|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

|

|

|

|

Since mid 2014 US MSM propagate the following bogus narrative: There is an oil glut in the USA market in particular despite the fact that the USA increasing their import of oil. To cry about glut on oil in the country which imports more and more oil is something new to me. That can happen only if some produced oil is subpar and nobody wants it (comment from blog post World oil supply and demand Econbrowser)

The Great Condensate Con?We have seen a large year over year increase in US and global Crude + Condensate (C+C) inventories. For example, EIA data show that US C+C inventories increased by 100 million barrels from late 2014 to late 2015, and this inventory build has contributed significantly to the sharp decline in oil prices.

The question is, what percentage of the increase in US and global C+C inventories consists of condensate?

Four week running average data showed the US net crude oil imports for the last four weeks of December increased from 6.9 million bpd in 2014 to 7.3 million bpd in 2015. Why would US refiners continue to import large–and increasing–volumes of actual crude oil, if they didn’t have to, even as we saw a huge build in US C+C inventories? Note that what the EIA calls “Crude oil” is actually C+C.

I frequently cite a Reuters article that discussed case histories of refiners increasingly rejecting blends of heavy crude and condensate that technically meet the upper limit for WTI crude (42 API gravity), but that are deficient in distillates. Of course, what the refiners are rejecting is the condensate component, i.e., they are in effect saying that “We don’t want any more stinkin’ condensate.” Following is an excerpt from the article:

U.S. refiners turn to tanker trucks to avoid ‘dumbbell’ crudes (March, 2015)

http://www.reuters.com/article/2015/03/23/us-usa-refiners-trucks-analysis-idUSKBN0MJ09520150323

In a pressing quest to secure the best possible crude, U.S. refiners are increasingly going straight to the source.

Firms such as Marathon Petroleum Corp and Delek U.S. Holdings are buying up tanker trucks and extending local pipeline networks in order to get more oil directly from the wellhead, seeking to cut back on blended crude cocktails they say can leave a foul aftertaste. . . .

Many executives say that the crude oil blends being created in Cushing are often substandard approximations of West Texas Intermediate (WTI), the longstanding U.S. benchmark familiar to, and favored by, many refiners in the region.

Typical light-sweet WTI crude has an API gravity of about 38 to 40. Condensate, or super-light crude that is abundant in most U.S. shale patches, ranges from 45 to 60 or higher. Western Canadian Select, itself a blend, is about 20.

While the blends of these crudes may technically meet the API gravity ceiling of 42 at Cushing, industry players say the mixes can be inconsistent in makeup and generate less income because the most desirable stuff is often missing.

The blends tend to produce a higher proportion of fuel at two ends of the spectrum: light ends like gasoline, demand for which has dimmed in recent years, and lower-value heavy products like fuel oil and asphalt. What’s missing are middle distillates like diesel, where growing demand and profitability lies.

My premise is that US (and perhaps global) refiners hit, late in 2014, the upper limit of the volume of condensate that they could process, if they wanted to maintain their distillate and heavier output–resulting in a build in condensate inventories, reflected as a year over year build of 100 million barrels in US C+C inventories.

Therefore, in my opinion the US and (and perhaps globally) C+C inventory data are fundamentally flawed, when it comes to actual crude oil inventory data. The most common dividing line between actual crude oil and condensate is 45 API gravity, although the distillate yield drops off considerably just going from 39 API to 42 API gravity crude, and the upper limit for WTI crude oil is 42 API.

In 2015, the EIA issued a report on US C+C production (what they call “Crude oil”), classifying the C+C by API gravity, and the data are very interesting:

https://www.eia.gov/todayinenergy/detail.cfm?id=23952

Note that 22% of US Lower 48 C+C production consists of condensate (45+ API gravity) and note that about 40% of US Lower 48 C+C production exceeds the maximum API gravity for WTI crude oil (42 API). The above chart goes a long way toward explaining why US net crude oil imports increased from late 2014 to 2015, even as US C+ C inventories increased by 100 million barrels, and I suspect that what is true for the US may also be true for the world, in regard to the composition of global C+C inventories.

Following is my analysis of global C+C production data versus estimated global crude oil production data, through 2014, using the available data bases:

Did Global Crude Oil Production Peak in 2005?

http://peakoilbarrel.com/worldwide-rig-count-dropping-again/comment-page-1/#comment-546170

How Quickly Can US Tight/Shale Operators Cause US C+C Production to Increase?

Because of equipment, personnel and financial constraints, in my opinion it is going to take much longer than most analysts expect for US operators to ramp up activity, even given a rising price environment.

Except for the 2008 “V” shaped price decline (which bottomed out in December, 2008), and the corresponding US rig count decline, the US (oil and gas) rig count has been around 1,800 to 2,000 in recent years. Note that it took about five years to go from around 1,000 rigs in 2003 to around 2,000 rigs in 2008, and it even took two years to go from around 1,000 rigs in 2009 to around 2,000 rigs in 2011.

And assuming a 15%/year rate of decline in existing US C+C production and assuming a 24%/year rate of decline in existing US gas production, the US has to put on line around 1.5 million bpd of new C+C production every year and around 17 BCF per day of new gas production every year, just to offset declines from existing wells. Based on 2013 EIA data, the estimated annual volumetric loss of production from existing US gas production exceeds the annual dry gas production of every country in the world, except for the US and Russia.

Generally the idea of oil glut in the USA and simultaneously increasing imports is something from Orwell novel 1984, where is was called doublespeak. If you’re an oil producer, you don’t pump oil unless you have orders for it. If you pump oil without orders, then you need your own storage to store it. You don’t ship any oil without getting paid for it. So oil glut theory claim that they are producers which have oil stored instead of shipped to customers and nobody wants this oil. So it is rotting in storage instead. And this bogus "theory" is propagated by MSM for more then 18 month now. The best example of article that subscribes to this fallacy I found in NYT:

Stock Prices Sink in a Rising Ocean of Oil

The world is awash in crude oil, with enough extra produced last year to fuel all of Britain or Thailand. And the price of oil will not stop falling until the glut shrinks.

The oil glut — the unsold crude that is piling up around the world — is a quandary and a source of investor anxiety that once again rattled global markets on Friday.

As prices have dropped, the amount of excess production has been cut in half over the last six months. About one million barrels of extra oil is now being dumped on the markets each day.

But that means the glut is still continuing to grow, and it could take years to work through the crude that is being warehoused, poured into petroleum depots or loaded onto supertankers for storage at sea.

The shakeout will be painful, taking an even bigger toll on companies, countries and investors.

I think the author never saw a real oil tanker and does not understand how much it costs to keep oil in tanker for, say, a year. Regular lease of 200 barrel oil truck is around $4000 a month. and at $40 the cost of 200 barrels is just $8000. So don't try this in your backyard ;-). An ultra-large crude carrier, with a 3 million barrel capacity can well cost around $40,000-60,000 a day. So in one day you burn 1000-1500 barrels (if we assume 40 pre barrel) of your stored oil. That comes to 10-15% of stored oil in one year just in leasing costs (reuters.com)

As this is a skeptical page, one thing the creates strong doubts in MSM coverage of the current oil prices slump is the idea of oil glut and Saudis supposed decision to "defend their share of the market" by supposedly flooding the market with oil (in reality they were unable significantly raise their exports (only by 0.3 Mb/d in 2016) and used predatory pricing since mid 2014 to slam the oil prices). There are strong indications that that was the political decision make by Saudi elite to hurt Iran after decision to lift sanctions was made by G7+Russia in mid 2014. It is due to this decision the country started to dump their oil on the market at artificially low prices undercutting other producers. They simply presented discount for each region they sell for their oil, essentially putting a price on each barrel they sold.

But to cry about glut on oil in the country that imports more and more oil is something new to me. This is something from Orwell novel 19884 and is called doublespeak. and that's was exactly the situation with the USA in 2015. So MSM are deceiving the public. But why and what is the real situation, if we can decipher it ?

The first thing to understand is that at a given stage of developing of drilling and other related technologies there is such thing as minimal price of oil below which production can be continued only at a loss. After all a well often costs $8 million, which need to be amortized for life of well. Which in case of shale/tight oil is approximately five-six years with more half of oil extracted in the first two years. The cost is much higher for non-conventional oil producers then for conventional producers. Canadian tar sand production is even more expensive. Deep water drilling is somewhere in between conventional and non-conventional oil.

