to see substantial declines of 3% to 7% per year (slow at first, but increasing over time). ( peakoilbarrel.com )

- 20160417 : Towards a Theory of Shadow Money by Daniela Gabor ( April 16, 2016 , www.nakedcapitalism.com )

- 20160413 : Annualized drop by almost two billion barrels a day is expected in the USA ( peakoilbarrel.com )

- 20160412 : 70-90% Decline In Well Completions Raises Hope For Oil Gas ( OilPrice.com )

- 20160411 : Why Low Oil Prices Haven't Helped The Economy ( OilPrice.com, )

- 20160411 : Not only KSA but most of the global production has been maintained from old depleted wells, using new techologies to sweep up remnants of trapped oil. ( peakoilbarrel.com )

- 20160410 : Possibility of Seneca cliff in oil production ( peakoilbarrel.com )

- 20160410 : Saudi Oil Gambit Moves to Phase Two ( Bloomberg )

- 20160409 : Looks like China is importing a lot of oil ( peakoilbarrel.com )

- 20160408 : Secular stagnation The long view ( www.economist.com )

- 20160403 : Norwegian oil fields average annual decline rate is about 11 percent ( peakoilbarrel.com )

- 20160402 : Unemployment Rate Edges Higher as Prime-Age Workers Reenter Labor Market ( April 01, 2016 , Economist's View )

- 20160402 : Where are new oil deposits even at 120 dollars per barrel ( peakoilbarrel.com )

- 20160330 : Investors see shale production falling and demand continuing to rise ( www.yahoo.com )

- 20160330 : India consumed 4.2 million barrels per day in 2016, overtaking Japan as the worlds third largest oil consumer ( www.bloomberg.com )

- 20160320 : Some forecast just dont pan out as expected. ( peakoilbarrel.com )

- 20160314 : Theres Only One Buyer Keeping S P 500s Bull Market Alive ( March 13, 2016 , Bloomberg Business )

- 20160303 : Barriers to Productivity Growth ( economistsview.typepad.com )

- 20160302 : Four Common-Sense Ideas for Economic Growth ( economistsview.typepad.com )

- 20160229 : Based on old data of 2007 we use close to half of oil for passenger travel, and only 2 percent of oil for farm use ( peakoilbarrel.com )

- 20160227 : The End of Normal by James Galbraith ( peakoilbarrel.com )

- 20160225 : The oil industry could barely overcome decline rates for conventional oil the last several year ( peakoilbarrel.com )

- 20160216 : Those damned NGO's (charities) that see it as their first mission to buy Toyota Landcruisers to ensure their pompous leaders can be carried in perfect comfort from one five star conference to another ( peakoilbarrel.com )

- 20160212 : An Interview with Larry Summers ( economistsview.typepad.com )

- 20160113 : Three Ways to Help the Working Class ( economistsview.typepad.com )

- 20160104 : Dollar Dominance Deconstructing the Myths and Untangling the Web ( Jan 04, 2016 , naked capitalism )

Notable quotes:

"... In Bristol County, which includes Fall River, New Bedford, and Taunton, manufacturing employed nearly a quarter of the workforce in 2000; now it provides jobs for only one in 10 workers. ..."

"... Most of the manufacturing jobs lost since 2000 are unlikely to return, economists said. Automation has made manufacturing much more specialized, requiring more education and fewer workers, leaving parts of the country struggling to figure out how to reinvent their economies. ..."

"... "We will probably never have as many manufacturing jobs as we had in 1960," Dunn said. "The question is how do we train workers and provide them opportunities to feel productive. What's clear from the election is an increasing number of people don't have those opportunities or don't feel that those opportunities will be available." ..."

"... Characteristics of people dying by suicide after job loss, financial difficulties and other economic stressors during a period of recession (2010–2011): A review of coroners׳ records ..."

Fred C. Dobbs :

December 27, 2016 at 03:37 AM

Suicide rates rise after jobs move overseas, study finds

http://www.bostonglobe.com/business/2016/12/26/suicide-rates-rise-after-jobs-move-overseas-new-study-funds/yVhFkZOslgnODKEjTfcDTK/story.html?event=event25

via @BostonGlobe - Deirdre Fernandes - December 27, 2016

FALL RIVER - In this struggling industrial city, changes in trade policy are being measured

not only in jobs lost, but also in lives lost - to suicide.

The jobs went first, the result of trade deals that sent them overseas. Once-humming factories

that dressed office workers and soldiers, and made goods to furnish their homes, stand abandoned,

overtaken by weeds and graffiti.

And now there is research on how the US job exodus parallels an increase in suicides. A one percentage

point increase in unemployment correlated with an 11 percent increase in suicides, according to

Peter Schott, a Yale University economist who coauthored the report with Justin Pierce, a researcher

at the Federal Reserve Board.

The research doesn't prove a definitive link between lost jobs and suicide; it simply notes

that as jobs left, suicides rose. Workers who lost their jobs may have been pushed over the edge

and turned to suicide or drug addiction, lacking financial resources or community connections

to get help, the authors suggest.

The research contributes to a growing body of work that shows the dark side of global trade:

the dislocation, anger, and despair in some parts of the country that came with the United States'

easing of trade with China in 2000. The impact of job losses was greatest in places such as Fall

River and other cities in Bristol County, along with rural manufacturing counties in New Hampshire

and Maine, vast stretches of the South, and portions of the Rust Belt.

"There are winners and losers in trade," Schott said. "If you go to these communities, you can

see the disruptions."

The unemployment rate in Fall River remains persistently high and at 5.5 percent in September

was a good two points above the Massachusetts average. Nearly one in three households gets some

sort of public assistance.

Opposition to global trade policies became a rallying cry in Donald Trump's campaign, propelling

him into the White House with strategic wins in the industrial Midwest and the South. Trump has

threatened to impose tariffs on Chinese goods and has bashed recent US trade pacts. ...

