Financial Skeptic Bulletin, July 2009

Prev

| Contents |

Next

Best

[Jul 26, 2009] Raw Story » Spitzer

Federal Reserve is ‘a Ponzi scheme, an inside job’

[Jun 12, 2009] Doomsville by Neil

Hume

[Jul 10, 2009] The Stimulus

Trap, by Paul Krugman, Commentary, NY Times

This economy can't get back on track because the track we were on

for years -- featuring flat or declining median wages, mounting consumer

debt, and widening insecurity, not to mention increasing carbon in the

atmosphere -- This economy can't get back on track because the track

we were on for years -- featuring flat or declining median wages, mounting

consumer debt, and widening insecurity, not to mention increasing carbon

in the atmosphere -- simply cannot be sustained.

[Jul 5, 2009] Yield Forecast

Further Rise Ahead in 2010 - Barrons.com

[Jul 5, 2009]

Econbrowser Back to the Stimulus Debate W, Timing, the States, and Baselines

Martin Feldstein predicts a relapse into recession (a beautiful symmetrical

W)

[Jul 5, 2009]

Whitney “I call this the great government momentum trade” by Tracy Alloway

[Jul 3, 2009] A different sort of

crowding out

Anonymous said...

I think it will be a W recovery.

After inventories are rebuilt manufacturers will discover that there

are still no buyers. Look at the cars for clunkers

to depress demand after is over. Same for RE in CA

ccie779 said...

It will be a VL shaped recovery.

Government spending makes at least 40%

of today's economy and would be interesting to see when that figure

comes down.

PacoCanada said...

I also fully expect a W, unfortunately.

The second dip will come when the govt stimulus effect fades

away, some time in late 2010 or 2011. As all mention,

there needs to be a resurgence of "non stimulus" (i.e. private-sector-led)

growth, which should take the lead after stimulus effect...

The problem seems to be in the transition between the hospital and

the street:

- Government could perhaps come up with a second mega stimulus

package, but the political context might not allow this to materialize.

- If there is a shift away from bonds towards equities due

to a perceived upward shift in GDP, bond prices will fall, interest

rates will rise, and it will make it that much more difficult

for the recovery to really take hold. This could be countered

by Fed interventions, however.

- With rising unemployment even months after the start of

the recovery (as we all know happens), will households and firms

have deleveraged enough to free up buying power to pave the

way for recovery?

Man I am worried!

Anonymous said...

Most people I know are scared "sh--less" about their jobs, debts,

401K's, etc. I think we've experienced

a "generational" shift in consumer attitudes towards debt and spending.

The deleveraging and defaulting hasn't even really begun yet.

No lasting recovery is coming.

What we've got going is the worlds largest Ponzi scheme.

Anonymous said...

Barry Ritholz wrote in his Big Picture blog: "Bottomline: An

improving, but weak report."

How could Barry make such a basic error? Sure the 2nd derivative

is improving, but -1.0% is not improving.

Clinton said...

According to Bloomberg y/y GDP is

down 3.9% from 2nd quarter 2008. Personally, I expect

2nd quarter 2009 GDP to be revised down just like all the others

quarters were.

From the article:

"GDP was down 3.9 percent from the second quarter in 2008, the biggest

drop

since quarterly records began in 1947. Last quarter’s decline was

the fourth in a

row, also the longest losing streak on record. "

http://www.bloomberg.com/apps/news?pid=20601103&sid=ayA7HltOFSHM

Donlast said...

The US economy is being re-calibrated

to a lower level of total output. The previous one

was false based on a debt binge. So why assume inventories will

be re-built? True, if inventory purge stops it will be a minor positive

but so what? Note too that if it were not for the fact that imports

fell faster than did exports the GDP metric could have been as much

as -2.5%. Better than minus 5%-6%, Yes. But again, so what.

If you are the bottom of a well down which you slipped by degrees

and the last slip was less than the previous one you are still at

the bottom of the well. Easing slippage provides no assurance that

you can climb out.

Cat said...

-1% is the new +2%. Any negative

number close to zero will be called "growth" from now on. "Not falling

as fast as last time" will be hailed as improvement.

People really do think that way. We only work well around relative

numbers.

Cat said...

Donlast: You hit it. The most frustrating

part of the last 2 years has been the constant refrain from pundits

(and two administrations) that we're going to return to our previous

experience of economic growth. Continuing this claim is completely

irresponsible. It is setting people up with false expectations rather

than preparing them for a more sober reality.

If nothing else, the cost (and eventual scarcity) of oil will force

us into a very much reduced level of productivity and already has.

The importance of free energy in the

growth seen post-WW2 simply cannot be overstated.

An era has just ended.

Any thinking person can see this, and many are relieved to see it

go. Nobody can say for sure what follows,

but it will be slower, less glamorous, and less energy intensive

than it was. Probably by an order of magnitude. Just

maybe, by more than that. Taking the opportunity now to prepare

people for that should be Job #1, but we've not seen even the first

step in that direction. People are going to wake up to a different

world at some point and may feel cheated and lied to, and start

looking around for someone (or some group) to vent their grievances

against. The European experience of

this in the last century does not inspire confidence.

plschwarz said...

"The estimates released today reflect the results of the comprehensive

(or benchmark) revision of the national income and product accounts

(NIPAs)."

Am I wrong in assuming that the figures released today are a

result of recalibration of the benchmark instrument, and that any

direct comparison with earlier estimates must be made with extreme

caution?

I would assume (??) that recalibration of the instrument would

be accompanied by using it on relevant earlier data to give a proper

comparison. Am i naive

PacoCanada said...

Quite obviously, everyone here is sane and sees the cold reality

we are all confronted with. Why the constant sidestepping by the

Obama team? DO "change" from the past, please - just be casually

sane, rational, and realistic. It would help a great deal in paving

the way forward. And it would be SO refreshing!

Emerging markets might kickstart their own internal domestic demand

and take the flag for supporting world aggregate demand to which

us Western economies could perhaps export to. Quite frankly, it

seems to be the ONLY way out of this mess that could potentially

give interesting positive growth going forward.

Otherwise, indeed, 0 or 1%will be the

new normalcy...

What do you people think?

Anonymous said...

Wow, this from Yves??? Ah, it's Ed Harrison. Damn, I'm starting

to detect blogger styles.

Ed, how can we expect an uptick in consumer

demand if people are still paying down debt?

We KNOW interest rates have nowhere

to go but up. Not the same as saying they will rise,

but paying down debt now is guaranteed to be cheaper than paying

later.

Can the government pump another 10% increase into the economy?

Hugh said...

I agree with Donlast too. What indication is there that once

companies have gotten rid of their excess inventory they will seek

to rebuild that inventory? Yes, current

inventory is a drag but wouldn't reduction and maintenance at a

new lower level just produce fresno dan's flat line?

Where does the up come from? As anonymous says, consumers are

paying down debt or saving because of fears about their jobs and

future security. So if companies aren't expanding and consumers

aren't buying where is the uptick to come from? From government?

How given current political conditions would this happen and even

if it did, would it be enough and intelligently directed (as did

not happen in the first stimulus plan)?

And how do we know that this is not part of a deflationary spiral:

cutting inventory and with it jobs which will reduce consumption

further creating another inventory overhang necessitating further

job cuts, etc.?

Neal said...

The GDP would at least be a minus 4% without the 12 percent increase

in government spending.

Does this really represent a sustainable growth pattern?

So, if the GDP turns up in the next quarter on the basis of additional

government spending, is this a real end to the recession, or just

another numbers game?

D said...

There need to be a post on the "Cash for Clunkers" program that

looks like it is going to vacuum up another few billion dollars

in the next few weeks.

One of the irony of this program is that clunkers that are at least

1984 are vehicles that by and large, have relatively modern exhaust

emission systems and greatly downsized from the behemoth engines

that are first generation electronic ignition / mechanical controls

mated with inefficient drivetrains and transmission ratios of pre-1980

cars.