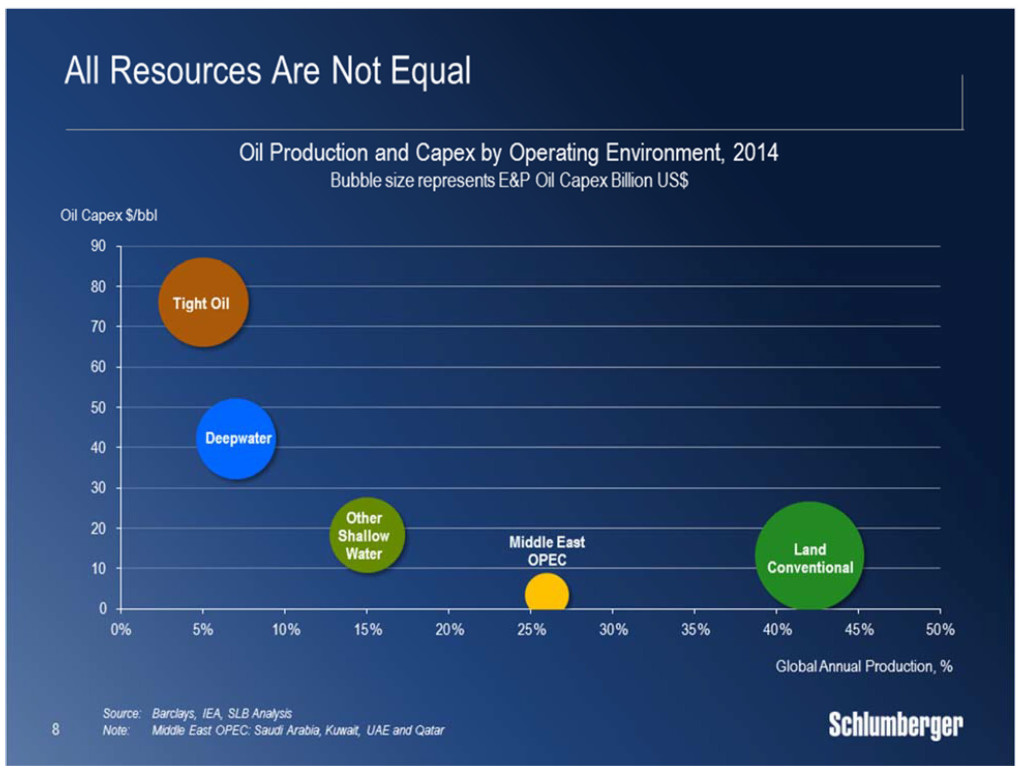

There are different estimates, but most analysts agree that shale/tight oil producers need around $70-$80 per barrel to be able to pay their debts and around $50-$60 to break even. Slightly less for deep water oil ($40-$50). The picture below illustrated difference prices to produce different types of oil ( see below) is reproduced from What Me Worry About Peak Oil Art Berman, December 27, 2015 ):

This means that production of light oil from tight zones need the price of $70-80 per barrel to break even. The same applies to extra heavy, deep water, and EOR projects. The implication seems to be that most industry investments do require higher prices and 2010-2013 were gold age for this types of oil as prices were close or above $100.

There were elements of glut in condensate and light oil before export restrictions were lifted because the US refineries were tuned to different type of oil. some even rejected blended oil as output from such oil in various fractions was different from "classic" oil to which refineries got used and that was cutting their profits. But that's about it.

The key problem for shale/tight oil companies is that they have chance to stay afloat only at around $70-$80 per barrel and most get to much debt in 2010-2013 trying to increase production to survive the current price slump. In North America, 42 companies with $17 billion in debt filed bankruptcy in 2015, the highest level since the financial crisis in 2008. Of these filings, 36 companies with $16.7 billion in debt filed in the U.S.

Here is an old article Crude oil is surging (May 21, 2015) that asks important question "How we can have a glut of oil one week and the next we don't "

Crude oil is having a big day. West Texas Intermediate crude oil rallied by more than 3% to cross back above the $60 per barrel mark. On Wednesday, the Energy Information Administration said that crude inventories fell by 2.7 million barrels last week.

It was the third straight week of declines in inventories, which have seen a huge swell in recent months to the highest levels in at least 80 years. Earlier this week, we highlighted comments from Morgan Stanley, noting that following the oil crash, drillers are now prioritizing profitability over their output of barrels.

Brent crude oil, the international benchmark, was also higher, up by more than 2%. Here's a chart showing the jump in WTI...

mad man

I can't understand, as everyone of us that are not greedy SOB's. How we can have a glut of oil one week and the next we don't . I wouldn't leave this country for another , I'll stand and fight for what we had in the past!

We have to rid this county of the #$%$S that think they are running it! Dem.'s or GOP's are all #$%$'s! . This is not for the PEOPLE BY PEOPLE any more. WE ALL have to try and fix it .

H e

Crude is surging because the US dollar has no backbone anymore and losing it's world's reserve currency status.

okeydokey

Market manipulation. Nothing more. As for Business Insider, this is a propaganda rag.

heybert17

I really enjoy reading all the expert opinions on oil. One says it will plummet, another says it will surge, and another says it will stay steady. What are these people "experts" of? It can't be oil or they would all say the exact same thing.

Here is another similar thread:

Steve,likbez, 12/25/2015 at 3:44 pmI agree with your post about market dynamics between customers having to pay through their purchasing power in order to retire loans created by financial industry for oil companies.

But there are a few things that make this oil crash little bit “strange” to say at least:

- OPEC (and mainly Saudis + GCC) did actually something by not doing anything and that is refusing to cut their production. Well that is “man made” decision as Oman oil minister said and not decision by invisible hand of market. I interpret this mainly as political decision and not economical.

- Second. Wall Street was pretty much shocked if not pissed by that Saudi decision. I interpret that to be political reaction as well.

- There is no worldwide collapse of demand that justify 65-70% fall of the oil price. I am sorry but Wall Street is creating ninja loans for cars, student loans, mortgages from the thin air with the same speed in the US. I would say that is political decision as well. Worldwide collapse is not happening as of now either that would justify 65-70% drop of price. Contraction is happening in Europe but very very gradually except in some marginal countries like Greece, and war torn countries in ME and Africa. But these marginal countries did not even have any big consumption to begin with.

- Shale oil producers based on their balance sheet were bankrupt from Day 1. Why LTO even got the loans to begin with? That is also political decision and not an economic. Why are we waiting even a year after low prices for any major mergers, buyouts or bankruptcies? I am sorry but 100% of LTO are bankrupt so why Wall Street is extending and pretending and keeping them on a life support? Well it is again political decision.

So yes there are some market dynamics around this oil crash but there are a lot of political dynamics as well.

Ves,Ves, 12/25/2015 at 5:32 pmThanks for the post. I agree with your reasoning.

To me too such a dramatic drop of oil prices looks like an engineered event, and is not only the result of supply and demand discrepancies. I think coming online way too many projects served a role, but not a decisive role. There was a political will to achieve that result.

One factor that might be in play ( it is NOT 100% reliable info) is that Saudis appropriated all or large part of Iran quota during sanctions period.

So on July 14, 2014, when agreement about lifting sanctions was reached, Iran asked to Saudis to compensate them for all this period. Saudis refused and started all this fun with declarations that they will defend their market share by all means possible.

Obama was surprisingly strongly “pro-deal”: On Tuesday Obama promised to use his veto on any domestic attempts to undermine the deal. “I am confident that this deal will meet the national security needs of the United States and our allies, so I will veto any legislation that prevents the successful implementation of this deal,” he said.”

Subsequently “sell as much as you can” regime for all OPEC members was instituted during the last OPEC meeting — no countries quotas anymore. Which, in a way, is the dissolution of OPEC.

So this “conspiracy theory” presupposes that this was the way Saudis reacted to lifting Iran sanctions, which threatened their share of oil market and also empowered their bitter regional enemy due to high oil prices. And they probably were angry as hell about the US administration duplicity — betrayal of the most reliable ally in the region, after the same trick with Mubarak.

Also it might well be that the agreement to lift sanctions from Iran was explicitly designed as a perfect Trojan horse for dropping oil prices to ease pressure from G7 economies which were in “secular stagnation” state. With Europe suffering from the cut from Russian market. In this case this was a real masterpiece of “divide and conquer” strategy.

Thanks likbez.I don’t pay too much attention to the price because the price is just the consequence of what buyers and sellers agree on. So there is no “engineering” in the classic sense of how we interpret in the real life. What bothers me is the amount of new and unprofitable shale oil that come to the market in the relatively short period of time. Well that is political engineering.

I thought for a while that this is all classic bubble of greed but then that did not make sense either. We know that bankers like bubbles because they always make money on swings, either going up or down. And that is ok with me; I accept that is how things work on this planet. But they could make bubbles with tulips and make money too? It has been done before. Oil is little bit different. You don’t piss oil on these swings when you are not making any money even on upswing.

