|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

|

|

Switchboard | ||||

| Latest | |||||

| Past week | |||||

| Past month | |||||

|

|

|

|

vatican.va

... Such an economy kills. How can it be that it is not a news item when an elderly homeless person dies of exposure, but it is news when the stock market loses two points? This is a case of exclusion. Can we continue to stand by when food is thrown away while people are starving? This is a case of inequality. Today everything comes under the laws of competition and the survival of the fittest, where the powerful feed upon the powerless. As a consequence, masses of people find themselves excluded and marginalized: without work, without possibilities, without any means of escape.

Human beings are themselves considered consumer goods to be used and then discarded. We have created a "disposable" culture which is now spreading. It is no longer simply about exploitation and oppression, but something new. Exclusion ultimately has to do with what it means to be a part of the society in which we live; those excluded are no longer society's underside or its fringes or its disenfranchised – they are no longer even a part of it. The excluded are not the "exploited" but the outcast, the "leftovers".

54. In this context, some people continue to defend trickle-down theories which assume that economic growth, encouraged by a free market, will inevitably succeed in bringing about greater justice and inclusiveness in the world. This opinion, which has never been confirmed by the facts, expresses a crude and naïve trust in the goodness of those wielding economic power and in the sacralized workings of the prevailing economic system. Meanwhile, the excluded are still waiting. To sustain a lifestyle which excludes others, or to sustain enthusiasm for that selfish ideal, a globalization of indifference has developed. Almost without being aware of it, we end up being incapable of feeling compassion at the outcry of the poor, weeping for other people's pain, and feeling a need to help them, as though all this were someone else's responsibility and not our own. The culture of prosperity deadens us; we are thrilled if the market offers us something new to purchase; and in the meantime all those lives stunted for lack of opportunity seem a mere spectacle; they fail to move us.

No to the new idolatry of money

55. One cause of this situation is found in our relationship with money, since we calmly accept its dominion over ourselves and our societies. The current financial crisis can make us overlook the fact that it originated in a profound human crisis: the denial of the primacy of the human person! We have created new idols. The worship of the ancient golden calf (cf. Ex 32:1-35) has returned in a new and ruthless guise in the idolatry of money and the dictatorship of an impersonal economy lacking a truly human purpose. The worldwide crisis affecting finance and the economy lays bare their imbalances and, above all, their lack of real concern for human beings; man is reduced to one of his needs alone: consumption.

56. While the earnings of a minority are growing exponentially, so too is the gap separating the majority from the prosperity enjoyed by those happy few. This imbalance is the result of ideologies which defend the absolute autonomy of the marketplace and financial speculation. Consequently, they reject the right of states, charged with vigilance for the common good, to exercise any form of control. A new tyranny is thus born, invisible and often virtual, which unilaterally and relentlessly imposes its own laws and rules. Debt and the accumulation of interest also make it difficult for countries to realize the potential of their own economies and keep citizens from enjoying their real purchasing power. To all this we can add widespread corruption and self-serving tax evasion, which have taken on worldwide dimensions. The thirst for power and possessions knows no limits. In this system, which tends to devour everything which stands in the way of increased profits, whatever is fragile, like the environment, is defenseless before the interests of a deified market, which become the only rule.

No to a financial system which rules rather than serves

57. Behind this attitude lurks a rejection of ethics and a rejection of God. Ethics has come to be viewed with a certain scornful derision. It is seen as counterproductive, too human, because it makes money and power relative. It is felt to be a threat, since it condemns the manipulation and debasement of the person. In effect, ethics leads to a God who calls for a committed response which is outside of the categories of the marketplace. When these latter are absolutized, God can only be seen as uncontrollable, unmanageable, even dangerous, since he calls human beings to their full realization and to freedom from all forms of enslavement. Ethics – a non-ideological ethics – would make it possible to bring about balance and a more humane social order. With this in mind, I encourage financial experts and political leaders to ponder the words of one of the sages of antiquity: "Not to share one's wealth with the poor is to steal from them and to take away their livelihood. It is not our own goods which we hold, but theirs".[55]

58. A financial reform open to such ethical considerations would require a vigorous change of approach on the part of political leaders. I urge them to face this challenge with determination and an eye to the future, while not ignoring, of course, the specifics of each case. Money must serve, not rule! The Pope loves everyone, rich and poor alike, but he is obliged in the name of Christ to remind all that the rich must help, respect and promote the poor. I exhort you to generous solidarity and a return of economics and finance to an ethical approach which favours human beings.

No to the inequality which spawns violence

59. Today in many places we hear a call for greater security. But until exclusion and inequality in society and between peoples is reversed, it will be impossible to eliminate violence. The poor and the poorer peoples are accused of violence, yet without equal opportunities the different forms of aggression and conflict will find a fertile terrain for growth and eventually explode. When a society – whether local, national or global – is willing to leave a part of itself on the fringes, no political programmes or resources spent on law enforcement or surveillance systems can indefinitely guarantee tranquility. This is not the case simply because inequality provokes a violent reaction from those excluded from the system, but because the socioeconomic system is unjust at its root. Just as goodness tends to spread, the toleration of evil, which is injustice, tends to expand its baneful influence and quietly to undermine any political and social system, no matter how solid it may appear. If every action has its consequences, an evil embedded in the structures of a society has a constant potential for disintegration and death. It is evil crystallized in unjust social structures, which cannot be the basis of hope for a better future. We are far from the so-called "end of history", since the conditions for a sustainable and peaceful development have not yet been adequately articulated and realized.

60. Today's economic mechanisms promote inordinate consumption, yet it is evident that unbridled consumerism combined with inequality proves doubly damaging to the social fabric. Inequality eventually engenders a violence which recourse to arms cannot and never will be able to resolve. This serves only to offer false hopes to those clamouring for heightened security, even though nowadays we know that weapons and violence, rather than providing solutions, create new and more serious conflicts. Some simply content themselves with blaming the poor and the poorer countries themselves for their troubles; indulging in unwarranted generalizations, they claim that the solution is an "education" that would tranquilize them, making them tame and harmless. All this becomes even more exasperating for the marginalized in the light of the widespread and deeply rooted corruption found in many countries – in their governments, businesses and institutions – whatever the political ideology of their leaders.

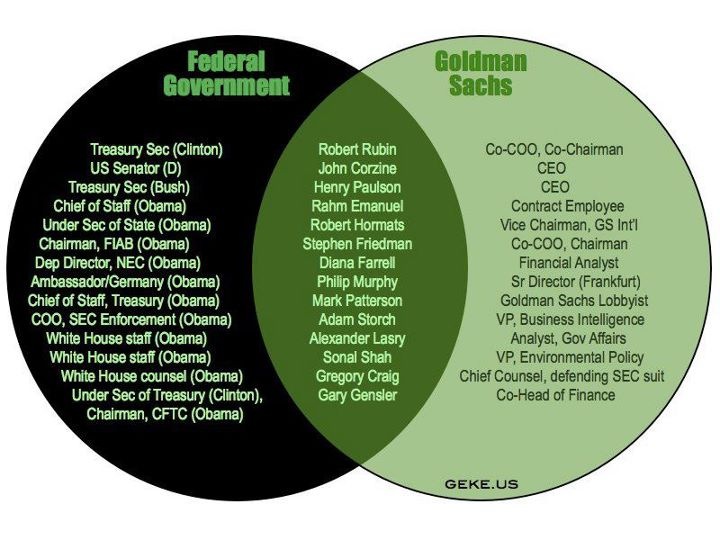

Zero Hedge

The root cancer at the core of the U.S., and indeed global economy, is cronyism and an absence of the rule of law when it comes to oligarchs. In the U.S., this cronyism is best described as an insidious relationship between large multi-national corporations and big government to funnel all of the wealth and resources of the nation to themselves at the expense of everyone else. In a genuine free market defined by heightened competition and governed by an equal application of the rule of law to all, the 0.1% does not aggregate all of a nation's wealth. This sort of thing only happens in crony capitalism, which is basically nothing more than complete and total insider deals to aggregate newly created money into the hands of the few. The following profile of Washington D.C.'s so-called "boom" from the St. Louis Post-Dispatch pretty much tells you all you need to know.