The cars that qualify in the program, namely, 1984 or later models,

are actually not the most inefficient vehicles on the road.

If they are driven relatively few miles,

they actually are very economic and energy efficient if the alternative

is to consume energy to manufacture a brand new vehicle that is

in turn, driven few miles.

Furthermore, by spurring the auto industry to build and sell more

new cars when we already know peak oil is upon us is simply not

very clever

This temporary lull in oil prices is deceiving buyers to buy

more car and engine than they need.

Furthermore, the industry is within 2 to 3 years of delivering

a generation of gasoline fueled vehicles with much better

mileage --- e.g. the new Fords with

direct gasoline injection and small turbo/super chargers.

At the same time, we are still at the peak of the horsepower race

- which like the tailfin race of another era - gave us sedans like

a Toyota Corolla with standard engines that develop over 130hp in

the USA.

This level of performance is far in excess of any reasonable, sensible

need that a sedan optimized for fuel economy should have, and comes

at the expense of lifetime fuel economy penalties in the form of

heavier engines, transmissions, brakes, chassis, that is paid even

in the absence of a lead footed driver.

By having the US (and EU) governments purchase cars now to "stimulate

demand", they have taken these buyers out of the market for many

years, and perhaps, make it less likely for them to upgrade to a

truly fuel efficient vehicle that will be widely available in a

few years --- when petroleum is back to $200 a barrel and gasoline

is scarce and expensive at over $7 a gallon.

Then there is the stupidity of the program administration --- which

required cars turned in to be disabled by having a mixture of water

and sodium silicate and water poured into the engine and run ---

in effect, sanding the engine and making it unusable from the inside.

The only problem is, scrap yards routinely salvage engines and transmissions

from their wrecks --- it is probably one of the best profit makers

in a yard to salvage these parts and resell them to be either rebuilt

or, if the mileage is low enough, placed straight into another car

with a bad motor/transmission.

Not surprisingly, scrap yards are now saying they may not accept

the vehicles (unless they are compensated otherwise) because the

disabled vehicles are nearly worthless, or worse, actually cost

the scrap yard money to dismantle (drain fluids, etc.) them ---

except to be shredded and sold for scrap to China or other steel

mills.

No one that rammed this program through, which is really a car dealer

bailout and bribery program to complement the GM / Chrysler / Auto

Parts bailout program, truly understand energy economics.

While the study of energy impact on the USA has yet to be done on

this program, I have a suspicious hunch that this program will end

up costing more energy than it saves.

But Congress, in their rush to spend money, didn't think of that

one.

Ina Pickle said...

The figures will just be revised downward. That, and by Q4 even

more of the people who are losing jobs daily will have run through

all of their unemployment insurance - and a goodly number from the

beginning of the depression will have run out of even the extended

benefits. Guys, if people don't have money, they don't buy things.

What I want to know is where is the real economy going to come from.

I have yet to hear one single person, ANYWHERE, suggest what we're

going to do for an export-based economy. We had already become a

new UK, exporting services (insurance and banking) as they did when

their empire collapsed. What will we be exporting now? Where will

the jobs be developed?

Until someone can give me a solid answer on that, I don't believe

that an end to the recession is in sight. I just don't.

Seeking Alpha

U.S. equities are rallying again today, and (as usual) it is a rally

with no basis in reality. Most of the enthusiasm comes from another

string of corporate quarterly results which “beat expectations”. I had

hoped that the sheep were starting to clue-in to this silly game, however

it appears there is a still a large pack of Pavlov's Dogs out there

– who respond to their propaganda cues without a moment of actual thought.

The truth is that all of the companies “beating expectations” are

still reporting steadily worse results year-over-year – and in many

cases, much worse results. Among the few exceptions are U.S. financial

corporations. However, since accounting-fraud was legalized in the United

States (see

“FASB strong-armed into mark-to-fantasy accounting”), their bottom-lines

have had absolutely no connection to their business operations.

The obvious point here is that if expectations are set low enough,

it is almost impossible not to exceed these “estimates”. The question

that must be asked is this: given that all these “market experts” are

claiming that the U.S. economy is “turning the corner”, why are all

these same “experts” continuing to predict terrible bottom-lines for

U.S. corporations – every quarter?

The other element fueling today's rally is the continuing stream

of propaganda pretending that both employment and the U.S. housing sector

are “stabilizing”. This aspect of U.S. propaganda is especially egregious.

The optimism in U.S. housing is built entirely on the fact that declines

in U.S. home prices have not been as bad as before – when they were

falling three times as fast as during the Great Depression. This is

a result of several factors.

First and foremost, U.S. banks are holding millions of foreclosed

properties off the market. In this case, the numbers don't lie. There

were 1.9 million foreclosures in the first 6 months of 2009, and Realty

Trac (an industry-friendly group) predicts at least 4 million foreclosures

this year – meaning that the rate of foreclosures

will continue increasing. How is this “stabilization”?

These foreclosure numbers become even more interesting when we look

at the ratio of foreclosure-sales relative to total sales. With total

housing sales forecast at 4.8 million (after a recent jump in sales)

and (at least 4 million foreclosures this year alone), foreclosure sales

would have to account for over 80% of total sales in order for U.S.

banks to clear their inventory as fast as they are taking on new foreclosed

properties.

In fact, foreclosure sales have never

exceeded 50% of total sales, and in the last two months have only averaged

35% of total sales – meaning U.S. banks are selling much less than half

of their foreclosed properties. This means that contrary

to fraudulent reports that housing inventories are “moderating”, all

that is taking place is that more and more

properties are simply being taken off the market – unsold.

The other important point about U.S. banks holding millions of foreclosed

properties off the market is that foreclosure sales are the primary

force pushing down U.S. housing prices. It should be expected that with

U.S. banks holding millions of foreclosed properties off the market

that U.S. house prices would be (temporarily) less-bad.

As I have pointed out many times, U.S. delinquency rates are at all-time,

record highs – meaning that when the dust

settles at the end of this year, U.S. foreclosures will likely be well

over 4 million units (meaning all the other numbers I

discussed will get even worse). In addition, we are only months away

from the largest wave of mortgage re-sets (see

“U.S. mortgage crisis to get MUCH worse in 2010-11”) - which will

last for two years.

Meanwhile, broke-and-retiring U.S. baby-boomers will have no choice

but to dump $1 to $2 trillion of real estate onto the market, to make

up for their under-funded retirements (see

“U.S. pension crisis: the $3 trillion question”), and the HUGE cuts

which must be made in government programs for seniors, to begin to reduce

the $70 TRILLION (or so) in U.S. unfunded liabilities. This means at

least a decade of vast amounts of new inventory being dumped onto the

market. This is “stabilization”?

Then we come to U.S. employment fiction. Weekly lay-offs have “improved”

(by a measly 10%), meaning there are 'only' about 2.5 million lay-offs

per month, compared to a normal month where there would be less than

1 million. Lay-offs are 2 ½ times greater than normal, and this is called

“stabilization”?

Fraudulent government numbers are claiming that there is only a net

job loss of less than 500,000 jobs per month (which is an historically

terrible number). However, the reality is that with 2.5 million lay-offs

per month, there must be at least 1.5 million (net) jobs lost each month

– based on those weekly numbers (see

"U.S. economy to lose 20 MILLION jobs this year").

These are Great Depression-like numbers.

The fact that job losses are “stabilizing” at Great Depression levels

is not good news for anyone living in the real world. Meanwhile, the

collapse in the U.S. retail sector is just beginning to to impact retail

sector employment (see

“The Death of the U.S. Consumer Economy”), and U.S. state governments

are just beginning to make the painful budget (and employment) reductions

they must make – as a response to the largest plunge in state revenues

in history.

In short, the “big picture” of the U.S.

economy is completely clear, it's in terrible shape and rapidly getting

worse. Meanwhile, the U.S. propaganda-machine continues

to fuel the U.S. fantasy-rally with nothing more than “smoke-and-mirrors”.