So it is kind a troubling to see what is really going on. It looks to me that some breakdown of communication happened between major oil producers and major bankers. But time will tell.

|

|

Switchboard | ||||

| Latest | |||||

| Past week | |||||

| Past month | |||||

| Home | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 1900 |

For the list of top articles see Recommended Links section

Jul 20, 2021 | peakoilbarrel.com

SHALLOW SAND IGNORED 07/19/2021 at 10:33 pm

Rasputin.

We have owned rigs. We could never keep an operator around long enough to make it worthwhile. We had a double drum and a single drum. Mud pump. Power swivel. Power tongs on both. Testing truck. The whole enchilada.

We sold them all to a man who had worked for someone else and then went out on his own. We gave him a good deal, and he did a lot of work for us. He still does work for us, but he can't find help that will stay.

We also owned a tank truck. Sold it also. It is currently parked, the man we sold it to cannot find a driver. He is a one horse tank truck driver. He turns down work all the time. We had to shut down a lease we haul water on for a few days when he got COVID. Thankfully he recovered.

All of us around here just cannot quite believe what is going on with the oilfield labor force. It is a perfect storm.

Meanwhile, most recently we paid $5.63 per foot for 2 3/8" steel tubing, which was under $3 a year ago. We priced a 115 fiberglass tank for $6,800, would have been $3,900 a year ago.

We had a couple wells down for a few weeks because we could neither get new nor rewound motors for them.

The man who owns the backhoes, trackhoes and cranes that does contract work for us is in his 70's and has great grandkids. He works in the field daily beside his son and grandson.

One of the last rig hands we had broke into our shop last winter. He got out of jail after a few weeks and immediately got a job in a local factory. Hope he stays clean. He was a good hand when he was, and had learned to operate a single drum also.

The prosecutor in our county announced the first six months of 2021 that 162 felony cases had been filed in our small county, that in 2019 the total for the year was 204 felonies, and that 33 of the 34 jail inmates were addicted to meth.

We do have one pumper now under 50. The rest are from 51 to 63. REPLY INGRAHAMMARK7 IGNORED 07/20/2021 at 1:34 am

How much land do you have left? At one well per section how many can you drill and how long it takes? That's when your business wraps up. REPLY RASPUTIN IGNORED 07/20/2021 at 2:40 am

Holy Moly SS

I guess the days of vertical doing things in house are gone. That labor mess is unreal. However, here in nowhere USA it is hard to find good help but you can usually find help. I was so surprised at some of the job turnover even during peak covid when some businesses were restricted and some essential. How are people living that have no jobs? Over the years I hired relatives that never got it, didn't stay sober and didn't see the long term upside. Maybe it's all about today for the younger generation.

Over the past year and a half I've been following your posts including labor issues. Were they so dreadful before covid and helicopter money? It might appear to the uninformed that training rig help. pumpers and the like is easy, but it's not. One small oops for man is one huge oops for you.

Perhaps, as we move away from the false narrative that you must have a college degree to get a good or high paying job, things will improve in the trades and the oilfield.

About 20 years ago I was visiting with a substantial independent stimulation company that was having labor issues. The head honcho lamented that they had already poached all of the young guys that grew up on farms and knew machinery, getting up early and how to work. Having known a few guys and what they earned they most likely didn't point their kids at basket weaving degrees.

Sure wish I had an answer for you. Personally, I'm shrinking down to a few wells close to the house/shop/yard, one of which I could walk to for daily exercise. However, I'll run my equipment myself as long as possible.

The best to you. REPLY SHALLOW SAND IGNORED 07/20/2021 at 5:53 am

Rasputin.

The number of basically "homeless" people living here in my part of very rural USA is startling. People aren't generally sleeping in the parks. They have duffle bags and backpacks and crash place to place.

We have the tremendous labor shortage, yet the public defender and conflicts public defender have over 400 clients combined. This in a county of a little less than 20K people. That right there is the labor force for a decent sized factory around here.

To qualify for the PD you must have income below 125% of federal poverty guidelines, which is very low. During the height of COVID, nothing got done with their cases because the PD's couldn't get ahold of them. Few have cell phones that are permanent (track phones) and few have permanent addresses. The jail is full so there aren't a lot of warrants being issued for the lower level crimes. So people haven't been showing up for their court cases for months/ over a year. Our county is going to send close to 100 people to prison this year, almost all for meth delivery. This is the situation all over rural USA. People who live here and aren't in the court system are oblivious to it until they get broken into or robbed (or have an addicted relative, which many do).

The primary reason for the labor shortage here is a combination of young people moving to larger towns/cities, a very large percentage of the working age population being addicted to meth (which is now being cut with heroin, fentanyl, etc) and the significant benefits that have been paid to not work. I hate to think of how many billions of borrowed money stimulus our future generations are now indebted with that went directly into the pockets of the foreign drug cartels.

As for the oilfield, add to that the hard work, not the greatest pay in the world at the bottom end (rig hands) the need to find people who can work unsupervised outdoors, and the young people being told the industry is dead and a job in that field will soon be gone. Finally, a ton of "old timers" simply retired during COVID.

Our country has no idea how dependent we are on labor from Mexico and Central America that keeps us alive. The only farm workers are Hispanic. However, most don't want to work in the oilfield either, it seems. We just harvested green beans, and all the crew were Hispanic. The same will be the case here shortly as we harvest watermelons and cabbage. If Trump were successful and closed the borders and sent everyone back, we would starve.

The largest oil company here shut in everything it owned when oil went negative. Unfortunately for them they laid off a lot of people. Many of their wells are still idle.

Maybe we are an outlier. But I doubt it. A decent amount people at the lower end of the labor force seem to have decided they aren't going to work, and offering a lot more $$ won't bring them back. Maybe they will come back when the government benefits end.

Even the prisons can't find employees. They pay $70K+ plus great benefits. Mentally difficult work though. Also, can't have a criminal record and cannot use drugs, even pot.

Keep in mind a large percentage of the USA population now smokes or ingests pot. That doesn't work well in a lot of industries where sobriety is mandatory.

The gas station I fill up at is offering a $300 signing bonus which is paid after 30 days of no unexcused absences. $13 and hour to start at the cash register. They can't find people to take that.

I'm rambling now, and I'll stop.

Surely there are some shale basin people reading this. Could any of you comment about whether there is a labor shortage in your shale basin? If there isn't, maybe we could persuade a few of them to come to our neck of the woods and work on the simple, shallow wells. Not a lot of traveling, no weekends unless you pump, and work is daytime only. KANSAS OIL IGNORED 07/20/2021 at 9:10 am

Shallow Sand –

I echo all of your sentiments. We are a small operator in Kansas, producing about 300 bbl/day in 13 various counties. We have approximately 50-60 bbl/day offline pushing 3 weeks. We're talking 8/8ths approximately $75,000 in revenue. Pre-Covid you could count on getting a pulling unit sometimes next day if you had a mechanical failure. Now it's 3-4 weeks. $20/hour for green rig hands evidently isn't enough to move the needle, whether it's because the work is too difficult, or it's easier to keep cashing the government checks. And by my count we are in a similar situation with oil field pumpers. We have 13 of them. 2 are 50s, and the rest are all over 60. I'm in my early 40s and my field superintendent is 56. He loves to work and will probably do so until he's 70-75. When he checks out will probably be when I check out. REPLY SHALLOW SAND IGNORED 07/20/2021 at 9:55 am

Kansas Oil.

Great to hear from you.

Thanks for confirming what we are experiencing.

The big question is whether this is also going on in the shale basins, primarily Permian. If it is, don't see how USA production grows much.

I drive across Kansas on both I 70 and the South Route through Wichita to the OK panhandle quite a bit. Always keep my eyes open for whether pumping units are moving or not.

I worry about whether the huge feed lots, hog facilities and packing plants out there can find enough help. People have no clue how much of the USA is fed from the TX, OK panhandles on up through Western KS and NE.

Hang in there!

Jul 08, 2021 | www.zerohedge.com

While much of the analysis of the recent OPEC+ disagreement has focused on why the UAE refused to commit to the new export plan, there are other factors that have been largely overlooked. A closer look at the ongoing investments by the UAE in its upstream and downstream industry is one such example. Abu Dhabi's national oil company ADNOC has put in place a production capacity increase that calls for a total reassessment of the underlying OPEC production baselines, which were agreed in 2018. At present Abu Dhabi is allowed to produce around 3.2 million bpd, based on the 2018 baseline, but has a capacity now of more than 3.8-4 million bpd. Looking at ongoing new projects and planned investments, production of more than 4 million bpd is possible in the coming years.

The aggressive investment strategy of ADNOC means that the UAE is plenty of incentives to increase production. An extended and controlled OPEC+ export quota system would not only impact the UAE's revenue streams but could even turn some of its multi-billion dollar investments into stranded assets in the long term.