Fred C. Dobbs -> Fred C. Dobbs... ,

December 27, 2016 at 03:41 AM

... Previous trade deals, including the 1994 North American Free Trade Agreement with Canada and

Mexico, chipped away at US manufacturing towns. But economists say the decision to normalize relations

with China was far more disruptive. Some economists have estimated the United States may have

lost at least 1 million manufacturing jobs from 2000 to 2007 due to freer trade with China.

In Bristol County, which includes Fall River, New Bedford, and Taunton, manufacturing employed

nearly a quarter of the workforce in 2000; now it provides jobs for only one in 10 workers.

Most of the manufacturing jobs lost since 2000 are unlikely to return, economists said.

Automation has made manufacturing much more specialized, requiring more education and fewer workers,

leaving parts of the country struggling to figure out how to reinvent their economies.

"We will probably never have as many manufacturing jobs as we had in 1960," Dunn said.

"The question is how do we train workers and provide them opportunities to feel productive. What's

clear from the election is an increasing number of people don't have those opportunities or don't

feel that those opportunities will be available."

Officials in Fall River and Bristol County said they are trying to provide appropriate training,

including computer programming, a prerequisite for many manufacturing jobs.

They also point out there have been recent victories.

- Amazon.com opened a distribution warehouse in Fall River and has been hiring in recent

months to fill 500 jobs.

- Companies are eyeing Taunton for its cheaper land, access to highways, and state tax breaks.

- Norwood-based Martignetti Cos., among the state's largest wine and spirits distributors,

last year agreed to move its headquarters to a Taunton industrial park.

Mayor Tom Hoye said Taunton has also been more active in recent years, holding community meetings

and expanding social services for residents facing distress and drug addiction.

Despite the hits the city and its residents have taken, there is reason to be optimistic about

the future, he said.

Jobs are returning, and the county's suicide rate dropped from 13 per 100,000 people in 2014

to 12 per 100,000 in 2015.

"We're reinventing ourselves," Hoye said on a recent morning as he sat in an old elementary

school classroom that has served as the temporary mayor's office for several years.

"It's tough to lift yourself out of the hole sometimes. But we're much better off than we were

10 years ago."

Fred C. Dobbs -> Fred C. Dobbs... ,

December 27, 2016 at 03:55 AM

'The research doesn't prove a definitive

link between lost jobs and suicide; it

simply notes that as jobs left,

suicides rose.'

Pierce, Justin R., and Peter K. Schott (2016). "Trade Liberalization and Mortality:

Evidence from U.S. Counties," Finance and Economics Discussion Series

2016-094. Washington: Board of Governors of the Federal Reserve System

https://www.federalreserve.gov/econresdata/feds/2016/files/2016094pap.pdf

http://faculty.som.yale.edu/peterschott/files/research/papers/pierce_schott_pntr_20150301.pdf

Fred C. Dobbs -> Fred C. Dobbs... ,

December 27, 2016 at 04:00 AM

(Note: The 2nd link is to a

different paper, same authors.)

'The Surprisingly Swift Decline

of US Manufacturing Employment�'

Fred C. Dobbs -> Fred C. Dobbs... ,

December 27, 2016 at 04:27 AM

Understanding vulnerability to self-

harm in times of economic hardship

and austerity: a qualitative study

M C Barnes, et al.

'This is the first UK study of self-harm

among people experiencing economic or

austerity-related difficulties.'

December 2015

http://bmjopen.bmj.com/content/6/2/e010131.full.pdf

---

Characteristics of people dying by suicide after job loss, financial difficulties and other

economic stressors during a period of recession (2010–2011): A review of coroners׳ records

Caroline Coope, et al

Journal of Affective Disorders

Volume 183, 1 - September 2015

http://www.sciencedirect.com/science/article/pii/S0165032715002694/pdfft?md5=bebc4ce035acbeeee6cb0b9bd586a5e3&pid=1-s2.0-S0165032715002694-main.pdf

Chris G -> Fred C. Dobbs... ,

-1

Suicide rates rise after jobs move overseas, study finds

That's consistent with the GOP's notion of how to most effectively cover health problems: shoveled

dirt.

Notable quotes:

"... I would say both parties are for the rich and both do their best to distract their respective base with talk of abortion or race, while neither would like these red meat distractions disappear by being in any solved. ..."

"... Why do they like these particular distractions? Because the rich don't care about either. ..."

"... Trump broke the mold by talking about jobs in a meaningful way immigration and exporting factories both boost unemployment, suppressing wages while boosting profits; these topics have been forbidden since Ross Perot spoke of millions of jobs going south on account of Nafta, exactly what happened. ..."

"... 8mm official unemployment. 16mm reduced participation since 2005 in 25-54 age group. ..."

"... 24mm total, not counting part timers that want full time and 10mm fewer voted for dems in 2016 than 2008. ..."

"... Exactly the same number that voted for Romney voted for trump, so Hillary lost obamas third term not because of a wave of trump racists but because there was somehow dissatisfaction among former dem voters regarding the great jobs program, low cost healthcare, and prosecution of bankers and other elites that drove the economy off the cliff. Granted, nominating the second most unpopular person in America might not guarantee success ..."

John k,

December 26, 2016 at 2:33 pm

Dems are the party of the rich and poor.

Really? When did they do something that benefitted the poor?

I would say both parties are for the rich and both do their best to distract their respective

base with talk of abortion or race, while neither would like these red meat distractions disappear

by being in any solved.

Why do they like these particular distractions? Because the rich don't care about either.

Trump broke the mold by talking about jobs in a meaningful way immigration and exporting factories

both boost unemployment, suppressing wages while boosting profits; these topics have been forbidden

since Ross Perot spoke of millions of jobs going south on account of Nafta, exactly what happened.