* * *

The more corrupt the state, the more numerous the laws.

- TacitusEver since I started writing about what is happening in the world around me, my primary theme has been that the root cancer at the core of the U.S., and indeed global economy, is cronyism and an absence of the rule of law when it comes to oligarchs. In the U.S., this cronyism is best described as an insidious relationship between large multi-national corporations and big government to funnel all of the wealth and resources of the nation to themselves at the expense of everyone else. In a genuine free market defined by heightened competition and governed by an equal application of the rule of law to all, the 0.1% does not aggregate all of a nation's wealth. This sort of thing only happens in crony capitalism, which is basically nothing more than complete and total insider deals to aggregate newly created money into the hands of the few.

The following profile of Washington D.C.'s so-called "boom" from the St. Louis Post-Dispatch pretty much tells you all you need to know. While I think the tone of the article is absurd considering this is no "economic boom," but merely parasitic wealth extraction on a unprecedented scale, it is still quite telling. It is no coincidence that as D.C. has grown wealthier, the nation has become much, much poorer. Key excerpts below:

The avalanche of cash that made Washington rich in the last decade has transformed the culture of a once staid capital and created a new wave of well-heeled insiders.

The winners in the new Washington are not just the former senators, party consiglieri and four-star generals who have always profited from their connections. Now they are also the former bureaucrats, accountants and staff officers for whom unimagined riches are suddenly possible. They are the entrepreneurs attracted to the capital by its aura of prosperity and its super-educated workforce. They are the lawyers, lobbyists and executives who work for companies that barely had a presence in Washington before the boom.

At the same time, big companies realized that a few million spent shaping legislation could produce windfall profits. They nearly doubled the cash they poured into the capital.

Sorry these aren't "entrepreneurs," they are parasitic opportunists.

At Cafe Joe, a greasy spoon near the National Security Agency in suburban Maryland, software engineers with top-secret clearances merely have to look at the place mats under their fried eggs to find federal contractors trying to entice them away from their government jobs with six-figure salaries and stock options. The place-mat ads cost $250 a week. They are sold out through 2014.

During the past decade, the region added 21,000 households in the nation's top 1 percent. No other metro area came close.

Two forces triggered the boom.

The share of money the government spent on weapons and other hardware shrank as service contracts nearly tripled in value. At the peak in 2010, companies based in Rep. James Moran's congressional district in Northern Virginia reaped $43 billion in federal contracts - roughly as much as the state of Texas.

Back in 2000, the company spent a mere $260,000 lobbying Congress, federal records show. Its lobbyists mostly talked to lawmakers about health care: medical manufacturing issues, Medicare reimbursement rates, privacy of health records, and congressional oversight of the Food and Drug Administration.

By the end of the decade, the company had broadened its horizons dramatically. "Government relations" now accounted for $2.6 million - a tenfold increase. On one quarterly disclosure report from 2010, Boston Scientific listed 35 different pieces of legislation on which it was lobbying. They included proposals on patent reform, tax penalties for moving American jobs abroad, tax credits for research and development, rules for transporting lithium batteries, limits on workers' ability to form labor unions and federal regulation of certain types of financial derivatives.

Government relations has become so important to the bottom line of a modern company, Becker said, that it should be a required course at business school. The numbers suggest she's right. Companies spent about $3.5 billion annually on lobbying at the end of the last decade, a nearly 90 percent increase from 1999 after adjusting for inflation, political scientist Lee Drutman notes in a forthcoming book, "The Business of America Is Lobbying."

And you wonder why the economy sucks?

Legal services also boomed, fueled by the growing complexities of federal business regulations. The number of lawyers in the D.C. metro area increased by a third from 2000 to 2012, nearly twice as fast as the growth rate nationwide. And those lawyers have the highest mean salaries in the country, according to George Mason University's Center for Regional Analysis.

The more companies spend on influence, the lower their effective tax rates and the higher their stock returns compared with competitors', according to recent research. A company called Strategas has built an index to track the stock performance of the 50 companies that lobby the most; last year, that index outperformed the rest of the market by 30 percent.

If you still are confused why the U.S. economy is completely stuck in the mud, look no further than the parasites of Washington D.C.

Full article here.

Nov 6, 2013 | Asia Times

Speaking Freely is an Asia Times Online feature that allows guest writers to have their say. Please click here if you are interested in contributing.

When Naomi Klein published her ground-breaking book The Shock Doctrine (2007), which compellingly demonstrated how neoliberal policy makers take advantage of overwhelming crisis times to privatize public property and carry out austerity programs, most economists and media pundits scoffed at her arguments as overstating her case. Real world economic developments have since strongly reinforced her views.

Using the unnerving 2008 financial crash, the ensuing long recession and the recurring specter of debt default, the financial oligarchy and their proxies in the governments of core capitalist countries have embarked on an unprecedented economic coup d'état against the people, the ravages of which include extensive privatization of the public sector, systematic application of neoliberal austerity economics and radical redistribution of resources from the bottom to the top. Despite the truly historical and paradigm-shifting importance of these ominous developments, their discussion remains altogether outside the discourse of mainstream economics.

The fact that neoliberal economists and politicians have been cheering these brutal assaults on social safety-net programs should not be surprising. What is regrettable, however, is the liberal/Keynesian economists' and politicians' glaring misdiagnosis of the plague of austerity economics: it is all the "right-wing" Republicans' or Tea Partiers' fault, we are told; the Obama administration and the Democratic Party establishment, including the labor bureaucracy, have no part or responsibility in the relentless drive to austerity economics and privatization of public property.

Keynesian and other liberal economists and politicians routinely blame the abandonment of the New Deal and/or Social-Democratic economics exclusively on Ronald Reagan's supply-side economics, on neoliberal ideology or on economists at the University of Chicago. Indeed, they characterize the 2008 financial collapse, the ensuing long recession and the recurring debt/budgetary turmoil on "bad" policies of "neoliberal capitalism," not on class policies of capitalism per se. [1]

Evidence shows, however, that the transition from Keynesian to neoliberal economics stems from much deeper roots or dynamics than pure ideology [2]; that neoliberal austerity policies are class, not "bad," policies [3]; that the transition started long before Reagan arrived in the White House; and that neoliberal austerity policies have been pursued as vigorously (though less openly and more stealthily) by the Democratic administrations of Bill Clinton and Barack Obama as their Republican counterparts. [4]

Indeed, it could be argued that, due to his uniquely misleading status or station in the socio-political structure of the United States, and equally unique Orwellian characteristics or personality, Obama has served the interests of the powerful financial oligarchy much better or more effectively than any Republican president could do, or has done - including Ronald Reagan. By the same token, he has more skillfully hoodwinked the public and harmed their interests, both in terms of economics and individual/constitutional rights, than any of his predecessors.

Ronald Reagan did not make any bones about the fact that he championed the cause of neoliberal supply-side economics. This meant that opponents of his economic agenda knew where he stood, and could craft their own strategies accordingly.