The always excellent quarterly memo from Oaktree Capital Management

Chairman Howard Marks is out on the firm's Web site and this quarters'

is one of the best yet. Marks is a veteran of the markets, particularly

the value and distressed areas that I frequent, and his commentary is

a must-read.

This time out he summarizes the history of the investment markets

and the continued chasing of returns while ignoring risk that has plagued

investors over time. In particular, he thinks

the excessive pursuit of ever-higher returns, and the thoughtless use

of leverage to achieve them, is the cause of much of the current crisis.

He interestingly remarks that the democratization of investing with

brokerage firms pushing the long-term reruns of stocks and the idea

that anyone could be the next Warren Buffett was a huge disservice to

investors. Rewards were overstated and risks

understated.

The mantra of long-term returns from

stocks caused investors to totally ignore risks and push prices higher

for far longer than valuations justified. Even if stocks

do always outperform bonds and bills over the long term, as we have

found out in the last 10 years or so, 30 years can be a long time to

wait.

The letter also talks about the dangers of ignoring risks.

When all the focus is on missing an opportunity

with little-to-no thought of the chance of losing money, there is danger

in the air.

We are seeing some of that right now. Everyone feels an almost desperate

need to get back into the stock market. There is no thought given to

the risk inherent in current price levels. As

Doug Kass pointed out yesterday, they are only focusing on the good

news and dismissing anything that might counter a positive point of

view.

I am always puzzled how the desire for

larger returns causes people to buy things they do not even begin to

understand. Given that there is no way to know the real

risks contained in the balance sheet at Citigroup, why would you

ever own that stock? What is the loss exposure at Bank of America from the Countrywide

and Merrill Lynch acquisitions? I do not know and I do not think

anyone else does either.

How many years out you we discount the earnings potential for growth

stock like Green Mountain Coffee Roasters. What growth rates should I use and at what

rate should I discount back the earnings stream?

Any answer to those questions is a guess at best.

What is the probability of the holdings

in my junk bond fund defaulting? No one takes the time to figure that

out before investing and that worries me.

"It's hard to describe it as anything but ugly," said Michael Pond,

an interest rate strategist at Barclays Capital. "The market is beginning

to choke on the increases in supply."" ...After the initial shock, the

bigger concern should be whether there will be enough demand for 10-year

and 30-year auctions in two weeks' time," Pond said.

...investors seem worried about holding on to debt for too long for

fear of inflation, which eats into bonds' fixed returns over time.

Many market players believe inflation is

an inevitable consequence of the government's numerous efforts to stimulate

the economy by flooding the financial system with cash and keeping borrowing

costs low.

If demand for government debt wanes further, the Treasury will be

forced to increase the returns on bonds to lure investors, which in

turn can discourage lending by raising borrowing costs for consumers

and businesses. Long-term Treasury yields determine interest rates on

mortgages and other kinds of loans.

Treasuries got some support Wednesday

from more purchases by the Federal Reserve, which bought up $3 billion

of long-term Treasury debt. The Fed has been buying large

amounts of Treasuries this year in an effort to offset the influx of

supply.

[Jul 29, 2009] Pimco's Kiesel says: "sell your

junk."

Jul 10, 2009

Mark Kiesel, at Pimco's Pacific Investment Management Company says it's

best to sell your junk bonds now. Why is he saying this?

The key factor is that economic growth is

not there. Kiesel looks for only 1-2% growth in GDP next

year.All of this talk about "green shoots" simply is not materializing.

Kiesel says the "green shoots" are turning to weeds. He further said

that credit is not re circulating. Business financing costs range from

10-12%, making it difficult for some businesses to stay afloat.

So far, junk bonds have returned 29.6%

this year. That beats most other investments by a country mile. So,

again, do not let the "greed" monster take hold of your psyche.

The advice here is to stay in investment

grade bonds, rated Baaa or BBB- by Moody's Investment Service and Standard

& Poor's. The rate of return on these bonds is about 10-12%.

Kiesel points out that the government can print all the money they

want, but that does not change you or your business. People are fearful

that their house prices will fall. Only when people see the price decline

ending will they decide to spend more freely.

Now for those who have a strong stomach

US high default rate bonds may reach a yield of 18% this year.

What percentage of bonds should be in your portfolio? Hint. Use your

age as a guide. If you are 50 years old, you should have 50% of your

investments in bonds.

Tags:

junk bonds,

JunkBonds,

Mark Kiesel,

MarkKiesel,

Pimco

Humor aside, the way GS is making profits (excessive trading and pyramid

lending is nothing but a way to extract cash pumped in by the government

) at the time when economy is in the downturn is perverse and, well, not

entirely honest. The clawback provision in Sarbanes-Oxley should probably

be used on GS executives including Paulson.

July 28, 2006 | Bloomberg

...America stands at a crossroads, and Goldman Sachs now owns both

of them. In choosing which road to take, ordinary Americans must not

be distracted by unproductive resentment toward the toll-takers. To

that end we at Goldman Sachs would like to dispel several false and

insidious rumors.

Rumor No. 1: “Goldman Sachs controls the U.S. government.”

Every time we hear the phrase “the United States of Goldman Sachs”

we shake our heads in wonder. Every ninth-grader knows that the U.S.

government consists of three branches. Goldman owns just one of these

outright; the second we simply rent, and the third we have no interest

in at all. (Note there isn’t a single former Goldman employee on the

Supreme Court.)

What small interest we maintain in the U.S. government is, we feel,

in the public interest. Our current financial crisis has its roots in

a single easily identifiable source: the envy others felt toward Goldman

Sachs.

The bozos at Merrill Lynch, the dimwits at

Citigroup, the nimrods at Lehman Brothers, the louts at Bear Stearns,

even that momentarily useful lunatic

Joe Cassano at AIG -- all of these people took risks that no non-Goldman

person should ever take, in a pathetic attempt to replicate Goldman’s

financial returns.

For too long we have allowed others to emulate us. Now we are working

productively with Treasury Secretary

Tim Geithner and the Congress to ensure that we alone are allowed

to take the sort of risks that might destroy the financial system.

Rumor No. 2: “When the U.S. government bailed out AIG, and paid

off its gambling debts, it saved not AIG but Goldman Sachs.”

... ... ...

Rumor No. 3: “As the U.S. government will eat the losses if Goldman

Sachs goes bust, Goldman Sachs shouldn’t be allowed to keep making these

massive financial bets.

... ... ...

Rumor No. 4: “Goldman employees all

look alike.”

... ... ...

Rumor No. 5: Goldman Sachs is “a

great vampire squid wrapped around the face of humanity, relentlessly

jamming its blood funnel into anything that smells like money.”

... ... ...

Those words are of course taken from a recent issue of Rolling Stone

magazine and they are transparently false.

For starters, the vampire squid doesn’t feed on human flesh.

Ergo, no vampire squid would ever wrap itself

around the face of humanity, except by accident. And nothing that happens

at Goldman Sachs -- nothing that Goldman Sachs thinks, nothing that

Goldman Sachs feels, nothing that Goldman Sachs does -- ever happens

by accident.

(Michael

Lewis is a columnist for Bloomberg News and the author of “Liar’s

Poker,” “Moneyball” and “The Blind Side,” soon to be a major motion

picture. The opinions expressed are his own.)