Recently, Crown Prince Mohammed bin Zayed has been pushing an independent geopolitical and economic strategy for the UAE. After years of cooperating with Saudi Arabia on everything from OPEC policy to regional geopolitical crises, the two powers are now beginning to diverge. Former cooperation on issues such as the Yemen war and the Qatar blockade has weakened drastically.

At the same time, Mohammed bin Salman has been aggressively pushing Saudi Arabia's regional power. Saudi Arabia's Vision 2030, the Kingdom's economic diversification plan, has driven the crown prince to take aim on other GCC countries as he attempts to force international investors and companies to set up shop in Saudi Arabia rather than Dubai or Doha. This transformation in the relationship between Saudi Arabia and the UAE certainly played a part in the recent OPEC+ conflict.

Riyadh is also targeting the logistics industry, an industry that the UAE has long dominated, establishing itself as a regional hub for logistics and connecting EU-Asian commodity and trade flows. In the last couple of months, Saudi Arabia has become increasingly aggressive in this space. While there has no been a direct conflict in this area, it is generally assumed that there is not enough space in the region for two supra-regional maritime logistic hubs. MBZ and Dubai are clearly unimpressed with Saudi Arabia's attempts to muscle in on the industry.

Another area of discord between the two nations is the UAE's increased cooperation with Israel. UAE-Israel cooperation in logistics, technology, defense, and agriculture, is a possible threat to Saudi Arabia's Vision 2030 projects. By bringing Israeli tech and know-how to Abu Dhabi and Dubai, the UAE projects will compete with the Saudi Giga-Projects, such as NEOM, for international investment. In response to these moves by the UEA, Riyadh has blocked technology and products exports by the UAE that are linked to Israel.

This economic and geopolitical confrontation is normal in the Arab world and is unlikely to cause a major rift between the two nations. The current cracks will likely be mended when one of the two parties is calling for a Majlis in the Desert. MBS and MBZ have more to win from cooperation than confrontation. A breakthrough in the OPEC discussions is certainly a possibility, but first, some saber-rattling must be done. Ultimately, MBS understands that both Aramco's and ADNOC's future revenues are important. Both NOCs will be able to gain a lot of market share in the coming years if they play their cards right. By being flexible while not losing face, both the nations could go on to cooperate in other fields. Emirati SWFs are still a viable source of financing for major projects in Saudi Arabia, while energy-transition projects in the Emirates thrive on Saudi cooperation and cash.

By showing a strong position in international and regional media, both Crown Princes aim to boost their own positions. MBS's strong approach towards regional economic issues is clear and will inevitably come into conflict with others. MBZ's more aggressive regional and supra-regional power aspirations are also set out for all to see. OPEC's infighting is a natural place for these tensions to play out. Both parties know that their long-term alliance will be key in the future. A full confrontation between the two nations would only serve as an advantage to the long list of regional adversaries for these two nations. By threatening non-compliance, Abu Dhabi is showing its willingness to confront market developments head-on. Saudi Arabia and Russia now need to understand that a Riyadh-Moscow agreement is not going to be enough to placate the other members. ADNOC is unlikely to destabilize the market by opening up its taps, but the symbolism of its resistance is important. Statements about the UAE's willingness to leave OPEC are based purely on rumors, not on facts. Stability is key in oil and gas, being part of the discussion inside of OPEC is more valuable to the UAE than being independent. There is plenty of complexity to unpick behind the scenes, but this particular disagreement is unlikely to cause any real problems for OPEC+

play_arrow

slokhmet 1 hour agojimmy12345 1 hour agoI have another hypothesis: with covid lockdowns and restricted travel, UAE's income from prostitution and laundering crashed. They needed to make it up somewhere else.

Simple, really.

GregT 1 hour agoAn oil glut is coming. As electric vehicles get cheaper and better year by year, there will a rapid adoption of EV's creating a glut in the oil market. In 2022, 10% of china's vehicles sales will be electric and the auto industry has announce over 100 billion dollars in investments in electric vehicles. The Russian cucks on here are screwed.

Ron_Paul_Was_Right 1 hour agoWrong. Ev's have been around for over a decade & still don't have 1% of the automobile market. They're a novelty. Not a viable path to move billions of people around in the world. Look at a previous article from today on ZH. China produced 225k this yr. If you live to be a million they might catch up to combustion engine cars & trucks.

Delusion Spotter 45 minutes agoI don't know about it taking a million years to get there, but to your point yes - EVs just aren't competitive with fuel burning vehicles at this time. It just doesn't work to drive 400 miles and have to wait an hour plus for a "fill up" to drive another 400 miles. Not when it takes 5 minutes to fill a gas tank, it just isn't competitive.

radical-extremist 1 hour agoMore Correct Analysis:

" Statements about the UAE's willingness to leave OPEC are based purely on rumors, not on facts. Stability is key in oil and gas, being part of the discussion inside of OPEC is more valuable to the UAE than being independent. "

UAE's going to stay in OPEC, and the latest OPEC sideshow will result in higher Oil Prices, not lower.

GregT 1 hour agoHow are world leaders allowing OPEC to produce or even exist at all...while Climate Change threatens our very existence on earth? They seem to be sending mixed messages.

bustdriver 1 hour agoBecause world leaders know climate change is a hoax to scare people into paying governments more taxes. They need & want oil as bad as everyone else.

I am guessing there is money angle in the mix.

Jul 03, 2021 | peakoilbarrel.com

RON PATTERSON IGNORED 07/03/2021 at 1:44 pm

We should know for sure sometime between January and December 2022. We will know when it is confirmed that Russia is in decline. That will be the tipping point. Many producers are already in decline but Russia is now the largest. Of course, the US being in decline, the two largest producers in the world, would leave no doubt about it. LIGHTSOUT IGNORED 07/03/2021 at 11:47 am

Thanks Ovi. KSA,Russia and US are starting to look like a line of domino's.

Jul 03, 2021 | peakoilbarrel.com

POLLUX IGNORED 07/03/2021 at 2:27 pm

Some news about Iraq:

Iraqi minister says BP mulls quitting Iraq, Lukoil wants to sell up

Iraqi Oil Minister Ihsan Abdul Jabbar said in a video posted on Saturday on the ministry's Facebook page that BP (BP.L) was considering withdrawing from Iraq, and that Russia's Lukoil (LKOH.MM) had sent a formal notification saying it wanted to sell its stake in the West Qurna-2 field to Chinese companies.

Iraqi tax commission cracks down on international energy companies

Iraq's top tax authority has ordered government departments to stop issuing visas and halt imports for nearly two dozen international energy companies whom it accuses of late tax payments.

If enforced, the orders, dated June 27, 2021, could prevent some of the biggest players in Iraq's oil, gas, and electricity sectors from bringing staff and equipment into Iraq, effectively depriving the country of work that is needed to meet its own production targets at a time when insufficient gas feedstock is causing nationwide electricity failures.

Iraq power cuts stir protests as summer temperatures scorch country

The power cuts have hit the south of Iraq especially hard. In Basra, where Iraq's oil wells are situated, people have started taking to the streets in protest and main roads had to be shut down. POLLUX IGNORED 07/03/2021 at 2:59 pm

Gasoline Shortages In Iran As Tanker Drivers Shun Fuel Shipments

An official of Iranian Truck and Fuel Tanker Drivers' Union said Thursday that drivers were refusing to transport fuel due to low or late payments from the government. There has been a shortage of supply in gasoline stations in recent days in various parts of the country.

In a statement published on social media Thursday, the National Association of Drivers' Unions expressed solidarity with striking contract oil and petrochemical workers and said drivers would join their strike if the oil workers' demands were ignored.

Jun 30, 2021 | peakoilbarrel.com

POLLUX IGNORED 06/28/2021 at 5:46 am

Russia plans to cut oil exports from its Western ports by 22% in July vs June – schedule

"On a daily basis, loadings will decline by 22% in July compared to the current month, Reuters calculations showed." REPLY POLLUX IGNORED 06/28/2021 at 1:37 pm

Russia struggles to raise oil output despite price rally -sources

"Russian oil production has declined so far in June from average levels in May despite a price rally in oil market and OPEC+ output cuts easing, two sources familiar with the data told Reuters on Monday.

Russia's compliance with the OPEC+ oil output deal was at close to 100% in May, which means the state is about to exceed its target in June.

Two industry sources said that lower output levels may be due to technical issues some Russian oil producers are experiencing with output at older oilfields." RON PATTERSON IGNORED 06/28/2021 at 2:38 pm

Yes, they are definitely experiencing issues with their older oilfields, it's called depletion. But that decline is only 33,000 bpd or .3%. But your post above that one says exports in the third quarter will decline by 22%. What gives there?