By contrast, Obama publicly portrays himself as a liberal opponent of neoliberal austerity policies (as he frequently bemoans the escalating economic inequality and occasionally sheds crocodile tears over the plight of the unemployed and economically hard-pressed), while in practice he is a major team player in the debt "crisis" game of charade, designed as a shock therapy scheme in the escalation of austerity economics. [5]

No president or major policy maker before Obama ever dared to touch the hitherto untouchable (and still self-financing) Social Security and Medicare trust funds. He was the first to dare to make these bedrock social programs subject to austerity cuts, as reflected, for example, in his proposed federal budget plan for fiscal year 2014, initially released in April 2013. Commenting on this unprecedented inclusion of entitlements in the social programs to be cut, Christian Science Monitor wrote (on April 9, 2013): "President Obama's new budget proposal ... is a sign that Washington's attitude toward entitlement reform is slowly shifting, with prospects for changes to Social Security and Medicare becoming increasingly likely."

Obama has since turned that "likelihood" of undermining Social Security and Medicare into reality. He did so by taking the first steps in turning the budget crisis that led to government shutdown in the first half of October into negotiations over entitlement cuts. In an interview on the second day of the shutdown (October 3rd), he called for eliminating "unnecessary" social programs and discussing cuts in "long-term entitlement spending". [6]

Five days later on October 5th, Obama repeated his support for cutting Social Security and Medicare in a press conference, reassuring congressional Republicans of his willingness to agree to these cuts (as well as to cuts in corporate tax rates from 35% to 28%) if the Republicans voted to increase the government's debt limit: "If anybody doubts my sincerity about that, I've put forward proposals in my budget to reform entitlement programs for the long haul and reform our tax code in a way that would ... lower rates for corporations". [7]

Only then, that is, only after Obama agreed to collaborate with the Republicans on ways to cut both the entitlements and corporate tax rates, the Republican budget negotiators agreed to the higher budget ceiling and the reopening of the government. The consensus bill that ended the government shutdown extends the automatic across-the-board "sequester" cuts that began last March into the current year. This means that "the budget negotiations in the coming weeks will take as their starting point the $1 trillion in cuts over the next eight years mandated by the sequestration process". [8]

And so, once again, the great compromiser gave in, and gave away - all at the expense of his (unquestioning) supporters.

To prepare the public for the long-awaited attack on Social Security, Medicare and other socially vital programs, the bipartisan ruling establishment has in recent years invented a very useful hobgoblin to scare the people into submission: occasional budget/debt crises and the specter or the actual pain of government shutdown. As Sheldon Richman recently pointed out:

"Wherever we look, there are hobgoblins. The latest is … DEFAULT. Oooooo.Economic policy makers in the White House and the Congress have invoked the debt/deficit hobgoblin at least three times in less than two years: the 2011 debt-ceiling panic, the 2012 "fiscal cliff" and, more recently, the 2013 debt-ceiling/government shutdown crisis - all designed to frighten the people into accepting the slashing of vital social programs. Interestingly, when Wall Street speculators needed trillions of dollars to be bailed out, or as the Fed routinely showers these gamblers with nearly interest-free money through the so-called quantitative easing, debt hobgoblins were/are nowhere to be seen!Apparently the threats of international terror and China rising aren't enough to keep us alarmed and eager for the tether. These things do tend to wear thin with time. But good old default can be taken off the shelf every now and then. It works like a charm every time.

No, no, not default! Anything but default!". [9]

The outcome of the latest (2013) "debt crisis management," which led to the 16-day government shutdown (October 1-16), confirmed the view that the "crisis" was essentially bogus. Following the pattern of the 2010, 2011 and 2012 budget/debt negotiations, the bipartisan policy makers kept the phony crisis alive by simply pushing its "resolution" several months back to early 2014. In other words, they did not bury the hobgoblin; they simply shelved it for a while to be taken off when it is needed to, once again, frighten the people into accepting additional austerity cuts - including Social Security and Medicare.

The outcome of the budget "crisis" also highlighted the fact that, behind the apparent bipartisan gridlock and mutual denunciations, there is a "fundamental consensus between these parties for destroying all of the social gains won by the working class over the course of the twentieth century". [10] To the extent there were disagreements, they were mainly over the tone, the temp, the magnitude, the tactics, and the means, not the end. At the heart of all the (largely contrived) bipartisan bickering was how best to escalate, justify or camouflage the brutal cuts in the vitally necessary social spending.

The left/liberal supporters of Obama, who bemoan his being "pressured" or "coerced" by the Tea Party Republicans into right-wing compromises, should look past his liberal/populist posturing. Evidence shows that, contrary to Barack Obama's claims, his presidential campaigns were heavily financed by the Wall Street financial titans and their influential lobbyists. Large Wall Street contributions began pouring into his campaign only after he was thoroughly vetted by powerful Wall Street interests, through rigorous Q & A sessions by the financial oligarchy, and was deemed to be their "ideal" candidate for presidency. [11]

Obama's unquestioning followers should also note that, to the extent that he is being "pressured" by his political opponents into compromises/concessions, he has no one to blame but himself: while the Republican Party systematically mobilizes its social base through offshoots like Tea Partiers, Obama tends to deceive, demobilize and disarm his base of supporters. Instead of mobilizing and encouraging his much wider base of supporters (whose more numerous voices could easily drown the shrill voices of Tea Partiers) to political action, he frequently pleads with them to "be patient," and "keep hope alive."

As Andre Damon and Barry Grey have keenly observed, "There was not a single mass organization that denounced the [government] shutdown or opposed it. The trade unions are completely allied with the Obama administration and support its policies of austerity and war". [12]

Obama's supporters also need to open their eyes to the fact that, as I have shown in an earlier essay, [13] Obama harbors ideological affinities that are more in tune with Ronald Reagan than with FDR. This is clearly revealed in his book, The Audacity of Hope, where he shows his disdain for

"...those who still champion the old time religion, defending every New Deal and Great Society program from Republican encroachment, achieving ratings of 100% from the liberal interest groups. But these efforts seem exhausted…bereft of energy and new ideas needed to address the changing circumstances of globalization". [14]

(Her own shortcomings aside, Hillary Clinton was right when, in her bid for the White House against Obama, she pointed out that Obama's economic philosophy was inspired largely by Reagan' supply-side economics. However, because the Wall Street and/or the ruling establishment had already decided that Obama was the preferred choice for the White House, the corporate media let Clinton's comment pass without dwelling much on the reasons behind it; which could readily be examined by simply browsing through his own book.)

The repeated claim that the entitlements are the main drag on the federal budget is false - for at least three reasons. To begin with, the assertion that the large number of retiring baby-boomers is a major culprit in budgetary shortfalls is bogus because while it is true that baby-boomers are retiring in larger than usual numbers they do not come from another planet; before retiring, they also worked and contributed to the entitlement trust fund in larger than usual numbers. This means that, over time, the outflow and inflow of baby-boomers' funds into the entitlement trust fund must necessarily even each other out.

Second, even assuming that this claim is valid, the "problem" can easily be fixed (for many years to come) by simply raising the ceiling of taxable income for Social Security from the current level of $113,700 to a slightly higher level, let's say, $140,000.

Third, the bipartisan policy makers' hue and cry about the alleged budget/debt crisis is also false because if it were true, they would not shy away from facing the real culprits for the crisis: the uncontrollable and escalating health care cost, the equally uncontrollable and escalating military/war/security cost, the massive transfer of private/Wall Street debt to public debt in response to the 2008 financial crash, and the considerable drop since the early 1980s in the revenue side of the government budget, which is the result of the drastic overhaul of the taxation system in favor of the wealthy.

A major scheme of the financial oligarchy and their bagmen in the government to substitute the New Deal with neoliberal economics has (since the early 1980s) been to deliberately create budget deficits in order to justify cuts in social spending. This sinister feat has often been accomplished through a combination of tax cuts for the wealthy and spending hikes for military/wars/security programs.

David Stockman, President Reagan's budget director and one of the main architects of his supply-side tax cuts, confirmed the Reagan administration's policy of simultaneously raising military spending and cutting taxes on the wealthy in order to force cuts in non-military public spending: "My aim had always been to force down the size of the domestic welfare state to the point where it could be adequately funded with the revenues after the tax cut". [15] That insidious policy of intentionally creating budget deficits in order to force neoliberal austerity cuts on vital social needs has continued to this day - under both Republican and Democratic administrations.