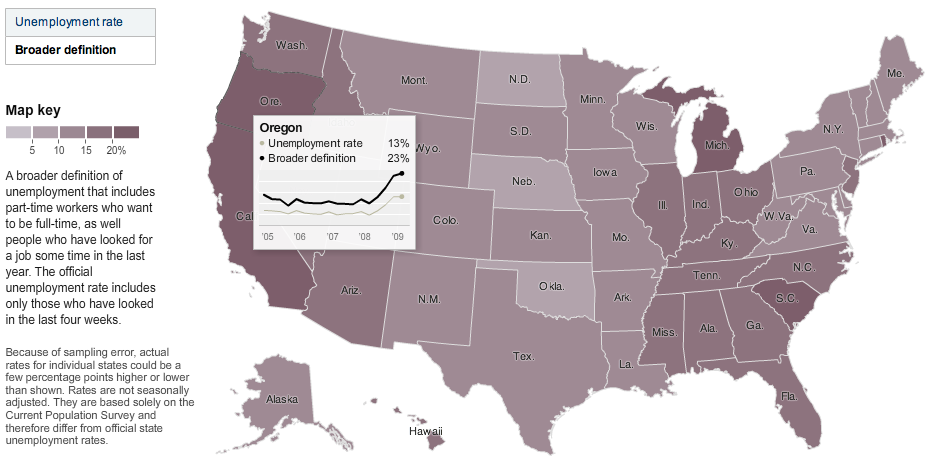

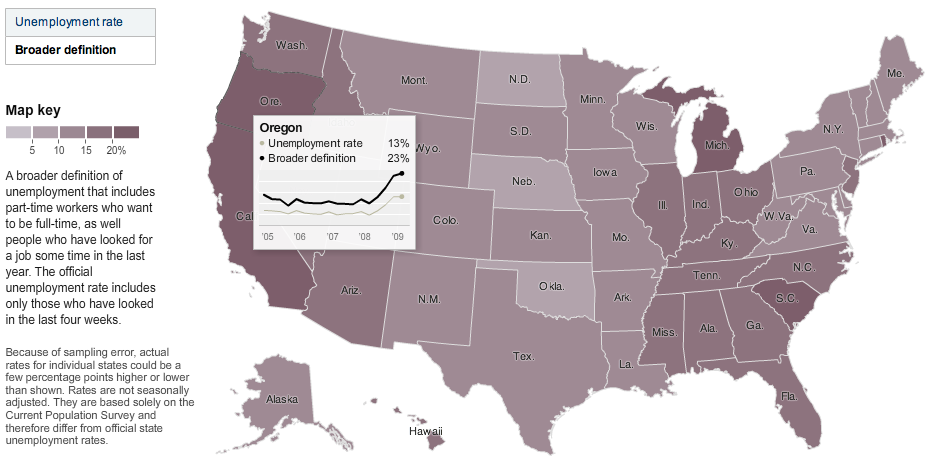

Unemployment crisis in the most serious of all in this recession...

The question "How do you put together a consumer

economy that works when the consumers are out of work?" is

really rhetoric. Wall Street

deleveraging troubles are not significant in comparison with the unemployment

problems but most of government money were used for solving it. Too

little money was devoted to solving unemployment problem.

How do you put together a consumer economy

that works when the consumers are out of work?

Why this rampant joblessness is not viewed as a crisis and approached

with the sense of urgency and commitment that a crisis warrants, is

beyond me. The Obama administration has committed a great deal of money

to keep the economy from collapsing entirely, but that is not enough

to cope with the scope of the jobless crisis.

There were roughly seven million people

officially counted as unemployed in November 2007, a month before the

recession began. Now there are about 14 million.

There are now more than five unemployed

workers for every job opening in the United States. The

ranks of the poor are growing, welfare rolls are rising and young American

men on a broad front are falling into an abyss of joblessness.

Workers under 30 have sustained nearly half the net job losses since

November 2007.

This is not a recipe for a strong economic recovery once the recession

officially ends, or for a healthy society. Young males, especially,

are being clobbered at an age when, typically, they would be thinking

about getting married, setting up new households and starting families.

Moreover, work habits and experience developed in one’s 20s often establish

the foundation for decades of employment and earnings.

l. chambers

Thank you, Mr. Herbert , for this serious and needed editorial.

On a personal level, I feel that the unscrupulous morons whose failed

gambles caused this disaster are the only ones benefitting. The

folks from Goldman Sachs and Citi have the President on speed-dial,

while middle-income citizens worry, not just with their children's

education, but with simply keeping their homes.

The system is not just unfair; it is incorrigibly crooked and

nothing that happened in the last election changed that for the

better. People need to wake up and see who is really making the

decisions in our government and our country.

Recommended by 157 Readers

Jonathan G.

Very good, but short on solutions. As long as our priorities

are to pour massive sums into things with limited amplifying benefits,

such as armaments, intelligence gathering, drug enforcement, while

letting oil companies exacting a huge tax on all citizens through

windfall profits, insurance and pharmaceutical and financial companies

diverting funds into the hands of the wealthiest few, it isn't clear

what tools we have with which to fix things. High-paying jobs can't

be created by waving a magic wand.

John

The high permanent unemployment is the result of massive immigration

over the last 30 years. Technology, by design, eliminates jobs and

an outsourced job also means the loss of its supporting jobs. So

a modern society needs fewer people to run it and at the same time

jobs are leaving the country. The bubble only masked the problem

and now that the bubble has burst and excess labor is being squeezed

out in the form of high unemployment there is nowhere for workers

to go unless there is another bubble. The American people have been

losing out year after year as immigration has ramped up and the

competition for jobs has increased so much that wages (healthcare

and pensions are wages) have fallen as people will work for less

just to have a job. Everything has finally reached the end of the

line. The middle class does not have money to spend so we do not

have consumers which would put others to work. It's a real mess.

Japan is trying to solve the problem by giving financial assistance

to its foreigners in an attempt to send them home and lower its

unemployment rate. Obama and gang will not solve the problem. They

benefit too much by it. They receive the minority vote for continuing

immigration and they receive money from the U.S. Chamber of Commerce,

agribusiness and billionaire high tech entrepreneurs to continue

this assault on the American people. Massive immigration and deregulation

used to be the hallmark of the Republican Party until Clinton sold

the working people out. It is a continuation of these policies which

enriches the political class and for that reason it will continue.

Obama has not imposed the tough regulations that are necessary to

insure a healthy financial system due to the financial contributions

nor will he address the lowered wages and loss of wages caused by

immigration since it is not to his benefit to do so. Unfortunately,

our people are paying for this lack of concern by the political

class and it will continue.

Recommended by 81 Readers

LAS

During the last half of the twentieth century appliances and

computers were invented with the purpose of saving time and labor.

These devices do save labor, but our society still operates on the

premise that people are expected to work full time plus overtime.

European countries scaled back the work week to less than 40 hours

and have given workers much more vacation and family time. The unemployment

problem won't be remedied until there is a restructuring of the

way work is distributed among people. More people need to work a

shorter work week with more vacation time. The problem is exacerbated

by increasingly narrowminded human resources policies. Jobs not

requiring a college degree are now universally filled by means of

psychological tests, so a person who doesn't score on the test as

a business "type" will not be considered. At the professional level,

anyone who is older, female, a minority, has a disability or who

has gaps on a resume, etc. will fall into a cycle of unemployment.

There will be a percentage of perfectly decent people who can never

obtain full time work. The disabled, for example, have a much higher

unemployment rate in spite of anti-discrimination laws.

We will need to have a public works program in which anyone who

wants to work can sign up and work, and not just at a menial level

of jobs, as well as an and to laissez faire employment law.

The success or failure of the current stimulus package cannot

be evaluated yet because the federal government has not even given

out a great deal of the money, particularly in scientific research.

Maryanne Conheim

Bravo, Mr. Herbert -- you are a brilliant

diagnostician. Our economy and 10 percent of its work force is on

life support, and the cure is not investment bank bailouts, but

massive, WPA-style public works programs. I am sure

that President Obama knows what should be done. One can only hope

that he has the grace and stamina to sell it to the Congress.

Recommended by 64 Readers

pdxtran

About 15 years ago, The Economist carried a cover story that

asked what happened to working class men when their jobs moved overseas.

It was a sensible, well-written article that admitted that such

job losses devastated communities and caused untold social problems.

In other words, the "Free" Trade Cultists in Britain and the U.S.

KNEW that their neoliberal policies were disastrous for ordinary

working people, and yet they continued insisting the outsourcing

first production, then IT work, and then routine clerical work to

low-wage foreign countries was the route to prosperity for all.