8mm official unemployment. 16mm reduced participation since 2005 in 25-54 age group.

24mm total, not counting part timers that want full time and 10mm fewer voted for dems in 2016

than 2008.

Exactly the same number that voted for Romney voted for trump, so Hillary lost obamas

third term not because of a wave of trump racists but because there was somehow dissatisfaction

among former dem voters regarding the great jobs program, low cost healthcare, and prosecution

of bankers and other elites that drove the economy off the cliff. Granted, nominating the second

most unpopular person in America might not guarantee success

Anyway, Trump should say,

Thanks, Obama!

Synoia ,

December 26, 2016 at 2:40 pm

8mm official unemployment. 16mm reduced participation since 2005 in 25-54 age group.

24mm total, not counting part timers that want full time

Obama's legacy. Read it and weep.

John k ,

December 26, 2016 at 3:23 pm

I mis spoke.

Nominating her had risks, but it assured Bernie would not be president, and Bernie was a far greater

risk to bankers and the other dem paymasters than trump. Remember, for them it was existential,

bernie would have jailed bankers. Trump is one of the oligarchs.

With her nom bankers let out a sigh of relief and could thankfully murmur, 'mission accomplished!'

WheresOurTeddy ,

December 26, 2016 at 3:29 pm

Bernie would not be president only if they Bobby Kennedy'd him.

It didn't come to that. They just fixed the primary.

Vatch ,

December 26, 2016 at 7:12 pm

If Sanders had won the Democratic nomination, and he had been "Bobby Kennedy'd", people besides

the conspiracy enthusiasts would have started to notice a pattern. Instead, there are millions

of people who actually believe that Sanders lost the primaries to Clinton fair and square. Some

of us know better. . . .

As for patterns, Trump's nominations for cabinet level offices are showing a pattern: billionaires,

hecto-millionaires, overt vassals of the ultra-rich, and at least one (alleged) criminal: Ryan

Zinke.

Yves Smith

,

December 26, 2016 at 10:22 pm

The one unambiguously positive feature of Obamacare was Medicaid expansion, which does help

the poor.

marym ,

December 26, 2016 at 10:47 pm

It does help people, but

increased privatization and

estate recovery make it not unambiguous.

ambrit ,

December 27, 2016 at 4:42 am

True. Because of estate recovery, I am doing without medical "insurance" of any kind. As I

tell Phyllis, if I get anything serious, just put me in my ragged old canvas chair in the back

yard and keep the beer coming until I stop complaining.

This entire Medicade story is curious. I had thought that any self respecting oligarchy would

want reasonably powerful clients to buttress the oligarch's power and influence. Instead, the

Medicade Oligarchy buys into a "power base" of the poor and disenfranchised. The funds for this

complex relationship are supplied, as best as I can discern, by the central government. What will

the Medicade Oligarchs do when the "X" Oligarchs cut off or even just restrict the flow of funds

from the central government?

Cry Shop ,

December 27, 2016 at 5:36 am

Not just estate recovery. Loading Medicaid with more claimants, particularly poor, ethnic minority

claimants, was a great way to stress it's gonig to need a neo-liberal cure, if the neo-cons don't

use the opportunity Obama gave them to out right kill it. Medicaid isn't Medicare, and the retired

folks know it. They, the retires, would kill it in a second if they could get an extra $100 per

annum in free drugs.

ambrit ,

December 27, 2016 at 5:46 am

I'm not too sure about the "Retired" "Poor" divide anymore. The two groups are converging and

merging. Any animus experienced here would be the result of restriction of total benefits available.

In other words, an artificially engineered conflict.

Once the "old folks" realize that they, as a class, are the poor, all bets will be off.

marym ,

December 27, 2016 at 8:44 am

Once the "old folks" actually are poor enough to qualify for Medicaid (dual eligible) they

are at risk for being

tossed off Medicare into Medicaid managed care .

marym ,

December 27, 2016 at 8:50 am

Nor is Medicare Medicare, in the sense of being a fully public program. Medicare Advantage,

Medicare supplemental insurance, and prescription drug insurance are all privatized.

Tully ,

December 27, 2016 at 11:41 am

the funds supplied by the central government. No.

they are supplied by the taxpayers.

That is the system – taxpayers subsidize private sector profits.

steelhead ,

December 26, 2016 at 2:59 pm

43 years. The decline started in 1973, the year I graduated from high school.

Nittacci ,

December 26, 2016 at 3:00 pm

"I'm guessing that upwards of 90% of United States voters work for wages"

How is that possible with a 62% labor participation rate? Do you believe unemployed, retired,

students and stay-at-home parents don't vote?

grayslady ,

December 26, 2016 at 5:48 pm

Yes, I had a problem with that phrase, as well; especially as older people (read "retired")

are known to have the highest percentage of actual voters. Assuming that the 90% is an overstatement,

I don't believe it negates the point that all ages and all races can find common ground on certain

issues–Medicare for All being one of those issues. Seniors would definitely get behind an improved

Medicare, just as students, unemployed, working poor, and others would support such a sensible

universal health care program.

ambrit ,

December 27, 2016 at 4:46 am

" sensible universal health care program."

Sensible for whom? For the presently entrenched oligarchs, the system in use now is perfectly

sensible.

Baldacci ,

December 26, 2016 at 9:31 pm

Only 30-35% of the total US population votes in any one election. 90% would be possible.

funemployed ,

December 27, 2016 at 9:34 am

They old though – retired folks love them some voting. Work or have worked for wages, or had

vital domestic labor supported by a wage earning family member would surely get us over 90 IMO.

(sorry for quibbling Lambert. I think we all get the point. Thanks for the lovely essay)

AngloSaxon :

December 26, 2016 at 10:24 PM

,

2016 at 10:24 PM

In my opinion, probably not. The government's 20th century

"growth as a factory" underestimates service sector growth

and our continued share shrink in 20th century industrial

production means our "potential" growth is by this factory

methiod, in decline. If we grow 3% it is a gaudy number by

the government's own statistical backwardness.