Although the bipartisan tactics of austerity cuts are subtle and obfuscating, they can be illustrated with the help of a few simple (hypothetical) numbers: first (and behind the scenes), the two sides agree on cutting non-military public spending by, let's say, $100 billion. To reach this goal, Republicans would ask for a $200 billion cut, for example.

The Obama administration/Democratic Party, pretending to represent the poor and working families, would vehemently object that this is too much ... and that all they can offer is $50 billion, again for example. Next, the Republican negotiators would come up with their own counter-offer of, let's say, $150 billion. Then come months of fake haggling and passionate speeches in defense of their positions ... until they meet eventually half way between $50 billion and $150 billion, which has been their hidden goal ($100 billion) from the beginning.

This is, of course, an overly simplified hypothetical example. But it captures, in broad outlines, the essence of the political game that the Republican and Democratic parties - increasingly both representing big finance/big business - play on the American people. All the while the duplicitous corporate media plays along with this political charade in order to confuse the public by creating the impression that there are no alternatives to austerity cuts, and that all the bipartisan public bickering over debt/budgetary issues vividly represents "democracy in action."

The atmosphere of panic and anxiety surrounding the debt/deficit negotiations is fabricated because the central claim behind the feigned crisis that "there is no money" for jobs, education, health care, Social Security, Medicare, housing, pensions and the like is a lie. Generous subsidies to major Wall Street players since the 2008 market crash has lifted financial markets to new highs, as evinced by the Dow Jones Industrial Average's new bubble above the 15000 mark.

The massive cuts in employment, wages and benefits, as well as in social spending, have resulted in an enormous transfer of economic resources from the bottom up. The wealthiest 1% of Americans now own more than 40% of the entire country's wealth; while the bottom 80% own only 7%. Likewise, the richest 1% now takes home 24% of the country's total income, compared to only 9% four decades ago. [16]

This means that there really is no need for the brutal austerity cuts as there really is no shortage of financial resources. The purported lack of resources is due to the fact that they are concentrated largely in the deep coffers of the financial oligarchy.

Ismael Hossein-zadeh is Professor Emeritus of Economics, Drake University, Des Moines, Iowa. He is the author of The Political Economy of U.S. Militarism (Palgrave-Macmillan 2007) and Soviet Non-capitalist Development: The Case of Nasser's Egypt (Praeger Publishers 1989). His latest book, Beyond Mainstream Explanations of the Financial Crisis: Parasitic Finance Capital, will be forthcoming from Routledge Books.

Sep 11, 2013 | Asia Times

"The powers of financial capitalism had another far reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole." - Prof Caroll Quigley, Georgetown University, Tragedy and Hope (1966).

Iraq and Libya have been taken out, and Iran has been heavily boycotted. Syria is now in the cross-hairs. Why? Here is one overlooked scenario.

In an August 2013 article titled "Larry Summers and the Secret 'End-game' Memo," Greg Palast posted evidence of a secret late-1990s plan devised by Wall Street and US Treasury officials to open banking to the lucrative derivatives business. To pull this off required the relaxation of banking regulations not just in the US but globally. The vehicle to be used was the Financial Services Agreement (FSA) of the World Trade Organization (WTO).

The "end-game" would require not just coercing support among WTO members but taking down those countries refusing to join. Some key countries remained holdouts from the WTO, including Iraq, Libya, Iran and Syria. In these Islamic countries, banks are largely state-owned, and "usury" - charging rent for the "use" of money - is viewed as a sin, if not a crime.

That puts them at odds with the Western model of rent extraction by private middlemen. Publicly owned banks are also a threat to the mushrooming derivatives business, since governments with their own banks don't need interest rate swaps, credit default swaps, or investment-grade ratings by private rating agencies in order to finance their operations.

Bank deregulation proceeded according to plan, and the government-sanctioned and -nurtured derivatives business mushroomed into a US$700-plus trillion pyramid scheme. Highly leveraged, completely unregulated, and dangerously unsustainable, it collapsed in 2008 when investment bank Lehman Brothers went bankrupt, taking a large segment of the global economy with it. The countries that managed to escape were those sustained by public banking models outside the international banking net.

These countries were not all Islamic. Forty percent of banks globally are publicly owned. They are largely in the BRIC countries - Brazil, Russia, India and China - which house 40% of the global population. They also escaped the 2008 credit crisis, but they at least made a show of conforming to Western banking rules.

This was not true of the "rogue" Islamic nations, where usury was forbidden by Islamic teaching. To make the world safe for usury, these rogue states had to be silenced by other means. Having failed to succumb to economic coercion, they wound up in the crosshairs of the powerful US military.

Here is some data in support of that thesis.

The end-game memo

In his August 22 article, Greg Palast posted a screenshot of a 1997 memo from Timothy Geithner, then assistant secretary of international affairs under Robert Rubin, to Larry Summers, then deputy secretary of the Treasury. Geithner referred in the memo to the "end-game of WTO financial services negotiations" and urged Summers to touch base with the CEOs of Goldman Sachs, Merrill Lynch, Bank of America, Citibank, and Chase Manhattan Bank, for whom private phone numbers were provided.

The game then in play was the deregulation of banks so that they could gamble in the lucrative new field of derivatives. To pull this off required, first, the repeal of Glass-Steagall, the 1933 Act that imposed a firewall between investment banking and depository banking in order to protect depositors' funds from bank gambling. But the plan required more than just deregulating US banks. Banking controls had to be eliminated globally so that money would not flee to nations with safer banking laws.

The "endgame" was to achieve this global deregulation through an obscure addendum to the international trade agreements policed by the World Trade Organization, called the Financial Services Agreement. Palast wrote:

Until the bankers began their play, the WTO agreements dealt simply with trade in goods - that is, my cars for your bananas. The new rules ginned-up by Summers and the banks would force all nations to accept trade in "bads" - toxic assets like financial derivatives.WTO members were induced to sign the agreement by threatening their access to global markets if they refused; and they all did sign, except Brazil. Brazil was then threatened with an embargo, but its resistance paid off, since it alone among Western nations survived and thrived during the 2007-2009 crisis.Until the bankers' re-draft of the FSA each nation controlled and chartered the banks within their own borders. The new rules of the game would force every nation to open their markets to Citibank, JP Morgan and their derivatives "products".

And all 156 nations in the WTO would have to smash down their own Glass-Steagall divisions between commercial savings banks and the investment banks that gamble with derivatives.

The job of turning the FSA into the bankers' battering ram was given to Geithner, who was named Ambassador to the World Trade Organization.

As for the others:

The new FSA pulled the lid off the Pandora's box of worldwide derivatives trade. Among the notorious transactions legalized: Goldman Sachs (where Treasury Secretary Rubin had been Co-Chairman) worked a secret euro-derivatives swap with Greece which, ultimately, destroyed that nation. Ecuador, its own banking sector de-regulated and demolished, exploded into riots. Argentina had to sell off its oil companies (to the Spanish) and water systems (to Enron) while its teachers hunted for food in garbage cans. Then, Bankers Gone Wild in the Eurozone dove head-first into derivatives pools without knowing how to swim - and the continent is now being sold off in tiny, cheap pieces to Germany.... ... ...

Ellen Brown is an attorney and president of the Public Banking Institute, PublicBankingInstitute.org. In Web of Debt, her latest of 11 books, she shows how a private cartel has usurped the power to create money from the people themselves, and how we the people can get it back. Her websites are WebofDebt.com and EllenBrown.com.

Feb 4, 2013 | youtube.com

Written and spoken by Michael Rivero. The written version is here: http://whatreallyhappened.com/WRHARTI...