Were they blinded by their mostly affluent origins and therefore

unable to see blue collar workers as human, or were they purposely

trying to reverse the progress that the working classes in the West

made in the twentieth century? Or were they so addled by their ideology,

"politically correct" in the original sense of the term, that if

their ideology and reality clashed, then there had to be something

wrong with reality?

If I were Economic Czarina, I would provide low-interest loans

and training to displaced workers from shutdown plants who wanted

to modernize and reopen their former workplaces. I would institute

government purchasing policies that gave preferential treatment

to manufacturers with U.S.-based workforces, no matter who the owners

of the company were. I would shut down businesses that hired illegal

immigrants and auction their tangible and intangible assets off

to new owners who promised to use legal workers. I would put people

to work on infrastructure projects, a WPA for the 21t century, building

affordable housing, new recreation areas, mass transit, and intercity

rail, and retrofitting existing communities for better access by

non-automobile transport. (Such projects might help us catch up

with Western Europe and East Asia.) How would I pay for this? Simply

by cutting the Pentagon's budget back to a strictly defensive level

and putting the world on notice that the U.S. was retiring from

the policing business, since it isn't very good at that kind of

work anyway.

Reversing the long-standing sicknesses in our economy will require

bold moves, maybe not the ones I suggested, but ones that will upset

and annoy the rich and powerful nevertheless. The Republicans will

never go against the powers that be, and the Democrats seem more

desperate for the Republicans' approval than for the voters' approval,

so I'm not optimistic about either of these political dinosaurs.

My fondest wish would be for the more progressive elements in

the Democratic Party to break away, unite with other left-leaning

groups, and form a new party that realizes something that individual

members of Congress have proved on a small scale: You don't need

PAC money if you win the loyalty of the voters through your integrity

and concern for the little person.

Recommended by 112 Readers

William

As a person under 30 myself, I do have to mention that in addition

to a bad economy, generation Y is also getting steamrolled by the

attitude that college is a place to pursue your passions rather

than learn a marketable skill that sets you apart from the crowd.

I love art history, music, pyschology, and general business as much

as the next person, but these are a dime a dozen.

Yet professors continually advised them

that this was ok, that they should pursue their passions as expensive

time consuming college degrees, rather than hobbies.

Combined with the fact that many of the degrees that are currently

still in demand required hard courses like the calculus III or organic

chem that were just too much of a hassle to take and you have a

recipe for disaster when the paper pushing jobs evaporate.

I can't stress enough the disillusionment

right now among my friends who have debt from their 4 years and

a degree that is currently worthless. For those of

us who slaved through more challenging degrees, often at the expense

of a few parties, we feel a mixture of sympathy and vindication.

I suppose that what this means for recovery is that we should

consider attacking this source of the problem as well, maybe by

offering federal reimbursement for getting a degree in a field that

is in demand (obviously a list that has to be revisited every so

often). The nation gets its talent, the citizens who take advantage

of the program get jobs. And I can assure the people who wanted

to pursue studies in artistic fields that there is plenty of time

to perfect those crafts outside of work, and often with more perspective

than if it were a career in itself.

Recommended by 41 Readers

Anna

"The first step in dealing with a crisis is to recognize that

it exists"

Thank you, Bob. There are profound systemic problems which must

be addressed. We need jobs and health care. Instead we hear mumbo

jumbo/psychobabbling about volunteering (killing whose few jobs

which still exist) and spinach eating. This is not normal.

Recommended by 65 Readers

Steve

With the Madoff fraud and the stock market crash,

there was panic earlier in the year

by society's parasite class - the wealthy speculators.

Now that the market has recovered some and the average taxpayer

has bailed out their poor investment choices, they have no further

concerns.

I can't say I blame them. For forty years now, Republican crooks

and criminals have been assuring them that only the wealthy are

of any consequence in America. They now have the right wing press

to continue this assurance.

Recommended by 82 Readers

See

Calculated Risk "The seasonal adjustment appears pretty good in the

'90s, but it appears insufficient now. I expect that the index will show

steeper declines, especially starting in October and November."

Gluskin Sheff’s chief economist and David Rosenberg appeared to be

delighted by the

rise in the Case-Schiller index of US house prices on Tuesday:

CASE-SHILLER HOME PRICE INDEX RISES - NOW

THIS IS A GREEN SHOOT!

One by one, the shocks that the U.S. economy

endured are being worked through (though there is one lingering

impediment).

The sharpest

part of the mean reversion in credit is probably over, but the credit

contraction still has a long way to go before household debt ratios

head back to anything remotely close to pre-bubble historical norms.

This in turn suggests that the trend

towards frugality will persist.

Now we have the second shock - housing -

subsiding. You couldn’t have written a better script, a day after

unsold new housing inventory plunges from 10.2 months’ supply to

a three-year low of 8.8 MS, we see the Case-Shiller home price index

rise (0.45% sequentially) for the first time since the bubble burst

in May 2006 (note that in seasonally adjusted terms, prices still

dipped 0.2% MoM) and 14 of the 20 cities eked out an increase.

Stabilizing residential real estate

prices is absolutely an essential ingredient in transitioning out

of the recession, though inventories are still far too high to warrant

a sustained upturn. Bottoming is one thing, booming is quite another.

This entry was posted by Stacy-Marie Ishmael

on Tuesday, July 28th, 2009 at 18:14 and is filed under

Capital markets,

People. Tagged with

David

Rosenberg,

green

shoots,

housing.

Calculated Risk Selected Comments

montas ankle

thanks CR.

others would prefer that you be bearish to the very end,

but by displaying restraint and balance in many of your posts,

when you come out with a potentially controversial statement

like this, well, we know that there must be a reason.

this summer will be quite the lull, and I would argue that

the low end will actually move in a rather unsticky fashion

(due to foreclosures and resales). the result is that CS will

likely show a stronger rebound than usual in the summer (NSA)

and will then pay the piper in the fall. perhaps just another

way of saying what CR just said, but I do believe it bears repeating.

the 'recovery' in home prices is a long way off.

wally

My observation is that, at least in

the Minneapolis area, "seasonal variation" is sort of a misleading

concept. Everybody lists stuff just before June. The good stuff

sells, the bad stuff lingers... by mid-winter the sellers of

what remains are highly motivated, but the product they have

for sale does not compare with what went in the summer.

So, what you are seeing is not true

seasonal variation of equal products, it is an artifact of the

fact that there is a prime selling season in this area.

Gary thinks the S&P 500 earnings will be ~ $40/share this year.

Assuming P/E 15 that gets us to fair value of 600, a 35% drop from today's

level.

We had Gary Shilling on TechTicker this morning. We'll post the

video soon.

In the meantime, here's a quick overview of Gary's outlook on things,

along with a gallery of exhibits from his recent monthly Insight.

- The economy won't start to recover until 2010

(versus the current consensus of now). It will recover because

the government will be forced into a second stimulus.

- ...the US consumer is cutting back fast. Consumer spending

will drop from 70% of GDP to 60% as consumers pay down debt and

go on a saving spree.

- Most recessions have a positive quarter or two of GDP,

so if we get one, it won't mean anything.

Looks more like statistical gimmick: stock market is one of the leading

indicators. And in turn is a side effect of stimulus package (plus possible

GS or other manipulation). In this case such a report might be a sign of

local top, not the bottom. See

The End Of The End Of The Recession

The index of leading indicators, which signals turning points in

the economy, is rising at a rate that has accurately indicated the end

of every recession since the index began to be compiled in 1959.

The index was reported this week to have risen for the third consecutive

month in June, and to have risen at a 12.8 percent annual rate over

those three months.

... ... ...

An end to recession is not, of course, the same thing as the beginning

of a boom. The indicator “has an unblemished record on calling the turning

point,” said another economist, Robert J. Barbera of ITG, “but it is

not a particularly good guide to the power of the upturn.”

Indeed, one of the strongest moves in the leading indicators came

at the end of the brief 1980 recession, as credit controls were removed.

But the economy soon fell into another, longer recession.