Their decline in May was 23,000 bpd. OVI IGNORED 06/28/2021 at 3:25 pm

Ron

I just checked the Russia site and they have revised up their original May estimate. It is one week later than the original. Production is now down 9,000 b/d. RON PATTERSON IGNORED 06/28/2021 at 4:50 pm

Yeah, they revised it up by 14,000 pbd. A pittance. Now they are down only 9,000 bpd instead of 23,000. Nothing to get excited about. Basically, they were flat in May. JEAN-FRANÇOIS FLEURY IGNORED 06/28/2021 at 4:09 pm

"Russia plans to decrease oil loadings from its Western ports to 6.22 million tonnes for July compared to 7.75 million tonnes planned for loading in June, the preliminary schedule showed." 7,75 x 10^6 – 6,62 x 10^6 = 1130000 t. 1130000×7,3/30 = 274966 b/d. Therefore, these decrease of oil export suggests a decrease of production of 274966 b/d. Precedently, it was announced that oil exports of Russia would decrease of 7,2 % for the period July-September or a decrease of 308222 b/d. Therefore, it's coherent. https://www.zawya.com/mena/en/markets/story/Russias_quarterly_crude_oil_exports_to_drop_72_schedule-TR20210617nL5N2NY2IQX8/?fbclid=IwAR0ZjvwzjVS427CbUAzTL1vJfqog7R8CDwaJAvI3uUdaw_0z5S5l_57SGFY I notice that it concerns the "Western ports", therefore the exports toward EU and USA. Well, EU is also the main customer of Russia with 59% of the oil exports of Russia. RON PATTERSON IGNORED 06/28/2021 at 4:59 pm

Western Syberia is where all the very old supergiant fields are. They produce 60% of Russian crude oil. Or at least they used to. LIGHTSOUT IGNORED 06/29/2021 at 2:11 am

Ron

If one of the West Siberian giants is rolling over in the same way as Daquing did, things could get very interesting very quickly. RON PATTERSON IGNORED 06/29/2021 at 7:24 amFour of Russia's five giant fields are in Western Siberia. The fifth is in the Urals, on the European side. All five have been creamed with infill horizontal drilling for almost 20 years. All five are on the verge of a steep decline. Obviously, one and possibly more have already hit that point.

This linked article below is 18 months old but there is a chart here that shows where Russia's oil is coming from. Notice only a tiny part is coming from Eastern Siberia, the hope for Russia's oil future. Those hopes are fading fast.

The Worrying Truth About Russia's Oil Industry EULENSPIEGEL IGNORED 06/29/2021 at 6:32 am

As I have written a few months ago: When you reduce output voluntarily for a longer time, all the nickel nursers from accounting and controlling will cut you any investing in over capacity you can't use at the moment. That works like this in any industry.

So you have to drill these additional infills and extensions after the cut is liftet. And this will take time, while fighting against the ever lasting decline.

Jul 03, 2021 | peakoilbarrel.com

SHALLOW SAND IGNORED 06/26/2021 at 8:19 pm

I haven't paid attention for awhile, but I think OXY was the number one producer of CO2 flood oil in the lower 48.

Anadarko also owned a lot of lower 48 secondary and tertiary production, as I recall.

These big, public US operators have a lot more in common with us stripper well folks than they care to admit.

Old freakin fields discovered over a century ago is where they operate. REPLY LIGHTSOUT IGNORED 06/27/2021 at 3:15 am

Don't worry shallow the Paradox basin will save the day. (Sarc)

https://www.zephyrplc.com/ REPLY HOLE IN HEAD IGNORED 06/27/2021 at 1:17 pm

REPLY JOHN S IGNORED 06/28/2021 at 1:21 pm

Shallow Sand,

You are damned right about that! REPLY D COYNE IGNORED 06/27/2021 at 8:46 am

On Fri the July futures contact for WTI closed at 74/bo and on June 21, 2021 (last data points at EIA) the spot price for WTI was $73.64/bo and Brent spot price was $74.49/bo, so a spread of under a dollar, quite unusual in the past 5 years or so when typical spread has been roughly $5/bo between WTI and Brent (Brent usually has been higher). FRUGAL IGNORED POLLUX IGNORED 06/28/2021 at 5:42 am

Adnoc imposes deeper cuts to September crude exports

"Abu Dhabi's state-owned Adnoc has informed customers that it will implement cuts of around 15pc to client nominations of all its crude exports loading in September, even as the Opec+ coalition considers further relaxing production quotas.

It was unclear why Adnoc is deepening reductions for its September-loading term crude exports, with the decision coming ahead of the next meeting of Opec+ ministers scheduled for 1 July when the group is expected to decide on its production strategy for at least one month"

World Oil Situation 2021

https://www.youtube.com/watch?v=EaXoAfa1tAw

This is an in-depth video of World production and consumption.

Jul 03, 2021 | peakoilbarrel.com

POLLUX IGNORED 06/28/2021 at 5:42 am

Adnoc imposes deeper cuts to September crude exports

"Abu Dhabi's state-owned Adnoc has informed customers that it will implement cuts of around 15pc to client nominations of all its crude exports loading in September, even as the Opec+ coalition considers further relaxing production quotas.

It was unclear why Adnoc is deepening reductions for its September-loading term crude exports, with the decision coming ahead of the next meeting of Opec+ ministers scheduled for 1 July when the group is expected to decide on its production strategy for at least one month"

Jun 23, 2021 | oilprice.com

In the paper market, Brent Crude prices already hit $75 a barrel this week, for the first time in over two years.

WTI Crude was above $73 early on Wednesday as demand strengthened and as U.S. crude oil inventories were estimated by the American Petroleum Institute (API) to have shrunk by 7.199 million barrels for the week ending June 18.

Backwardation in the WTI futures continues to tighten "a sign of a tighter market.

For example, the September-October spread is at a seven-year high at $1.09 per barrel on expectations that storage levels at the WTI futures delivery hub at Cushing will continue to decline amid strong Midwest refinery demand, Saxo Bank said on Tuesday.

Jun 22, 2021 | finance.yahoo.com

The growing consensus on Wall Street is that the rally in oil prices has more room to the upside

At more than $74.63 a barrel currently , brent crude oil prices are trading at levels not seen since fall 2018. The price of brent crude is up about 88% over the past year .

... ... ...

Similar to BofA, Goldman Sachs is expecting firmer oil prices moving forward. Strategists at the investment bank don't rule out prices nearing $100 a barrel before year end.

"Near term our highest conviction long is oil where we still see brent [crude oil] averaging $80/bbl this third quarter with potential spikes well above $80/bbl. Global demand likely rose to 97.0 million barrels a day in recent days from 95.0 million barrels a day just a few weeks ago as the U.S. passes the baton to Europe and emerging markets, where even India is beginning to show improvements," Goldman Sachs global head of commodities research Jeffrey Currie contends .

Adds Currie, "With such robust demand growth against an almost inelastic supply curve outside of core OPEC+ (GCC + Russia), the global oil market is facing its deepest deficits since last summer at nearly 3.0 million barrels a day. With refiners quickly responding to small improvements in margins, petroleum product supplies have broadly matched this jump in end-use demand, leaving this deficit almost entirely in crude."

Brian Sozzi is an editor-at-large and anchor at Yahoo Finance . Follow Sozzi on Twitter @BrianSozzi and on LinkedIn . ->

Jun 23, 2021 | peakoilbarrel.com

OVI IGNORED 06/19/2021 at 8:01 pm

Ron

Enjoy a fourth. I wonder how much production will drop due to Claudette.

I think we are heading for the confirmation of peak oil sometime between mid 2022 and late 2023. REPLY RON PATTERSON IGNORED 06/19/2021 at 8:16 pm

What do you mean by confirmation? Do you mean they will confirm that the peak was 2018-2019? If so, I cannot agree. No, there will be deniers all the way down. There is something about the human psyche that just cannot accept reality... MATT MUSHALIK IGNORED 06/19/2021 at 8:57 pm

Thanks for continuing to monitor crude oil production. As of now, we are back to 2005 levels!

I have been looking at BP

17/6/2021

BP peak oil (UK decline, asset sales and decommissioning part 2)

https://crudeoilpeak.info/bp-peak-oil-uk-decline-asset-sales-and-decommissioning-part-230/4/2021

BP peak oil (UK decline, asset sales and decommissioning part 1)

https://crudeoilpeak.info/bp-peak-oil-uk-decline-asset-sales-and-decommissioning-part-1Many problems we see are now worse than in any peak oil scenario, especially in the airline industry. So I have been looking at the numbers and found:

22/5/2021

China-Australia passenger traffic has peaked 2018-19 before Covid

https://crudeoilpeak.info/china-australia-passenger-traffic-has-peaked-2018-19-before-covidIt is also generally assumed that electric vehicles will take over.