Video This video is in the public domain. The producers have waived their copyright to this video. Listen to a post production conversation between the producers by clicking on this mp3: https://soundcloud.com/eonitao-state/...

You are welcome to make copies and to distribute this video freely. A free downloader is available here: http://www.dvdvideosoft.com/products/...

You might need this CD burner application (because the above application might be a little buggy) http://www.2download.co/cdburnerxp.ht...

If you have a PC you can use the above link (download the software first) to download it and burn it to a DVD and it is easy to do it. It is for your friends that don't have a computer and may have a DVD player instead or to give out to the public as a form of activism. http://www.dollardvdprojectliberty.com

Aug 17, 2013 | Safehaven.com

The Fed has been talking about bubbles for 20 years. I've been diligently studying bubbles and Money & Credit for longer. I'm here with a sense of humility. After all, I'm again relegated to wearing the proverbial "dunce cap," as I persevere through my third major bull market, "new era" and "new paradigm."

The great American economist Hyman Minsky is best known for "stability is destabilizing" and the "Financial Instability Hypothesis" - the evolution of finance from "hedge finance" to "speculative finance" and finally to highly unstable "Ponzi finance."

Minsky delineated the "Stages of Development of Capitalist Finance":

"In both Keynes and Schumpeter the in-place financial structure is a central determinant of the behaviour of a capitalist economy. But among the players in financial markets are entrepreneurial profit-seekers who innovate. As a result these markets evolve in response to profit opportunities which emerge as the productive apparatus changes. The evolutionary properties of market economies are evident in the changing structure of financial institutions as well as in the productive structure... To understand the short-term dynamics of business cycles and the longer-term evolution of economies it is necessary to understand the financing relations that rule, and how the profit-seeking activities of businessmen, bankers and portfolio managers lead to the evolution of financial structures."

Minsky saw the evolution Capitalist finance as having developed in four stages: Commercial Capitalism, Finance Capitalism, Managerial Capitalism and Money Manager Capitalism. "These stages are related to what is financed and who does the proximate financing - the structure of relations among businesses, households, the government and finance."

Commercial Capitalism:

"The essence of commercial capitalism was bankers providing merchant finance for goods trading and manufacturing. Financing of inventories but not capital investment."

Early economic thinkers focused on seasonal monetary phenomenon. Credit and economic cycles were prominent, although relatively short in duration.

Finance Capitalism:

"Industrial Revolution and the huge capital requirements for durable long-term capital investment... The capital development of these economies mainly depended upon market financing. Flotations of stocks and bonds - securities markets, investment bankers and the Rothchilds, JP Morgan and the other money barons... The great crash of 1929-1933 marked the end of the era in which investment bankers dominated financial markets."

Managerial Capitalism:

"During the great depression, the Second World War and the peace that followed government became and remained a much larger part of the economy... Government deficits led to profits - the government took over responsibility for the adequacy of profits and aggregate demand. The flaw in managerial capitalism is the assumption that enterprise divorced from banker and owner pressure and control would remain efficient... As the era progressed, individual wealth holdings increasingly took the form of ownership of the liabilities of managed funds..."

Money Manager Capitalism:

"The emergence of return and capital-gains-oriented block of managed money resulted in financial markets once again being a major influence in determining the performance of the economy... Unlike the earlier epoch of finance capitalism, the emphasis was not upon the capital development of the economy but rather upon the quick turn of the speculator, upon trading profits... A peculiar regime emerged in which the main business in the financial markets became far removed from the financing of the capital development of the country. Furthermore, the main purpose of those who controlled corporations was no longer making profits from production and trade but rather to assure that the liabilities of the corporations were fully priced in the financial market..."

Late in life Minsky wrote

"Today's financial structure is more akin to Keynes' characterization of the financial arrangements of advanced capitalism as a casino."

The above quotes were from a Minsky paper published in 1993. That year was notable for the inflation of a major bond market speculative Bubble. This Bubble began to burst on February 4, 1994 when Fed raised rates 25bps.

I still view 1994 as a seminal year in finance. The highly leveraged hedge funds were caught in a bond Bubble; there were serious derivative problems; and speculative deleveraging was having significant global effects, most notably the financial and economic collapse in Mexico.

Posted on January 25, 2013 by James Kwak | 70 CommentsBy James Kwak

One of the last things I did in law school was write a paper about the concept of "cultural capture," which Simon and I discussed briefly in 13 Bankers as one of the elements of the "Wall Street takeover." The basic idea was that you can observe the same outcomes that you get with traditional regulatory capture without there being any actual corruption. The hard part in writing the paper was distinguishing cultural capture from plain old ideology-regulators making decisions because of their views about the world.

Anyway, the result is being included in a collection of papers on regulatory capture organized by the Tobin Project. It will be published by Cambridge sometime this year, but for now you can download the various chapters here. It features a lineup including many authors far more distinguished than I, including Richard Posner, Luigi Zingales, Tino Cuéllar, Richard Revesz, David Moss, Dan Carpenter, Nolan McCarty, and others. Enjoy.

The Wall Street Journal

The nation's biggest banks are going on the offensive to fend off growing efforts in Washington to rein them in.

The banks have hired longtime, influential Washington hands to deflect regulatory and political pressure to strengthen their finances and to sell assets. Regulators and some lawmakers have raised concern that large banks remain "too big to fail" and could require another government bailout in the event of a new financial meltdown.

Associated Press Former Bush aide Tony Fratto has been hired by banks.The effort by banks marks a lobbying turning point for the industry, which adopted a mostly low-profile stance to new regulations in the wake of the financial crisis. It also comes as banks such as Morgan Stanley, Bank of America Corp. and Goldman Sachs Group Inc. are shedding lucrative assets that would have required them to hold more capital to compensate for their risk.

While the banks are joining forces, much of the work is being coordinated through trade groups.

Several banks and the Financial Services Forum, a top trade association, have hired Tony Fratto, a former Bush administration official, to provide what they call a "rapid response" to criticism that banks remain too large. The too big to fail notion implies that the government would have to step in and provide funding to institutions whose failure could disrupt the financial system, as it did during the 2008 financial crisis.

Regulators and lawmakers increasingly are signaling that more work is needed to lessen the risk posed by large, complex banks, including bigger capital cushions and minimum amounts of expensive long-term debt.

The moves by banks include pushing back against bipartisan legislation sponsored by Sens. David Vitter, a Louisiana Republican, and Sherrod Brown, an Ohio Democrat, that would sharply increase capital cushions at large banks to the point where most analysts expect firms would be forced to shrink.

Stephanie Cutter, a former adviser to President Barack Obama, and Ed Gillespie, a former Bush administration official, are providing strategic advice to Bank of America on several issues, including efforts to break up the banks. Morgan Stanley recently hired Michele Davis, a top aide to former Bush administration Treasury Secretary Henry Paulson, to help bolster the firm's credibility in Washington.

The more-aggressive profile comes as the big banks that received 2008 bailout money provided under the Troubled Asset Relief Program have repaid it.

Top bank officials are trying to coordinate more closely and present a united front. On April 10, top officials from five major banks gathered for a strategy session at Bank of America's Washington office to discuss what they should do about the growing perception that big banks continue to pose a threat to financial stability, according to several people with knowledge of the session.

For about 30 minutes, U.S. Bancorp Chief Executive Richard Davis, Citigroup Inc. CEO Michael Corbat, Bank of America Chief Brian Moynihan, Wells Fargo & Co. CEO John Stumpf, and Michael Cavanagh, a top official from J.P. Morgan Chase & Co., talked about the recent surge of momentum in the too-big-to-fail debate, including where it came from and what to do about it.