Mr. Bandholz thinks we may get a “W” recovery, in which early gains

are followed by weaker figures. “We do not expect this recovery to be

strong and self-sustaining,” he said. “What is lacking is support from

consumer spending.”

During the most recent three months, the strongest indicators have

been the financial ones. The Standard & Poor’s 500-stock index has risen

while the gap has widened between long-term and short-term interest

rates. The indicators index was also helped by an increase in consumer

expectations and a slowing in deliveries by suppliers. (Slower deliveries

are assumed to be caused by rising orders, although such a change could

indicate the suppliers simply laid off too many workers.)

Two of the 10 indicators — the money supply and new orders for consumer

goods — have shown declines.

Another measure compiled by the Conference Board, the index of coincident

indicators, has fallen for eight consecutive months, and dropped in

17 of the last 19 months. That indicator is often used by the economic

research bureau in dating decisions, and its failure to stabilize is

a reason that Mr. Bandholz says he thinks the downturn is not yet over.

The index of coincident indicators has fallen 6.4 percent from the

peak it reached in November 2007, making this the deepest recession

since 1960. Before this cycle, its steepest decline was a 5.6 percent

slide during the 1973-’75 downturn.

I saved this from Saturday’s Off the Charts column by Floyd Norris:

THE American recession appears to be nearing an end, but only after

it has become the deepest downturn in more than half a century.

The index of leading indicators, which signals turning points in

the economy, is rising at a rate that has accurately indicated the end

of every recession since the index began to be compiled in 1959.

The index was reported this week to have risen for the third consecutive

month in June, and to have risen at a 12.8 percent annual rate over

those three months. Such a rise, pointed out Harm Bandholz, an economist

with UniCredit Group, “has always marked the end of the contraction.”

Mr. Bandholz said he expected that the National Bureau of Economic Research,

the official arbiter of American economic cycles, would eventually conclude

that the recession bottomed out in August or September of this year.

Why isn’t the Conference Board ready to declare the recession over?

The index of coincident indicators — now down for eight consecutive

months (down 17 of the last 19 months). That indicator is often used

by the National Bureau of Economic Research in making dating decisions,

and its failure to stabilize is likely why we haven’t seen any declaration

that the downturn is officially over yet.

Source:

Leading Indicators Are Signaling the Recession’s End

Floyd Norris

NYT, July 24, 2009

http://www.nytimes.com/2009/07/25/business/economy/25charts.html

PERMALINK

Facebook 45 Responses to “Leading Indicators Say “The End is Near””

jc Says:

Not scientific but I just can’t imagine what will restore consumer

discretionary spending while wages are being lost on such a scale

and the consumer has been scared into saving. Is there anything

about the stimuli that could be causing the leading indicators to

send a false signal????

Super-Anon Says:

Too bad the consumer isn’t participating so far. It’s going to

be interesting to see how long this “recovery” lasts without them.

Lugnut Says:

- Maybe because unemployment hasn’t stabilized, much less recovered

- Maybe cause bankruptcies and foreclosures are still high, and

consumer spending is low

- Maybe cause commercial re is just now caving

- Maybe cause there is a massive deficit bomb looming over the

Treasury market that threatens the stability of all capital markets

Just MHO

primordial_ooze Says:

Total BS. Tell me why the current uptick isn’t like the 1980-81

case? The index could plunge this fall.

Past performance is no predictor of future performance.

Mannwich Says:

I wonder - can we have a true recovery with so much unemployment

and people in debt to their eyeballs? Maybe those who have good

jobs will keep the economy afloat right now, but I doubt that will

be sufficient for a true “recovery” and a climate back to growth.

Maybe once enough of that debt is defaulted on and written off but

not yet.

I think this is the new “normal” for quite a while. Not exactly

Japan but a close knock-off to it.

Mike in Nola Says:

Just an illustation of Economists trying to pass themselves off

as scientific by creating statistics and talking about them and

making predictions about them Problem is that there is little correlation

between these statistics and the real economy.

Best example is the increase in GDP that occurs during bubbles,

including the most recent one. The activity being measured is not

necessarily beneficial to the economy as a whole, but produces good

numbers. Best summed up by John Mauldin’s use of the phrase “statistical

recovery.” We will get some artificial numbers that will be touted

as better, but things won’t really be any better.

hue Says:

we’ve heard “this time it’s different” on the way up in both

recent bubbles. could this recession from two huge back to back

bubbles be different too? where signs of past recoveries don’t work

as tea leaves?

R. Timm Says:

Employment is a lagging indicator and it will lag more than usual

in this recovery. The only LEI that I see as troublesome is the

recent stock market performance. This rally is overbought and will

retrace back to 800 S&P before heading higher again.

Mannwich Says:

@jc: Are flat panel tv’s a leading indicator or lagging? Me-thinks

this level of economic activity is the new “normal”, which means

retailers are still in for a world of hurt and some will be ripe

for shorting activities. Unless many can simply pile on more debt

to their crappy balance sheets (which is possible, I suppose), many

retailers are going down in the coming years. We haven’t even begun

to see that carnage.

cvienne Says:

I love it when, for example, last week a time chart was put on

display showing the “timeline” of the 1929-1932 period…Some wanted

to negate those comparisons by saying it was essentially USELESS

to draw any type of correlation…

Do you suppose they say the same about this graph? Or does the

mind just see what it wants to see?

Mannwich Says:

@cvienne: I think you know the answer to that question. Me-thinks

it’s the latter.

globaleyes Says:

I’m bullish on interest rates, this recession and foreclosures

which means I expect all three to continue into the indefinite future.

I hope I’m wrong.

http://www.marketvane.net/bull2.jpg

ben22 Says:

I might be a little more compelled by this data comparison if

this recession were anything like the others compared to here, or

if the causes of the past recessions were the same but from where

I sit neither applies.

Like some others above I haven’t noticed that since December

2007 we moved away from being a consumer based economy so how from

here there will be a great expansion when it comes to spending,

credit expansion, and job creation which in turn increases disposable

income, not just for the currently employed, but also putting back

to work the unemployed/underemployed, is not something I can see.

I suppose it is possible that this happens, but it doesn’t seem

probable. Not with the following:

- The U-6 unemployment rate in June, at 16.5% is more than half

the rate at the bottom of the GD in 1933.

- Unemployment rates for workers 45

and older have soared to their highest level since at least 1948.

-Employed are working fewer hours, average of only 33.1/wk in May

-Part-time work is at a record high, overtime a record low.

-The loss of two million jobs in the first quarter of 2009 was the

largest in any three-month period since at least 1939, when the

data begin.

Certainly the market appears overbought right now but that doesn’t

mean it can’t stay that way for a lot longer than anyone expects.

In any event, things had better rebound quick or stocks like Macy’s,

which has run from roughly $5, to almost $14 since the March lows,

will have nowhere to go but down.

karen Says:

the presentation of the new home sales data was as hilarious

as ever.. up 11%, biggest month over month increase since… the fact

is that sales are down 22% or so from last june..

looks like a good number of california families will be going

back to one earner households.. that is when the adult kids are

pitching in to help the parents keep up with their mortgage payments..

that’ll do wonders for the real estate affordability index..

Mannwich Says:

@Mike in Nola: Boom times in debt-binging China maybe, where

they are following our previous bubble path. It worked so well here,

the Chinese thought they’d just emulate it. They’ll do OK with that

strategy until their bubble eventually pops too.

DeDude Says:

As we all know it’s always different every time, but the question

is how is it different, and what those differences do to the parameters

we are looking at. So I am wondering how much the stimulus package

(the thing that is different this time) is influencing these leading

indicatiors.

dead hobo Says:

In the weekend papers, I saw autos were heavily advertised and

heavily discounted, without regard to cash for clunkers. Either

they are reflecting the new cost structure (doubtful because both

foreign and domestic were begging for customers) or autos are not

following the fantasy recovery plan.

I went to a Marshall’s. I was surprised to see the inventory

thin and the racks spread out very obviously. Few customers and

the parking lot was almost empty in front of the shopping areas.