But in Australia power generation is insufficient to support any number of EVs which would be relevant to reduce oil demand:

14/6/2021

NSW power spot price spikes May 2021 become regular (part 2)

https://crudeoilpeak.info/nsw-power-spot-price-spikes-may-2021-become-regular-part-27/6/2021

NSW power spot price spikes May 2021 become regular (part 1)

https://crudeoilpeak.info/nsw-power-spot-price-spikes-may-2021-become-regular-part-1

Jun 22, 2021 | peakoilbarrel.com

OVI IGNORED 06/17/2021 at 10:03 am

Ron

The chart is old and was published in 2016 by Wood Mackenzie and there is no data for 2016. It also leaves out the discovery of Ghawar in 1948, first bar/spike. I have not seen any updates since then. Not sure if Guyana had been discovered in 2016. The original is attached.

REPLY SCHINZY IGNORED 06/18/2021 at 5:57 am

Here is Rystad's discovery graph 2013-2019 including gas. 2019 was better than 2016-2018 in terms of BOE, but it was a bit gassy:

REPLY RON PATTERSON IGNORED 06/17/2021 at 6:00 am

Is the energy transition just a fad??? Irina Slav at Oil Price.com says it is.

Energy Transition Fad Will Send Oil Sky High

Ironically, the wave of ESG investing in global energy markets may lead to much higher oil prices as a serious lack of capital expenditure on new fossil fuels dries up just as demand for crude continues to grow

Pressure from investors, tighter emissions regulation from governments, and public protests against their business have become more or less the new normal for oil companies. What the world -- or at least the most affluent parts of it -- seem to want from the oil industry is to stop being the oil industry.

Many investors are buying into this pressure. ESG investing is all the rage, and sustainable ETFs are popping up like mushrooms after a rain. But some investors are taking a different approach. They are betting on oil. Because what many in the pressure camp seem to underestimate is the fact that the supply of oil is not the only element of the oil equation.

"Imagine Shell decided to stop selling petrol and diesel today," the supermajor's CEO Ben van Beurden wrote in a LinkedIn post earlier this month. "This would certainly cut Shell's carbon emissions. But it would not help the world one bit. Demand for fuel would not change. People would fill up their cars and delivery trucks at other service stations."

Van Beurden was commenting on a Dutch court's ruling that environmentalists hailed as a landmark decision, ordering Shell to reduce its emissions footprint by 45 percent from 2019 levels by 2030.

Jun 22, 2021 | peakoilbarrel.com

RON PATTERSON IGNORED 06/17/2021 at 6:00 am

Is the energy transition just a fad??? Irina Slav at Oil Price.com says it is.

Energy Transition Fad Will Send Oil Sky High

Ironically, the wave of ESG investing in global energy markets may lead to much higher oil prices as a serious lack of capital expenditure on new fossil fuels dries up just as demand for crude continues to grow

Pressure from investors, tighter emissions regulation from governments, and public protests against their business have become more or less the new normal for oil companies. What the world -- or at least the most affluent parts of it -- seem to want from the oil industry is to stop being the oil industry.

Many investors are buying into this pressure. ESG investing is all the rage, and sustainable ETFs are popping up like mushrooms after a rain. But some investors are taking a different approach. They are betting on oil. Because what many in the pressure camp seem to underestimate is the fact that the supply of oil is not the only element of the oil equation.

"Imagine Shell decided to stop selling petrol and diesel today," the supermajor's CEO Ben van Beurden wrote in a LinkedIn post earlier this month. "This would certainly cut Shell's carbon emissions. But it would not help the world one bit. Demand for fuel would not change. People would fill up their cars and delivery trucks at other service stations."

Van Beurden was commenting on a Dutch court's ruling that environmentalists hailed as a landmark decision, ordering Shell to reduce its emissions footprint by 45 percent from 2019 levels by 2030. REPLY HICKORY IGNORED 06/18/2021 at 9:37 am

Cute headline.

'Energy Transition Fad'

Wrong terminology.

Its a shift that has barely started.

The global economy isn't going to just sit around while fossil fuel sources go into decline, despite how poorly large human organizations perform in the job of planning.

The effort is very weak to this point.

Poor grasp of the situation.

It will be grasped eventually, and then the effort will be strong.

Fad no. REPLY likbez 06/22/2021 at 4:10 pm There is a possibility of Seneca cliff as major Western countries probably will not be able to adapt to dramatically shirking of oil supply. That raises the question of the size of Earth population which is sustainable without "cheap oil" and several other interesting questions about the destiny of the current civilization and neoliberalism. Which is already in crisis since 2008 and the USA economy is in "secular stagnation" mode since the same date. The USA standard of living is partially based on cheap oil and when cheap oil is gone the crisis of neoliberalism will probably became more acute. It is difficult to predict what forms it will take but Trump in the past and the current woke movement are two examples of mal-adaptation to the crisis of neoliberalism in the USA and loss of legitimacy of neoliberal elite (woke movement=, which is supported by Dems and several major companies, is the attempt to switch the attention from this issue -- "look squirrel") I suspect this that current "irrational exuberance" about EV among the neoliberal elite and upper middle class (especially techno hamsters of Silicon Valley) will play a bad joke with the USA. Prols can't care less about this fashion and will stick to tried and true combustion engine cars, especially with the current exorbitant prices on EV.

Jun 14, 2021 | www.zerohedge.com

Authored by Cyril Widdershoven via OilPrice.com,

In its latest Monthly Oil Report, the IEA called on OPEC+ to increase production in order to counter higher demand in 2022.

... ... ...

The current market situation is very clear. OPEC+ is leading the sector, no matter what political strategies or activist shareholders at IOCs are planning. The market is still fully hydrocarbon addicted, and this will not change overnight.

The IEA also needs to reassess its current strategies and press approach, as a continuation of the diffuse ''Lala-land predictions'' will not make their case stronger.

As indicated by the IEA OMR report demand will increase by 5.36 million bpd in 2021, and another 3.07 million bpd in 2022. At the end of 2022, global demand is expected to be at 99.46 million b/d on average.

This optimism in the market is widely shared, looking at price predictions from Goldman Sachs, Bank of America, and Citibank, with some analysts even predicting $100 per barrel in 2022.

cowdiddly 1 hour ago (Edited)gregga777 48 minutes ago (Edited) remove linkI do not listen to government clowns.

"You want to know what the price of oil is going to do watch the rig count" T. Boone Pickins

Single best piece of energy investment advice I ever had.

Falconsixone 40 minutes agoThe IEA seems to be following this very mature behavioral advice:

"When in trouble,

When in doubt,

Run in circles,

Scream and shout."

GrayManSix 23 minutes agoTanks eat a lot of fuel.

radical-extremist 39 minutes ago remove linkInstead of "kill all the lawyers," it should now be "kill all the academics." People in ivory towers who have no inkling of the real world realities....

19331510 48 minutes ago remove linkI highly recommend "Unsettled" by Steven E. Koonin.

He does the best job to date of unpacking what we know and don't know about Climate Change.

Educate yourself on it...and hurry before the book is banned.

SonOfSam 48 minutes ago remove linkThere is no climate emergency and absolutely no reason to pursue net-zero emissions.

Co2 is 0.04% of the atmosphere and it is impossible for that small amount of gas to significantly impact the climate.

Co2 is the key driver of photosynthesis and higher levels of atmospheric co2 increase agricultural production necessary to feed an ever growing population.

The UAH temperature data indicates the average global temperature is 0.08 C above the 30 year average. There is no global warming.

The severity of storms and and number of severe storms are not increasing.

The oceans may be rising between 1.8 mm/yr to 3.6 mm/yr if at all. Tide gauges a wrought with issues.

The pursuit of a green economy will destroy our economy. manhattan-institute.org Mark P. Mills

There is no need to end the use hydrocarbons. Please educate yourself.

...The IEA has ALWAYS wanted OPEC+ to keep their pumps running...

Jun 13, 2021 | peakoilbarrel.com

RON PATTERSON IGNORED 06/13/2021 at 2:44 pm

Another scenario is that some exporting nations realize they will need this oil as the world stares into a scarcity of oil. They might say: "Shit, why are we selling this stuff when we will desperately need it for ourselves in a few years?" And as they cut back, or stop exporting altogether, the problem gets a lot worse, and prices spike even higher. REPLY DOUG LEIGHTON IGNORED 06/13/2021 at 3:34 pm

L.O.L. The decision concerning the proportion of a domestic resource that should be preserved for domestic needs, and how much to export, is interesting. China's REE deposits come to mind. Also, the impact of the immediate use of a resource versus a lower level of exploitation over time might come into play in some (perhaps unrealistic) scenarios as well. Not many examples of countries that have exhaustible natural resources saving some for future generations I'm aware of; probably would result in an unwelcome war or another ugly result!