To regenerate American factory growth is not possible

right now under a market system. I mean, it simply isn't.

If we tried, we would crater industrial growth as well

with consumption cuts.

likbez -> AngloSaxon...

, -1

Growth of the service sector is also under attack due to

increasing "robotization", replacing salaried workers with

"perma-temps" and underpaid contractors (Uber) as well as

offshoring of help desk and such.

What's left? Military Keynesianism ?

Notable quotes:

"... Excellent critique. Establishment Democrats are tone-deaf right now; the state of denial they live in is stunning. I'd like to think they can learn after the shock of defeat is over, but identity politics for non-white, non-male, non-heterosexual is what the Democratic party is about today and has been the last decade or so. ..."

"... That's the effect of incessant Dem propaganda pitting races and sexes against each other. ..."

"... And Democrats' labeling of every Republican president/candidate as a Nazi - including Trump - is desensitizing the public to the real danger created by discriminatory policies that punish [white] children and young adults, particularly boys. ..."

"... So, to make up for the alleged screw job that women and minorities have supposedly received, the plan will be screwing white/hetro/males for the forseeable future. My former employer is doing this very plan, as we speak. Passed over 100 plus males, who have been turning wrenches on airplanes for years, and installed a female shop manager who doesn't know jack-$##t about fixing airplanes. No experience, no certificate......but she has a management degree. But I guess you don't know how to do the job to manage it. ..."

"... Bernie Sanders was that standard bearer, but Krugman and the Neoliberal establishment Democrats (ie. Super Delegates) decided that they wanted to coronate Clinton. ..."

"... Evolution of political parties happens organically, through evolution (punctuated equilibrium - like species and technology - parties have periods of stability with some sudden jumps in differentiation). ..."

"... If Nancy Pelosi is re-elected (highly likely), it will be the best thing to happen to Republicans since Lincoln. They will lose even more seats. ..."

"... The Coastal Pelosi/Schumer wing is still in power, and it will take decimation at the ballot box to change the party. The same way the "Tea Party" revolution decimated the Republicans and led to Trump. Natural selection at work. ..."

"... The central fact of the election is that Hillary has always been extraordinarily unlikable, and it turned out that she was Nixonianly corrupt ..."

"... I'm from Dallas. Three of my closest friends growing up (and to this day), as well as my brother in law, are hispanic. They, and their families, all vote Republican, even for Trump. Generally speaking, the longer hispanics are in the US, the more likely they tend to vote Republican. ..."

"... The Democratic Establishment and their acolytes are caught in a credibility trap. ..."

"... I also think many Trump voters know they are voting against their own economic interest. The New York Times interviewed a number who acknowledge that they rely on insurance subsidies from Obamacare and that Trump has vowed to repeal it. I know one such person myself. She doesn't know what she will do if Obamacare is repealed but is quite happy with her vote. ..."

"... Krugman won his Nobel for arcane economic theory. So it isn't terribly surprising that he spectacularly fails whenever he applies his brain to anything remotely dealing with mainstream thought. He is the poster boy for condescending, smarter by half, elite liberals. In other words, he is an over educated, political hack who has yet to learn to keep his overtly bias opinions to himself. ..."

"... Funny how there's all this concern for the people whose jobs and security and money have vanished, leaving them at the mercy of faceless banks and turning to drugs and crime. Sad. Well, let's bash some more on those lazy, shiftless urban poors who lack moral strength and good, Protestant work ethic, shall we? ..."

"... Clinton slammed half the Trump supporters as deplorables, not half the public. She was correct; about half of them are various sorts of supremacists. The other half (she said this, too) made common cause with the deplorables for economic reasons even though it was a devil's bargain. ..."

"... I have never commented here but I will now because of the number of absurd statements. I happen to work with black and Hispanic youth and have also worked with undocumented immigrants. To pretend that trump and the Republican Party has their interest in mind is completely absurd. As for the white working class, please tell me what programs either trump or the republican have put forward to benefit them? I have lost a lot of respect for Duy ..."

"... The keys of the election were race, immigration and trade. Trump won on these points. What dems can do is to de-emphasize multiculturalism, racial equality, political correctness etc. Instead, emphasize economic equality and security, for all working class. ..."

"... Krugman more or less blames media, FBI, Russia entirely for Hillary's loss, which I think is wrong. As Tim said, Dems have long ceased to be the party of the working class, at least in public opinion, for legitimate reasons. ..."

"... All Mr. Krugman and the Democratic establishment need to do is to listen, with open ears and mind, to what Thomas Frank has been saying, and they will know where they went wrong and most likely what to do about it, if they can release themselves from their fatal embrace with Big Money covered up by identity politics. ..."

"... Pretty sad commentary by neoliberal left screaming at neoliberal right and vice versa. ..."

"... The neoliberals with their multi-culti/love them all front men have had it good for a while, now there's a reaction. Deal with it. ..."

Jason Nordsell : ,

November 27, 2016 at 08:02 AM

Excellent critique. Establishment Democrats are tone-deaf right now; the state of denial they

live in is stunning. I'd like to think they can learn after the shock of defeat is over, but identity

politics for non-white, non-male, non-heterosexual is what the Democratic party is about today

and has been the last decade or so.

The only way Dems can make any headway by the midterms is if Trump really screws up,

which is a tall order even for him. He will pick the low-hanging fruit (e.g., tax reform, Obamacare

reform, etc), the economy will continue to recover (which will be attributed to Trump), and Dems

will lose even more seats in Congress. And why? Because they refuse to recognize that whites from

the middle-class and below are just as disadvantaged as minorities from the same social class.