The chiefs identified several catalysts, including the more than $6 billion trading loss last year by the so-called London whale at J.P. Morgan, repeated calls by some top bank regulators for a breakup of big banks and recent comments from Attorney General Eric Holder that some banks were too big to "jail," suggesting some firms are so large and interconnected that prosecuting them could harm the economy.

U.S. Bancorp's Mr. Davis, who called for the meeting, urged the other executives to join with regional and community banks in pursuing a strategy to stop the breakup efforts. A united front, he said, might be more effective in tamping down the momentum.

"If just the big banks oppose it, it will be a problem," Mr. Davis said, according to a person familiar with the conversation.

Ultimately, the CEOs rejected Mr. Davis's suggestion and decided to hand the effort over to the Financial Services Forum, which represents the CEOs of the nation's 19-largest financial institutions. In a Forum-organized meeting the next day with President Obama, a bank official briefly raised concerns about capital levels, saying that banks were under growing regulatory pressure to boost their capital cushions and cautioned it could hinder their ability to lend and affect the broader economy, according to people who attended the White House meeting.

Banks are making a similar pitch in meetings with lawmakers, telling members of Congress that every additional dollar in capital they are required to hold translates into $8 to $10 less to lend, according to industry representatives.

"One of the things we've been saying for some time is no one knows what the cumulative effects of the changes on the system are going to be," said Kenneth Bentsen Jr., acting president and CEO of the Securities Industry and Financial Markets Association. "Some of them aren't even done, and the industry has legitimate concerns that it will be hard to make loans and raise capital for businesses."

The desire to push back has picked up urgency amid recent comments by top Federal Reserve officials that current regulatory efforts to reduce the systemic footprint of large banks may not be enough.

Yet the bank effort is somewhat hampered by disagreement among institutions and as some regional banks seek to distance themselves from their larger peers.

Two weeks ago, officials from U.S. Bancorp, Wells Fargo, J.P. Morgan and other banks called off a planned meeting to discuss the Fed's effort to require that companies hold minimum amounts of long-term unsecured debt after it became clear there wasn't agreement among the banks, according to people familiar with the meeting.

Justin Baer and Michael Crittenden contributed to this article.Write to Deborah Solomon at [email protected], Robin Sidel at [email protected] and Aaron Lucchetti at [email protected]

August 23, 2010 | FT.com

The conservative economic counter-revolution associated with the names of Ronald Reagan and Margaret Thatcher began some three decades ago. The Great Recession almost certainly marks its end. What follows will be something different, though how different it will is still unclear. This is a good opportunity to assess the broad economic consequences of that revolution.

For the sake of simplicity, I focus on gross domestic product per head in the six biggest high-income economies: the US; Japan; Germany; the UK; France; and Italy. (I also use the Conference Board database. These data are in purchasing power parity (Elteto-Koves-Szulc (EKS) method).)

There is much more to performance than GDP per head. These data ignore the distribution of income, which is of crucial importance, especially for the US, where a very large proportion of additional income seems to have accrued to the wealthiest. The data also ignore the underlying causes of changes in GDP per head: changes in output per hour, in hours per worker and in employment. Even so, they are revealing.

The single most important point from the chart on relative GDP per head is that the US remains where it has been for over a century: the most productive large economy in the world. At its peak, in 1991, Japan's GDP per head reached 89 per cent of US levels. It then fell substantially in the 1990s. United Germany, France and Italy also experienced substantial relative declines in GDP per head over this period. The UK was the only one of these five countries to have achieved rising GDP per head, relative to the US, since 1990. This surely suggests that reforms led by American and British policymakers did bear some fruit.

The chart on growth of GDP per head elaborates this picture somewhat. The UK and US had the highest trend growth of GDP per head between 1980 and 2009. (All-German data are unavailable for the entire period.) But there are other interesting events: first, there is a progressive deceleration in trend growth: only Japan achieved faster trend growth in GDP per head between 2000-07 (that is, before the recent deep recession) than it did in the 1990s; second, the US growth deceleration in the most recent periods is marked, with growth in GDP per head only at the same rate as Japan between 2000 and 2007 – so much for the magic of the Bush-era tax cuts - and also between 2000 and 2009; third, GDP per head grew at less than 1 per cent a year in Germany, France and Italy in the most recent decade.

At first glance, then, the conservative revolution seems to have achieved some improvements in the previously lagging US and UK economies. But the magic potion started to lose effectiveness in the 2000s, particularly in the US.

The more interesting question, however, is how far this improved performance of the US and UK will turn out to have been a blip. There are two reasons for believing this.

- First, the expansion of the financial sector and associated leveraging of the household sector played a big part in the growth of the economies of the US and UK. The question is how far growth driven by these two linked developments will turn out to have been a mirage. It is not difficult to see why that might be the case. The financial sector creates money and credit not only used to pay fees to itself and to a host of brokers and agents, but also to finance construction booms. Furthermore, the next decade is likely to see deleveraging in the US and UK, in both household and financial sectors, while the willingness to leverage up the government sector seems set to hit political or economic limits. This combination of factors might make these countries' performance look a little like that of Japan in the 1990s, with chronically weak aggregate demand.

- Second, the US and UK have run substantial current account deficits in recent decades. Andrew Smithers of London-based Smithers & Co argues that this has allowed the relative shrinkage of manufacturing, a capital-intensive sector. That, in turn, has permitted the two economies to grow quite fast, despite relatively low rates of investment in physical capital. In the coming decade, this process is likely to be reversed. Savings and investment would then have to rise substantially to sustain given rates of overall economic growth. Should this not happen, growth would slow further.

Bubbles induce severe over-estimates of underlying economic performance. Will the same prove true of the US and UK? I would guess so. Might the next decade belong to Germany or Japan, instead? That would not surprise me either. Expect the unexpected. It is a good rule.

- Kevin Alexander | August 23 9:07pm

The "Great Recession"? It may yet to turn out as the neo-Dark Ages, where stupidity reigns.

- Gavyn Davies | August 23 10:19pm

Martin - I think we need to ask four separate questions.

- First, did the Reagan/Thatcher reforms help the relative performance of the US and UK, compared to other economies, in sectors other than the financial sector? My answer to this would be a resounding "yes".

- Second, did the US and the UK also gain because they had comparative advantages in the financial sector, which was the area of the global economy which expanded most rapidly from 1982-2007. My answer would be "yes" again.

- Third, did the conservative revolution itself contribute to the forces which triggered the growth in the global financial sector? Clearly, yes again.

- And, fourthly, can the pre-2007 growth in financial services be maintained in the long run? That seems very doubtful, to say the least.

If this is all true, then the conservative revolution may have improved the performance of the non-financial sectors in the UK/US, while also shifting resources excessively towards finance in those economies.

We may not be able to judge the final outcome until finance has settled down its sustainable share of global GDP, which is probably less than it was in 2007.

But we can ask ourselves this: is it possible to design the next revolution so that non financial sectors improve their performance, without also shifting resources (perhaps wastefully) into finance? It may require us to encourage market forces in some sectors, while regulating them in others. Not an easy message for politicians to get across.

- Richard W | August 23 10:38pm

I think in the context of future growth for Germany and Japan you would also need to calculate what impact a declining population will have on growth. Both countries have a declining population and an ageing population through declining births. Although the declining population will likely see GDP per capita growing. I would think nominal GDP will disappoint. Moreover, the demographics of an ageing population must have effects on the rate of new startup firms. Much will depend on whether the young can increase their per-capita output to support the inverted population pyramid. Although the US and UK face problems with deleveraging they do not have the declining population problem.

- Munzoenix | August 23 10:42pm

I agree with Martin on his last point -- that the relatively high growth in the US and UK could be due to higher leverage, and less investment in capital-intensive sectors like manufacturing.