OK near a grocery store.

I don’t think the rumored inventory rebuild is going to happen

as vigorously as claimed by the pundits. If so, companies like Marshall’s

would be bursting at the seams and not trying to look full. Rather,

I think we’re going to a new state of equilibrium where less of

many things will be the new normal.

dead hobo Says:

Also, with oil on the rise again in spite of lowered demand …

people aren’t stupid when it comes to managing the household budget

while income is uncertain. They can be an infinity past the point

of stupefying stupidity when times are good, but reality has been

a rude visitor of late.

With oil on the rise again, people will hunker down more deeply.

Excess cash will go into the bank and maybe to a dinner at an upscale

chain restaurant.

In spite of the pundits, it’s looking more and more like a double

dip is on the horizon. We’re falling to a new equilibrium and not

going back to the former one in any reasonable time.

bdg123 Says:

This is bull-oney. These models work until they no longer work.

If one breaks down the LEI, nothing based on fundamental capital

creation in the economy has moved upward. The bullishness is all

based on the credit and risk components in financial markets. It’s

bullshit. It’s like ECRI and their WLI that is now at multi-year

highs. ECRI is also too beholden to models that work until they

no longer work. They were deer in the headlights when it came to

anticipating the shocks that hit us. And both will again be deer

in the headlights to future shocks.

Onlooker from Troy Says:

Yes, the LEI are being influenced by monetary and fiscal policy

(i.e. the stimulus package). And it’s bumping things up with a little

sugar high. But that won’t be sustainable for all the reasons outlined

by others and that have been covered here ad nauseum.

It’s apparently good for a stock market

rally, as investors don’t seem to be able to see past their noses

anymore, and the herd is riding the wave.

Once again, maybe the recession is drawing to a close on a technical

basis, producing a positive GDP print. But it really doesn’t matter

in any substantive way to most people. GDP is a rather crappy way

to assess the economic health of the nation anyway. There are many

ways that it is influenced that look good on paper but are really

not healthy. One reason is the analogy I like that it’s like looking

only at a company’s income statement while completing ignoring the

balance sheet. That’s folly when the company is really limping along

with huge debt and practically insolvent. They may be able to produce

some current income due to one time circumstances, but the longer

term prospects are terrible. Sounds like the banks, and our nation.

tradeking13 Says:

Why do we keep comparing this credit induced recession to past

business cycle recessions?

Also, isn’t “stock market prices” one of the indicators in the

LEI? I’d like to see what the relative impact the stock market is

having on the LEI.

wally Says:

Have we ever come out of a recession

loaded with the absolutely crushing levels of debt

that we now carry as a result of our gifts to the big banks at the

expense of Main Street? Have we ever come out of one with all the

credit transactions shadowed by the implicit guarantees that are

now in place?

Given that this is a first-time situation, I’d be cautious. Also,

if I were Bernanke I would be cautious about playing the saviour

role in front of the people he is robbing to ’save’.

Mike C Says:

July 27th, 2009 at 11:13 am

@ben 22

This is the kind of regulation we are going to get, hope people

start to understand that soon. This sort of regulation does nothing

to stop the already problematic conflict

of interest in this industry which is that at these companies the

rep does not get paid when the client is in cash.

Ben, there is a way around this. Why not just go independent

and start your own separate RIA firm rather then work for a wirehouse.

This is what I’ve done. Sure, you don’t have their back office support

and marketing muscle, but you can do things your way and get paid

if you decide sitting in cash is the right thing to do because you

charge a flat percentage of assets and it doesn’t matter whether

you are in stocks or cash as presumably you are actively deciding

which is better at any given time.

Been awhile since I posted so a position update. I’m about 60-70%

invested in equities and 30-40% cash. I got faked out on that bogus

head and shoulders breakdown, and trimmed 10% of my equity exposure

at SPX 870ish. Oh well, you can’t get them all right, and that is

why I always move gradually, incrementally and don’t make ALL or

NOTHING type changes.

The higher the market goes the more

I will sell off. If and when SPX hits 1200, I expect to be very

light in equity exposure. More then a few technicians

have 1200 price targets even though that number makes ZERO sense

to me from an fundamentals or valuation perspective. Incidentally,

I’ve come more around to your credit deflation view, but I think

one still cannot underestimate the impact that fiscal and monetary

stimulus could have on the market in the short-term. Go back and

reread Grantham’s quarterly letter.

http://www.tradersnarrative.com/how-high-can-this-market-go-2799.html

http://www.decisionpoint.com/ChartSpotliteFiles/090717_rr.html

”Bottom Line: The violation of the head and shoulders neckline

has proven to be a bear trap, and my opinion is that the rally from

the March lows is resuming. My upside price target is about 1200

on the S&P 500. I have to say that this doesn’t make any sense considering

what I think I know about the economy, which is why I try to ignore

fundamentals in favor of the charts.”

http://www.decisionpoint.com/ChartSpotliteFiles/090724_bt.html

”I think the weekly chart (below) does a good job of conveying

the power in this rally. We can see the breakout above the long-term

declining trend line, as well as the horizontal resistance, which

is the neckline of a reverse head and shoulders pattern. The pattern

has executed and the minimum upside price target is about 1200.”

Just curious, for those who have held and continue to hold a

“buy and hold” short position in leveraged ETFs, what do you do

here if you didn’t take any money off the table at SPX 666-700 when

the market was the most technically oversold in a generation? Do

you ride the position up to SPX 1200 if that is what is going to

happen, or do just continue to hold with the view that at some point

your fundamental valuation outlook will be proven right (SPX 450?)

DeDude Says:

And don’t forget that the economy is not reported in absolute

numbers (i.e. 14.1 trillion per year) but as a second derivative,

% annualized change. So numbers actually turns positive when the

falling ends, not when we are back to “normal”.

Onlooker from Troy Says:

Indeed it does seem crazy that we have to cover this ground over

and over again. But I guess it has to be restated continually because

there are many who just don’t see the forest for the trees and continue

to be sucked in by the noise, ignoring the larger signal. And people

will get hurt falling for it. So we try. But it does get a bit old,

doesn’t it?

The bottom line for me is that the

argument that we are on the verge of real, sustainable recovery,

and therefore a sustainable uptrend in the stock and housing markets,

is based on thin evidence and a huge dollop of hope and confidence

that we’re different and those bad outcomes just won’t happen to

us (i.e. Japan’s lost decades, another depression, etc.) On the

other hand there is huge, objective, overwhelming data stating otherwise.

I won’t bet on the hope and hubris side myself.

alfred e Says:

@DeDude correct about stimulus influencing LEI as well as daily

SLP pumps.

IMHO, the velocity of money is currently so low and will remain

low for some time, that the LEI s are way too optimistic. The big

dogs continue to pick the carcass clean.

mathman Says:

Nothing to see here, move along:

http://rawstory.com/08/news/2009/07/25/spitzer-federal-reserve-is-a-ponzi-scheme-an-inside-job/

constantnormal Says:

Yeah, the LEI says The End is Near, go check out David Rosenberg’s

& Tyler Durden’s presentation over at ZeroHedge … The End of the

End of the Recession, for the bigger picture.

Jdamon33 Says:

I’m in a leveraged 3X short ETF (FXP and FAZ). I use these to

hedge a pretty large long position(s) in my IRA’s.

I will probably just ride it up to the 1,200 level (if that is

where we are going). At that time, I will sell off all my Long IRA

funds. At some point, I believe reality

will hit the market square in the face and we will be back down

to the 800 SPX range. I don’t think we will get back to the 700’s

again, but I could be wrong.

Jdamon33 Says:

After reading Rosenbergs piece, I’m thinking FDIC backed CD’s

for the next 3 - 4 years (at least). Dire situation we have here

folks.

lakshman Says:

Hi Barry,

When I saw this in the NYT I thought you might pick up on it!