If white privilege exists at all (its about as silly as the "Jews control the banks and media"

conspiracy theories), it exists for the upper classes. Poor whites need help too. And young men

in/out of college today are being displaced by women - not because the women have superior academic

qualification, but because they are women. I've seen it multiple times firsthand in some of the

country's largest companies and universities (as a lawyer, when an investigation or litigation

takes place, I get to see everyone's emails, all the way to CEO/board). There is a concerted effort

to hire only women and minorities, especially for executive/managerial positions. That's not equality.

That's the effect of incessant Dem propaganda pitting races and sexes against each other.

This election exposed the media's role, but its not over. Fortunately, Krugman et al. are

showing the Dems are too dumb to figure out why they lost. Hopefully they keep up their stupidity

so identity politics can fade into history and we can get back to pursuing equality.

bob -> Jason Nordsell... ,

November 28, 2016 at 03:02 PM

"There is a concerted effort to hire only women and minorities, especially for executive/managerial

positions."

Goooooolllllllllllllly, gee. Now why would that be? I hope you're not saying there shouldn't

be such an effort. This is a good thing. It exactly and precisely IS equality. It may be a bit

harsh, but if certain folks continually find ways to crap of women and minorities, then public

policies would seem warranted.

Are you seriously telling us that pursuing public policies to curb racial and sexual discrimination

are a waste of time?

How, exactly, does your vision of "pursuit of equality" ameliorate the historical fact of discrimination?

Jason Nordsell -> bob... ,

November 29, 2016 at 10:17 AM

You don't make up for past discrimination with discrimination. You make up for it by equal application

of the law. Today's young white men are not the cause of discrimination of the 20th century, or

of slavery. If you discriminate against them because of the harm caused by other people, you're

sowing the seeds of a REAL white nationalist movement. And Democrats' labeling of every Republican

president/candidate as a Nazi - including Trump - is desensitizing the public to the real danger

created by discriminatory policies that punish [white] children and young adults, particularly

boys.

Displacement of white men by lesser-qualified women and minorities is NOT equality.

Paid Minion -> bob... ,

December 26, 2016 at 01:29 PM

So, to make up for the alleged screw job that women and minorities have supposedly received,

the plan will be screwing white/hetro/males for the forseeable future. My former employer is doing

this very plan, as we speak. Passed over 100 plus males, who have been turning wrenches on airplanes

for years, and installed a female shop manager who doesn't know jack-$##t about fixing airplanes.

No experience, no certificate......but she has a management degree. But I guess you don't know

how to do the job to manage it.

God forbid somebody have to "pay some dues" before setting them loose as suit trash.

This will not end well.

Richard -> Jason Nordsell... ,

November 30, 2016 at 03:45 PM

You had me nodding until the last part.

Back when cultural conservatives ruled the roost (not that long ago), they didn't pursue equality

either. Rather, they favored (hetero Christian) white men. So hoping for Dem stupidity isn't going

to lead to equality. Most likely it would go back to favoring hetero Christian white men.

Todd : ,

November 27, 2016 at 08:46 AM

"...should they find a new standard bearer that can win the Sunbelt states and bridge the divide

with the white working class? I tend to think the latter strategy has the higher likelihood of

success."

Easy to say. What would that standard bearer or that strategy look like?

Bill -> Todd... ,

November 27, 2016 at 08:59 AM

Bernie Sanders was that standard bearer, but Krugman and the Neoliberal establishment Democrats

(ie. Super Delegates) decided that they wanted to coronate Clinton. Big mistake that we are

now paying for...

Bob Salsa -> Bill... ,

November 28, 2016 at 12:56 PM

Basic political math - Sanders would have been eaten alive with his tax proposals by the GOP anti-tax

propaganda machine on Trump steroids.

His call to raise the payroll tax to send more White working class hard-earn money to Washington

would have made election night completely different - Trump would have still won, it just wouldn't

have been a surprise but rather a known certainty weeks ahead.

dwb : ,

November 27, 2016 at 10:47 AM

Evolution of political parties happens organically, through evolution (punctuated equilibrium

- like species and technology - parties have periods of stability with some sudden jumps in differentiation).

Old politicians are defeated, new ones take over. The old guard, having been successful in

the past in their own niche rarely change.

If Nancy Pelosi is re-elected (highly likely), it will be the best thing to happen to Republicans

since Lincoln. They will lose even more seats.

The Coastal Pelosi/Schumer wing is still in power, and it will take decimation at the ballot

box to change the party. The same way the "Tea Party" revolution decimated the Republicans and

led to Trump. Natural selection at work.

In 1991, Republicans thought they would always win, Democrats thought the country was relegated

to Republican Presidents forever. Then along came a new genotype- Clinton. In 2012, Democrats

thought that they would always win, and Republicans were thought to be locked out of the electoral

college. Then along came a new genotype, Trump.

A new genotype of Democrat will have to emerge, but it will start with someone who can win

in flyover country and Texas. Hint: They will have to drop their hubris, disdain and lecturing,

some of their anti-growth energy policies, hate for the 2nd amendment, and become more fiscally

conservative. They have to realize that *no one* will vote for an increase in the labor supply

(aka immigration) when wages are stagnant and growth is anemic. And they also have to appreciate

people would rather be free to choose than have decisions made for them. Freedom means nothing

unless you are free to make mistakes.

But it won't happen until coastal elites like Krugman and Pelosi have retired.

swampwiz -> dwb... ,

November 28, 2016 at 12:59 AM

My vote for the Democratic Tiktaalik is the extraordinarily Honorable John Bel Edwards, governor

of Louisiana. The central fact of the election is that Hillary has always been extraordinarily

unlikable, and it turned out that she was Nixonianly corrupt (i.e., deleted E-mails on her

illegal private server) as well - and she still only lost by 1% in the tipping point state (i.e.,

according to the current count, which could very well change).

bob -> dwb... ,

November 28, 2016 at 03:09 PM

You know what will win Texas? Demographic change. Economic growth. And it is looking pretty inevitable

on both counts.