But, I think Martin also did not mention two points I think are very valuable:1) that growth rates in various countries are reported in domestic currencies. The US and UK have shown to have high growth rates, but when you standardize/normalize all the growth rates using one currency for comparison, the US and UK economy shrunk markedly in the past decade if all these economies were compared in euros or yens. The pound had lost almost 20% of its value in the last year, which in euro terms is a 20% decline in the UK's per capita income measured in euros. So, all the growth the UK experienced in relation to Germany, France and Italy is a mirage already.

2) per capita incomes are usually measured in purchasing power parity (and looking at how low Japan's figures were in Martin's graph, I'm assuming PPP was used). But this can be somewhat misleading. There is value in reading PPP, because it allows economists to measure what people can actually buy because it adjusts for varying price levels across countries. But, looking at nominal exchange rate also has value.

US PPP per capita income is high because prices levels are low -- NOT FOR GOOD reasons like higher productivity from greater capital-intensive utilization. US price levels are low because 1/3rd of the labor force lost their job in the manufacturing sector due to an overvalued dollar (thanks to Reagan excessive government debt). All this manufacturing labor flooded into the "booming" service sector, putting downward wage and price presses on service goods from restaurant meals to haircuts. Thus, haircuts and other services that comprise a country's price level are lower in America than a country like Sweden -- Thus using PPP makes Sweden look poorer, when in reality, the economy is more balanced for having more labor employed in a highly competitive goods-producing, capital-intensive manufacturing sector, that there is less labor in services that overall price levels are higher.

Therefore, using nominal market exchange rate to measure per capita income in the above countries maybe useful (alongside PPP).

In that case, Japan and Germany are far better off (and balanced) than the US and UK. In addition, growth is far more equal across those societies than in the US where all growth is top heavy, as Martin mentioned.

Overall, good article, nonetheless.

- Francobollo | August 24 1:08am

The idea that finance and leverage have made up part of the relative gains of US/UK seems eminently plausible. Nevertheless it doesn't seem, despite the Great Recession, that neo-con policies are dead. An example is Cameron's 'Big Society' concept which seems to be pure Gordon Tullock in seeking to transfer government activities to the voluntary sector.

- Padmanabha Rao Hari Prasad | August 24 2:07am

The relatively poor and declining quality of physical and human capital in the US will surely limit its growth over the next decade or more.

Raghuram Rajan has quite an extensive discussion in "Fault Lines" of how the US educational system and society are failing to provide an increasing portion of the population with the skills (and the socializing for the attitudes and work habits) needed for the more technologically sophisticated jobs of today.

The policy consensus to address these constraints seems all the more difficult to achieve in a highly polarized political environment.

- Akira Chimura | August 24 4:14am

I am surprised by Martin's analysis, based on PPP. I can choose nothing but to seriouly doubt the economic theory or further all logical theories as well as logical and abstract thinking itself. Only one ironical conclusion is "I think, therefore I am", just as Descarters said.

Concretely, Japan must unchangeably seek for a new catch-up model, successful in Ex-Japan Asia, signifying that more and more savings and capital-intensive investments in physical assets should be made. Does this signify a stronger inertia of continuing the conventionalities of the past, and so a more helpless vicious cycle of the debt-deflation dynamics, basically different from recently rising Germany? Greater havoc or collapse for Japan? Because no matter how based on PPP, the revenue by corporat tax peaked at a level of 13.4 trillion yen in 1991 and then sharply declined to a level of 5 trillion yen in FY 2009, and also other tax revenues similarly declined, except the revenue by consumption tax. Therefore, the country cannot stand up. Even though the tax system is the basics of the country, if Japan's tax system could be changed into the European-style tax system, centering around added value tax, would Japan get out from the vicious cycle of the debt-deflation dynamics and be really revived? What matters most importantly is that this task is the genuine difficulty for Japan, because it crucially and vitally needs a really strong leadership, differently different from "Leadersless Japan" ( The economist criticised ).

- Bryan Lewis | August 24 4:23am

Mr. Wolf.

I am in Japan. I just bought a new computer that is half the price of one I bought 5 years ago. It is much faster and has better features. If this pricing and growth in efficiency was carried across the board the GDP would fall by half.

So what kind of a measure of the economy is the GDP used in your graphs?- Liberty | August 24 4:52am

Everyone can quote others' data and say "expect the unexpected." Wolf should find another job. Thatcher and Reagan did not achieve turning the tide of socialism in the west. They just stopped its progress for a while. That's why the West is not doing well. The real counter-revolutions were in China, India and eastern Europe, which are significantly less socialist now than before.

- Mycroft | August 24 6:38am

Reagan/Thatcher slowed the growth of the State, but hardly did they roll it back by any objective measure... just look at the budget numbers, number of govt. employees, etc..

Reagan in particular disillusioned his Goldwaterite supporters on every front.. from failing to abolish the Dept. of Education, to burying the Gold Comission, to incurring in huge deficits... Since then the US Empire and it's Welfare state have done nothing but grow.

If you want to see the triumph of market reforms, look to China, where a little more freedom has gone a long way...

- Roy | August 24 7:55am

honestly.. this is a bit of a joke.. in these decadent days we call anything a revolution... even if it's just tinkering around the edges.

If you want a measuring rod which will show you just how lame Reagan reforms were... contrast to Thomas Jefferson's spending cuts (almost 50% of the Federal budget in 4 years)..

- kedarsat | August 24 8:04am

Does conservatism allow for ZIRP?

In my book, low interest rates and a pernicious form of crony-capitalism brought the UK and US down. These need to be abandoned, rather than the conservatism that never was.

The decline in US public finances will lead to a partial dismantling of US public education, which could be the beginning of the re-skilling of the US.

- sceptic | August 24 8:16am

I love the way Krugman, Wolf and co. are trying to drive the keynesian dual narrative of "deregulation caused the bust" and "austerity killed the recovery".

Anything to focus the debate away from establishment sacred cows. I'll leave it to the reader to figure out what those are.

- Econoclast | August 24 8:29am

I am amazed by some of the comments here, which seem to imply quasi-socialism is a major constraint on the US and the UK.

As Martin Wolf points out, we've had 30 years of deregulation, which simply encouraged massive over-investment in housing to the detriment of other physical capital.

Thatcher-Reagan deregulation has failed. I regard the comparisons with China, India and eastern Europe has completely misplaced.

Look at the mess in many eastern European economies who shared in the financial/housing mania. And China and India are reaping the benefits of putting hundreds of millions of people to work. The true test for their political and economic systems will come over the next 20 years.

- central economic plannning | August 24 8:31am

10 Planks of the Communist manifesto:

5. Centralisation of credit in the hands of the State, by means of a national bank with State capital and an exclusive monopoly.

- Gaute | August 24 9:58am

@ econoclast, "The true test for their political and economic systems will come over the next 20 years"

20 years is a very short perspective. Remember what Chou En Lai allegdly answered when asked about his opinion on the outcome of the French revolution. It was too early to tell.

- Brian Reading | August 24 10:15am

US industrial ICOR fell substantially from the early 1980s (measured over 7 years to smooth the cycle). Less investment was needed. Meanwhile LSR calculates that TFE was close to zero in the 1970s, rose to over 0.5% pa over the next two decades and in the noughties fell back to zero. I wonder how far the take-up of new technology has substantially increased TFP.

From 1985 US NIPA does allow for quality changes using hedonic pricing covering 20% of expenditure categories. Non-residential investment has been on a declining trend as a share of nominal GDP while on a rising trend on chain linked.

A good many years ago I devised a method of looking at relative performance using the errors in successive OECD GDP growth and inflation forecasts. The idea was that models are slow to capture changes in regression relationships. The result of a structural improvement should show up as a bias towards under estimating growth and over estimating inflation. There was such a bias for the US and UK but not for Germany, France and Japan. I have not repeated this exercise for many years. How long ago this was can be guess by the fact that Anthony Harris reported in in the FT.