A few comments for consideration:

1. Current version of the LEI has issues, as Floyd points out,

component estimations (using econometric models), etc., but it IS

starting to fall in line behind earlier rise in ECRI’s leading indexes

(LLI & WLI).

2. ECRI’s Weekly Coincident Index, while not yet positive, seems

to be fairing better — see chart mid-page here:

http://www.businesscycle.com/resources/

3. ECRI Leading Indexes in no way represent an econometric model

that has been fitted to the data, but they are based on relationships

that predate the Great Depression, so they have some validity in

jungle variety recessions like the one that we believe is now ending.

4. both the U.S. in the 1930s and Japan in the 1990s had business

cycle expansions despite big problems:

http://www.nber.org/cycles/

http://ecri-prod.s3.amazonaws.com/reports/samples/1/BC_0907.pdf

5. unlikely to get an NBER call on recession’s end until well

into 2010 as they wait for jobs and GDP data revisions to settle

down. The estimates of those data in the near-term, made by econometric

models, systematically experience their largest errors in the vicinity

of cycle turning points.

Kind regards,

Lakshman

fusionbaby Says:

Fiction is fact. White is black. Everything is actually the opposite

of what it seems. Immorality, corruption and hidden agendas have

worked their way so deeply into the system on a viral level that

a once decent system with potential is now worthless. As regards

material and financial survival, it has reached the point now where

it is everyman for himself. We’d better have our economic solution

in place for the very different future that we are speeding into

like a locomotive. We’ve allowed ourselves to be had. All MSM, government

or industry statistics are tripe. Go out, walk around, look around,

talk to the people in the street… that is where the statistics and

trends are. And they spell TROUBLE the likes of which America has

not seen for a very very long time. And the global situation will

mirror what happens here.

cvienne Says:

1930’s “business cycle expansion” = manufacturing for future

European ally war effort

1990’s “business cycle expansion” = building out internet infrastructure

2010’s “business cycle expansion” = SHOW ME THE MONEY (and/or

the credit to pay for such expansion)

Dr. Kenneth Noisewater Says:

When we get polywell-based fusion electric power that makes electricity

too cheap to meter and makes electric or hydrogen cars feasible,

and we stop spending money on home heating and transportation, _that_

should free up enough consumer spending to pay down debt and expand

the consumer business cycle.

I’m not seeing much else being able to get over the _consumer_

debt hump.

What else out there is going to start getting 70% of the economy

going again? Massive consumer defaults?

Steve Duncan Says:

July 27th, 2009 at 8:39 pm

Hey Lakshman,

Why don’t you talk about what the ECRI Long Leading Index (LLI)

did versus the Coincident Index during the Great Depression? The

ECRI Long Leading Index went positive in 1930 while the ECRI US

Coincident Index continued to go negative for two more years until

the middle of 1932. The ECRI Long Leading Index then went negative

for a second time and followed the Coincident Index to a bottom

in 1932.

So, the initial ECRI Long Leading Index (LLI) was predicting

an end to the Great Depression in 1930 and it was wrong (and the

ECRI LLI is going to be wrong again this time). Your current ECRI

Long Leading Index (LLI) is jumping the gun due to being based on

false indicators predicting the end of the Great Recession. You

won’t tell us what the ECRI indicators are (proprietary) but they

are probably made up of some of following one time or temporary

increases due to Govt intervention: interest rate spreads, stock

prices, money supply, commodities (oil spike), and inventory rebuilding.

Keep putting that positive spin on it baby.

http://www.thestreet.com/story/10039739/1/time-tested-tools-see-no-double-dip-ahead.html

Kind regards,

Steve Duncan

bdg123 Says:

If that truly is lakshman you are

showing a large vlind spot by citing Japan post 1987 and the U.S.

post 1933. The dynamics are completely different than today.

And even though you are citing that some of your data points are

not yet positive, you are citing on your web site that the economic

recovery is at hand re the WLI

http://www.businesscycle.com/news/press/1500

I find it HIGHLY DUBIOUS that your use of some data points in

your models pre-dates the Great Depression. Some of the granularity

in statistics used are not available pre the Great Depression. And,

your own research on your site shows a correlation well past the

Great Depression. I can’t help but think you are taking a literal

liberal liberty. And, the Conference Board LEI is just as adept

as the WLI is. They are both wrong that all is clear ahead.

BusinessWeek has an interesting cover story this week about

The Leaner Baby Boomer Economy.

Calling Mercedes the "the quintessential boomer brand", BusinessWeek

estimates that Mercedes will sell a third fewer cars in America. The

article also notes efforts by companies like Nordstrom (JWN), Starwood

Hotels & Resorts (HOT), Outback Steakhouse, BMW and Target (TGT) to

offer value shopping or "cheap chic" in an effort to reach out to generations

X and Y.

By now most are familiar with this new wave of frugality. Thus the

real story is not article itself but the easy to miss sidebar statistics

as follows:

-

$400 Billion: Amount that will come out of annual U.S. consumption

as thrifty boomers push savings rate from 1% to nearly 5%.

-

47%: Boomers share of national disposable income in 2005 before

the bubble burst. Boomers contributed only 7% to national savings.

-

2.4%: Forecasted GDP growth over the next three decades as boomers

ratchet back. GDP has grown 3.2% a year since 1965.

-

69%: Portion of boomers aged 54 to 63 who are financially unprepared

for retirement.

-

78%: Boomers' share of GDP growth during the bubble years of 1995

to 2005

Those stats are from a McKinsey study, and there is nothing remotely

inflationary about any of them.In his

Town Hall Meetings Bernanke said:

"It takes GDP growth of about 2.5 percent to keep the jobless rate constant.

But the Fed expects growth of only about 1 percent in the last six months

of the year. So that's not enough to bring down the unemployment rate."

Inquiring minds might be asking: Why does it take 2.5% growth to

keep the jobless rate constant? The answer is the first 2.5%+- of GDP

is based on hedonics and imputations. In plain English, the first 2.5%+-

of GDP (if not much more) is fictional. When the economy is growing

at 2% it feels like a recession because it probably is, even though

no one will admit it.

Now consider the implications of a 2.4% GDP forecast for three decades.

If Bernanke is correct that it takes 2.5% GDP growth just to keep

the unemployment rate constant, and McKinsey is also correct in its

2.4% forecast, we will be stuck with 10% unemployment for decades.

GS foxes wants your money poor 401K Pinocchio ;-)

Been Down So Long It Seems Like

Up To Me, the precocious 1966 novel by the late Richard Farina,

defined the late 1960s counterculture. The stock market rally that's

pushed the Dow Jones Industrial Average back above 9000 for the first

time since early January could be given the same title, and it might

well come to define the much-wished-for financial recovery.

What's pushing the stock market upward? Mainly, unexpectedly positive

second-quarter corporate profits. But those profits aren't being powered

by consumers who have suddenly found themselves with a lot more money

in their pockets. The profits are coming from dramatic cost-cutting

-- including, most notably, payroll cuts. If a firm cuts its costs enough,

it can show a profit even if its sales are still in the basement.

The problem here is twofold. First, such profits can't be maintained.

There's a limit to how much can be cut without a business eventually

disappearing -- becoming, in effect, a balance sheet in space. Secondly,

when businesses slash payrolls to show profits, consumers end up with

even less money in their pockets to buy the things businesses produce.

Even if they hold on to their jobs, they're likely to fear that they

won't have the jobs for long, which causes them to retreat even further

from the malls.

Most companies that have reported earnings so far have surpassed

analyst's estimates, but that only means that earnings have been less

bad than analysts had feared. According to the chief investment officer

at BNY Mellon Wealth Management, if the companies that haven't yet reported

earnings show the same pattern a the companies that have reported so

far, overall corporate earnings will have dropped 25 percent over the

past year. That may not be as much of a drop as analysts had expected,

but it's still awful. Operating income for companies in the S&P 500

that have reported so far has been almost 29 percent lower than last

year, more than 80 percent lower than 2007, according to Standard and

Poors. Ouch.

"Better-than-expected" is Wall Street's euphemism these days for