I'm also pretty damned tired of being dismissed as "elitist", "smug" and condescending. I grew

up in a red state. I know their hate. I know their condescension (they're going to heaven, libruls

are not).

It cuts both ways. The Dems are going into a fetal crouch about this defeat. Did the GOP do

that after 2008? Nope. They dug in deeper.

Could be a lesson there for us.

Smugly your,

dwb -> bob... ,

November 28, 2016 at 06:27 PM

Ahh yes, all Texas needs is demographic change, because all [Hispanics, Blacks, insert minority

here] will always and forever vote Democrat. Even though the Democrats take their votes for granted

and Chicago/Baltimore etc. are crappy places to live with no school choice, high taxes, fleeing

jobs, and crime. Even though Trump outperformed Romney among minorities.

Clinton was supposed to be swept up in the winds of demographics and the Democrats were supposed

to win the White House until 2083.

Funny things happen when you take votes for granted. Many urban areas are being crushed by

structural deficits and need some Detroit type relief. I predict that some time in the next 30

years, poles reverse, and urban areas are run by Republicans.

If you are tired of being dismissed as "elitist", "smug" and condescending, don't be those

things. Don't assume people will vote for your party because they have always voted that way,

or they are a certain color. Respect the voters and work to earn it.

Jason Nordsell -> bob... ,

November 29, 2016 at 10:27 AM

The notion that hispanic=democrat that liberals like bob have is hopelessly ignorrant.

I'm from Dallas. Three of my closest friends growing up (and to this day), as well as my

brother in law, are hispanic. They, and their families, all vote Republican, even for Trump. Generally

speaking, the longer hispanics are in the US, the more likely they tend to vote Republican.

The Democratic Party's plan to wait out the Republicans and let demographics take over is ignorant,

racist and shortsighted, cooked up by coastal liberals that haven't got a clue, and will ultimately

fail.

In addition to losing hispanics, Democrats will also start losing the African American vote

they've been taking for granted the last several decades. Good riddance to the Democratic party,

they are simply unwilling to listen to what the people want.

RJ -> bob... ,

December 06, 2016 at 11:20 PM

You might be tired of it, but clearly you are elitist, smug, and condescending.

Own it. Fly your freak flag proudly,

Tom : ,

November 27, 2016 at 11:42 AM

This is a really shoddy piece that repeats the medias pulling of Clintons quote out of context.

She also said "that other basket of people are people who feel that the government has let them

down, the economy has let them down, nobody cares about them, nobody worries about what happens

to their lives and their futures, and they're just desperate for change. It doesn't really even

matter where it comes from. They don't buy everything he says, but he seems to hold out some hope

that their lives will be different. They won't wake up and see their jobs disappear, lose a kid

to heroin, feel like they're in a dead-end. Those are people we have to understand and empathize

with as well."

Now maybe it is okay to make gnore this part of the quote because you think calling racism

"deplorable" is patently offensive. But when the ignored context makes the same points that Duy

says she should have been making, that is shoddy.

dwb -> Tom... ,

November 27, 2016 at 12:07 PM

There are zero electoral college votes in the State of Denial. Hopefully you understand a)the

difference between calling people deplorable and calling *behavior* deplorable; b) Godwin's Law:

when you resort to comparing people to Hitler you've lost the argument. Trump supporters were

not racist, homophobic, xenophobic, or any other phobic. As a moderate, educated, female Trump

supporter counseled: He was an a-hole, but I liked his policies.

Even my uber liberal friends cannot tell me what Clinton's economic plan was. Only that they

are anti-Trump.

Trump flanked Clinton on the most popular policies (the left used to be the anti-trade party

of union Democrats): Lower regulation, lower taxes, pro-2nd amendment, trade deals more weighted

in favor of US workers, and lower foreign labor supply. Turn's out, those policies are sufficiently

popular that people will vote for them, even when packaged into an a-hole. Trump's anti-trade

platform was preached for decades by rust belt unions.

The coastal Democrats have become hostages to pro-big-government municipal unions crushing

cities under structural deficits, high taxes, poorly run schools, and overbearing regulations.

The best thing that can happen for the Democrats is for the Republicans to push for reforms of

public pensions, school choice, and break municipal unions. Many areas see the disaster in Chicago

and Baltimore, run by Democrats for decades, and say no thank you. Freed of the need to cater

to urban municipal unions, Democrats may be able to appeal to people elsewhere.

Nick : ,

November 27, 2016 at 01:16 PM

Where can you move to for a job when wages are so low compared to rents?

The young generations are not happy with house prices or rents as well.

Giant_galveston -> Tim C....

,

December 05, 2016 at 08:43 PM

Tim, I believe you've missed the point: by straightforward measures, Democratic voters in USA

are substantially under-represented. The problem is likely to get much worse, as the party whose

policies abet minority rule now controls all three branches of the federal government and a substantial

majority of state governments.

Tim C. : ,

November 27, 2016 at 02:50 PM

This is an outstanding takedown on what has been a never-ending series of garbage from Krugman.

I used to hang on every post he'd made for years after the 2008 crisis hit. But once the Clinton

coronation arose this year, the arrogant, condescending screed hit 11 - and has not slowed down

since. Threads of circular and illogical arguments have woven together pathetic - and often non-liberal

- editorials that have driven me away permanently.

Since he's chosen to ride it all on political commentary, Krugman's credibility is right there

with luminaries such as Nial Ferguson and Greg Mankiw.

Seems that everyone who chooses to hitch their wagon to the Clintons ends up covered in bilge.....

funny thing about that persistent coincidence...

dazed and confused : ,

November 27, 2016 at 02:58 PM

"And it is an especially difficult pill given that the decline was forced upon the white working

class.... The tsunami of globalization washed over them....in many ways it was inevitable, just

as was the march of technology that had been eating away at manufacturing jobs for decades. But

the damage was intensified by trade deals.... Then came the housing crash and the ensuing humiliation

of the foreclosure crisis."