Jun 13, 2021 | peakoilbarrel.com

LIKBEZ IGNORED 06/07/2021 at 6:40 pm

WTI at $70 is probably still bearable. Higher numbers dramatically increase chances of the recession (actually the USA is in secular stagnation since 2008).

Today I read the EROEI of solar is around 0.8 outside of deserts. A recent paper by Ferroni and Hopkirk estimated an EROI=0.8 for PV in Switzerland. https://www.sciencedirect.com/science/article/pii/S0301421516307066

You need EROEI around 7 for the source of energy to be economically viable. Wind barely makes it, but solar, outside of deserts does not.

Another interesting figure is that the energy density ( KW/kg ) of lithium batteries is approximately 100 times less then energy density of diesel (gas has slightly lower energy density; kerosene approximately the same).

A subcompact car with a 10-gallon gas tank can store the energy equivalent of 7 Teslas, 15 Nissan Leafs or 23 Chevy Volts, according to industry sources. REPLY PHIL S IGNORED 06/07/2021 at 7:50 pm

" interesting figure is that the energy density ( KW/kg ) of lithium batteries is approximately 100 times less then energy density of diesel "

but don't forget the energy in the diesel is about 30% efficient converting into work while the battery is over 90% efficent doing work – so comparing energy "stored" in compact cars and teslas etc is either pretty useless or pretty misleading REPLY MIKE SUTHERLAND IGNORED HOLE IN HEAD IGNORED 06/12/2021 at 6:35 amLikbez , I will make an effort to answer your 3 questions .

1. Peak oil was /is 2018 . Plateau will be 5 years . Why ? The parameter is exportable oil production and not total oil production . ELM is a bitch .

2 . Nuclear fusion . Not going to happen . It is like the horizon . We can see it but we can't reach it .

3 . USA situation . I am least qualified to comment as I am in Europe , but still the safest is that the current political system cannot continue for long especially when I look at it with the lenses of resource availability . There are no volunteers for starvation . What will replace this ? I don't know .

P.S :Your sentence "Like in war this is the question of strategy. Wrong strategy usually leads to defeat. " I am going to be using this . Hope you don't have a copyright on this . 🙂But your post is also misleading and leaves the reader with the impression that you're little more than an EV propagandist. Even at 30% efficiency for diesel, there is still 100/3 = 33.3x more energy available than a comparably sized lithium battery. That huge difference is far and anyway superior to anything a battery will ever do, ever. It will never be matched by any electrochemical storage scheme. So there is that. REPLY KLEIBER IGNORED 06/09/2021 at 1:42 pm

Indeed. The advantages EVs have come from efficiency in weight reduction (aside from the battery pack) and aerodynamics, along with electric motors being super simple and efficient. But in terms of raw energy density, you cannot beat chemical fuels, and there really isn't anything that threatens this by virtue of the chemistry.

Batteries, for all their advantages in simplicity, are never going to be lighter and more energy dense. Lithium is just about the best there is in terms of weight to energy ratio, something quite key for a moving vehicle. REPLY LIKBEZ IGNORED 06/09/2021 at 7:10 pm

Mike,

Electrical engines proved to be viable for small cars and delivery trucks with short ranges. No question about it. But that does not mean they are optimal. This is just a fashion partially fueled by people who missed their STEM classes 😉

I think natural gas is currently a viable competitor to EV and is IMHO a much better feat.

First of all charging efficiency of lithium battery is only 80%.

That's true that electrical motor is more efficient, but when you have a transmission using multiple gears most of this difference is lost.Also you overestimated the efficiency of the tandem lithium battery -- electrical motor, as it includes converter with efficiency less then 90% and a lithium battery has its own internal resistance which increases with age and also lead to losses. 0.8*0.8*0.9=0.57. BTW modern diesel engines efficiency is about 43%-44%, based on 2013-2014 certified engines.

Moreover the efficiency of lithium battery in winter is dismal. And not only because at low temperatures is simply does not work well and its capacity is less. A lot of energy is consumed by the cabin heater. IMHO driving EV in severe winter is dangerous not withstanding short trips to nearby sky resort that some make on their Tesla 3 🙂 REPLY JOHN NORRIS IGNORED 06/10/2021 at 7:06 am

The average US car goes 0.74 miles on a kWh of gasoline. Many Teslas and the Hyundai Kona (among others) go 4.0 miles per kWh.

Cost per mile is $0.12 for gasoline, $0.06 for California EV, $0.03 for average EV. HICKORY IGNORED 06/07/2021 at 10:35 pm

Likbez.

Switzerland has poorer solar input than any place in the lower 48, even pacific northwest coastal, so its a lame site to use as a yardstick.

I know people who do 100% of their driving miles with solar from the roof, at lower cost than your miles.

And they didn't check the EROEI figures before or after the purchase of equipment.

The solar is already paid off for them, and they've got 2 to 4 more decades of electricity coming from that system.

And I know people who have driven across the entire country with no liquid fuel tank-nothing for energy storage in their EV but lithium. And the acceleration of their car will pin you deep in your seat if they aren't careful with the pedal.Hey- look on the bright side- every mile that solar/electric vehicles travel is just another mile of gasoline left for you. REPLY MIKE SUTHERLAND IGNORED 06/09/2021 at 9:22 am

Hickory, how many of those solar panels were subsidized by government? A lot of them. And what's more, even though early adopters charged their Teslas from those subsidized panels, did that somehow change the EREOI from 0.8? How is the rest of society going to benefit if all the early opportunists managed to get cheap cells at an artificially low price, that actually were fantastically expensive in real terms regarding the cheap energy (at the time) that was used to make them?

And so what if they drove across the country in electric power??? WTF? What does that prove? Was there actually anything productive generated by this hugely energy intensive self-interested activity? No, there was not. It was nothing more than a display of self indulgence, and an excessive one at that. REPLY HICKORY IGNORED 06/09/2021 at 10:11 am

MikeS.

"The Energy Payback Time of PV systems is dependent on the geographical location: PV systems in Northern Europe need around 1.5 years to balance the input energy, while PV systems in the South equal their energy input after 1 year and less,"

https://www.ise.fraunhofer.de/content/dam/ise/de/documents/publications/studies/Photovoltaics-Report.pdf

After 25 years modern panels still have between 82-93% peak capacity output.In regard to the feasibility of lithium batteries- I was pointing out that they work well enough (are dense enough) to get the job done. Its not a complicated idea. Likebz referenced diesel energy density. Thats very good, but in case you haven't been keeping up- peak crude oil is upon us, so time to adapt. Past time actually.

Bottomline- both solar energy and electric vehicles are viable systems for transportation. And that is nice considering the world faces peak oil supply.

Some people would prefer to witness the countries economy crash and burn as peak oil becomes a reality. I guess they think they would make more money for the short term. Others would like to see the country gradually deploy other ways to get around. REPLY KLEIBER IGNORED 06/09/2021 at 1:57 pm

If nothing else, this scenario will lead to a radical reshaping of how we as a species go about doing logistics. If the pandemic hasn't called into question the application of JIT logistics for all industries, then the loss of cheap diesel certainly will. Even if long haul electric trucks become a thing, it will require a different approach to matters.

Cars are otherwise a solved issue with EVs. There's nothing that an ICE can really offer over an EV. Trucking and heavy industry is another matter, and that's where problems will be. Frankly, I welcome this uprooting of a paradigm that has no resilience built in whatsoever. LIKBEZ IGNORED 06/10/2021 at 3:26 pm

You are both funny and superficial.

There is no question that "electric vehicles are viable systems for transportation. " that's true since 1940th I think. Just think about electric trains and diesel-electric trains :-). Also as compact cars they are viable in temperate climate (Leaf, Tesla, etc) and possibly in big cities and corresponding metropolitan areas.

Some people would prefer to witness the countries economy crash and burn as peak oil becomes a reality. I guess they think they would make more money for the short term. Others would like to see the country gradually deploy other ways to get around.

Like in war this is the question of strategy. Wrong strategy usually leads to defeat. I think the current EV fashion driven by people who missed their STEM classes is counterproductive and probably harmful.

It might well lead to problems in the near future. You should never put all eggs into one basket. Lightweight and emotion-driven arguments like your above just does not make the cut, if we are taking about the strategy.Some interesting questions are

1. If we reached "plato oil" stage (I think so), then how long it will last before Seneca cliff? 10 year, 50 years, 100 years ? That's a big difference.

2. Will we get fusion energy driven energy generation or not.

3. Will neoliberalism be replaced in the USA by some other social system, because neoliberalism (and connected with it imperial tendencies ("Full Spectrum Domination" doctrine), and the corresponding level of military expenses -- money that should be allocated toward the energy transition are simply waited on maintaining and expanding of the empire) can't reform itself and probably will drive this country off the economic cliff, or to the WWIII (with even worse results).