- StuBails | August 24 10:23am

@ Martin Wolf

You said that the conservative revolution seems to have achieved some improvements in the previously lagging US/ UK economies.

Is there an alternative explanation here? Could it be that in the early 90s outsourcing started in earnest? The US & UK farmed out commodity production to the East and concentrated on comparative advantages in Financial Services/ property/ professional services. Was it this that accelerated growth rather than the deregulation of the US/ UK economies?

Either way, both countries are facing monster issues in the coming thirty years. The UK does have to concentrate more on exports, but my guess is that this will not result in manufacturing comprising a bigger % of GDP than it currently does.

- Luis H Arroyo | August 24 10:40am

I do not think the conservative revolution was the direct cause of the crisis. Therefore, I do not think the solution is the return of Keynesianism. Keynesianism has had its day, and lost the battle miserably. Moreover, much of today's problems come from the debts accumulated by the European countries that have chosen to follow Keynes.

There are many factors that have strayed from their beds Conservative revolution. for example, the commercialism of China, which has devastated the productive sectors of the world. In the West we have praised China as a simpleton when it has never been a credible rival.Then the history of the euro has played a key role in the crisis, as determined interest rates very low in the countries which embarked on the bubble. Now, the Euro is a huge barrier for these countries to adjust their failure competitiveness.

These and other conditions can not be charged to the account of the Conservative Revolution, that brought capitalism to depressed areas that are now very close to us.

- Itzman | August 24 10:50am

The history of civilization is the history of economics, but it is not the history of economic theory or of political interference with it.

They merely lag the true economic history of it.

Wolf, Krugman et al would do well to step back from theories that express the conditions of limited populations with access to more resource bases than they can exploit, (the politics and economics of expansion) and look to develop an economics that reflects the situation today, of the only unlimited thing being our ability to generate people we have no hope of ever finding useful employment for. And print empty promises on banknotes.

Everything else is in short supply.

In short, stop behaving as though by believing in it, the world will become what we think it ought to be, and start treating with it, as it is, and must inevitably be. With or without political an economic fiddling.

The economic wealth of a nation is nothing more or less than the the resource bases it has access to, and its efficiency in exploiting them into desirable product, divided by its population (squared) . As higher density populations need proportionality higher use of resource per capita to regulate and organise. One man on an island needs no government or defence force or police force or waste disposal....60M need rather more..

Which leads to a simple conclusion. The only way forward to greater prosperity lies in managing populations down. The longer this distasteful alternative so at odds with expansionist economic and political theory is shied away from, the bigger will be the crash when some externality does what politicians and economists are so afraid to face.

The rest may be safely left to those engaged in economic activity: The best that government can do is not stand in the way. Economists, may not be worth the paper they write upon, sadly.

- Per Andersson | August 24 11:47am

Mr Wolf overestimates the influence of individual politicians (Reagan/Thatcher). What he calls 'the conservative counter-revolution' consists of two developments:

- The growth of the welfare state was halted.

- Technology enabled product markets to be deregulated (or, perhaps more appropriate, de-monopolized) to a much larger extent than before.

Both these developments took place in other industrialized nations, even in those that did not have political forces as strongly identified as 'conservative' as Reagan or Thatcher.

The welfare state itself was not significantly cut back, either by Reagan or Thatcher. This is because the welfare state was and is overwhelmingly popular. A large-scale reduction in the size of government through a dismantling of the welfare state simply is not politically feasible, despite the protestations of 'Tea-Partiers'.

- maximus | August 24 11:50am

Yes, Interesting article although I suspect that there is a bit of a sub text here- i.e all this deregulation - did it really deliver? Some really don't want to buy that argument! I think that RichardW below is on the right lines, although it is obviously variable by country/region. The developed world post WW II baby boom has coincided with much of these changes... looking at the UK.. greatly expanded higher education, student power, new families, house acquisition, overseas travel and rising real incomes, financial service needs, now retirement for many. It has run its course. You can measure some of these by tracking the "Branson Empire" as it has morphed along with that generation. I think it has very little to do with conventional economic theory and much to do with the available choices to most of those baby boomers. This has now run its course- ergo the pile of problems from pensions et al.

- Barry Thornton | August 24 1:05pm

A curious article.

you start by mentioning the deficiencies of using GDP as a metric, but then proceed to use it anyway and finally question the conclusions that can be drawn from the limited data.

It is not very surprising that since the 80s the GDP of the US and UK have surged ahead, what with the expansion of the financial sector and the flow of credit. However, the big gripe with conservative policies has been that this has only benefited a tiny minority (as you mention).

A far more instructive comparison would include median wages, inflation (including property inflation), average number of hours worked, employment (not unemployment), health care and crime.

I appreciate that the conservative reforms were mostly economic and financial in nature, but the success or otherwise of these reforms should be judged with a broad range of metrics, not just economic ones.

I suspect in such an analysis, the conservative revolution would not look as good.

- antitrust | August 24 1:27pm

Anybody who talks about regulation.. or deregulation.. and fails to mention that the monetary and banking system is set up as a government orchestrated cartel, that the whole financial sphere of economic life is, if not outright nationalized, pretty much directed by governments and a few govt-licensed players... is being short-sighted at best.

- Driftersescape | August 24 1:35pm

I would have thought that when one talks of 'Reganomics' in the very next breath Milton Friedman would be mentioned and then inevitably monetarism. John Maynard Keynes, one of the most brilliant minds of his generation has become persona non grata.

Rather oddly the article above mentions none of these. Those of a certain age will recall not awaiting the next unemployment number but that of the latest M4 and then M0.

Those have of course been assigned to the trashcan of history (about 1987) I think i.e. the same place as the conservative revolution you refer to.

The list of failures is too long to mention but in the charge sheet is rapid deregulation though to the shameless 'jacking up' of the UK economy to win the 1987 general election. Result, an overheating economy and galloping inflation brought under control, for many business and individuals by sky high interest rates leading to a very painful recession that lasted from 1989 to 1993/4.

You are right in one thing, it surely did begin thirty years ago and tragically that flawed theme (deregulation morphing into light touch regulation) was brought to a shuddering halt in the blood bath of that late 2008 early 2009 credit crunch.

The final analysis of the conservative revolution? An unmitigated disaster.

- Alasdair Rankin | August 24 1:42pm

The problem is essentially one of goals. Wasn't the conservative counter-revolution simply a piece of ideological special pleading by the owners of capital? Look at the proportion of the increase in GDP in the US which went to the owners of capital. They also seem to believe that the state should only spend money on things they like. All the rest is best left to the "private sector". But what's "private" about driving the global economy into a deep recession, which would have been a depression without international government intervention?

The goal of capital is ever more capital. Conservative theorists will tell you at great length about the merits of individual responsibility but what do they have to say about economic responsibility or the responsibilities of capital? Rather less. Their economic theory, including "trickle-down"and Laffer curves, is no more than intellectual window-dressing.

Health care provision in the US is a classic case. The UK's health service has long consumed less GDP per head than the US health sector. That is, it is more efficient. But overall efficiency and human welfare have come second in the US to vested interests and maximizing private profit. We shouldn't be surprised - the economic system is set up that way.

For balanced, sustainable economic development find, and maintain, the balance between democratic goals and wealth creation. If there is an economic holy grail, maybe that's it.

- eian | August 24 2:17pm

I wonder if the US data on GDP per capita include the 10-12 million undocumented workers -- the vast majority active in the workforce -- who contributed to that GDP growth?

If not, we should estimate and subtract their contribution to US GDP to make a fair comparison. Of course, other countries also have undocumented workers. But of the ones compared here, I would think that the scale of US reliance on such workers far exceeds the others.

- The Slog | August 24 2:39pm

The Conservative Agenda made one entirely erroneous assumption: that the ethics of those in banks and business were up to less regulation.