All the more amazing then that Trump pulled out such a squeaker of an election beating Clinton

by less than 2% in swing states and losing the popular vote overall. In the shine of Duy's lights

above, I would have imagined a true landslide for Trump... Just amazing.

Jesse : ,

November 27, 2016 at 04:29 PM

The Democratic Establishment and their acolytes are caught in a credibility trap.

dimknight : ,

November 27, 2016 at 11:48 PM

"I don't know that the white working class voted against their economic interest".

I think you're pushing too hard here. Democrats have been for, and Republicans against many

policies that benefit the white working class: expansionary monetary policy, Obamacare, housing

refinance, higher minimum wage, tighter worker safety regulation, stricter tax collection, and

a host of others.

I also think many Trump voters know they are voting against their own economic interest.

The New York Times interviewed a number who acknowledge that they rely on insurance subsidies

from Obamacare and that Trump has vowed to repeal it. I know one such person myself. She doesn't

know what she will do if Obamacare is repealed but is quite happy with her vote.

Doug Rife : ,

November 28, 2016 at 07:17 AM

There is zero evidence for this theory. It ignores the fact that Trump lied his way to the White

House with the help of a media unwilling to confront and expose his mendacity. And there was the

media's obsession with Clinton's Emails and the WikiLeaks daily release of stolen DNC documents.

And finally the Comey letter which came in the middle of early voting keeping the nation in suspense

for 11 days and which was probably a violation of the hatch act. Comey was advised against his

unjustified action by higher up DOJ officials but did it anyway. All of these factors loomed much

larger than the deplorables comment. Besides, the strong dollar fostered by the FOMC's obsession

with "normalization" helped Trump win because the strong dollar hurts exporters like farmers who

make up much of the rural vote as well as hurting US manufacturing located in the midwest states.

The FOMC was objectively pro Trump.

Nate F : ,

November 28, 2016 at 07:57 AM

I was surrounded by Trump voters this past election. Trust me, an awful lot of them are deplorable.

My father is extremely anti semetic and once warned me not to go to Minneapolis because of there

being "too many Muslims." One of our neighbors thinks all Muslims are terrorists and want to do

horrible things to all Christians.

I know, its not a scientific study. But I've had enough one on one conversations with Trump

supporters (not just GOP voters, Trump supporters) to say that yes, as a group they have some

pretty horrible views.

Giant_galveston -> Nate F...

,

December 05, 2016 at 08:38 PM

Yep. I've got plenty of stories myself. From the fact that there are snooty liberals it does NOT

follow that the resentment fueling Trump's support is justified.

Denis Drew : ,

November 28, 2016 at 08:41 AM

One should note that the "The racist, sexist, homophobic, xenophobic, Islamaphobic - you name

it ... " voted for Obama last time around.

When the blue collar voter (for lack of a better class) figures out that the Republicans (Trump)

are not going to help them anymore than the Dems did -- it will be time for them to understand

they can only rely on themselves, namely: through rebuilding labor union density, which can be

done AT THE STATE BY PROGRESSIVE STATE LEVEL.

To keep it simple states may add to federal protections like the minimum wage or safety regs

-- just not subtract. At present the NLRB has zero (no) enforcement power to prevent union busting

(see Trump in Vegas) -- so illegal labor market muscling, firing of organizers and union joiners

go completely undeterred and unrecoursed.

Recourse, once we get Congress back might include mandating certification elections on finding

of union busting. Nothing too alien: Wisconsin, for instance, mandates RE-certification of all

public employee unions annually.

Progressive states first step should be making union busting a felony -- taking the power playing

in our most important and politically impacting market as seriously as taking a movie in the movies

(get you a couple of winters). For a more expansive look (including a look at the First Amendment

and the fed cannot preempt something with nothing, click here):

http://ontodayspage.blogspot.com/2016/11/first-100-days-progressive-states-agenda.html

Labor unions -- returned to high density -- can act as the economic cop on every corner --

our everywhere advocates squelching such a variety of unhealthy practices as financialization,

big pharam gouging, for profit college fraud (Trump U. -- that's where we came into this movie).

6% private union density is like 20/10 bp; it starves every other healthy process (listening blue

collar?).

Don't panic if today's Repub Congress passes national right-to-work legislation. Germany, which

has the platinum standard labor institutions, does not have one majority union (mostly freeloaders!),

but is almost universally union or covered by union contracts (centralized bargaining -- look

it up) and that's what counts.

Gary Anderson : ,

November 28, 2016 at 09:47 AM

Trump took both sides of every issue. He wants high and low interest rates. He wants a depression

first, (Bannonomics) and inflation first, (Trumponomics), he wants people to make more and make

less. He is nasty and so he projected that his opponent was nasty.

Now he has to act instead of just talk out of both sides of his mouth. That should not be as

easy to do.

C Jones : ,

November 28, 2016 at 10:31 AM

Hi Tim, nice post, and I particularly liked your last paragraph. The relevant question today if

you have accepted where we are is effectively: 'What would you prefer - a Trump victory now? Or

a Trump type election victory in a decade or so? (with todays corresponding social/economic/political

trends continuing).

I'm a Brit so I was just an observer to the US election but the same point is relevant here in

the UK - Would I rather leave the EU now with a (half sensible) Tory government? Or would I rather

leave later on with many more years of upheaval and a (probably by then quite nutty) UKIP government?

I know which one I prefer - recognise the protest vote sooner, rather than later.

Bob Salsa : ,

November 28, 2016 at 12:48 PM

Sure they're angry, and their plight makes that anger valid.

However, not so much their belief as to who and what caused their plight, and more importantly,

who can and how their plight would be successfully reversed.