Jun 13, 2021 | peakoilbarrel.com

FRUGAL IGNORED ROGER IGNORED 06/11/2021 at 9:35 am

"Ideology will obviously always trump common sense." So true ;).

Saudi Arabia And Russia Warn Of Major Oil Supply Crunch

Environmentalists and activist shareholders intensified pressure on large public oil firms to align their businesses with a net-zero scenario, while some of the international majors acknowledged they have a part to play in the energy transition.

But the leaders of the OPEC+ group, Saudi Arabia and Russia, will continue to invest in oil and gas because, they say, the world will still need those resources for decades, despite the growing push against fossil fuels and investment in new supply.

Chronic underinvestment in oil and gas supply while operational oilfields mature would lead to a supply crunch and a spike in oil prices down the road, analysts and Big Oil top executives such as TotalEnergies' Patrick Pouyanné say.

Apologies if this has already been posted. REPLY RON PATTERSON IGNORED 06/10/2021 at 6:57 pm

From your link: BP's chief executive Bernard Looney wrote that forecasts of much lower investments in oil and gas were "in many ways consistent with our approach – to reduce our oil and gas production by 40% in the next decade.

Snip.

In Russia, the chief executive of the largest Russian oil producer, state-controlled Rosneft, warned that underinvestment in oil is setting the stage for a severe deficit in supply.Yes, oil production will be falling and oil prices will be rising. Anyone with half a brain can see that. But it will have to happen before the world will be able to see what is right now as plain as the nose on their face. Their worldview keeps them from seeing the very blatantly obvious. Ideology will obviously alwayse trump common sense. REPLY FRUGAL IGNORED 06/10/2021 at 8:17 pm

It's looking more and more like peak oil is here right now. REPLY RON PATTERSON IGNORED 06/10/2021 at 8:56 pm

Nah, peak oil was in 2018.

Jun 12, 2021 | oilprice.com

John Kilduff of Again Capital has predicted Brent to hit $80 a barrel and WTI to trade between $75 and $80 in the summer, thanks to robust gasoline demand. Brent is currently trading at $71.63 per barrel, while WTI is changing hands at $69.13.

Jun 11, 2021 | peakoilbarrel.com

HHH IGNORED 06/11/2021 at 4:57 am

On 05/07/21 the US 10year chart formed a hammer candlestick on daily chart within a consolidation pattern. Which suggested higher yields coming. Well little over a month later price broke below the bottom of that candlestick which suggest that the bond market doesn't believe the inflation we have seen is here to stay. Yield headed lower.

The inflation we have had seems to be supply side due to covid. If inflation is at peak which bond market is suggesting. Oil price might not have much more room to run higher. And I'd take it a step further and say price inflation due to a weaker dollar is starting to real hurt places like China and they are going to act by tightening monetary policy. You think this would be positive for the yuan and push the dollar even lower. But when you tightening monetary policy credit contracts and economic activity contracts.

I do expect oil price to rollover and head back to $50-$55 might happen from a slightly higher price from here because of lag time between when bond market signals rollover in inflation back into deflation and when prices start reacting to this. REPLY EULENSPIEGEL IGNORED 06/11/2021 at 10:07 am

This isn't your history bond market.

Inflation doesn't really matters, what only matters is the one big question: "How much bonds does the one market member with unlimited funds buy?".

And the time the FED was able to rise more than .25% is in the rear mirror "" when they hike now, inflation or not, all these zombie companies and zombie banks will fail and no lawyer in the world will be able to clean up the chaos after all these insolvency filings.

They have to talk the way out of this inflation. They have to talk until it stops, or longer. They can't hike. They can perhaps hike again when most of the debt is inflated away "" a period with 10+% inflation and 1% bond interrest.

And yes, they can buy litterally any bond dumped onto the market "" shown this in March last year when they stopped the corona crash in an action of one week.

I think most non-investment-banks are zombies at the moment, and more than 20% of all companies. They all will fail in less than 1 year when we would have realistic interrest rates. On the dirty end, this would mean 10%+ for all this junk out there "" even mighty EXXON will be downgraded to B fast.

In old times the FED rates would be more than 5% now with these inflation numbers. Nobody can pay this these days.

And now in the USA "" look for how much social justice and social security laws you'll get. The FED has to provide cover for all of them.

We in Europe will do this, too. New green deal, new CO2 taxes, better social security "" the ECB already has said they will swallow everything dumped on the market.

So, oil 100$ the next years "" but some kind of strange dollars buying less then they used to.

Just my 2 cents. REPLY D COYNE IGNORED 06/11/2021 at 7:58 am

From

https://longforecast.com/oil-price-today-forecast-2017-2018-2019-2020-2021-brent-wti

better resolution at link above, a very different oil price forecast from HHH. Over $100/bo for Brent by the end of 2021.

REPLY RON PATTERSON IGNORED 06/11/2021 at 8:28 am

This is nonsense. They have Brent crude oil prices peaking, so far, in March 2025 at $164.11. And they have WTI peaking the same month at $132.55, $32.56 lower. There is no way the spread could be that large. Also, they have natural gas prices dropping over the same period. Just who the hell are these "Longforcast.com" people?

REPLY KLEIBER IGNORED 06/11/2021 at 11:35 am

Disregard anything with "forecast" in the title. They don't have a time machine, and extrapolation is a horrible metric with dynamic markets as complex as the energy ones.

Might as well show me the tea leaves or goat entrails and tell me the price on 11 June 2027. REPLY SHALLOW SAND IGNORED 06/11/2021 at 3:58 pm

Dennis Gartman is still considered a commodities expert.

He infamously said in 2016 that WTI would never be above $44 again in his lifetime. He is still alive last I knew.

Since I have owned working interests in oil wells (1997) I have sold oil for a low of $8 and a high of $140 per barrel. 6/14 oil sold for $99.25 per barrel. 4/20 oil sold for $15.40 per barrel.

Predicting oil prices is impossible.

About the only oil price prediction I have had right so far is that if Biden won, oil prices would rebound. Of course, we can argue about why that is, and if there is even any connection.

There are still no drilling rigs running in the field we operate in. There are still hundreds of production wells shut in. There are still less than 10 workover rigs running in our field. The largest operator still has a help wanted sign up in front of its office. We finally found one summer worker, he is still in high school, but thankfully covered by our workers comp. He cannot drive our trucks, and is limited to painting, mowing, weed control, digging with a shovel, cleaning the shops and pump houses and other tasks like those. That's ok, because we need that, but not being able to drive is a pain. But auto ins won't allow anyone under 21 to be covered. REPLY IRON MIKE IGNORED 06/11/2021 at 11:53 am

Yea Ron i agree with Kleiber, I wouldn't take anything on that site too seriously. REPLY OVI IGNORED 06/11/2021 at 1:34 pm

The IEA is now starting to sound warnings about supply. Last week they were telling the oil companies to stop exploring and to move toward a renewable energy future.

IEA: OPEC needs to increase supply to keep global oil markets adequately supplied

In its monthly oil report, the International Energy Agency (IEA) has said that global oil demand is set to return to pre-pandemic levels by the end of 2022, rising by 5.4 million bpd in 2021 and by a further 3.1 million bpd next year. The OECD accounts for 1.3 million bpd of 2022 growth while non-OECD countries contribute 1.8 million bpd. Jet and kerosene demand will see the largest increase ( 1.5 million bpd year-on-year), followed by gasoline ( 660 000 bpd year-on-year) and gasoil/diesel ( 520 000 bpd year-on-year).

World oil supply is expected to grow at a faster rate in 2022, with the US driving gains of 1.6 million bpd from producers outside the OPEC alliance. That leaves room for OPEC to boost crude oil production by 1.4 million bpd above its July 2021-March 2022 target to meet demand growth. In 2021, oil output from non-OPEC is set to rise 710 000 bpd, while total oil supply from OPEC could increase by 800 000 bpd if the bloc sticks with its existing policy.

https://www.iea.org/reports/oil-market-report-june-2021

https://www.oilfieldtechnology.com/special-reports/11062021/iea-opec-needs-to-increase-supply-to-keep-global-oil-markets-adequately-supplied/ REPLY RON PATTERSON IGNORED 06/11/2021 at 2:09 pm

(IEA) has said that global oil demand is set to return to pre-pandemic levels by the end of 2022, rising by 5.4 million bpd in 2021 and by a further 3.1 million bpd next year.

That comes to about 500,000 barrels per day monthly increase, every month until the end of 2022. I really don't believe that is going to happen. No doubt most nations can increase production somewhat, but returning to pre-pandemic levels will be a herculean task for most of them.