Most people have had enough personal experiences to know that it is when we are most angry

that we do the stupidest of things.

Lars : ,

November 28, 2016 at 05:58 PM

Krugman won his Nobel for arcane economic theory. So it isn't terribly surprising that he

spectacularly fails whenever he applies his brain to anything remotely dealing with mainstream

thought. He is the poster boy for condescending, smarter by half, elite liberals. In other words,

he is an over educated, political hack who has yet to learn to keep his overtly bias opinions

to himself.

Douglas P Anthony : ,

November 29, 2016 at 08:16 AM

Tim's narrative felt like a cold shower. I was apprehensive that I found it too agreeable on one

level but were the building blocks stable and accurate?

Somewhat like finding a meal that is satisfying, but wondering later about the ingredients.

But, like Tim's posts on the Fed, they prompt that I move forward to ponder the presentation

and offer it to others for their comment. At this time, five-stars on a 1-5 system for bringing

a fresh approach to the discussion. Thanks, Professor Duy. This to me is Piketty-level pushing

us onto new ground.

JohnR : ,

November 29, 2016 at 12:07 PM

Funny how there's all this concern for the people whose jobs and security and money have vanished,

leaving them at the mercy of faceless banks and turning to drugs and crime. Sad. Well, let's bash

some more on those lazy, shiftless urban poors who lack moral strength and good, Protestant work

ethic, shall we?

Raven Onthill : ,

November 29, 2016 at 04:12 PM

Clinton slammed half the Trump supporters as deplorables, not half the public. She was correct;

about half of them are various sorts of supremacists. The other half (she said this, too) made

common cause with the deplorables for economic reasons even though it was a devil's bargain.

Now, there's a problem with maternalism here; it's embarrassing to find out that the leader

of your political opponents knows you better than you know yourself, like your mother catching

you out in a lie. It was impolitic for Clinton to have said this But above all remember that when

push came to shove, the other basket made common cause with the Nazis, the Klan, and so on and

voted for a rapey fascist.

Rick McGahey : ,

November 30, 2016 at 02:44 PM

"Economic development" isn't (and can't) be the same thing as bringing back lost manufacturing

(or mining) jobs. We have had 30 years of shifting power between labor and capital. Restoring

labor market institutions (both unions and government regulation) and raising the floor through

higher minimum wages, single payer health care, fair wages for women and more support for child

and elder care, trade policies that care about working families, better safe retirement plans

and strengthened Social Security, etc. is key here, along with running a real full employment

economy, with a significant green component. See Bob Polllin's excellent program in

https://mitpress.mit.edu/books/back-full-employment

That program runs up against racism, sexism, division, and fear of government and taxation,

and those are powerful forces. But we don't need all Trump supporters. We do need a real, positive

economic program that can attract those who care about the economics more than the cultural stuff.

Sandra Williams : ,

December 01, 2016 at 12:20 AM

How about people of color drop the democrats and their hand wringing about white people when they

do nothing about voter suppression!! White fragility is nauseating and I'm planning to arm myself

and tell all the people of color I know to do the same. I expect nothing from the democrats going

forward.

Robert Hurley : ,

December 01, 2016 at 11:04 AM

I have never commented here but I will now because of the number of absurd statements. I happen

to work with black and Hispanic youth and have also worked with undocumented immigrants. To pretend

that trump and the Republican Party has their interest in mind is completely absurd. As for the

white working class, please tell me what programs either trump or the republican have put forward

to benefit them? I have lost a lot of respect for Duy

Giant_galveston -> Robert Hurley...

,

December 05, 2016 at 08:32 PM

Couldn't agree more.

RJ -> Robert Hurley... ,

December 06, 2016 at 11:26 PM

No one should advocate illegal immigration. If you care about being a nation of laws.

[email protected] : ,

December 01, 2016 at 06:13 PM

I think much of appeal of DJT was in his political incorrectness. PC marginalises. Very. Of white

working class specifically. it tells one, one cannot rely on one's ideas any more. In no uncertain

terms. My brother, who voted for Trump, lost his job to PC without offending on purpose, but the

woman in question felt free to accuse him of violating her, with no regard to his fate. He was

never close enough to do that. Is that not some kind of McCarthyism?

Eclectic Observer : ,

December 05, 2016 at 10:55 AM

Just to be correct. Clinton was saying that half (and that was a terrible error-should have said

"some") were people that were unreachable, but that they had to communicate effectively with the

other part of his support. People who echo the media dumb-ing down of complex statements are part

of the problem.

Still, I believe that if enough younger people and african-americans had come out in the numbers

they did for Obama in some of those states, Clinton would have won. Certainly, the media managed

to paint her in more negative light than she objectively deserved-- even if she deserved some

negatives.

I am in no way a fan of HRC. Still, the nature of the choice was blurred to an egregious degree.

Procopius : ,

December 05, 2016 at 08:40 PM

"The tough reality of economic development is that it will always be easier to move people to

jobs than the jobs to people."

This is indisputable, but I have never seen any discussion of the point that moving is not

cost-free. Back in the '90s I had a discussion with a very smart person, a systems analyst, who

insisted that poor people moved to wherever the welfare benefits were highest.

I tried to point out that moving from one town to another costs more than a bus ticket. You

have to pay to have your possessions transported. You have to have enough cash to pay at least

two months' rent and maybe an additional security deposit.

You have to have enough cash to pay for food for at least one month or however long it takes

for your first paycheck or welfare check to come in. There may be other costs like relocating

your kids to a new school system and maybe changing your health insurance provider.

There probably are other costs I'm not aware of, and the emotional cost of leaving your family

and your roots. The fact that some people succeed in moving is a great achievement. I'm amazed

it works at all in Europe where you also have the different languages to cope with.

Kim Kaufman : ,

December 07, 2016 at 10:03 PM